Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Wholesale and retail buying interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Wholesale and retail buying Interview

Q 1. Explain the difference between wholesale and retail pricing strategies.

Wholesale and retail pricing strategies differ significantly due to their target markets and sales volumes. Wholesale pricing focuses on selling large quantities of goods to retailers or other businesses at a lower per-unit price, enabling them to mark up the products and sell them to end consumers. Retail pricing, on the other hand, focuses on individual consumers and incorporates factors like perceived value, competition, and profit margins at a higher price point per unit.

Example: Imagine a clothing manufacturer producing t-shirts. They might sell 1000 t-shirts to a retailer at $5 each (wholesale price). The retailer then sells each t-shirt to individual customers for $15 (retail price), making a $10 profit per unit. The manufacturer makes a profit on the volume sold, while the retailer makes a profit on the markup.

Key differences are summarized as follows:

- Volume: Wholesale deals with high volumes, retail with individual sales.

- Price: Wholesale price is lower per unit, retail price is higher per unit.

- Margins: Wholesale margins are lower but volume driven, retail margins are higher but based on individual sales.

- Target customer: Wholesale targets businesses, retail targets consumers.

Q 2. How do you analyze market trends to inform buying decisions?

Analyzing market trends is crucial for successful buying. My approach involves a multi-faceted strategy. Firstly, I closely monitor industry publications, trade shows, and market research reports to identify emerging trends and predict future demand. Secondly, I analyze sales data from previous periods, including seasonality and promotions, to understand buying patterns and customer preferences. Finally, I use social media listening tools and competitor analysis to gauge consumer sentiment and competitive landscape. This holistic view allows me to make informed decisions, aligning my purchasing with current demand and future projections.

Example: If I notice a surge in demand for sustainable products via market research and social media, I’ll adjust my buying strategy to prioritize eco-friendly items, ensuring I meet the increasing consumer demand.

Q 3. Describe your experience with negotiating prices with vendors.

Negotiating with vendors is a key skill. My approach is collaborative yet firm. I start by building strong relationships with vendors, understanding their costs and business constraints. I then present a well-researched offer, backing it up with market data and sales projections. I always aim for a win-win scenario where both parties benefit. If the initial offer is rejected, I explore alternatives such as negotiating payment terms, order quantities, or exploring different product variations. I’m always prepared to walk away if the terms are not favorable, demonstrating my commitment to securing optimal pricing for my company.

Example: Once, I negotiated a bulk discount with a vendor by committing to a larger order size over a longer period. This provided cost savings for both of us – them through guaranteed sales and me through reduced unit cost.

Q 4. How do you manage inventory levels to minimize waste and maximize profitability?

Managing inventory efficiently is key to profitability. I use a combination of forecasting techniques and inventory management systems to maintain optimal stock levels. Demand forecasting helps predict future sales, while inventory management software allows for real-time tracking of stock levels. This allows us to prevent stockouts, minimize waste due to obsolescence or spoilage, and avoid tying up capital in excess inventory. Regularly reviewing sales data and adjusting forecasts as needed ensures our inventory aligns with actual demand.

Example: Using ABC analysis, we prioritize high-value items (A items) which require tighter inventory control, and allocate resources accordingly. Low-value items (C items) may have more lenient stock management strategies.

Q 5. What metrics do you use to assess the success of your buying decisions?

Several key metrics assess the success of buying decisions. Gross margin return on investment (GMROI) measures the profitability of inventory, indicating how efficiently inventory is turned into profit. Inventory turnover rate shows how quickly inventory is sold, highlighting efficiency and minimizing the risk of obsolescence. Sell-through rate tracks the percentage of purchased inventory sold, providing insights into demand accuracy. Stockout rate measures the frequency of product unavailability, indicating potential losses from unmet demand. By tracking these metrics, I can identify areas for improvement and fine-tune my purchasing strategies.

Q 6. Explain your process for selecting and evaluating potential vendors.

Selecting and evaluating vendors requires a thorough process. I start by identifying potential vendors through industry directories, online searches, and referrals. The evaluation involves assessing several factors, including their financial stability, manufacturing capabilities, quality control processes, ethical practices, and delivery reliability. I request samples and conduct thorough quality checks. I also examine their references and review past performance. Finally, I negotiate contracts outlining clear terms and conditions, including pricing, payment schedules, and quality standards.

Example: Before selecting a new vendor, I always request several samples and have them rigorously tested to ensure they meet our quality standards before committing to a large order.

Q 7. How do you handle unexpected supply chain disruptions?

Supply chain disruptions are inevitable. My approach involves proactive risk management and a flexible response strategy. I diversify my sourcing to avoid reliance on a single supplier. I maintain strong relationships with multiple vendors to ensure alternative options are available. When disruptions occur, I immediately assess the impact on our supply chain, communicate proactively with customers, and explore alternative sourcing options or substitute products. If necessary, I might expedite orders from existing vendors or work with logistics providers to find alternative shipping routes.

Example: During a recent port congestion issue, I leveraged my relationships with multiple vendors and secured shipments via alternative ports, minimizing the impact on our customers.

Q 8. Describe your experience with forecasting demand and managing inventory.

Accurate demand forecasting and inventory management are crucial for profitability in wholesale and retail. It’s a balancing act between avoiding stockouts (losing sales) and minimizing excess inventory (tying up capital and risking obsolescence). My approach involves a multi-faceted strategy.

Historical Data Analysis: I leverage past sales data, considering seasonality, trends, and promotional impacts. For example, I’d analyze sales figures for the past three years to understand the typical demand for winter coats during November and December.

Market Research and Trend Analysis: Staying updated on market trends – via industry publications, competitor analysis, and social media monitoring – helps predict future demand. If a new style of shoe is trending, I’d adjust my forecast accordingly, anticipating higher-than-usual demand.

Sales and Marketing Input: Close collaboration with sales and marketing teams provides crucial insights into upcoming promotions, planned campaigns, and anticipated customer behavior. Knowing a major marketing campaign is launching for a specific product allows for proactive inventory adjustments.

Forecasting Techniques: I utilize various forecasting methods, including moving averages, exponential smoothing, and more sophisticated statistical models (e.g., ARIMA) depending on data availability and complexity. The choice of model depends on factors like data stability and the forecasting horizon.

Inventory Management Systems: I am proficient in using inventory management software to track stock levels, monitor sales velocity, and generate automated re-order points. This ensures we maintain optimal stock levels while minimizing storage costs.

Regular Review and Adjustment: Forecasts are not set in stone. I regularly review and adjust my forecasts based on actual sales data, market feedback, and any unexpected events (e.g., supply chain disruptions). This iterative process ensures accuracy and responsiveness.

Q 9. How do you identify and capitalize on emerging market trends?

Identifying and capitalizing on emerging market trends requires a proactive and data-driven approach. I combine several strategies to achieve this:

Market Research: I regularly analyze market research reports, industry publications, and trade shows to stay abreast of the latest trends. This includes examining consumer behavior, competitive landscape, and technological advancements.

Social Media Monitoring: I actively monitor social media platforms (e.g., Instagram, TikTok, Twitter) to identify emerging trends and understand consumer preferences. For instance, observing the increasing popularity of sustainable fashion on social media allows us to source and stock more eco-friendly products.

Competitor Analysis: I carefully analyze the strategies and product offerings of competitors to identify gaps in the market and potential opportunities. This involves assessing what’s working for them and what’s not.

Customer Feedback: Gathering and analyzing customer feedback – through surveys, reviews, and direct interactions – allows us to identify unmet needs and emerging preferences. This helps us develop products that are specifically tailored to what customers want.

Data Analytics: I leverage data analytics tools to identify patterns and trends within our sales data and customer profiles. This allows us to spot emerging demand signals before they become mainstream.

Early Adoption: Once an emerging trend is identified and validated, I prioritize sourcing and stocking related products to gain a first-mover advantage.

Q 10. How do you collaborate with marketing and sales teams to align buying strategies?

Aligning buying strategies with marketing and sales requires seamless collaboration and transparent communication. I ensure this by:

Joint Forecasting Meetings: Regular meetings with marketing and sales teams to discuss sales forecasts, promotional plans, and market trends. This ensures that buying decisions are aligned with overall business objectives.

Sharing Market Intelligence: Sharing market research and trend analysis with the marketing and sales teams so they can develop relevant campaigns and messaging.

Sales Data Sharing: Providing sales teams with real-time inventory data and sales performance updates to support their sales strategies.

Collaborative Planning: Working collaboratively with marketing to align product launches with inventory availability and promotional campaigns.

Feedback Loops: Establishing feedback loops to ensure the buying team is aware of any sales performance issues or market shifts. This allows for proactive adjustments.

Shared Goal Setting: Collaboratively setting common goals and metrics for success to ensure alignment across all departments.

Q 11. What is your experience with different purchasing methods (e.g., auctions, RFQs)?

I have extensive experience with diverse purchasing methods, each with its own advantages and disadvantages. My experience includes:

Negotiated Contracts: Establishing long-term contracts with key vendors, leveraging volume discounts and securing favorable payment terms. This approach is ideal for consistent, high-volume purchases.

Auctions: Participating in online and offline auctions for specific items or surplus inventory, allowing for cost-effective sourcing in competitive markets. This can be very effective for finding unique or hard-to-source items.

Requests for Quotations (RFQs): Issuing RFQs to multiple vendors to compare pricing, quality, and delivery times. This ensures competitive pricing and selection of the best vendor for a specific need.

Spot Buying: Making immediate purchases to address urgent inventory needs or capitalize on short-term opportunities. This is helpful when dealing with sudden changes in demand.

Reverse Auctions: Participating in reverse auctions (where vendors bid down prices) for standardized products, optimizing cost efficiency. This requires a strong understanding of the market to ensure you get the best value.

The choice of purchasing method depends on factors such as the type of product, quantity needed, urgency, market conditions, and vendor relationships.

Q 12. Describe your experience with using purchasing software and systems.

My experience with purchasing software and systems spans several leading platforms. I’m proficient in using ERP (Enterprise Resource Planning) systems such as SAP and Oracle, as well as specialized procurement software like Coupa and Ariba. These systems are crucial for efficient inventory management, purchase order processing, supplier relationship management, and data analysis.

Purchase Order Management: I use these systems to generate and track purchase orders, ensuring timely delivery and accurate accounting.

Inventory Tracking: I leverage the integrated inventory modules to monitor stock levels, set re-order points, and optimize inventory turnover.

Supplier Relationship Management (SRM): I utilize the SRM capabilities of these systems to manage communications, track performance metrics, and maintain strong relationships with vendors.

Reporting and Analytics: I use the built-in reporting and analytics tools to generate reports on purchasing costs, inventory levels, and supplier performance.

Data Integration: I understand the importance of integrating purchasing systems with other enterprise systems such as sales and finance to ensure data consistency and accurate reporting.

Beyond the specific software, I also have hands-on experience with implementing and optimizing purchasing processes to maximize the efficiency of these systems.

Q 13. How do you maintain strong relationships with key vendors?

Maintaining strong vendor relationships is fundamental to securing favorable terms, ensuring timely delivery, and maintaining product quality. My approach is built on:

Open Communication: I prioritize regular and transparent communication with key vendors, keeping them updated on our needs and providing prompt feedback.

Fair and Ethical Practices: I ensure fair and ethical dealings, respecting contractual agreements and fostering mutual trust. This includes timely payments and open communication during challenges.

Collaborative Problem-Solving: I actively work with vendors to address any issues promptly and collaboratively. This demonstrates commitment to a mutually beneficial relationship.

Performance Evaluation: I regularly evaluate vendor performance based on metrics such as delivery times, product quality, and responsiveness. This provides objective feedback and encourages improvement.

Strategic Partnerships: I strive to develop strategic partnerships with key vendors beyond transactional relationships. This involves building rapport and understanding each other’s business needs.

Regular Visits and Meetings: I conduct regular visits to vendor facilities whenever possible to foster personal relationships and gain insights into their operations.

Building strong relationships isn’t just about securing good deals; it’s about fostering a collaborative environment where both parties work together to achieve mutual success.

Q 14. How do you ensure compliance with ethical sourcing and sustainability practices?

Ethical sourcing and sustainability are not just trends; they are critical components of responsible business practices. My approach to ensuring compliance includes:

Supplier Audits: Conducting regular audits of key vendors to ensure they adhere to ethical labor practices, environmental regulations, and sustainable sourcing standards.

Certifications and Standards: Prioritizing vendors with relevant certifications (e.g., Fair Trade, B Corp, ISO 14001) and adhering to industry best practices.

Traceability and Transparency: Working with vendors to ensure traceability of materials and products, promoting transparency throughout the supply chain.

Sustainable Materials: Prioritizing the use of sustainable and recycled materials whenever possible and minimizing the environmental impact of our sourcing decisions.

Ethical Labor Practices: Ensuring that all vendors uphold ethical labor practices, including fair wages, safe working conditions, and no child labor.

Continuous Improvement: Continuously reviewing and improving our sourcing practices to minimize our environmental footprint and support ethical and sustainable operations.

Collaboration and Partnerships: Partnering with organizations dedicated to promoting ethical sourcing and sustainability initiatives to stay updated on best practices and share knowledge.

Ethical sourcing and sustainability are not merely compliance issues; they represent a commitment to responsible business practices that benefit our company, our customers, and the planet.

Q 15. What is your experience with analyzing sales data to inform future buying decisions?

Analyzing sales data is the cornerstone of effective buying. It’s not just about looking at numbers; it’s about understanding the why behind them. I use a multi-faceted approach, starting with identifying key performance indicators (KPIs) like sell-through rate, average order value, and gross margin. Then, I delve deeper, segmenting the data by product category, season, customer demographics, and even marketing campaign.

For example, if a particular style of sweater consistently outperforms others within its category, I’ll investigate factors like its color, material, or price point. This helps me understand what resonates with customers and informs my future orders, potentially increasing the allocation of similar products for the next season. Conversely, if a product consistently underperforms, I’ll analyze if the issue is pricing, marketing, or perhaps a flaw in the product itself. I utilize data visualization tools to identify trends and anomalies, making complex information more easily digestible and actionable. Ultimately, data analysis helps me make informed decisions, minimizing risk and maximizing profitability.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your process for developing a seasonal buying plan.

Developing a seasonal buying plan is a strategic process that requires forecasting, market research, and a keen understanding of current trends. It typically starts with analyzing historical sales data from the previous year and comparing it to current market trends. Then, I consider upcoming events, such as holidays or fashion weeks, which can significantly influence demand.

Next, I identify key product categories and develop a range of potential product offerings, keeping the target audience and brand image in mind. This involves evaluating potential vendors, examining their quality and production capabilities, and negotiating prices. This process often involves considering factors like lead times and minimum order quantities. I build a budget allocation based on forecasted demand and profit margins, ensuring a balanced assortment across different price points. Finally, I create a detailed timeline for each stage of the buying process, from order placement to delivery and in-store placement, making adjustments as needed throughout the season.

Q 17. How do you balance cost considerations with quality and brand image?

Balancing cost, quality, and brand image is a delicate act, a bit like a three-legged stool – if one leg is weak, the whole thing collapses. It requires a strategic approach. I begin by defining the target customer and their expectations. This determines the acceptable quality threshold. Then, I thoroughly research vendors, comparing quality, production capabilities, and pricing.

For example, opting for a slightly more expensive fabric might be justified if it significantly improves the garment’s quality and longevity, thus enhancing the brand’s image and ultimately leading to higher customer satisfaction and repeat business. Finding the right balance often requires compromising on certain aspects; for instance, I might opt for a slightly less expensive, yet high-quality fabric to achieve a better price point while maintaining the desired brand aesthetic. The key is to understand the trade-offs and ensure the overall value proposition remains attractive to the customer.

Q 18. How do you prioritize your buying decisions based on business needs?

Prioritizing buying decisions is crucial for maximizing ROI. I use a multi-criteria decision-making framework, taking into account factors such as projected sales volume, profit margin, inventory turnover, and alignment with overall business objectives.

I often use a scoring system, assigning weights to each factor based on its relative importance to the business. For example, a high-margin, fast-selling item would score higher than a low-margin, slow-selling item. This helps me rank potential purchases in order of priority. Additionally, I consider business needs such as filling gaps in product categories or responding to unexpected spikes in demand. This flexible approach ensures I effectively allocate resources while optimizing overall profitability.

Q 19. How do you manage returns and address quality control issues?

Managing returns and addressing quality control issues is vital for maintaining customer satisfaction and minimizing financial losses. I implement a robust quality control system, beginning with rigorous inspections of incoming goods. This involves checking for defects, inconsistencies, and damage.

I establish clear return policies for customers and ensure efficient processing of returns. Detailed documentation of returned items helps identify patterns or issues with specific vendors or product lines, allowing for proactive improvements in quality control. Moreover, I use the data gathered from returns to adjust future buying decisions, potentially reducing the risk of stocking problematic products. Effective return management not only reduces losses but also improves customer loyalty by showing a commitment to product quality and customer satisfaction.

Q 20. How do you handle situations where products do not meet expected sales targets?

When products fail to meet sales targets, it’s crucial to understand the underlying reasons. I start by analyzing sales data, marketing efforts, and competitor activity. Then, I evaluate the product itself: Is it priced correctly? Does it match current trends? Is the quality satisfactory?

Depending on the findings, strategies include implementing markdown promotions, repositioning the product (e.g., targeting a different customer segment), or discontinuing the product altogether to free up inventory space and capital for more promising items. In some cases, collaborating with the marketing team to create new campaigns or highlighting the product’s unique selling points can help boost sales. Regular review and adaptation are key to minimize losses and learn from underperforming products, improving future buying decisions.

Q 21. What is your understanding of different retail channels and their implications for buying?

Understanding different retail channels is essential for effective buying. Each channel presents unique challenges and opportunities. For instance, buying for an online store requires different considerations than buying for a brick-and-mortar store. Online retailers need to consider factors like shipping costs, website presentation, and inventory management, while brick-and-mortar stores need to focus on in-store display and customer experience.

The buying process might also vary depending on the channel. For example, a retailer selling through multiple channels may need to adjust inventory levels and product selection to meet the specific demands of each channel. For example, a specific product might perform better online due to visual appeal, while a different product performs better in-store due to touch and feel. Understanding the characteristics of each channel allows for more targeted buying decisions and optimal resource allocation.

Q 22. What strategies do you employ to identify and mitigate risks associated with sourcing?

Sourcing risk mitigation is crucial for profitability and operational stability. My approach involves a multi-layered strategy focusing on proactive identification and reactive mitigation.

- Supplier Due Diligence: Before engaging with a supplier, I conduct thorough background checks, assessing their financial stability, production capabilities, ethical practices, and compliance history. This often involves site visits and third-party audits.

- Diversification of Supply: Relying on a single supplier is risky. I actively diversify my sourcing to multiple vendors, geographically dispersed if possible, to reduce dependence and protect against disruptions such as natural disasters or political instability.

- Contractual Safeguards: Robust contracts are essential. They clearly outline specifications, payment terms, quality standards, delivery schedules, and dispute resolution mechanisms. Force majeure clauses protect against unforeseen circumstances beyond the control of either party.

- Quality Control: Implementing rigorous quality control measures throughout the supply chain, including regular inspections and testing, minimizes the risk of receiving substandard products. This can involve both on-site inspections and lab testing.

- Risk Monitoring and Contingency Planning: I continuously monitor geopolitical events, economic indicators, and supplier performance for potential risks. Contingency plans are developed to address potential disruptions, such as finding alternative suppliers or adjusting production schedules.

For example, during the recent global chip shortage, I proactively engaged with multiple semiconductor suppliers, securing alternative sources and negotiating long-term contracts to ensure a steady supply for our products.

Q 23. How do you stay informed about industry best practices and emerging trends?

Staying abreast of industry best practices and trends is vital. My approach is multifaceted:

- Industry Publications and Reports: I regularly read trade journals, industry reports (like those from McKinsey or Gartner), and follow relevant blogs and podcasts to understand market shifts and emerging technologies.

- Networking and Conferences: Attending industry conferences, trade shows, and workshops provides opportunities to learn from experts, network with peers, and discover innovative solutions.

- Professional Organizations: Membership in professional organizations like the National Retail Federation (NRF) offers access to exclusive resources, training, and networking events.

- Data Analytics: Analyzing sales data, market trends, and competitor activities provides valuable insights into emerging consumer preferences and market demands.

- Supplier Relationships: Building strong relationships with suppliers provides valuable insights into their innovations and the broader industry landscape. They often are on the front lines of new trends.

For instance, by attending a recent supply chain management conference, I learned about blockchain technology and its potential to improve supply chain transparency and traceability, which I’m now exploring for implementation in our procurement process.

Q 24. Describe your experience with different pricing strategies (e.g., cost-plus, value-based).

Pricing strategies are critical for profitability. I have experience applying various approaches, adapting them to specific product categories and market conditions.

- Cost-Plus Pricing: This involves calculating the total cost of production (including materials, labor, and overhead) and adding a markup percentage to determine the selling price. It’s straightforward but doesn’t consider market demand or competitor pricing.

- Value-Based Pricing: This approach focuses on the perceived value of the product to the customer. It involves understanding customer needs, identifying the unique benefits of the product, and setting a price that reflects that value. This is more sophisticated but requires strong market research.

- Competitive Pricing: This strategy involves setting prices based on competitor pricing. It’s suitable for highly competitive markets but can lead to price wars if not managed carefully.

- Penetration Pricing: Used to quickly gain market share, this involves setting a low initial price to attract customers, gradually increasing the price as market share grows.

For example, for a new, innovative product with strong customer demand, a value-based pricing strategy would be appropriate. However, for a commodity product in a highly competitive market, a competitive pricing strategy might be more effective.

Q 25. How do you utilize data analytics to optimize the buying process?

Data analytics is fundamental to optimizing the buying process. I leverage data in several ways:

- Demand Forecasting: Analyzing historical sales data, seasonality, and market trends helps accurately predict future demand, minimizing stockouts and overstocking.

- Supplier Performance Analysis: Tracking supplier lead times, quality rates, and on-time delivery rates enables me to identify top-performing vendors and address issues with underperforming ones.

- Inventory Optimization: Data analysis helps determine optimal inventory levels, minimizing storage costs and reducing the risk of obsolescence. This often involves using techniques like ABC analysis or EOQ (Economic Order Quantity) calculations.

- Price Optimization: Analyzing sales data and market pricing helps determine the optimal price point for maximizing revenue and profitability.

- Category Management: Data helps understand consumer preferences and buying patterns within different product categories, enabling better assortment planning and product selection.

For instance, by using predictive analytics, we were able to anticipate a surge in demand for a specific product during a holiday season, allowing us to proactively increase our inventory levels and avoid stockouts.

Q 26. What is your approach to identifying and developing new product lines?

Developing new product lines requires a structured approach:

- Market Research: In-depth market research, including competitor analysis, consumer surveys, and trend analysis, identifies unmet customer needs and market opportunities.

- Idea Generation: This involves brainstorming sessions, collaborating with designers and product developers, and leveraging consumer feedback to generate innovative product concepts.

- Product Development: This phase involves prototyping, testing, and refining the product to ensure it meets quality standards and customer expectations.

- Sourcing and Manufacturing: Identifying reliable and cost-effective suppliers for materials and manufacturing is critical.

- Go-to-Market Strategy: A comprehensive go-to-market strategy outlines the marketing plan, pricing strategy, and distribution channels.

For example, by analyzing consumer feedback and noticing a trend toward sustainable products, we developed a new line of eco-friendly apparel, which has been a significant success.

Q 27. How do you deal with vendor disputes or contract breaches?

Vendor disputes and contract breaches are unfortunately sometimes unavoidable. My approach is proactive and focuses on prevention and resolution:

- Clear Contracts: Well-drafted contracts that clearly define responsibilities, obligations, and dispute resolution mechanisms are paramount in preventing disputes.

- Open Communication: Maintaining open and transparent communication with vendors helps identify and address potential issues early on.

- Negotiation and Mediation: I attempt to resolve disputes through negotiation and mediation, seeking mutually agreeable solutions.

- Legal Action: If negotiations fail, I’m prepared to pursue legal action to protect our interests, but this is always a last resort.

In one instance, a vendor failed to meet a delivery deadline, causing a potential stockout. Through prompt communication and negotiation, we were able to secure an expedited shipment and minimize the impact on our business.

Q 28. Describe your experience with managing budgets and controlling costs.

Budget management and cost control are integral parts of my role. I use various techniques to effectively manage budgets and contain costs:

- Budget Planning and Forecasting: I develop detailed budgets based on historical data, sales forecasts, and anticipated expenses. Regular monitoring and adjustments are key.

- Cost Analysis: I regularly analyze costs associated with sourcing, manufacturing, and transportation to identify areas for potential savings.

- Negotiation and Supplier Relationship Management: Strong relationships with suppliers allow for better negotiation of pricing and terms, resulting in cost savings.

- Inventory Management: Efficient inventory management minimizes storage costs and reduces the risk of obsolescence.

- Technology and Automation: Utilizing technology and automation in the procurement process can significantly reduce operational costs and increase efficiency.

For example, by implementing a new inventory management system, we reduced our warehousing costs by 15% while improving inventory accuracy.

Key Topics to Learn for Wholesale & Retail Buying Interviews

- Market Analysis & Trend Forecasting: Understanding market trends, consumer behavior, and competitive landscapes to inform buying decisions. Practical application: Analyzing sales data to predict future demand and adjust inventory accordingly.

- Sourcing & Vendor Management: Identifying and selecting reliable suppliers, negotiating favorable terms, and managing supplier relationships. Practical application: Developing strong relationships with key vendors to secure competitive pricing and timely delivery.

- Inventory Management & Control: Optimizing inventory levels to minimize carrying costs while ensuring sufficient stock to meet customer demand. Practical application: Implementing inventory control systems to track stock levels, predict shortages, and manage stock rotation.

- Pricing & Profitability: Determining optimal pricing strategies to maximize profitability while remaining competitive. Practical application: Analyzing cost structures, market prices, and competitor pricing to set profitable margins.

- Negotiation & Communication: Effectively negotiating with suppliers and internal stakeholders to achieve mutually beneficial outcomes. Practical application: Mastering persuasive communication skills to secure favorable terms and build consensus.

- Demand Planning & Forecasting: Utilizing historical data and market insights to accurately predict future demand. Practical application: Implementing forecasting models to optimize inventory levels and minimize stockouts or overstocking.

- Category Management: Developing and implementing strategies to optimize the performance of specific product categories. Practical application: Analyzing sales data to identify opportunities for growth within specific product categories.

- Supply Chain Management: Understanding the entire supply chain process, from sourcing to delivery, and identifying areas for improvement. Practical application: Implementing strategies to streamline the supply chain and reduce lead times.

Next Steps

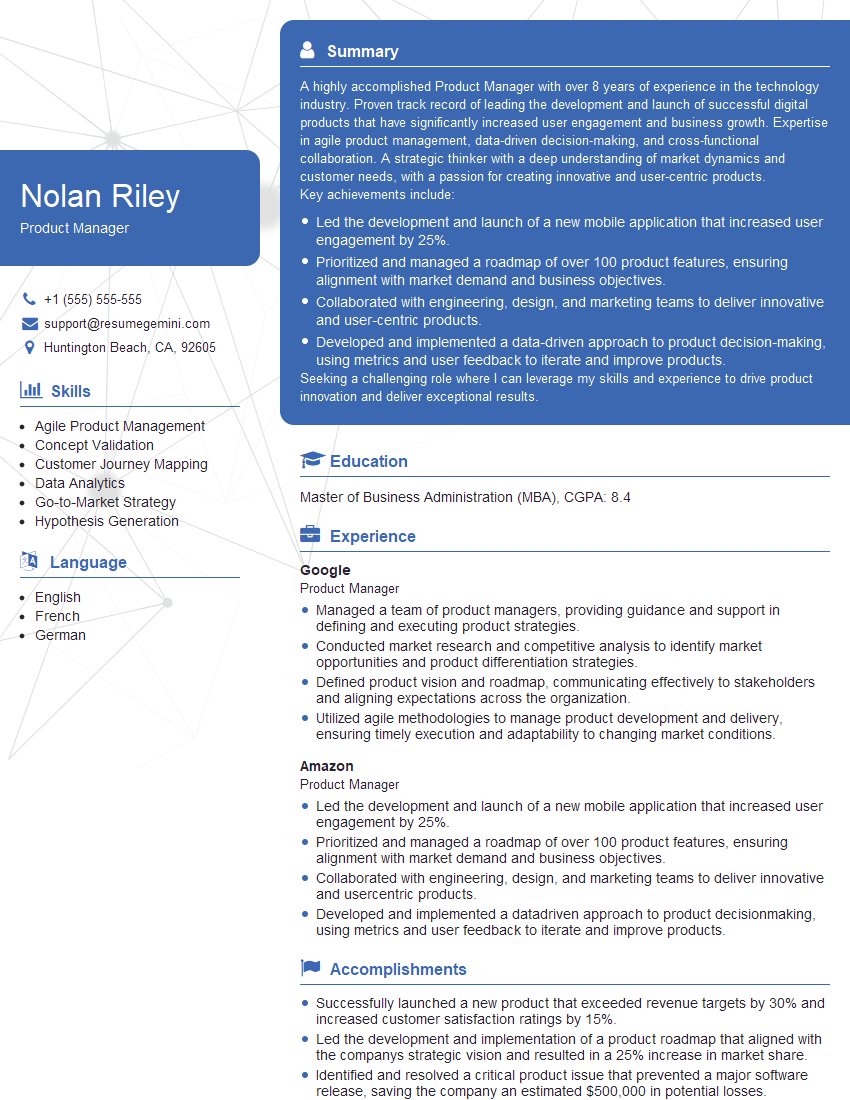

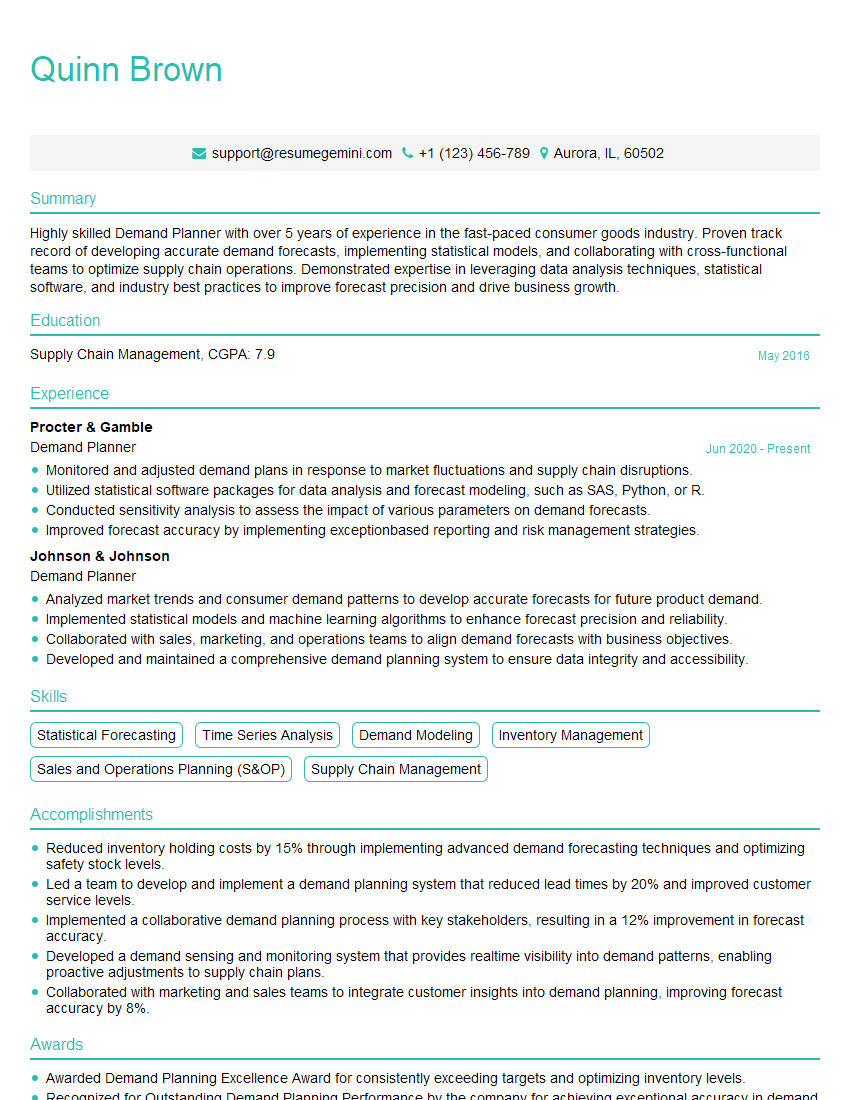

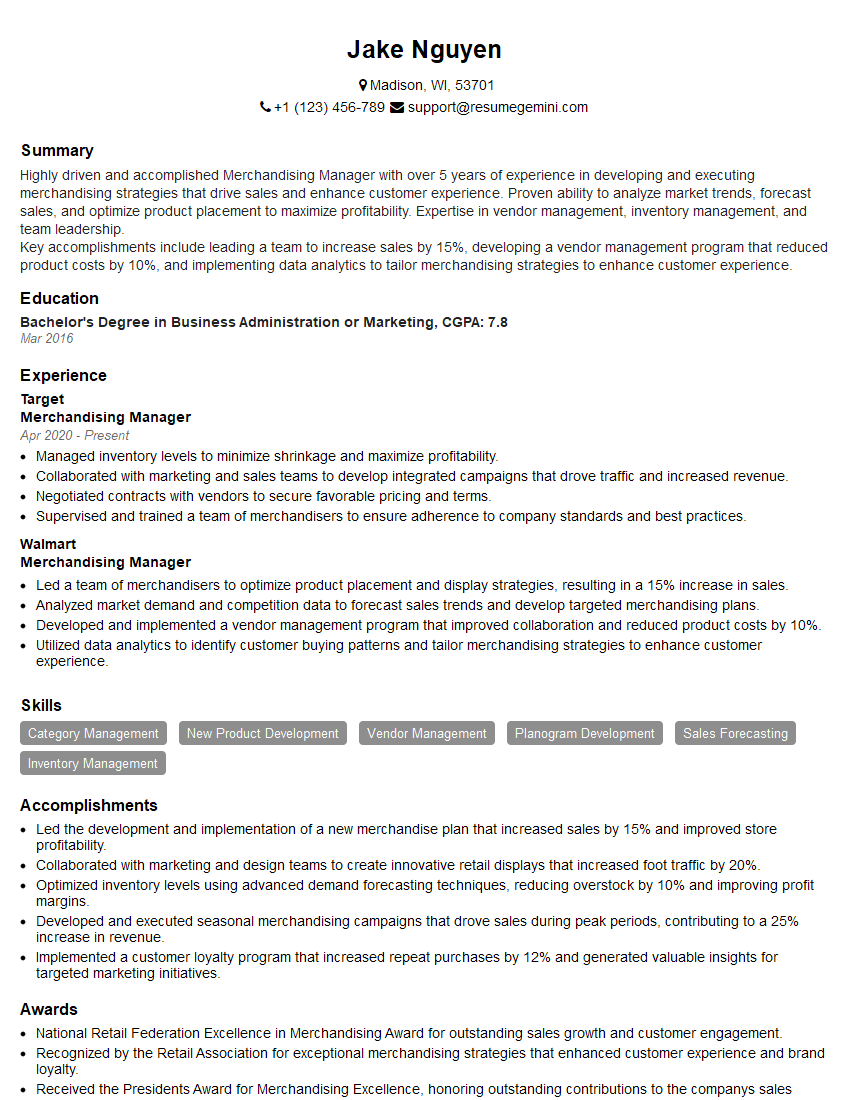

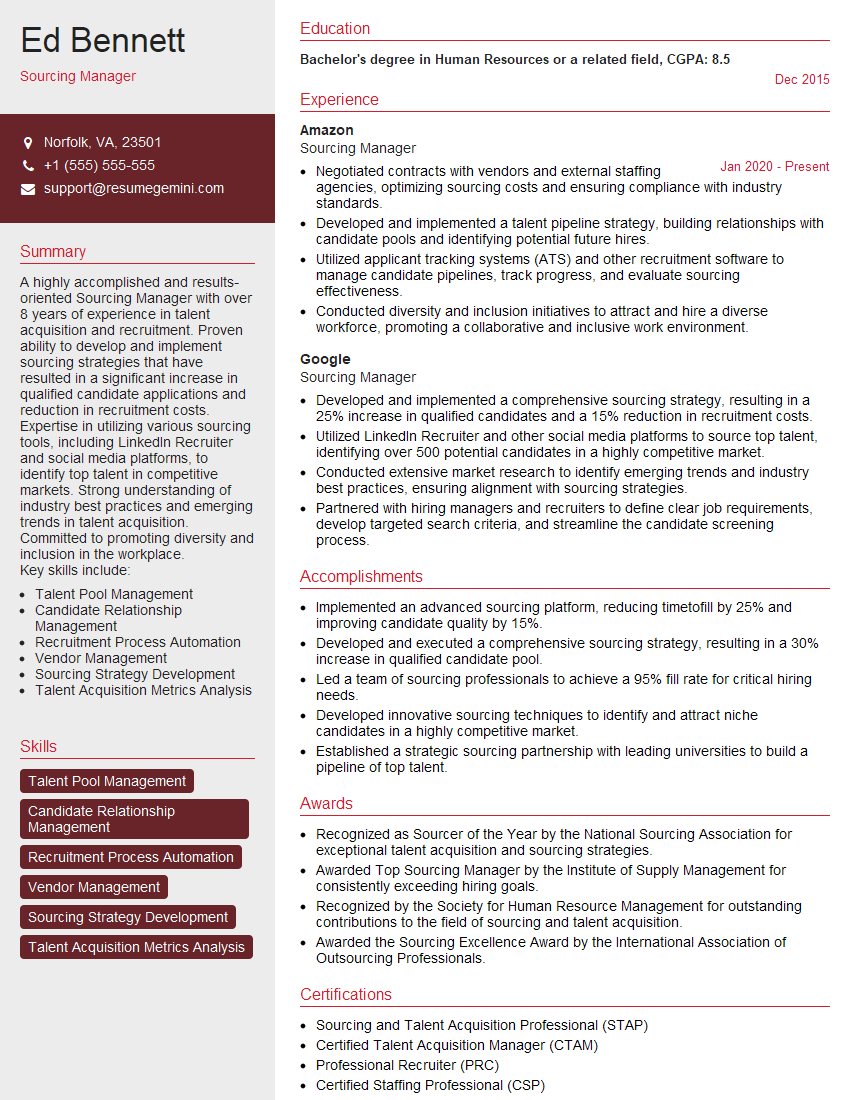

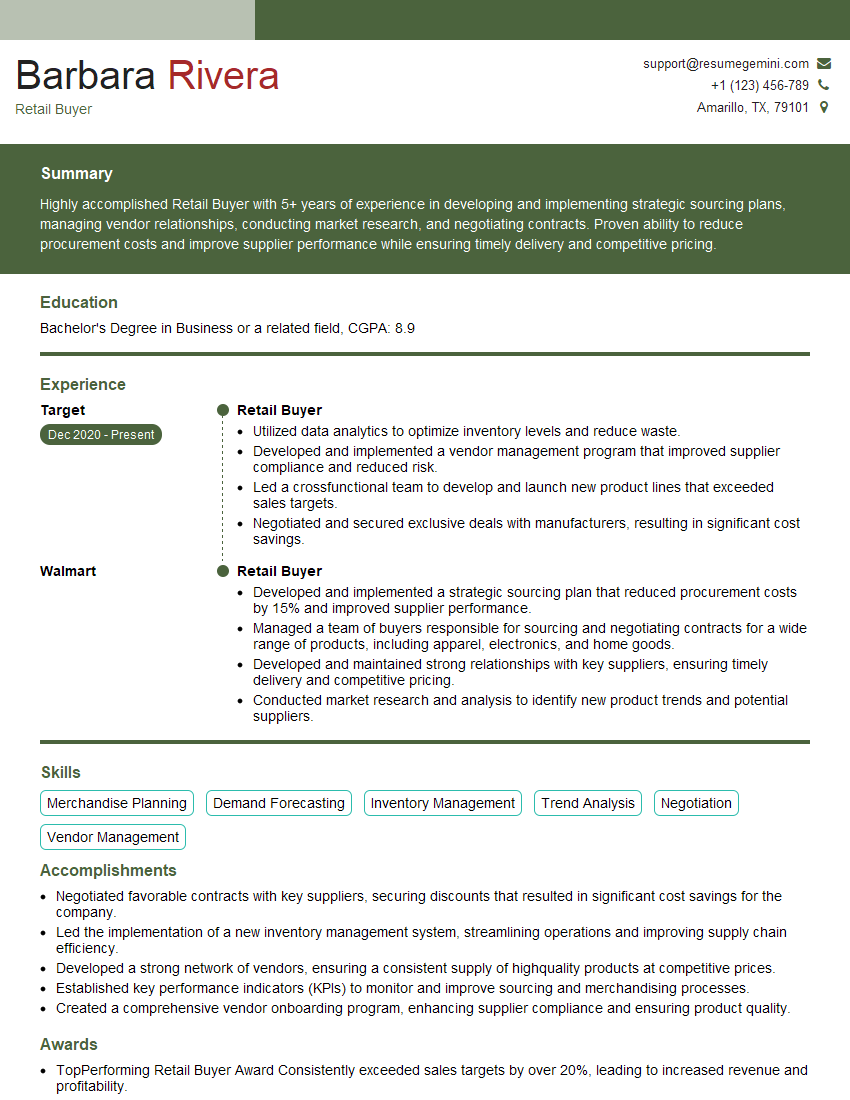

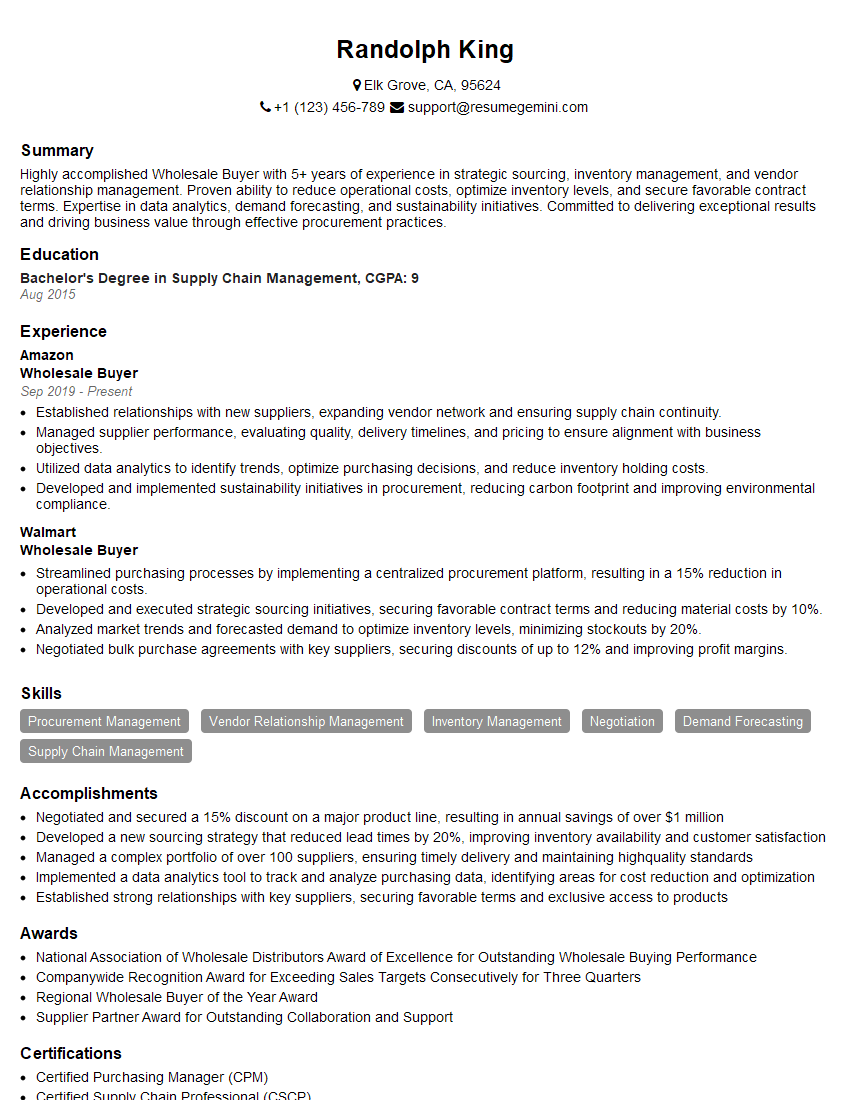

Mastering wholesale and retail buying is crucial for career advancement in this dynamic field. A strong understanding of these concepts will significantly enhance your interview performance and open doors to exciting opportunities. To maximize your job prospects, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. They provide examples of resumes tailored specifically to the Wholesale and Retail Buying field, helping you present your qualifications in the best possible light. Take the next step in your career journey – build a winning resume with ResumeGemini today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good