Unlock your full potential by mastering the most common Business Development and Strategic Planning interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Business Development and Strategic Planning Interview

Q 1. Describe your experience developing and implementing a business development strategy.

Developing and implementing a business development strategy is a multifaceted process that requires a deep understanding of the market, the competitive landscape, and the organization’s strengths and weaknesses. It begins with a thorough assessment of the current state, defining clear goals and objectives, identifying target markets, and outlining specific tactics to achieve those goals. I typically follow a five-step process:

- Strategic Analysis: This involves market research, competitive analysis (detailed below), SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), and internal capability assessment.

- Goal Setting: Defining SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals. For example, increasing market share by 15% within 12 months or securing 10 new key clients.

- Target Market Identification: Pinpointing specific customer segments most likely to benefit from our offerings and determining their needs and preferences.

- Tactical Planning: Developing specific actions such as marketing campaigns, sales strategies, partnership development, and product innovation to reach the defined goals. This includes budgeting and resource allocation.

- Implementation and Monitoring: Executing the plan, closely monitoring progress, making necessary adjustments based on performance data, and providing regular reports.

For instance, in my previous role at [Previous Company Name], I developed a strategy to expand into a new geographic market. This involved extensive market research, identifying key distributors, developing a tailored marketing campaign, and establishing strong local partnerships, which resulted in exceeding our projected sales target by 20% within the first year.

Q 2. How do you identify and prioritize market opportunities?

Identifying and prioritizing market opportunities requires a systematic approach combining market research, competitive analysis, and internal capabilities. I use a framework that involves these steps:

- Market Research: Understanding market size, growth potential, customer needs, and trends through various methods like surveys, focus groups, competitor analysis, and industry reports. Tools like market research databases and social listening platforms are invaluable.

- Competitive Analysis: Identifying competitors, analyzing their strengths and weaknesses, and evaluating market gaps (explained more fully in the next question).

- SWOT Analysis: Assessing our internal strengths and weaknesses in relation to identified market opportunities and threats. This helps to determine which opportunities are most realistically achievable.

- Opportunity Scoring: Assigning scores to each potential opportunity based on factors like market size, growth rate, profitability, competitive intensity, and alignment with our strategic goals. This allows for objective prioritization.

- Prioritization Matrix: Using a matrix (e.g., a Prioritization Matrix) to visually represent the scored opportunities, allowing for easy comparison and ranking based on strategic importance and feasibility.

For example, I once prioritized entering the sustainable packaging market over a more established market with high competition, as the sustainable market offered higher long-term growth potential and aligned perfectly with our company’s values and commitment to environmental responsibility.

Q 3. Explain your process for conducting a competitive analysis.

Conducting a thorough competitive analysis is crucial for understanding the competitive landscape and identifying opportunities. My process typically involves these steps:

- Identify Competitors: This includes both direct and indirect competitors. Direct competitors offer similar products or services, while indirect competitors address the same customer needs through alternative solutions.

- Gather Information: Research competitor offerings, pricing strategies, marketing efforts, customer reviews, and financial performance (if publicly available). This involves exploring their websites, social media presence, industry reports, and news articles.

- Analyze Strengths and Weaknesses: Evaluate competitors’ strengths and weaknesses across various dimensions such as product quality, pricing, marketing effectiveness, brand reputation, and customer service. Tools like SWOT analysis can be incredibly helpful.

- Identify Competitive Advantages: Determine your own unique value proposition and competitive advantages compared to the rivals. This could involve superior technology, better customer service, unique brand positioning, or a more efficient supply chain.

- Forecast Competitive Moves: Based on your analysis, anticipate the future actions of competitors and identify potential threats and opportunities.

For instance, in a recent project, I identified a competitor who was lagging in online marketing. This presented an opportunity for us to capture market share by improving our digital presence and targeting their customer segment.

Q 4. How do you measure the success of a business development initiative?

Measuring the success of a business development initiative requires defining key performance indicators (KPIs) beforehand. The specific metrics used will depend on the initiative’s goals, but they typically fall under these categories:

- Financial Metrics: Revenue generated, profit margins, return on investment (ROI), customer lifetime value (CLTV), cost of acquisition (CAC).

- Market Metrics: Market share, brand awareness, customer acquisition rate, customer churn rate, lead generation.

- Operational Metrics: Sales cycle length, conversion rates, number of new partnerships secured, efficiency of sales processes.

It’s important to track these metrics regularly and compare the actual results against the projected targets. Data visualization tools and dashboards can be extremely beneficial for monitoring progress and identifying areas for improvement. For example, if a new partnership was meant to increase sales by 10%, we’d monitor monthly sales against this target and adjust strategies accordingly if we are falling short.

Q 5. What strategies would you use to penetrate a new market?

Penetrating a new market requires a well-defined strategy tailored to the specific characteristics of that market. My approach typically involves:

- Market Research and Segmentation: Thoroughly understanding the new market, identifying target customer segments, and analyzing their needs and preferences.

- Go-to-Market Strategy: Developing a clear plan to reach the target market, including distribution channels, marketing campaigns, and sales strategies. This might include direct sales, partnerships, distributors, or a multi-channel approach.

- Localization: Adapting products or services to meet the specific needs and preferences of the new market. This might include language translation, cultural adaptation, or product modifications.

- Marketing and Branding: Creating a strong brand presence and implementing effective marketing campaigns tailored to the new market. This may require local marketing partnerships or adjusting messaging to resonate with the local culture.

- Strategic Partnerships: Establishing strategic alliances with local businesses, distributors, or other key players to facilitate market entry and expand reach.

- Customer Relationship Management (CRM): Building strong relationships with customers in the new market through excellent customer service and ongoing engagement.

For example, when entering a new international market, I would prioritize thorough cultural research and partner with a local company experienced in navigating the specific market regulations and consumer preferences.

Q 6. How do you build and maintain strong relationships with key stakeholders?

Building and maintaining strong relationships with key stakeholders is critical for success in business development. This involves consistent communication, mutual respect, and a focus on creating value for all parties. My approach includes:

- Proactive Communication: Regularly communicating updates, progress reports, and relevant information to stakeholders using various channels such as email, phone calls, and in-person meetings.

- Active Listening: Paying close attention to stakeholders’ concerns, feedback, and needs, and demonstrating empathy and understanding.

- Value Creation: Focusing on creating value for stakeholders by exceeding expectations, delivering on commitments, and providing exceptional service.

- Relationship Building: Investing time in building personal relationships with key stakeholders through networking events, social interactions, and regular communication.

- Transparency and Honesty: Being transparent and honest about progress, challenges, and any potential issues.

- Conflict Resolution: Effectively addressing any conflicts or disagreements that may arise in a professional and constructive manner.

For instance, I maintained a strong relationship with a key investor by providing regular updates, involving them in decision-making processes, and proactively addressing any concerns they raised, fostering trust and strengthening our partnership.

Q 7. Describe a time you had to overcome a significant challenge in a business development project.

In a previous project, we faced a significant challenge when our primary manufacturing partner experienced unexpected production delays, threatening to jeopardize the launch of a crucial new product. This delay risked missing a critical market window and negatively impacting our projected sales figures. To overcome this, I took these steps:

- Problem Identification and Assessment: We immediately identified the root cause of the delay, assessing the potential impact on our launch timeline and overall business goals.

- Contingency Planning: We developed a contingency plan which involved exploring alternative manufacturing options, expediting the remaining production process at our primary partner, and adjusting the product launch timeline.

- Communication and Collaboration: We maintained open and transparent communication with our internal teams, customers, and the manufacturing partner, keeping everyone informed of the situation and our plans to mitigate the impact.

- Negotiation and Problem Solving: We negotiated with our manufacturing partner to expedite the production process and explored alternative suppliers to ensure sufficient inventory for the launch.

- Resource Allocation: We reallocated resources to support the contingency plan and ensure the launch could proceed as smoothly as possible under the circumstances.

Through decisive action, effective communication, and proactive problem-solving, we were able to minimize the impact of the delay, successfully launching the product with only a minor postponement and ultimately meeting our sales targets within a reasonable timeframe.

Q 8. How familiar are you with different market entry strategies?

Market entry strategies are the plans businesses use to expand into new markets. Choosing the right strategy is crucial for success and depends heavily on factors like the target market, the company’s resources, and the competitive landscape. I’m familiar with a range of strategies, including:

- Exporting: This is the simplest approach, involving selling existing products in a new market without establishing a physical presence. Think of a small wine producer selling their product through an importer in a new country.

- Licensing/Franchising: This involves granting another company the right to produce or sell your product or service in a new market. McDonald’s operates globally primarily through franchising.

- Joint Ventures: This involves partnering with a local company to leverage their knowledge and resources in the new market. A US tech firm teaming up with a local telecommunications company in a developing nation to roll out a new mobile service is a great example.

- Foreign Direct Investment (FDI): This involves establishing a physical presence in the new market, such as setting up a subsidiary or acquiring an existing company. Many car manufacturers have FDI in multiple countries, establishing local factories and sales networks.

- Acquisitions: This involves purchasing an existing company in the target market to quickly gain market share and established operations. A tech company acquiring a smaller competitor with a strong user base in a new region.

My experience allows me to assess the pros and cons of each strategy and recommend the best approach based on a thorough market analysis and the company’s specific circumstances.

Q 9. What are your preferred methods for forecasting sales and revenue?

Accurately forecasting sales and revenue is critical for strategic planning. My preferred methods combine quantitative and qualitative approaches for a more robust prediction. I utilize:

- Historical Data Analysis: Examining past sales trends, seasonality, and market growth to identify patterns and project future performance. This involves using statistical methods like regression analysis.

- Market Research: Gathering data on market size, customer demographics, competitor analysis, and industry trends. This can involve surveys, focus groups, and analyzing publicly available data.

- Salesforce Forecasting: Using sales team input and their knowledge of the pipeline to predict future sales. This is crucial for incorporating real-time insights into the forecast.

- Economic Indicators: Considering macroeconomic factors like GDP growth, inflation, and interest rates which can significantly influence consumer spending.

- Scenario Planning: Developing multiple sales forecasts based on different potential scenarios (e.g., optimistic, pessimistic, most likely). This approach helps anticipate potential risks and opportunities.

I often use software like Excel or dedicated forecasting tools to manage this data and generate forecasts. The key is to regularly review and adjust forecasts as new information becomes available.

Q 10. Describe your experience with financial modeling and business case development.

Financial modeling and business case development are core to my skillset. I’ve extensive experience building detailed financial models to evaluate investment opportunities, assess the financial viability of new projects, and support strategic decision-making. This involves:

- Developing Pro Forma Financial Statements: Projecting income statements, balance sheets, and cash flow statements for future periods. This demonstrates how the business is expected to perform financially over time.

- Discounted Cash Flow (DCF) Analysis: Evaluating the present value of future cash flows to determine the net present value (NPV) and internal rate of return (IRR) of an investment. This helps assess the profitability of a project.

- Sensitivity Analysis: Assessing the impact of changes in key assumptions (e.g., sales growth, cost of goods sold) on the financial outcomes. This provides insights into the risks and uncertainties associated with the project.

- Break-even Analysis: Determining the point at which revenues equal costs. This helps to understand when the project becomes profitable.

Business cases are then created around these models, highlighting the strategic rationale, market opportunity, financial projections, and risk assessment. I’ve used this approach successfully to secure funding for numerous projects and guide strategic investments.

Q 11. How do you develop a strategic plan?

Developing a strategic plan is an iterative process involving several key steps:

- Define the Vision and Mission: Clearly articulate the long-term aspirations and the organization’s purpose.

- Conduct a SWOT Analysis: Identify the organization’s internal strengths and weaknesses, and external opportunities and threats.

- Set Strategic Goals and Objectives: Establish measurable, achievable, relevant, and time-bound (SMART) goals that align with the vision and mission.

- Develop Strategies: Outline specific actions and initiatives required to achieve the objectives. This might involve market penetration, product development, or diversification.

- Resource Allocation: Determine the resources (financial, human, technological) needed to execute the plan.

- Implementation Plan: Outline the steps involved in putting the strategies into action, including timelines and responsibilities.

- Monitor and Evaluate: Track progress, measure results, and make adjustments as needed.

The process is often collaborative, involving input from various stakeholders across the organization. The plan should be flexible and adaptable to changing market conditions.

Q 12. What are the key elements of a successful strategic plan?

A successful strategic plan needs several key elements:

- Clarity and Focus: The plan must clearly define the organization’s vision, mission, and goals. It should not try to be everything to everyone; instead, it should prioritize a few key areas for focus.

- Measurable Objectives: Goals need to be specific, measurable, achievable, relevant, and time-bound (SMART) to track progress effectively.

- Realistic Assumptions: The plan should be based on realistic market analysis and projections, taking into account potential risks and challenges.

- Flexibility and Adaptability: The plan should be adaptable to unforeseen circumstances and changing market conditions. Regular review and updates are crucial.

- Strong Communication and Buy-in: All stakeholders must understand and buy into the plan for successful implementation. This requires clear communication and involvement in the planning process.

- Accountability and Responsibility: Clear roles and responsibilities must be defined for each task and initiative.

In essence, a successful plan acts as a roadmap that guides the organization towards its long-term goals, providing direction, coordination, and a framework for decision-making.

Q 13. How do you monitor and evaluate the effectiveness of a strategic plan?

Monitoring and evaluating a strategic plan is an ongoing process. I typically utilize these methods:

- Key Performance Indicators (KPIs): Establish specific, measurable KPIs aligned with the strategic objectives. This could include market share, customer satisfaction, revenue growth, or profitability.

- Regular Reporting and Dashboards: Develop regular reports and dashboards to track progress against the KPIs. These should be easily accessible and understandable by all stakeholders.

- Performance Reviews: Conduct regular performance reviews to assess progress, identify challenges, and make necessary adjustments to the plan.

- Variance Analysis: Compare actual performance against the planned targets and identify any significant variances. This analysis helps to understand the reasons for deviations and inform corrective actions.

- Post-Implementation Review: Conduct a thorough review of the plan once it’s complete to assess its overall success, identify lessons learned, and inform future planning.

This continuous monitoring process is crucial for ensuring that the strategic plan remains relevant and effective, and enables the organization to adapt to changes and improve its performance.

Q 14. How do you align business development efforts with overall strategic goals?

Aligning business development efforts with overall strategic goals requires a clear understanding of both. I approach this by:

- Defining Target Markets: Identifying target markets that align with the strategic goals. For example, if a strategic goal is to expand into a new geographic region, business development efforts should focus on developing relationships with potential customers and partners in that region.

- Prioritizing Opportunities: Focusing business development efforts on opportunities that are most likely to contribute to the achievement of strategic goals. This might involve prioritizing certain products or services or focusing on specific customer segments.

- Developing a Business Development Plan: Creating a detailed business development plan that outlines specific actions, timelines, and resources required to achieve the strategic goals. This plan should integrate with and support the overall strategic plan.

- Measuring Progress: Regularly tracking the progress of business development activities and their contribution to the overall strategic goals. This ensures that efforts are on track and adjustments can be made if necessary.

- Integrating Business Development and Strategic Planning: Ensuring that business development activities are considered as part of the overall strategic planning process, rather than operating in isolation. This involves regular communication and collaboration between business development and strategic planning teams.

By systematically aligning business development efforts with strategic goals, a company can ensure that its resources are focused on the most impactful activities, enhancing the likelihood of achieving its long-term objectives.

Q 15. Explain your understanding of SWOT analysis and its application.

SWOT analysis is a fundamental strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats involved in a project or in a business venture. It helps organizations make informed decisions by understanding their internal capabilities and the external environment.

Strengths are internal positive attributes that give a competitive advantage (e.g., strong brand reputation, skilled workforce, proprietary technology). Weaknesses are internal negative attributes that hinder performance (e.g., outdated technology, lack of skilled labor, high production costs). Opportunities are external factors that could be exploited to the company’s advantage (e.g., emerging markets, new technologies, changes in regulations). Threats are external factors that could harm the organization (e.g., increased competition, economic downturn, changing customer preferences).

Application: Imagine launching a new organic food delivery service. A SWOT analysis might reveal:

- Strengths: Sustainable sourcing, high-quality ingredients, strong online presence.

- Weaknesses: Limited delivery area, high initial investment costs, relatively small team.

- Opportunities: Growing demand for healthy food, increasing consumer awareness of sustainability, potential for partnerships with local farmers.

- Threats: Intense competition from established players, fluctuating food prices, potential supply chain disruptions.

By identifying these factors, the company can develop strategies to leverage its strengths, mitigate weaknesses, capitalize on opportunities, and address threats. For example, they might expand their delivery area (addressing a weakness) by partnering with another company (leveraging an opportunity) while developing a robust supply chain management system (mitigating a threat).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with market research and data analysis.

My experience with market research and data analysis spans various methodologies, from qualitative research (focus groups, interviews) to quantitative research (surveys, statistical analysis). I’ve utilized tools like SPSS and R for advanced statistical modeling and data visualization. For example, in a previous role, we were launching a new software product. We conducted extensive market research, including surveys to understand customer needs and preferences, competitor analysis to identify market gaps and strengths, and beta testing to gather user feedback. We used this data to refine the product features, pricing, and marketing strategies.

Data analysis is crucial. I’m proficient in extracting insights from large datasets to identify trends, customer segments, and potential growth areas. In one project, we analyzed customer transaction data to identify churn patterns, allowing us to proactively engage at-risk customers and improve retention rates. This involved segmenting customers based on their behavior and developing targeted interventions for each group.

Q 17. How do you identify and mitigate risks in business development projects?

Risk mitigation is a critical aspect of business development. I employ a proactive approach, identifying potential risks early in the project lifecycle. My process involves:

- Risk Identification: Brainstorming sessions with the team, reviewing past project experiences, analyzing market trends, and using risk assessment matrices are some of the methods I utilize.

- Risk Analysis: Assessing the likelihood and impact of each identified risk. This often involves quantifying potential losses or delays.

- Risk Response Planning: Developing mitigation strategies for each risk. This may involve contingency planning (e.g., having backup suppliers), risk transfer (e.g., purchasing insurance), risk avoidance (e.g., choosing a different project approach), or risk acceptance (e.g., accepting a small risk with a low probability of occurring).

- Monitoring and Control: Regularly reviewing the effectiveness of mitigation strategies and adapting plans as needed. This involves tracking key performance indicators (KPIs) and actively managing any emerging risks.

For instance, in a recent project involving international expansion, we identified potential risks related to political instability, currency fluctuations, and regulatory changes. We mitigated these risks by partnering with local experts, securing appropriate insurance coverage, and building flexibility into our timelines.

Q 18. What are your preferred methods for negotiating contracts?

My negotiation style is collaborative and solution-oriented. I aim for win-win outcomes, building strong relationships while protecting the interests of my organization. My approach involves:

- Preparation: Thoroughly researching the counterparty, understanding their needs and priorities, and defining my organization’s BATNA (Best Alternative To a Negotiated Agreement).

- Active Listening: Paying close attention to the counterparty’s concerns and perspectives.

- Value Creation: Identifying opportunities for mutual benefit beyond simply splitting the pie. This might involve exploring creative solutions or finding areas of common ground.

- Clear Communication: Articulating my organization’s needs and position clearly and persuasively.

- Flexibility: Being willing to compromise, while always keeping sight of the organization’s bottom line.

I believe in fostering trust and transparency throughout the process. In a recent contract negotiation, we managed to secure favorable terms by offering a long-term partnership and demonstrating mutual benefits beyond the immediate transaction. This resulted in a stronger, more collaborative relationship with our partner.

Q 19. Describe your experience with building and managing a team.

Building and managing high-performing teams is a key skill for me. My approach is centered around creating a positive and collaborative work environment. I start by clearly defining roles and responsibilities and setting shared goals. I encourage open communication and provide regular feedback, both positive and constructive. I also focus on:

- Delegation: Effectively delegating tasks based on team members’ skills and strengths.

- Mentorship and Training: Providing opportunities for professional development and growth.

- Motivation: Recognizing and rewarding achievements, fostering a sense of team accomplishment.

- Conflict Resolution: Addressing conflicts promptly and fairly.

In a previous role, I led a team through a significant organizational restructuring. By clearly communicating the changes, providing support and training to affected employees, and creating opportunities for collaboration, I managed to maintain team morale and productivity throughout the transition. The result was a more efficient and effective team structure.

Q 20. How do you handle competing priorities and deadlines?

Handling competing priorities and deadlines requires effective time management and prioritization skills. I use a combination of techniques, including:

- Prioritization Matrices: Using frameworks like Eisenhower Matrix (urgent/important) to identify tasks that require immediate attention versus those that can be delegated or postponed.

- Project Management Tools: Utilizing tools like Gantt charts or project management software to visualize timelines, dependencies, and milestones.

- Time Blocking: Allocating specific time slots for focused work on different tasks.

- Regular Review and Adjustment: Regularly reviewing progress, identifying roadblocks, and adjusting plans as needed.

If deadlines are genuinely conflicting, I proactively communicate with stakeholders, explaining the situation and negotiating priorities. Transparent communication is key to managing expectations and preventing frustration. For example, in a fast-paced project, I once had to prioritize a critical deliverable, resulting in a slight delay on another. By proactively communicating the trade-off and its rationale to all stakeholders, I managed to secure their understanding and avoid any negative consequences.

Q 21. How do you stay up-to-date on industry trends and best practices?

Staying current on industry trends and best practices is crucial in business development. I utilize several strategies, including:

- Industry Publications and Journals: Regularly reading trade publications, industry reports, and academic journals relevant to my field.

- Conferences and Workshops: Attending industry conferences and workshops to network and learn from experts.

- Online Courses and Webinars: Participating in online courses and webinars offered by reputable institutions.

- Networking: Maintaining a strong professional network through industry events, online communities, and mentoring relationships.

- Competitive Analysis: Regularly monitoring the activities of competitors and analyzing their strategies.

For instance, I recently completed a course on the latest advancements in digital marketing to enhance my skills and stay abreast of evolving trends. This knowledge has already been valuable in updating our marketing strategies and improving our results.

Q 22. Describe your approach to problem-solving in a business development context.

My approach to problem-solving in business development is systematic and data-driven. I begin by clearly defining the problem, gathering all relevant data, and analyzing it to identify root causes. This involves market research, competitor analysis, and internal assessments. I then brainstorm potential solutions, evaluating each based on feasibility, impact, and risk. This often involves creating a decision matrix to weigh pros and cons objectively. Finally, I implement the chosen solution, monitor its effectiveness, and make adjustments as needed. For example, when faced with declining sales for a specific product, I wouldn’t jump to conclusions. Instead, I’d analyze sales data, customer feedback, and market trends to pinpoint the issue – perhaps it’s pricing, competition, or a shift in consumer preferences. Then I’d develop solutions like a targeted marketing campaign, price adjustments, or product enhancements, testing and iterating until we see positive results.

Q 23. How do you handle conflict and disagreements within a team?

Conflict is inevitable in any team, but healthy disagreement can lead to innovation. My approach focuses on open communication and respectful dialogue. I encourage team members to express their views openly and honestly, while emphasizing active listening and empathy. I facilitate constructive discussions, helping the team identify common goals and explore alternative solutions collaboratively. If needed, I’ll act as a mediator, ensuring everyone feels heard and valued. The goal is not to eliminate conflict but to manage it effectively, transforming disagreements into opportunities for growth and improved decision-making. For instance, if two team members have conflicting strategies for a marketing campaign, I wouldn’t simply side with one. Instead, I’d guide them through a process of comparing data, exploring the pros and cons of each approach, and potentially combining elements of both to create a stronger, more comprehensive plan.

Q 24. How do you present complex information to a non-technical audience?

Presenting complex information to a non-technical audience requires simplifying the message without sacrificing accuracy. I use clear, concise language, avoiding jargon and technical terms whenever possible. I rely heavily on visual aids like charts, graphs, and infographics to illustrate key points. I use storytelling and analogies to make the information relatable and memorable. For example, instead of explaining intricate financial models, I might use a simple analogy, comparing investment strategies to planting seeds and nurturing their growth. I also break down complex information into smaller, digestible chunks, ensuring the audience understands each step before moving on. Finally, I always encourage questions and ensure everyone feels comfortable asking for clarification.

Q 25. What is your understanding of the different types of business models?

Business models describe how a company creates, delivers, and captures value. There are many types, but some key ones include:

- Freemium: Offers a basic service for free and charges for premium features (e.g., Spotify).

- Subscription: Provides access to a product or service for a recurring fee (e.g., Netflix).

- Franchise: Grants the right to operate a business using an established brand and system (e.g., McDonald’s).

- Affiliate Marketing: Earns commission by promoting other companies’ products or services (e.g., many bloggers and influencers).

- Razor-and-Blade: Sells a low-cost product (the “razor”) and profits from higher-margin consumables (the “blades”) (e.g., printer manufacturers).

- Advertising: Generates revenue by displaying ads to users (e.g., Google, Facebook).

Understanding these models is crucial for developing a successful business strategy, as it helps define revenue streams, target markets, and competitive advantages.

Q 26. Describe your experience working with cross-functional teams.

I have extensive experience collaborating with cross-functional teams, including marketing, sales, product development, and engineering. I excel at fostering open communication and collaboration, ensuring everyone understands the shared goals and contributes their expertise effectively. In one project, I led a team consisting of marketers, engineers, and sales representatives to develop a new go-to-market strategy for a software product. My focus was on ensuring clear communication, aligning individual team goals with the overall objective, and creating a sense of shared ownership. This resulted in a successful product launch and exceeded sales projections. My ability to bridge communication gaps and build consensus across different departments is a significant strength.

Q 27. How do you adapt your approach based on the specific needs of a client or organization?

Adaptability is key in business development. I always start by thoroughly understanding the client’s or organization’s specific needs, challenges, and goals. This involves deep listening, asking insightful questions, and conducting thorough research. I tailor my approach based on their industry, market position, and internal capabilities. For example, a start-up will have different needs than a large corporation. A start-up might require assistance with securing seed funding and building brand awareness, while a corporation might need help expanding into new markets or optimizing existing sales processes. I leverage my expertise in strategic planning to develop customized solutions that address their unique circumstances, ensuring alignment with their overall business strategy.

Q 28. What are your salary expectations?

My salary expectations are commensurate with my experience and skills, and are dependent on the specific details of the role and compensation package. I’m open to discussing a competitive salary range based on industry benchmarks and the responsibilities associated with the position. I’m more interested in a role where I can significantly contribute and grow my career than focusing solely on a specific number.

Key Topics to Learn for Business Development and Strategic Planning Interview

- Market Analysis & Competitive Landscape: Understanding market trends, identifying key competitors, and analyzing their strengths and weaknesses. Practical application: Developing a competitive analysis report for a new product launch.

- Business Strategy Formulation: Defining clear goals, developing actionable strategies, and aligning resources effectively. Practical application: Creating a go-to-market strategy for a new service.

- Financial Modeling & Forecasting: Proficiently using financial tools to project revenue, expenses, and profitability. Practical application: Building a financial model to assess the viability of a new business venture.

- Sales & Business Development Processes: Understanding lead generation, sales pipeline management, and closing deals. Practical application: Designing a sales process optimization plan to increase conversion rates.

- Strategic Partnerships & Alliances: Identifying and developing mutually beneficial relationships with other organizations. Practical application: Negotiating a strategic partnership agreement.

- Risk Management & Mitigation: Identifying potential risks and developing strategies to mitigate their impact. Practical application: Conducting a risk assessment for a major project.

- Communication & Presentation Skills: Effectively communicating complex ideas to diverse audiences. Practical application: Preparing and delivering compelling presentations to stakeholders.

- Data Analysis & Interpretation: Analyzing data to identify trends, insights, and opportunities. Practical application: Using data to inform strategic decision-making.

Next Steps

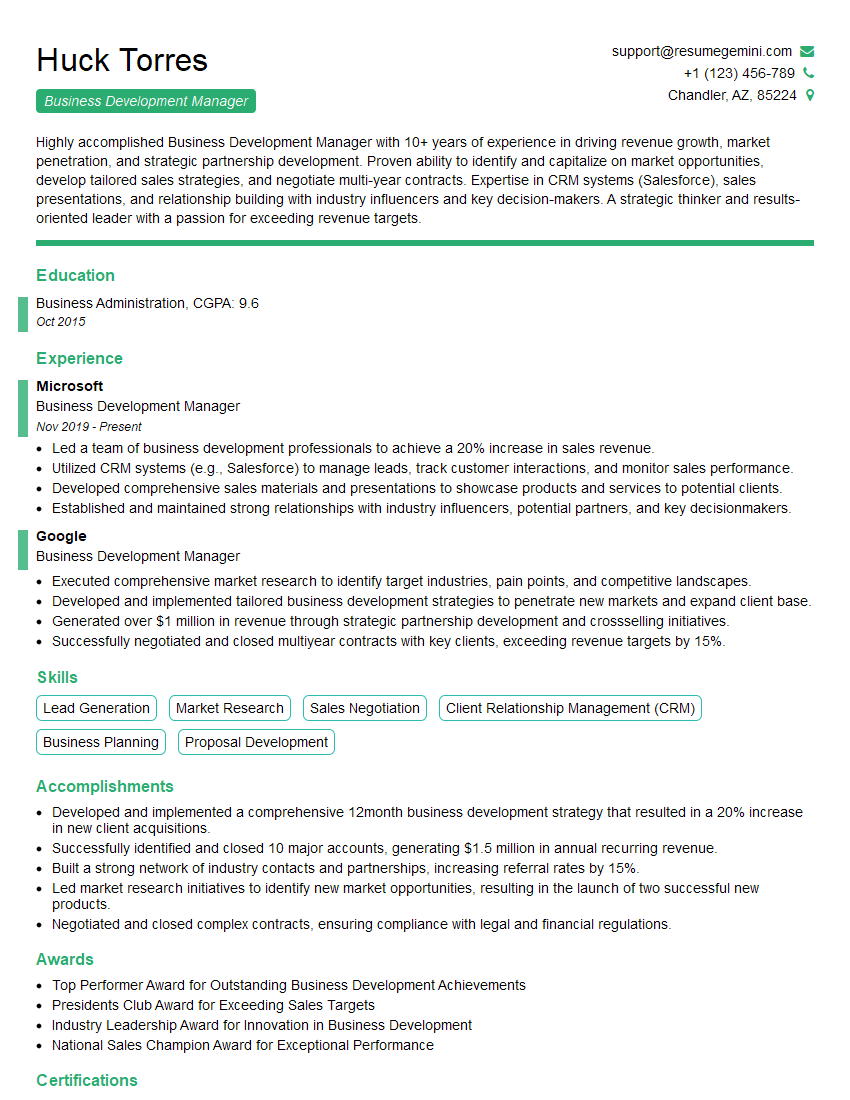

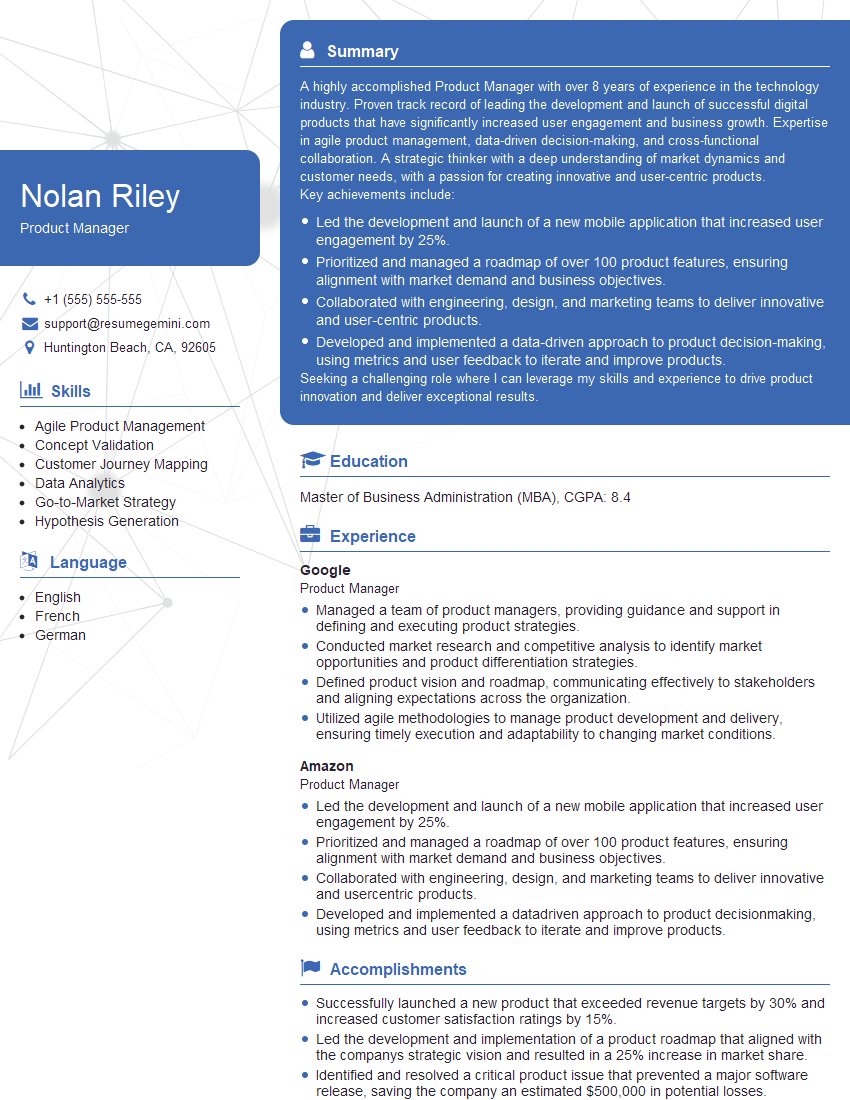

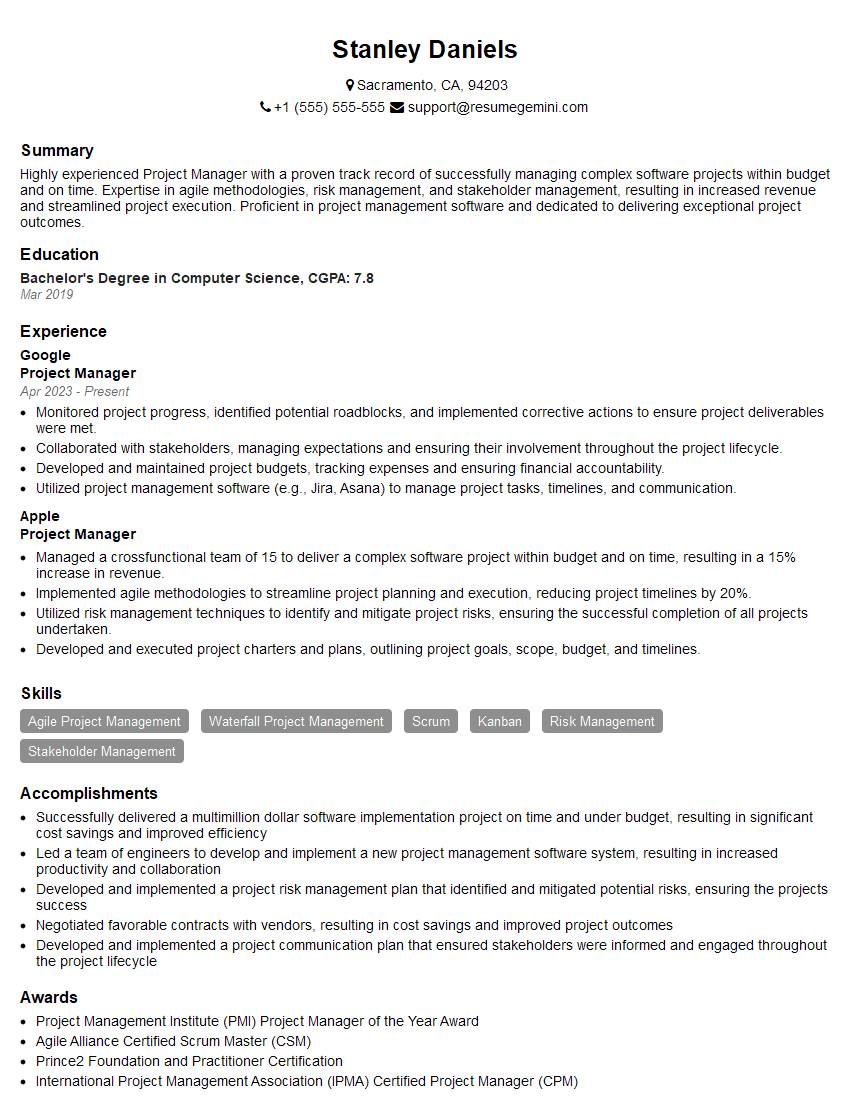

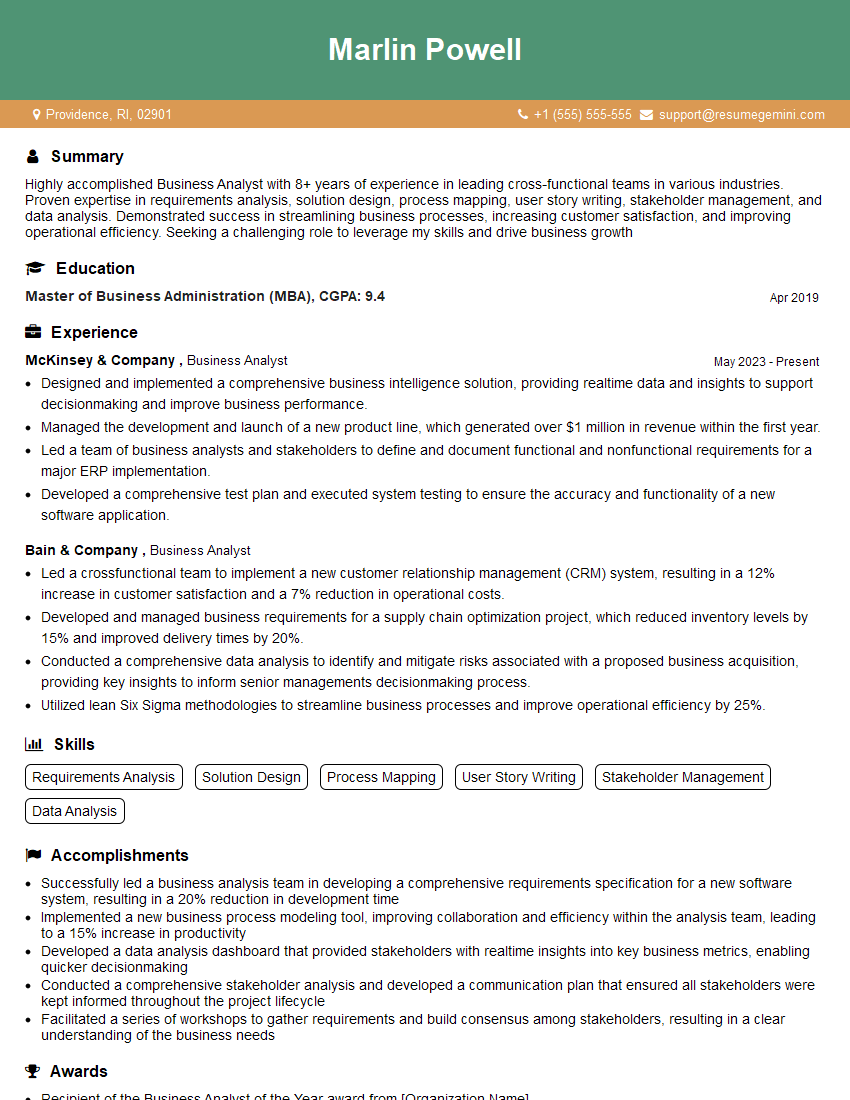

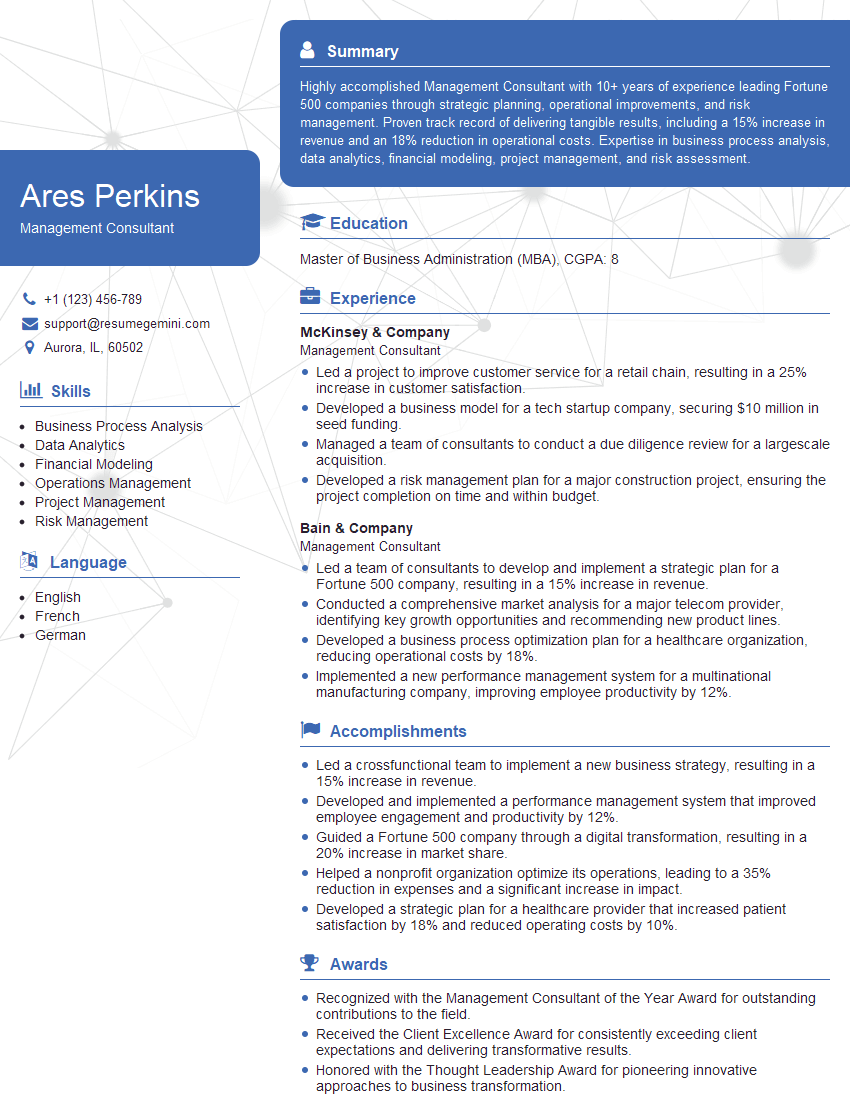

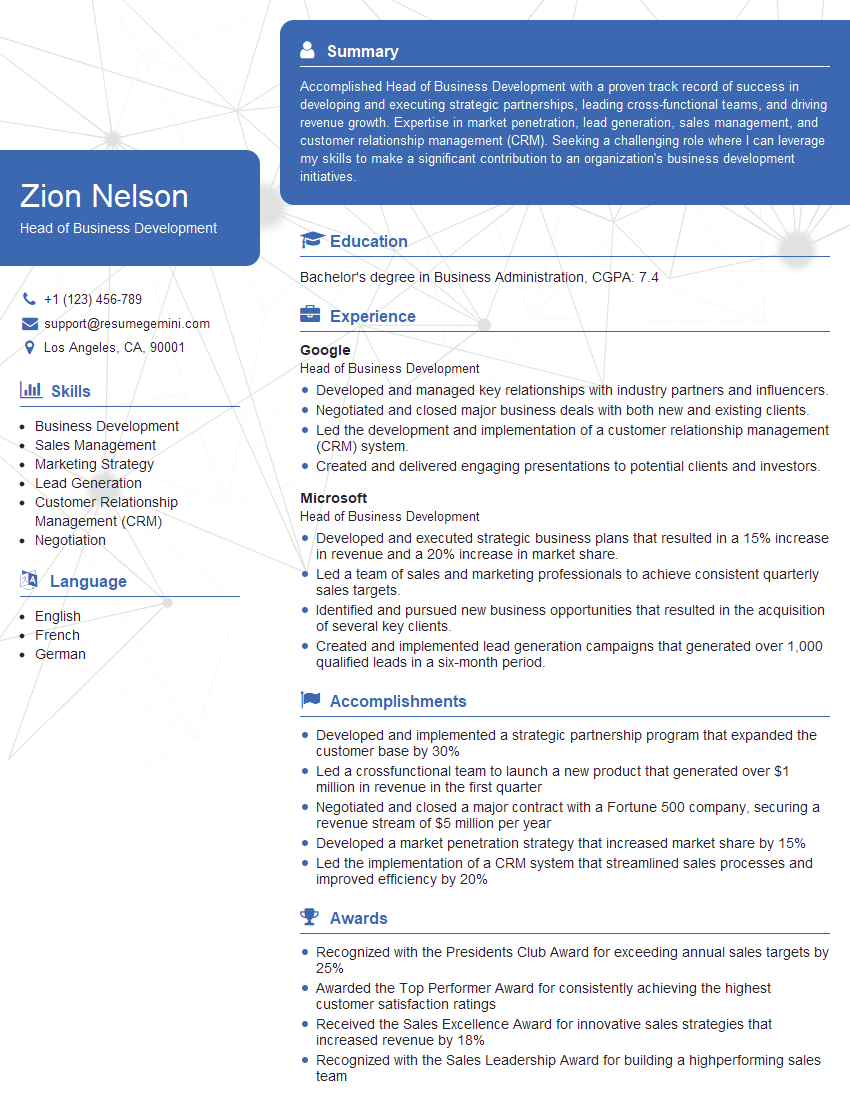

Mastering Business Development and Strategic Planning is crucial for career advancement, opening doors to leadership roles and significantly increasing earning potential. To maximize your job prospects, it’s essential to present your skills and experience effectively. Building an ATS-friendly resume is paramount in today’s competitive job market. ResumeGemini is a trusted resource to help you craft a professional and impactful resume that highlights your qualifications. We provide examples of resumes tailored to Business Development and Strategic Planning to help guide you in showcasing your unique strengths. Take the next step in your career journey – build a resume that gets noticed!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good