Unlock your full potential by mastering the most common Grain Merchandising and Marketing interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Grain Merchandising and Marketing Interview

Q 1. Explain the concept of basis in grain trading.

Basis in grain trading represents the difference between the local cash price of a grain commodity and its price on a futures exchange. Think of it as the premium or discount a buyer or seller receives relative to the standardized futures contract. For example, if the December corn futures contract is trading at $6.00 per bushel, but the local cash price is $5.80, the basis is -$0.20 (or 20 cents under). This negative basis means the local cash price is trading at a discount compared to the futures market. This difference is influenced by factors such as location, transportation costs, quality variations, and supply and demand dynamics within a specific region. Understanding basis is crucial because it directly impacts a grain merchandiser’s profitability. A strong understanding of basis allows for better pricing strategies and risk management.

For instance, a producer might sell corn at a fixed price (say $5.80) plus a basis. If the basis widens favorably to -0.10 before delivery, they profit more than they had anticipated. Conversely, a negative change in basis could impact their margins. Effective basis management involves predicting and leveraging these price movements to maximize returns.

Q 2. Describe the process of hedging grain price risk.

Hedging grain price risk involves using financial instruments, primarily futures contracts, to offset potential losses from price fluctuations. Imagine you’re a farmer with a large corn crop ready to sell in three months. You’re worried that prices might fall by then. To hedge, you’d sell corn futures contracts for the same quantity and delivery period. If prices indeed decline, the loss on your physical corn would be offset (at least partially) by the profit you make on the futures contracts. The goal isn’t to speculate on price movements, but rather to lock in a price for your commodity and protect your profit margin.

The hedging process typically involves:

- Analyzing Price Forecasts: Carefully examining market trends, weather patterns, and global supply and demand forecasts to understand potential price risks.

- Selecting Futures Contract: Choosing the appropriate futures contract (commodity, expiry date, etc.) that closely matches the volume and delivery date of your physical grain.

- Establishing Hedge Ratio: Determining the amount of futures contracts to sell (or buy) relative to the amount of physical grain. This ratio depends on factors like the correlation between spot and futures prices.

- Monitoring and Adjustment: Regularly monitoring the futures market and adjusting the hedge position if necessary (e.g., taking partial profits or adding further protection).

Q 3. How do you analyze grain market trends and forecasts?

Analyzing grain market trends and forecasts requires a multi-faceted approach that combines fundamental and technical analysis. Fundamental analysis focuses on macroeconomic factors that influence supply and demand: weather patterns (droughts, floods, excessive heat), crop yields, government policies (trade agreements, subsidies), global economic conditions (inflation, recessionary pressures), and geopolitical events (wars, trade disputes). I use data from USDA reports (WASDE, Crop Production reports) and other reputable sources.

Technical analysis, on the other hand, looks at historical price and trading volume data to identify trends and patterns using tools such as moving averages, trendlines, and chart patterns. I leverage trading software and charting platforms to perform this analysis. This provides insights into potential price momentum and support/resistance levels. Ultimately, a comprehensive approach combining both analyses leads to a more accurate and informative forecast.

Q 4. What are the key factors influencing grain prices?

Grain prices are influenced by a complex interplay of factors. The most significant include:

- Supply and Demand: The basic principle of economics; larger harvests generally lead to lower prices, and vice-versa. Unexpected weather events can significantly impact supply.

- Government Policies: Subsidies, trade policies, export regulations, and biofuel mandates can significantly influence grain prices.

- Global Economic Conditions: Economic growth affects demand. During times of economic prosperity, demand for grain usually increases.

- Input Costs: Fertilizer, fuel, and other input costs influence farmers’ production costs and consequently impact prices.

- Currency Fluctuations: The exchange rate between the US dollar and other currencies affects the price competitiveness of grain exports.

- Storage and Transportation Costs: Higher storage and transportation costs can push prices up, particularly during periods of tight supply.

- Speculation: Investor activity in the futures market can also influence grain prices.

Q 5. Explain the different types of grain storage and their advantages/disadvantages.

Grain storage options vary significantly, each with its own advantages and disadvantages. Common types include:

- On-farm storage: Bins, silos, or other storage structures on the farm. Advantages: Convenient, reduces transportation costs. Disadvantages: Limited capacity, potential for quality degradation, higher risk of spoilage.

- Commercial grain elevators: Large-scale storage facilities operated by companies or cooperatives. Advantages: High capacity, good quality control, often connected to transportation networks. Disadvantages: Storage costs, handling fees, potential for price negotiations.

- Government-owned storage: Storage facilities operated by government agencies. Advantages: Price support programs, safety net during market disruptions. Disadvantages: Typically require adherence to specific regulations, limited availability.

Q 6. How do you manage grain quality throughout the supply chain?

Managing grain quality throughout the supply chain is paramount to maintaining profitability and customer satisfaction. It requires a comprehensive approach that begins at harvest and continues through storage, transportation, and processing. This involves:

- Proper Harvesting Techniques: Minimizing damage during harvesting to maintain the grain’s physical condition and prevent contamination.

- Effective Drying and Cleaning: Removing moisture and impurities to prevent spoilage and improve the grain’s overall quality.

- Appropriate Storage Conditions: Maintaining suitable temperature and humidity levels to prevent deterioration and insect infestation. Regular monitoring of storage conditions is also key.

- Careful Handling and Transportation: Avoiding damage during loading, unloading, and transportation processes to preserve grain quality. Clean equipment is essential to prevent cross-contamination.

- Regular Quality Testing: Conducting routine testing at various stages (moisture content, protein, foreign material, etc.) to track quality and identify potential issues promptly.

Q 7. Describe your experience with grain transportation logistics.

My experience in grain transportation logistics encompasses all aspects, from planning and scheduling to execution and monitoring. I’ve worked extensively with various modes of transportation including rail, trucks, and barges, coordinating shipments both domestically and internationally. This includes:

- Route Optimization: Choosing the most efficient and cost-effective transportation routes to minimize delays and logistical costs, considering factors like distance, road conditions, and available capacity.

- Carrier Selection: Selecting reliable and reputable carriers that meet the required safety and quality standards. This includes negotiating rates and ensuring timely delivery.

- Documentation and Tracking: Managing all necessary documentation (bills of lading, certificates of origin, etc.) and using tracking systems to monitor shipments in real-time, ensuring timely delivery and preventing losses.

- Risk Management: Implementing strategies to mitigate transportation risks such as delays, damage, or theft. This might involve using insurance and other risk mitigation strategies.

Q 8. How do you negotiate contracts with grain producers and buyers?

Negotiating grain contracts requires a balanced approach, understanding both the producer’s needs and the buyer’s requirements. It’s a delicate dance of building rapport, analyzing market conditions, and leveraging your knowledge of pricing and logistics.

With producers, I focus on establishing trust. I begin by understanding their crop yield, quality, and their desired selling timeline. I then present various contract options, outlining the pricing mechanisms (fixed price, forward contract, basis pricing), delivery terms, and payment schedules. For example, I might offer a higher price for earlier delivery to secure grain for immediate needs or a slightly lower price for deferred delivery to spread out purchasing risks. Active listening and clear communication are paramount; I always ensure the producer understands the contract’s implications.

With buyers, the focus shifts to their needs. What quantity do they need? What quality specifications must the grain meet? What’s their risk tolerance and pricing strategy? I tailor my offers to match their requirements. Negotiation here often involves price adjustments based on market fluctuations, logistical considerations (transportation costs, storage fees), and quality premiums or discounts. For example, a buyer needing a large volume of high-quality grain might be willing to pay a premium, whereas a buyer with flexible needs could secure a lower price.

Successful negotiation involves finding a win-win solution that benefits all parties involved. I leverage my extensive market knowledge to anticipate potential issues and propose solutions proactively, establishing strong, long-term relationships based on mutual trust and respect.

Q 9. What are the common risks associated with grain merchandising?

Grain merchandising is inherently risky. Several factors contribute to this, including:

- Price volatility: Grain prices fluctuate significantly due to weather patterns, global supply and demand, economic conditions, and government policies. A sudden price drop can wipe out profits.

- Storage and handling risks: Improper storage can lead to spoilage, insect infestation, or quality degradation, reducing the value of the grain.

- Transportation risks: Delays, damage, or loss during transportation can significantly impact profitability. Inclement weather, logistical bottlenecks, or accidents are potential hazards.

- Basis risk: This refers to the difference between the local cash price and the futures price. Basis can fluctuate unpredictably, impacting the final selling price.

- Quality variations: Grain quality can vary significantly from field to field, impacting market value. Testing and grading are crucial to minimize losses.

- Credit risk: Buyers or sellers might default on their obligations, resulting in financial losses.

- Regulatory and political risks: Government regulations, trade policies, and political instability can influence grain prices and trading conditions.

Q 10. How do you mitigate these risks?

Mitigating these risks requires a multi-pronged approach:

- Hedging with futures and options contracts: This helps to lock in prices or limit potential losses due to price fluctuations. I use a variety of hedging strategies depending on market conditions and risk tolerance.

- Diversification: Spreading risk across various grain types, geographic locations, and buyers mitigates the impact of localized problems or unexpected price swings.

- Proper storage and handling: Investing in appropriate storage facilities, employing best practices in handling and quality control, and regularly inspecting grain minimizes quality deterioration and spoilage.

- Effective risk management tools: Utilizing advanced market analysis tools and employing sophisticated risk modeling techniques help in anticipating and managing risks proactively.

- Strong contract management: Clearly defined contracts that address delivery terms, payment schedules, quality standards, and dispute resolution mechanisms minimize misunderstandings and legal issues.

- Credit checks and insurance: Thoroughly vetting buyers to assess their creditworthiness and obtaining appropriate insurance coverage protect against potential defaults and losses.

- Staying informed: Closely monitoring market information, including weather forecasts, government policies, and international market trends, helps to make informed decisions.

Q 11. Explain your experience with using market information and data analysis tools.

I have extensive experience utilizing market information and data analysis tools. My daily routine involves using various software and platforms to analyze market trends, price forecasts, and weather data. I’m proficient in using tools such as Bloomberg, Refinitiv Eikon, and specialized agricultural market information providers. These platforms provide real-time market data, historical price charts, weather forecasts, and crop production estimates. I use this data to generate forecasts, conduct sensitivity analyses, and assess the risk-reward profile of different trading strategies.

For example, I might use a statistical model to analyze historical price data and predict future price movements for corn, considering factors such as planting progress, weather conditions, and global supply and demand. Data visualization tools allow me to present this information clearly to clients, helping them to make informed decisions.

Beyond these tools, I also utilize various spreadsheets and databases to track inventory levels, manage contracts, and calculate profitability. My analytical skills allow me to extract meaningful insights from raw data and translate it into actionable business strategies.

Q 12. Describe your understanding of futures and options contracts in the grain market.

Futures and options contracts are crucial risk management tools in grain merchandising. Futures contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a future date. They provide a way to lock in a price for future delivery, protecting against price volatility. For instance, a farmer might sell a futures contract to guarantee a minimum price for their corn harvest, regardless of the spot price at harvest time. Conversely, a buyer could purchase a futures contract to secure a supply of grain at a fixed price.

Options contracts offer more flexibility. They give the buyer the right, but not the obligation, to buy (call option) or sell (put option) a commodity at a specific price on or before a specific date. Options are useful for hedging against price risks while maintaining some upside potential. For example, a farmer might buy a put option to protect against a price drop, while still benefiting if the market price rises above the strike price.

Understanding the nuances of futures and options contracts, including margin requirements, pricing models, and risk management techniques, is critical for successful grain merchandising. I have years of experience using these tools to manage price risk and optimize profitability.

Q 13. How do you determine the optimal selling price for grain?

Determining the optimal selling price involves a combination of art and science. It’s not just about maximizing immediate profit; it also involves considering market trends, storage costs, and risk tolerance. My approach involves:

- Market analysis: I carefully examine current and projected market prices, taking into account factors such as supply and demand, weather conditions, and global economic conditions.

- Basis analysis: I analyze the difference between the local cash price and the futures price to determine the optimal time to sell. This involves considering factors such as transportation costs and storage availability.

- Risk assessment: I assess the farmer’s risk tolerance and develop a pricing strategy that aligns with their preferences. This might involve hedging techniques to protect against price drops.

- Cost analysis: I take into account storage costs, handling charges, and transportation expenses when determining the optimal selling price.

- Client needs: I work closely with clients to understand their individual needs and preferences, ensuring the pricing strategy meets their financial objectives.

In practice, I might use a combination of forward contracts, cash sales, and hedging strategies to secure the best possible price while managing risk. The optimal price isn’t a fixed point; it’s a dynamic target that changes based on evolving market conditions.

Q 14. How do you manage inventory levels efficiently?

Efficient inventory management is crucial for minimizing storage costs, spoilage, and maximizing profitability. My approach involves a combination of forecasting, monitoring, and strategic decision-making.

- Demand forecasting: I accurately predict future demand based on market trends, contracts, and customer orders. This allows me to optimize inventory levels and avoid overstocking or shortages.

- Inventory tracking: I use sophisticated inventory management systems to track grain quantity, quality, and location in real-time. This provides a clear overview of inventory levels and helps to identify potential issues promptly.

- Quality control: Regular inspections and testing ensure grain quality is maintained throughout the storage period. This helps to prevent spoilage and reduce losses.

- Storage optimization: I strategically allocate grain to different storage facilities based on cost, capacity, and location, optimizing storage costs and logistics.

- Risk management: I continuously monitor market conditions and potential risks, adjusting inventory levels to mitigate losses due to price fluctuations or unforeseen events.

For instance, if I anticipate a price surge in a particular grain, I might increase inventory levels to benefit from the price rise. Conversely, if I anticipate a price drop, I might reduce inventory levels to minimize potential losses.

Q 15. How do you build and maintain strong relationships with clients?

Building and maintaining strong client relationships in grain merchandising is paramount. It’s not just about making a sale; it’s about fostering trust and long-term partnerships. I achieve this through consistent communication, proactive problem-solving, and a genuine commitment to understanding my clients’ needs.

- Regular Communication: I prioritize regular check-ins, not just during transactions, but also to share market updates, discuss industry trends, and simply stay connected. This keeps the lines of communication open and allows me to address potential concerns proactively.

- Understanding Client Needs: I take the time to understand each client’s unique business goals, risk tolerance, and specific requirements. This allows me to tailor my services and provide solutions that truly meet their needs.

- Proactive Problem-Solving: When challenges arise (and they inevitably do in commodity trading!), I am quick to respond, offering creative solutions and working collaboratively with the client to find the best possible outcome. Transparency is key here – I always keep my clients informed about any potential issues or delays.

- Building Trust: Ultimately, strong relationships are built on trust. This comes from consistently delivering on promises, being reliable, and acting with integrity. I always strive to be the go-to person my clients can rely on.

For example, I once worked with a smaller milling company that was struggling to secure consistent high-quality wheat. Through regular communication and market analysis, I was able to identify a reliable supplier and negotiate favorable pricing, helping them improve their profitability and secure their operations. This built a strong, lasting relationship.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are your strategies for identifying new business opportunities?

Identifying new business opportunities in the grain market requires a multi-faceted approach that blends market analysis, networking, and a proactive sales strategy.

- Market Research and Analysis: I constantly monitor global and regional market trends, analyzing supply and demand dynamics, price fluctuations, and geopolitical events that could impact grain production and prices. This helps me identify potential shortages or surpluses, leading to opportunities for arbitrage or strategic sourcing.

- Networking and Relationship Building: I actively attend industry conferences, trade shows, and participate in professional organizations. This allows me to build relationships with potential clients, suppliers, and other industry professionals, creating a network for sourcing and finding new business opportunities.

- Proactive Sales and Marketing: I utilize various marketing techniques like direct outreach (emails, phone calls), attending industry events, and potentially leveraging digital marketing tools to showcase my expertise and capabilities to potential clients. I always aim to add value through market insights and informed advice.

- Developing New Product Offerings: Innovation is key. Exploring new markets, grain varieties, or value-added services can lead to unique opportunities. For instance, I’ve successfully introduced a new organic grain sourcing program to cater to the growing demand for organic food products.

For example, during a period of drought in a key wheat-producing region, my market analysis identified a potential shortage. I proactively contacted clients in need, securing supply from alternative regions and securing profitable contracts. This demonstrates how proactive market analysis can directly lead to profitable business opportunities.

Q 17. Describe your experience with international grain trading.

My experience with international grain trading spans over [Number] years, encompassing various aspects from sourcing to logistics and regulatory compliance. I have worked extensively with [mention specific regions or countries] and have a deep understanding of the complexities involved in navigating international markets. This includes dealing with diverse regulations, currency fluctuations, and logistical challenges associated with transporting grain across borders.

- Sourcing and Procurement: I have established relationships with reliable international suppliers and can efficiently source high-quality grains from various countries, adapting to differing growing seasons and quality standards.

- Logistics and Transportation: I am proficient in managing the entire logistics chain, from arranging shipping and insurance to ensuring timely delivery and adhering to all international regulations related to grain transportation.

- Regulatory Compliance: I have a solid grasp of international trade laws, phytosanitary regulations, and import/export procedures, ensuring seamless and compliant operations across borders.

- Risk Management: International grain trading involves inherent risks (currency exchange, political instability, etc.). I have strategies in place to mitigate these risks, including hedging techniques and thorough due diligence in selecting international partners.

For instance, I successfully navigated a complex situation involving a shipment of corn destined for a buyer in [Country]. Due to unforeseen political instability, there were potential delays and logistical challenges. By utilizing my network of contacts and thorough understanding of the region’s regulations, I secured alternative routes and ensured the shipment reached its destination on time and without issue.

Q 18. What is your understanding of grain inspection and grading standards?

Grain inspection and grading standards are crucial for ensuring quality and fair trade in the grain industry. My understanding encompasses both official grading standards (e.g., USDA standards in the US, or similar standards in other countries) and the practical application of these standards in the field.

- Official Standards: I am familiar with the various official standards utilized in different regions, such as the USDA standards for grain in the US, or the relevant standards in Canada, Australia, or the EU. These standards define quality factors like moisture content, protein level, test weight, and foreign material.

- Inspection Procedures: I understand the procedures involved in official grain inspections, from sample selection to laboratory analysis. I know how to interpret inspection certificates and understand the implications of grading results on pricing and contractual agreements.

- Practical Application: Beyond the official standards, I have hands-on experience in evaluating grain quality visually and using testing equipment. This allows me to assess grain quality during loading, unloading, and storage.

- Dispute Resolution: Understanding grading standards is vital for resolving disputes related to quality discrepancies. I can use my knowledge to negotiate fair settlements and ensure adherence to contractual agreements.

For example, I once helped a client resolve a dispute with a supplier over the protein content of a shipment of soybeans. By referencing the relevant grading standards and collaborating with an independent inspector, we were able to reach a fair resolution that protected my client’s interests.

Q 19. Explain your experience with using different sales and marketing techniques.

My experience with sales and marketing techniques in grain merchandising involves a balanced approach that combines traditional methods with more modern strategies.

- Relationship Building (Traditional): This is foundational. Developing strong relationships with clients and suppliers through personal contact, regular communication, and consistent performance is crucial. Building trust leads to repeat business.

- Market Intelligence and Analysis (Traditional & Modern): Using market reports, news, and my own analysis to identify opportunities and tailor my sales pitch to clients’ specific needs is essential. This also leverages modern data analysis tools.

- Digital Marketing (Modern): While not the primary method in this industry, targeted digital marketing, such as email campaigns and participation in online industry forums, has been used to connect with new potential clients.

- Networking (Traditional & Modern): Industry events and trade shows are excellent venues for networking, as are online professional platforms and groups. I actively participate in these to expand my network and generate new leads.

- Value-Added Services (Modern): I can offer value-added services beyond just the grain itself. This could include risk management strategies, logistics support, or specialized storage solutions, setting me apart from competitors.

For example, I developed a targeted email campaign to inform existing clients of a new organic grain sourcing program. This resulted in increased sales and strengthened relationships with clients seeking sustainable options.

Q 20. How do you handle disputes or conflicts with clients or suppliers?

Handling disputes or conflicts is an inevitable part of grain merchandising. My approach is centered on open communication, fair negotiation, and a commitment to finding mutually beneficial solutions.

- Open Communication: I encourage open and honest communication from the outset. Clearly articulating expectations and addressing any concerns early can prevent misunderstandings from escalating into major conflicts.

- Fair Negotiation: When disputes arise, I prioritize fair and equitable negotiation. This involves considering all perspectives and working to find a solution that is acceptable to all parties involved.

- Mediation and Arbitration: If negotiations fail to reach a resolution, I am prepared to utilize mediation or arbitration services as a neutral third party to assist in resolving the conflict. I carefully select mediators or arbitrators based on their experience and expertise in the grain industry.

- Documentation: Maintaining thorough documentation of all agreements, communications, and transactions is vital. This provides a clear record for resolving disputes and protecting all parties’ interests.

For example, I once had a disagreement with a supplier over a late shipment. By utilizing clear documentation and remaining calm, we were able to negotiate a mutually agreeable compensation that resolved the issue without damaging the relationship. This reinforces the need for open communication and detailed documentation in conflict resolution.

Q 21. What is your experience with using grain trading software and platforms?

My experience with grain trading software and platforms is extensive. I am proficient in using various platforms for market analysis, order management, and risk management.

- Market Analysis Platforms: I utilize sophisticated market analysis platforms to track prices, analyze trends, and identify profitable trading opportunities. This includes both proprietary platforms and widely used industry software.

- Order Management Systems (OMS): I utilize OMS software to manage orders, track shipments, and ensure efficient execution of trades. This often includes integrating with logistics providers and other relevant stakeholders.

- Risk Management Tools: I employ various risk management tools to monitor and mitigate potential risks associated with price fluctuations, currency exchange rates, and logistical delays. This often involves the use of hedging techniques and other financial instruments.

- Data Analytics: I leverage data analytics features to track key performance indicators (KPIs), identify trends, and optimize trading strategies.

For example, using a specific trading platform, I could identify a small price discrepancy between two markets, a difference small enough to be unnoticed by less sophisticated tools. This arbitrage allowed me to make a profit with minimal risk. The utilization of sophisticated data analytic and trading software platforms are critical to success in this field.

Q 22. Describe your understanding of government regulations related to grain trading.

Government regulations in grain trading are multifaceted and crucial for ensuring fair practices, food safety, and market stability. They vary by country but generally cover aspects like grading standards, weighing procedures, contract enforcement, and trading practices. For instance, the USDA in the US sets standards for grain quality, providing a common framework for transactions. These standards define factors like moisture content, damaged kernels, and foreign material, impacting pricing and trade. Regulations also address issues like preventing fraud and manipulation, with penalties for activities such as misrepresentation of grain quality or quantity. Another critical aspect is the regulation of warehousing and storage, ensuring grain safety and preventing losses due to improper handling. Finally, many countries have regulations on grain exports and imports, including licensing, tariffs, and quotas, which significantly influence international trade flows. Understanding these regulations is paramount for avoiding legal issues and operating ethically within the grain market.

For example, a grain merchandiser needs to be fully aware of the specific weight and grade standards mandated by the relevant authority in their region. Failing to adhere to these rules can lead to significant financial penalties and reputational damage.

Q 23. How do you manage grain transportation costs?

Managing grain transportation costs requires a strategic approach encompassing multiple factors. It starts with selecting the most efficient transportation mode – rail, truck, or barge – based on factors like distance, volume, and infrastructure availability. For example, rail is cost-effective for large volumes over long distances, while trucks provide flexibility for shorter hauls and smaller quantities. Negotiating favorable rates with carriers is crucial, leveraging volume discounts and long-term contracts. Optimization of routes and schedules helps minimize transportation time and fuel costs. Real-time tracking and efficient logistics management using technology play a vital role in reducing delays and unexpected expenses. Additionally, careful planning of loading and unloading processes to minimize downtime is essential. For instance, using high-capacity equipment and coordinating with the receiver to ensure smooth handover reduces idle time and labor costs.

In my experience, accurately forecasting demand and optimizing the timing of shipments helps reduce storage costs and prevents transportation bottlenecks, leading to considerable savings. A detailed analysis of all transportation related costs including fuel surcharges, insurance and potential delays in transit is always factored into decision making.

Q 24. How do you assess the creditworthiness of buyers?

Assessing the creditworthiness of buyers is critical to mitigate financial risk in grain trading. This involves a thorough due diligence process encompassing several steps. First, I review the buyer’s financial statements, including balance sheets, income statements, and cash flow statements, to evaluate their financial health and liquidity. Secondly, I assess their payment history, checking for any defaults or late payments with other suppliers. Credit reports from reputable agencies provide valuable insights into their credit history and risk profile. Furthermore, I consider the buyer’s business reputation and track record in the industry. This often involves speaking with industry contacts and verifying their claims independently. Finally, I may require letters of credit or other forms of security to minimize potential losses. The level of scrutiny varies depending on the buyer’s history and the size of the transaction. For smaller, less established buyers, more stringent credit checks are applied.

A real-world example would be a large multinational food processing company versus a smaller, regional mill. The multinational would likely require less intensive credit assessment due to their established financial standing, while more rigorous checks would be essential for the smaller mill.

Q 25. What are your experience with forecasting grain production?

Forecasting grain production involves integrating various data sources and analytical techniques to estimate future yields. I utilize historical yield data, weather forecasts, planting intentions surveys, and satellite imagery to build predictive models. Weather patterns, particularly rainfall and temperature throughout the growing season, are key factors. I also incorporate information on fertilizer usage, pest control measures, and evolving agricultural practices. Statistical methods, such as time-series analysis and regression models, are employed to analyze the data and generate production forecasts. These forecasts are usually presented with a range of possible outcomes to account for uncertainty. Regularly updating the forecasts as new data becomes available is vital to maintain accuracy. For example, an unexpected drought could significantly alter the initial production forecast requiring immediate updates and adjustment of marketing strategies.

My experience includes developing forecasts for major grain producing regions, accurately anticipating yield variations caused by climatic events and technological changes in agricultural practices.

Q 26. What are your strategies for managing grain spoilage and losses?

Managing grain spoilage and losses requires a multi-pronged approach starting with proper storage conditions. This includes maintaining optimal temperature and humidity levels to prevent insect infestation, mold growth, and moisture damage. Regular inspection and monitoring of stored grain are crucial to identify and address issues promptly. Proper aeration of grain bins helps maintain air quality and prevents the buildup of moisture. Effective pest control measures, such as fumigation or the use of insect repellents, are essential in preventing infestations. Finally, maintaining clean and sanitary storage facilities minimizes contamination and reduces the risk of spoilage. In addition, employing a First-In, First-Out (FIFO) system for grain inventory management ensures that older grain is sold before newer grain, minimizing the risk of spoilage in storage.

For example, regularly checking for hot spots in grain storage bins using temperature sensors is a crucial preventive measure. A localized increase in temperature can indicate the onset of spoilage, enabling early intervention before significant losses occur.

Q 27. Describe your experience with developing marketing strategies for specific grain types.

Developing marketing strategies for specific grain types requires a deep understanding of market dynamics, including supply and demand factors, pricing trends, and competitor activities. For example, marketing corn might focus on its use in ethanol production, while wheat marketing emphasizes its suitability for bread making or animal feed. Identifying target markets is crucial—are we focusing on domestic or international buyers, large-scale processors or smaller mills? This influences pricing, logistics, and contract terms. Effective marketing leverages market intelligence to identify opportunities and make informed decisions on timing and pricing of sales. Building strong relationships with buyers, understanding their needs and providing quality products consistently is vital. Effective communication is key—clearly conveying grain quality, delivery terms, and pricing information. Finally, using hedging strategies can help mitigate price risks and ensure profitable sales.

For instance, for a high-protein wheat variety, the marketing strategy would focus on its suitability for high-quality bread-making, targeting premium buyers willing to pay a premium price. Conversely, a lower-protein variety may be targeted to animal feed manufacturers.

Q 28. Explain your approach to building and maintaining a profitable grain merchandising business.

Building and maintaining a profitable grain merchandising business requires a holistic approach integrating several key elements. First, a deep understanding of market dynamics, including supply and demand, pricing, and risk management, is essential. This involves continuously monitoring market trends, analyzing data, and making informed decisions on buying and selling. Efficient operations are crucial, optimizing logistics, storage, and handling to minimize costs and maximize efficiency. Building and maintaining strong relationships with producers, buyers, and other stakeholders is critical for securing favorable contracts and ensuring reliable supply chains. Effective risk management, including hedging and insurance, protects the business against price fluctuations and other uncertainties. Finally, leveraging technology and data analytics enhances operational efficiency and decision-making. Investing in software for inventory management, market analysis, and risk management helps optimize operations and improve profitability.

An example of effective risk management would be hedging a portion of future sales by using futures contracts to lock in a price, mitigating the risk of unexpected price drops. This strategy protects profit margins and helps secure long-term viability.

Key Topics to Learn for Grain Merchandising and Marketing Interview

- Market Analysis & Forecasting: Understanding supply and demand dynamics, price trends, and utilizing market data to anticipate future opportunities and risks. Practical application: Analyzing historical grain prices to predict future pricing strategies.

- Contract Negotiation & Risk Management: Mastering the art of negotiating favorable contracts, hedging strategies to mitigate price volatility, and understanding various risk management tools. Practical application: Developing a hedging strategy to protect against potential price drops.

- Logistics & Supply Chain Management: Understanding grain transportation, storage, and handling. Optimizing logistics for cost-effectiveness and efficiency. Practical application: Evaluating different transportation methods to minimize storage and shipping costs.

- Quality Control & Standards: Knowledge of grain quality parameters, grading standards, and quality assurance processes. Practical application: Implementing quality control measures to ensure grain meets customer specifications.

- Sales & Marketing Strategies: Developing effective marketing plans, identifying target markets, and building strong relationships with buyers and sellers. Practical application: Creating a marketing campaign to increase sales of a specific grain type.

- Financial Analysis & Budgeting: Understanding cost accounting, pricing strategies, profit margins, and managing budgets effectively. Practical application: Developing a detailed financial plan for a specific grain merchandising project.

- Global Trade & Regulations: Understanding international trade regulations, import/export processes, and navigating global market dynamics. Practical application: Exploring opportunities to export grain to international markets.

Next Steps

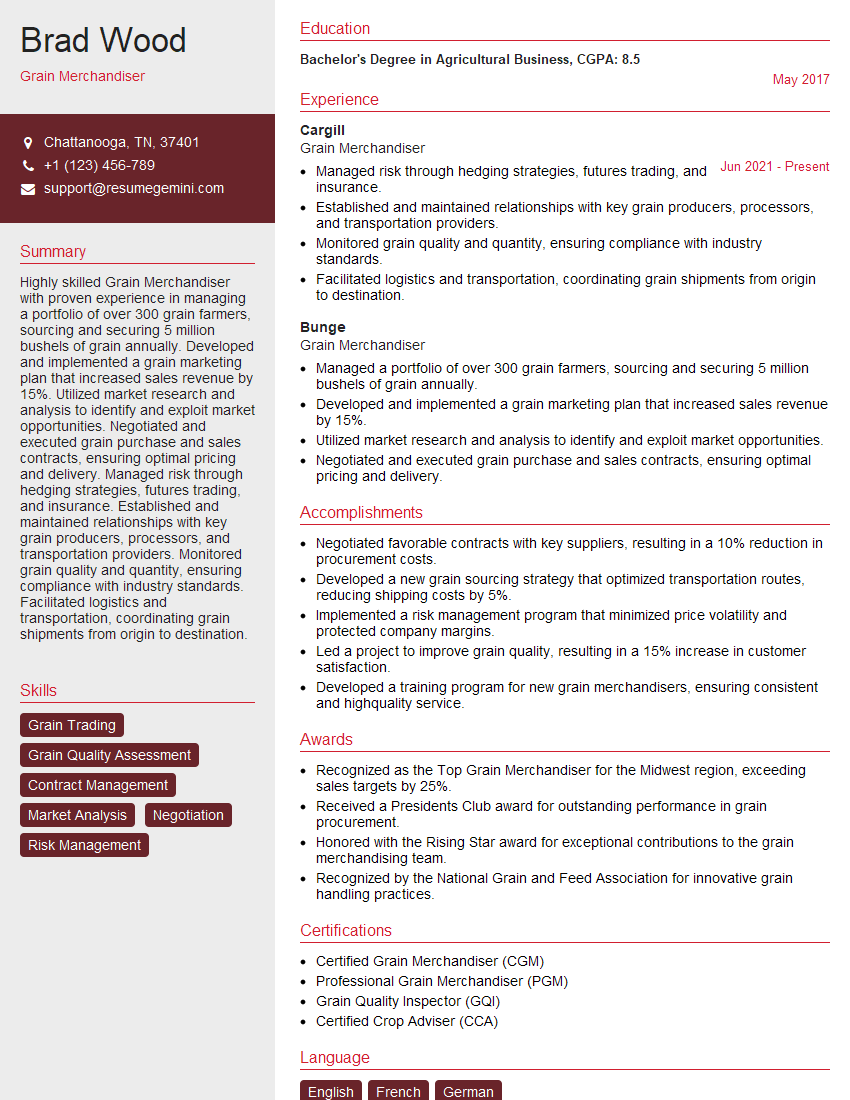

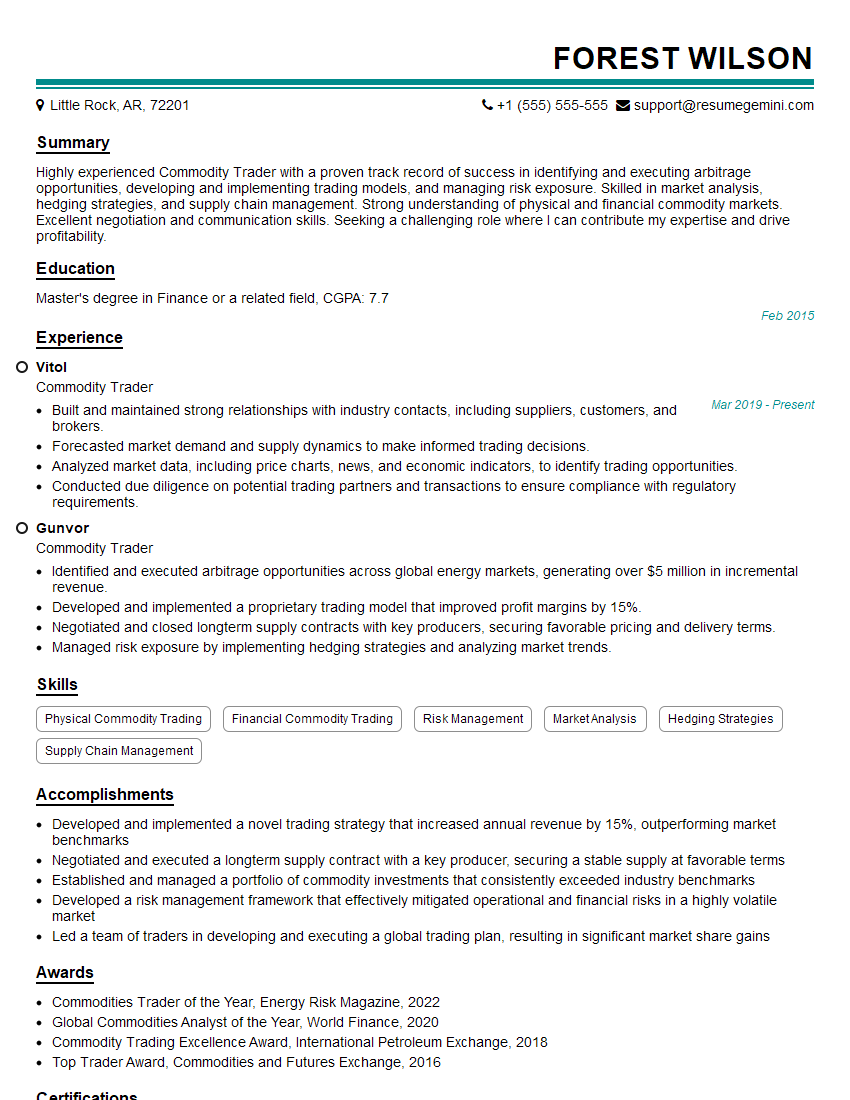

Mastering Grain Merchandising and Marketing opens doors to a rewarding and dynamic career with significant growth potential. A strong understanding of these key areas will set you apart in the competitive job market. To significantly boost your job prospects, investing in a well-crafted, ATS-friendly resume is crucial. ResumeGemini is a trusted resource that can help you build a professional resume tailored to the specific requirements of the Grain Merchandising and Marketing industry. Examples of resumes optimized for this field are available within ResumeGemini to guide you. Take the next step towards securing your dream job – create a powerful resume today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

good