The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Upper closing interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Upper closing Interview

Q 1. Explain the process of preparing closing documents.

Preparing closing documents is a meticulous process requiring precision and attention to detail. It involves gathering all necessary documentation from both the buyer and seller, verifying its accuracy, and ensuring all parties understand the terms and conditions before signing. This typically includes the deed, mortgage, title insurance policies, closing disclosure, and any other relevant agreements.

- The Deed: This legally transfers ownership of the property from the seller to the buyer. We ensure it accurately reflects the property’s legal description and the names of the parties involved.

- Mortgage Documents (if applicable): These detail the terms of the buyer’s loan, including interest rate, repayment schedule, and any associated fees. We verify these match the buyer’s loan commitment letter.

- Title Insurance Policies: These protect both the buyer and the lender against potential title defects or claims. We review these to ensure proper coverage and confirm that all necessary endorsements are in place.

- Closing Disclosure: This document provides a final, itemized list of all debits and credits for both the buyer and the seller. We meticulously review this for accuracy, ensuring all funds are accounted for correctly.

- Other Relevant Agreements: This may include surveys, inspections reports, homeowner’s association documents, and any other addendums agreed upon by both parties. We ensure that all these are consistent with the overall transaction.

Think of it like assembling a complex puzzle; every piece needs to be in the right place for the complete picture to emerge. A missing or incorrect document can delay or even derail the entire closing process.

Q 2. Describe your experience with title insurance and its role in the closing process.

Title insurance is crucial in protecting both the buyer and the lender from financial losses due to title defects. These defects could include errors in the property’s chain of title, undisclosed liens, or boundary disputes. In my experience, I’ve handled numerous closings where title insurance proved invaluable. For example, we uncovered a previously unrecorded easement during the title search for a property – this was identified in the title commitment, which avoided a significant potential issue for the buyer after closing.

My role involves working closely with the title company to obtain and review the title commitment and insurance policies. We review the commitment for any exceptions or issues, and negotiate with the seller or other parties to resolve these before closing. We also verify that the insurance policies accurately reflect the terms of the transaction. Without title insurance, buyers and lenders face considerable risk, potentially leading to costly legal battles and significant financial setbacks.

Q 3. How do you handle discrepancies found in closing documents?

Discrepancies in closing documents are unfortunately not uncommon. My approach is systematic and involves a thorough investigation to identify the root cause and implement a resolution.

- Identify the Discrepancy: Carefully compare all documents, pinpointing the exact nature and location of the discrepancy. Is it a numerical error, a conflicting date, or an omission of information?

- Investigate the Cause: Determine the source of the error. Was it a simple typographical error, a miscalculation, or a more significant issue requiring further investigation?

- Communicate with Relevant Parties: Engage with the buyer, seller, lender, title company, and real estate agents to clarify the issue and find a solution. Documentation is key, providing a record of all communications and agreed-upon corrections.

- Document Corrections: Make necessary corrections to the affected documents. Ensure all parties agree upon and sign any amendment or addendum needed to rectify the problem.

- Update Closing Disclosure: Ensure the closing disclosure accurately reflects all changes, showing final debits and credits.

For example, a discrepancy in the property tax calculation could require contacting the county assessor’s office for clarification. Open communication and a collaborative approach are essential in resolving these discrepancies efficiently.

Q 4. What are the key legal and regulatory considerations in Upper closing?

Legal and regulatory considerations in upper closing are paramount. We must adhere to strict compliance standards to ensure ethical and legal transactions. Key considerations include:

- RESPA (Real Estate Settlement Procedures Act): This federal law regulates closing procedures, requiring clear disclosure of all fees and charges. We must strictly adhere to its guidelines, including providing the Closing Disclosure at least three business days before closing.

- Truth in Lending Act (TILA): This ensures accurate disclosure of loan terms, interest rates, and fees to the borrower. We verify the accuracy of this information and ensure it aligns with the loan documents.

- State-Specific Regulations: Each state has its own real estate laws and regulations governing closing procedures. We need to be intimately familiar with the relevant state laws applicable to the transaction. For example, some states may have specific requirements for the execution of deeds.

- Fair Housing Laws: All transactions must comply with fair housing laws, preventing discrimination based on race, religion, national origin, sex, familial status, disability, or other protected characteristics.

- Anti-Money Laundering (AML) regulations: We must comply with AML regulations to prevent financial crimes and thoroughly identify parties involved in the transaction, ensuring they are legitimate.

Non-compliance can result in significant penalties, fines, and legal repercussions. Therefore, ongoing professional development and staying updated on the latest regulations are critical.

Q 5. Explain your understanding of escrow accounts and their management.

Escrow accounts are crucial in real estate transactions. They are essentially trust accounts held by a neutral third party (often a title company or escrow agent) to manage funds during the closing process. My role involves carefully monitoring these accounts, ensuring that funds are received and disbursed in accordance with the transaction’s terms.

We meticulously track all deposits, including earnest money, loan proceeds, and seller proceeds. We verify the accuracy of all deposits against the closing disclosure and ensure that the funds are appropriately applied to pay off existing liens, taxes, and other closing costs. We then release funds to the appropriate parties only upon completion of the closing and confirmation that all conditions are met. Any discrepancies require immediate attention and investigation. Think of the escrow account as a secure vault ensuring all money is handled responsibly and transparently. Strict adherence to escrow regulations ensures the protection of all parties involved and prevents misappropriation of funds.

Q 6. How do you ensure accuracy and completeness in closing statements?

Accuracy and completeness in closing statements are paramount. We employ a multi-layered approach to ensure this.

- Reconciliation: We carefully reconcile all debits and credits in the closing disclosure to ensure that the total debits equal the total credits. Any discrepancies necessitate investigation until resolved.

- Cross-referencing: We meticulously cross-reference the closing statement against all other relevant documents, including the purchase agreement, loan documents, title insurance policy, and payoff statements. This ensures consistency across all paperwork.

- Double-checking Calculations: We don’t rely on automated calculations alone. We independently verify all figures to catch any potential errors in formulas or data entry.

- Review by Multiple Parties: Often, multiple people within the closing team review the statement before finalization. This creates a robust system of checks and balances to minimize the possibility of errors.

- Use of Closing Software: While we manually verify, we also use closing software to enhance accuracy and streamline the process. This software aids in calculations and ensures proper formatting, reducing the risk of human error.

These measures ensure that the closing statement is a true and accurate reflection of the financial aspects of the transaction. It safeguards all parties involved and prevents costly disputes.

Q 7. Describe your experience with wire transfers and fund disbursement.

Wire transfers are the most common method for transferring funds in real estate closings. My experience includes handling numerous wire transfers, both incoming and outgoing. We prioritize security and accuracy in all wire transactions.

Before initiating a transfer, we carefully verify the recipient’s banking details and obtain written authorization from the relevant party. We also use secure communication channels and follow strict protocols to prevent fraud. We keep meticulous records of all wire transfers, including the transaction ID, date, amount, and recipient information. For instance, if a seller is receiving a large sum, we ensure that all details are confirmed with the seller before initiating the wire to prevent errors that could create delays or additional costs.

Post-transfer, we diligently follow up to ensure that the funds have been successfully received. Any issues with funds transfers are swiftly investigated and resolved collaboratively with the relevant parties and the banks.

Q 8. How do you manage multiple simultaneous closings effectively?

Managing multiple simultaneous closings effectively requires meticulous organization and a robust system. Think of it like conducting an orchestra – each instrument (closing) needs careful attention, but the conductor (me) must ensure harmony and timely execution. My approach involves:

- Prioritization and Scheduling: I use a digital calendar and task management system to meticulously schedule each closing, considering deadlines and potential overlaps. This helps me allocate my time efficiently and avoid conflicts.

- Detailed File Management: Each closing has its dedicated, meticulously organized digital file. This ensures quick access to crucial documents and minimizes the risk of errors. I utilize a color-coded system to further categorize urgency.

- Teamwork and Delegation (if applicable): In high-volume periods, I delegate tasks to trusted team members, ensuring clear communication and oversight. This allows for parallel processing, improving overall efficiency.

- Regular Check-ins: I schedule regular check-ins with team members and involved parties to track progress and address any arising issues promptly. This proactive approach prevents small problems from escalating.

For example, I recently handled five closings in a single week. By employing this system, I ensured each closing proceeded smoothly, with all parties informed and satisfied. No deadlines were missed, and all transactions were closed successfully.

Q 9. What is your process for identifying and resolving title issues?

Identifying and resolving title issues is critical. It’s like a detective investigation, meticulously examining every aspect of the property’s history to uncover any potential problems before they impact the closing. My process is:

- Thorough Title Review: I meticulously review the title commitment, looking for liens, encumbrances, easements, or any other potential issues. This includes checking for unpaid taxes, judgments, or bankruptcies.

- Communication with Title Company: I collaborate closely with the title company to clarify any unclear items or investigate potential problems. Open communication is crucial here.

- Research and Investigation: If issues are identified, I conduct further research, often involving contacting relevant parties, examining public records, and engaging with legal professionals when necessary. This ensures a comprehensive understanding of the problem.

- Resolution Strategies: Depending on the nature of the issue, I develop and implement strategies for resolving the problem. This could involve negotiating with lien holders, procuring releases, or even taking legal action when required.

For instance, I recently uncovered a previously unrecorded easement during a title review. By working closely with the title company and the involved parties, we successfully resolved the issue, preventing a delay in closing.

Q 10. How do you handle communication with clients, agents, and lenders during the closing process?

Effective communication is the backbone of a successful closing. Imagine it as being a conductor of a well-rehearsed symphony, ensuring all players are in sync. I maintain open communication channels with all parties involved:

- Regular Updates: I provide regular updates to clients, agents, and lenders throughout the process using email, phone calls, and sometimes video conferencing, depending on preference. I prioritize transparency.

- Clear and Concise Communication: I use clear and concise language, avoiding jargon, to ensure everyone understands the status of the transaction. This minimizes confusion and misunderstandings.

- Proactive Communication: I proactively communicate potential issues or delays, providing solutions and timelines. Addressing problems early prevents surprises and fosters trust.

- Multiple Communication Channels: I cater to different communication preferences, offering multiple options for contact.

Recently, a lender needed a last-minute document. By immediately contacting them and coordinating with other parties, I was able to promptly provide the necessary paperwork, preventing any delays.

Q 11. Explain your experience with different types of closing transactions (e.g., residential, commercial).

My experience encompasses a wide range of closing transactions, including residential and commercial, each with its own unique complexities. Residential closings often focus on individual home purchases, while commercial closings can involve intricate lease agreements, multiple parties, and significant financial stakes. My experience includes:

- Residential Closings: I have handled hundreds of residential closings, from simple purchases to complex refinances, including FHA, VA, and conventional loans.

- Commercial Closings: I have experience with commercial property transactions, including office buildings, retail spaces, and industrial properties, often involving significant due diligence and legal review.

- Short Sales and Foreclosures: I’m also experienced in navigating the complexities of short sales and foreclosures, ensuring all legal requirements are met.

This diverse experience allows me to adapt quickly to different situations and handle any challenges with confidence and efficiency.

Q 12. Describe your experience with using closing software and related technologies.

I am proficient in utilizing various closing software and technologies to streamline the closing process and enhance efficiency. This improves accuracy and reduces the risk of errors. I have extensive experience with:

- Title and Escrow Software: I’m proficient in using various title and escrow software platforms for document preparation, tracking, and communication. This allows for efficient management of files and seamless collaboration.

- eClosing Platforms: I am familiar with eClosing platforms, allowing for secure electronic signing and document management. This is environmentally friendly and increases speed.

- Real Estate Databases: I use various real estate databases for research and information gathering. This provides comprehensive data for informed decision-making.

For example, the use of e-signature software significantly reduces the time it takes to get documents signed and returned, thus shortening the closing timeline.

Q 13. How do you identify and mitigate potential risks in a closing transaction?

Risk mitigation is a crucial aspect of my role. It’s like being a pilot performing pre-flight checks; careful preparation is key to avoiding unexpected turbulence. My approach focuses on:

- Due Diligence: Thorough due diligence is paramount. This involves carefully reviewing all documents, conducting title searches, and verifying information to identify potential risks before they become problems.

- Compliance Adherence: I strictly adhere to all relevant laws and regulations. This ensures compliance and reduces the risk of legal issues.

- Risk Assessment: I systematically assess potential risks at each stage of the closing process, anticipating potential problems and developing mitigation strategies. This is a proactive approach.

- Escrow Management: Careful management of escrow funds minimizes financial risks for all parties. This involves maintaining accurate records and ensuring compliance with all regulations.

By consistently performing these steps, I minimize potential risks and ensure smooth, compliant transactions.

Q 14. How do you handle last-minute changes or unexpected issues during the closing?

Handling last-minute changes or unexpected issues requires calm, decisive action and strong problem-solving skills. It’s like being a firefighter – swift, precise action is critical. My approach is:

- Assess the Situation: I quickly assess the nature and impact of the change or issue.

- Develop Solutions: I develop several potential solutions, considering their impact on the timeline and involved parties.

- Communicate Effectively: I immediately communicate the issue and proposed solutions to all relevant parties.

- Document Everything: I meticulously document all changes and communications to maintain a clear record of events.

- Negotiate and Collaborate: I negotiate with all parties to reach an agreeable solution. Collaboration is key to resolving issues efficiently.

In one instance, a buyer’s financing fell through at the last minute. I swiftly worked with the seller and the buyer to find an alternative financing solution, saving the transaction and preventing significant financial losses for all parties involved.

Q 15. What is your approach to ensuring compliance with all relevant laws and regulations?

Compliance is paramount in real estate closings. My approach involves a multi-layered strategy. First, I maintain a thorough understanding of all applicable federal, state, and local laws and regulations, including RESPA (Real Estate Settlement Procedures Act), TILA (Truth in Lending Act), and Fair Housing Act provisions. I regularly attend industry seminars and workshops to stay updated on changes in legislation and best practices. Second, I meticulously review all closing documents, ensuring complete accuracy and adherence to these regulations. This includes verifying proper disclosures, ensuring all required signatures are present and valid, and confirming that all fees are appropriately disclosed and calculated. Third, I leverage compliance checklists and internal review processes to identify and address potential issues proactively. Finally, I document all actions taken to ensure compliance, creating an auditable trail for future reference. Think of it like building a house – you wouldn’t skip inspecting the foundation; similarly, neglecting compliance in closings can lead to serious legal and financial repercussions.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you prioritize tasks and manage your workload during peak periods?

During peak periods, effective prioritization is key. I use a combination of techniques. First, I employ a project management system, prioritizing tasks based on urgency and importance using methods like the Eisenhower Matrix (Urgent/Important). This allows me to identify and tackle time-sensitive tasks such as imminent closing deadlines while still allocating time for crucial but less urgent activities like reviewing upcoming files. Second, I communicate proactively with clients, lenders, and other stakeholders to manage expectations and ensure everyone is informed of potential delays or changes in timelines. Third, I delegate tasks appropriately whenever possible, leveraging the expertise of my colleagues to handle less critical but still necessary assignments. Fourth, I regularly review my schedule and adjust priorities as needed, adapting to the dynamic nature of a busy closing environment. Think of it like conducting an orchestra – you need to manage many instruments (tasks) harmoniously to create a beautiful performance (successful closings).

Q 17. Describe your experience with post-closing procedures and reconciliation.

Post-closing procedures and reconciliation are crucial for ensuring a smooth and error-free transaction. My experience includes preparing and submitting all necessary documentation to relevant parties, including lenders, title companies, and government agencies. I meticulously reconcile all funds received and disbursed, comparing them against the closing statement to identify and resolve any discrepancies. This involves reviewing bank statements, wire transfer confirmations, and other financial records. I also address any outstanding issues or adjustments, ensuring all parties are informed and satisfied. Furthermore, I prepare and file the necessary post-closing reports, maintaining accurate records for audit trails and compliance purposes. For example, I once identified a minor discrepancy in a wire transfer immediately after closing, preventing a potential delay and ensuring a seamless experience for the client. The diligence in this stage prevents future complications.

Q 18. How do you handle challenging clients or stakeholders?

Handling challenging clients or stakeholders requires patience, empathy, and effective communication. My approach is to listen actively to their concerns, understand their perspectives, and address them professionally and respectfully. I focus on finding solutions that meet everyone’s needs while staying within the legal and ethical boundaries of the transaction. If necessary, I escalate issues to my supervisor or involve other relevant parties to facilitate a resolution. For example, I once had a client who was understandably anxious about the closing process. By clearly explaining each step, providing regular updates, and demonstrating understanding of their concerns, I successfully calmed their nerves and ensured a smooth closing. Remember, building rapport is crucial, even when faced with difficult situations. Clear, consistent communication is key.

Q 19. How do you ensure data security and confidentiality in closing transactions?

Data security and confidentiality are paramount. I adhere strictly to company policies and industry best practices to protect sensitive client information. This includes using secure systems for storing and transmitting data, employing strong passwords and access controls, and regularly updating software to address security vulnerabilities. I avoid discussing client information in public spaces and never leave sensitive documents unattended. Furthermore, I am meticulous about shredding or securely disposing of any documents containing personal or financial data that are no longer needed. This commitment to security protects clients’ trust and prevents potential breaches and legal ramifications. Imagine it as guarding a valuable treasure; security measures are vital to safeguard the data’s integrity.

Q 20. Explain your understanding of various closing costs and their calculation.

Understanding closing costs is fundamental to successful closings. These are fees associated with the purchase or sale of a property, paid by either the buyer or seller, or sometimes shared. Common closing costs include loan origination fees, appraisal fees, title insurance premiums, recording fees, transfer taxes, and escrow fees. The calculation of these costs involves reviewing the relevant contracts, loan documents, and local regulations. Each cost is typically itemized on the closing disclosure, allowing both buyer and seller to review all expenses in detail before proceeding with the closing. Accurate calculation of closing costs requires meticulous attention to detail, often relying on specialized software or calculators to ensure accuracy and transparency. Errors in calculating closing costs can lead to delays and disputes, highlighting the importance of thoroughness and expertise in this area.

Q 21. What is your experience with reviewing and interpreting loan documents?

My experience with reviewing and interpreting loan documents is extensive. This includes reviewing promissory notes, mortgages, deeds of trust, and other loan-related documentation to identify any potential issues or discrepancies. I am proficient in understanding various loan structures, including fixed-rate, adjustable-rate, and interest-only mortgages. I carefully examine the terms and conditions of the loan, including interest rates, repayment schedules, prepayment penalties, and other relevant details. My thorough review process helps identify potential problems early on, preventing complications during the closing process and beyond. This includes verifying that the loan terms align with the borrower’s financial capabilities and that all necessary disclosures have been properly provided. Think of it as a meticulous detective work – ensuring everything in the loan document is accurate and serves the interest of the client.

Q 22. How do you maintain accurate records and documentation throughout the closing process?

Maintaining accurate records is paramount in real estate closings. Think of it like meticulously building a skyscraper – every detail counts. I utilize a robust, digital document management system that allows for easy access, version control, and secure storage of all closing-related documents. This includes purchase agreements, loan documents, title insurance policies, disclosures, and any other relevant correspondence. Every document is meticulously timestamped and indexed with descriptive keywords for rapid retrieval. For instance, if a question arises about the earnest money deposit, I can instantly locate the relevant section within the purchase agreement. Furthermore, I maintain a detailed closing checklist to ensure no step is missed, creating a comprehensive audit trail throughout the entire process. This system not only ensures accuracy but also significantly reduces the risk of errors and disputes.

Q 23. Describe your experience with working within tight deadlines.

Meeting tight deadlines is an integral part of my role. I thrive under pressure and have consistently delivered successful closings within stringent timeframes. In one instance, a closing was unexpectedly pushed forward by three days due to a buyer’s urgent relocation. I immediately coordinated with all parties involved – the lender, title company, and attorneys – to reschedule appointments and expedite document review. By prioritizing tasks, leveraging efficient communication channels, and working diligently, we successfully concluded the closing on schedule, showcasing my adaptability and commitment to timely execution. My organizational skills and efficient workflow allow me to manage multiple simultaneous closings without compromising accuracy or quality.

Q 24. Explain your problem-solving approach in resolving closing-related issues.

Problem-solving is a daily occurrence in real estate closings. My approach is systematic and proactive. First, I clearly identify the issue. Then, I gather all relevant information from all parties involved, ensuring I have a complete understanding. Next, I brainstorm potential solutions, considering their implications for each party. Finally, I choose the most appropriate and effective solution, documenting the decision-making process and ensuring it aligns with legal and ethical standards. For example, if a discrepancy arises in the appraisal, I’ll work collaboratively with the lender and appraiser to resolve the issue through negotiation or supplementary documentation. My goal is always to find a resolution that benefits all involved while adhering to the highest standards of professional conduct.

Q 25. How do you stay updated on changes in real estate laws and regulations?

Staying current on real estate laws and regulations is crucial. I subscribe to reputable legal journals and online resources specifically focused on real estate law in my jurisdiction. I also regularly attend industry conferences and webinars, networking with other professionals and sharing best practices. I actively monitor changes in legislation through official government websites and professional associations. By staying informed about changes in regulations like those concerning disclosure requirements or lending practices, I guarantee compliance and ensure clients receive the best possible service, minimizing potential risks and legal complications.

Q 26. Describe your experience with preparing for and conducting closing meetings.

Preparing for and conducting closing meetings is a crucial element of my role. Prior to the meeting, I ensure all necessary documents are organized, reviewed, and readily available. I confirm the attendance of all parties and schedule the meeting at a time convenient for everyone. During the meeting, I meticulously guide the parties through the process, answering their questions clearly and concisely, ensuring everyone understands the agreements and financial aspects involved. I maintain a professional and calm demeanor, fostering a collaborative environment, and addressing concerns promptly and effectively. I also ensure all relevant documents are signed and accurately completed before closing the meeting, following a structured agenda to maintain order and efficiency.

Q 27. How do you ensure a smooth and efficient closing experience for all parties involved?

A smooth closing hinges on clear communication and proactive problem-solving. I begin by setting clear expectations with all parties from the outset, ensuring they understand the timeline and necessary steps involved. I proactively communicate any potential issues, offering solutions and keeping everyone informed throughout the process. My goal is to build trust and rapport, fostering a collaborative environment. Through consistent communication, diligent preparation, and timely execution of each stage, I help ensure the closing runs smoothly, minimizing stress and frustration for everyone involved. By prioritizing clear communication and collaboration, I contribute to a positive experience, often receiving positive feedback from clients and stakeholders.

Q 28. What is your understanding of the differences between residential and commercial closings?

Residential and commercial closings differ significantly in complexity and the involved parties. Residential closings typically involve fewer parties and simpler transactions, focusing primarily on a single-family home or condo. Commercial closings, on the other hand, are much more intricate, often involving multiple properties, complex financing structures, and numerous parties with diverse interests (investors, lenders, business partners, etc.). The legal documentation is also significantly more extensive, including lease agreements, business contracts, and specialized commercial loan documents. For example, a commercial closing might necessitate extensive due diligence, environmental assessments, and lease review, while a residential closing primarily revolves around the property’s title and the mortgage. Understanding these differences is key to managing each type of closing effectively and efficiently.

Key Topics to Learn for Upper Closing Interview

- Negotiation Strategies: Understanding different negotiation tactics and approaches, including collaborative and competitive strategies, and adapting your approach based on the specific situation.

- Contractual Agreements: Reviewing and understanding key contractual clauses, including payment terms, timelines, deliverables, and intellectual property rights. Practice analyzing sample agreements.

- Risk Management: Identifying potential risks and challenges in closing deals and developing mitigation strategies to protect the interests of all parties involved.

- Relationship Building: Cultivating strong relationships with clients and internal stakeholders to facilitate a smooth and successful closing process. Understand the importance of trust and communication.

- Closing Techniques: Mastering various closing techniques, adapting your approach depending on client personality and communication style, and confidently presenting final proposals.

- Legal and Ethical Considerations: Ensuring all actions and negotiations adhere to legal and ethical standards, including compliance with regulations and internal policies.

- Financial Analysis: Understanding and interpreting financial statements, analyzing profitability, and making informed decisions based on financial data relevant to the deal.

- Problem-Solving and Decision-Making: Developing effective problem-solving skills to address unforeseen issues or challenges during the closing process, and making decisive and timely decisions.

Next Steps

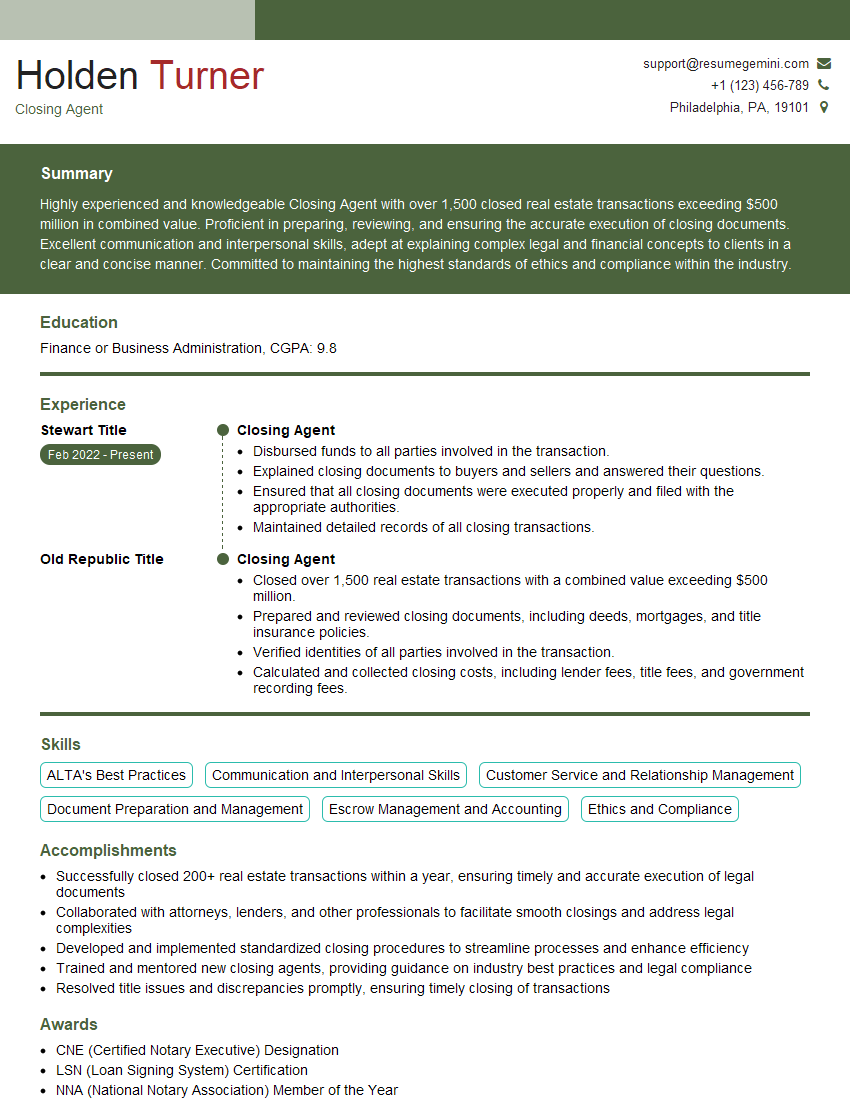

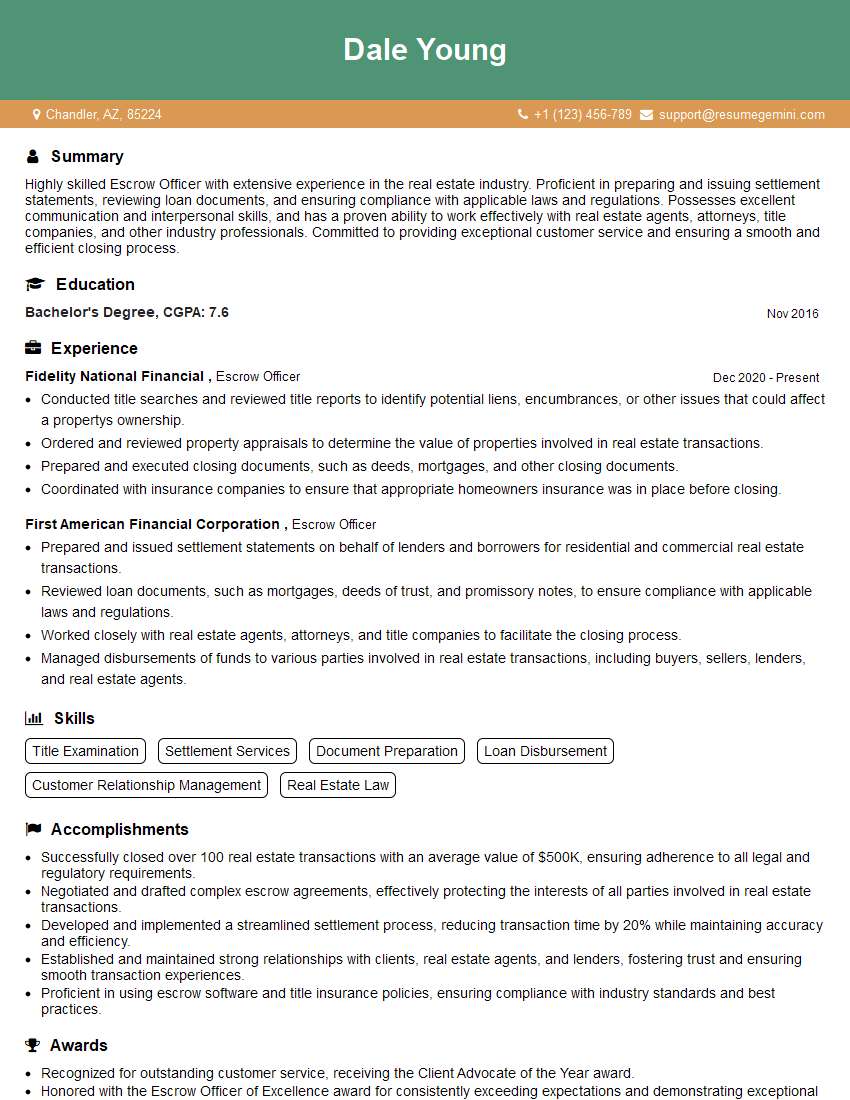

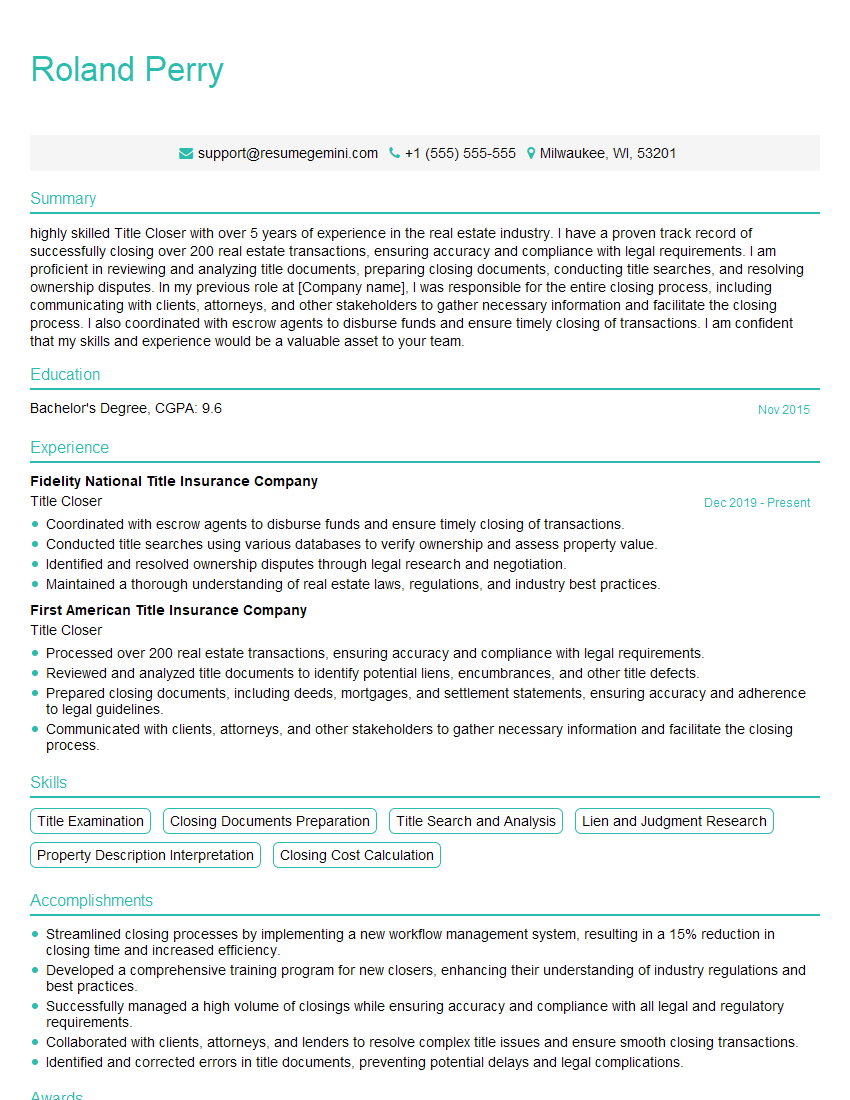

Mastering upper closing is crucial for career advancement in many fields, opening doors to senior roles and increased earning potential. An ATS-friendly resume is your first step towards showcasing your skills and experience to potential employers. To ensure your resume effectively highlights your capabilities in upper closing, we highly recommend using ResumeGemini. ResumeGemini offers a streamlined and intuitive platform for crafting professional resumes, and we provide examples of resumes tailored to upper closing roles to help guide you. Invest the time to create a compelling resume – it’s your key to unlocking exciting opportunities.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good