Cracking a skill-specific interview, like one for Financial Management and Record Keeping, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Financial Management and Record Keeping Interview

Q 1. Explain the difference between accrual and cash accounting.

The core difference between accrual and cash accounting lies in when revenue and expenses are recognized. Cash accounting records transactions only when cash changes hands – when money is received or paid. Accrual accounting, on the other hand, records revenue when it’s earned and expenses when they’re incurred, regardless of when the actual cash flow occurs.

Example: Imagine you provide a service in December but receive payment in January. Cash accounting would record the revenue in January. Accrual accounting would record the revenue in December, reflecting the fact that the service was performed then.

Practical Application: Cash accounting is simpler for small businesses with minimal outstanding invoices. Accrual accounting provides a more accurate picture of a company’s financial health over time, complying with Generally Accepted Accounting Principles (GAAP) and offering a clearer financial picture for investors and lenders. It’s crucial for larger businesses and those seeking funding.

Q 2. Describe your experience with different accounting software (e.g., QuickBooks, Xero).

I have extensive experience with several accounting software packages, including QuickBooks and Xero. I’ve utilized QuickBooks Desktop and Online versions for managing accounts payable and receivable, generating financial reports, and managing inventory for small businesses. My Xero experience centers on its cloud-based features, particularly its robust invoicing, expense tracking, and bank reconciliation capabilities. I find Xero’s user-friendly interface and real-time data particularly beneficial for collaborative projects and multi-user environments. I’m also proficient in customizing reporting features to fit specific business needs within both platforms. My experience extends to migrating data between different accounting systems, ensuring data integrity during transitions.

Q 3. How do you reconcile bank statements?

Bank reconciliation is a crucial process to ensure the accuracy of both your company’s accounting records and your bank statement. It involves comparing your internal cash records (like your general ledger) with your bank statement to identify any discrepancies. This process helps identify errors such as unrecorded deposits, outstanding checks, bank charges, and errors in recording transactions.

Step-by-Step Process:

- Obtain Bank Statement: Download or request the bank statement for the period you’re reconciling.

- Prepare Bank Reconciliation Worksheet: Create a worksheet listing the bank statement’s ending balance as a starting point.

- Add Deposits in Transit: Add any deposits made that haven’t yet appeared on the bank statement.

- Subtract Outstanding Checks: Subtract any checks written but not yet cashed.

- Adjust for Bank Errors: Add or subtract any adjustments for errors made by the bank.

- Adjust for Book Errors: Account for any errors made in your internal records (e.g., incorrect recording of transactions).

- Compare Adjusted Balances: The adjusted bank balance should now match your adjusted book balance. Any remaining discrepancies need further investigation.

Example: Let’s say the bank statement shows a balance of $10,000, but you have outstanding checks totaling $500 and a deposit in transit of $1,000. Your adjusted bank balance will be $10,500 ($10,000 + $1,000 – $500).

Q 4. What are the key financial statements and how are they used?

Key financial statements offer a comprehensive snapshot of a company’s financial performance and position. They include:

- Income Statement (Profit & Loss Statement): Shows revenue, expenses, and net income over a specific period. It helps assess profitability.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It showcases the company’s financial position.

- Cash Flow Statement: Tracks the movement of cash both into and out of a company over a period. It details cash from operating, investing, and financing activities.

How they’re used: These statements are integral to internal decision-making (e.g., budgeting, performance evaluation), external reporting (to investors, creditors, and regulatory bodies), and financial analysis (evaluating trends, profitability, liquidity, etc.). For example, a low cash flow from operations on the cash flow statement might indicate concerns despite showing high profits on the income statement.

Q 5. Explain the concept of working capital management.

Working capital management focuses on efficiently managing a company’s short-term assets (like cash, accounts receivable, and inventory) and short-term liabilities (like accounts payable and short-term debt). The goal is to ensure enough liquidity to meet immediate operational needs while optimizing the use of resources.

Key Aspects: Effective working capital management involves:

- Inventory Management: Maintaining optimal inventory levels to minimize storage costs and stockouts.

- Accounts Receivable Management: Collecting payments promptly to reduce the time money is tied up in receivables.

- Accounts Payable Management: Negotiating favorable payment terms with suppliers to extend payment periods.

- Cash Management: Maintaining sufficient cash reserves to cover immediate expenses while investing excess funds profitably.

Example: A company with poor working capital management might find itself struggling to pay suppliers, leading to strained relationships and potential disruptions to operations. Conversely, a company with strong working capital management can leverage its resources effectively for growth and profitability.

Q 6. How do you calculate Return on Investment (ROI)?

Return on Investment (ROI) measures the profitability of an investment relative to its cost. It helps evaluate the efficiency of different investments or business ventures.

Calculation:

ROI = (Net Profit / Cost of Investment) x 100%

Where:

- Net Profit: Revenue minus expenses related to the investment.

- Cost of Investment: The initial investment amount.

Example: If you invest $10,000 in a project and generate a net profit of $2,000, the ROI is (2000/10000) x 100% = 20%. A higher ROI generally indicates a more successful investment.

Q 7. What are the different methods of depreciation?

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. Several methods exist, each with its own implications:

- Straight-Line Depreciation: The simplest method, allocating an equal amount of depreciation expense each year.

Depreciation Expense = (Asset Cost - Salvage Value) / Useful Life - Declining Balance Depreciation: An accelerated method that allocates higher depreciation expense in the early years of an asset’s life. It uses a fixed depreciation rate applied to the asset’s net book value (cost less accumulated depreciation).

- Units of Production Depreciation: Depreciation expense is based on the actual use of the asset, calculated by the number of units produced or hours used.

- Sum-of-the-Years’ Digits Depreciation: Another accelerated method, allocating depreciation expense more heavily in the early years. The formula is more complex but results in higher depreciation in the early years and less in later years.

Choosing a Method: The choice of method depends on factors like the asset’s nature, expected usage pattern, and tax implications. Straight-line is simple, while accelerated methods offer tax advantages in the early years.

Q 8. What is your experience with budgeting and forecasting?

Budgeting and forecasting are crucial for financial planning. Budgeting involves creating a detailed plan of expected income and expenses over a specific period, acting as a roadmap for financial operations. Forecasting, on the other hand, uses historical data, market trends, and other factors to predict future financial performance. My experience encompasses developing both operational and capital budgets across diverse industries, including manufacturing and retail. For instance, at my previous role, I developed a comprehensive budget for a new product launch, incorporating market research to project sales and detailed cost estimations for production, marketing, and distribution. This budget proved instrumental in securing necessary funding and ensuring the project’s success. We used a rolling forecast, updating the projections quarterly to reflect actual performance and changing market conditions. This iterative process allowed for proactive adjustments to the budget, preventing potential shortfalls and maximizing profitability.

Q 9. Describe your experience with variance analysis.

Variance analysis is the process of identifying and explaining the differences between planned and actual financial results. This involves comparing budgeted figures to actual results, identifying significant variances, and determining their underlying causes. In my experience, I’ve utilized variance analysis to pinpoint inefficiencies, highlight areas for improvement, and make data-driven decisions. For example, when a significant unfavorable variance was detected in the cost of goods sold, I conducted a thorough analysis which revealed an unexpected increase in raw material prices. This led to renegotiating supplier contracts and implementing cost-saving measures in production. The findings were presented in clear, concise reports incorporating visualizations like charts and graphs which helped stakeholders understand the impact and proposed solutions.

Q 10. How do you handle discrepancies in financial records?

Discrepancies in financial records are a serious concern requiring immediate attention. My approach involves a systematic investigation, beginning with a detailed review of the affected records. This includes comparing source documents like invoices and receipts to the corresponding entries in the accounting system. I employ a combination of reconciliation techniques, identifying where the error may have occurred (e.g., data entry, processing errors, or fraud). For example, I once discovered a significant discrepancy in a bank reconciliation. After a thorough investigation, I uncovered a fraudulent transaction. I immediately reported this to the appropriate authorities and implemented measures to strengthen internal controls to prevent future occurrences. Effective communication with involved parties is vital. Documenting the entire process is also crucial to understand and prevent recurrence.

Q 11. Explain your understanding of Generally Accepted Accounting Principles (GAAP).

Generally Accepted Accounting Principles (GAAP) are a common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB). They provide a consistent framework for preparing and presenting financial statements, ensuring transparency and comparability across companies. My understanding of GAAP is extensive. I am familiar with its core principles, including the revenue recognition principle, matching principle, and the historical cost principle. I ensure all financial records are prepared in accordance with these principles. Compliance with GAAP is critical for ensuring the reliability of financial reporting and maintaining investor confidence. Non-compliance can lead to significant legal and financial consequences.

Q 12. How do you ensure the accuracy and integrity of financial records?

Accuracy and integrity are paramount in financial record-keeping. I ensure this through a multi-layered approach. This includes implementing robust internal controls, such as segregation of duties, regular bank reconciliations, and periodic reviews of financial statements. Data validation checks at various stages of the accounting process are implemented to catch errors before they become material. Regular training for staff on proper accounting procedures and ethical conduct is also a key element. We use automated data entry and validation systems wherever possible to minimize human error. Finally, regular audits by external auditors provide independent verification of the accuracy and reliability of our financial records.

Q 13. What are your experiences with internal controls?

Internal controls are designed to mitigate risks and ensure the reliability of financial information. My experience encompasses designing, implementing, and evaluating various internal controls, aligned with industry best practices and regulatory requirements. This includes implementing controls over cash handling, inventory management, and revenue recognition. For example, in a previous role, I designed a new system for purchasing and payment processing that incorporated multiple levels of authorization and automated reconciliation. This significantly reduced the risk of fraud and errors. A strong internal control framework is not only essential for financial reporting but also contributes to operational efficiency and organizational effectiveness. Regular review and updates to these controls are critical given changes in the business environment.

Q 14. Describe your experience with audit processes.

I have extensive experience with various audit processes, both internal and external. I have actively participated in numerous audits, assisting auditors in gathering information, documenting processes, and responding to audit inquiries. I understand the importance of providing accurate and timely information to auditors, and I am familiar with various audit methodologies and standards. I have also worked to improve our organization’s preparedness for audits, implementing processes to streamline the information gathering process. The goal is to ensure a smooth and efficient audit, minimizing disruption to the organization’s operations. The experience has honed my understanding of best practices for financial reporting and strengthened our commitment to transparency and accountability.

Q 15. How do you manage accounts payable and accounts receivable?

Managing accounts payable (AP) and accounts receivable (AR) efficiently is crucial for maintaining a healthy cash flow. Think of AP as money you owe and AR as money owed to you.

Accounts Payable (AP): My approach involves implementing a robust system for tracking invoices, ensuring timely payment to vendors, and negotiating favorable payment terms. This includes:

- Centralized Invoice Processing: Using accounting software to log all invoices, categorize them, and match them to purchase orders to prevent discrepancies.

- Vendor Relationship Management: Establishing clear communication channels with vendors to address any discrepancies promptly and negotiate payment discounts.

- Payment Scheduling: Creating a payment schedule optimized for cash flow management, prioritizing critical vendors and taking advantage of early payment discounts.

- Internal Controls: Implementing a system of checks and balances to prevent duplicate payments or fraudulent activities.

Accounts Receivable (AR): Effective AR management involves a proactive approach to ensure timely payment from customers. My strategies include:

- Clear Invoicing Practices: Ensuring invoices are accurate, clear, and delivered promptly.

- Automated Reminders: Utilizing automated systems to send timely reminders to customers before payments are due.

- Credit Policy: Implementing a credit policy and credit risk assessment to minimize bad debt.

- Debt Collection Procedures: Establishing a clear process for handling overdue payments, including friendly reminders, escalating to formal collection agencies when necessary, and legal actions as a last resort.

For example, in my previous role, I implemented a new AR system that reduced our days sales outstanding (DSO) by 15%, significantly improving our cash flow.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with financial modeling?

Financial modeling is a core skill for me. I’m proficient in building and utilizing various models, from basic forecasting to complex valuation models. My experience encompasses:

- Forecasting: Developing financial projections based on historical data, market trends, and assumptions. I use tools like Excel and specialized financial modeling software to create detailed forecasts of revenue, expenses, and cash flow.

- Valuation: Applying discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions to determine the value of businesses or assets. This includes understanding the limitations and assumptions inherent in each valuation method.

- Sensitivity Analysis: Testing the impact of changes in key assumptions on the financial model’s output to understand potential risks and opportunities. For instance, I’ve modeled the effects of interest rate hikes on a company’s profitability.

- Scenario Planning: Building different scenarios (best case, base case, worst case) to assess the range of possible outcomes and prepare for various economic conditions.

I’ve used financial modeling extensively to support strategic decision-making, including investment appraisals, mergers and acquisitions, and business planning. For instance, I once developed a comprehensive financial model to justify a significant capital expenditure project, demonstrating its positive return on investment (ROI) and securing funding.

Q 17. How do you handle financial risk?

Financial risk management is a holistic process that requires a proactive and systematic approach. It involves identifying, assessing, and mitigating potential risks that could negatively impact an organization’s financial health. My approach involves:

- Risk Identification: Identifying potential risks across various areas, such as market risk, credit risk, operational risk, and liquidity risk. This often involves brainstorming sessions, reviewing historical data, and considering industry best practices.

- Risk Assessment: Evaluating the likelihood and potential impact of identified risks using qualitative and quantitative methods. This might involve assigning risk scores and prioritizing high-risk areas.

- Risk Mitigation: Developing and implementing strategies to reduce the likelihood or impact of identified risks. These strategies can include diversification, hedging, insurance, and internal controls.

- Risk Monitoring and Reporting: Regularly monitoring risks and reporting on their status to management. This involves tracking key risk indicators and adjusting strategies as needed.

For example, in a previous role, I helped implement a hedging strategy to mitigate the impact of foreign exchange rate fluctuations on our international operations, significantly reducing our exposure to currency risk.

Q 18. Explain your understanding of financial ratios.

Financial ratios are powerful tools used to analyze a company’s financial health and performance by comparing different line items on its financial statements. They provide insights into profitability, liquidity, solvency, and efficiency. Understanding these ratios is essential for informed decision-making.

Examples include:

- Profitability Ratios: Gross profit margin, net profit margin, return on assets (ROA), return on equity (ROE) – these indicate how efficiently a company generates profit.

- Liquidity Ratios: Current ratio, quick ratio – these assess a company’s ability to meet its short-term obligations.

- Solvency Ratios: Debt-to-equity ratio, times interest earned – these measure a company’s ability to meet its long-term obligations.

- Efficiency Ratios: Inventory turnover, accounts receivable turnover – these gauge how effectively a company manages its assets and liabilities.

Analyzing these ratios in conjunction with each other and against industry benchmarks provides a comprehensive understanding of a company’s financial position. For example, a high debt-to-equity ratio might indicate a high level of financial risk, while a low inventory turnover ratio could suggest inefficiencies in inventory management.

Q 19. What is your experience with tax compliance?

Tax compliance is paramount in financial management. My experience covers various aspects, including:

- Tax Planning: Advising on tax-efficient strategies to minimize tax liabilities while remaining fully compliant with relevant tax laws and regulations.

- Tax Preparation: Preparing and filing accurate and timely tax returns, including corporate income tax, sales tax, and payroll tax returns. This includes using tax software and staying abreast of changes in tax legislation.

- Tax Audits: Managing and responding to tax audits, ensuring accurate and comprehensive documentation is available to support tax filings.

- Staying Updated: Continuously monitoring changes in tax laws and regulations to ensure compliance.

In my previous role, I successfully navigated a complex tax audit, resulting in a favorable outcome for the company by meticulously organizing documentation and clearly articulating our tax positions.

Q 20. Describe your experience with regulatory compliance in finance.

Regulatory compliance is a critical aspect of financial management. My experience encompasses navigating various regulations, including:

- Sarbanes-Oxley Act (SOX): Understanding and implementing internal controls to ensure financial reporting accuracy and compliance with SOX requirements.

- Generally Accepted Accounting Principles (GAAP): Applying GAAP principles to ensure financial statements are presented fairly and accurately.

- International Financial Reporting Standards (IFRS): Experience with IFRS is also beneficial for global organizations.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations: Implementing procedures to comply with AML and KYC regulations to prevent financial crimes.

Compliance requires a proactive and diligent approach, including regular training, internal audits, and staying updated on regulatory changes. I have a strong understanding of these frameworks and have successfully implemented compliance programs in various settings.

Q 21. How do you prioritize tasks in a fast-paced financial environment?

Prioritizing tasks in a fast-paced environment requires a structured approach. I typically use a combination of techniques:

- Prioritization Matrices: Using tools like Eisenhower Matrix (urgent/important) to categorize tasks and focus on high-impact activities first.

- Time Management Techniques: Employing techniques like time blocking and the Pomodoro Technique to enhance focus and efficiency.

- Delegation: Effectively delegating tasks where appropriate to utilize team resources and maximize productivity.

- Communication: Maintaining clear communication with stakeholders to ensure alignment and avoid unnecessary delays.

- Flexibility: Adapting to changing priorities and unexpected events – a critical skill in a dynamic environment.

For example, during a period of high workload, I used a Kanban board to visualize tasks, manage workflows, and ensure timely completion of critical projects. This improved team coordination and minimized bottlenecks.

Q 22. How do you handle pressure and tight deadlines?

I thrive under pressure and tight deadlines. My approach is systematic: I prioritize tasks using methods like the Eisenhower Matrix (urgent/important), breaking down large projects into smaller, manageable chunks. This allows for focused effort and prevents feeling overwhelmed. I also proactively communicate potential delays or challenges to my team and management, ensuring transparency and collaborative problem-solving. For example, during the recent year-end audit, we faced a significantly compressed timeline due to a last-minute client request. By delegating efficiently, implementing a streamlined workflow, and working extended hours (while maintaining work-life balance!), we successfully completed the audit on time and met all regulatory requirements. My ability to remain calm and focused under pressure has consistently allowed me to deliver high-quality work even in demanding circumstances.

Q 23. How do you ensure data security in financial record-keeping?

Data security in financial record-keeping is paramount. My approach is multi-layered. First, I ensure strict access control, implementing role-based permissions to limit access to sensitive information based on job responsibilities. This minimizes the risk of unauthorized access. Second, I leverage strong encryption methods, both in transit and at rest, to protect data from interception or unauthorized decryption. Third, I adhere to robust data backup and recovery protocols, ensuring regular backups are performed and stored securely offsite to mitigate data loss risks. Fourth, I promote a culture of security awareness within the team through regular training on best practices, phishing awareness, and password management. Finally, I stay updated on the latest security standards and regulations like GDPR and CCPA, ensuring compliance and implementing any necessary updates to our security protocols. Think of it like a fortress – multiple layers of protection ensuring no single breach compromises the whole system.

Q 24. Describe your experience with data analysis and reporting.

I have extensive experience in data analysis and reporting using various tools, including SQL, Excel, and specialized financial software like [mention specific software e.g., SAP, Oracle Financials]. I’m proficient in extracting, cleaning, and analyzing financial data to identify trends, anomalies, and key performance indicators (KPIs). For instance, in my previous role, I analyzed sales data to identify seasonal trends, which allowed the company to optimize inventory management and improve cash flow. I then created comprehensive reports and dashboards visualizing these findings, which were instrumental in strategic decision-making. I am comfortable presenting my findings to both technical and non-technical audiences, ensuring clear and concise communication of complex financial information.

Q 25. How do you stay updated on changes in accounting standards?

Staying updated on accounting standards is crucial. I achieve this through a combination of methods: I subscribe to professional accounting journals like the Journal of Accountancy and publications from organizations such as the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). I also actively participate in continuing professional development (CPD) programs and webinars offered by industry-leading institutions, ensuring I remain abreast of the latest changes. Furthermore, I leverage online resources and networking with fellow professionals to discuss and share insights on new developments. Regularly reviewing and updating our internal accounting policies and procedures based on these changes is also a key element of my approach. Think of it as lifelong learning; the accounting landscape is constantly evolving, and staying current is essential for accuracy and compliance.

Q 26. What are your strengths and weaknesses in financial management?

My strengths in financial management lie in my analytical skills, attention to detail, and problem-solving abilities. I’m highly organized and efficient, capable of managing multiple projects simultaneously. I’m also a strong communicator, able to explain complex financial information clearly and concisely. A weakness I’m actively working on is delegating tasks more effectively. While I enjoy the challenge of handling various aspects of a project myself, I recognize the importance of empowering my team and distributing workloads appropriately for optimal efficiency. I’m actively incorporating strategies like time management techniques and improved communication to address this.

Q 27. Describe a situation where you had to solve a complex financial problem.

In my previous role, we faced a significant discrepancy in our year-end financial statements. The initial investigation revealed several inconsistencies in the accounts receivable ledger. To solve this, I systematically reviewed all transactions, implemented a new reconciliation process, and cross-referenced data with our CRM and sales systems. This painstaking process involved identifying and correcting several data entry errors, uncovering a previously undetected fraud attempt, and ultimately resolving the discrepancy. The experience highlighted the importance of robust internal controls and regular auditing processes. Through diligent investigation and meticulous attention to detail, we not only resolved the immediate issue but also improved our accounting practices to prevent similar situations in the future. The resulting improved accuracy in our financial reporting boosted investor confidence and enhanced the company’s overall financial stability.

Q 28. What is your salary expectation?

My salary expectation is commensurate with my experience and skills, and aligned with the industry standards for a professional with my qualifications in this role. Considering my background and the specific responsibilities of this position, I am targeting a salary range of [Insert Salary Range]. However, I am open to discussing this further based on the comprehensive details of the compensation package, including benefits and long-term incentives.

Key Topics to Learn for Financial Management and Record Keeping Interview

- Financial Statement Analysis: Understanding balance sheets, income statements, and cash flow statements; interpreting key ratios and indicators to assess financial health and performance. Practical application: Analyzing a company’s financial health to determine investment viability.

- Budgeting and Forecasting: Developing and managing budgets; forecasting future financial performance; variance analysis and corrective actions. Practical application: Creating a realistic budget for a small business and monitoring its performance.

- Cost Accounting: Tracking and analyzing costs; identifying cost drivers and areas for improvement; cost allocation and pricing strategies. Practical application: Determining the cost of goods sold and optimizing production processes for maximum efficiency.

- Record Keeping and Compliance: Maintaining accurate and organized financial records; adhering to relevant accounting standards (e.g., GAAP); ensuring compliance with tax regulations. Practical application: Implementing a robust system for tracking invoices, payments, and expenses to meet audit requirements.

- Internal Controls: Designing and implementing internal controls to safeguard assets, ensure data accuracy, and prevent fraud. Practical application: Implementing segregation of duties and authorization procedures to minimize risks.

- Financial Risk Management: Identifying, assessing, and mitigating financial risks; implementing risk management strategies. Practical application: Developing strategies to manage currency exchange rate risk or interest rate risk for a multinational company.

- Data Analysis and Reporting: Utilizing data analysis tools to extract meaningful insights from financial data; preparing clear and concise financial reports for management and stakeholders. Practical application: Using Excel or specialized software to create dashboards visualizing key financial performance indicators.

Next Steps

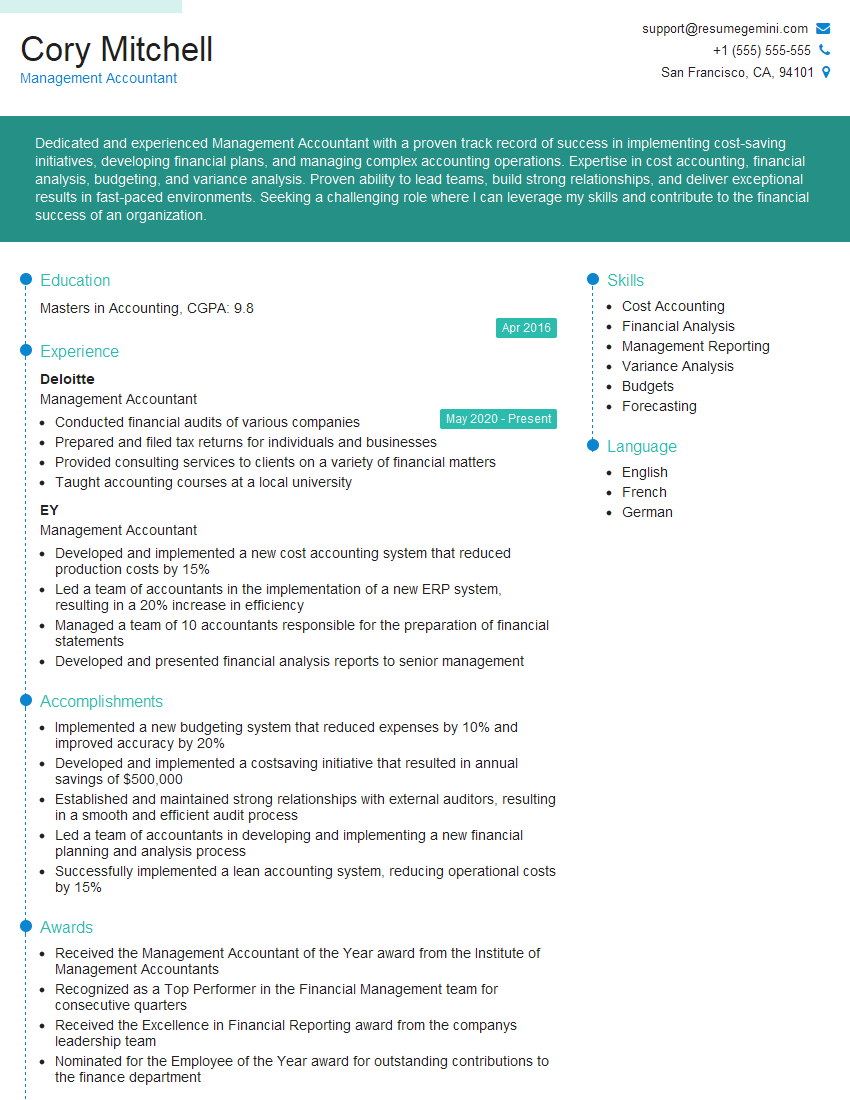

Mastering Financial Management and Record Keeping is crucial for career advancement in numerous fields. A strong understanding of these principles demonstrates valuable skills and opens doors to exciting opportunities with increased responsibility and earning potential. To significantly enhance your job prospects, it’s vital to present your skills effectively. Creating an ATS-friendly resume is paramount. ResumeGemini is a trusted resource that can help you build a professional, impactful resume tailored to the specific requirements of Financial Management and Record Keeping roles. Examples of resumes tailored to this field are provided to guide you. Invest time in crafting a compelling resume – it’s your first impression and a key to unlocking your career aspirations.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good