Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Knowledge of Finance interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Knowledge of Finance Interview

Q 1. Explain the difference between debt and equity financing.

Debt and equity financing are two primary ways companies raise capital. Debt financing involves borrowing money that must be repaid with interest, while equity financing involves selling ownership stakes in the company. Think of it like this: debt is like taking out a loan – you owe money back, but retain full control of your business. Equity is like bringing on a partner – they invest money in exchange for a share of the profits and ownership.

- Debt Financing: Examples include bank loans, bonds, and lines of credit. The advantage is that you retain full control, and interest payments are tax-deductible. However, debt increases financial risk, as failure to repay can lead to bankruptcy.

- Equity Financing: Examples include issuing stock, angel investors, and venture capital. The advantage is that you don’t need to repay the investment, and it can provide valuable expertise and connections. The disadvantage is that you relinquish ownership and share profits with investors.

The choice between debt and equity depends on factors such as the company’s financial health, risk tolerance, and growth plans. A stable company might prefer debt due to its tax advantages, while a high-growth startup might lean towards equity to access capital without immediate repayment pressures.

Q 2. What are the three main financial statements, and how are they interconnected?

The three main financial statements are the Income Statement, the Balance Sheet, and the Statement of Cash Flows. They provide a comprehensive view of a company’s financial performance and position. They’re interconnected, offering a holistic picture.

- Income Statement: Shows a company’s revenues, expenses, and resulting profit or loss over a specific period (e.g., a quarter or year). Think of it as a snapshot of profitability.

- Balance Sheet: Presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It reveals the company’s financial position – what it owns, what it owes, and what belongs to the owners.

- Statement of Cash Flows: Tracks the movement of cash both into and out of a company over a period. It shows how the company generated and used cash, categorizing it into operating, investing, and financing activities. It bridges the gap between the income statement (which uses accrual accounting) and the balance sheet, focusing on actual cash transactions.

The interconnection is crucial: Net Income from the Income Statement flows into the retained earnings section of the Balance Sheet. The Statement of Cash Flows explains the changes in cash and cash equivalents shown on the Balance Sheet, linking changes in working capital (appearing on the Balance Sheet) to the operating activities section of the Statement of Cash Flows.

Q 3. Describe the time value of money and its importance in financial decision-making.

The time value of money (TVM) is the core principle that a dollar received today is worth more than a dollar received in the future. This is due to its potential earning capacity. Imagine you have $100 today – you could invest it and earn interest, making it worth more than $100 a year from now. This concept is crucial in financial decision-making because it allows us to compare cash flows occurring at different points in time.

TVM is critical for evaluating investments, loans, and other financial decisions. For example, when deciding whether to invest in a project, we need to discount future cash flows back to their present value to determine whether the investment is worthwhile. Ignoring TVM can lead to poor decisions and substantial financial losses.

Q 4. Explain the concept of Net Present Value (NPV) and its application.

Net Present Value (NPV) is a crucial financial metric that calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Essentially, it tells us the value added by an investment or project in today’s dollars.

A positive NPV indicates that the project is expected to generate more value than it costs, making it a worthwhile investment. Conversely, a negative NPV suggests the project will likely result in a net loss. NPV is calculated by discounting all future cash flows back to their present value using a predetermined discount rate (often the company’s cost of capital).

NPV = Σ [CFt / (1 + r)^t] - C0

Where:

- CFt = Cash flow at time t

- r = Discount rate

- t = Time period

- C0 = Initial investment

Companies use NPV to evaluate capital budgeting projects, mergers and acquisitions, and other long-term investment decisions. A higher NPV generally indicates a more attractive investment.

Q 5. How do you calculate Return on Investment (ROI)?

Return on Investment (ROI) measures the profitability of an investment relative to its cost. It’s a simple yet powerful metric used to assess the efficiency of various investments. A higher ROI indicates a more successful investment.

The basic formula for ROI is:

ROI = (Net Profit / Cost of Investment) * 100%

For example, if you invest $10,000 and earn a net profit of $2,000, your ROI would be (2000/10000) * 100% = 20%. This indicates a 20% return on your initial investment.

While simple, it’s important to consider that ROI doesn’t account for the time value of money. A longer investment horizon with a lower ROI might yield a higher overall profit compared to a shorter investment with a higher ROI.

Q 6. What is discounted cash flow (DCF) analysis?

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the value of an investment based on its expected future cash flows. It’s a powerful technique for valuing companies, projects, or other assets by discounting future cash flows to their present value using a discount rate that reflects the risk involved.

The core idea behind DCF analysis is that an investment’s value is the sum of the present values of all its expected future cash flows. This method explicitly incorporates the time value of money, making it a more sophisticated approach compared to methods that ignore the time element.

DCF analysis is widely used in corporate finance, investment banking, and private equity for valuing companies, making investment decisions, and determining the fair price for mergers and acquisitions.

Q 7. What are the key ratios used to assess a company’s financial health?

Several key ratios are used to assess a company’s financial health. These ratios provide insights into different aspects of a company’s performance, liquidity, and solvency. Analyzing these ratios together paints a more comprehensive picture.

- Liquidity Ratios (e.g., Current Ratio, Quick Ratio): Measure a company’s ability to meet its short-term obligations. A low ratio indicates potential liquidity problems.

- Profitability Ratios (e.g., Gross Profit Margin, Net Profit Margin, Return on Equity): Assess a company’s ability to generate profits from its operations. These ratios reveal efficiency and profitability.

- Solvency Ratios (e.g., Debt-to-Equity Ratio, Times Interest Earned): Indicate a company’s ability to meet its long-term debt obligations. High debt levels might indicate increased financial risk.

- Efficiency Ratios (e.g., Inventory Turnover, Asset Turnover): Measure how effectively a company manages its assets to generate sales. Slow turnover suggests potential inefficiencies.

Analyzing these ratios in conjunction with the financial statements and industry benchmarks provides a robust assessment of a company’s financial health. It’s crucial to compare a company’s ratios to its industry peers to understand its relative performance and potential risks.

Q 8. Explain the difference between operating leverage and financial leverage.

Operating leverage and financial leverage both magnify returns, but they do so through different mechanisms. Operating leverage focuses on the relationship between a company’s fixed and variable costs, while financial leverage centers on the use of debt financing.

Operating Leverage: This refers to the degree to which a company uses fixed costs in its operations. A high degree of operating leverage means a larger proportion of fixed costs (rent, salaries, depreciation) compared to variable costs (raw materials, direct labor). Think of a manufacturing plant – the plant itself is a fixed cost. If sales increase, the fixed costs remain constant, leading to a disproportionately larger increase in profits. Conversely, if sales decline, profits fall sharply because of these high fixed costs.

Example: Imagine two companies, A and B, both selling widgets. Company A has high operating leverage (high fixed costs, low variable costs). A small increase in sales translates to a significant jump in profit. Company B has low operating leverage (low fixed costs, high variable costs). The same sales increase yields a smaller profit gain. However, in a downturn, Company B will fare better as its lower fixed costs cushion the blow.

Financial Leverage: This refers to the extent to which a company uses debt financing to fund its assets. Using debt magnifies both profits and losses. Higher debt means higher interest payments, but if the company’s return on assets exceeds the interest rate, it increases profitability. However, if returns fall below the interest rate, losses are amplified. Think of it like a seesaw: debt is the fulcrum; higher debt makes the seesaw more sensitive to changes in returns.

Example: A company with high financial leverage might borrow heavily to acquire new equipment. If the equipment boosts profits significantly, the company will experience strong returns. If the project fails, though, the high debt burden could lead to financial distress.

In essence, operating leverage impacts profitability through the cost structure, while financial leverage leverages debt to magnify both profits and losses. A company can use both types of leverage, and understanding the interplay between them is crucial for risk management and profitability.

Q 9. What is capital budgeting, and what are some common capital budgeting techniques?

Capital budgeting is the process a company uses for evaluating potential major projects or investments. It involves analyzing the potential profitability and risks of long-term investments such as new equipment, new facilities, or research and development projects. The goal is to maximize the value of the firm by selecting the most profitable projects.

Common Capital Budgeting Techniques:

- Net Present Value (NPV): This method calculates the difference between the present value of cash inflows and the present value of cash outflows. A positive NPV indicates that the project is expected to generate more value than it costs.

- Internal Rate of Return (IRR): This method calculates the discount rate that makes the NPV of a project equal to zero. A higher IRR indicates a more profitable project.

- Payback Period: This method determines how long it takes for a project to recoup its initial investment. Shorter payback periods are generally preferred.

- Discounted Payback Period: Similar to the payback period, but it accounts for the time value of money by discounting future cash flows.

- Profitability Index (PI): This method calculates the ratio of the present value of cash inflows to the present value of cash outflows. A PI greater than 1 indicates a profitable project.

Practical Application: A company considering building a new factory would use capital budgeting techniques to evaluate the expected costs (construction, equipment, etc.) against the projected revenue stream (sales of goods produced). By calculating NPV, IRR, and payback periods, the company can make an informed decision about whether the investment is worthwhile.

Q 10. What are the different types of risk in finance?

Risk in finance encompasses various types, all potentially impacting investment decisions and financial stability. They’re often interconnected, and understanding their nuances is essential for informed decision-making.

Types of Risk:

- Market Risk (Systematic Risk): This risk is inherent in the overall market and cannot be diversified away. Examples include changes in interest rates, economic downturns, and geopolitical events. Think of a broad market crash affecting all stocks.

- Credit Risk (Default Risk): This refers to the possibility that a borrower will fail to repay a loan or meet its debt obligations. This is particularly relevant for lenders and bondholders.

- Liquidity Risk: This is the risk that an asset cannot be quickly bought or sold without significantly impacting its price. Less liquid assets (e.g., real estate) pose higher liquidity risk.

- Operational Risk: This encompasses the risks associated with a company’s internal processes, systems, or people. A cybersecurity breach or a supply chain disruption could exemplify operational risk.

- Financial Risk: This involves the potential for losses due to inappropriate financial leverage or inadequate capital structure. High levels of debt increase this type of risk.

- Interest Rate Risk: Fluctuations in interest rates affect the value of fixed-income securities like bonds. Rising rates decrease bond values, and vice versa.

- Inflation Risk (Purchasing Power Risk): The erosion of purchasing power due to inflation impacts the real return on investments. High inflation diminishes the value of future cash flows.

- Reinvestment Risk: This risk arises when an investor needs to reinvest cash flows from an investment at a lower rate than initially earned.

Understanding these risks is vital for portfolio diversification, risk mitigation strategies, and overall financial planning.

Q 11. Explain the concept of diversification in portfolio management.

Diversification in portfolio management involves spreading investments across different asset classes, sectors, and geographies to reduce overall risk. The core idea is that when one investment performs poorly, others might offset those losses, leading to more stable returns.

The Concept: Don’t put all your eggs in one basket! Diversification reduces the impact of unsystematic risk (risks specific to individual assets or industries) By holding a mix of assets that are not perfectly correlated (their price movements don’t always move together), investors can minimize the volatility of their portfolio.

Example: Instead of investing solely in technology stocks, a diversified portfolio might include a mix of stocks, bonds, real estate, and commodities. If the technology sector underperforms, the other asset classes could potentially provide a cushion, limiting overall portfolio losses.

Effective Diversification: It’s not just about the number of holdings but also their correlation. Holding many stocks within the same sector isn’t truly diversified. Ideally, one should aim for negatively correlated assets – those that tend to move in opposite directions. This is challenging to achieve perfectly, but it’s the underlying principle of effective diversification.

Q 12. What are some common valuation methods used in finance?

Numerous valuation methods exist in finance, each with its strengths and weaknesses. The best approach often depends on the specific asset being valued and the available information.

Common Valuation Methods:

- Discounted Cash Flow (DCF) Analysis: This is a fundamental method that estimates the value of an asset based on its future cash flows, discounted back to their present value using an appropriate discount rate. It’s widely used for valuing companies and projects.

- Comparable Company Analysis (Relative Valuation): This method compares the valuation multiples (e.g., Price-to-Earnings ratio, Price-to-Sales ratio) of a target company to those of similar publicly traded companies. It’s useful for quickly benchmarking a company’s valuation.

- Precedent Transactions Analysis: This method analyzes the prices paid in similar acquisitions or mergers to estimate the value of a target company. It’s valuable when comparable public company data is limited.

- Asset-Based Valuation: This approach values a company based on the net asset value of its underlying assets. It’s particularly relevant for companies with significant tangible assets.

- Liquidation Valuation: This method estimates the value that would be realized if the company’s assets were sold off individually. It’s often used in bankruptcy situations.

Choosing the right method: The choice depends on factors like the availability of data, the nature of the asset being valued, and the investor’s objectives. Often, a combination of methods is used to provide a more robust valuation.

Q 13. How do interest rates affect bond prices?

Interest rates and bond prices have an inverse relationship. When interest rates rise, bond prices fall, and when interest rates fall, bond prices rise.

The Reason: Bonds pay a fixed stream of interest payments (coupons) until maturity, when the principal is repaid. When interest rates rise, newly issued bonds offer higher yields. This makes existing bonds with lower coupon rates less attractive, causing their prices to fall to compensate for the lower yield. Conversely, if interest rates fall, existing bonds with higher coupon rates become more desirable, driving up their prices.

Example: Suppose you own a bond with a 5% coupon rate. If market interest rates rise to 6%, new bonds are offering a higher return. To make your 5% bond competitive, its price must fall, thus increasing its yield to maturity to match or nearly match the 6% rate of newer bonds.

Important Note: The magnitude of the price change depends on factors like the bond’s maturity, coupon rate, and the shape of the yield curve. Longer-maturity bonds are more sensitive to interest rate changes than shorter-maturity bonds.

Q 14. Explain the concept of inflation and its impact on financial markets.

Inflation is a general increase in the prices of goods and services in an economy over a period of time. It reduces the purchasing power of money – meaning that the same amount of money buys fewer goods and services.

Impact on Financial Markets:

- Bond Prices: Inflation erodes the real return on fixed-income investments like bonds. If inflation rises unexpectedly, bond prices usually fall as investors demand higher yields to compensate for the loss of purchasing power.

- Stock Prices: Inflation’s impact on stock prices is more complex. High inflation can increase companies’ costs, potentially squeezing profit margins. However, if inflation reflects strong economic growth, it might lead to higher corporate earnings and higher stock prices.

- Interest Rates: Central banks often raise interest rates to combat inflation. Higher interest rates make borrowing more expensive, potentially slowing economic growth and dampening inflationary pressures, but also impacting investment decisions.

- Real Estate: Inflation can drive up the prices of real estate as construction costs and other related expenses increase.

- Commodities: Commodities like gold are often seen as a hedge against inflation, as their prices tend to rise when inflation is high.

Managing Inflation Risk: Investors often use strategies like investing in inflation-protected securities (TIPS), diversifying across asset classes, and adjusting their investment portfolios based on inflation expectations to mitigate the negative effects of inflation.

Q 15. What is a derivative, and what are some common examples?

A derivative is a financial contract whose value is derived from an underlying asset. This underlying asset can be anything from stocks and bonds to commodities like gold or oil, or even interest rates. Derivatives themselves don’t have intrinsic value; their worth is tied directly to the performance of the underlying asset. Think of them as bets on the future price movement of something else.

- Futures Contracts: An agreement to buy or sell an asset at a predetermined price on a future date. Imagine a farmer agreeing to sell their wheat harvest at a specific price six months from now, hedging against potential price drops.

- Options Contracts (Calls and Puts): These give the buyer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specific price (strike price) on or before a certain date (expiration date). This allows investors to manage risk or speculate on price movements.

- Swaps: Agreements to exchange cash flows based on different underlying assets or interest rates. For example, two companies might swap fixed-rate debt payments for floating-rate payments to manage their interest rate risk.

Derivatives are powerful tools used for hedging (reducing risk) and speculation (betting on price movements). However, they can also be very risky if not understood and managed properly.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is a put option, and how does it work?

A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a specific price (the strike price) on or before a certain date (the expiration date). Let’s imagine you think the price of XYZ stock, currently at $100, is going to drop. You could buy a put option with a strike price of $95 and an expiration date of one month.

If the price falls below $95 before the expiration date, you can exercise your option and sell the stock at $95, limiting your losses. If the price stays above $95, your option expires worthless, and you only lose the premium you paid to buy the put option. Essentially, a put option acts as insurance against price declines.

The seller (writer) of the put option is obligated to buy the stock at the strike price if the buyer exercises the option. The writer receives the premium upfront but bears the risk of potentially having to buy the stock at a higher price than the market value.

Q 17. What is a call option, and how does it work?

A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a specific price (the strike price) on or before a certain date (the expiration date). Let’s say you believe the price of ABC stock, currently at $50, is going to rise. You could buy a call option with a strike price of $55 and an expiration date of three months.

If the price rises above $55 before the expiration date, you can exercise your option and buy the stock at $55, then sell it at the market price, making a profit. If the price remains below $55, your option expires worthless, and you only lose the premium you paid to buy the call option. A call option lets you profit from price increases without having to buy the asset outright.

The seller (writer) of the call option is obligated to sell the stock at the strike price if the buyer exercises the option. The writer receives the premium but bears the risk of potentially having to sell the stock at a lower price than the market value.

Q 18. What are the different types of financial markets?

Financial markets can be categorized in several ways. Here are some key distinctions:

- By Asset Class: This categorizes markets based on the type of asset being traded. Examples include:

- Equity Markets: Stocks are traded, representing ownership in a company (e.g., the New York Stock Exchange, NASDAQ).

- Debt Markets: Bonds and other debt instruments are traded (e.g., the bond market).

- Derivatives Markets: Options, futures, and swaps are traded (e.g., the Chicago Mercantile Exchange).

- Foreign Exchange (Forex) Markets: Currencies are traded (e.g., the global decentralized forex market).

- Commodities Markets: Raw materials like gold, oil, and agricultural products are traded (e.g., the New York Mercantile Exchange).

- By Maturity: Markets are classified based on the length of time until the asset matures.

- Money Markets: Trade short-term debt instruments (less than one year).

- Capital Markets: Trade long-term debt and equity instruments (more than one year).

- By Trading Mechanism: This describes how trading occurs.

- Exchange-Traded Markets: Trading occurs on organized exchanges with centralized order books.

- Over-the-Counter (OTC) Markets: Trading happens directly between two parties, without a central exchange.

Q 19. Explain the role of the Federal Reserve in monetary policy.

The Federal Reserve (the Fed) is the central bank of the United States. Its primary role in monetary policy is to manage the money supply and credit conditions to promote maximum employment, stable prices, and moderate long-term interest rates. They achieve this through several tools:

- Federal Funds Rate: This is the target rate that the Fed wants banks to charge each other for overnight loans. By influencing this rate, the Fed impacts borrowing costs across the economy.

- Discount Rate: The interest rate at which commercial banks can borrow money directly from the Fed. A lower discount rate encourages borrowing and increases the money supply.

- Reserve Requirements: The percentage of deposits that banks must hold in reserve. Lowering reserve requirements frees up funds for lending, expanding the money supply.

- Open Market Operations: The most frequently used tool, involving the buying and selling of U.S. Treasury securities. Buying securities injects money into the economy, while selling securities withdraws money.

The Fed’s actions influence inflation, interest rates, employment, and overall economic growth. A well-executed monetary policy aims to maintain a stable and healthy economy.

Q 20. What is quantitative easing, and how does it work?

Quantitative easing (QE) is a type of unconventional monetary policy where a central bank creates new money electronically and uses it to purchase longer-term government bonds or other assets from commercial banks and other financial institutions. The goal is to increase the money supply and lower long-term interest rates to stimulate the economy, particularly during times of economic crisis or deflationary pressure.

How it works: When the central bank buys assets, it injects liquidity into the financial system. This increases the reserves that banks hold, encouraging them to lend more money, lowering borrowing costs, and stimulating investment and spending. QE aims to reduce long-term interest rates, potentially boosting investment and economic growth. The effect is to increase the money supply without directly lowering short-term interest rates, which may already be near zero.

It’s important to note that QE carries risks, including potential inflation if the increased money supply isn’t absorbed by economic growth. It’s a powerful tool, but its effectiveness is a subject of ongoing debate among economists.

Q 21. What is securitization?

Securitization is the process of pooling together a group of similar financial assets (like mortgages, car loans, or credit card debt) and packaging them into a tradable security. This new security is then sold to investors in the capital markets. Think of it like taking many individual pieces and combining them into a single, more easily traded product.

The process typically involves a Special Purpose Vehicle (SPV) which is a separate legal entity created to hold the assets. This isolates the original lender from the risk associated with the pooled assets. Investors receive payments from the SPV based on the cash flows generated by the underlying assets.

Examples include mortgage-backed securities (MBS) and collateralized debt obligations (CDOs). Securitization can help spread risk, increase liquidity, and make financing more efficient. However, it also played a significant role in the 2008 financial crisis due to the complexity of some securitized products and the difficulty in assessing their true risk.

Q 22. Explain the difference between accounting and finance.

Accounting and finance are closely related but distinct disciplines. Accounting focuses on the recording, classifying, summarizing, and interpreting of financial transactions. Think of it as meticulously documenting a company’s financial history. Finance, on the other hand, uses that accounting information to make decisions about the future. It’s about planning, securing funding, investing capital, and managing risk to maximize value.

Analogy: Imagine building a house. Accounting is like keeping a detailed record of every expense and material used – the lumber, nails, labor costs, etc. Finance is about deciding whether to build the house in the first place, securing a mortgage, managing construction budgets, and eventually selling the house for a profit.

- Accounting: Primarily backward-looking; focuses on accuracy and compliance with accounting standards (e.g., GAAP, IFRS).

- Finance: Primarily forward-looking; focuses on strategic decision-making to optimize value and achieve financial goals.

Q 23. Describe your experience with financial modeling.

I have extensive experience building financial models using Excel and specialized software. My experience spans various models including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and merger and acquisition (M&A) valuations. For example, in my previous role at XYZ Corporation, I developed a three-statement projection model to forecast revenue, expenses, and cash flows over a five-year horizon. This model incorporated key assumptions like market growth rates, pricing strategies, and capital expenditure plans. It was crucial in securing a $50 million loan from our bank. I also regularly perform sensitivity analysis to assess the impact of various factors on projected outcomes, helping management make informed decisions.

I’m proficient in using advanced Excel functions such as VLOOKUP, INDEX/MATCH, SUMPRODUCT, and Data Tables to create dynamic and robust models. I understand the importance of model assumptions and validation, and I always ensure my models are clear, transparent, and auditable.

Q 24. How would you assess the creditworthiness of a company?

Assessing a company’s creditworthiness involves a thorough analysis of its financial health and ability to repay its debts. I would use a multi-faceted approach encompassing several key ratios and qualitative factors.

- Financial Ratios: I’d examine key ratios like the current ratio (liquidity), debt-to-equity ratio (leverage), interest coverage ratio (ability to pay interest), and return on assets (profitability). These provide a quantitative assessment of the company’s financial strength.

- Qualitative Factors: Beyond numbers, I’d consider the company’s industry position, competitive landscape, management quality, and overall business strategy. These factors offer valuable insights into the company’s long-term prospects and risk profile.

- Credit Reports: Reviewing credit reports from agencies like Dun & Bradstreet or Experian provides valuable historical data on the company’s payment behavior and any existing defaults.

By combining quantitative and qualitative analysis, I can develop a comprehensive view of the company’s creditworthiness and assign a credit rating, indicating the level of risk associated with lending to the company.

Q 25. How would you handle a situation where you disagree with your supervisor’s financial decision?

Disagreeing with a supervisor is a delicate situation that requires careful handling. My approach would be professional, respectful, and data-driven. First, I’d listen carefully to their reasoning and try to understand their perspective. Then, I’d respectfully present my alternative view, supported by strong evidence and data. I’d focus on the potential consequences of the supervisor’s decision and highlight the potential risks or missed opportunities.

For example, if I disagreed with a proposed investment based on flawed financial projections, I would present my own analysis, highlighting the underlying assumptions and potential inaccuracies. I would emphasize the importance of using a more robust model and present alternative investment options.

Ultimately, if we cannot reach an agreement, I would document my concerns and perspectives for the record. However, my primary goal would be to find a solution that aligns with the best interests of the company, even if it means compromising on some aspects of my original recommendation.

Q 26. What is your understanding of the current economic climate?

The current economic climate is characterized by several significant trends. Inflation remains a significant concern in many parts of the world, impacting consumer spending and business investment. Interest rates are rising in response to inflationary pressures, affecting borrowing costs for businesses and individuals. Global supply chains are still recovering from the disruptions caused by the pandemic, contributing to persistent inflationary pressures. Geopolitical uncertainties, such as the ongoing conflict in Ukraine, further complicate the outlook, adding to market volatility.

These factors create a complex environment for businesses. Companies need to navigate inflationary pressures by managing costs efficiently, adapting pricing strategies, and securing sufficient capital. Investors need to be cautious, diversifying their portfolios and carefully assessing risk before making investment decisions.

Q 27. Explain your experience with a specific financial software or tool (e.g., Bloomberg Terminal, Excel).

I have extensive experience using Microsoft Excel for financial analysis and modeling, as well as Bloomberg Terminal for market data and financial information. In my previous role, I used Excel to build complex financial models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models and pro forma financial statements. I’m proficient in using VBA (Visual Basic for Applications) to automate repetitive tasks and enhance the efficiency of my financial analysis. My Bloomberg Terminal proficiency enables me to quickly access real-time market data, financial news, and company information, improving my ability to make informed decisions. For example, I regularly use the terminal to screen for potential investments, analyze industry trends and assess the creditworthiness of companies.

Q 28. Describe a situation where you had to make a critical financial decision under pressure.

During a period of significant market volatility, our company faced a potential liquidity crisis. A major customer unexpectedly delayed payment on a substantial invoice, jeopardizing our ability to meet immediate financial obligations, such as payroll and supplier payments. Under considerable pressure, I had to quickly devise a solution to mitigate this risk. I immediately contacted the customer to negotiate a revised payment schedule, while simultaneously exploring alternative financing options, such as short-term loans. I also initiated cost-cutting measures to reduce expenses. Through a combination of negotiation, securing a bridging loan, and implementing cost-cutting measures, we successfully navigated the crisis without major disruptions. This experience highlighted the importance of proactive risk management, decisive action under pressure, and the need for a diverse set of financial solutions.

Key Topics to Learn for Your Knowledge of Finance Interview

- Financial Statements Analysis: Understand how to interpret balance sheets, income statements, and cash flow statements. Focus on key ratios and their implications for a company’s financial health and performance. Practice analyzing real-world financial statements.

- Valuation Methods: Familiarize yourself with different valuation techniques, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. Understand the strengths and weaknesses of each method and their practical applications in different contexts.

- Capital Budgeting: Learn how companies make investment decisions. This includes understanding concepts like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period, and how these are used to evaluate project profitability.

- Working Capital Management: Grasp the importance of managing current assets and liabilities effectively. Understand concepts like cash conversion cycle and how efficient working capital management contributes to profitability.

- Financial Risk Management: Explore different types of financial risks (market risk, credit risk, operational risk) and the strategies used to mitigate them. This includes understanding hedging techniques and risk assessment methodologies.

- Accounting Principles: Possess a solid understanding of basic accounting principles (e.g., accrual accounting, Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS)). This forms the foundation for interpreting financial statements.

Next Steps

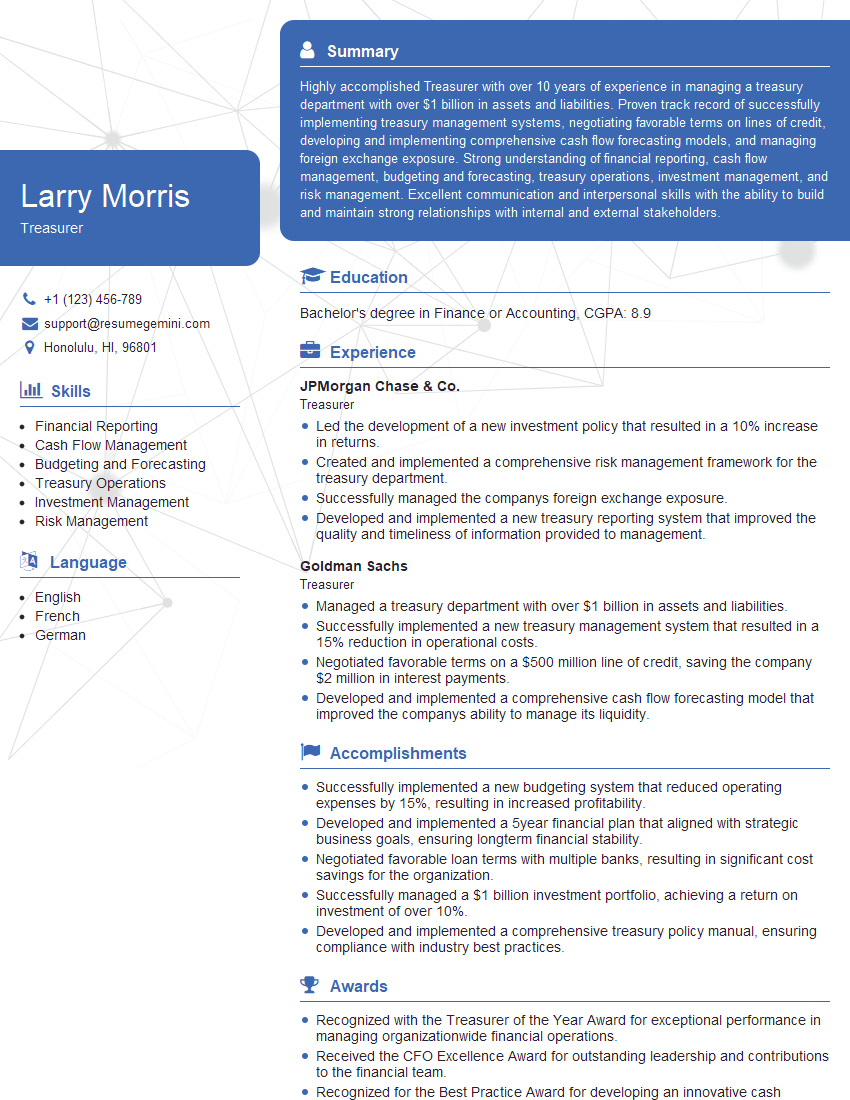

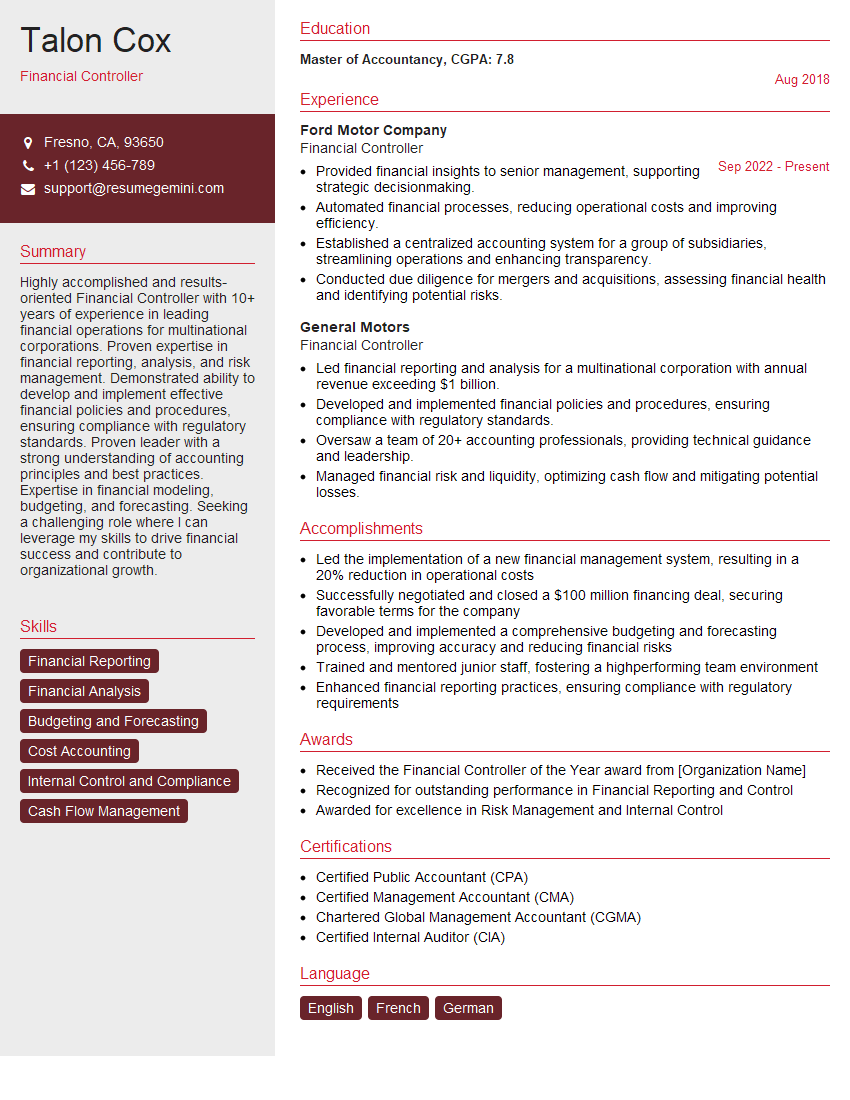

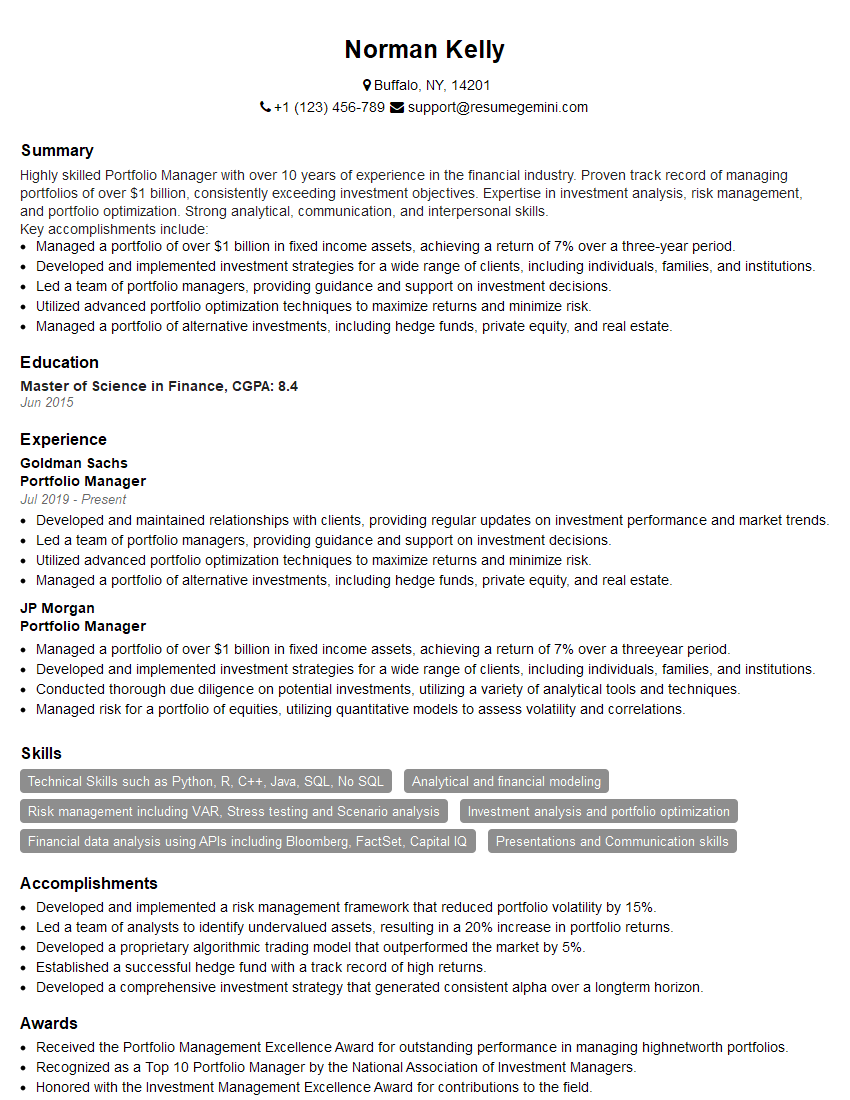

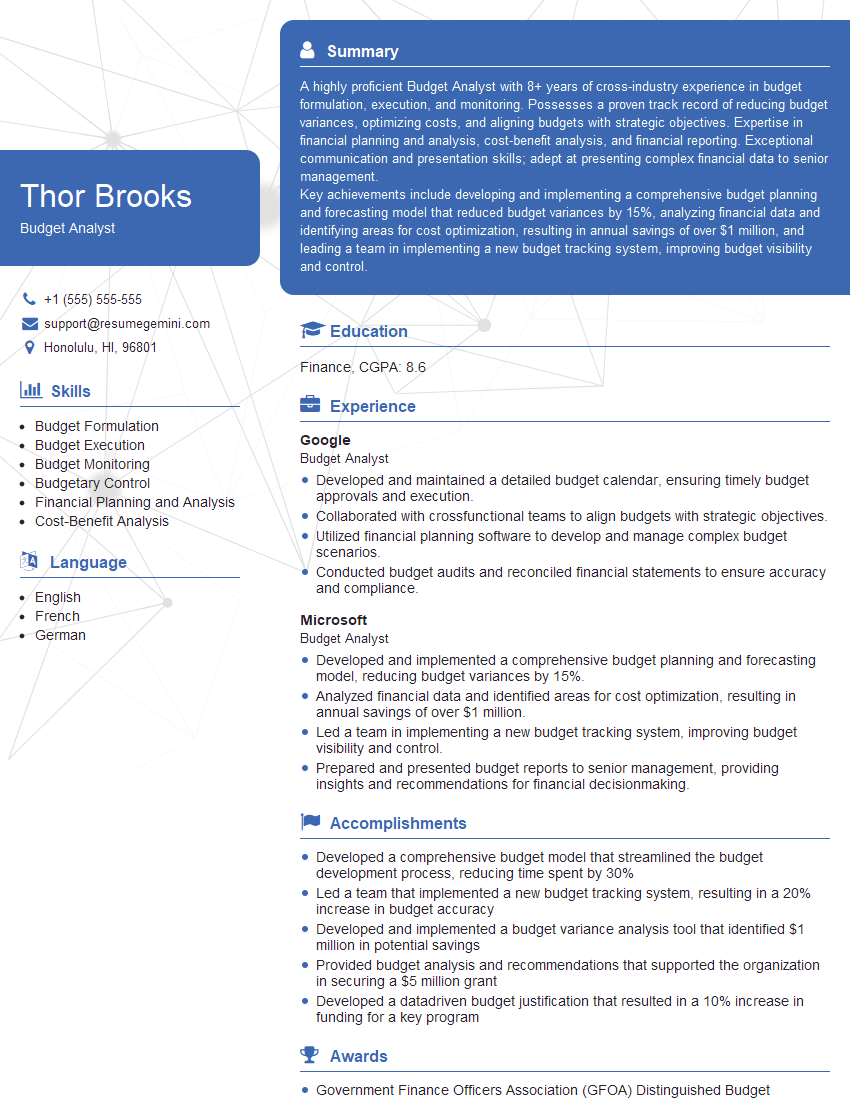

Mastering Knowledge of Finance is crucial for advancing your career in numerous fields, opening doors to higher-paying roles and increased responsibility. A strong foundation in finance demonstrates analytical skills, problem-solving abilities, and a deep understanding of business operations – highly valued attributes in today’s job market. To maximize your chances of landing your dream role, it’s essential to present your skills effectively through a well-crafted, ATS-friendly resume. ResumeGemini is a trusted resource that can help you build a professional resume that highlights your finance expertise and gets noticed by recruiters. We offer examples of resumes tailored to Knowledge of Finance to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).