Cracking a skill-specific interview, like one for Collection Procedures, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Collection Procedures Interview

Q 1. Explain the collections process from initial delinquency to final resolution.

The collections process begins the moment a payment becomes delinquent. It’s a journey with several stages, each requiring a different approach. Think of it like a funnel, starting wide and narrowing as you move towards resolution.

- Initial Delinquency (0-30 days): This is often handled with automated reminders – emails, text messages, or automated phone calls. The goal is gentle encouragement and a reminder of the outstanding balance. We might also offer a self-service portal for easy payment.

- Early-Stage Delinquency (30-60 days): More proactive measures are implemented. This includes personalized phone calls, explaining the consequences of non-payment, and offering payment options. We aim to understand the customer’s situation and find a solution that works for both parties.

- Late-Stage Delinquency (60-90+ days): If payment remains outstanding, more assertive collection strategies are employed. This might involve certified mail, escalating phone calls, and exploring options like payment plans or debt settlement. We might also begin to explore legal options depending on the situation.

- Final Resolution: This could involve successful payment in full, a negotiated payment plan, a debt settlement, charge-off, or, as a last resort, legal action. Each resolution is meticulously documented.

For example, I once worked with a client who had fallen behind due to unforeseen medical expenses. By understanding their situation and offering a flexible payment plan, we managed to avoid escalation and recover the debt successfully.

Q 2. Describe your experience with various collection methods (e.g., phone, email, mail).

My experience encompasses a variety of collection methods, each tailored to the debtor’s communication preference and the stage of delinquency. Phone calls are often the most effective for immediate engagement and understanding, allowing for a personal touch and negotiation. Emails provide a written record, useful for documentation and complex situations. Mail, particularly certified mail, offers a formal record of communication, especially important before legal action.

I’ve successfully implemented a multi-channel approach, starting with automated emails and texts, then progressing to phone calls, and finally resorting to certified mail for significant delinquencies. This layered approach maximizes the chance of contact and successful resolution. For instance, in one case, email reminders failed to reach the debtor, but a phone call immediately identified a change in address, resulting in a swift resolution.

Q 3. How do you prioritize accounts for collection efforts?

Prioritization is crucial for efficient collection efforts. I utilize a multi-faceted approach, considering factors like:

- Account Age: Older debts are prioritized as they are more likely to face challenges in recovery.

- Debt Amount: Larger debts warrant faster attention due to their higher financial impact.

- Debtor’s Payment History: Consistent payment history may indicate a higher likelihood of successful recovery, while repeated delinquencies might require more immediate attention.

- Legal Considerations: Accounts with potential legal implications (statute of limitations, etc.) are often moved to the front of the queue.

I use a scoring system that weighs these factors to create a prioritized list, ensuring efficient allocation of resources and maximizing recovery rates. This system allows me to focus on the accounts that are most likely to yield a positive outcome in the shortest amount of time.

Q 4. What strategies do you use to negotiate payment plans with debtors?

Negotiating payment plans requires empathy and understanding. I start by actively listening to the debtor’s circumstances and validating their concerns. Then I present several options that consider their capabilities while meeting the business needs. Here’s my typical approach:

- Assessment: I thoroughly assess the debtor’s financial situation – their income, expenses, and existing debts.

- Option Presentation: I propose various payment plan options, ranging from shorter, higher-payment plans to longer, lower-payment plans. I might also suggest a lump-sum settlement if it’s feasible.

- Negotiation: I negotiate with the debtor to arrive at a plan they can comfortably afford while ensuring a reasonable recovery for the creditor.

- Documentation: I create detailed, written documentation of the agreed-upon payment plan, outlining payment amounts, due dates, and consequences of default.

For example, I recently helped a small business owner create a flexible payment plan after their business suffered a downturn due to an unexpected economic slump. This allowed them to stay afloat and still pay back the debt, preventing a potential default.

Q 5. How do you handle difficult or abusive debtors?

Handling difficult or abusive debtors requires a calm and professional approach. My primary focus is to de-escalate the situation while maintaining a firm stance on the outstanding debt. I utilize several strategies:

- Active Listening: I allow them to vent their frustrations and address their concerns. Often, simply being heard can de-escalate a tense situation.

- Empathy and Validation: I demonstrate empathy, even if I don’t agree with their viewpoint. This doesn’t mean condoning abuse, but it does help create a more constructive conversation.

- Clear Communication: I clearly reiterate the facts of the debt and the payment options, maintaining a professional and respectful tone.

- Documentation: I meticulously document every interaction, including instances of abuse or threatening behavior, for legal purposes.

- Disengagement: If the behavior continues to be abusive or threatening, I will disengage from the conversation, documenting the incident and potentially referring it to legal counsel.

It’s crucial to remember that maintaining professionalism doesn’t compromise firmness. My goal is to resolve the debt, but my safety and well-being are paramount.

Q 6. What is your experience with skip tracing?

Skip tracing is a critical skill in debt recovery. It involves locating debtors who have become unreachable or intentionally avoid contact. My experience includes utilizing various tools and techniques, including:

- Public Records Search: Accessing databases containing property records, voter registration, and other public information.

- People Search Engines: Using online search engines specializing in locating individuals.

- Social Media: Leveraging social media platforms to find contact information or updated addresses.

- Commercial Skip Tracing Services: Employing specialized services that provide comprehensive skip tracing capabilities.

Successful skip tracing often involves piecing together small bits of information from different sources to create a complete picture of the debtor’s current location and contact information. I’ve found that persistence and a methodical approach are key to successful skip tracing.

Q 7. How familiar are you with Fair Debt Collection Practices Act (FDCPA)?

I am intimately familiar with the Fair Debt Collection Practices Act (FDCPA). It is the cornerstone of my work, guiding my every interaction with debtors. The FDCPA outlines strict guidelines for how debt collectors can contact debtors, what information they can collect, and how they can conduct their business. I understand the regulations concerning:

- Communication Restrictions: Knowing the permissible times and methods of contacting debtors.

- Prohibited Practices: Avoiding harassing, abusive, or deceptive practices.

- Validation of Debts: Ensuring that debts are accurately validated before pursuing collection.

- Verification of Information: Carefully verifying personal information to prevent inaccuracies and potential violations.

Compliance with the FDCPA is not just a legal requirement; it’s an ethical obligation. I regularly update my knowledge on FDCPA regulations to maintain best practices and ensure legal and ethical compliance in every interaction.

Q 8. Describe your experience with different types of debt (consumer, commercial).

My experience spans both consumer and commercial debt collections. Consumer debt typically involves smaller balances owed by individuals for personal expenses like credit cards, medical bills, or personal loans. These collections often require a more empathetic approach, focusing on understanding the debtor’s financial situation and working towards manageable repayment plans. For example, I’ve successfully negotiated payment arrangements with individuals facing unexpected job losses, helping them avoid further negative impacts on their credit scores. Commercial debt, conversely, involves larger sums owed by businesses for invoices, loans, or other commercial transactions. These cases often involve more complex legal and financial considerations, requiring a deeper understanding of business operations and financial statements. I’ve worked on commercial collections involving disputes over contract terms and negotiated settlements that were mutually beneficial to both the creditor and the debtor.

The key difference lies in the scale of the debt, the legal recourse available, and the overall approach. Consumer debt often involves more emotional negotiation, whereas commercial debt involves a more business-oriented, strategic approach.

Q 9. How do you document your collection activities?

Thorough documentation is crucial for compliance and efficient collection management. Every interaction with a debtor is meticulously recorded. This includes the date and time of contact, the method of contact (phone, email, mail), the individual contacted, a summary of the conversation, any agreements reached, and any actions taken or planned. For example, if a payment arrangement is agreed upon, the details of the arrangement – payment amounts, due dates, and payment methods – are documented in detail. I use a robust system of numbered files, both physical and digital, for easy retrieval and audit trails. This ensures complete transparency and helps in resolving any potential disputes later. All documents are stored securely according to regulatory compliance standards.

Q 10. How do you track and report on key collection metrics?

Tracking and reporting key collection metrics is paramount for evaluating performance and identifying areas for improvement. We track metrics such as the number of accounts placed for collection, the average collection period, the recovery rate, the number of successful payment arrangements, and the write-off rate. I utilize dashboards and reports to visualize this data, allowing for a quick understanding of trends and patterns. For instance, a consistently high average collection period might indicate a need for process improvement, while a low recovery rate might suggest the need for more aggressive collection strategies or better debtor communication. These metrics are regularly reported to management, along with an analysis of contributing factors and recommendations for enhancing collection efficiency.

Q 11. What software or systems have you used for collections management?

Throughout my career, I’ve utilized various software and systems for collections management. These include:

- Specialized Collection Software: Systems like [Software Name 1] and [Software Name 2] provide features for automated calling, email campaigns, and case management, streamlining the collection process and offering detailed reporting capabilities.

- Customer Relationship Management (CRM) Systems: CRMs such as Salesforce or Microsoft Dynamics 365 allow for centralized management of debtor information, communication history, and payment details. This provides a holistic view of each account.

- Spreadsheet Software: While not a dedicated collection management system, spreadsheets are often used to track accounts and key performance indicators (KPIs) for quick analysis.

My experience with these systems enables me to leverage technology effectively to manage large volumes of accounts and maintain accurate records.

Q 12. How do you identify and address obstacles in the collection process?

Obstacles in the collection process are inevitable. Identifying and addressing them requires a proactive and systematic approach. Obstacles can include:

- Debtor Disputes: Addressing these requires careful review of documentation, open communication, and potentially negotiation or compromise.

- Insufficient Debtor Information: This necessitates employing strategies to locate debtors and obtain updated contact information.

- Financial Hardship: This may require exploring options such as payment plans or working with debt relief agencies.

- Legal Restrictions: Adhering to legal guidelines and regulations is crucial throughout the entire process.

My approach is to analyze the root cause of each obstacle, tailor solutions accordingly, and document the entire process to avoid future issues. For instance, if a debtor consistently misses payments due to a valid hardship, we’ll explore options like extending repayment terms, reducing payment amounts, or finding other solutions.

Q 13. Describe your experience with collections agency interactions.

I have extensive experience interacting with collections agencies. This includes referring accounts to agencies, negotiating settlements, and coordinating efforts to ensure seamless transfer of information and efficient recovery. It’s essential to maintain clear and concise communication to avoid duplication of effort and ensure compliance with legal requirements. For example, I have worked with agencies to develop strategies for addressing high-risk accounts that require more specialized legal attention. Building strong relationships with trustworthy agencies is crucial for successful debt recovery and ensuring fair treatment of debtors.

Q 14. How do you maintain accurate and compliant records?

Maintaining accurate and compliant records is paramount. This involves adhering strictly to all applicable federal and state regulations, including the Fair Debt Collection Practices Act (FDCPA). All communications are documented, stored securely, and readily accessible for audits. Data is regularly reviewed for accuracy and completeness. We use a combination of physical and digital storage methods, ensuring data backups and redundancy to prevent data loss. Regular training on compliance regulations is mandatory for all team members to ensure consistent adherence to best practices and legal requirements.

Q 15. What is your experience with bankruptcy procedures related to debt collection?

Bankruptcy significantly impacts debt collection. When a debtor files for bankruptcy, an automatic stay is put in place, halting most collection activities. This means I can’t contact the debtor, file lawsuits, or pursue any further collection efforts until the bankruptcy court lifts the stay or the case is discharged. My experience involves understanding the different chapters of bankruptcy (Chapter 7, Chapter 13, etc.), knowing which debts are dischargeable and which are not (like student loans or some taxes), and cooperating with the bankruptcy trustee to claim any assets that might be available to creditors. I’ve worked with legal counsel to file the appropriate proofs of claim within the established deadlines to ensure our company’s interests are protected in the bankruptcy proceedings. This process requires meticulous record-keeping and a precise understanding of the legal framework surrounding bankruptcy filings. For example, I once handled a case where a debtor filed for Chapter 7 bankruptcy. We filed a proof of claim and successfully recovered a portion of the outstanding debt during the bankruptcy trustee’s liquidation of assets.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle disputes and challenges to debt validity?

Handling disputes about debt validity is crucial and often involves a detailed review of the account history. I meticulously verify the debt’s origination, ensuring the debtor is indeed responsible for it. This involves checking the original contract, payment history, and any supporting documentation. If a discrepancy is found, I investigate thoroughly. If the debt is indeed invalid, I take immediate steps to correct our records and inform the debtor, apologizing for any inconvenience caused. If the dispute is unfounded, I explain clearly how the debt was incurred and the steps the debtor needs to take to resolve it. I approach these situations with empathy, understanding that a valid dispute can easily arise from lost paperwork or miscommunication. For instance, I recently resolved a dispute where a client claimed they had overpaid their bill. My careful review of payment history confirmed the overpayment, leading to a prompt refund and reinforced client trust.

Q 17. What is your understanding of the statute of limitations on debt?

The statute of limitations is the legal time limit within which a creditor can pursue legal action to collect a debt. This timeframe varies depending on the state and the type of debt. It’s critical to know and abide by these limitations, as attempting to collect on a time-barred debt is illegal in most jurisdictions. For example, a medical debt might have a shorter statute of limitations than a credit card debt. Ignoring this could lead to serious legal and ethical consequences for the collection agency. My knowledge ensures that our collection efforts stay within legal boundaries; I actively monitor the age of debts in our portfolio and prioritize those that fall within the statute of limitations. This includes regularly updating our systems to reflect the changing statute of limitations based on the debtor’s location.

Q 18. Describe a time you successfully resolved a difficult collection case.

One challenging case involved a debtor who was consistently unresponsive and avoided all contact attempts. Initial attempts through phone calls, letters, and emails were unsuccessful. I then employed a more strategic approach. After thoroughly reviewing the documentation, I identified a specific detail that caught the debtor’s attention – a small, yet significant, detail in the original agreement. By addressing this specific detail in my communications, I opened a channel of communication. I proposed a payment plan tailored to the debtor’s financial situation, reflecting a genuine understanding of their predicament. Through consistent and empathetic communication, I eventually secured an agreement, which resulted in full repayment of the debt. This case highlighted the importance of personalized communication and demonstrating genuine concern for the debtor’s circumstances, even in the most challenging situations.

Q 19. How do you manage your workload and prioritize tasks in a high-volume environment?

Managing a high-volume workload requires efficient prioritization and organization. I employ a system that prioritizes debts based on their age, the amount owed, and the debtor’s responsiveness. Accounts with imminent statute of limitations deadlines are handled first. I utilize a CRM system to track all accounts, organize my communications, and ensure nothing falls through the cracks. Time-blocking and regular review of my daily tasks keep me on track. Moreover, I delegate tasks appropriately where possible to optimize workflow and distribute the workload effectively. I also utilize automation tools to streamline repetitive tasks, freeing up time for more complex cases requiring a personal touch. This strategy prevents burnout and ensures the timely and efficient management of every case.

Q 20. How do you ensure compliance with all relevant regulations?

Compliance is paramount in debt collection. I’m intimately familiar with the Fair Debt Collection Practices Act (FDCPA) and all state-specific regulations. This includes understanding restrictions on contact times, permissible communication methods, and the required disclosures when communicating with debtors. Our processes are carefully designed to adhere to all regulations. We regularly update our training materials and processes to reflect any changes in the law. Moreover, we maintain detailed records of all interactions with debtors, ensuring complete transparency and accountability. We also undergo regular internal and external audits to ensure ongoing compliance. Non-compliance can result in hefty fines and severe legal repercussions; meticulous adherence to regulations is therefore a priority.

Q 21. What are your strategies for improving collection rates?

Improving collection rates is a continuous process involving several strategies. First, effective communication is key. Personalized communication, which takes into account a debtor’s individual circumstances, helps build rapport and increases the likelihood of cooperation. Second, offering flexible payment plans tailored to the debtor’s financial capabilities can significantly improve repayment rates. Third, leveraging technology, such as automated reminders and AI-powered predictive analytics, can enhance efficiency and improve collection outcomes. Fourth, continuous monitoring of key performance indicators (KPIs) such as collection rates, average days to collect, and write-off rates, helps in identifying areas for improvement and refining strategies. Finally, ongoing training for staff on best practices, negotiation techniques, and legal compliance significantly contributes to enhanced performance.

Q 22. How do you stay up-to-date on changes in debt collection laws and regulations?

Staying current with debt collection laws and regulations is crucial for ethical and legal compliance. I employ a multi-pronged approach. First, I subscribe to industry-specific publications and newsletters, such as those from the ACA International and state bar associations. These provide updates on legislative changes and court rulings. Second, I actively participate in professional development webinars and conferences, engaging with experts and learning best practices. Third, I regularly review and update internal compliance manuals and training materials to reflect the latest legal standards. Finally, I maintain contact with legal counsel specializing in debt collection to address any ambiguities or evolving interpretations of the law. This proactive approach ensures our collection processes remain compliant and mitigates legal risk.

Q 23. Explain your experience with using data analytics to improve collections.

Data analytics plays a vital role in optimizing collection strategies. In my previous role, we implemented a predictive modeling system to identify debtors most likely to respond positively to different communication channels and approaches. For example, we analyzed historical data on payment behavior, demographics, and communication preferences to segment debtors into groups. This allowed us to personalize outreach – using email for younger demographics and phone calls for older ones, and tailoring our messaging to their specific circumstances. We also used data analysis to track the effectiveness of different collection strategies, enabling us to optimize our approach in real-time. This resulted in a significant increase in collection rates and a reduction in operational costs by focusing resources on the most promising cases.

Q 24. Describe your experience with automated collection systems.

My experience with automated collection systems is extensive. I’ve worked with various systems, from automated dialer and SMS platforms to sophisticated CRM systems integrating predictive modeling and automated workflow tools. These systems significantly enhance efficiency by automating repetitive tasks such as sending reminders, making outbound calls, and generating reports. However, I firmly believe that technology should support, not replace, human interaction. While automation handles high-volume tasks, I leverage these systems to identify accounts requiring personalized attention. For example, the system may flag accounts with complex payment arrangements or those exhibiting signs of financial distress, allowing me to intervene with a more empathetic and tailored approach. The key is finding the right balance between automation and personalized communication for maximum effectiveness.

Q 25. How do you maintain professionalism while enforcing collection policies?

Maintaining professionalism while enforcing collection policies is paramount. I believe in treating every debtor with respect, regardless of their circumstances. This involves using courteous and professional language, actively listening to their concerns, and remaining calm even in challenging situations. I clearly explain the terms of the debt and the collection process, offering multiple payment options whenever possible. I avoid using threatening or abusive language, and always adhere to the Fair Debt Collection Practices Act (FDCPA) guidelines. Furthermore, I document every interaction meticulously to ensure accountability and transparency. Building a professional relationship based on respect and understanding is far more effective in the long run than employing aggressive tactics.

Q 26. Describe a situation where you had to escalate a difficult case.

I once encountered a case involving a debtor who was consistently unresponsive and had made several false promises. After exhausting all standard collection methods, I escalated the case to our legal department. This involved providing them with comprehensive documentation of all communication attempts, payment history, and relevant account details. The legal team reviewed the case and initiated appropriate legal action, leading to a successful resolution. This situation highlighted the importance of clearly documented communication and a structured escalation process within the organization. Escalation wasn’t a first resort, but a necessary step after all attempts at resolution had been exhausted through standard procedures.

Q 27. How do you build rapport with debtors?

Building rapport with debtors is essential for successful collections. I begin by actively listening to their situation and expressing empathy. I understand that financial difficulties can be stressful and try to create a collaborative environment rather than an adversarial one. I avoid judgmental language and focus on finding a payment solution that works for both parties. I often start conversations by acknowledging their situation and expressing understanding before discussing the debt. For example, I might say something like, “I understand that you’re going through a difficult time financially, and I’m here to help you find a solution.” This approach fosters trust and increases the likelihood of cooperation.

Q 28. How do you handle situations where payment is impossible?

When payment is truly impossible due to factors beyond the debtor’s control (e.g., job loss, medical emergency), a compassionate and realistic approach is necessary. I work closely with the debtor to thoroughly document their financial hardship, often requesting proof of income, medical bills, or other relevant documents. Then, I explore options such as debt settlement, repayment plans tailored to their capabilities, or referral to credit counseling services. The goal is to find a mutually agreeable solution that is both fair and sustainable, even if it doesn’t involve full repayment immediately. Documentation of these efforts is critical for record-keeping and to demonstrate good faith attempts at resolution.

Key Topics to Learn for Collection Procedures Interview

- Regulatory Compliance: Understanding and adhering to Fair Debt Collection Practices Act (FDCPA) and other relevant regulations. Practical application: Analyzing a collection scenario to identify potential compliance risks and develop compliant strategies.

- Communication Strategies: Mastering effective verbal and written communication techniques for interacting with debtors. Practical application: Crafting empathetic yet firm collection letters and adapting communication style based on debtor responses.

- Debt Negotiation and Settlement: Developing skills in negotiating payment plans, settlements, and compromise agreements. Practical application: Evaluating a debtor’s financial situation to propose a feasible repayment plan.

- Account Management & Prioritization: Efficiently managing a portfolio of accounts, prioritizing based on delinquency and risk. Practical application: Using data analysis to identify high-risk accounts and develop tailored collection strategies.

- Technology & Tools: Proficiency in using collection software, CRM systems, and other relevant technologies. Practical application: Demonstrating understanding of how technology streamlines the collection process and improves efficiency.

- Documentation & Record Keeping: Maintaining accurate and comprehensive records of all collection activities. Practical application: Understanding the importance of detailed documentation for audit trails and legal purposes.

- Ethical Considerations: Maintaining ethical and professional conduct throughout the collection process. Practical application: Identifying and addressing ethical dilemmas in real-world collection scenarios.

Next Steps

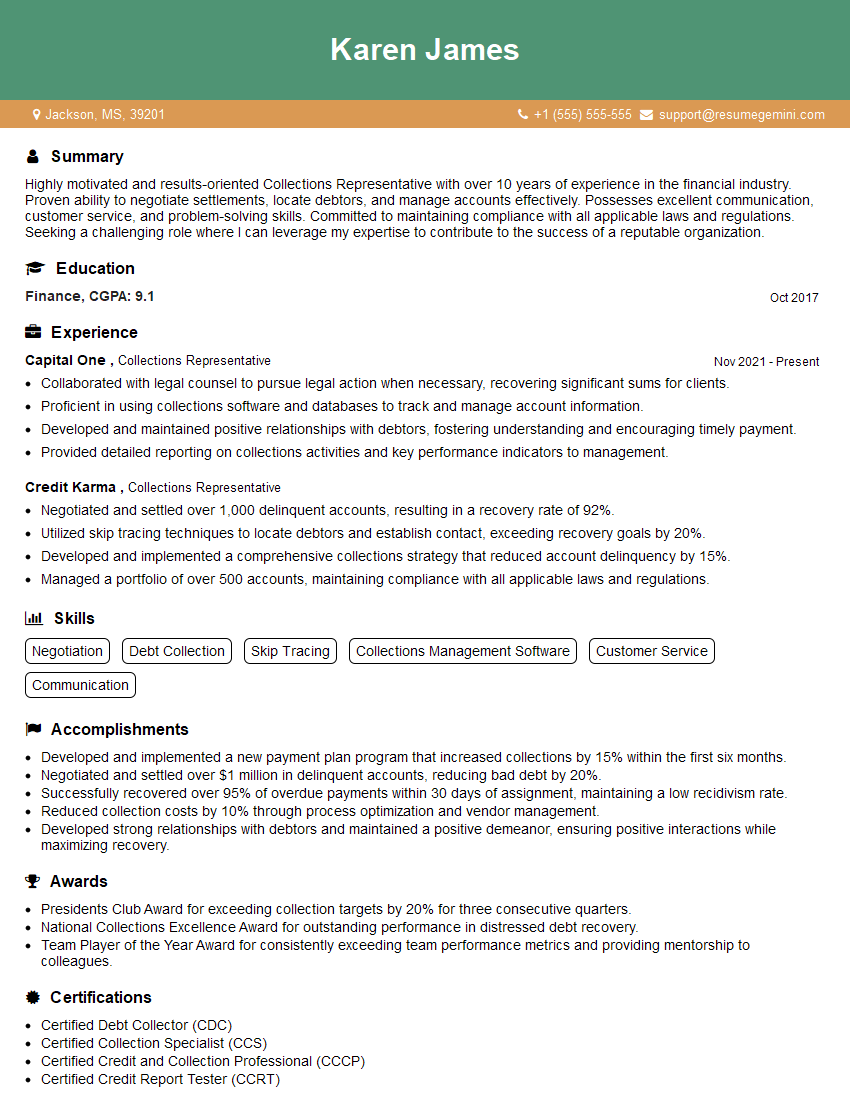

Mastering Collection Procedures significantly enhances your career prospects, opening doors to rewarding roles with increased responsibility and earning potential. An ATS-friendly resume is crucial for getting your application noticed by recruiters. To create a compelling resume that showcases your skills and experience in Collection Procedures, leverage the power of ResumeGemini. ResumeGemini provides a streamlined and user-friendly platform to build a professional resume, and we offer examples of resumes tailored specifically to Collection Procedures to help you get started. Take the next step towards your dream career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good