Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Collection Plan Development interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Collection Plan Development Interview

Q 1. Describe your experience in developing and implementing collection plans.

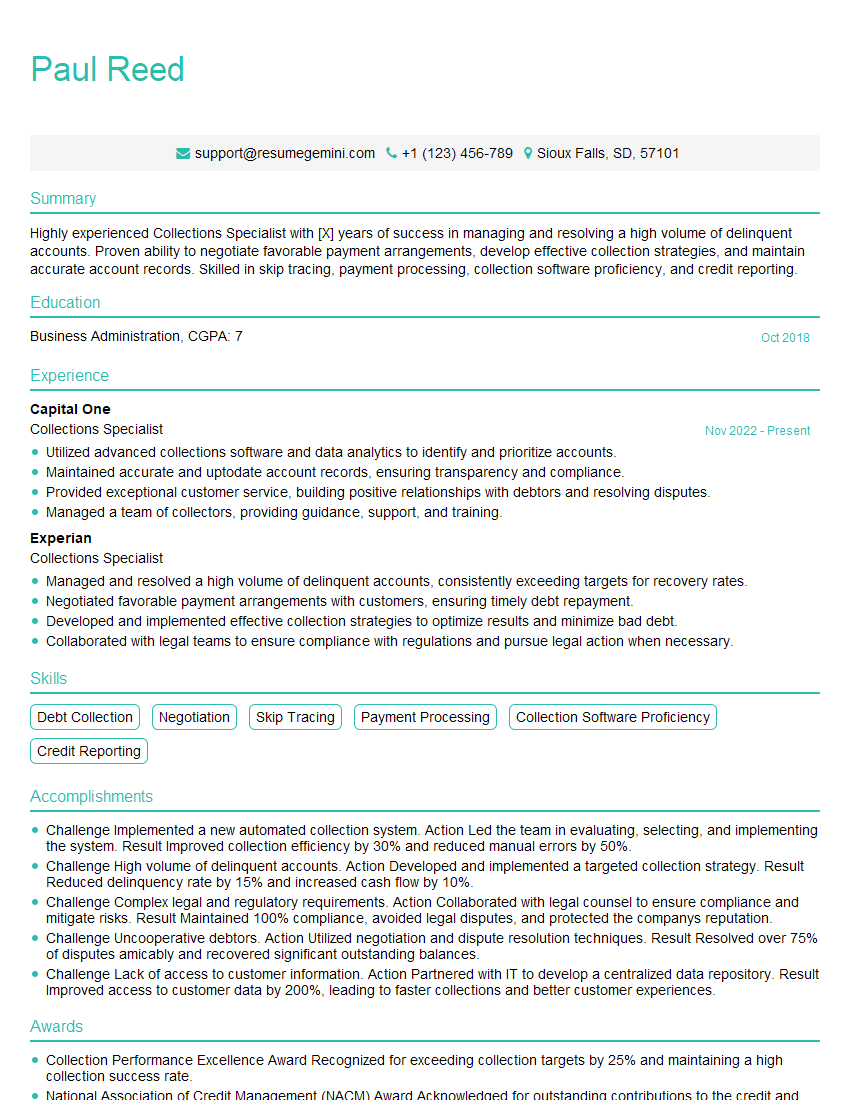

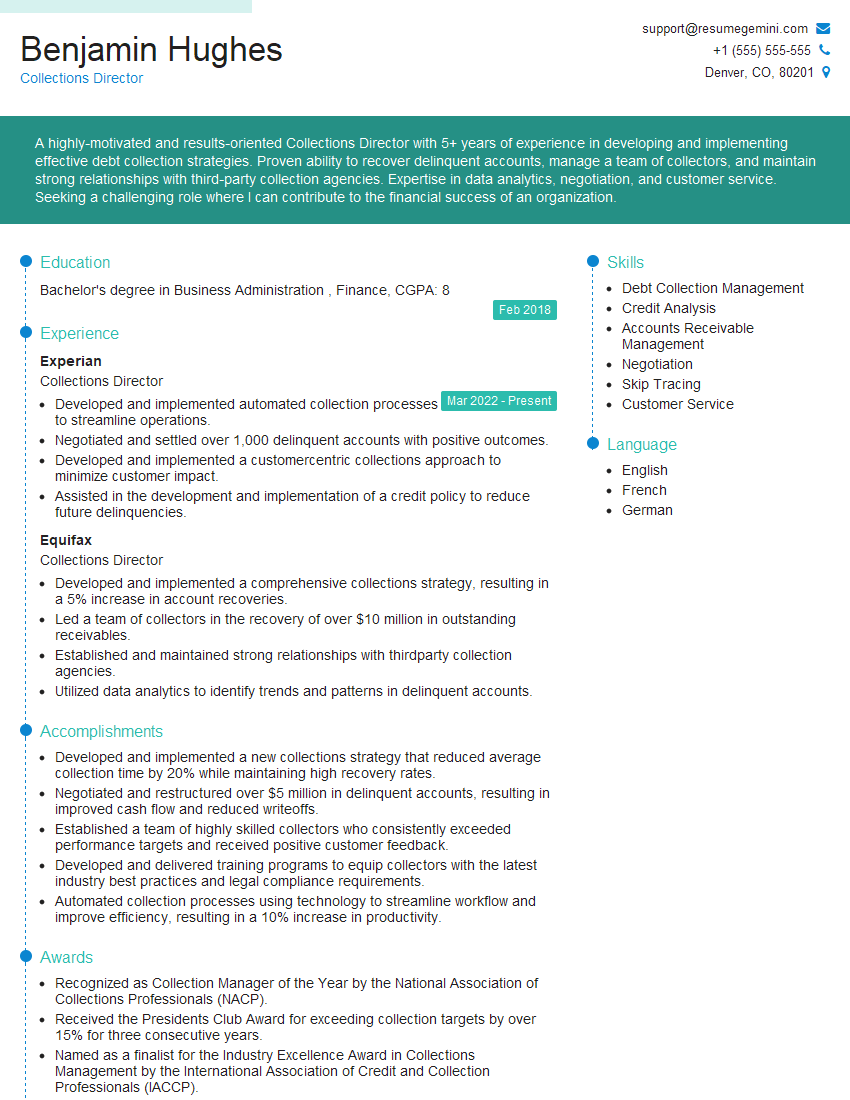

Developing and implementing collection plans involves a systematic approach to recovering outstanding debts. My experience spans diverse industries, encompassing both B2B and B2C environments. I’ve worked on plans ranging from small-scale projects focusing on individual delinquent accounts to large-scale initiatives involving thousands of debtors. This has involved everything from designing the initial strategy, including selecting appropriate collection methods and timelines, to managing the team responsible for execution and analyzing results to improve future strategies. A key part of my approach is creating a plan that’s both effective at recovering funds and compliant with all relevant regulations, ensuring we maintain positive customer relationships where possible.

For example, in a previous role, I developed a collection plan for a telecommunications company struggling with a high rate of overdue bills. By segmenting customers based on their payment history and demographics, we were able to tailor our communication strategies. This resulted in a 15% increase in on-time payments within six months.

Q 2. What key performance indicators (KPIs) do you track to measure the effectiveness of a collection plan?

Measuring the effectiveness of a collection plan relies on several key performance indicators (KPIs). These KPIs provide insights into the efficiency and efficacy of the processes used. Some critical KPIs include:

- Recovery Rate: The percentage of outstanding debt successfully recovered.

- Days Sales Outstanding (DSO): The average number of days it takes to collect payment after a sale. A lower DSO indicates more efficient collection.

- Cost to Collect: The expense incurred in recovering debt, expressed as a percentage of the amount recovered. Lower costs are desirable.

- First Contact Resolution Rate: The percentage of debts resolved on the first contact attempt.

- Write-off Rate: The percentage of debt deemed unrecoverable. A lower rate is the goal.

Tracking these KPIs allows for ongoing monitoring, identification of bottlenecks, and timely adjustments to the collection strategy. Regular reporting on these metrics helps to ensure the plan is meeting its objectives.

Q 3. How do you segment debtors for targeted collection strategies?

Segmenting debtors is crucial for implementing targeted collection strategies. This ensures that we use the most appropriate approach for each individual or business. Segmentation typically involves using several factors:

- Payment History: Grouping debtors based on their past payment behavior, such as consistently late, occasionally late, or consistently on time.

- Debt Age: Categorizing debtors based on how long their debt has been outstanding (e.g., 0-30 days, 31-60 days, 61-90 days, etc.).

- Debt Amount: Separating debtors based on the size of their outstanding debt (high-value vs. low-value).

- Account Type: Differentiating between individual consumers and business accounts, as strategies may differ.

- Communication Preference: Understanding if a debtor prefers email, phone calls, or mail.

Once segmented, tailored collection strategies can be applied. For example, a debtor with a consistently good payment history who is only slightly late may receive a friendly reminder, while a debtor with a history of late payments and a large debt may require more assertive action.

Q 4. Explain your approach to developing a collection plan for a high-value delinquent account.

High-value delinquent accounts require a more personalized and cautious approach. My strategy would involve:

- Thorough Account Review: A comprehensive review of the account history, including payment patterns, communication logs, and any relevant agreements.

- Personalized Communication: Direct communication with the debtor (or decision-maker in a business account) expressing understanding of their situation while emphasizing the importance of payment.

- Negotiated Payment Plans: Offering flexible payment options, such as installment plans or reduced lump-sum settlements, to facilitate recovery.

- Escalation Protocol: Establishing clear escalation procedures, moving to more assertive collection methods if negotiations fail. This might include involving senior management or legal counsel.

- Documentation: Maintaining detailed records of all communication and agreements to protect the company’s legal position.

The goal is to recover as much of the debt as possible while preserving the relationship, if possible. In some cases, writing off a portion of the debt might be a strategic decision to secure at least partial recovery.

Q 5. What strategies do you employ to mitigate the risk of legal action during collections?

Mitigating the risk of legal action requires meticulous adherence to legal and ethical guidelines. This involves:

- Compliance with Regulations: Strict adherence to the Fair Debt Collection Practices Act (FDCPA) and other relevant regulations to prevent legal challenges.

- Detailed Record Keeping: Maintaining comprehensive documentation of all communication, agreements, and actions taken. This provides evidence of compliance and supports the company’s position in case of disputes.

- Accurate Debt Validation: Ensuring the debt is accurately validated before initiating collection efforts.

- Professional Communication: Employing respectful and professional language in all communication with debtors. Avoiding threats or harassment is crucial.

- Legal Counsel Consultation: Seeking advice from legal counsel when necessary, particularly in complex or challenging cases. This helps ensure compliance and proactively addresses potential risks.

By prioritizing compliance and professionalism, the likelihood of legal action can be significantly reduced.

Q 6. How do you handle difficult or uncooperative debtors?

Handling difficult or uncooperative debtors requires patience, empathy, and a structured approach. My strategy would be:

- Attempt Empathy and Understanding: Try to understand the debtor’s situation and address their concerns in a compassionate way.

- Active Listening: Listen carefully to what they are saying and respond accordingly. Often, a simple conversation can resolve misunderstandings.

- Clear and Concise Communication: Ensure all communication is clear, concise, and easy to understand.

- Document Everything: Maintain detailed records of all communication and attempted resolutions.

- Escalation if Necessary: If all other approaches fail, escalate the matter to a supervisor or legal counsel.

Remember, maintaining a professional demeanor is essential, even in frustrating situations. It’s crucial to balance firmness with respect.

Q 7. Describe your experience with different collection methods (e.g., phone calls, letters, email).

My experience encompasses a range of collection methods. Each has its strengths and weaknesses, and the optimal approach often depends on the debtor and the debt itself:

- Phone Calls: Offer immediate feedback and the chance for a personalized interaction. However, they can be time-consuming and may not be effective for all debtors.

- Letters: Provide a formal record of communication but are less immediate and may not receive prompt attention.

- Emails: Offer a convenient and efficient means of communication but lack the personal touch of a phone call.

- SMS/Text Messages: Suitable for brief reminders and updates, but overuse can be intrusive.

Often, a multi-channel approach is most effective. For example, starting with a friendly reminder email, followed by a phone call if there’s no response, and finally a formal letter if the debt remains unpaid. The key is to tailor the method to the specific debtor and situation.

Q 8. How do you prioritize accounts for collection efforts?

Prioritizing accounts for collection efforts is crucial for maximizing recovery rates and resource allocation. I typically employ a multi-faceted approach, combining several key factors. This isn’t a ‘one-size-fits-all’ solution, and the weighting of these factors might shift depending on the specific client or portfolio.

- Account Age: Older debts are often more challenging to collect, as the likelihood of recovery decreases over time. These accounts get higher priority.

- Debt Amount: Larger debts represent a higher potential return on investment, so they deserve more immediate attention.

- Debtor’s Payment History: A history of consistent payments, even partial ones, suggests a higher probability of successful recovery and warrants priority.

- Debtor’s Contact Information: Accounts with readily available and accurate contact details are easier to pursue, making them higher priority.

- Risk Assessment: This involves assessing factors such as the debtor’s financial stability, employment status, and willingness to cooperate. Higher-risk accounts, those likely to dispute or default, might require a more tailored and potentially faster approach.

For example, I might use a scoring system assigning weights to each factor. An account with a high age, large debt amount, and good contact information would receive a higher score and be prioritized over an account with a lower age, small debt, and unreliable contact details. This system allows for a data-driven approach to prioritization, promoting efficiency and maximizing recovery.

Q 9. What software or tools have you used to manage collections?

Throughout my career, I’ve utilized a variety of software and tools to streamline collection management. My experience includes working with both industry-specific platforms and more general CRM systems adapted for collections.

- Specialized Collection Software: These platforms typically offer features such as automated dialer systems, reporting and analytics dashboards, and integrated communication tools (email, SMS, etc.). I’ve worked with systems that allow for detailed account tracking, customized collection strategies, and compliance monitoring.

- CRM Systems (Customer Relationship Management): While not strictly collection-focused, CRMs like Salesforce or Microsoft Dynamics 365 can be effectively configured to manage collections, offering functionalities like contact management, task automation, and reporting capabilities. We can customize fields to include debt information, payment history, and communication logs.

- Spreadsheets and Databases: While less sophisticated, spreadsheets (Excel, Google Sheets) and databases (Access, MySQL) can be helpful for smaller-scale operations or for specific tasks such as generating reports or tracking key performance indicators (KPIs).

The choice of software depends heavily on the size and complexity of the collection portfolio, budget, and specific needs. Regardless of the system, data integrity and security are paramount.

Q 10. How do you stay current with changes in collection regulations and best practices?

Staying abreast of changes in collection regulations and best practices is essential for ethical and legal compliance. I employ a multi-pronged approach:

- Professional Associations: Active participation in organizations such as the ACA International (previously known as the American Collectors Association) keeps me informed through conferences, webinars, and publications on industry trends and regulatory updates.

- Regulatory Websites and Publications: Regularly reviewing websites of relevant regulatory bodies (like the Consumer Financial Protection Bureau – CFPB) and subscribing to industry newsletters ensure I am aware of any new laws, rules, or interpretations.

- Continuing Education: I actively seek out continuing education opportunities – courses, workshops, or certifications – to enhance my knowledge of best practices and emerging technologies within the field.

- Legal Counsel: When facing complex or ambiguous situations, I consult with legal professionals specialized in debt collection to ensure compliance and avoid potential legal issues.

Staying updated isn’t just a legal requirement but also a strategic advantage. By adapting to the latest regulations and best practices, I can improve collection effectiveness while safeguarding the integrity of the process.

Q 11. Explain your understanding of the Fair Debt Collection Practices Act (FDCPA).

The Fair Debt Collection Practices Act (FDCPA) is a U.S. federal law designed to protect consumers from abusive, deceptive, and unfair practices by debt collectors. It sets strict guidelines on how debt collectors can contact debtors, what information they can collect and disclose, and the methods they can use to pursue payment.

Key aspects of the FDCPA include:

- Restrictions on Contact Methods: Collectors are limited in when and how they can contact debtors (e.g., time of day, frequency, methods of communication).

- Prohibition of Harassment and Abuse: The FDCPA prohibits threatening or abusive language, repeated calls, and contact with third parties without consent.

- Validation of Debts: Collectors must provide consumers with validation of the debt within a specific timeframe upon request, including the amount owed and the creditor’s name.

- Accuracy of Information: Collectors must ensure the accuracy of the information they use and provide to consumers.

- Communication Requirements: Collectors must clearly identify themselves as debt collectors in all communications.

Non-compliance with the FDCPA can result in significant penalties for debt collectors. My understanding and adherence to the FDCPA are paramount in my daily work, ensuring ethical and legal debt recovery processes.

Q 12. How do you measure the return on investment (ROI) of a collection plan?

Measuring the ROI of a collection plan is crucial for evaluating its effectiveness and making data-driven improvements. It involves comparing the costs incurred in implementing the plan against the revenue generated from the collected debts.

The calculation is relatively straightforward:

ROI = (Revenue Generated - Costs Incurred) / Costs Incurred

Revenue Generated: This is the total amount of money recovered through the collection plan.

Costs Incurred: These include all expenses associated with the plan, such as staffing costs, software expenses, communication costs, and legal fees. It’s critical to include all direct and indirect costs.

Example: If a collection plan costs $10,000 to implement and generates $50,000 in revenue, the ROI is 400% ( ($50,000 – $10,000) / $10,000 ).

However, a simple ROI calculation may not be sufficient. A comprehensive evaluation should also consider other key performance indicators (KPIs), such as:

- Recovery Rate: Percentage of outstanding debt successfully recovered.

- Average Collection Cost per Dollar Recovered: Indicates efficiency of collection efforts.

- Time to Recovery: Average time taken to collect outstanding debts.

Analyzing these KPIs alongside the ROI provides a more complete picture of the plan’s success and can help identify areas for improvement.

Q 13. How do you adapt a collection plan based on performance data?

Adapting a collection plan based on performance data is a continuous process. Regular monitoring and analysis are essential for maximizing effectiveness. This involves a cyclical process of:

- Data Collection and Analysis: Regularly collect data on key performance indicators (KPIs), including recovery rates, collection costs, time to recovery, and debtor response rates. Analyze this data to identify trends and areas for improvement. This often involves using dashboards and reports from the collection software.

- Identifying Bottlenecks: Pinpoint specific stages in the collection process that are underperforming. This might involve examining individual account performance, assessing the effectiveness of different communication channels, or identifying gaps in the collection strategy.

- Strategy Adjustment: Based on the data analysis, make necessary adjustments to the collection plan. This might involve:

- Optimizing Communication Strategies: Testing different communication methods (e.g., email, phone, SMS) to find what works best for different debtor segments.

- Refining Collection Procedures: Streamlining internal processes to improve efficiency and reduce costs.

- Adjusting Prioritization: Shifting resources towards higher-performing segments or accounts.

- Implementing New Technologies: Adopting new tools or technologies to enhance the collection process.

- Testing and Iteration: Implement changes gradually, testing their impact on KPIs. Continuously monitor performance and make further adjustments as needed.

For instance, if data shows a low response rate to email communication, the plan might be adjusted to prioritize phone calls or SMS messages for a particular segment of debtors. This iterative approach ensures that the collection plan remains dynamic and responsive to changing circumstances and performance.

Q 14. Describe your experience in forecasting collection revenue.

Forecasting collection revenue requires a blend of historical data, current market conditions, and informed judgment. It’s not an exact science, but employing robust methodologies can lead to more accurate projections.

My approach typically involves:

- Analyzing Historical Data: Reviewing past collection performance, focusing on trends in recovery rates, average collection periods, and the distribution of debt amounts across various aging buckets. This forms the foundation of the forecast.

- Considering Economic Factors: Assessing macroeconomic conditions – interest rates, unemployment levels, and consumer spending patterns – which influence debtor repayment capacity and willingness.

- Segmenting Accounts: Dividing the accounts receivable into meaningful segments (e.g., by age of debt, type of debtor, or payment history) allows for more accurate predictions for each segment.

- Using Forecasting Models: Employing statistical techniques like regression analysis or time series modeling to project future collection performance based on historical data and identified trends. These models can incorporate various factors to improve accuracy.

- Incorporating Qualitative Factors: Considering non-quantifiable factors, such as changes in collection strategies, regulatory changes, or anticipated changes in debtor behavior, can enhance the forecast’s accuracy.

For example, if historical data shows a consistent 70% recovery rate for debts less than 90 days old, and current market conditions suggest no significant changes in consumer financial health, we can project a similar recovery rate for future debts in that age range. However, if a new regulatory change impacts the collection methods, that must be factored into the prediction, possibly reducing the projected recovery rate. Regular review and adjustments based on actual collection performance are essential to refine future forecasts.

Q 15. How do you handle disputes and objections from debtors?

Handling disputes and objections requires a calm, professional, and empathetic approach. My strategy centers around active listening and thorough documentation. First, I ensure I completely understand the debtor’s objection. This might involve reviewing their account history, verifying the debt, and addressing any discrepancies. Then, I clearly explain the terms of the debt and the legal ramifications of non-payment, but always in a respectful manner.

For example, if a debtor claims they never received a bill, I’d verify the mailing address and potentially offer alternative proof of communication. If they dispute the amount owed, I meticulously go through the calculation, providing supporting documentation. Finally, I explore potential solutions, such as payment plans or compromise offers, to reach a mutually agreeable resolution. Every interaction is meticulously documented to protect both the debtor and the company.

If the dispute cannot be resolved, we follow established internal protocols, which may involve escalation to a supervisor or legal counsel. The key is to maintain professionalism, follow procedures, and document every step of the process thoroughly.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with collection agencies or third-party vendors?

I have extensive experience working with both collection agencies and third-party vendors. In previous roles, I’ve successfully managed outsourcing of delinquent accounts to reputable agencies, negotiating contracts that align with our company’s compliance standards and recovery goals. I’ve overseen the selection process, ensuring agencies have a proven track record, appropriate licensing, and adherence to fair debt collection practices. My experience encompasses contract negotiation, performance monitoring, and regular communication with agencies to ensure optimal results and maintain a high standard of ethical conduct.

Specifically, I’ve utilized agencies for high-volume, complex cases that required specialized expertise, significantly improving our recovery rates. I’ve also implemented robust KPI tracking systems to measure agency performance, identifying areas for improvement and optimizing our partnerships. This ensures accountability and transparency in our outsourcing strategy.

Q 17. How do you manage and motivate a collection team?

Motivating a collection team requires a multi-faceted approach that combines clear expectations, effective training, supportive leadership, and performance-based incentives. I start by establishing clear, measurable goals and providing ongoing training on industry best practices, compliance regulations, and effective communication techniques. This ensures the team is equipped with the necessary skills to succeed.

Regular team meetings are crucial for providing feedback, addressing challenges, and fostering a collaborative environment. I emphasize the importance of ethical behavior and empower team members to make informed decisions. I also implement a system of recognition and rewards for exceptional performance, promoting healthy competition and boosting morale. Finally, I believe in open communication and actively seek feedback from team members to address concerns and improve team dynamics. It’s like coaching a sports team; you need strategy, skill-building, and encouragement to win.

Q 18. Describe your experience in creating collection reports and presentations.

Creating comprehensive collection reports and presentations is a critical part of my role. I use data analysis tools to extract meaningful insights from our collection data, including recovery rates, average collection period, and delinquency trends. These insights are then visualized using charts, graphs, and other visual aids to create clear and concise reports that highlight key performance indicators (KPIs).

For example, I might create a report showing the effectiveness of different collection strategies or a presentation summarizing the overall performance of the collection department for a given period. My presentations are designed to be engaging and easy to understand, even for audiences without a deep understanding of collections. I tailor the content to the audience, using language and visual aids that effectively communicate the key findings and recommendations.

Q 19. How do you ensure compliance with all applicable laws and regulations?

Compliance is paramount. We adhere to all applicable federal and state laws and regulations regarding debt collection, including the Fair Debt Collection Practices Act (FDCPA) and state-specific regulations. We maintain a comprehensive compliance program that includes regular training for our team, ongoing monitoring of our processes, and periodic audits to ensure we’re meeting all legal requirements. We also maintain detailed records of all communications with debtors.

For instance, we ensure all communications are compliant with FDCPA guidelines regarding contact frequency, times of contact, and permissible language. We implement robust procedures for handling disputes and validating debts. Our compliance program is not a static document; it’s a continuously evolving process that adapts to changes in legislation and best practices. We proactively seek guidance from legal counsel to stay ahead of any potential compliance issues.

Q 20. How do you build rapport with debtors to encourage payment?

Building rapport is fundamental to successful debt recovery. I approach each interaction with empathy and understanding, recognizing that financial difficulties can be stressful and emotionally challenging. I begin by actively listening to the debtor’s situation, acknowledging their challenges without judgment. I use clear, concise language, avoiding jargon, and personalize the communication, showing I’m genuinely interested in finding a solution that works for them.

For example, instead of demanding immediate payment, I might ask open-ended questions to understand their financial circumstances. This approach builds trust and encourages them to be more open and cooperative. Maintaining a professional and respectful tone throughout the conversation is critical, fostering collaboration rather than confrontation. The goal isn’t to pressure them, but to create a mutually respectful dialogue that fosters cooperation.

Q 21. What strategies do you use to negotiate payment plans?

Negotiating payment plans requires flexibility and a willingness to find creative solutions. I begin by understanding the debtor’s financial capacity and exploring different payment options. This might involve a lump-sum payment, a series of smaller payments, or a combination of both. The key is to create a plan that is both realistic and achievable for the debtor while protecting the creditor’s interests. I always put the agreement in writing.

For instance, if a debtor is facing significant hardship, I might propose a reduced payment amount for a longer period. Conversely, if they have a stronger capacity to pay, I might propose a higher payment amount over a shorter period. I often use amortization schedules to clearly illustrate the payment plan and ensure transparency. The negotiation process requires careful consideration of all factors involved, with the ultimate goal of reaching a mutually acceptable agreement that secures payment without resorting to harsh collection methods.

Q 22. How do you handle charge-offs and write-offs?

Handling charge-offs and write-offs requires a meticulous approach that balances financial realities with regulatory compliance. A charge-off is the accounting practice of removing a bad debt from the books, acknowledging its probable uncollectibility. A write-off is the formal process of removing the debt from the company’s records. They aren’t always simultaneous.

My process involves:

- Strict adherence to internal policies and procedures: This ensures consistency and minimizes legal risk. We have clearly defined criteria for determining when a debt is truly uncollectible, factoring in factors like aging, attempts at collection, and debtor’s financial situation.

- Thorough documentation: Every step in the process, from initial delinquency to the final charge-off/write-off, is meticulously documented. This includes communication logs, payment history, and any legal actions taken. This documentation is crucial for audits and potential disputes.

- Regular review and analysis: We regularly analyze charge-off/write-off rates to identify trends and potential areas for improvement in our collection strategies. High rates might indicate a problem with our credit approval process, customer service, or collection techniques.

- Collaboration with legal counsel: In complex cases, or those involving potential fraud, we consult with legal counsel to ensure compliance and explore all legal options.

For example, if a debt remains uncollectible after multiple attempts and several months of delinquency, and it meets our internal criteria, we’ll initiate the formal charge-off and write-off process. The accounting department will adjust the balance sheet, and the debt will be removed from our active collection portfolio.

Q 23. How do you identify and address systemic issues affecting collection performance?

Identifying and addressing systemic issues impacting collection performance requires a data-driven approach combined with insightful analysis. It’s not enough to simply react to individual failures; we need to understand the underlying causes.

My strategy focuses on:

- Data analysis: Key performance indicators (KPIs) such as collection rate, days sales outstanding (DSO), and average collection period are meticulously tracked and analyzed. Trends and anomalies are carefully examined. For instance, a sudden spike in DSO might indicate a problem with invoice processing or a shift in customer payment behavior.

- Root cause analysis: Once a problem is identified, a thorough root cause analysis is conducted using methods like the ‘5 Whys’ to drill down to the fundamental issue. Is it a technological glitch? A flaw in our communication strategy? A change in the economic climate affecting our customer base?

- Process improvement: Based on the root cause analysis, improvements are implemented. This might involve updating our collection software, implementing new training programs for collectors, improving communication channels with customers, or revising our credit risk assessment process.

- Regular performance monitoring: The implemented changes are closely monitored to measure their effectiveness. We use control groups and A/B testing to assess the impact of new initiatives.

For example, if we observe a consistent drop in our collection rate for a particular customer segment, we might analyze their payment history, demographics, and interactions with our company to pinpoint the cause. This might reveal a need for more tailored collection strategies for this segment or improvements to our customer service interactions.

Q 24. Explain your understanding of different collection agency business models.

Collection agency business models vary widely, each with its own strengths and weaknesses. Here are a few key models:

- Percentage-based model: Agencies charge a percentage of the amount collected. This incentivizes high recovery rates but can lead to aggressive collection practices if not properly managed.

- Flat-fee model: Agencies charge a fixed fee per account or a flat monthly retainer. This provides predictability for budgeting but might not incentivize maximizing recoveries.

- Hybrid model: Agencies combine percentage-based and flat-fee structures, offering a balance between incentive and predictability. For example, a base fee might be charged per account, with a bonus added for successful collections above a certain threshold.

- Debt buying model: Agencies purchase portfolios of delinquent debts at a discounted price and then pursue collection. This model carries higher risk but also higher potential reward, depending on the portfolio’s quality.

The choice of model depends heavily on the client’s needs and risk tolerance. A company with a large volume of low-value debts might prefer a flat-fee model, while a company with a few high-value debts might choose a percentage-based model to incentivize strong recovery efforts. Understanding these models is crucial for negotiating fair and effective contracts.

Q 25. What are some common challenges in collection plan development, and how do you overcome them?

Developing effective collection plans presents many challenges. Here are a few common ones and how I approach them:

- Balancing recovery rates with customer relationships: Aggressive collection tactics might improve recovery rates in the short term but damage customer relationships in the long term. I address this by implementing a tiered approach, starting with gentle reminders and escalating only when necessary. Clear communication and empathy are crucial.

- Regulatory compliance: Collection activities must comply with various state and federal laws (e.g., Fair Debt Collection Practices Act). I ensure compliance by staying updated on relevant regulations and incorporating them into our collection policies and procedures. Training staff on compliance is also paramount.

- Resource constraints: Collection departments often face limitations in terms of budget, staff, and technology. I overcome this by prioritizing accounts based on their potential recovery value and using technology to automate repetitive tasks, freeing up staff for more complex cases.

- Data accuracy and accessibility: Inaccurate or incomplete data can severely hinder collection efforts. I address this by implementing rigorous data quality control measures and using integrated systems to ensure all relevant information is accessible to collectors in real-time.

For instance, if we face resource constraints, I might prioritize the collection of debts with the highest probability of recovery, focusing on accounts that are relatively recent and have a history of on-time payments. This ensures efficient use of limited resources.

Q 26. How do you maintain accurate and up-to-date records of collection activities?

Maintaining accurate and up-to-date records is crucial for efficient collection and regulatory compliance. My approach involves:

- Centralized database: All collection activities are documented in a centralized database, accessible to authorized personnel. This eliminates data silos and ensures everyone has access to the latest information.

- Automated data entry: Wherever possible, data entry is automated to minimize errors and save time. For example, automated systems can integrate with our accounting software to update account balances automatically.

- Regular data audits: Regular audits are conducted to ensure data accuracy and identify any inconsistencies or missing information. This could involve comparing data against external sources like credit bureaus.

- Secure data storage: All data is stored securely to protect against unauthorized access and data breaches. This includes encryption, access controls, and regular security updates.

- Version control: Important documents like collection plans and policies are version-controlled to track changes and ensure that everyone is working with the most current version.

For example, we use a CRM system to track all communication with debtors, including phone calls, emails, and letters. This centralized record provides a complete history of each account, making it easier to track progress and make informed decisions.

Q 27. Describe your experience in developing and implementing collection policies and procedures.

I have extensive experience in developing and implementing collection policies and procedures, focusing on compliance, efficiency, and ethical practices. My approach involves:

- Needs assessment: The first step is to assess the organization’s specific needs and challenges. This involves analyzing existing processes, identifying weaknesses, and understanding regulatory requirements.

- Policy development: Based on the needs assessment, comprehensive collection policies are developed. These policies define the agency’s approach to collection, including communication strategies, escalation procedures, and compliance guidelines.

- Procedure development: Detailed procedures are created to support the policies. These procedures outline step-by-step instructions for collectors, ensuring consistency and efficiency across the team.

- Training and implementation: All staff are thoroughly trained on the new policies and procedures. This includes role-playing and simulated scenarios to reinforce learning.

- Monitoring and review: The policies and procedures are regularly monitored and reviewed to identify areas for improvement. Feedback from collectors and stakeholders is actively sought.

In a previous role, I developed a new collection policy that incorporated a more empathetic approach to customer communication, resulting in a significant improvement in customer satisfaction without negatively impacting recovery rates. This was achieved by providing training that emphasized clear, concise communication and the importance of building rapport with customers.

Q 28. How do you leverage technology to improve collection efficiency?

Technology plays a vital role in improving collection efficiency. I leverage various technologies, including:

- Collection automation software: This software automates many repetitive tasks, such as sending reminders, generating reports, and scheduling calls. This frees up collectors to focus on more complex cases.

- Predictive analytics: These tools use data analysis to predict which accounts are most likely to default, allowing for proactive intervention. This helps prioritize accounts for collection efforts.

- CRM systems: Customer relationship management systems provide a centralized repository for all customer data, enabling better tracking of communication and payment history.

- IVR (Interactive Voice Response) systems: IVR systems can handle initial customer contact, gathering information and routing calls to the appropriate collector, streamlining the process and handling high call volumes more effectively.

- Secure communication platforms: These platforms ensure secure and compliant communication with debtors, reducing the risk of data breaches and maintaining regulatory compliance.

For example, implementing predictive analytics allowed us to identify accounts at high risk of delinquency, enabling us to contact those customers proactively. This resulted in a significant reduction in the number of accounts going into default.

Key Topics to Learn for Collection Plan Development Interview

- Understanding Debtor Behavior: Learn to analyze different debtor profiles and predict their likely responses to collection strategies. This includes understanding factors influencing payment behavior, such as financial situations and communication styles.

- Legal and Regulatory Compliance: Master the legal frameworks governing debt collection in your region. This includes Fair Debt Collection Practices Act (FDCPA) knowledge (if applicable) and understanding ethical considerations in collection strategies.

- Developing Effective Collection Strategies: Explore various collection strategies, including early-stage intervention techniques, negotiation tactics, and the escalation process. Understand how to tailor strategies to specific debtor situations and risk levels.

- Risk Assessment and Mitigation: Learn to identify and assess risks associated with different collection strategies, and develop mitigation plans to minimize potential losses and legal repercussions.

- Technology and Automation in Collections: Familiarize yourself with collection management software and automation tools. Understand how these tools enhance efficiency and improve collection outcomes.

- Performance Measurement and Reporting: Learn to track key performance indicators (KPIs) such as recovery rates, average collection time, and write-off rates. Understand how to analyze this data to optimize collection plans and demonstrate effectiveness.

- Communication and Negotiation Skills: Practice effective communication and negotiation techniques to build rapport with debtors, resolve disputes, and secure payment arrangements. Emphasize empathy and professionalism in all interactions.

- Collection Plan Documentation and Presentation: Practice clearly and concisely documenting collection plans, and presenting them effectively to stakeholders. Demonstrate your ability to justify your proposed strategies.

Next Steps

Mastering Collection Plan Development is crucial for career advancement in the finance and collections industries, opening doors to leadership roles and increased earning potential. To significantly boost your job prospects, create a compelling and ATS-friendly resume that highlights your skills and experience. We highly recommend using ResumeGemini to build a professional and impactful resume that showcases your abilities in this specialized field. ResumeGemini provides examples of resumes tailored to Collection Plan Development to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good