The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Understanding of Investment Products interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Understanding of Investment Products Interview

Q 1. Explain the difference between stocks and bonds.

Stocks and bonds represent different ways to invest in companies and governments. Stocks, or equities, represent ownership in a company. When you buy stock, you become a shareholder, owning a tiny piece of the company and entitled to a share of its profits (through dividends) and its potential growth in value. Bonds, on the other hand, are essentially loans you make to a company or government. You lend them money for a set period, and they pay you interest in return. At the end of the term, they repay the principal (the original loan amount).

Think of it like this: If you buy stock in a bakery, you’re a part-owner, sharing in the bakery’s success or failure. If you buy a bond from the bakery, you’re a lender, receiving interest payments regardless of whether the bakery flourishes or struggles (unless it defaults on the loan). Stocks generally offer higher potential returns but also carry higher risk than bonds.

- Stocks: Higher risk, higher potential return, ownership stake.

- Bonds: Lower risk, lower potential return, debt instrument.

Q 2. What are the key risks associated with investing in emerging markets?

Investing in emerging markets offers potentially high returns, but it also comes with significant risks. These risks stem from the inherent volatility and uncertainty present in these developing economies.

- Political and Economic Instability: Emerging markets are often prone to political turmoil, currency fluctuations, and unpredictable economic policies, all of which can significantly impact investment returns. A sudden change in government or a major economic crisis can wipe out investment value quickly.

- Regulatory Uncertainty: The regulatory environment in emerging markets can be less developed and more prone to changes, creating uncertainty for investors.

- Currency Risk: Fluctuations in the local currency can significantly impact the value of your investment when converted back to your home currency.

- Liquidity Risk: It can be more difficult to buy or sell investments in emerging markets compared to developed markets, meaning you might not be able to exit your position easily when needed.

- Higher Volatility: Emerging market securities tend to be more volatile than those in developed economies, leading to greater price swings.

For example, an investor who bought stock in a company in a country experiencing a sudden political upheaval could see their investment plummet in value.

Q 3. Describe the concept of diversification and its importance in portfolio management.

Diversification is the strategy of spreading investments across different asset classes, sectors, and geographies to reduce risk. The core idea is that if one part of your portfolio performs poorly, other parts may offset those losses. It’s like not putting all your eggs in one basket.

Imagine having all your money in a single stock. If that company fails, you lose everything. However, if you diversify across several stocks, bonds, real estate, and other asset classes, the impact of any single investment’s failure is lessened. Diversification doesn’t guarantee profits, but it significantly reduces the likelihood of catastrophic losses and helps manage overall portfolio volatility. A well-diversified portfolio aims for a balance between risk and reward, tailored to an investor’s risk tolerance and financial goals.

Q 4. What are mutual funds and how do they work?

Mutual funds are investment pools that combine money from many investors to invest in a diversified portfolio of securities, such as stocks, bonds, or other assets. They’re managed by professional fund managers who research, select, and actively manage the investments within the fund.

How they work: Investors purchase shares in the mutual fund. The fund manager uses that pooled money to buy various securities according to the fund’s investment objective (e.g., growth, income, or a blend). The fund’s value fluctuates based on the performance of its underlying holdings. Investors can then buy or sell their shares in the fund at the end of each trading day. Mutual funds provide diversification and professional management, making them accessible to even small investors. However, they usually come with management fees.

Q 5. Explain the difference between active and passive investment strategies.

Active and passive investment strategies represent different approaches to managing a portfolio.

- Active investing involves actively trying to beat the market by selecting specific securities believed to outperform. Active managers research and trade frequently, aiming to identify undervalued assets or predict market trends. They often charge higher fees to reflect this hands-on approach.

- Passive investing focuses on mirroring a specific market index (like the S&P 500), avoiding trying to beat the market. Passive strategies generally involve buying and holding a diversified portfolio of securities that tracks the index’s composition. This approach is generally lower cost because it requires less active management.

For example, an active manager might research individual companies and invest heavily in ones they believe will surge, while a passive investor might simply buy an index fund that mirrors the S&P 500, owning a small slice of each company in the index. The choice between active and passive depends on an investor’s risk tolerance, time horizon, and belief in their ability to consistently outperform the market.

Q 6. What are Exchange Traded Funds (ETFs) and their advantages over mutual funds?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges like individual stocks. They track a specific index, sector, commodity, or other asset. Similar to mutual funds, they provide diversification and professional management, but they offer several key advantages.

- Lower expense ratios: ETFs typically have lower fees than mutual funds.

- Intraday trading: ETFs can be bought and sold throughout the trading day, unlike mutual funds which are priced only once at the end of the day.

- Tax efficiency: ETFs generally have lower tax implications than mutual funds due to their structure.

- Transparency: The holdings of ETFs are publicly available, making it easy for investors to see what they are invested in.

In essence, ETFs offer the benefits of mutual funds with added flexibility and lower costs. They are a popular choice for investors seeking diversified exposure to a particular market segment without significant management fees.

Q 7. Define systematic risk and unsystematic risk. How can investors mitigate each?

Systematic risk (also known as market risk) is the risk inherent to the overall market. It affects all investments and cannot be diversified away. Unsystematic risk (also called specific risk) is the risk associated with a specific company or industry. It can be reduced through diversification.

- Systematic Risk: Examples include market crashes, recessions, interest rate changes, and geopolitical events. Mitigation strategies include hedging (using derivatives to offset potential losses), diversifying across asset classes (e.g., stocks and bonds), and adjusting portfolio allocation based on market outlook.

- Unsystematic Risk: Examples include a company’s poor management, a product recall, or a specific industry downturn. Mitigation strategies focus on diversification. Holding stocks from different industries, sectors, and even countries reduces the impact of a single company or industry’s negative performance.

For example, a market crash (systematic risk) impacts all investments, while a company filing for bankruptcy (unsystematic risk) only affects that specific company’s investors. Diversification is key to mitigating unsystematic risk.

Q 8. Explain the concept of Modern Portfolio Theory (MPT).

Modern Portfolio Theory (MPT) is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It’s based on the principle of diversification – don’t put all your eggs in one basket. Instead of focusing solely on individual asset returns, MPT emphasizes the overall portfolio’s risk and return.

At its core, MPT uses statistical measures like expected return, standard deviation (a measure of volatility or risk), and correlation between assets to optimize the portfolio. The goal is to find the optimal combination of assets that provides the highest expected return for a given level of acceptable risk, or conversely, the lowest risk for a given desired return.

Example: Imagine you’re investing in two stocks: Stock A (high return, high risk) and Stock B (low return, low risk). MPT suggests that a combination of both, rather than investing solely in either, might be the optimal solution. The precise allocation would depend on your risk tolerance and the correlation between the two stocks (if they tend to move in opposite directions, you can reduce overall portfolio risk).

Practical Application: MPT is widely used by financial advisors, portfolio managers, and institutional investors to construct diversified portfolios tailored to individual investor needs and risk profiles. Software packages employ sophisticated algorithms based on MPT principles to optimize asset allocation.

Q 9. How do you evaluate the performance of an investment portfolio?

Evaluating investment portfolio performance requires a multifaceted approach, going beyond simply looking at the total return. Key metrics include:

- Total Return: The overall percentage change in the portfolio’s value over a specific period (e.g., annualized return).

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe ratio indicates better performance relative to the risk taken. It’s calculated as (Portfolio Return – Risk-Free Rate) / Portfolio Standard Deviation.

- Sortino Ratio: Similar to the Sharpe ratio, but it only considers downside deviation (losses), making it a more refined measure of risk-adjusted return.

- Alpha: Measures the excess return of a portfolio compared to a benchmark (e.g., the S&P 500). A positive alpha suggests the portfolio outperformed the benchmark.

- Beta: Measures the volatility of a portfolio relative to a benchmark. A beta of 1 means the portfolio moves in line with the benchmark, while a beta greater than 1 implies higher volatility.

- Maximum Drawdown: The largest percentage decline from a peak to a trough in the portfolio’s value. This metric is crucial for assessing risk tolerance.

Example: Suppose two portfolios have the same total return. However, one has a higher Sharpe ratio, indicating it achieved that return with less risk. This information is vital for assessing which portfolio performed better overall.

Practical Application: These metrics are essential for comparing the performance of different portfolios, evaluating the effectiveness of investment strategies, and making informed decisions about future investment allocation.

Q 10. What are the different types of investment options available to retail investors?

Retail investors have access to a wide array of investment options, each with its own risk and return profile:

- Stocks: Represent ownership in a company. They offer potentially high returns but carry significant risk.

- Bonds: Represent loans to a company or government. They generally offer lower returns than stocks but are considered less risky.

- Mutual Funds: Professionally managed portfolios that pool money from multiple investors. They offer diversification and professional management but incur fees.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but trade on exchanges like stocks, offering greater flexibility.

- Real Estate: Investing in physical properties or REITs (Real Estate Investment Trusts). It can offer diversification and potential for rental income but involves higher transaction costs and illiquidity.

- Commodities: Investing in raw materials such as gold, oil, or agricultural products. These investments can act as a hedge against inflation but are highly volatile.

- Annuities: Contracts with insurance companies that provide a stream of income for a specified period. They offer guaranteed income but typically have lower returns than other investments.

Practical Application: The choice of investment option depends on an investor’s risk tolerance, investment goals (e.g., retirement, education), time horizon, and financial knowledge. Diversification across different asset classes is crucial to manage risk.

Q 11. Explain the concept of Capital Asset Pricing Model (CAPM).

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an asset or investment. It’s based on the idea that an asset’s return should compensate investors for the systematic risk (market risk) associated with the investment.

The formula is: Expected Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate)

Where:

- Risk-Free Rate: The return on a risk-free investment (e.g., government bonds).

- Beta: A measure of systematic risk. A beta of 1 indicates the asset’s price will move with the market; a beta greater than 1 suggests higher volatility than the market, and less than 1 indicates lower volatility.

- Market Return: The expected return of the overall market.

Example: If the risk-free rate is 2%, the market return is 8%, and an asset has a beta of 1.5, the expected return would be: 2% + 1.5 * (8% – 2%) = 11%.

Practical Application: CAPM is used to determine the required rate of return for an asset, which is essential for making investment decisions, evaluating project feasibility, and pricing assets. It provides a framework for comparing the expected return of different investments based on their risk profiles.

Q 12. What are derivatives and how are they used in investment strategies?

Derivatives are financial contracts whose value is derived from an underlying asset. The underlying asset can be anything from stocks and bonds to commodities and currencies. Derivatives are not investments in themselves; they are tools used to manage risk or speculate on price movements.

Types of Derivatives:

- Futures Contracts: Agreements to buy or sell an asset at a specific price on a future date.

- Options Contracts: Give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a specific date (expiration date).

- Swaps: Agreements to exchange cash flows based on different underlying assets or interest rates.

Investment Strategies using Derivatives:

- Hedging: Reducing risk by offsetting potential losses in one investment with gains in a derivative contract.

- Speculation: Betting on the price movements of the underlying asset. This carries high risk but offers the potential for significant gains.

- Arbitrage: Exploiting price differences between related assets to generate risk-free profits.

Example: A farmer might use futures contracts to lock in a price for their crops, hedging against potential price declines. A speculator might buy call options on a stock, hoping the price will rise above the strike price before the option expires.

Practical Application: Derivatives are widely used by institutional investors, corporations, and individuals to manage risk, speculate on price movements, and create complex investment strategies. However, they are complex instruments and require a thorough understanding of their risks.

Q 13. Describe the different types of options contracts.

Options contracts are of two main types:

- Call Options: Give the buyer the right, but not the obligation, to buy an underlying asset at a specific price (the strike price) on or before a specific date (the expiration date). The seller (writer) of the call option is obligated to sell the asset if the buyer exercises their right.

- Put Options: Give the buyer the right, but not the obligation, to sell an underlying asset at a specific price (the strike price) on or before a specific date (the expiration date). The seller (writer) of the put option is obligated to buy the asset if the buyer exercises their right.

Further Classification: Options can also be classified as:

- American Options: Can be exercised at any time before the expiration date.

- European Options: Can only be exercised at the expiration date.

Example: A call option on a stock with a strike price of $100 and an expiration date of December 31st would allow the buyer to purchase the stock at $100 any time before December 31st. A put option would allow the buyer to sell the stock at $100 before that date.

Practical Application: Options are used for hedging, speculation, and income generation. They offer leverage, allowing investors to control a larger amount of underlying asset with a smaller investment than direct ownership.

Q 14. Explain the concept of Net Present Value (NPV) and its application in investment decisions.

Net Present Value (NPV) is a crucial concept in investment appraisal. It calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV indicates that the investment is expected to generate more value than it costs, making it a worthwhile undertaking.

The formula is: NPV = Σ [Ct / (1 + r)^t] - C0

Where:

- Ct: Net cash inflow during the period t

- r: Discount rate (reflecting the cost of capital or the opportunity cost of investing elsewhere)

- t: Number of time periods

- C0: Initial investment

Example: An investment requires an initial outlay of $100,000 and is expected to generate cash inflows of $30,000 per year for five years. With a discount rate of 10%, the NPV can be calculated. A positive NPV suggests the project is financially viable.

Practical Application: NPV is widely used in capital budgeting decisions, where companies evaluate potential projects or investments. A positive NPV suggests the project adds value to the company, while a negative NPV suggests it would reduce value. The decision rule is to accept projects with a positive NPV and reject those with a negative NPV.

Q 15. What is the difference between a bull market and a bear market?

A bull market and a bear market are two contrasting phases in the stock market, characterized by the overall direction of price movements. A bull market is characterized by rising prices, investor optimism, and a general feeling of confidence in the economy. Imagine a bull charging forward – that’s the aggressive upward momentum of a bull market. Conversely, a bear market is defined by falling prices, widespread pessimism, and fear among investors. Think of a bear swiping downwards – that’s the downward trajectory of a bear market. These terms describe prevailing sentiment and price trends, not specific timeframes.

Example: The period from 2009 to 2020 saw a significant bull market in many global equity indices, while the market downturn in 2008 is a prime example of a bear market.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do interest rates affect bond prices?

Bond prices and interest rates have an inverse relationship. This means that when interest rates rise, bond prices generally fall, and vice versa. This is because when new bonds are issued at higher interest rates, existing bonds with lower coupon rates become less attractive, leading to a decrease in their market price to compensate for the lower yield. Think of it this way: if you can buy a new bond paying 5% interest, you’re less likely to buy an older bond paying only 3%, unless the price of the older bond drops to offer a comparable yield.

Example: If the Federal Reserve raises interest rates, newly issued government bonds will have higher coupon payments. Existing bonds with lower coupon rates will see their prices fall to make them competitive with the newer, higher-yielding bonds.

Q 17. Explain the concept of inflation and its impact on investments.

Inflation is a general increase in the prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

Inflation significantly impacts investments. High inflation erodes the real return on investments. For example, if you earn a 5% return on an investment but inflation is at 7%, your real return is actually -2%. This is because the purchasing power of your returns has decreased. Different investment types react differently to inflation. For instance, stocks generally perform better during periods of moderate inflation, as companies can often pass increased costs onto consumers. However, bonds typically underperform during inflationary periods, as their fixed income streams lose purchasing power.

Example: If inflation consistently exceeds the return of a savings account, the real value of the savings will decrease over time.

Q 18. What are the key factors to consider when analyzing a company’s financial statements?

Analyzing a company’s financial statements requires a thorough examination of several key factors to assess its financial health and performance. These include:

- Profitability: Metrics like net profit margin, return on assets (ROA), and return on equity (ROE) reveal how efficiently the company generates profits.

- Liquidity: Liquidity ratios such as the current ratio and quick ratio assess the company’s ability to meet its short-term obligations.

- Solvency: Solvency ratios, like the debt-to-equity ratio and times interest earned, indicate the company’s ability to meet its long-term debt obligations.

- Efficiency: Metrics such as inventory turnover and accounts receivable turnover reveal how effectively the company manages its assets.

- Cash Flow: Analyzing cash flow statements helps understand the actual cash generated and used by the company’s operations, investing, and financing activities.

By evaluating these factors, investors can gain a comprehensive understanding of a company’s financial position and its potential for future growth.

Q 19. How do you assess the creditworthiness of a bond issuer?

Assessing the creditworthiness of a bond issuer involves evaluating their ability and willingness to repay their debt obligations. Several factors are crucial in this assessment:

- Credit Rating Agencies: Agencies like Moody’s, S&P, and Fitch provide ratings that reflect the creditworthiness of the issuer. Higher ratings indicate lower risk.

- Financial Statements: A thorough analysis of the issuer’s financial statements, including its balance sheet, income statement, and cash flow statement, is essential to evaluate its financial health.

- Debt Levels: High levels of debt relative to equity indicate higher financial risk.

- Cash Flow: Strong and consistent cash flow demonstrates the issuer’s ability to meet its debt obligations.

- Industry Conditions: The overall health and stability of the industry in which the issuer operates also play a significant role.

By carefully considering these factors, investors can make informed decisions about the risk associated with investing in a particular bond.

Q 20. What are the ethical considerations in investment management?

Ethical considerations in investment management are paramount. Investment professionals have a fiduciary duty to act in the best interests of their clients. Key ethical considerations include:

- Transparency and Disclosure: Full transparency about fees, investment strategies, and potential conflicts of interest is crucial.

- Client Suitability: Investments should be tailored to the individual client’s risk tolerance, financial goals, and investment timeframe. Recommending unsuitable investments is unethical.

- Conflict of Interest: Avoiding situations where personal interests conflict with client interests is vital.

- Misrepresentation and Fraud: Providing false or misleading information is unethical and illegal.

- Fair Dealing: Treating all clients fairly and equitably, regardless of their net worth, is a core ethical principle.

Adherence to a strong ethical framework is not only morally right but also crucial for maintaining client trust and long-term success in the industry.

Q 21. Explain the concept of due diligence in investment analysis.

Due diligence in investment analysis is a systematic process of investigating and verifying all aspects of a potential investment before committing capital. It’s like conducting a thorough background check before making a significant purchase. This involves gathering, analyzing, and interpreting relevant information to make informed investment decisions and minimize risks.

The process often includes:

- Financial Statement Analysis: Scrutinizing a company’s financial health through balance sheets, income statements, and cash flow statements.

- Industry Research: Understanding the industry landscape, competitive forces, and growth prospects.

- Management Assessment: Evaluating the competence and integrity of the company’s management team.

- Legal and Regulatory Compliance: Checking for any legal issues or regulatory violations.

- Valuation: Determining the intrinsic value of the investment using various valuation methods.

Thorough due diligence is a critical step to mitigate risks and enhance investment returns. Failing to conduct sufficient due diligence can lead to significant financial losses.

Q 22. What are some common investment fraud schemes?

Investment fraud schemes prey on unsuspecting investors, often promising unrealistic returns or employing deceptive tactics. Common examples include:

- Ponzi Schemes: These fraudulent operations pay existing investors with funds from new investors, creating a false impression of profitability. The scheme collapses when new investments dwindle. Bernie Madoff’s scheme is a notorious example.

- Pyramid Schemes: Similar to Ponzi schemes, these focus on recruiting new members rather than selling legitimate products or services. Earnings are primarily derived from recruitment fees, and the vast majority of participants lose money.

- Pump-and-Dump Schemes: Fraudsters artificially inflate the price of a stock (the “pump”) through misleading information, then sell their holdings at the inflated price (the “dump”), leaving other investors with losses.

- Advance-Fee Fraud: Investors are promised large returns but are required to pay upfront fees for services that are never delivered. These fees often vanish without a trace.

- Churning: This involves excessive trading in a client’s account to generate commissions for the broker, regardless of the client’s investment goals or the market conditions. It often leads to significant losses.

Protecting yourself involves thorough due diligence, careful vetting of investment opportunities, and a healthy dose of skepticism towards promises of unusually high returns. Always consult with a reputable financial advisor before making any investment decisions.

Q 23. Describe your experience with financial modeling.

My experience with financial modeling spans over ten years, encompassing a wide range of models from simple discounted cash flow (DCF) analyses to complex Monte Carlo simulations. I’ve utilized these models across various asset classes, including equities, fixed income, and real estate.

For example, I recently developed a DCF model to evaluate the potential acquisition of a privately held company. This involved projecting the company’s future cash flows, considering various sensitivity analyses to assess the impact of different economic scenarios on the valuation. I then used the model to determine a fair market price, ultimately aiding the negotiation process.

My proficiency extends to using software such as Excel, Python with libraries like Pandas and NumPy, and specialized financial modeling software like Bloomberg Terminal. I understand the limitations of each model and always emphasize the importance of incorporating qualitative factors alongside quantitative analysis.

Q 24. How do you stay up-to-date on market trends and investment opportunities?

Staying abreast of market trends and investment opportunities is crucial in this dynamic environment. My strategy involves a multi-faceted approach:

- Financial News and Publications: I regularly read reputable sources like the Wall Street Journal, Financial Times, and Bloomberg to stay informed about macroeconomic trends, geopolitical events, and market sentiment.

- Industry Conferences and Webinars: Attending industry conferences and webinars provides valuable insights from leading experts and allows networking with other professionals.

- Data Analytics: I utilize advanced data analytics tools to identify emerging patterns and potential investment opportunities based on historical data and predictive modeling.

- Direct Interaction with Companies: I often engage directly with companies through earnings calls, presentations, and site visits to gain first-hand knowledge of their operations and prospects.

- Subscription Services: I subscribe to premium research platforms that offer in-depth analysis and investment recommendations.

This combination of qualitative and quantitative approaches ensures I have a comprehensive understanding of the market landscape and can effectively identify promising investment prospects.

Q 25. What is your investment philosophy?

My investment philosophy centers on a long-term, value-oriented approach emphasizing fundamental analysis and risk management. I believe in investing in high-quality companies with sustainable competitive advantages, strong management teams, and a clear path to future growth.

I prioritize diversification across asset classes and geographies to mitigate risk. I’m not driven by short-term market fluctuations; instead, I focus on identifying undervalued assets and holding them for the long term, allowing their intrinsic value to appreciate. This long-term perspective helps weather market volatility and achieve consistent returns over time. I believe in a disciplined approach to investing, following a well-defined process, and sticking to my investment strategy regardless of short-term market noise.

Q 26. How would you handle a situation where an investment is underperforming?

When an investment underperforms, I follow a systematic process to assess the situation and determine the appropriate course of action. This typically involves:

- Reviewing the Fundamentals: I first re-examine the underlying fundamentals of the investment. Has the company’s performance deteriorated? Have there been significant changes in the industry or macroeconomic environment?

- Assessing the Market Context: I evaluate the broader market conditions. Is the underperformance due to sector-specific issues, or is it a reflection of a broader market downturn?

- Considering Alternative Scenarios: I conduct sensitivity analysis and scenario planning to determine the potential outcomes under various market conditions.

- Determining the Appropriate Course of Action: Based on my analysis, I decide whether to hold, sell, or average down (buy more at a lower price). This decision depends on the severity of the underperformance, the outlook for the underlying asset, and my overall portfolio strategy.

- Documenting the Decision: I carefully document my reasoning for the decision made and any modifications to my investment strategy.

Open communication with clients is crucial during such situations to explain the rationale behind the decision and maintain transparency.

Q 27. Describe a time you had to make a difficult investment decision.

One of the most challenging investment decisions I faced involved a technology startup during the dot-com bust. The company had innovative technology and experienced management, but the market was extremely volatile and investor sentiment was highly negative.

The decision was whether to hold the investment, despite significant short-term losses, or to sell and crystallize the losses. After conducting thorough due diligence, reviewing the company’s revised business plan, and assessing the potential for long-term growth, I decided to hold. This decision was based on a belief in the company’s long-term potential, even in the face of short-term setbacks. Fortunately, the decision proved to be correct. The company eventually recovered, and the investment yielded significant returns. This experience reinforced the importance of maintaining a long-term perspective and conducting thorough due diligence before making any investment decision.

Q 28. How do you explain complex financial concepts to clients/non-experts?

Explaining complex financial concepts to clients who may not have a financial background requires clear, concise communication and the use of relatable analogies. I avoid technical jargon as much as possible and focus on explaining concepts in plain language.

For instance, when explaining the concept of diversification, I might use the analogy of not putting all your eggs in one basket. When discussing risk tolerance, I’d ask them about their comfort level with potential losses, relating it to their overall financial goals and time horizon. Visual aids such as charts and graphs can greatly enhance understanding. I always ensure clients understand the potential risks and benefits of an investment before they make a decision. Active listening and tailoring my explanations to the client’s individual knowledge and understanding are also key elements of effective communication.

Key Topics to Learn for Understanding of Investment Products Interview

- Asset Classes: Understanding the characteristics, risks, and returns associated with various asset classes (equities, fixed income, real estate, commodities, alternative investments). Be prepared to discuss the diversification benefits of different asset classes and their role in a well-rounded portfolio.

- Investment Strategies: Familiarize yourself with different investment strategies such as value investing, growth investing, passive investing (index funds, ETFs), and active investing. Understand the underlying principles and practical applications of each.

- Risk Management: Demonstrate a strong understanding of risk assessment and mitigation techniques. This includes understanding risk tolerance, diversification, asset allocation, and the use of hedging strategies.

- Portfolio Construction and Management: Be able to discuss portfolio construction principles, including asset allocation, diversification, and rebalancing. Understand how to monitor and adjust a portfolio based on market conditions and investor goals.

- Financial Statement Analysis: Develop your ability to analyze financial statements (balance sheets, income statements, cash flow statements) to assess the financial health and investment potential of companies.

- Valuation Techniques: Become proficient in various valuation methodologies used to determine the intrinsic value of investments, including discounted cash flow (DCF) analysis and relative valuation.

- Regulatory Environment: Understand the regulatory landscape governing investment products and the ethical considerations involved in investment management.

- Market Analysis and Forecasting: Develop your ability to analyze market trends, economic indicators, and geopolitical events to make informed investment decisions. Be ready to discuss your approach to market research.

Next Steps

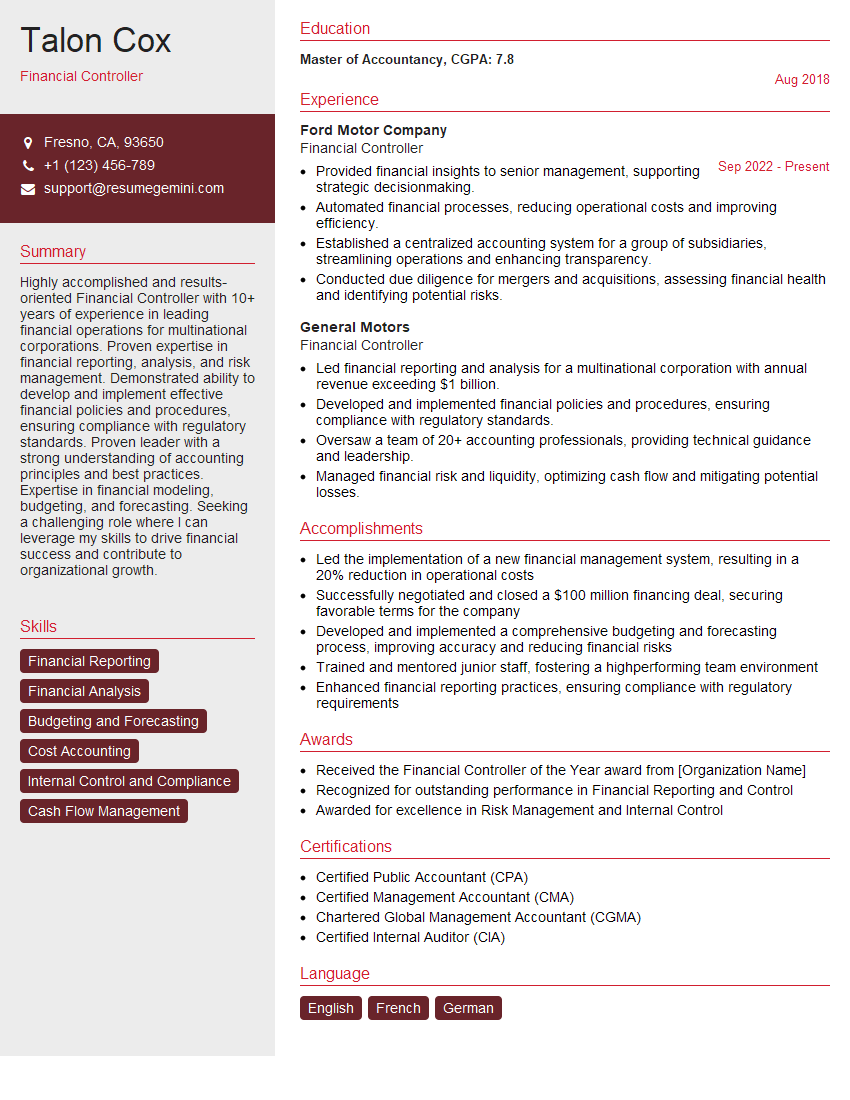

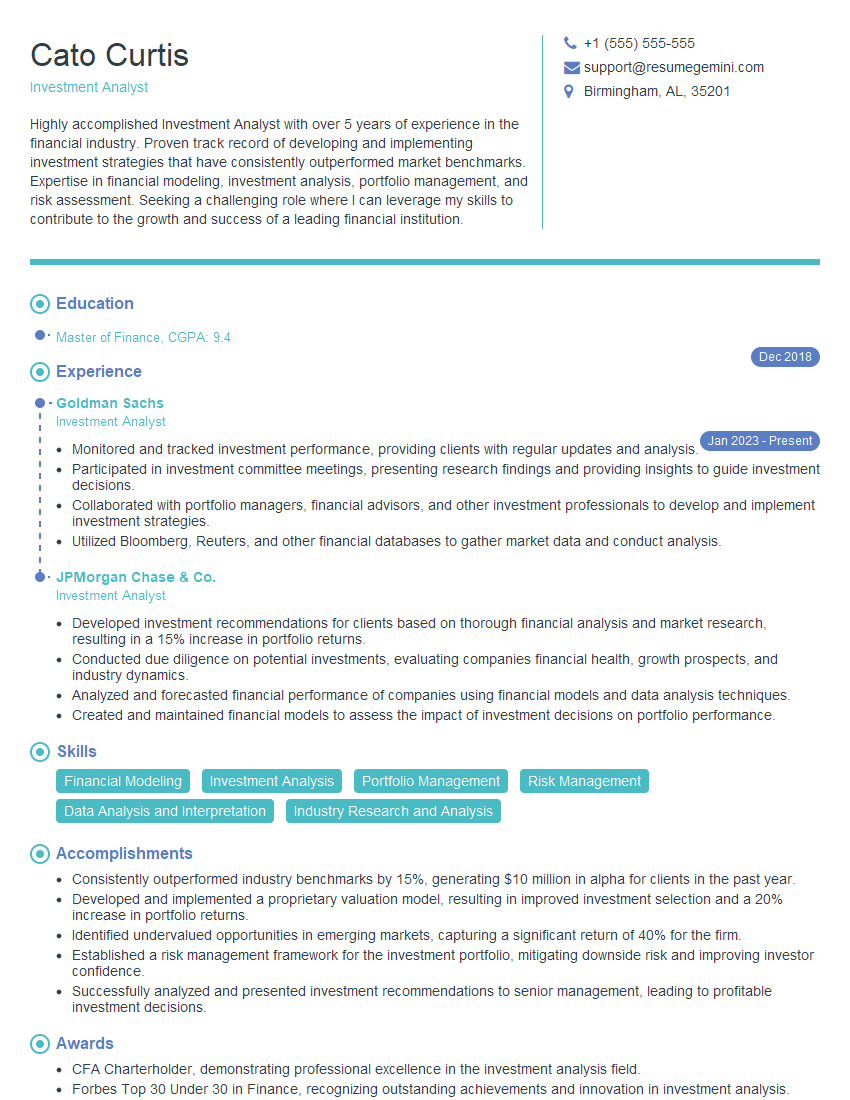

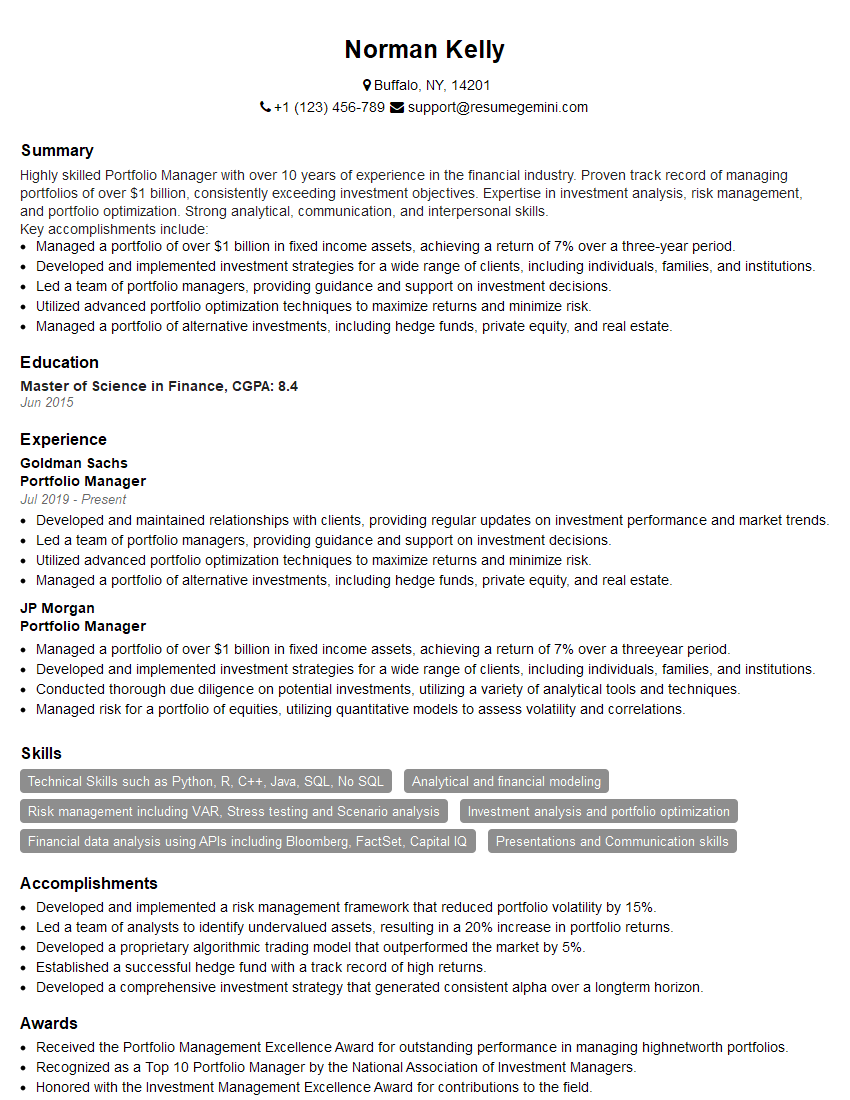

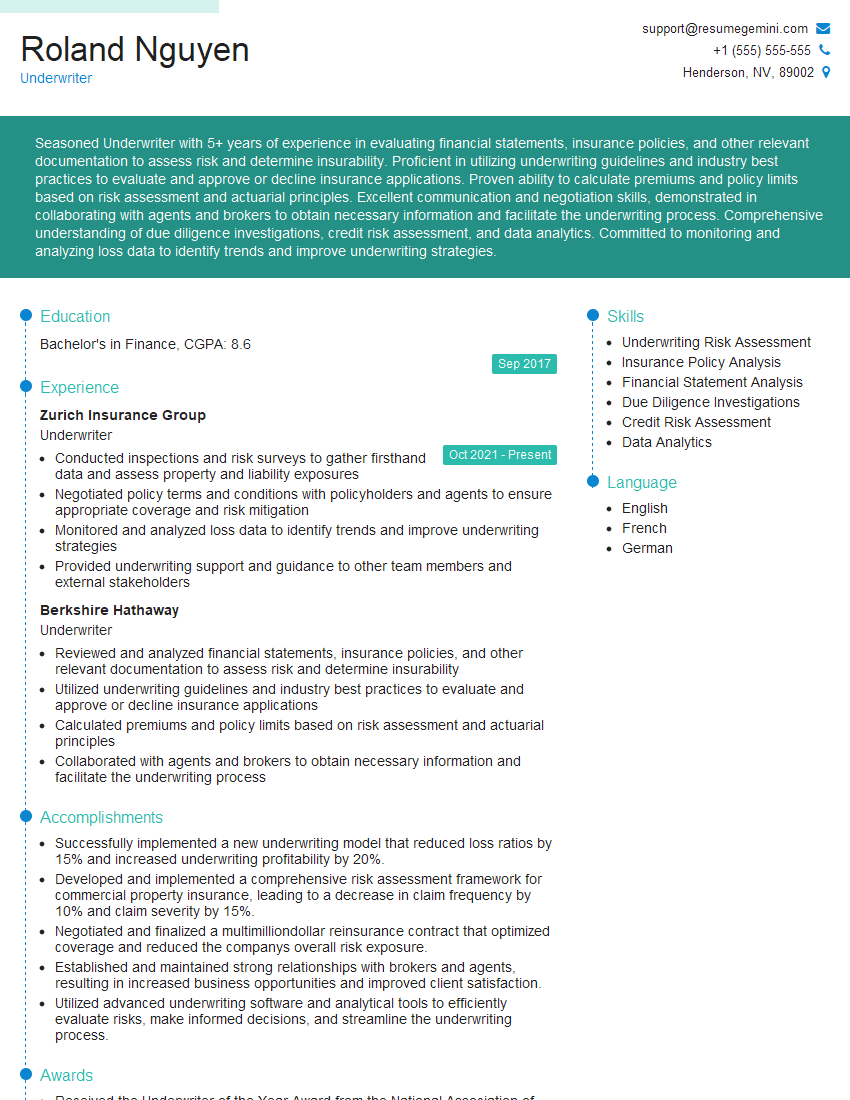

Mastering the intricacies of investment products is crucial for career advancement in finance. A strong understanding of these concepts will significantly enhance your interview performance and open doors to exciting opportunities. To maximize your job prospects, create a compelling and ATS-friendly resume that showcases your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to the Understanding of Investment Products field to guide you in creating your best application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good