Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Due Diligence and Contract Negotiation interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Due Diligence and Contract Negotiation Interview

Q 1. Explain the different phases of a due diligence process.

The due diligence process is a systematic investigation designed to verify information and identify potential risks before a significant business decision, like an acquisition or investment. It typically unfolds in phases:

- Phase 1: Pre-Due Diligence/Scoping: This initial phase involves defining the scope and objectives of the due diligence process. We identify key areas of focus based on the transaction type and the target entity. This often includes reviewing preliminary information, such as financial statements and transaction documents, to assess initial viability and refine the scope.

- Phase 2: Information Gathering: This is where the bulk of the work takes place. We request and review extensive documentation from the target company, covering areas like financials, legal, regulatory compliance, operational aspects, and environmental matters. This can involve document reviews, site visits, and interviews with key personnel.

- Phase 3: Analysis and Risk Assessment: We analyze the gathered information to identify and assess potential risks. This phase is crucial as it allows us to prioritize findings and evaluate their potential impact on the transaction. We quantify the risks, determining their likelihood and potential severity.

- Phase 4: Reporting and Recommendations: We compile our findings into a comprehensive report, detailing our assessment of the target entity and outlining any material risks identified. We provide recommendations on how to mitigate these risks or negotiate favorable terms within the transaction.

- Phase 5: Negotiation and Closing: Based on the due diligence findings, we advise on negotiation strategies and work with the client to secure the best possible outcome. This phase involves using the due diligence report as a powerful tool to negotiate terms, secure indemnities, and modify transaction structures.

For example, in an acquisition, phase 2 might involve scrutinizing the target company’s intellectual property portfolio to ensure that all necessary licenses and patents are in order, while phase 3 would involve assessing the risk of potential intellectual property infringement lawsuits.

Q 2. What are the key components of a legally sound contract?

A legally sound contract protects both parties involved and minimizes future disputes. Key components include:

- Offer and Acceptance: A clear offer by one party and an unequivocal acceptance by the other, demonstrating mutual agreement on the terms.

- Consideration: Something of value exchanged by each party (e.g., money, goods, services). This signifies a legally binding agreement.

- Capacity: Both parties must have the legal capacity to enter into a contract; they must be of legal age and have the mental capacity to understand the terms.

- Legality: The subject matter of the contract must be legal and not violate any laws or regulations.

- Mutual Assent (Meeting of the Minds): Both parties must have a clear understanding of the terms and conditions of the contract.

- Certainty and Completeness: All essential terms must be clearly defined and unambiguous to avoid future disputes. Vague or incomplete terms can invalidate the contract.

- Proper Formalities: Some contracts require specific formalities like being in writing and signed by both parties (e.g., contracts involving the sale of land).

For instance, a vague clause like “reasonable efforts” should be replaced with specific, measurable targets to prevent future disagreements about performance.

Q 3. How do you identify and assess potential risks during due diligence?

Identifying and assessing potential risks during due diligence requires a structured approach. We employ a combination of techniques:

- Financial Statement Analysis: Scrutinizing financial records to detect inconsistencies, potential fraud, or unsustainable financial practices. We look for red flags like unusual account balances or inconsistencies between different financial statements.

- Legal Review: Examining contracts, licenses, permits, and other legal documents to identify potential legal issues, compliance risks, or outstanding litigation.

- Operational Review: Assessing the target’s operational efficiency, management quality, key personnel, and technological infrastructure. This might involve site visits and interviews.

- Environmental Review: Assessing environmental risks, including potential liabilities related to pollution, waste disposal, or environmental regulations.

- Regulatory Compliance Review: Checking for compliance with all relevant laws and regulations. This can be industry-specific or general.

- Reputational Risk Assessment: Evaluating the target’s reputation, public image, and potential risks associated with negative publicity or past controversies.

For example, discovering significant undisclosed liabilities during the financial statement analysis phase could be a material adverse finding significantly impacting the transaction’s value and feasibility.

Q 4. Describe your experience negotiating complex contracts.

I have extensive experience negotiating complex contracts across various industries, including mergers and acquisitions, joint ventures, and technology licensing agreements. My approach is strategic and collaborative. I prioritize:

- Thorough Preparation: I meticulously review the contract, understand the client’s objectives, and identify key areas for negotiation.

- Understanding Counterparty Needs: I strive to understand the other party’s motivations and interests to find mutually beneficial solutions.

- Creative Problem-Solving: I am adept at finding creative solutions that address the concerns of all parties while achieving the client’s goals.

- Strong Communication: I communicate clearly and persuasively, effectively conveying our position while actively listening to the other party.

- Documentation: I maintain detailed records of all negotiations, ensuring clarity and avoiding misunderstandings.

In one instance, I negotiated a technology licensing agreement that included complex clauses on intellectual property rights, payment terms, and termination conditions. Through diligent preparation and strategic negotiation, I secured favorable terms for my client, mitigating potential risks and maximizing the return on their investment.

Q 5. What are your strategies for dealing with contract disputes?

My strategies for dealing with contract disputes aim for efficient and cost-effective resolution. I prioritize:

- Negotiation and Mediation: I attempt to resolve disputes through amicable negotiation and, if necessary, mediation. This approach often preserves the business relationship while achieving a satisfactory outcome.

- Arbitration: If negotiation fails, arbitration is a faster and less expensive alternative to litigation. It involves a neutral third party who makes a binding decision.

- Litigation: As a last resort, litigation is pursued when other methods fail to resolve the dispute. I work with experienced litigation counsel to present a strong case.

- Contractual Clauses: To minimize disputes, I strategically draft contracts including dispute resolution mechanisms, such as arbitration clauses or specific jurisdiction clauses.

For example, in a recent dispute involving a breach of contract, I successfully negotiated a settlement through mediation, avoiding costly litigation and preserving the long-term business relationship.

Q 6. How do you prioritize due diligence tasks in a time-sensitive environment?

Prioritizing due diligence tasks in a time-sensitive environment requires a structured and efficient approach. I use a risk-based prioritization framework:

- Identify Critical Risks: I start by identifying the most critical risks to the transaction, focusing on aspects that could be deal-breakers. For instance, material financial issues or significant legal hurdles.

- Assess Time Sensitivity: I assess the time constraints imposed by external factors such as deadlines or regulatory requirements.

- Allocate Resources: I allocate resources—personnel and time—proportionately to the identified risks and time sensitivity. More critical risks receive higher priority and more resources.

- Parallel Processing: I utilize parallel processing wherever possible, allowing multiple teams to work on different aspects of the due diligence simultaneously.

- Regular Monitoring: I implement a system for regularly monitoring progress, identifying bottlenecks, and adjusting the plan as needed.

Imagine a situation where a deal is closing in just 3 weeks. We would prioritize reviewing financial statements and legal documents related to material contracts immediately, while assigning lower priority to less crucial areas.

Q 7. Explain the difference between material and immaterial adverse findings.

The distinction between material and immaterial adverse findings is crucial in due diligence. A material adverse finding is a significant issue that could substantially impact the value, operations, or viability of the target entity. It could lead to renegotiation of the transaction terms or even the termination of the deal. An immaterial adverse finding is a minor issue that is unlikely to significantly affect the overall assessment of the target. It might require minor adjustments but wouldn’t derail the transaction.

For example, discovering significant undisclosed debt (material) would be far more impactful than finding minor bookkeeping errors (immaterial). The determination of materiality is often context-dependent and requires careful consideration of the specific facts and circumstances of each transaction.

Q 8. What are some common red flags to look for during financial due diligence?

Financial due diligence is a critical process to identify potential risks before a merger, acquisition, or investment. Common red flags can be broadly categorized into accounting irregularities, operational issues, and financial health concerns. Let’s explore some examples.

- Inconsistencies in Financial Statements: Sudden and unexplained changes in revenue, expenses, or assets warrant further investigation. For instance, a significant jump in revenue without a corresponding increase in sales or customer base could indicate fraudulent activity. I would meticulously compare financial statements across several years, looking for anomalies and trends.

- High Levels of Debt: A company burdened with excessive debt may struggle to meet its financial obligations, increasing the risk of default. I analyze debt-to-equity ratios, interest coverage ratios, and cash flow statements to assess debt sustainability. A high debt-to-equity ratio, coupled with declining cash flow, is a serious warning sign.

- Aggressive Accounting Practices: Look out for aggressive revenue recognition, capitalization of expenses that should be expensed, or other accounting maneuvers that artificially inflate profits. A deep dive into the accounting policies and footnotes is crucial here.

- Related-Party Transactions: Transactions with related parties, such as family members or affiliated companies, need careful scrutiny. They can be used to siphon off funds or mask financial problems. Full transparency and proper documentation are essential.

- Lack of Transparency: Resistance to providing financial data or inadequate documentation should raise concerns. A thorough due diligence process demands complete and unrestricted access to all relevant financial information.

Identifying these red flags isn’t just about finding problems; it’s about understanding their potential impact on the deal’s valuation and future success. A thorough analysis allows informed decision-making and risk mitigation.

Q 9. How do you manage expectations during contract negotiations?

Managing expectations in contract negotiations is crucial for building trust and achieving a mutually beneficial agreement. It’s about clear communication, realistic goal-setting, and a collaborative approach. I start by actively listening to understand the other party’s needs and priorities, even if they seem unreasonable at first glance.

- Setting Clear Expectations from the Start: I clearly articulate my client’s objectives and limitations upfront, emphasizing what’s negotiable and what’s non-negotiable. This sets a foundation of transparency and prevents misunderstandings later on.

- Regular Communication and Updates: I keep all stakeholders informed throughout the negotiation process. This includes regular updates on progress, potential roadblocks, and alternative solutions.

- Compromise and Collaboration: Negotiation is not a zero-sum game. I actively seek win-win solutions by identifying areas of mutual benefit and exploring creative compromises. Flexibility is key.

- Managing Internal Expectations: Equally important is managing the expectations within my own team. Clear communication of potential outcomes and challenges keeps everyone aligned and avoids internal conflicts.

- Documenting Agreements: Every agreed-upon point, no matter how small, should be documented in writing. This prevents disputes arising from misinterpretations or memory lapses later.

By employing these strategies, I ensure that all parties understand the process, their roles, and the likely outcomes, leading to smoother negotiations and more robust agreements.

Q 10. How do you handle conflicts of interest during due diligence?

Conflicts of interest pose significant threats to the integrity and objectivity of due diligence. My approach focuses on proactive identification, disclosure, and mitigation.

- Identifying Potential Conflicts: I start by carefully reviewing my own team’s backgrounds and relationships to identify any potential conflicts with the target company, its stakeholders, or the transaction itself. This involves reviewing personal financial holdings, past engagements, and family connections.

- Disclosure and Transparency: Any identified or potential conflict of interest is immediately disclosed to all relevant parties – the client, the target company, and regulatory bodies as required. Transparency is paramount.

- Recusal and Independence: If a conflict is unavoidable, the involved individual is recused from the due diligence process, ensuring the independence and impartiality of the investigation.

- Independent Verification: When possible, I rely on independent third-party experts to verify findings, particularly in areas where a potential conflict might have influenced the assessment.

- Ethical Guidelines and Compliance: My work strictly adheres to professional ethical guidelines and relevant regulations to maintain objectivity and integrity throughout the due diligence process.

By proactively addressing conflicts of interest, I ensure the credibility and reliability of the due diligence findings, thus protecting the interests of my clients and upholding professional standards.

Q 11. Describe your experience using due diligence software or tools.

I have extensive experience leveraging various due diligence software and tools to streamline and enhance the process. My experience spans from basic data aggregation tools to sophisticated analytics platforms.

- Data Room Platforms: I’m proficient in using secure virtual data rooms (VDRs) like Intralinks and Firmex to manage and review large volumes of financial and legal documents. These platforms offer features such as access control, document versioning, and audit trails, ensuring data security and efficient collaboration.

- Financial Modeling Software: I regularly utilize financial modeling tools like Excel, but also more specialized software such as Bloomberg Terminal, providing advanced analytical capabilities for financial statement analysis, valuation, and forecasting.

- Data Analytics Tools: I’ve used tools to automate parts of the due diligence process, such as identifying trends, anomalies, and inconsistencies in large datasets. This reduces manual effort and enhances accuracy.

- Compliance Software: I am familiar with compliance software that helps navigate and ensure adherence to various legal and regulatory requirements across jurisdictions.

Choosing the right tools is crucial. It depends on the specific transaction and its complexity. However, my proficiency in using a variety of tools allows me to adapt to different situations and effectively utilize technology to enhance the accuracy and efficiency of my due diligence work.

Q 12. How do you ensure compliance with relevant laws and regulations during due diligence?

Ensuring compliance with all relevant laws and regulations during due diligence is paramount. It’s not just about avoiding legal penalties; it’s about building trust, mitigating risk, and ensuring the long-term success of the transaction.

- Identifying Applicable Laws and Regulations: I begin by thoroughly researching and identifying all applicable laws and regulations relevant to the transaction, including those related to antitrust, securities, environmental protection, and data privacy. The specific regulations vary widely depending on the industry, jurisdiction, and the type of transaction.

- Regulatory Due Diligence: I conduct a dedicated regulatory due diligence review to assess the target company’s compliance history. This involves reviewing permits, licenses, environmental impact assessments, and other regulatory filings.

- Legal Counsel Collaboration: Close collaboration with legal counsel is essential to ensure compliance and to navigate complex regulatory landscapes. Legal experts provide crucial guidance and interpret legal requirements.

- Internal Controls Assessment: I evaluate the target company’s internal controls to assess its ability to prevent and detect violations of laws and regulations. Effective internal controls are critical to maintaining compliance.

- Documentation and Record Keeping: Meticulous documentation is crucial for demonstrating compliance and providing a clear audit trail. This includes maintaining records of all investigations, findings, and any remedial actions taken.

Compliance is an ongoing process, not a one-time event. By consistently adhering to these practices, I mitigate legal risk and enhance the overall quality and credibility of my due diligence work.

Q 13. What is your experience with different types of contracts (NDA, SLA, etc.)?

I have substantial experience working with a variety of contracts, each serving a unique purpose within the due diligence and transaction process.

- Non-Disclosure Agreements (NDAs): These are fundamental in protecting confidential information shared during due diligence. My experience includes drafting, reviewing, and negotiating NDAs to ensure appropriate levels of confidentiality and protection are in place for sensitive data. I always pay close attention to the scope of confidentiality, permitted disclosures, and remedies for breaches.

- Service Level Agreements (SLAs): These are crucial in defining the terms and expectations of service providers involved in the due diligence process. My expertise involves specifying performance metrics, reporting requirements, and service credits, ensuring that external parties meet agreed-upon standards.

- Master Service Agreements (MSAs): These are framework agreements that set overarching terms and conditions for multiple transactions or engagements. They provide a consistent foundation for future work, streamlining negotiations and minimizing administrative burdens.

- Purchase Agreements/Merger Agreements: These complex agreements govern the actual acquisition or merger transaction. My experience includes participating in the negotiation of these agreements, focusing on key terms like purchase price, representations and warranties, conditions precedent, and closing mechanisms.

Understanding the nuances of each contract type is crucial to ensuring a smooth and efficient transaction process. I ensure that the contracts accurately reflect the parties’ intentions and adequately protect my client’s interests.

Q 14. How do you quantify the value of a contract negotiation?

Quantifying the value of a contract negotiation is often challenging, but it’s essential for demonstrating the return on investment (ROI) of the due diligence and negotiation process. It’s not simply about the immediate financial gains but also the long-term implications.

- Financial Gains: The most direct measure of value is the financial benefits achieved through negotiation, such as a lower purchase price, improved payment terms, or reduced liabilities.

- Risk Mitigation: Successfully negotiating favorable terms reduces risks, such as penalties, breaches, and future disputes. The cost avoidance of these risks is a key element of value.

- Efficiency Gains: Streamlined processes and clearer contracts lead to operational efficiency and cost savings. These indirect gains can be significant over time.

- Strategic Advantages: Negotiating beneficial terms can provide strategic advantages, such as gaining access to key resources or establishing strong relationships with strategic partners.

- Reputational Benefits: Successful contract negotiations can enhance a company’s reputation and build trust with stakeholders.

To quantify the value, I employ a range of analytical techniques such as discounted cash flow (DCF) analysis, net present value (NPV) calculations, and sensitivity analysis, carefully considering both short-term gains and the long-term impact of the negotiated terms. Presenting this quantified value to clients demonstrates the tangible impact of the negotiation process.

Q 15. Describe a time you had to negotiate a difficult clause in a contract.

One particularly challenging negotiation involved a clause concerning liability limitations in a software licensing agreement. The client, a large corporation, insisted on a clause limiting their liability to a relatively small amount, even if their misuse of the software caused significant damages to our company. This was unacceptable. Instead of outright rejecting their proposal, I started by acknowledging their concerns regarding risk management. I then presented data showing the value they would receive from our software and explained how the proposed limit was disproportionate to potential damages, which could have significant financial repercussions for us. We countered with a tiered liability approach. This involved a lower liability cap for minor incidents caused by client negligence and a significantly higher cap for incidents stemming from gross negligence or willful misconduct on the client’s part. This solution addressed their concerns while mitigating our risk. The process involved several rounds of back-and-forth, requiring careful documentation of each concession and counter-proposal, but ultimately resulted in a mutually acceptable agreement.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are some common legal pitfalls to avoid when drafting contracts?

Common legal pitfalls when drafting contracts include:

- Ambiguity and Vagueness: Using unclear language can lead to disputes over interpretation. Be precise and define all key terms. For example, instead of ‘reasonable efforts,’ specify concrete actions.

- Incomplete or Missing Clauses: Overlooking critical aspects like termination rights, dispute resolution mechanisms, intellectual property ownership, or governing law can leave significant gaps.

- Unrealistic or Unenforceable Provisions: Clauses that are overly restrictive or violate existing laws are unlikely to hold up in court.

- Lack of Consideration: A contract must include a mutual exchange of value. Without it, the contract is unenforceable.

- Failure to Address Contingencies: Contracts should anticipate potential problems, such as delays or changes in market conditions, and include clauses to address them.

- Incorrect Signature and Execution: Ensure all parties sign the contract and follow the proper execution process as required by law.

Always seek legal counsel to review and finalize contracts to minimize the risk of these pitfalls.

Q 17. How do you assess the creditworthiness of a counterparty?

Assessing a counterparty’s creditworthiness involves a multi-faceted approach. I typically start by reviewing their financial statements (balance sheets, income statements, cash flow statements) to understand their liquidity, profitability, and debt levels. This provides a quantitative view. Next, I look at their credit reports from agencies like Dun & Bradstreet or Experian to identify their credit history, payment patterns, and any potential red flags. I also analyze industry benchmarks to compare their performance against their competitors. Furthermore, qualitative factors play a crucial role. This involves researching the company’s management team, their track record, and the overall stability of their business model. For larger companies, I might even perform a detailed financial analysis including detailed ratio analysis and cash flow projections. In smaller situations, references or bank confirmations can also be highly informative. Finally, I examine the specific contract terms to ensure they align with the counterparty’s apparent financial capacity to meet their obligations.

Q 18. What is your understanding of intellectual property due diligence?

Intellectual property (IP) due diligence focuses on verifying the ownership and validity of a target company’s IP assets. This includes patents, trademarks, copyrights, and trade secrets. The process involves reviewing IP registration documents, licenses, agreements, and internal records to ensure there are no undisclosed issues like infringement, challenges to validity, or conflicting claims. It also includes assessing the value and commercial viability of the IP portfolio. I would also look for any potential issues concerning employee ownership of inventions or the existence of any undisclosed IP assignments. A comprehensive IP audit is often conducted by an expert to ensure a thorough assessment. Any gaps or inconsistencies would be highlighted, and recommendations for mitigation, such as further due diligence or legal review, would be formulated. The ultimate goal is to understand the potential risks and opportunities associated with the IP portfolio before entering into an agreement.

Q 19. How do you approach environmental due diligence?

Environmental due diligence involves investigating potential environmental liabilities associated with a property or business. This includes assessing compliance with environmental regulations, identifying potential contamination (soil, water, air), and uncovering any past environmental incidents. The process starts with a review of publicly available information, like environmental permits, regulatory filings, and historical site assessments. On-site inspections, often involving environmental specialists, may be necessary. The goal is to identify any potential environmental risks, such as cleanup costs, fines, or operational restrictions, that could impact the transaction’s feasibility or value. A phase I environmental site assessment, a standardized approach, is often the starting point. This may lead to further investigation (phases II and III) depending on the findings. The output aims to quantify potential environmental liabilities and factor them into the negotiation process.

Q 20. How do you validate the information gathered during due diligence?

Validating information gathered during due diligence is crucial for making informed decisions. This process involves cross-referencing information from multiple sources. For example, financial information from financial statements should be corroborated with data from credit reports and industry benchmarks. Similarly, legal documents should be compared against regulatory filings and company records. Independent verification is also critical; seeking confirmation from third parties (e.g., customers, suppliers, industry experts) regarding certain aspects, like revenue streams or customer relationships, is key. The information gathered is usually documented with complete trails including source and verification methodologies. This not only enhances the credibility of the findings but also aids in protecting against potential legal challenges later on. Any discrepancies or inconsistencies require further investigation to determine the accuracy and reliability of the information before proceeding.

Q 21. How do you balance risk and reward in contract negotiations?

Balancing risk and reward in contract negotiations is a delicate art. It involves a thorough understanding of the potential risks and opportunities involved and developing a negotiation strategy to maximize the latter while minimizing the former. This requires clearly defining your priorities, quantifying potential risks (financial, legal, reputational), and assessing the potential return on investment. A risk matrix can be a useful tool here. I also consider the best alternative to a negotiated agreement (BATNA), which allows for a more informed decision on whether to proceed or walk away. The negotiation strategy should involve a balanced approach; be assertive in protecting your interests while demonstrating flexibility and understanding of the other party’s needs. Compromise is often necessary, but it should never compromise fundamental principles or acceptable risk levels. Throughout the process, meticulous documentation is critical to ensure that agreements are clearly defined and enforceable, thereby mitigating future disputes.

Q 22. Describe your experience with different negotiation styles.

Negotiation styles vary widely, and my experience encompasses several key approaches. I adapt my style based on the specific context, the counterparty, and the desired outcome. For instance, in a collaborative negotiation, I focus on building rapport and finding mutually beneficial solutions. This often involves brainstorming together and exploring options that meet everyone’s needs. I’ve successfully used this approach in negotiating joint ventures where trust and long-term relationships are crucial. Conversely, a competitive negotiation might be necessary when dealing with a less cooperative party. In such scenarios, I focus on clearly defining my position, preparing strong arguments, and being assertive while remaining respectful. I utilized this approach when negotiating the purchase of a distressed asset where the seller was initially reluctant to compromise. Finally, a principled negotiation, focusing on interests rather than positions, allows me to find creative solutions even in complex scenarios. I employed this method when navigating environmental regulations during a land acquisition, ensuring all stakeholders’ concerns were addressed.

My approach isn’t rigid; I seamlessly blend these styles as needed. For example, I might begin with a collaborative approach, aiming for mutual gain, but switch to a more competitive stance if necessary to protect my client’s interests. The key is adaptability and a deep understanding of human psychology in the negotiation process.

Q 23. How do you maintain a positive working relationship during contentious negotiations?

Maintaining positive relationships during contentious negotiations is paramount. It’s crucial to remember that the relationship often outlasts the specific deal. My strategy is multi-pronged. First, I emphasize active listening and empathy; I strive to understand the other party’s perspective and concerns, even if I don’t agree with them. I try to separate the person from the problem. Second, I maintain respectful communication, avoiding personal attacks or inflammatory language. Even when disagreeing strongly, I ensure my tone is professional and courteous. Third, I focus on finding common ground and identifying shared goals. This helps shift the focus from conflict to collaboration. Finally, I actively manage expectations and communicate clearly and transparently throughout the process. I’ve often found that offering concessions where possible, even small ones, can go a long way in de-escalating tension and building trust.

For example, in a particularly challenging negotiation involving intellectual property rights, I focused on clearly articulating the legal and commercial aspects to the other party, allowing them to feel confident in the process. This, in turn, prevented the negotiation from becoming overly emotional and helped maintain a professional atmosphere.

Q 24. What is your approach to documenting the due diligence process?

My approach to documenting the due diligence process is highly structured and meticulous. I use a combination of digital and physical methods, ensuring a comprehensive and auditable trail. This typically involves creating a detailed due diligence plan outlining the scope of work, timelines, and responsibilities. Each step is meticulously documented using checklists, spreadsheets, and project management software. All findings, both positive and negative, are recorded, along with supporting evidence such as financial statements, legal documents, and interview transcripts. This ensures that the findings can be easily accessed, reviewed and used in future decisions.

Furthermore, I maintain a central repository (typically a secure cloud-based system) for all documents related to the due diligence process. This ensures easy access for the team and relevant stakeholders. Version control is essential, and any changes are logged for accountability and transparency. Finally, a summary report is prepared at the conclusion of the due diligence process, synthesizing the key findings and recommendations.

Q 25. How do you ensure confidentiality throughout the due diligence process?

Confidentiality is paramount in due diligence. My approach begins with establishing clear confidentiality agreements with all parties involved, including clients, advisors, and third-party vendors. Access to sensitive information is strictly controlled through role-based access permissions in our secure systems. All materials are marked ‘confidential’ and handled with care. We also employ data encryption and secure data storage solutions to protect information from unauthorized access. Internal communication about the due diligence findings adheres to strict confidentiality protocols. Finally, any electronic devices used during the process are secured with strong passwords and encryption. Regular security audits are conducted to ensure compliance with data protection regulations and maintain the highest level of security.

For example, during a due diligence investigation for a large multinational corporation, we utilized end-to-end encryption for all communications and ensured all documents were stored in secure data centers with access control based on a strict ‘need to know’ basis. This prevented any risk of sensitive information being compromised.

Q 26. How do you use data analysis in due diligence?

Data analysis is integral to my due diligence approach. I leverage data analysis techniques to identify trends, patterns, and anomalies that might otherwise go unnoticed. This often involves using financial modeling to project future performance, assess risk, and value assets. For example, I might utilize regression analysis to predict future revenue based on historical data or discounted cash flow analysis to estimate the net present value of an acquisition target. I also employ data visualization techniques such as charts and graphs to present complex data in an easily understandable format to stakeholders.

Moreover, I use data analytics tools to perform detailed reviews of large datasets, such as transaction records and customer data, to identify potential red flags or inconsistencies that might indicate fraud or other issues. The combination of quantitative and qualitative analysis ensures a thorough and well-rounded due diligence process. For instance, in a recent engagement, I used statistical modeling to identify a subtle but significant trend in customer churn, a key piece of information that impacted the final valuation.

Q 27. How do you present your due diligence findings to stakeholders?

Presenting due diligence findings to stakeholders requires clarity, precision, and tailored communication. I begin by understanding the stakeholders’ backgrounds and their level of understanding of the subject matter. This allows me to tailor my presentation to meet their specific needs and expectations. The presentation typically starts with an executive summary that highlights the key findings and recommendations. The main body then delves into the details, using a combination of narrative explanations, data visualizations, and supporting documentation. I always focus on providing clear and concise explanations, avoiding unnecessary jargon.

I make extensive use of visuals, such as charts, graphs, and infographics, to present complex data in an easily understandable format. Finally, I conclude with a Q&A session where I address any questions or concerns that stakeholders may have. My goal is to facilitate an informed decision-making process by ensuring that stakeholders fully understand the implications of the due diligence findings. I’ve found that a clear and well-structured presentation increases the confidence of stakeholders in the due diligence process and allows for more informed decisions.

Q 28. Describe your experience working with legal teams during contract negotiations.

My collaboration with legal teams during contract negotiations is seamless and highly effective. I work closely with legal counsel to ensure that all contractual terms align with our due diligence findings and protect our client’s interests. This involves a continuous exchange of information, including due diligence reports, legal opinions, and other relevant documents. I actively participate in discussions with legal counsel to identify potential legal risks and develop strategies to mitigate them. I provide the legal team with the necessary factual and commercial context, and they provide the legal framework for sound contract drafting.

I’ve found that a collaborative approach, where both the legal and commercial aspects are considered simultaneously, produces the best results. For example, in negotiating a complex software licensing agreement, I worked closely with our legal team to draft a contract that protected our client’s intellectual property rights while ensuring the commercial viability of the agreement. This required a clear understanding of both the technological and legal implications of various contractual clauses, resulting in a contract that effectively protected our client’s interest and was commercially sound.

Key Topics to Learn for Due Diligence and Contract Negotiation Interviews

Ace your interview by mastering these critical areas. We’ve broken down the key concepts to help you build a strong foundation and showcase your expertise.

- Due Diligence: Financial Analysis: Understanding financial statements, identifying key performance indicators (KPIs), and assessing financial health and risks. Practical application: Analyzing a company’s balance sheet to identify potential liabilities before acquisition.

- Due Diligence: Legal and Regulatory Compliance: Identifying potential legal and regulatory risks, understanding compliance requirements, and assessing potential liabilities. Practical application: Reviewing contracts and permits to ensure compliance with relevant laws and regulations.

- Due Diligence: Operational Assessment: Evaluating operational efficiency, identifying potential bottlenecks, and assessing the effectiveness of existing processes. Practical application: Analyzing supply chain operations to identify areas for improvement and cost reduction.

- Contract Negotiation: Understanding Contract Law Fundamentals: Grasping key legal principles, interpreting contract clauses, and identifying potential risks and liabilities. Practical application: Identifying and mitigating potential risks within a complex contract.

- Contract Negotiation: Negotiation Strategies and Tactics: Developing effective negotiation strategies, understanding different negotiation styles, and achieving mutually beneficial outcomes. Practical application: Employing collaborative negotiation techniques to secure favorable terms within a contract.

- Contract Negotiation: Risk Management and Mitigation: Identifying and assessing potential risks, developing mitigation strategies, and incorporating appropriate clauses within contracts. Practical application: Including clauses to protect against unforeseen circumstances and liabilities.

- Problem-Solving in Due Diligence and Negotiation: Analyzing complex situations, identifying potential problems, and developing creative solutions. Practical application: Developing contingency plans to address potential challenges during a negotiation or due diligence process.

Next Steps

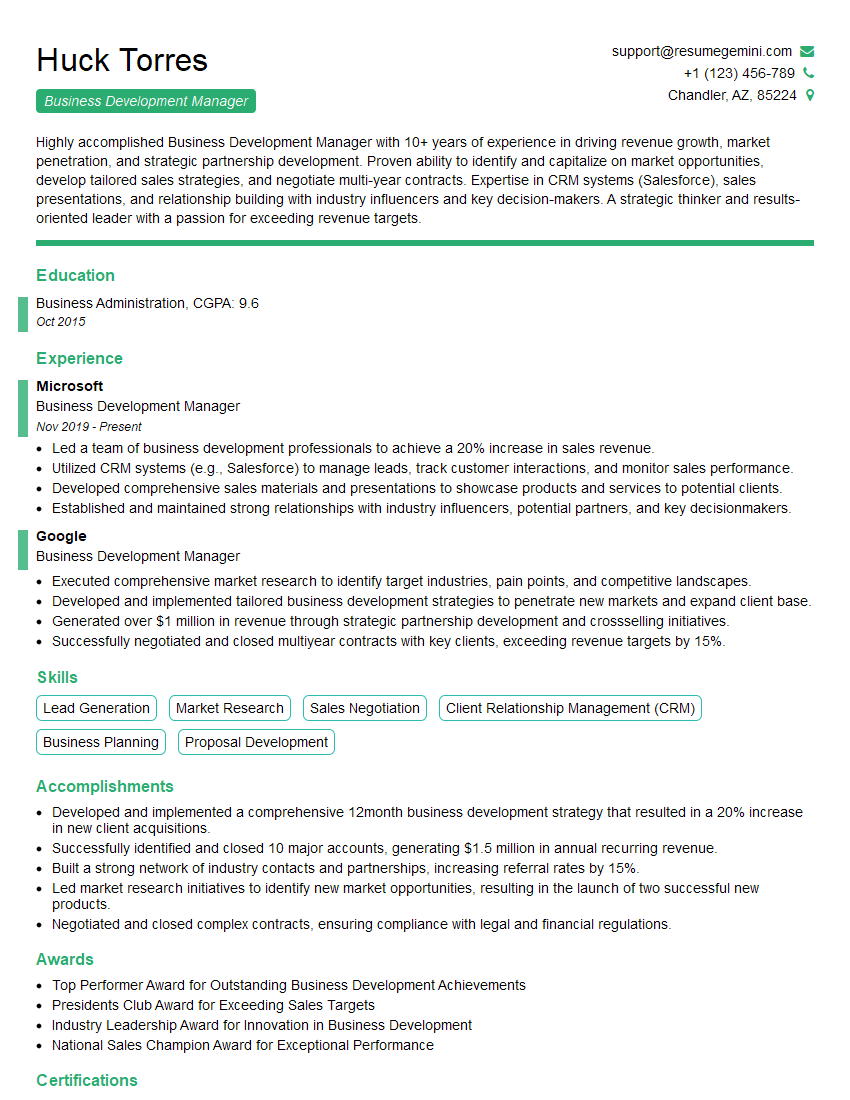

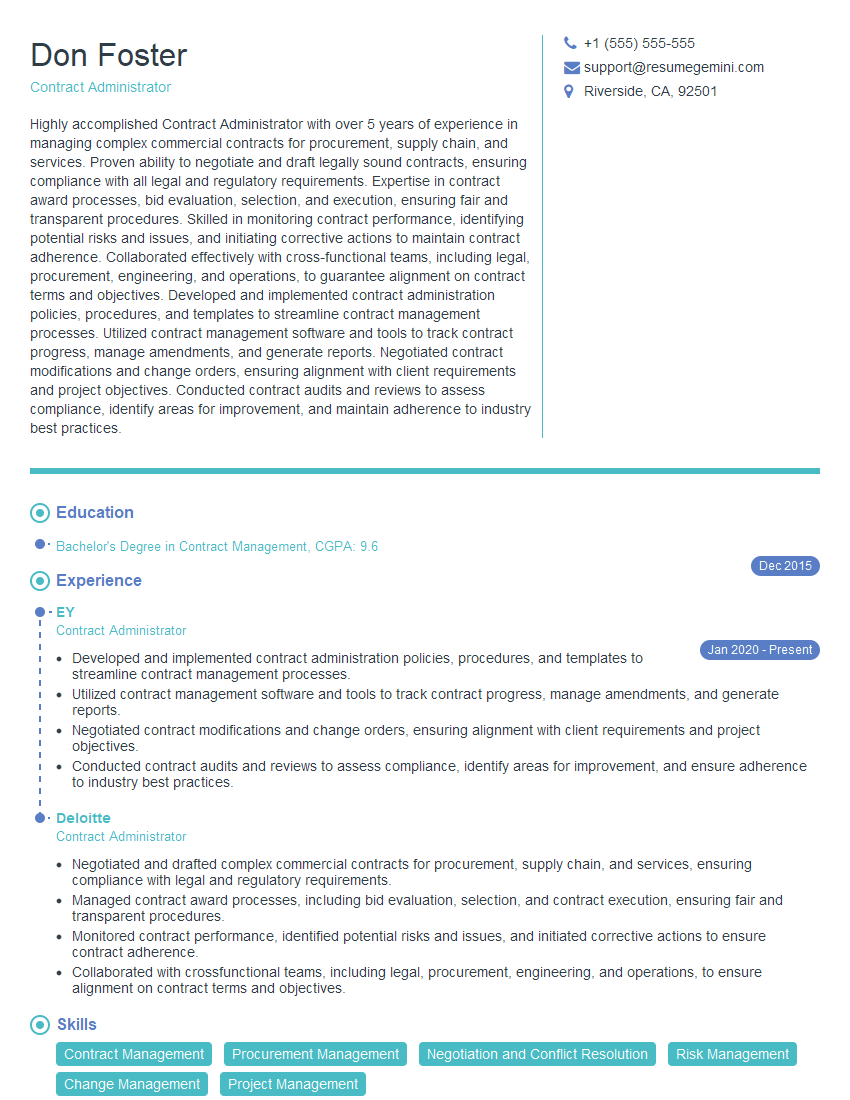

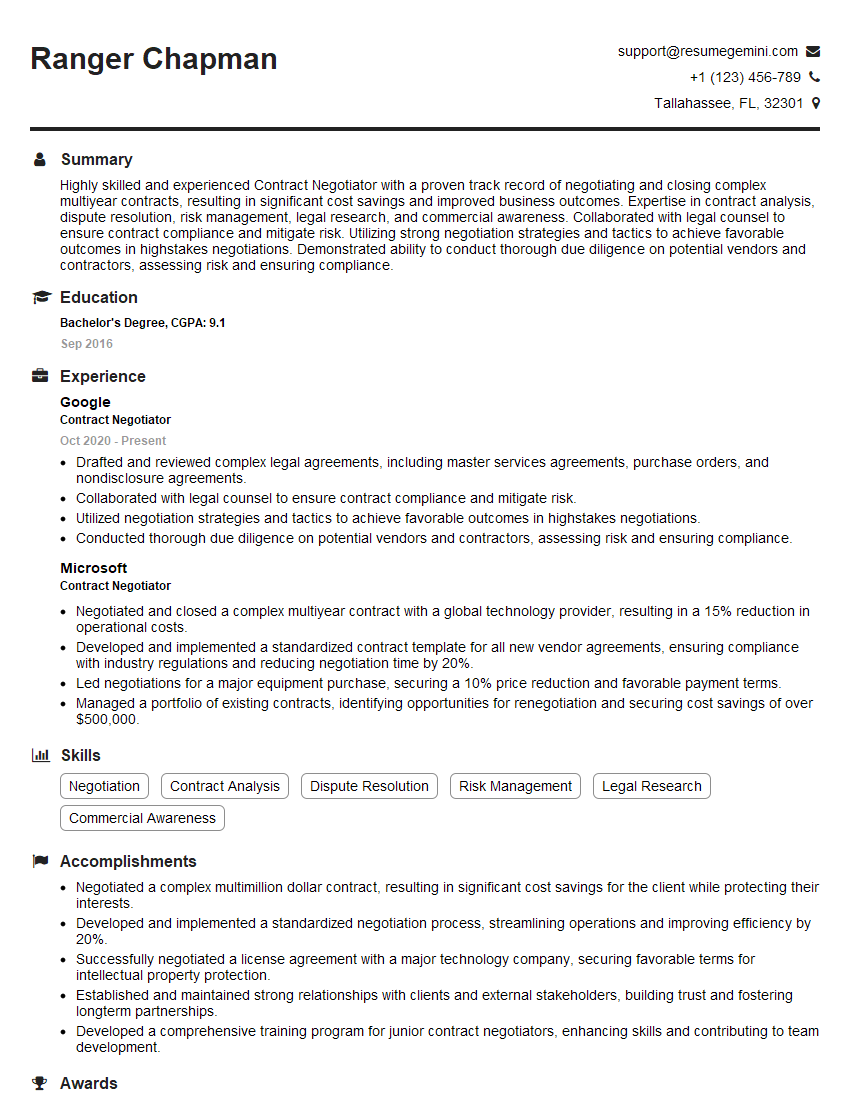

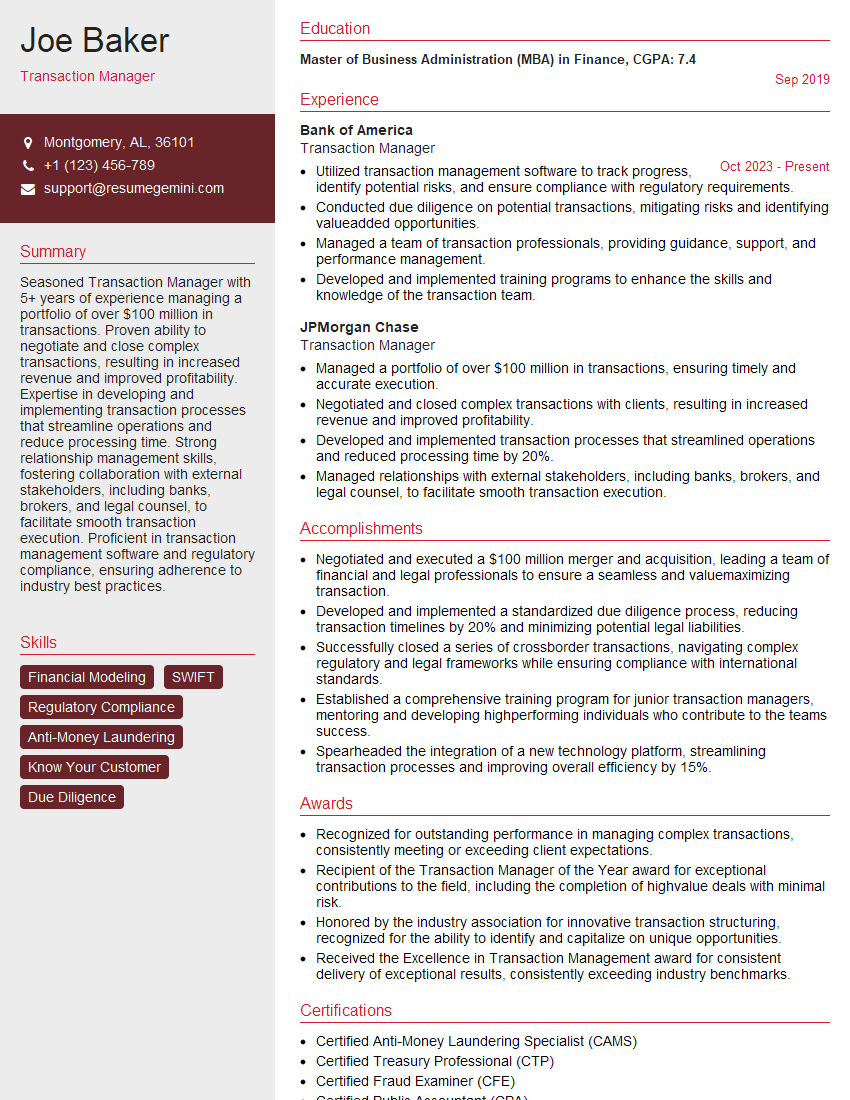

Mastering Due Diligence and Contract Negotiation is crucial for advancement in many high-impact roles. These skills demonstrate your analytical abilities, strategic thinking, and ability to manage risk – highly sought-after qualities in today’s competitive market. To maximize your job prospects, create an ATS-friendly resume that highlights your achievements and expertise. ResumeGemini is a trusted resource to help you build a professional and impactful resume that gets noticed. We provide examples of resumes tailored to Due Diligence and Contract Negotiation to guide you. Let ResumeGemini help you land your dream job!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good