Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Medical Device Market Research and Analysis interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Medical Device Market Research and Analysis Interview

Q 1. Explain the difference between primary and secondary market research in the medical device industry.

In medical device market research, primary and secondary research represent distinct approaches to gathering data. Primary research involves collecting original data directly from the source, while secondary research analyzes existing data.

Primary Research: This entails methods like surveys, focus groups, clinical trials, and in-depth interviews with clinicians, patients, and other stakeholders. For example, a survey distributed to cardiologists to gauge their preference for a new stent design would be primary research. It provides firsthand insights specific to the research question. The advantages include tailored data and direct feedback, but it’s generally more expensive and time-consuming.

Secondary Research: This leverages publicly available or commercially purchased information, such as market reports, industry publications, regulatory filings, and clinical trial data from databases like ClinicalTrials.gov. Analyzing existing sales figures of competing devices constitutes secondary research. It’s more cost-effective and efficient for initial exploration, but the data might not be specific enough or reflect current trends adequately.

Often, a combination of both primary and secondary research methods provides a comprehensive understanding of the market.

Q 2. Describe your experience with market sizing and forecasting for medical devices.

My experience encompasses the entire market sizing and forecasting process for medical devices. This begins with defining the target market (e.g., minimally invasive cardiac surgery devices within the US), identifying relevant product categories, and understanding the current market dynamics. I utilize a combination of top-down and bottom-up approaches.

Top-Down Approach: This method starts with the total market size (e.g., the overall cardiac surgery device market) and then breaks it down into sub-segments. I use publicly available data from market research firms (like Kalorama Information or Medtech Insight), industry reports, and government sources (FDA databases). I then apply growth factors and market penetration rates based on historical data, current market trends (like aging population and technological advancements), and expert interviews.

Bottom-Up Approach: This involves estimating the market size by summing up the sales of individual devices within the target segment. This requires detailed competitive analysis and data on individual product sales, where possible. If direct sales data is unavailable, this can be approximated via sales estimates derived from company press releases, financial statements, and market share reports.

Forecasting involves extrapolating these findings into the future, considering factors such as technological advancements, regulatory changes, reimbursement policies, and competitive activity. Statistical modeling and scenario planning are employed to provide a range of potential outcomes.

Q 3. How do you identify and analyze key market trends impacting the medical device sector?

Identifying and analyzing key market trends requires a multi-faceted approach. It begins with continuous monitoring of industry publications, news articles, regulatory updates, and attending industry conferences. Further, analyzing publicly available data, conducting competitor analyses, and participating in customer interviews are crucial.

Key Trends: Some significant trends I consistently track include:

- Technological advancements: The integration of AI, machine learning, and IoT in medical devices.

- Regulatory changes: New regulations regarding device approval processes and cybersecurity.

- Reimbursement policies: Changes in healthcare financing that impact market access.

- Patient preferences: Growing emphasis on minimally invasive procedures and home healthcare.

- Consolidation and partnerships: Mergers and acquisitions within the medical device industry.

Analysis: The analysis involves assessing the impact of these trends on market size, growth, and competitive landscape. This involves utilizing statistical methods and qualitative assessments to determine potential opportunities and risks for various medical device segments. For example, analyzing the impact of increasing adoption of telemedicine on the demand for remote patient monitoring devices.

Q 4. What are the key regulatory considerations when conducting market research for medical devices?

Regulatory considerations are paramount in medical device market research. Compliance with regulations ensures the integrity and ethical conduct of the research process and safeguards patient safety.

Key Regulatory Considerations:

- HIPAA (Health Insurance Portability and Accountability Act): Protecting patient privacy and data security is critical when collecting and handling patient information.

- GDPR (General Data Protection Regulation): Similar concerns extend to the European Union, requiring careful consideration of data protection regulations.

- FDA regulations (21 CFR Part 820): Research activities must adhere to quality system regulations concerning data integrity, documentation, and validation.

- IRB (Institutional Review Board) approvals: For primary research involving human subjects, ethical review and approval from an IRB are mandatory.

- Data privacy and security: Implementing robust measures to protect sensitive patient data during all stages of research.

Ignoring these regulations can result in significant legal repercussions, reputational damage, and compromised research validity. Therefore, establishing a strong regulatory compliance framework is essential for any medical device market research project.

Q 5. Explain your familiarity with competitive intelligence tools and techniques.

My familiarity with competitive intelligence tools and techniques is extensive. These tools and techniques help in gathering, analyzing, and interpreting information about competitors to gain a competitive advantage.

Tools:

- Market research databases: Accessing reports and market analyses from firms like Statista, IBISWorld, and specialized medical device market research firms.

- Company websites and financial filings: Analyzing public information about competitor strategies, products, and financial performance (SEC filings, press releases).

- Patent databases: Tracking competitor innovation and intellectual property landscape (e.g., USPTO database).

- Social media monitoring: Tracking brand mentions, customer reviews, and industry discussions.

- Web scraping and data analytics tools: Gathering and analyzing large datasets from various online sources.

Techniques:

- Competitive benchmarking: Comparing the company’s performance against key competitors across various metrics.

- SWOT analysis: Identifying strengths, weaknesses, opportunities, and threats of competitors.

- Porter’s Five Forces: Analyzing the competitive forces in the industry to understand market dynamics.

- Scenario planning: Developing different scenarios based on possible competitor actions.

The combination of these tools and techniques provides a holistic picture of the competitive landscape.

Q 6. How do you assess the competitive landscape for a specific medical device?

Assessing the competitive landscape involves a structured approach. It begins by identifying key competitors and understanding their market position, product portfolio, strengths, weaknesses, and strategies. For a specific medical device, the analysis will typically involve:

1. Competitor Identification and Profiling: This includes listing all relevant competitors, their market share, and their key product offerings. Detailed profiles would include financial performance, R&D activities, marketing strategies, and distribution channels.

2. Market Share Analysis: Determining each competitor’s market share to identify the dominant players and market concentration.

3. Product Analysis: A deep dive into the features, functionalities, pricing, and clinical evidence for competing devices. This can involve comparing the new device to existing ones in terms of performance, safety, and usability.

4. Competitive Advantage Assessment: Identifying the unique selling propositions (USPs) and competitive advantages of each competitor. This includes evaluating their intellectual property, manufacturing capabilities, and go-to-market strategies.

5. Competitive Strategy Analysis: Understanding the strategies each competitor is employing to gain market share (e.g., pricing, product innovation, strategic partnerships).

The result is a comprehensive competitive landscape report that provides actionable insights for the company.

Q 7. How would you evaluate the potential market for a new medical device?

Evaluating the potential market for a new medical device requires a thorough assessment of market size, growth rate, target customer needs, and competitive landscape. This involves a multi-stage process:

1. Market Definition and Segmentation: Clearly define the target market and segment it based on factors like geography, disease indication, patient type, and healthcare setting.

2. Market Sizing and Forecasting: Estimate the current market size and project future growth, considering factors discussed in the market sizing and forecasting section.

3. Needs Assessment: Understand the unmet needs of the target customer segment. This requires conducting primary research such as surveys, interviews, and focus groups to gather insights from clinicians, patients, and payers.

4. Competitive Analysis: Evaluate the competitive landscape to identify existing alternatives, potential substitutes, and the competitive advantages of the new device.

5. Regulatory Pathway Analysis: Assess the regulatory hurdles and approval timelines associated with the device.

6. Pricing and Reimbursement Strategy: Develop a pricing strategy that is competitive and aligns with the reimbursement landscape.

7. Market Entry Strategy: Develop a plan for launching the device, considering distribution channels, marketing strategies, and sales force development.

This comprehensive evaluation provides a clear picture of the potential market opportunity, helping to inform strategic decisions regarding development, launch, and commercialization of the new medical device.

Q 8. Describe your experience with qualitative research methods (e.g., focus groups, interviews).

Qualitative research is crucial in understanding the why behind market trends in the medical device sector. I have extensive experience conducting in-depth interviews with clinicians, patients, and hospital administrators to gather rich, nuanced data. Focus groups, another key method I utilize, allow for the exploration of shared perspectives and the identification of common themes. For example, in a recent project focusing on a new surgical tool, individual interviews helped uncover specific anxieties surgeons had regarding the device’s ergonomics, while a focus group session revealed a collective concern about the device’s integration into existing surgical workflows. These qualitative insights are invaluable in shaping product design and messaging.

My approach emphasizes active listening, open-ended questioning, and a non-judgmental environment to encourage participants to share their honest opinions. Data analysis involves thematic analysis, identifying recurring patterns and meanings within the transcribed interviews and focus group recordings. This allows us to move beyond simple summaries and truly understand the underlying needs and motivations.

Q 9. Describe your experience with quantitative research methods (e.g., surveys, statistical analysis).

Quantitative research provides the numerical data necessary to quantify market size, assess adoption rates, and predict future trends. My experience encompasses designing and implementing large-scale surveys, analyzing data using statistical software (like SPSS or R), and employing various statistical techniques such as regression analysis and hypothesis testing. For instance, to evaluate market potential for a new diabetic monitoring device, we deployed a large online survey to gather data on prevalence of diabetes, current treatment methods, and patient preferences. This quantitative data allowed us to segment the market and identify key target demographics.

I’m proficient in using statistical methods to analyze survey data, sales figures, and clinical trial results to identify significant trends and patterns. This includes interpreting p-values, confidence intervals, and effect sizes to accurately represent findings and minimize biases. This rigorous approach ensures that our quantitative insights are both statistically sound and actionable.

Q 10. How do you use market research data to inform product development decisions?

Market research data is the cornerstone of informed product development. It guides every stage, from initial concept generation to final product launch. We use market size estimations to assess the commercial viability of a new device. For example, if our research shows a small target market for a niche device, we might reassess the project’s feasibility or adjust the marketing strategy to focus on a more lucrative segment. Patient feedback, gathered through qualitative methods, shapes design features and usability. Quantitative data, like competitor analysis, informs pricing strategies and market positioning.

A practical example would be the development of a minimally invasive surgical instrument. Qualitative data from surgeons might reveal a preference for smaller, lighter instruments. Quantitative data on procedure volume in specific surgical specialties would determine target market size and potential revenue. By integrating these data points, we can design a device that meets clinical needs and has a viable business model.

Q 11. How do you interpret and present market research findings to stakeholders?

Presenting research findings clearly and concisely to stakeholders, including executives, engineers, and clinicians, is critical. My approach is tailored to the audience, balancing technical detail with accessibility. I avoid technical jargon when possible and use visual aids like charts, graphs, and infographics to illustrate key findings. For example, instead of presenting a table of raw survey data, I might create a bar chart comparing patient satisfaction scores across different device features. This allows stakeholders to quickly grasp the information and make informed decisions.

My presentations typically include a clear executive summary highlighting key insights and recommendations, followed by a deeper dive into the methodology and data analysis. I also encourage interactive discussions to ensure all stakeholders understand the implications of the research and can contribute to the decision-making process. A strong emphasis is placed on transparently explaining any limitations or uncertainties associated with the data.

Q 12. What are the key success factors for launching a new medical device?

Successfully launching a new medical device requires a multi-faceted strategy. Key success factors include a strong regulatory pathway (navigating FDA or equivalent approvals), a compelling clinical need, robust clinical data supporting efficacy and safety, a well-defined target market, a competitive market strategy, and strong manufacturing and supply chain capabilities. Equally crucial is a skilled commercialization team experienced in medical device sales and marketing.

One significant aspect often overlooked is establishing a strong intellectual property (IP) portfolio to protect the innovation. For example, a device with weak IP protection would be vulnerable to competition and potentially hinder its long-term success. Ultimately, a successful launch requires a synergistic alignment between clinical value, regulatory compliance, market readiness, and a robust commercial strategy.

Q 13. How do you identify unmet clinical needs in the medical device market?

Identifying unmet clinical needs requires a thorough understanding of current practices and limitations. I combine several methods. Firstly, I review existing medical literature, including peer-reviewed articles and clinical trial results, to identify gaps in treatment options or technological limitations. Secondly, I conduct in-depth interviews with clinicians to understand their frustrations, challenges, and unmet needs in their daily practice. Thirdly, I analyze patient feedback to understand their experiences and perspectives.

For example, through conversations with cardiologists, we identified a need for a less invasive method for treating a specific cardiac condition. Current methods were often associated with lengthy recovery times. This insight led to the development of a new minimally invasive device, validated through rigorous clinical trials, addressing the previously unmet clinical need and improving patient outcomes. The process involves iterative feedback loops to continuously refine our understanding of the problem and potential solutions.

Q 14. What are some common challenges in conducting medical device market research?

Medical device market research presents unique challenges. One major hurdle is gaining access to relevant data. Clinical data is often proprietary, and patient privacy regulations (like HIPAA) impose strict limitations on data sharing. Another challenge is the complexity of the regulatory landscape. Research must adhere to stringent guidelines to ensure ethical and accurate results, which can be complex and time-consuming. The long sales cycles typical in the medical device industry also make it harder to quickly assess the market impact of a new product.

Furthermore, the high cost of medical device development and testing means that research needs to be extremely efficient to justify investment. The dynamic nature of the healthcare industry and its technological advancements also mean market research must adapt rapidly to remain relevant. For example, changes in healthcare reimbursement policies can significantly alter market dynamics, making accurate forecasting challenging.

Q 15. Explain your experience using market research databases (e.g., IMS Health, IQVIA).

My experience with market research databases like IMS Health (now IQVIA) and IQVIA itself is extensive. I’ve utilized these platforms for over ten years to gather comprehensive data on various medical device markets. This involves not just accessing the raw data but also mastering the nuances of their respective interfaces and analytical tools. For example, I’ve used IQVIA’s databases to analyze procedure volumes for cardiovascular implants, identifying key growth areas in specific geographic regions. With IMS data, I’ve tracked market share changes over time for a particular diagnostic device, pinpointing competitive dynamics and informing strategic planning for a client. My expertise extends to effectively navigating the different data sets available – from sales and procedure data to market forecasts and reimbursement information – to build a holistic understanding of the market landscape.

Beyond basic data retrieval, I’m proficient in utilizing advanced analytical functionalities within these platforms, such as cohort analysis to segment patient populations based on disease severity or treatment patterns. This granular level of analysis has proven invaluable for creating targeted marketing campaigns and shaping product development strategies.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you manage and analyze large datasets in market research?

Managing and analyzing large datasets in medical device market research requires a structured approach combining technical skills with domain expertise. Think of it like assembling a complex puzzle – each piece of data needs to be correctly placed to form a coherent picture.

- Data Cleaning and Preprocessing: This initial step is critical. I use tools like R and Python with packages such as

pandasanddplyrto clean and transform raw data, handling missing values, outliers, and inconsistencies. This ensures the accuracy and reliability of subsequent analyses. - Statistical Analysis: I employ various statistical methods, including regression analysis, time series forecasting, and hypothesis testing, to extract meaningful insights from the data. For example, regression analysis helps determine the correlation between factors like physician adoption rates and device sales.

- Data Visualization: Clear and effective data visualization is paramount. I utilize tools such as Tableau and Power BI to create dashboards and reports that present complex data in an easily digestible format for both technical and non-technical audiences. This allows for quick identification of trends and patterns.

- Database Management Systems (DBMS): For larger projects, I leverage DBMS like SQL Server or MySQL to efficiently store, manage, and query massive datasets. This ensures scalability and facilitates data sharing among team members.

The entire process is iterative, requiring constant validation and refinement of the analysis based on the evolving understanding of the market.

Q 17. Describe your experience with market segmentation and targeting strategies.

Market segmentation and targeting are crucial for effective marketing and product development in the medical device industry. It’s about understanding the diverse needs and characteristics of different customer groups. I typically segment the market based on several factors:

- Physician Specialty: Cardiologists, orthopedists, and neurosurgeons have distinct needs and preferences for medical devices.

- Hospital Size and Type: Large academic medical centers versus smaller community hospitals may have different purchasing power and priorities.

- Geographic Location: Reimbursement policies and patient demographics vary significantly across regions.

- Clinical Needs: Segmentation can be based on the specific disease or condition the device addresses (e.g., different types of cardiac arrhythmias).

Once segmented, I develop targeted strategies to reach each segment effectively. For instance, a new minimally invasive surgical device might target high-volume surgical centers first, focusing on physicians who are early adopters of new technologies. A less complex device, however, might be initially targeted at community hospitals with simpler procedures.

Q 18. How do you use market research to inform pricing strategies for medical devices?

Market research plays a vital role in setting optimal pricing strategies for medical devices. It’s not simply about maximizing profits; it’s about finding the price point that balances profitability with market competitiveness and customer affordability.

My approach involves:

- Competitive Analysis: Analyzing prices of similar devices offered by competitors to understand the market landscape and benchmark our pricing.

- Value Assessment: Determining the perceived value of the device to the customer, considering factors like clinical efficacy, ease of use, and long-term benefits. Higher perceived value justifies higher prices.

- Cost Analysis: Understanding the total cost of producing and distributing the device to ensure profitability at the target price.

- Price Elasticity: Analyzing how demand changes in response to price variations. A highly price-elastic market might benefit from a lower price point to gain market share.

- Reimbursement Landscape: Understanding reimbursement policies (e.g., Medicare, private insurers) is critical, as these significantly impact customer willingness to pay.

Ultimately, the goal is to find a price point that optimizes sales revenue while achieving profitability and market acceptance. For instance, a breakthrough device with superior clinical outcomes may command a premium price, while a less innovative device may require a more competitive price to compete in the marketplace.

Q 19. How do you assess the reimbursement landscape for a medical device?

Assessing the reimbursement landscape for a medical device is a critical step in the market analysis process. It directly influences the market accessibility and potential for commercial success.

My approach includes:

- Payer Landscape Analysis: Identifying all relevant payers (Medicare, Medicaid, private insurance companies) and their respective reimbursement policies for the device’s intended use.

- Coding and Classification: Determining the appropriate Healthcare Common Procedure Coding System (HCPCS) codes and other relevant classifications for the device to ensure accurate billing and reimbursement.

- Reimbursement Rate Analysis: Analyzing the reimbursement rates offered by various payers to project potential revenue streams.

- Regulatory Pathways: Understanding the regulatory requirements necessary to obtain reimbursement approval (e.g., FDA approval, CMS coverage determination).

- Policy Trends: Monitoring changes in healthcare policy, including reimbursement regulations, which can significantly impact profitability.

For instance, a new device might need to go through a prolonged process to obtain coverage from Medicare. Understanding this timeline and its impact on market entry is essential for making informed business decisions.

Q 20. What are the key differences between researching different medical device categories (e.g., diagnostics, implants)?

Researching different medical device categories requires adapting methodologies to the specific characteristics of each category. The differences are significant:

- Diagnostics: Research in this area focuses on market size, testing volumes, accuracy and sensitivity comparisons with existing technologies, and the regulatory pathway for approval. Market segmentation is frequently driven by specific disease states and testing methodologies.

- Implants: For implants, the research delves into procedure volumes, surgeon adoption rates, clinical outcomes data from clinical trials and post-market surveillance, and the cost-effectiveness relative to alternative treatments. Market segmentation can be driven by patient demographics and the specific implant type (e.g., hip replacement versus knee replacement).

- Other Categories (e.g., therapeutic devices): Other categories, such as therapeutic devices, require tailored approaches based on their specific function and application. For example, researching minimally invasive surgical tools would require a deep understanding of surgical procedures, hospital infrastructure, and surgeon preferences.

Essentially, each device category requires a specialized understanding of the clinical landscape, the competitive dynamics, and the regulatory environment to successfully conduct market research.

Q 21. How do you stay up-to-date on industry trends and regulatory changes in medical device market research?

Staying current in the dynamic medical device market is critical. My approach is multifaceted:

- Industry Publications and Journals: I regularly read leading industry publications such as MD+DI, Medical Device Technology, and journals like the Journal of Medical Devices, staying abreast of technological advancements, market trends, and regulatory changes.

- Conferences and Trade Shows: Attending key industry events like the AdvaMed conference provides direct exposure to new technologies, market insights, and networking opportunities with industry leaders.

- Regulatory Agencies’ Websites: Closely monitoring websites of the FDA (in the US) and other relevant regulatory bodies worldwide allows me to track policy changes and upcoming regulatory announcements.

- Competitive Intelligence: Analyzing competitor activity through press releases, patent filings, and market reports allows me to anticipate shifts in the competitive landscape.

- Professional Networks: Participating in industry associations and maintaining a network of contacts within the medical device sector offers a valuable source of up-to-date information and insights.

This multi-pronged approach allows me to proactively adapt my analyses and insights to stay ahead of industry shifts and inform strategic decisions for my clients.

Q 22. Describe your experience with developing market research reports and presentations.

Developing comprehensive market research reports and presentations for the medical device industry requires a meticulous approach. My experience encompasses the entire process, from initial research design and data collection to final report writing and presentation delivery. I’ve led numerous projects, involving both quantitative and qualitative methods. This includes defining the scope of the research, identifying key target audiences (e.g., surgeons, hospital administrators, patients), developing questionnaires and interview guides, managing data collection (often involving multiple sources like surveys, interviews, and secondary data analysis), performing statistical analysis, and ultimately creating compelling narratives to communicate findings.

For instance, in a recent project analyzing the market for minimally invasive surgical robots, I led a team that conducted extensive primary and secondary research. We surveyed surgeons to understand their preferences and needs, analyzed sales data to identify market trends, and conducted competitive analyses to understand the strengths and weaknesses of existing products. The final report included detailed market sizing, segmentation, and growth forecasts, presented in a visually engaging format with clear actionable insights for the client.

My presentations are always tailored to the audience, whether it’s a board of directors, a marketing team, or a sales force. I focus on delivering key findings clearly and concisely, using visuals like charts, graphs, and maps to enhance understanding and impact. I’m experienced in using presentation software like PowerPoint and specialized data visualization tools to create high-impact presentations.

Q 23. How do you handle conflicting data or interpretations in your market research?

Conflicting data or interpretations are common in market research, particularly in a complex industry like medical devices. My approach involves a systematic process to resolve these discrepancies. First, I rigorously review the data sources and methodologies to identify potential biases or errors. This often involves checking for inconsistencies in data collection, sampling methods, and data entry. If discrepancies persist, I delve deeper into the context of the data, considering factors like regional variations, changes in healthcare policies, or the influence of competitive products.

For example, if primary research suggests a strong preference for a particular feature, while secondary data suggests a different trend, I would investigate the potential reasons for this divergence. This might involve examining the demographics of the survey respondents or exploring the limitations of the secondary data source. Sometimes, reconciling conflicting data requires a qualitative approach— conducting further interviews or focus groups to gather additional insights and contextual information.

Ultimately, my aim is not to force a single, simplistic conclusion, but rather to present a nuanced picture that acknowledges the uncertainties and complexities involved. The final report will transparently discuss any unresolved conflicts, outlining potential reasons for the discrepancies and their implications for decision-making.

Q 24. Describe a time you had to adapt your market research approach due to unexpected challenges.

During a study on the adoption rate of a new cardiac monitoring device, we initially planned to conduct a large-scale survey of cardiologists. However, we encountered unexpectedly low response rates due to competing priorities and time constraints among our target audience. To overcome this challenge, we quickly adapted our approach. We switched to a mixed-methods design, supplementing the survey with in-depth interviews with key opinion leaders in the cardiology community.

This allowed us to gather richer qualitative data and to triangulate our findings by comparing the results of our interviews with the limited survey data. It allowed us to capture insights that might not have been apparent from a solely quantitative approach. The interviews provided deeper context and explained the reasons for the low survey response rates, for example, certain cardiologists hadn’t had exposure to the new technology.

This experience highlighted the importance of flexibility and adaptability in market research. We needed to be prepared to modify our strategy based on real-world conditions and to recognize the limitations of any single research method. The resulting report, while smaller in scale than originally planned, provided valuable qualitative insight and reliable market projections.

Q 25. How familiar are you with different market research methodologies (e.g., conjoint analysis, discrete choice experiments)?

I’m highly familiar with various market research methodologies, including both quantitative and qualitative approaches. My expertise includes advanced techniques such as conjoint analysis and discrete choice experiments which are particularly valuable in the medical device market. Conjoint analysis helps understand how consumers weigh different attributes of a product (e.g., price, efficacy, safety, ease of use) when making purchase decisions. This is crucial for optimizing product design and pricing strategies for medical devices.

Discrete choice experiments (DCEs) are similar but focus on the choice between different alternatives. This is extremely useful for predicting market share and understanding the factors driving preference for one medical device over another. Both methods require a strong understanding of statistical modeling and are valuable for creating predictive models, informing go-to-market strategies, and predicting market share.

Beyond these, I have extensive experience with other methods, including surveys (both online and in-person), focus groups, interviews, secondary data analysis (using databases like Medline, regulatory filings, and market reports), and competitive intelligence gathering. The choice of methodology depends heavily on the specific research question, budget, and timeline.

Q 26. How do you ensure the ethical conduct of market research in the medical device industry?

Ethical conduct is paramount in medical device market research. My approach adheres strictly to relevant regulations and ethical guidelines, including those set by the International Chamber of Commerce (ICC) and the Market Research Society (MRS). I prioritize informed consent, ensuring participants understand the purpose of the research, their rights, and how their data will be used and protected. Anonymity and confidentiality are strictly maintained throughout the research process and data security protocols are meticulously implemented to prevent unauthorized access.

In the medical device industry, particular attention must be paid to the potential impact on patient safety and data privacy. For example, when conducting research involving patient data, I ensure compliance with HIPAA (Health Insurance Portability and Accountability Act) regulations in the United States, or equivalent regulations in other jurisdictions. I rigorously review all research protocols and materials to minimize any potential risks or biases that could compromise the integrity of the study or endanger participants.

Transparency is also crucial. I ensure all research sponsors and stakeholders are informed of the research methodology, limitations, and any potential conflicts of interest. The accurate reporting of findings is also essential and I avoid any misrepresentation or manipulation of data.

Q 27. Describe your experience with using statistical software (e.g., SPSS, R, SAS) for market research analysis.

I’m proficient in several statistical software packages, including SPSS, R, and SAS. My experience spans data cleaning, manipulation, analysis, and visualization. I regularly use these tools for descriptive statistics, regression analysis (linear, logistic, etc.), hypothesis testing, and other statistical methods necessary for market research analysis. I’m comfortable working with large datasets and performing complex statistical modeling.

For instance, in a recent project, I used R to perform a conjoint analysis to determine the relative importance of different features of a new surgical instrument. The data was cleaned and prepared in R, and then the conjoint analysis was performed using specialized packages. The results were visualized using custom-built graphs and charts, illustrating the tradeoffs between different feature combinations and their impact on predicted market share.

My proficiency extends to data visualization techniques, ensuring that findings are presented clearly and effectively. I can create informative and visually appealing charts and graphs to communicate complex statistical results to both technical and non-technical audiences. I regularly leverage R’s ggplot2 package for creating high-quality visualizations.

Q 28. How do you integrate market research findings with other business functions (e.g., sales, marketing, R&D)?

Integrating market research findings with other business functions is crucial for maximizing their impact. I strive to make the results actionable and relevant for sales, marketing, and R&D teams. This starts with clear communication of findings, tailored to the specific needs of each team.

For the sales team, this might involve identifying key target customer segments and their unmet needs, or providing forecasts to help with sales planning. For marketing, the research provides insights into effective messaging, channel selection, and product positioning. For R&D, market research provides critical information for product development, ensuring the company is focusing its resources on products with strong market potential.

In practice, this integration often involves workshops and presentations to disseminate the findings and facilitate collaborative discussions. I actively participate in these sessions to explain the research and address questions from other departments. I also help to develop actionable recommendations based on the research, creating implementation plans to translate the insights into concrete strategies.

For example, in a project studying the market for a new diagnostic device, the market research revealed a strong need for improved user-friendliness. This led to collaborative work between the R&D team, who modified the device’s design, and the marketing team, who developed training programs to support user adoption.

Key Topics to Learn for Medical Device Market Research and Analysis Interview

- Market Sizing and Forecasting: Understanding methodologies like top-down and bottom-up approaches, and applying them to estimate market potential for specific medical devices. Practical application: Developing a forecast for a new minimally invasive surgical tool considering factors like adoption rates and reimbursement policies.

- Competitive Analysis: Identifying key competitors, analyzing their strengths and weaknesses, and understanding their market share. Practical application: Creating a competitive landscape report for a specific type of cardiac implant, including analysis of pricing strategies and technological advancements.

- Regulatory Landscape: Deep understanding of FDA regulations (510(k), PMA), EU MDR, and other relevant international regulations impacting medical device development and commercialization. Practical application: Assessing the regulatory pathway for a new diagnostic device and estimating timelines for approval.

- Data Analysis and Interpretation: Proficiency in using statistical software (e.g., SPSS, R) to analyze market data, identify trends, and draw meaningful conclusions. Practical application: Analyzing sales data to identify key drivers of growth and areas for improvement in marketing strategies.

- Market Segmentation and Targeting: Identifying and defining key customer segments within the medical device market based on demographics, clinical needs, and purchasing behavior. Practical application: Defining target customer profiles for a new telehealth device targeting specific patient populations.

- Report Writing and Presentation: Effectively communicating research findings through concise and compelling reports and presentations. Practical application: Presenting market research findings to senior management, including recommendations for strategic decision-making.

- Qualitative Research Methods: Understanding and applying qualitative methods such as interviews, focus groups, and ethnography to gain insights into customer needs and preferences. Practical application: Conducting user interviews with surgeons to understand their requirements for a new surgical instrument.

Next Steps

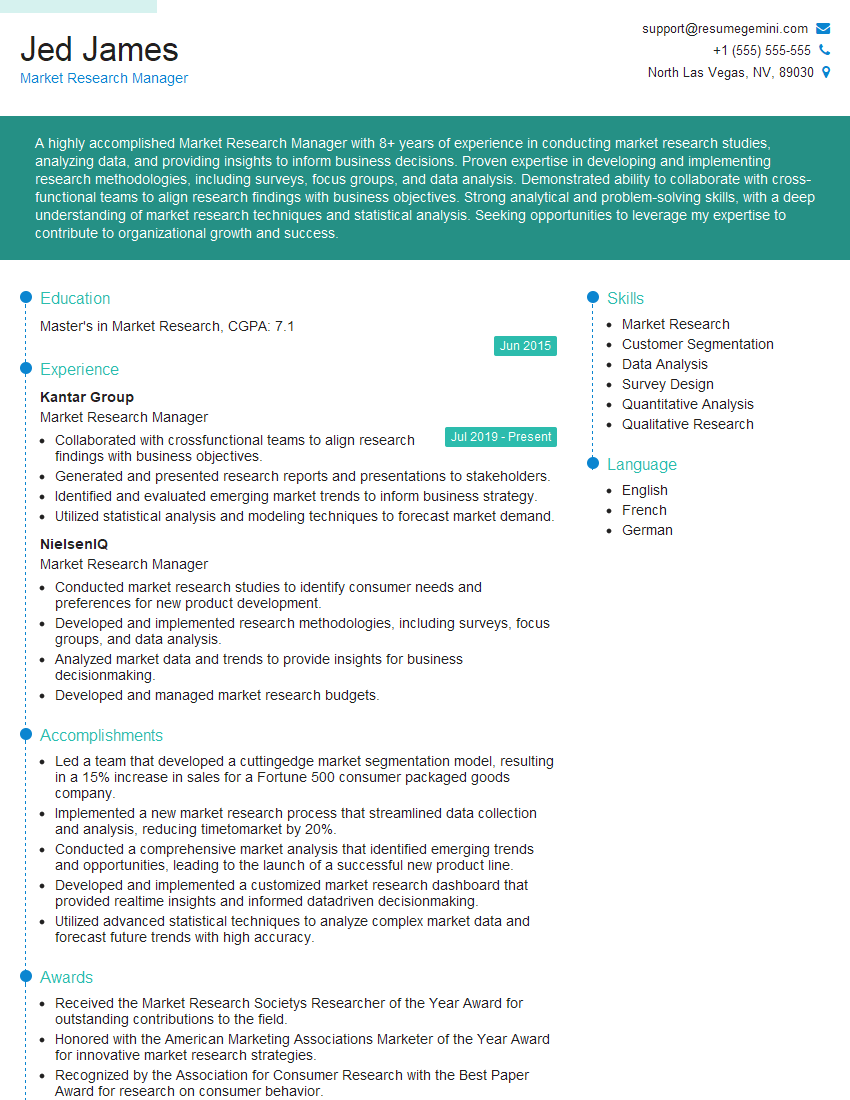

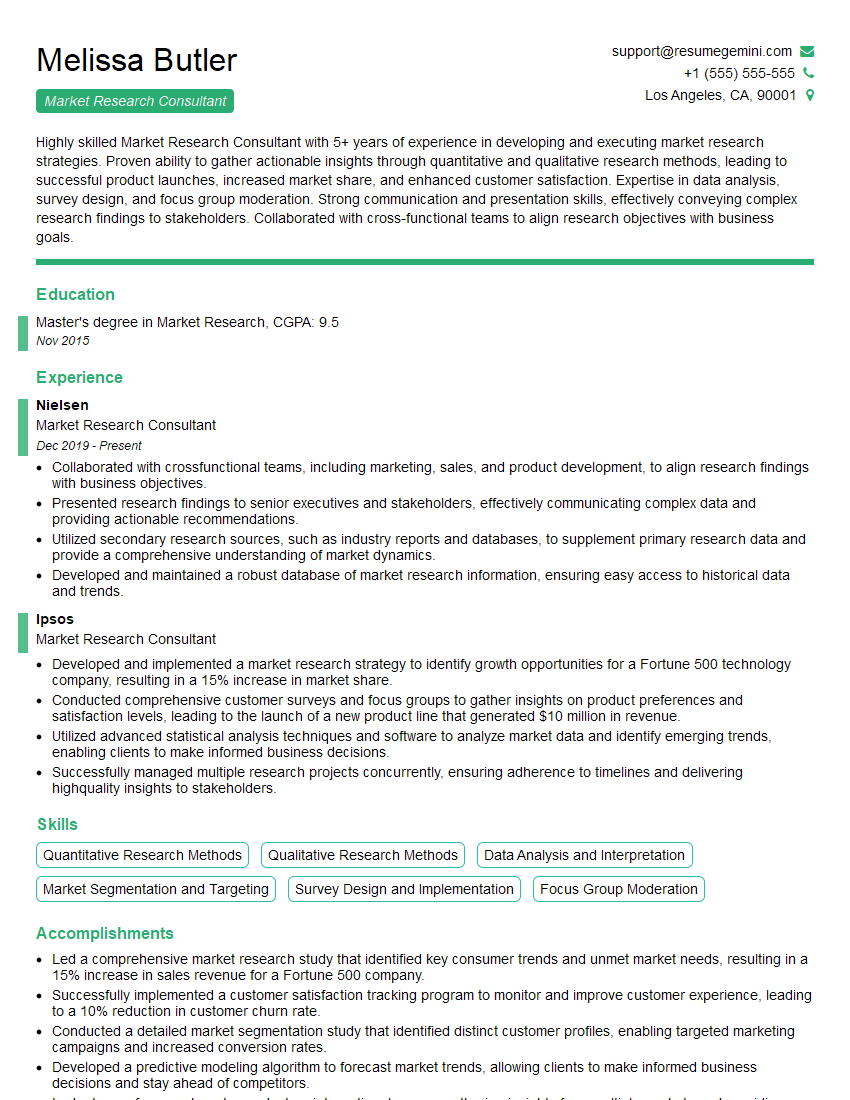

Mastering Medical Device Market Research and Analysis is crucial for career advancement in this dynamic field. It opens doors to leadership roles, higher earning potential, and the opportunity to significantly impact patient care. To maximize your job prospects, it’s essential to create a compelling, ATS-friendly resume that highlights your skills and experience. We highly recommend using ResumeGemini to build a professional and impactful resume that showcases your expertise in this specialized area. ResumeGemini provides examples of resumes tailored to Medical Device Market Research and Analysis, helping you create a document that stands out from the competition. Invest in your future – build a standout resume today.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good