The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Adherence to Regulatory Compliance interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Adherence to Regulatory Compliance Interview

Q 1. Describe your experience in developing and implementing a regulatory compliance program.

Developing and implementing a regulatory compliance program is a multi-faceted process requiring a deep understanding of applicable laws and a structured approach. It begins with identifying all relevant regulations impacting the organization, such as industry-specific rules, data privacy laws (like GDPR or CCPA), and general business regulations. Then, a comprehensive risk assessment is conducted to pinpoint areas of vulnerability. This assessment considers both internal factors (like employee training and IT security) and external factors (like evolving legislation and emerging threats).

Next, I develop policies and procedures that align with identified regulations. This includes creating easily understood documentation, training materials, and ongoing monitoring mechanisms. Key elements are establishing clear lines of accountability, defining roles and responsibilities for compliance, and integrating compliance into all business processes. Finally, regular audits and reviews are crucial to identify and address any weaknesses or gaps in the program. For example, in a previous role, I led the development of a new compliance program for a healthcare provider focusing on HIPAA compliance. This included creating tailored training modules for employees, developing data breach response plans, and implementing regular audits of patient data access logs.

Q 2. How do you stay current with changes in relevant regulations?

Staying current with regulatory changes is a continuous process. I utilize several strategies, including subscribing to reputable legal and regulatory news sources, attending industry conferences and webinars, and actively participating in professional organizations focused on compliance. Many regulatory bodies also offer email alerts or newsletters announcing changes to their rules. I also maintain a system for tracking relevant regulations and regularly review them for updates. Think of it like a gardener tending to a garden – constant monitoring and tending are essential for a healthy and thriving plant, just as staying updated on regulations is essential for a healthy compliance program. Regularly reviewing these sources ensures that I have the most current information and can adapt our compliance program accordingly.

Q 3. Explain your understanding of the Sarbanes-Oxley Act (SOX).

The Sarbanes-Oxley Act of 2002 (SOX) is a US federal law aimed at improving corporate governance and financial disclosures. It was enacted in response to major corporate accounting scandals. SOX’s primary focus is on enhancing the accuracy and reliability of corporate financial reporting. Key aspects of SOX include establishing stricter standards for corporate responsibility, improving internal controls over financial reporting, and increasing auditor independence. For example, SOX Section 302 requires company executives to personally certify the accuracy of financial reports. Section 404 mandates the establishment and documentation of internal controls over financial reporting, requiring regular testing and evaluation to ensure their effectiveness. Compliance with SOX is essential for publicly traded companies to maintain investor confidence and avoid substantial penalties.

Q 4. What is your experience with HIPAA compliance?

HIPAA, the Health Insurance Portability and Accountability Act, is a US law designed to protect the privacy and security of protected health information (PHI). My experience with HIPAA compliance includes developing and implementing policies and procedures to ensure the confidentiality, integrity, and availability of PHI. This encompasses various areas, such as employee training on HIPAA regulations, implementing robust security measures to safeguard electronic PHI (ePHI), and establishing procedures for handling data breaches. I have also conducted risk assessments to identify potential vulnerabilities related to PHI and implemented corrective actions to mitigate those risks. In a previous role, I successfully guided the organization through a HIPAA audit, demonstrating our adherence to the regulations and ensuring the security of patient data.

Q 5. Describe a time you identified a compliance violation. What actions did you take?

During a routine internal audit, I discovered a compliance violation involving the unauthorized access of sensitive customer data. An employee had inadvertently left their computer unlocked, allowing another employee to access confidential information. My immediate actions involved securing the affected system, initiating an investigation to determine the extent of the breach, and reporting the incident to management. Then, we implemented corrective actions, including additional employee training on data security protocols, reinforcing password policies and implementing multi-factor authentication. We also conducted a thorough review of our existing security policies and procedures to identify any additional vulnerabilities and strengthen our overall security posture. This incident highlighted the importance of ongoing employee training and regular security audits in maintaining a robust compliance program.

Q 6. How do you conduct a risk assessment related to regulatory compliance?

A risk assessment for regulatory compliance involves a systematic process of identifying, analyzing, and prioritizing potential risks related to non-compliance. I typically use a framework that involves several steps: First, identifying applicable regulations and legal requirements. Then, identifying potential threats or vulnerabilities that could lead to non-compliance, such as inadequate employee training, system security weaknesses, or process flaws. Next, I evaluate the likelihood and potential impact of each risk. This involves considering factors like the severity of potential penalties or reputational damage. Then, I prioritize risks based on their likelihood and impact. High-priority risks receive immediate attention, and mitigation strategies are developed and implemented. Finally, I document the entire process, including the identified risks, assessments, mitigation strategies, and responsible parties. This documentation serves as a crucial element for ongoing monitoring and reporting.

Q 7. Explain your experience with internal audits related to compliance.

Internal audits related to compliance are crucial for ensuring the effectiveness of a compliance program. My experience includes conducting both planned and unplanned audits, focusing on various aspects of the program, such as policy adherence, security controls, and data handling procedures. I use a risk-based approach, concentrating audit efforts on areas identified as high-risk during the risk assessment process. The audit process involves reviewing documentation, interviewing employees, testing controls, and analyzing data to assess compliance. My approach focuses on objectivity and thoroughness, adhering to a well-defined audit methodology. Following an audit, I prepare a comprehensive report highlighting findings, including both positive observations and areas for improvement. I then work with management to develop and implement corrective action plans to address any identified deficiencies. This ensures that the compliance program continues to evolve and adapt to mitigate risks.

Q 8. How do you ensure compliance with data privacy regulations (e.g., GDPR, CCPA)?

Ensuring compliance with data privacy regulations like GDPR and CCPA requires a multi-faceted approach. It’s not just about ticking boxes; it’s about embedding data protection into the very fabric of your organization’s operations.

- Data Mapping and Inventory: We begin by meticulously identifying all personal data collected, processed, and stored. This involves categorizing data by type (e.g., name, address, financial information), source, and purpose. Think of it like creating a detailed inventory of all your valuable possessions – you need to know what you have to protect it.

- Data Minimization and Purpose Limitation: We strive to collect only the necessary data for specified, explicit, and legitimate purposes. We avoid collecting excessive or irrelevant data. For instance, if you’re selling shoes online, you don’t need the user’s medical history.

- Consent Management: We implement robust consent mechanisms, ensuring individuals understand how their data will be used and have clear choices about providing it. We maintain detailed records of consent, making it easy to demonstrate compliance. Imagine obtaining a signed contract before using someone’s information.

- Data Security Measures: We implement strong security measures, including encryption, access controls, and regular security audits, to protect personal data from unauthorized access, loss, or disclosure. This involves firewalls, intrusion detection systems, and employee training on security best practices.

- Data Subject Rights: We establish processes for handling data subject requests (e.g., access, rectification, erasure). This involves setting up dedicated teams, providing clear procedures, and implementing secure systems to fulfill these requests promptly and efficiently. We think of this as empowering individuals to control their information.

- Data Breach Response Plan: We have a comprehensive plan to address data breaches, including procedures for notification, investigation, and remediation. This plan ensures we’re prepared to act quickly and minimize the impact of any security incidents.

In practice, this often involves collaborating with legal counsel, IT security experts, and other stakeholders to ensure a holistic and effective approach. Regular reviews and updates to our policies and procedures are crucial to keep pace with evolving regulatory landscapes.

Q 9. Describe your experience with creating and delivering compliance training.

I have extensive experience developing and delivering compliance training programs. My approach is to create engaging and interactive learning experiences that move beyond simple lectures and promote knowledge retention and practical application.

- Needs Assessment: I begin with a thorough needs assessment to identify specific knowledge gaps and tailor the training to the audience’s roles and responsibilities.

- Modular Design: I structure the training into modules, making it easier to digest and allowing flexibility in delivery.

- Interactive Methods: I utilize various teaching methods, including interactive scenarios, quizzes, role-playing, and case studies. These make learning more active and engaging.

- Multiple Delivery Methods: I offer diverse delivery methods, including online courses, in-person workshops, and self-paced modules, accommodating diverse learning styles and schedules.

- Practical Application: A key component of my training is the emphasis on practical application. Learners apply their new knowledge through exercises and real-world scenarios, solidifying understanding and promoting better retention.

- Ongoing Evaluation and Improvement: I conduct regular assessments to measure the training’s effectiveness. Feedback from participants is used to improve future sessions.

For example, when training employees on GDPR compliance, I’ve developed interactive modules covering data subject rights, consent management, and data breach procedures. Participants actively engage in scenario-based exercises, simulating real-world challenges and learning how to apply their knowledge in practice. Post-training assessments and ongoing reinforcement are essential to ensure long-term compliance.

Q 10. What metrics do you use to measure the effectiveness of a compliance program?

Measuring the effectiveness of a compliance program requires a balanced approach using qualitative and quantitative metrics. It’s not just about numbers; it’s about understanding the overall health and maturity of the program.

- Incident Rates: Tracking the number of compliance incidents (e.g., data breaches, violations) provides insight into the program’s effectiveness in preventing violations. A decrease in incidents suggests improvement.

- Training Completion Rates: Monitoring training completion rates indicates the extent of employee engagement and comprehension. High completion rates suggest a successful training program.

- Audit Findings: The number and severity of audit findings identify areas requiring attention or improvement. A reduction in findings over time signifies improved compliance.

- Employee Knowledge and Awareness: Regular assessments, surveys, and quizzes measure employee knowledge of compliance policies and procedures. Higher scores represent increased awareness and understanding.

- Regulatory Reporting Accuracy: The accuracy and timeliness of regulatory reports indicate the program’s efficiency and effectiveness in gathering and reporting data. Few errors and timely submission suggest strong performance.

- Cost of Non-Compliance: Analyzing the financial costs associated with non-compliance, including fines, legal fees, and reputational damage, demonstrates the financial benefits of a robust compliance program. A reduced cost of non-compliance highlights its value.

These metrics are typically analyzed over time to identify trends and areas for improvement. Regular review and adaptation of the compliance program based on the results of these measurements ensure ongoing effectiveness and adaptation to changing regulations.

Q 11. How do you handle conflicts between different regulatory requirements?

Conflicts between different regulatory requirements are common, especially in global organizations. Resolving these conflicts requires a careful and systematic approach.

- Identify and Analyze: The first step is to clearly identify the conflicting requirements. This involves a detailed review of all applicable regulations and a careful analysis of their scope and overlap.

- Prioritization: Once the conflicts are identified, prioritize them based on factors like the severity of potential penalties and the likelihood of non-compliance. The regulations with the most significant potential impact should be addressed first.

- Develop a Compliance Strategy: Based on the prioritization, a compliance strategy is developed to address each conflict. This could involve choosing the most stringent requirement, seeking clarification from regulatory authorities, or implementing controls to achieve compliance with multiple regulations simultaneously.

- Documentation: All decisions and rationale regarding conflict resolution should be meticulously documented. This is vital for demonstrating due diligence and justifying the chosen approach.

- Ongoing Monitoring: Once implemented, the chosen approach needs continuous monitoring to ensure ongoing compliance and identify any emerging conflicts.

For instance, if a company operates in both the EU (subject to GDPR) and California (subject to CCPA), it may need to adopt a comprehensive approach that meets the requirements of both. This often involves harmonizing data protection policies and procedures to align with the most stringent standards, ensuring compliance with both sets of regulations.

Q 12. Explain your experience with regulatory reporting and filing.

My experience in regulatory reporting and filing encompasses a wide range of activities, from preparing and submitting reports to interacting with regulatory agencies.

- Understanding Requirements: This begins with a thorough understanding of the specific reporting requirements for each applicable regulation. This includes understanding deadlines, formatting requirements, and the specific data points that need to be reported.

- Data Collection and Aggregation: A robust system for collecting and aggregating the necessary data is crucial. This often involves integrating data from various sources across the organization.

- Report Preparation: Once the data is collected, it is meticulously reviewed and prepared according to the specific requirements of the regulatory body. This ensures accuracy and completeness.

- Submission and Follow-up: Reports are submitted according to the established deadlines. Follow-up procedures are established to address any queries or requests for additional information from the regulatory agencies.

- Record Keeping: Comprehensive records of all reports, submissions, and communications with regulatory bodies are maintained. This allows for easy tracking and audit trail.

For instance, I’ve been involved in preparing and submitting annual reports to data protection authorities under GDPR, ensuring that all required information was accurately reported and submitted on time. This included detailed descriptions of data processing activities, security measures, and data breach incidents.

Q 13. How do you ensure the accuracy and completeness of compliance documentation?

Ensuring the accuracy and completeness of compliance documentation is critical for demonstrating compliance and mitigating risk. It’s not just about having documents; it’s about having the *right* documents, accurate and up-to-date.

- Version Control: Implementing a version control system ensures that only the most current and accurate versions of documents are used. Tools like document management systems are essential.

- Regular Review and Updates: Compliance policies and procedures should be regularly reviewed and updated to reflect changes in regulations, business practices, and technology.

- Approval Processes: Establish clear approval processes for all compliance documentation. This ensures that documents are reviewed and approved by the appropriate individuals before implementation.

- Centralized Repository: Use a centralized repository for all compliance documentation. This ensures that everyone has access to the most current information.

- Data Validation: Implement procedures to validate the accuracy of data included in compliance documentation. This includes using automated checks and manual verification.

- Audit Trails: Maintaining audit trails for all changes made to compliance documents provides transparency and accountability.

Imagine a scenario where a critical policy change is made but not properly documented. During an audit, this could result in significant fines and reputational damage. A robust documentation management system prevents such scenarios.

Q 14. Describe your experience with conducting compliance investigations.

Conducting compliance investigations requires a thorough, objective, and impartial approach. It’s like being a detective, carefully gathering evidence to determine the facts.

- Define Scope: Clearly define the scope of the investigation, including the specific allegations, individuals involved, and timeframe.

- Gather Evidence: Systematically gather evidence through interviews, document review, and data analysis. All evidence must be properly documented and preserved.

- Interview Witnesses: Conduct interviews with relevant individuals, ensuring fairness and objectivity. Record interviews accurately and obtain statements.

- Document Review: Thoroughly review relevant documents, including emails, contracts, and internal policies. Look for evidence supporting or refuting allegations.

- Data Analysis: Analyze relevant data to identify trends or patterns that may be indicative of non-compliance.

- Report Findings: Prepare a comprehensive report summarizing the investigation’s findings, conclusions, and recommendations.

For instance, if an allegation of data misuse is made, I would start by defining the scope of the investigation, then collect evidence from various sources like emails, database logs, and employee interviews. The report would then detail the findings, whether the allegation is substantiated, and recommendations for corrective actions.

Q 15. How do you communicate compliance requirements effectively to different stakeholders?

Effective communication of compliance requirements is crucial for ensuring everyone understands their responsibilities. My approach involves tailoring the message to the audience’s level of understanding and role within the organization.

- For executives: I focus on the high-level strategic implications of non-compliance, including financial risks and reputational damage, presenting data-driven insights and potential scenarios.

- For managers: I emphasize practical steps for implementation, providing clear guidelines, checklists, and training materials. I also highlight the manager’s role in monitoring compliance within their teams.

- For employees: I use clear, concise language, avoiding jargon. Training sessions, interactive modules, and easily accessible resources like FAQs and cheat sheets are essential. Regular reminders and updates keep compliance top-of-mind.

For example, when implementing a new data privacy regulation, I would prepare a tailored presentation for the executive team outlining the potential penalties and the overall impact on the business strategy, while providing departmental heads with a detailed compliance checklist and training materials for their staff. I would further simplify this for individual employees with concise infographics and readily available Q&A documents.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with remediation of compliance issues?

Remediation of compliance issues requires a structured and thorough approach. My experience involves identifying the root cause, implementing corrective actions, and preventing recurrence. It’s not just about fixing the immediate problem; it’s about learning from it.

My process typically involves:

- Identifying the issue: Thorough investigation to understand the nature and extent of the non-compliance.

- Root cause analysis: Determining why the non-compliance occurred – was it due to a lack of training, inadequate processes, or systemic failures?

- Developing a remediation plan: This includes specific corrective actions, timelines, and responsible parties. It often involves updating policies, procedures, and training materials.

- Implementing the plan: Overseeing the execution of corrective actions and monitoring progress.

- Monitoring and prevention: Implementing measures to prevent similar issues from occurring in the future. This may involve improved controls, enhanced monitoring, and ongoing employee training.

For instance, if an audit revealed a weakness in our data security protocols, I would lead the remediation effort by collaborating with IT to enhance security measures, develop and deliver updated training for employees on data security best practices, and implement a robust monitoring system to detect future vulnerabilities. Post-remediation, we’d conduct follow-up audits to validate the effectiveness of our changes.

Q 17. How do you utilize technology to enhance regulatory compliance?

Technology plays a vital role in enhancing regulatory compliance. It allows for automation, improved monitoring, and efficient data management.

- Compliance management software: These platforms can automate tasks such as policy distribution, training tracking, and audit scheduling.

- Data loss prevention (DLP) tools: These tools help prevent sensitive data from leaving the organization’s control, a crucial aspect of many regulations.

- Governance, risk, and compliance (GRC) platforms: These systems provide a centralized view of compliance-related activities, risks, and controls.

- Automated reporting and analytics: These tools can generate reports and dashboards to track compliance metrics and identify potential issues early on.

For example, using a GRC platform, we can centralize all our compliance documentation, track the progress of our compliance initiatives, and generate reports to demonstrate our adherence to regulatory requirements to both internal stakeholders and external auditors.

Q 18. Describe your experience with working with external regulatory bodies.

I have extensive experience interacting with external regulatory bodies, including responding to audits, providing information requests, and negotiating settlements. Effective communication and collaboration are paramount.

My approach involves:

- Proactive engagement: Regularly monitoring regulatory updates and maintaining open communication with regulators to ensure alignment.

- Thorough documentation: Maintaining meticulous records of compliance activities and processes to demonstrate adherence to regulations.

- Responsive communication: Promptly addressing any inquiries or concerns from regulatory bodies.

- Collaboration: Working cooperatively with regulators to address any identified deficiencies.

In one instance, we proactively contacted the relevant authority to discuss a proposed change to our internal controls before implementing it. This collaborative approach allowed us to receive feedback and ensure our proposed changes aligned with their expectations, preventing potential future issues.

Q 19. How do you manage compliance in a rapidly changing regulatory environment?

Managing compliance in a dynamic regulatory environment requires a flexible and proactive approach.

My strategy focuses on:

- Continuous monitoring: Staying abreast of changes in regulations through subscriptions to legal updates, attending industry conferences, and engaging with regulatory bodies.

- Agile methodology: Adapting compliance processes and controls to quickly respond to evolving regulatory demands.

- Scenario planning: Considering potential regulatory changes and developing contingency plans to address them.

- Regular review and updates: Periodically reviewing and updating our compliance programs to reflect changes in the regulatory landscape.

For instance, when a new data privacy law was enacted, we immediately convened a cross-functional team to analyze the implications for our organization. We updated our data privacy policies, employee training materials, and internal processes to ensure full compliance within the stipulated timeframe.

Q 20. What are the key elements of an effective compliance culture?

A strong compliance culture is not merely about policies and procedures; it’s about embedding ethical behavior and accountability into the organization’s DNA.

Key elements include:

- Leadership commitment: Senior management must visibly demonstrate their commitment to compliance.

- Clear communication: Communicating compliance expectations clearly to all employees.

- Accountability: Holding individuals and teams accountable for their compliance responsibilities.

- Ethical behavior: Fostering a culture of ethical decision-making and reporting.

- Training and awareness: Providing regular training to keep employees informed about compliance requirements.

- Open communication channels: Establishing channels for employees to report compliance concerns without fear of retaliation.

Think of it like building a house – a strong foundation (leadership commitment) is needed, followed by carefully constructed walls (clear processes), and finally, a strong roof (accountability) to protect against external pressures. Regular maintenance (training and awareness) is key for long-term sustainability.

Q 21. How do you prioritize compliance efforts?

Prioritizing compliance efforts requires a risk-based approach, focusing on the areas that pose the greatest risk to the organization.

My process involves:

- Risk assessment: Identifying and assessing the potential risks associated with non-compliance.

- Risk ranking: Ranking the risks based on their likelihood and potential impact.

- Resource allocation: Allocating resources to address the highest-priority risks first.

- Regular review: Periodically reviewing and updating the risk assessment and prioritization.

Using a risk matrix, we might identify data breaches as a high-likelihood, high-impact risk and dedicate significant resources to strengthening our data security protocols. A lower-priority risk, such as a minor reporting requirement, would receive less immediate attention, but still be addressed in a timely manner.

Q 22. Describe your understanding of whistleblower protection laws.

Whistleblower protection laws are designed to safeguard individuals who report illegal or unethical activities within their organizations. These laws protect whistleblowers from retaliation, such as demotion, termination, or harassment, for reporting suspected violations. The specifics vary by jurisdiction, but generally, these laws require employers to establish procedures for reporting concerns and to investigate those reports thoroughly and fairly. Effective whistleblower protection is crucial for fostering a culture of ethics and compliance.

For example, the Sarbanes-Oxley Act (SOX) in the United States offers significant protection to whistleblowers reporting financial fraud. Similarly, the Dodd-Frank Act includes provisions that incentivize whistleblowing and offer substantial financial rewards for reporting serious violations.

A key element is ensuring confidentiality during the reporting and investigation process. Whistleblowers need to trust that their identities will be protected and that their reports will be handled discreetly. Strong whistleblower protection programs also often include provisions for anonymous reporting mechanisms.

Q 23. Explain your experience with implementing a compliance monitoring program.

In my previous role at a large financial institution, I was instrumental in implementing a comprehensive compliance monitoring program. This involved several key steps: first, we identified key compliance risks, such as anti-money laundering (AML) violations, sanctions compliance, and data privacy breaches. Then we developed a risk-based approach to monitoring, focusing resources on the areas posing the greatest risk.

We implemented a system of automated checks and manual reviews. Automated checks flagged potential issues, such as unusual transactions or inconsistencies in data. Manual reviews were conducted by compliance officers to investigate flagged alerts and ensure appropriate actions were taken. We used a combination of software tools and internal audits to collect data, allowing us to identify trends and patterns. Regular reporting to senior management provided oversight and transparency.

Key to success was establishing clear metrics and reporting mechanisms. This allowed us to track the effectiveness of our monitoring program and to identify areas needing improvement. For example, we tracked the number of alerts generated, the time taken to investigate alerts, and the number of violations identified. This data informed our resource allocation and allowed us to refine our monitoring procedures over time.

Q 24. What are the potential consequences of non-compliance?

The consequences of non-compliance can be severe and far-reaching, impacting an organization’s reputation, finances, and even its survival. These consequences can include:

- Financial penalties: Significant fines and penalties can be levied by regulatory bodies for violations.

- Legal action: Civil lawsuits and criminal prosecution can result from non-compliance.

- Reputational damage: Negative publicity and loss of consumer trust can severely harm an organization’s brand.

- Operational disruptions: Investigations, audits, and remediation efforts can disrupt normal business operations.

- Loss of licenses and permits: Organizations may lose the ability to operate in certain markets or industries.

- Imprisonment: In some cases, individuals responsible for non-compliance can face imprisonment.

For example, a company failing to comply with data privacy regulations like GDPR could face millions of dollars in fines and severe reputational damage. A healthcare provider neglecting HIPAA compliance could face legal action and loss of patient trust.

Q 25. How do you assess the effectiveness of a compliance training program?

Assessing the effectiveness of a compliance training program requires a multi-faceted approach that goes beyond simple completion rates. We need to measure both knowledge retention and behavioral change.

Methods include:

- Pre- and post-training assessments: These tests measure knowledge gained through training. A significant improvement demonstrates effective learning.

- Surveys and feedback: Gathering employee feedback on the training’s clarity, relevance, and engagement level is crucial for identifying areas of improvement.

- Observation of employee behavior: Observing whether employees are applying the learned concepts in their day-to-day work is a critical measure of behavioral change. This might involve reviewing internal documentation or conducting simulated scenarios.

- Tracking of compliance incidents: A decrease in the number of compliance incidents after training suggests the training is effective in preventing violations.

- Regular refresher training: Periodic refresher training ensures knowledge remains current and relevant, mitigating the risk of outdated information leading to non-compliance.

By using a combination of these methods, a comprehensive picture of the training program’s effectiveness emerges, allowing for data-driven adjustments to optimize the program’s impact.

Q 26. Describe your experience with developing a compliance policy manual.

My experience in developing a compliance policy manual involved a collaborative, iterative process. I started by analyzing relevant laws, regulations, and industry best practices. Then, I organized the information into a clear, concise, and user-friendly document. The manual was structured logically, using plain language to avoid legal jargon and ensure accessibility for all employees.

The key to a successful policy manual is clarity and comprehensibility. Each policy should be clearly stated, with specific examples where appropriate. The manual needs to be regularly reviewed and updated to reflect any changes in legislation or best practices. Moreover, it’s essential to ensure that the policy manual aligns with the organization’s overall risk management strategy.

For instance, the manual would cover areas such as anti-bribery and corruption, data protection, conflicts of interest, and workplace conduct. It should also outline reporting procedures for suspected violations and explain the organization’s disciplinary process. Version control and dissemination were carefully managed to ensure every employee had access to the most recent version.

Q 27. Explain your understanding of different types of compliance risks.

Compliance risks can be categorized in several ways. A common approach is to classify them based on their source or nature:

- Legal and regulatory risks: These stem from non-compliance with laws and regulations, such as environmental protection laws, financial reporting standards, or data privacy regulations. These are often the most serious risks due to potential legal and financial consequences.

- Operational risks: These arise from internal processes and failures within the organization, such as inadequate internal controls or flawed business processes. An example would be an inefficient AML system leading to missed red flags.

- Reputational risks: These pertain to damage to an organization’s image and public perception. Negative media coverage or consumer boycotts can result from ethical lapses or perceived wrongdoing. A product recall due to safety concerns is a prime example.

- Strategic risks: These are high-level risks relating to the overall business strategy and objectives. For instance, expanding into a new market without properly evaluating its regulatory landscape could create significant risks.

Understanding the various types of compliance risks allows for a tailored risk management strategy, focusing resources on the highest-priority issues.

Q 28. How do you ensure the ongoing effectiveness of your compliance program?

Ensuring the ongoing effectiveness of a compliance program is an iterative process requiring continuous monitoring, evaluation, and improvement. This involves:

- Regular monitoring and auditing: Regular monitoring ensures that the program is functioning as intended and that controls are effective. Audits provide an independent assessment of the program’s effectiveness.

- Staying updated on regulatory changes: Legislation and regulatory guidelines constantly evolve. Staying informed and adapting the compliance program accordingly is crucial.

- Employee training and awareness: Ongoing training reinforces compliance awareness and helps employees stay up-to-date on policies and procedures.

- Incident reporting and investigation: A robust incident reporting system allows for swift identification and resolution of compliance issues. Thorough investigations provide valuable insights for improvement.

- Performance measurement and reporting: Key performance indicators (KPIs) track the effectiveness of the compliance program, providing data for continuous improvement. Regular reporting to senior management ensures transparency and accountability.

- Continuous improvement and adaptation: Regularly review and update the program based on monitoring results, audit findings, and regulatory changes. Treat the compliance program as a dynamic, living document.

By integrating these elements into a well-defined program, organizations can create a culture of compliance and proactively mitigate the risks associated with non-compliance.

Key Topics to Learn for Adherence to Regulatory Compliance Interview

- Understanding Relevant Regulations: Grasp the core principles and specific regulations governing your industry (e.g., HIPAA, GDPR, SOX). Consider the practical implications of non-compliance.

- Risk Assessment and Mitigation: Learn how to identify potential regulatory risks, analyze their impact, and develop effective mitigation strategies. Practice explaining your approach to risk management in a clear and concise manner.

- Internal Controls and Audits: Understand the design and implementation of internal controls to ensure regulatory compliance. Be prepared to discuss your experience with audits and compliance reviews.

- Data Privacy and Security: Explore the critical aspects of data protection and security, including data breach response protocols and best practices for handling sensitive information. Be ready to discuss real-world scenarios.

- Ethical Considerations and Reporting Mechanisms: Discuss the importance of ethical conduct in maintaining compliance. Understand whistleblower protection laws and reporting procedures within organizations.

- Policy Development and Implementation: Familiarize yourself with the process of creating, implementing, and maintaining compliance policies and procedures. Think about how to translate regulations into actionable steps.

- Continuous Monitoring and Improvement: Discuss the importance of ongoing monitoring and improvement processes to ensure sustained compliance. Be prepared to share examples of how you’ve contributed to these efforts.

Next Steps

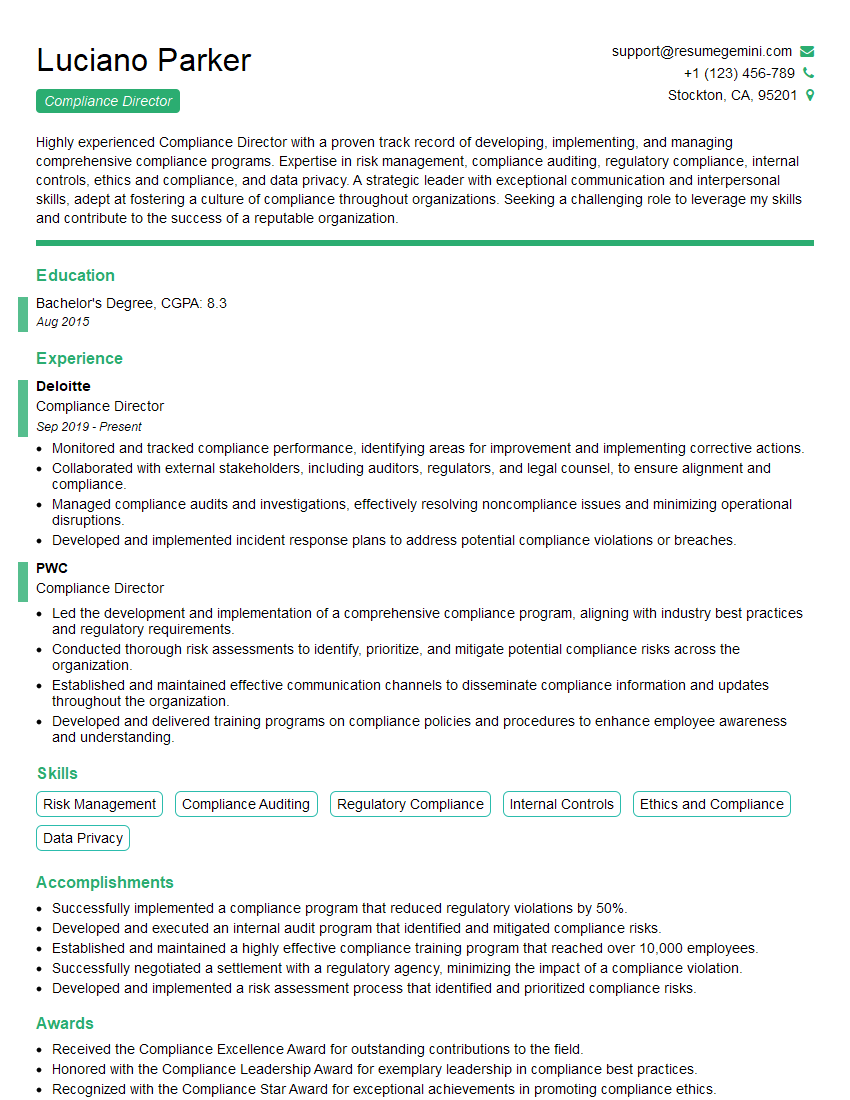

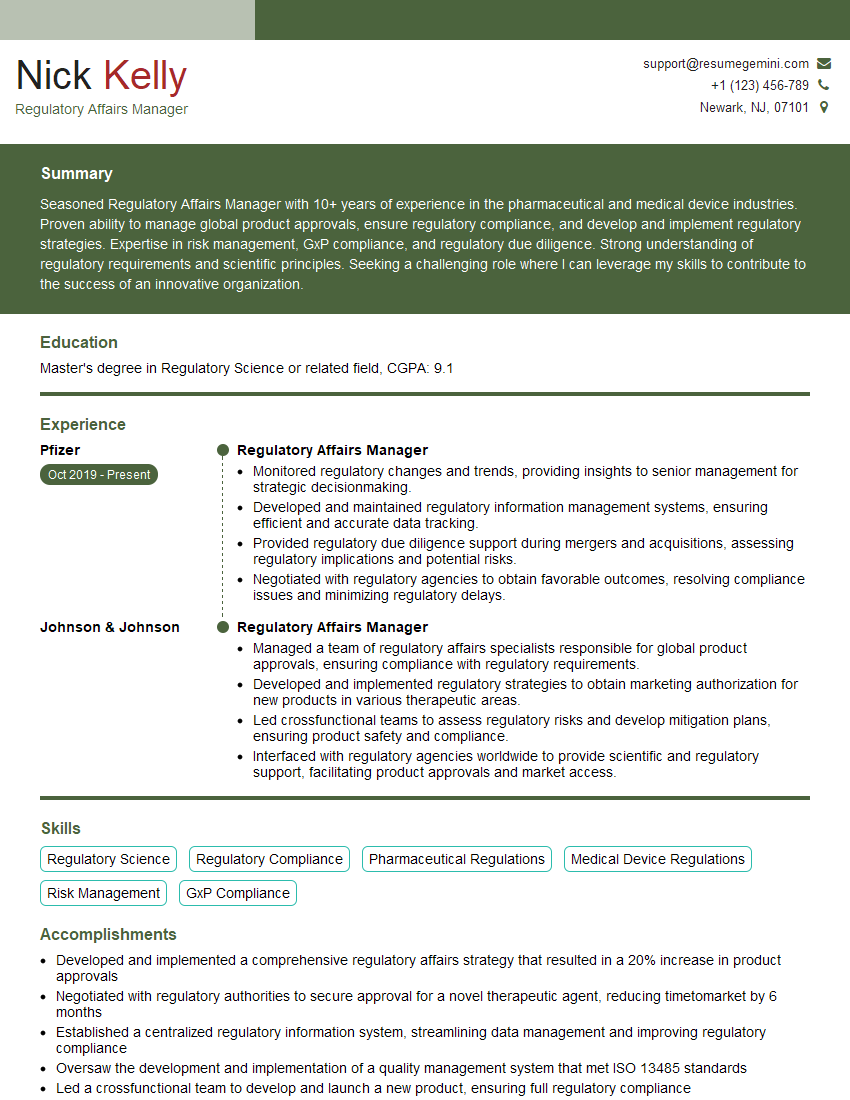

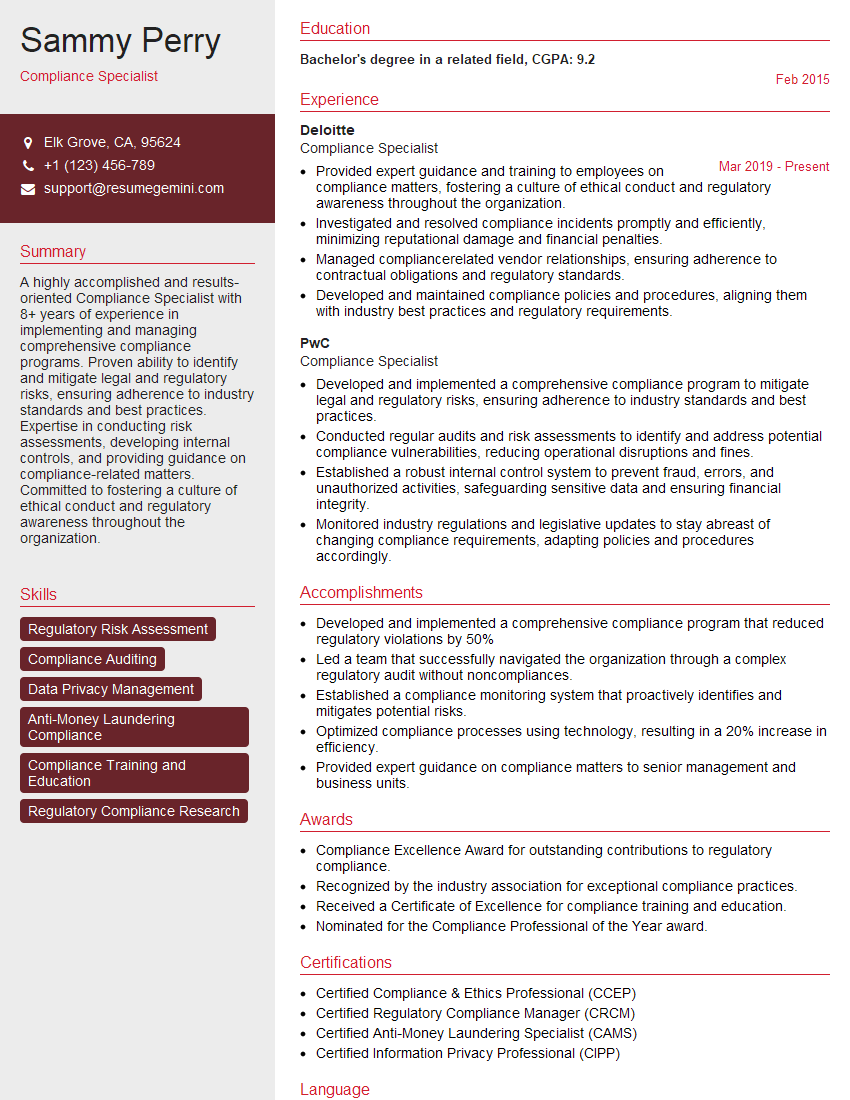

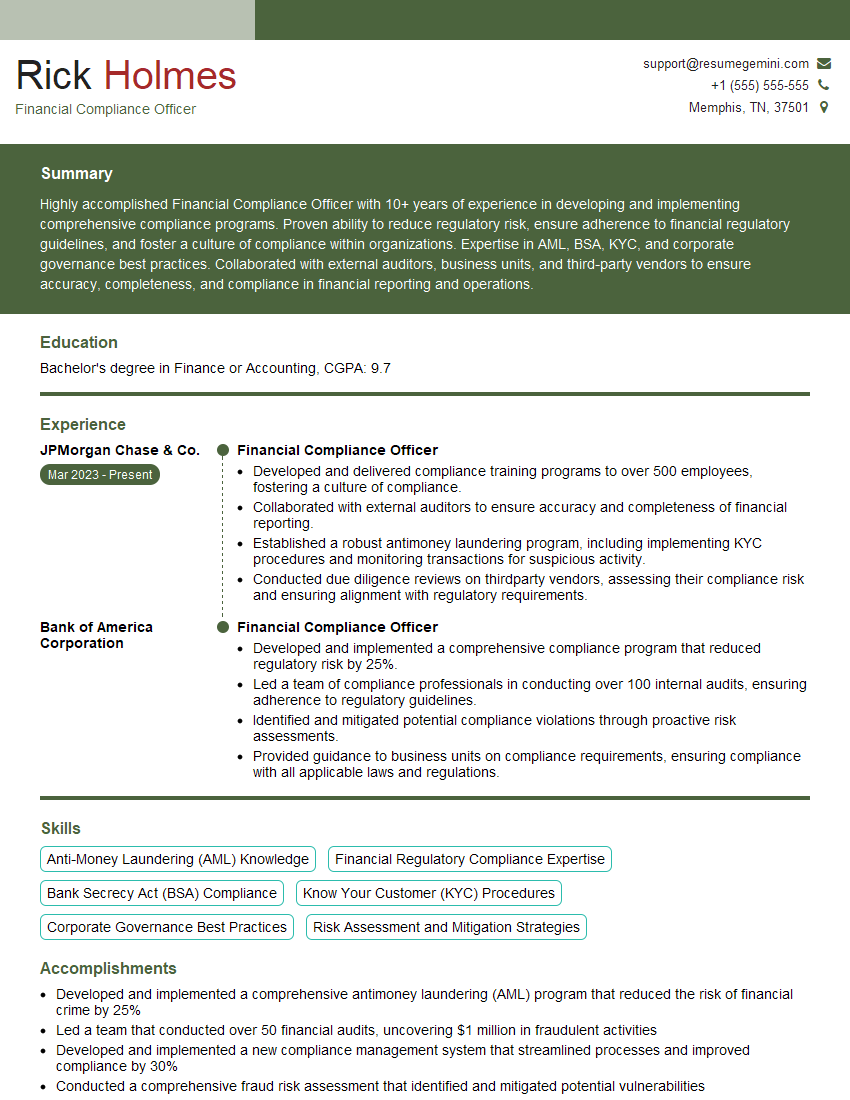

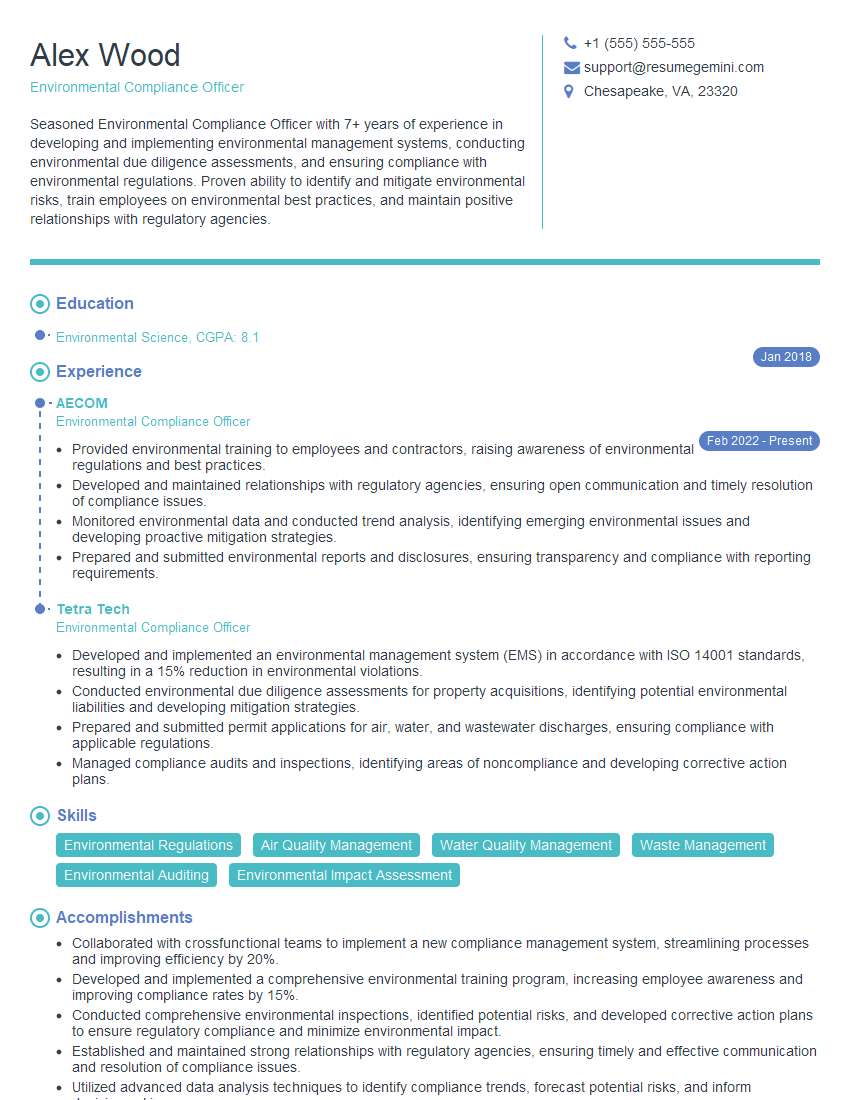

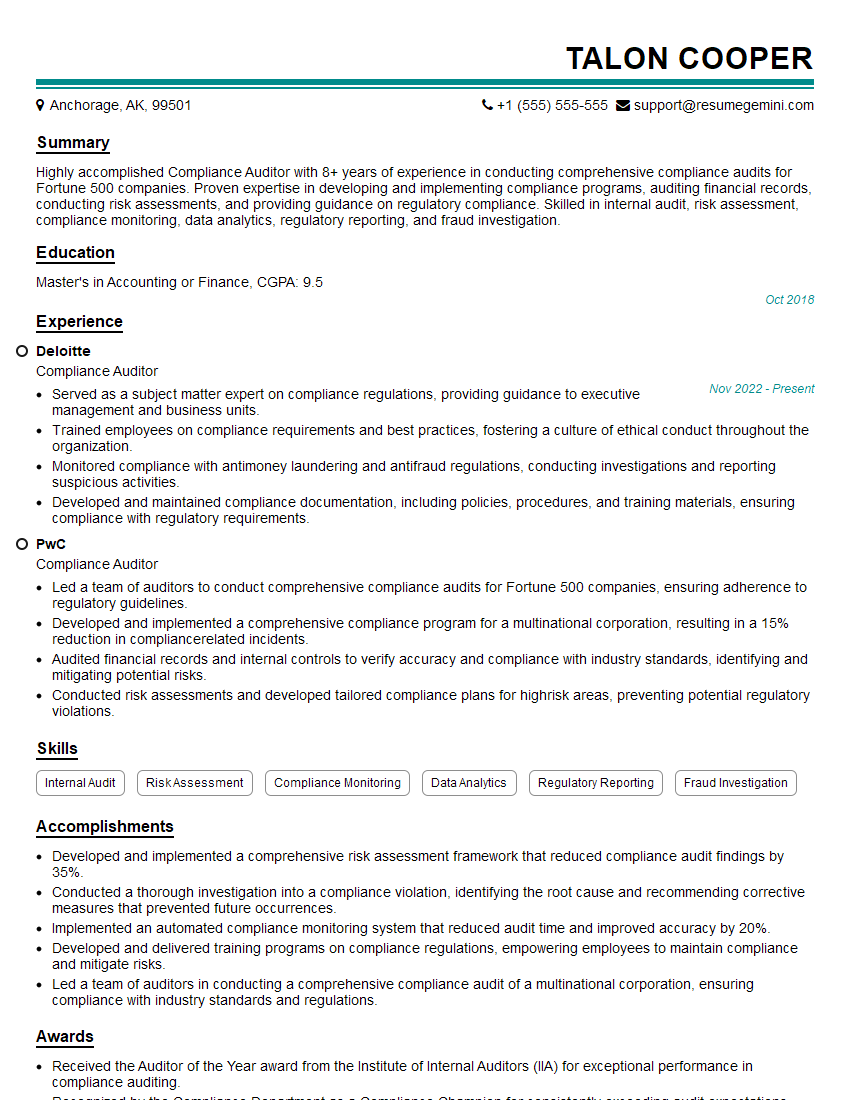

Mastering Adherence to Regulatory Compliance is crucial for career advancement in virtually any industry. It demonstrates your commitment to ethical business practices and your ability to manage risk effectively – highly sought-after qualities by employers. To significantly boost your job prospects, create an ATS-friendly resume that showcases your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume, ensuring your qualifications shine through to potential employers. Examples of resumes tailored to Adherence to Regulatory Compliance are available to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good