Unlock your full potential by mastering the most common Knowledge of Compliance Requirements interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Knowledge of Compliance Requirements Interview

Q 1. Explain the Sarbanes-Oxley Act (SOX) and its impact on compliance.

The Sarbanes-Oxley Act of 2002 (SOX) is a US federal law enacted to protect investors from fraudulent accounting practices. It was a direct response to major corporate accounting scandals like Enron and WorldCom. SOX’s impact on compliance is profound, impacting virtually every aspect of financial reporting and internal controls within publicly traded companies.

Key aspects and their compliance implications:

- Section 302: Corporate Responsibility for Financial Reports: This section holds company executives directly accountable for the accuracy of financial statements. Compliance requires robust internal controls and a thorough review process before reports are filed.

- Section 404: Management Assessment of Internal Controls: This mandates that companies establish and maintain a system of internal controls over financial reporting (ICFR) and have it annually audited. Compliance demands a rigorous framework for assessing, documenting, testing, and improving these controls.

- Increased Auditor Independence: SOX strengthens the independence of external auditors, aiming to prevent conflicts of interest and enhance the reliability of audit opinions. Compliance requires careful management of the relationship between the company and its auditors.

Real-world impact: SOX has significantly improved the accuracy and reliability of financial reporting. It has also driven the implementation of more robust internal controls across organizations. However, compliance can be costly and time-consuming, requiring substantial investment in resources and expertise.

Q 2. Describe your experience with HIPAA compliance.

My experience with HIPAA compliance spans several years, encompassing both policy development and practical implementation. I’ve worked with healthcare providers to ensure their systems and practices adhere to the Health Insurance Portability and Accountability Act of 1996 (HIPAA), which protects the privacy and security of Protected Health Information (PHI).

Specific experiences include:

- Risk assessments: Conducting thorough risk assessments to identify vulnerabilities in data storage, access control, and data transmission.

- Policy development and training: Developing and implementing HIPAA-compliant policies and procedures, and providing comprehensive training to staff on PHI handling and security best practices. This included creating training materials, conducting sessions, and monitoring employee understanding.

- Security audits: Participating in regular security audits to ensure ongoing compliance and identify any needed improvements. This involved reviewing access logs, security protocols, and data encryption methods.

- Incident response planning: Developing and executing incident response plans to handle data breaches and other security incidents effectively and in accordance with HIPAA regulations. This included establishing clear communication protocols and reporting procedures.

Example: In one instance, we discovered a potential security vulnerability in a client’s electronic health record system. We immediately implemented corrective measures, reported the incident internally, and notified the appropriate authorities as per HIPAA breach notification rules.

Q 3. What is GDPR, and what are the key compliance requirements?

The General Data Protection Regulation (GDPR) is a European Union regulation on data protection and privacy for all individuals within the EU and the European Economic Area (EEA). It gives individuals more control over their personal data and places significant obligations on organizations that process that data.

Key compliance requirements include:

- Lawful basis for processing: Organizations must have a valid legal basis (e.g., consent, contract, legal obligation) for processing personal data.

- Data minimization: Only collect and process data necessary for specified, explicit, and legitimate purposes.

- Data security: Implement appropriate technical and organizational measures to protect personal data against unauthorized or unlawful processing and accidental loss, destruction, or damage.

- Data subject rights: Individuals have the right to access, rectify, erase, restrict processing, and object to the processing of their personal data. They also have the right to data portability.

- Data breach notification: Organizations must report data breaches to the supervisory authority within 72 hours and, in certain cases, to affected individuals.

Example: A company collecting customer data for marketing purposes must obtain explicit consent, inform customers about how their data will be used, and provide a simple mechanism for them to withdraw consent.

Q 4. How do you identify and mitigate compliance risks?

Identifying and mitigating compliance risks requires a proactive and multi-faceted approach. I typically employ a risk-based methodology that involves the following steps:

- Risk Assessment: Identifying potential compliance risks through a combination of internal audits, external reviews, and stakeholder interviews. This involves considering regulatory changes, industry best practices, and the organization’s specific operations.

- Risk Prioritization: Categorizing risks based on likelihood and impact, focusing on those with the highest potential for negative consequences.

- Risk Response Planning: Developing strategies to address prioritized risks. This might involve implementing new controls, enhancing existing procedures, or providing additional training.

- Monitoring and Review: Regularly monitoring the effectiveness of risk mitigation strategies and making adjustments as needed. This is a continuous process that ensures ongoing compliance.

Example: In a recent project, we identified a risk related to the inadequate protection of sensitive customer data. Our response involved implementing stronger encryption protocols, improving access controls, and providing enhanced security training to employees.

Q 5. Explain your understanding of internal controls and their role in compliance.

Internal controls are the processes, policies, and procedures implemented by an organization to ensure the reliability of financial reporting, operational efficiency, and compliance with laws and regulations. They act as a framework to mitigate risks and prevent errors or fraud.

Role in compliance: Internal controls are fundamental to compliance. They provide assurance that an organization is operating within the boundaries of applicable laws and regulations. Strong internal controls help prevent violations, improve the accuracy of financial reporting, and enhance overall governance.

Types of Internal Controls:

- Preventive controls: Designed to stop errors or fraud before they occur (e.g., segregation of duties, access controls).

- Detective controls: Designed to identify errors or fraud that have already occurred (e.g., reconciliations, audits).

- Corrective controls: Designed to rectify errors or fraud once they have been detected (e.g., error correction procedures, disciplinary actions).

Example: Segregation of duties, where different individuals are responsible for different stages of a transaction, is a crucial preventive control to mitigate fraud. Regular bank reconciliations act as a detective control to identify discrepancies.

Q 6. Describe your experience conducting compliance audits.

I have extensive experience conducting compliance audits, encompassing various regulatory frameworks, including SOX, HIPAA, and GDPR. My approach involves a detailed planning phase, rigorous testing procedures, and thorough documentation of findings.

My audit process typically follows these steps:

- Planning and Scoping: Defining the audit’s objectives, scope, and timeline, considering the specific regulations and the organization’s unique context.

- Data Collection: Gathering evidence through interviews, document reviews, and observation. This involves examining policies, procedures, and supporting documentation.

- Testing and Analysis: Evaluating the effectiveness of controls and identifying any weaknesses or gaps in compliance.

- Reporting: Documenting the audit findings, including identified risks, recommendations for improvements, and an overall assessment of compliance status.

- Follow-up: Monitoring the implementation of recommendations and ensuring that identified issues are addressed effectively.

Example: During a recent SOX audit, we identified a weakness in the company’s change management process. We documented the issue and recommended improvements to strengthen controls and prevent future problems. We then followed up to ensure these improvements were implemented.

Q 7. How do you stay updated on changes in relevant regulations?

Staying updated on changes in relevant regulations is crucial for effective compliance. I employ a multi-pronged approach that combines:

- Subscription to regulatory updates: Subscribing to newsletters, alerts, and publications from relevant regulatory bodies (e.g., the SEC, HHS, European Commission).

- Professional development: Attending conferences, webinars, and training sessions to stay abreast of emerging trends and best practices.

- Networking with peers: Engaging in discussions with other compliance professionals to share knowledge and insights.

- Monitoring industry news and publications: Regularly reviewing industry-specific publications and news sources to identify potential changes in the regulatory landscape.

- Utilizing compliance software and tools: Utilizing specialized software and tools designed to track regulatory changes and compliance requirements.

Example: I regularly monitor the websites of the SEC and the HHS for updates related to SOX and HIPAA, respectively. I also participate in industry events and conferences to learn about emerging trends and engage with colleagues.

Q 8. What is your experience with developing and implementing compliance programs?

My experience in developing and implementing compliance programs spans over a decade, encompassing diverse industries like finance, healthcare, and technology. I’ve led the design and execution of programs addressing various regulations, including SOX, HIPAA, GDPR, and CCPA. This involves a multi-faceted approach:

- Risk Assessment: Identifying potential compliance vulnerabilities through thorough analysis of business processes, considering internal and external factors.

- Policy Development: Creating clear, concise, and easily accessible policies and procedures that align with relevant regulations and best practices. This includes regular updates to reflect evolving legal landscapes.

- Training and Education: Developing and delivering comprehensive training programs to ensure employees understand their compliance responsibilities. This goes beyond simple awareness; it involves practical application and scenario-based learning.

- Monitoring and Auditing: Establishing robust monitoring mechanisms, including regular audits, to identify and address potential compliance gaps proactively. This utilizes both automated tools and manual reviews.

- Reporting and Remediation: Implementing a system for reporting compliance issues and tracking remediation efforts. This promotes transparency and accountability.

For example, in my previous role at a financial institution, I spearheaded the implementation of a new anti-money laundering (AML) program. This involved collaborating with various departments, conducting thorough risk assessments, and developing comprehensive training materials resulting in a significant reduction in compliance violations.

Q 9. How do you handle non-compliance situations?

Handling non-compliance situations requires a structured and decisive approach. My process follows these steps:

- Immediate Investigation: Conducting a thorough investigation to determine the nature and extent of the non-compliance.

- Root Cause Analysis: Identifying the underlying causes of the non-compliance to prevent recurrence. This often involves interviewing relevant personnel and reviewing processes.

- Corrective Actions: Implementing immediate corrective actions to address the non-compliance. This may involve process changes, disciplinary actions, or remediation activities.

- Reporting and Documentation: Documenting the entire process, including the investigation, root cause analysis, corrective actions, and any follow-up measures. This is crucial for auditing and compliance reporting.

- Preventative Measures: Implementing preventative measures to reduce the likelihood of future non-compliance incidents. This might involve enhancing training, updating policies, or strengthening internal controls.

For instance, if we discover a data breach, I would immediately initiate an investigation, notify relevant authorities (if legally required), implement security patches, and conduct a thorough review of our data security policies and procedures to prevent similar incidents in the future. The entire process is meticulously documented and reported to relevant stakeholders.

Q 10. Describe a time you had to explain complex compliance issues to non-compliance professionals.

During my time at a healthcare organization, I had to explain the complexities of HIPAA to a group of clinicians who were primarily focused on patient care. They were understandably less familiar with the regulatory intricacies. I simplified the explanation by:

- Using Analogies: I compared HIPAA regulations to everyday scenarios, like keeping personal information confidential. This made the concepts easier to grasp.

- Focusing on Practical Application: Instead of getting bogged down in legal jargon, I explained how the regulations impacted their daily work, focusing on the practical implications of non-compliance, such as fines and reputational damage.

- Interactive Sessions: I incorporated interactive sessions, such as Q&A and case studies, to reinforce understanding and address specific concerns.

- Creating Visual Aids: I used visual aids, like flowcharts and infographics, to represent complex processes and regulations in a more accessible format.

This approach transformed a potentially daunting task into an engaging and productive learning experience, significantly improving understanding and compliance among the clinicians.

Q 11. How familiar are you with the Foreign Corrupt Practices Act (FCPA)?

I am very familiar with the Foreign Corrupt Practices Act (FCPA). It’s a crucial piece of legislation that prohibits bribery of foreign officials to obtain or retain business. My understanding encompasses:

- Prohibitions: I understand the prohibitions against direct and indirect bribery, including facilitating payments and other forms of corrupt influence.

- Accounting Provisions: I am aware of the accounting requirements for maintaining accurate and transparent books and records to prevent the concealment of corrupt payments.

- Internal Controls: I understand the importance of establishing robust internal controls and compliance programs to mitigate FCPA risk.

- Jurisdictional Reach: I know that the FCPA’s jurisdiction extends beyond US citizens and companies to encompass those who conduct business within the US or use US financial institutions.

In practice, this means implementing comprehensive due diligence processes for international business ventures, providing rigorous training on FCPA compliance, and ensuring thorough documentation of all financial transactions involving foreign entities.

Q 12. What is your experience with data privacy and protection regulations?

My experience with data privacy and protection regulations is extensive, covering GDPR, CCPA, HIPAA, and other regional regulations. This includes:

- Data Mapping: Conducting data mapping exercises to identify and classify personal data held by the organization.

- Privacy Impact Assessments (PIAs): Conducting PIAs to evaluate the privacy risks associated with data processing activities.

- Data Security Measures: Implementing appropriate technical and organizational security measures to protect personal data from unauthorized access, use, disclosure, alteration, or destruction.

- Data Subject Rights: Ensuring compliance with data subject rights, such as the right to access, rectification, erasure, and data portability.

- Cross-border Data Transfers: Managing the complexities of cross-border data transfers, ensuring compliance with data transfer mechanisms like standard contractual clauses.

For example, when implementing GDPR compliance, I worked with IT teams to ensure appropriate technical safeguards were in place, including data encryption and access controls. Simultaneously, we revised our data processing agreements and developed comprehensive procedures for managing data subject requests.

Q 13. What is your approach to risk assessment and mitigation within a compliance framework?

My approach to risk assessment and mitigation within a compliance framework is systematic and proactive. It involves:

- Identifying Risks: Using a combination of qualitative and quantitative methods to identify potential compliance risks. This includes analyzing business processes, regulatory requirements, and industry best practices.

- Analyzing Risks: Assessing the likelihood and potential impact of identified risks. This involves considering factors such as the severity of potential consequences and the probability of occurrence.

- Prioritizing Risks: Prioritizing risks based on their likelihood and impact, focusing efforts on the most critical areas.

- Developing Mitigation Strategies: Developing and implementing mitigation strategies to address identified risks. These might include implementing new controls, revising policies and procedures, or enhancing training programs.

- Monitoring and Review: Regularly monitoring the effectiveness of implemented mitigation strategies and reviewing the risk assessment process on a periodic basis (e.g., annually) to ensure its ongoing relevance.

For example, a risk assessment might reveal a vulnerability in our data security protocols. The mitigation strategy would involve implementing multi-factor authentication, upgrading security software, and providing additional cybersecurity training for employees.

Q 14. How do you ensure compliance with industry-specific regulations?

Ensuring compliance with industry-specific regulations requires a deep understanding of the relevant legal and regulatory frameworks. My approach involves:

- Regulatory Research: Staying abreast of changes in industry-specific regulations through continuous monitoring of regulatory updates and legal developments.

- Industry Best Practices: Following industry best practices and guidelines to complement regulatory requirements.

- Collaboration with Experts: Consulting with industry experts and legal counsel to clarify ambiguous aspects of the regulations and address specific compliance challenges.

- Tailored Compliance Programs: Developing tailored compliance programs that address the unique risks and challenges associated with specific industries. These programs will vary depending on the sector, considering industry-specific requirements.

- Ongoing Monitoring and Adaptation: Regularly monitoring compliance with industry-specific regulations and adapting the compliance program as needed to reflect changes in the regulatory landscape or industry best practices.

For example, in the financial services industry, maintaining compliance with KYC/AML regulations requires constant vigilance, due diligence, and adaptation to changing methodologies and regulatory requirements.

Q 15. Describe your experience with compliance reporting and documentation.

Compliance reporting and documentation are crucial for demonstrating adherence to regulations and internal policies. My experience encompasses developing and implementing comprehensive reporting frameworks, ensuring data accuracy and completeness, and maintaining detailed records to support audits. This includes everything from creating customized reports to track key compliance metrics, to managing document control systems to ensure version control and accessibility of essential compliance documents.

For example, in my previous role at a financial institution, I developed a reporting system that streamlined the process of submitting regulatory filings by automating data extraction and validation. This reduced reporting time by 40% and significantly minimized the risk of errors. Another example involved designing a document management system for a healthcare provider, ensuring HIPAA compliance by implementing strict access controls and audit trails for sensitive patient information.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How would you handle a situation where a compliance violation is suspected?

Suspected compliance violations require immediate and careful attention. My approach follows a structured process: First, I would gather all relevant information to confirm the potential violation. This involves interviewing individuals, reviewing documents, and analyzing systems. Second, I’d escalate the matter to appropriate management, documenting the findings thoroughly. Third, I’d collaborate with legal and other relevant departments to determine the appropriate response, which might include internal investigations, remediation efforts, and potentially reporting to regulatory bodies. Transparency and thorough documentation are paramount throughout this entire process.

For instance, in a previous role, we uncovered a potential data breach. Following this procedure, we were able to quickly contain the situation, notify affected individuals, and mitigate the potential damage, avoiding significant penalties. The key is to act swiftly, decisively, and with a focus on remediation and prevention.

Q 17. What is your understanding of the role of technology in compliance?

Technology plays a transformative role in compliance. It allows for automation of tasks, such as data collection and analysis, reducing human error and increasing efficiency. Compliance management software, for example, can automate workflows, track deadlines, and manage documentation centrally, improving overall compliance posture. Data analytics can provide insights into compliance trends and help identify potential risks proactively. Furthermore, technology enables robust audit trails, facilitating easier investigation and demonstration of compliance.

Imagine trying to manage compliance across multiple jurisdictions and regulations manually – it would be a logistical nightmare! Technology empowers organizations to effectively navigate this complexity. For example, using a GRC (Governance, Risk, and Compliance) platform can centralize all compliance-related activities, creating a single source of truth and allowing for more effective monitoring and reporting.

Q 18. How do you prioritize compliance initiatives in a resource-constrained environment?

Prioritizing compliance initiatives in a resource-constrained environment requires a risk-based approach. This involves identifying and assessing the potential risks associated with non-compliance. High-risk areas, like those with significant potential financial penalties or reputational damage, should be prioritized. A cost-benefit analysis helps determine the most efficient allocation of resources. This might involve focusing on automation and leveraging technology to improve efficiency and reduce manual effort.

For example, if an organization faces significant penalties for failing to comply with data privacy regulations, that should be a top priority, even if it means delaying less critical initiatives. A clear communication strategy is essential to keep stakeholders informed about the prioritization decisions and the reasoning behind them.

Q 19. Describe your experience working with external auditors or regulatory bodies.

I have extensive experience working with both external auditors and regulatory bodies. This involves preparing for audits, providing requested documentation, responding to inquiries, and collaborating to resolve any identified issues. Effective communication and a proactive approach are essential for successful collaboration. Understanding the regulatory requirements and auditor expectations allows for efficient and transparent interactions.

In one instance, I worked closely with an auditor to address some minor discrepancies in our documentation. By proactively addressing the issues and maintaining open communication, we successfully completed the audit with minimal disruption. This experience underscored the importance of maintaining accurate records and building strong relationships with auditors.

Q 20. What are the key elements of an effective compliance training program?

An effective compliance training program should be engaging, relevant, and tailored to the specific needs and roles of employees. It should incorporate multiple learning methods, including interactive modules, case studies, and quizzes, to ensure knowledge retention. The program should cover all relevant regulations and internal policies, emphasizing practical application and real-world scenarios. Regular refresher training and updates are crucial to maintain compliance with evolving regulations and best practices.

For example, a training program for a financial institution might include modules on anti-money laundering regulations, data privacy laws, and internal policies on ethical conduct. The use of interactive elements and real-life examples helps employees understand the importance of compliance and how to apply it in their daily work.

Q 21. Explain your experience with using compliance management software.

I have experience using several compliance management software platforms, including [mention specific software if comfortable, otherwise omit]. These tools provide centralized repositories for policies, procedures, and training materials. They also offer features for tracking compliance activities, automating workflows, and generating reports. My experience includes configuring these systems to meet specific organizational needs, training users on their functionality, and leveraging their reporting capabilities to monitor compliance effectiveness.

For example, I used a particular software to automate the annual review of our contracts, which significantly reduced the time and effort required for this task. The software’s reporting features enabled me to quickly identify any potential compliance gaps and address them promptly.

Q 22. How do you measure the effectiveness of your compliance program?

Measuring the effectiveness of a compliance program is a multifaceted process that goes beyond simply checking boxes. It requires a holistic approach, incorporating both quantitative and qualitative metrics to assess its impact. We need to track key performance indicators (KPIs) to understand its strengths and weaknesses.

Key Risk Indicators (KRIs): Monitoring KRIs helps identify emerging risks and vulnerabilities. For example, tracking the number of near misses or identified violations provides early warning signs. A rise in these indicators might signal a gap in our training or procedures.

Compliance Audits and Assessments: Regular audits are crucial for identifying weaknesses and ensuring adherence to regulations. This could involve internal audits, third-party assessments, or regulatory inspections. The findings from these audits should lead to corrective action plans.

Employee Training and Awareness: Measuring employee understanding of compliance policies through testing, surveys, and observed behavior is critical. A decrease in compliance-related incidents can indicate effective training programs.

Incident Reporting and Response: A robust incident reporting system is essential. Tracking the number of reported incidents, time to resolution, and corrective actions demonstrates the effectiveness of our response mechanisms. A high number of unreported incidents signals a problem with the reporting culture.

Management Reviews and Reporting: Regular reviews by senior management ensure accountability and alignment with strategic goals. This involves reviewing key metrics, discussing challenges, and adjusting the program as needed.

By analyzing these indicators, we can gain a clear picture of the program’s effectiveness and identify areas for improvement. For instance, a high number of compliance violations despite robust training might indicate a need for revised policies or more frequent reinforcement.

Q 23. What are some common challenges in ensuring compliance, and how do you overcome them?

Ensuring compliance presents numerous challenges, often stemming from a combination of internal and external factors. Here are a few common ones, and how I approach them:

Keeping up with evolving regulations: Regulations change constantly. My approach involves subscribing to relevant legal updates, attending industry conferences, and working with legal counsel to stay informed about changes and their impact on our operations.

Resource constraints: Compliance initiatives require resources – time, money, and personnel. I prioritize tasks based on risk, allocating resources to areas posing the highest potential for non-compliance. I also leverage technology to automate processes where possible, improving efficiency.

Lack of employee awareness and buy-in: Compliance isn’t just a legal requirement; it’s a cultural one. I focus on engaging employees through training, clear communication, and by demonstrating the importance of compliance to the overall success of the business. I actively solicit feedback and suggestions.

Third-party risk: Working with vendors and suppliers introduces external risks. I use robust due diligence processes to evaluate their compliance programs, including contractual agreements and regular monitoring.

Data security and privacy: Protecting sensitive data is paramount. We implement strong security controls, conduct regular security assessments, and provide regular employee training on data privacy best practices. This is especially important in compliance with regulations like GDPR and CCPA.

Overcoming these challenges requires a proactive, risk-based approach, a strong compliance culture, and ongoing monitoring and improvement.

Q 24. Describe your experience with conducting compliance due diligence.

Compliance due diligence is a crucial aspect of mitigating risk. My experience encompasses a variety of situations, including mergers and acquisitions, vendor selection, and internal investigations. The process usually involves:

Identifying relevant regulations and legal requirements: This first step involves a thorough understanding of the applicable laws and regulations for the specific context. For example, acquiring a company would necessitate understanding regulations within their specific industry and location.

Assessing existing compliance programs and controls: We review documentation, interview key personnel, and conduct on-site inspections to evaluate the effectiveness of existing controls. For vendors, this might involve reviewing their security policies and certifications.

Identifying gaps and remediation plans: Once potential weaknesses are identified, a remediation plan outlines steps needed to address them. This plan often includes timelines, assigned responsibilities, and necessary resources.

Ongoing monitoring and reporting: Due diligence isn’t a one-time event; it’s an ongoing process. We establish a monitoring plan to track the effectiveness of implemented changes and report findings to relevant stakeholders.

For example, during a recent acquisition, our due diligence uncovered a gap in the target company’s data security practices. We worked collaboratively to implement enhanced security measures before finalizing the acquisition, minimizing potential risks.

Q 25. How do you build and maintain strong relationships with stakeholders related to compliance?

Building strong stakeholder relationships is essential for effective compliance. It requires open communication, trust, and mutual respect. I employ several strategies:

Regular communication: I schedule regular meetings and provide updates on compliance initiatives, risks, and achievements. This keeps everyone informed and allows for timely feedback.

Transparency and openness: I foster a culture of transparency by openly discussing challenges and successes. This builds trust and encourages collaboration.

Active listening: I actively listen to concerns and feedback from stakeholders, demonstrating that their input is valued.

Collaboration and teamwork: Compliance isn’t a solo act; it requires a team effort. I promote collaboration across departments and encourage a shared responsibility for compliance.

Building trust through expertise and consistency: Demonstrating expertise and consistently delivering on commitments builds trust and strengthens relationships.

In practice, this means proactively engaging with business leaders to understand their concerns and incorporating their perspectives into compliance strategies. I regularly meet with legal counsel to stay abreast of evolving regulations, ensuring a unified approach.

Q 26. How do you balance compliance with business objectives?

Balancing compliance with business objectives is a constant juggling act. It’s not a matter of choosing one over the other, but rather finding a way to integrate them. Compliance should be seen as an enabler, not a constraint, of business success. My approach involves:

Risk-based approach: Prioritize compliance efforts based on the potential impact of non-compliance on the business. Focusing resources on high-risk areas ensures efficient allocation.

Integrating compliance into business processes: Embedding compliance into daily operations makes it less of an afterthought. This could involve integrating compliance checks into workflows or developing automated compliance tools.

Communicating the business value of compliance: Demonstrating the positive impact of compliance – reduced risks, enhanced reputation, increased customer trust – helps gain buy-in from business leaders.

Finding creative solutions: Sometimes, strict adherence to regulations may seem to conflict with business objectives. In such cases, we explore creative solutions that meet both regulatory requirements and business needs. This often involves innovation in processes or technology.

Seeking guidance and expertise: When faced with complex compliance issues, seeking guidance from legal counsel or industry experts is crucial.

For example, implementing a new software system might initially seem costly and time-consuming, but if it streamlines compliance processes and reduces the risk of non-compliance, it becomes a valuable business investment.

Q 27. Describe a situation where you had to make a difficult decision related to compliance.

One particularly challenging situation involved a potential violation of data privacy regulations. A subcontractor accidentally exposed some sensitive customer data. The decision we faced was whether to disclose the breach immediately, potentially impacting our reputation, or to try to resolve it internally first.

Following our internal protocols, we conducted a thorough investigation to assess the extent of the breach, the potential impact on affected individuals, and the root cause. We also sought legal counsel to understand our reporting obligations. Ultimately, we decided to immediately disclose the breach to the relevant authorities and the affected individuals, aligning with our commitment to transparency and ethical conduct. While this decision had immediate short-term consequences, it demonstrated our commitment to integrity and ultimately protected our long-term reputation. This incident led to significant improvements in our data security policies, procedures, and employee training.

Key Topics to Learn for Knowledge of Compliance Requirements Interview

- Regulatory Frameworks: Understanding relevant laws and regulations (e.g., GDPR, HIPAA, SOX) and their implications for different industries. Focus on the theoretical underpinnings and how these frameworks are practically implemented.

- Risk Management & Assessment: Learn how to identify, assess, and mitigate compliance risks. Practice applying risk management frameworks and methodologies to real-world scenarios. Consider case studies demonstrating proactive risk mitigation.

- Internal Controls & Audits: Master the design, implementation, and testing of internal controls to ensure compliance. Understand the audit process and how to respond effectively to audit findings. Explore different audit methodologies and their application.

- Data Privacy & Security: Deepen your understanding of data protection principles and best practices. Explore practical applications like data encryption, access control, and incident response planning. Consider ethical implications of data handling.

- Compliance Monitoring & Reporting: Learn how to establish effective monitoring programs and generate accurate compliance reports. Practice presenting findings clearly and concisely to stakeholders. Develop skills in data analysis for compliance purposes.

- Ethical Considerations & Professional Conduct: Understand the ethical responsibilities of compliance professionals and the importance of maintaining professional integrity. Explore real-world examples of ethical dilemmas and their resolutions within a compliance context.

Next Steps

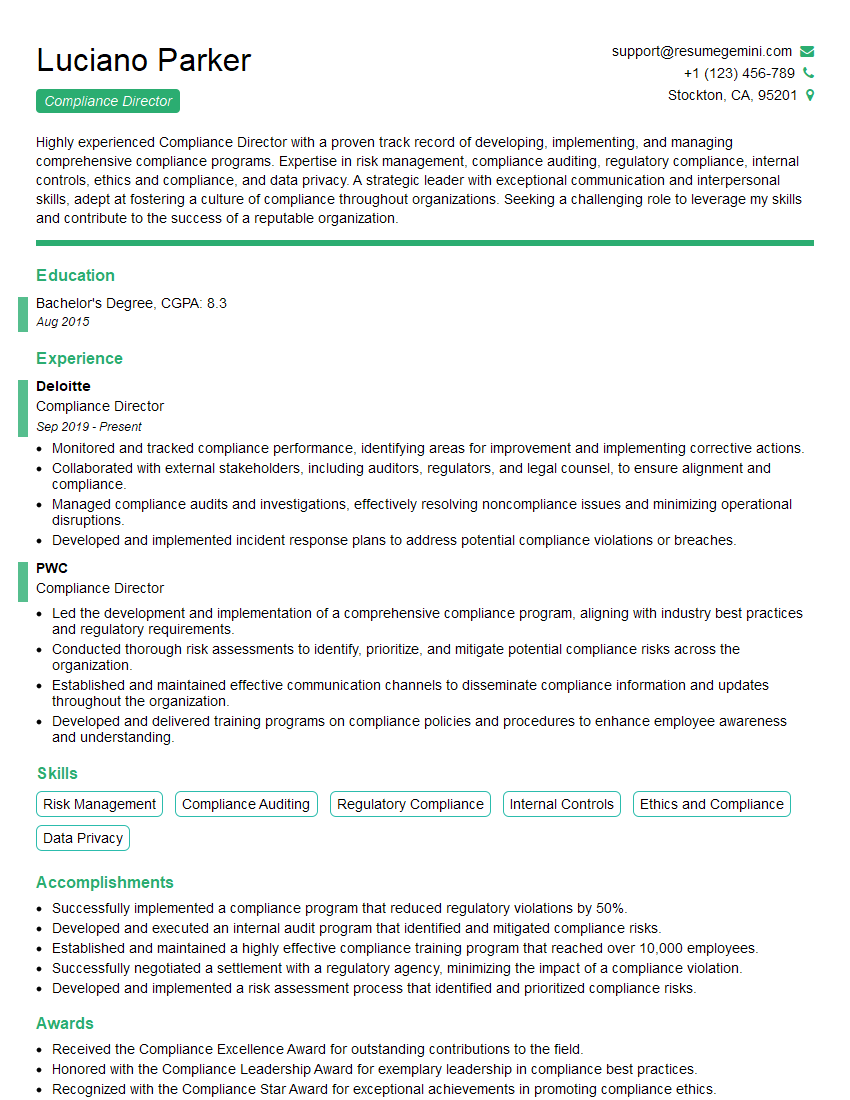

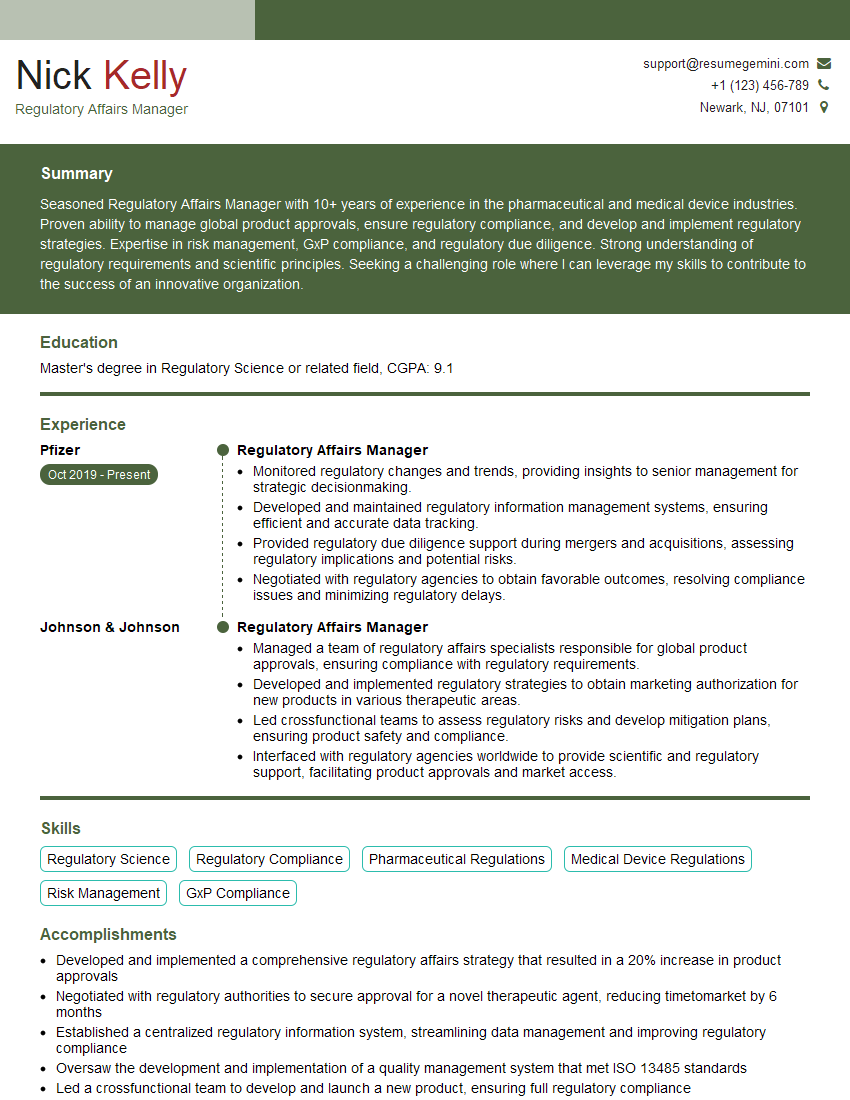

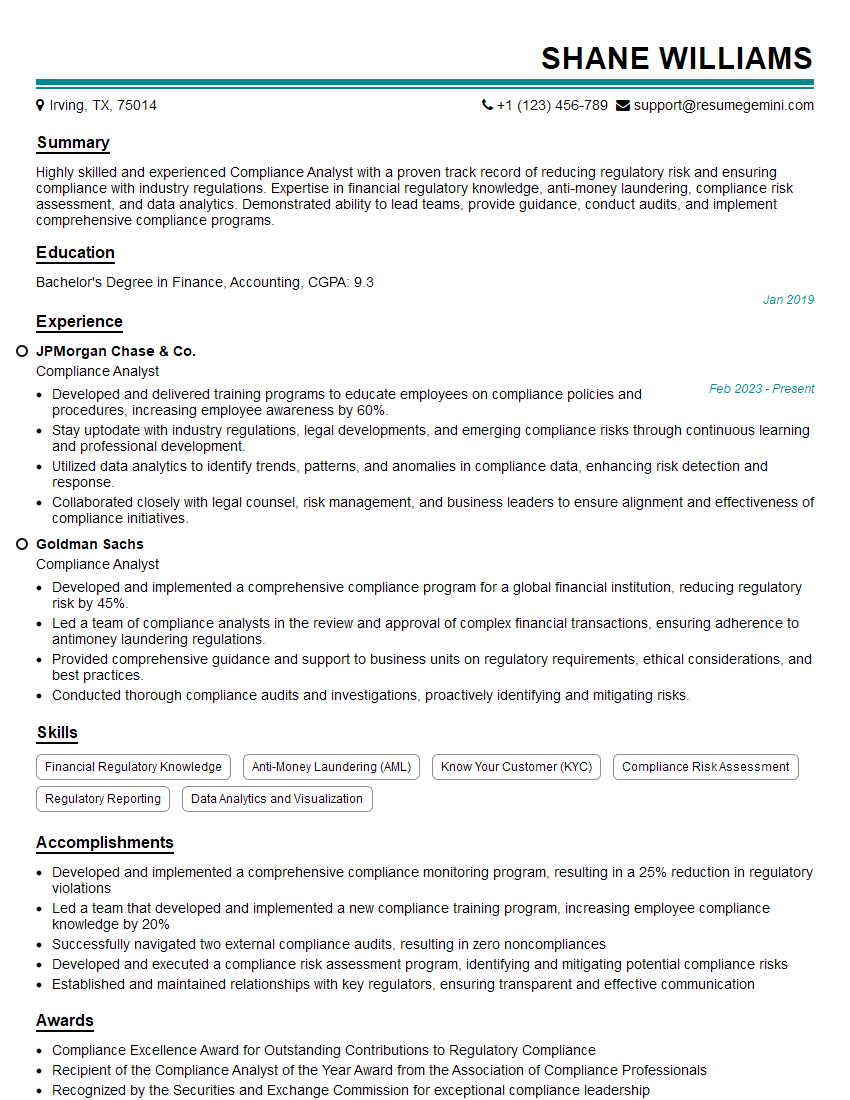

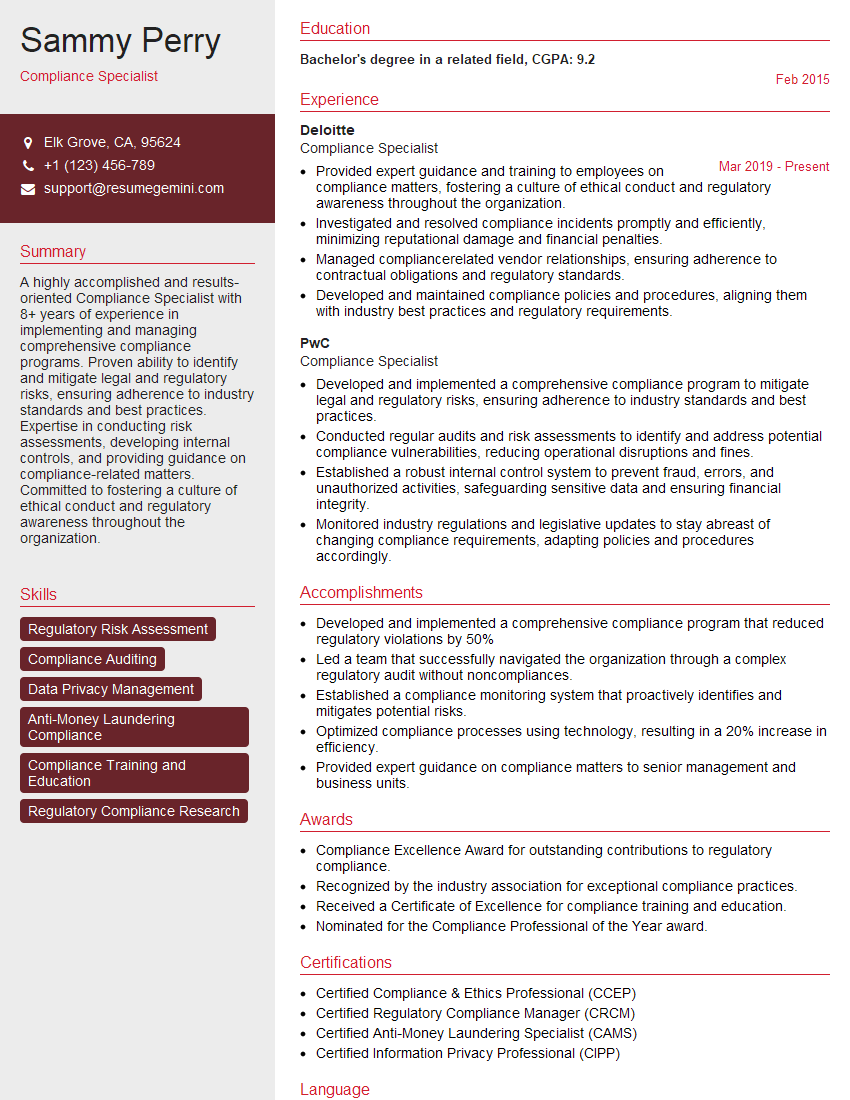

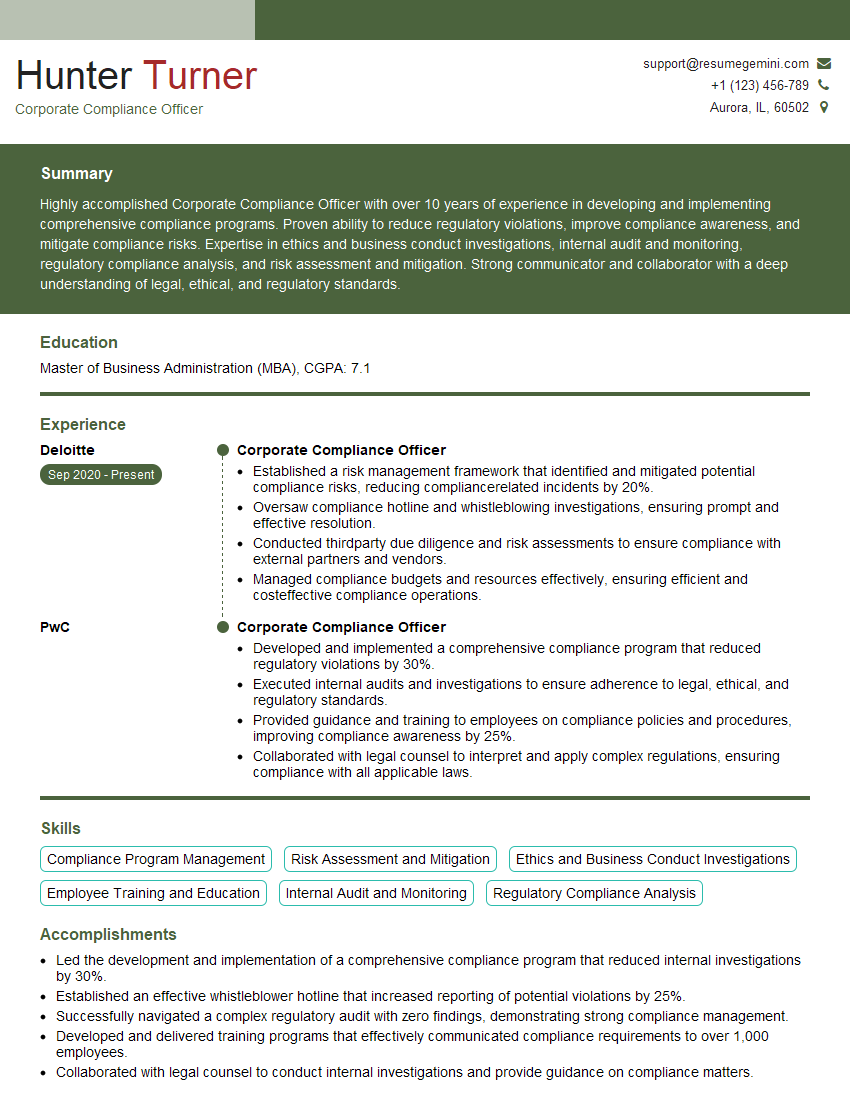

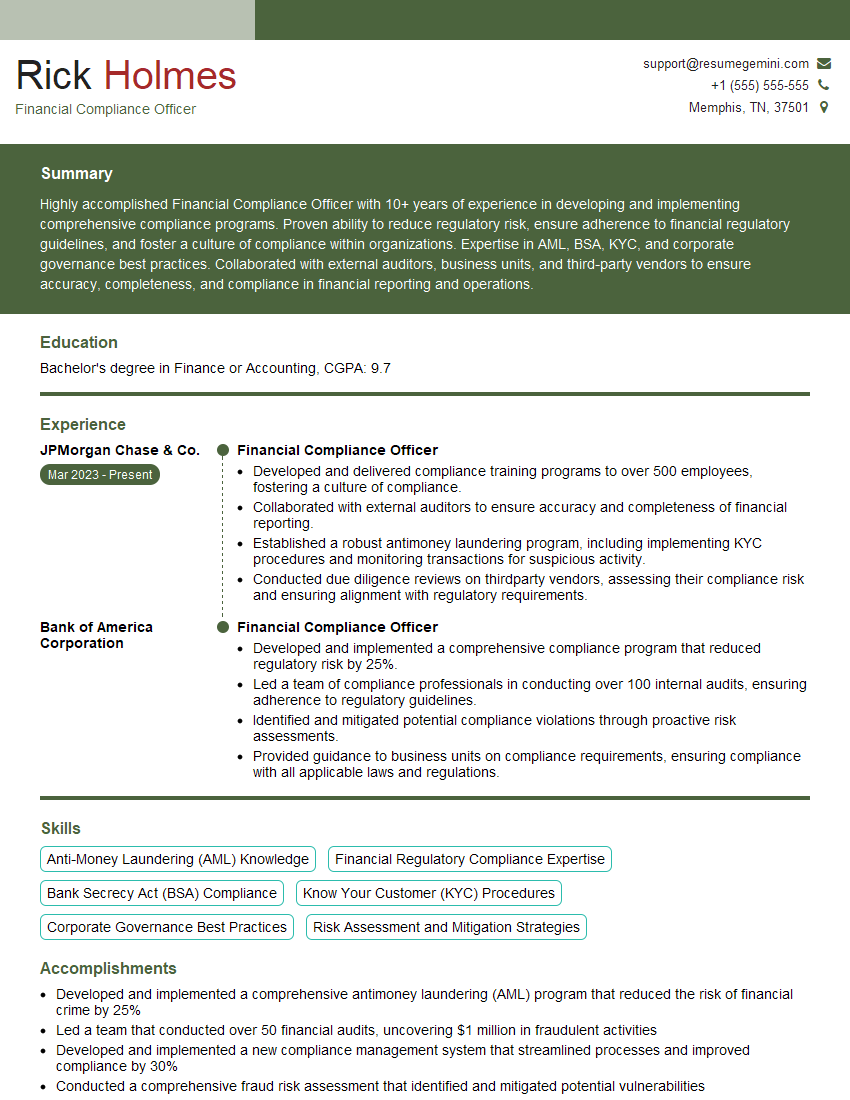

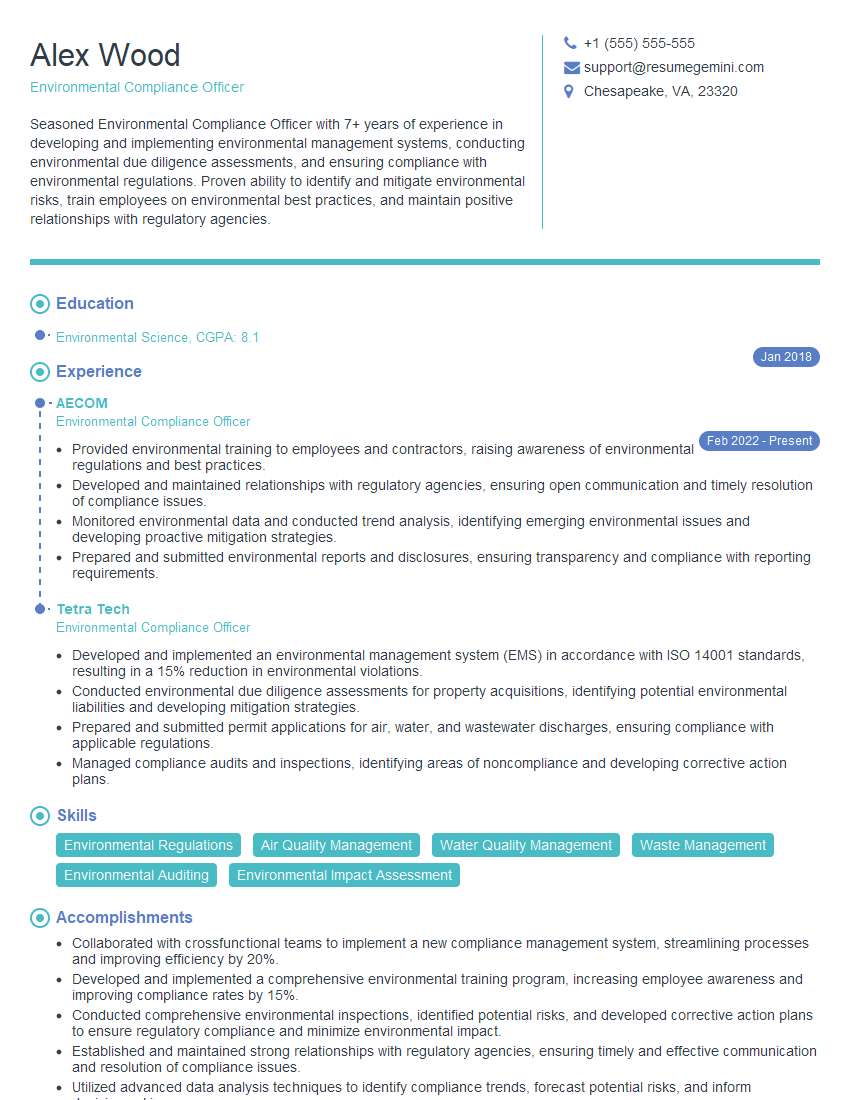

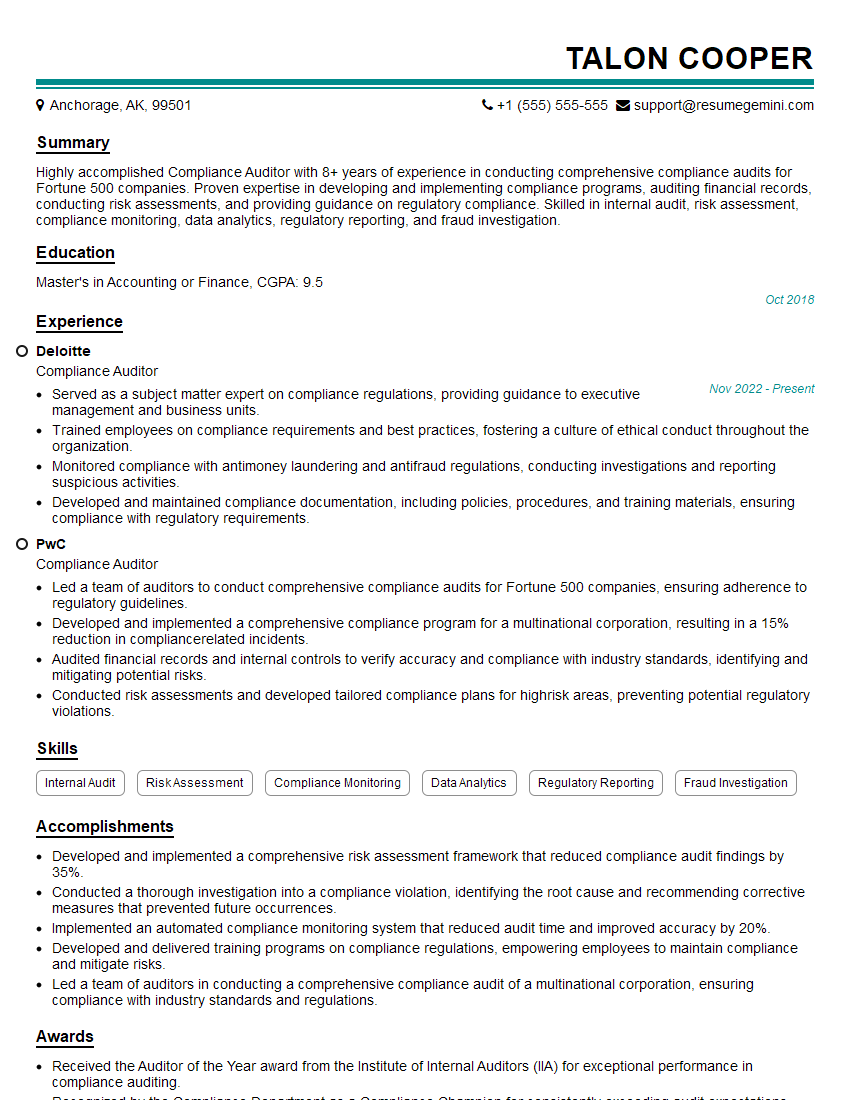

Mastering Knowledge of Compliance Requirements is crucial for career advancement in today’s regulated business environment. It demonstrates a commitment to ethical practices and risk mitigation, opening doors to higher-level positions and increased earning potential. To maximize your job prospects, building an ATS-friendly resume is paramount. This ensures your application gets noticed by recruiters and hiring managers. ResumeGemini is a trusted resource that can help you craft a compelling and effective resume tailored to highlight your compliance expertise. Examples of resumes tailored to Knowledge of Compliance Requirements are available through ResumeGemini to help guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good