Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Budget Control and Resource Management interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Budget Control and Resource Management Interview

Q 1. Describe your experience with different budgeting methods (e.g., zero-based, incremental).

I’ve worked extensively with various budgeting methods, each with its strengths and weaknesses. Incremental budgeting, the most common approach, uses the previous year’s budget as a base, adjusting it for anticipated changes. Think of it as fine-tuning an existing machine – relatively simple but potentially overlooking areas needing significant change. For example, if marketing costs were $100,000 last year, an incremental budget might increase it to $105,000 based on inflation and projected growth. In contrast, zero-based budgeting (ZBB) requires justifying every expense from scratch each year. It’s like building a new machine from the ground up – time-consuming but potentially more efficient. Imagine a department needing to justify every software subscription, every staff member’s salary, and every training course; it forces a critical evaluation of expenditures. Finally, activity-based budgeting focuses on the cost of specific activities and their contribution to organizational goals. This method aligns spending directly with strategic objectives. For instance, if a key goal is increasing customer acquisition, the budget would allocate resources to the activities directly driving that goal, such as marketing campaigns and sales training. I find the best approach often involves a blend of these methods, tailoring the strategy to the organization’s size, complexity, and objectives.

Q 2. How do you develop a budget from scratch?

Developing a budget from scratch is a structured process. First, I clearly define the organization’s goals and objectives for the budgeting period. This ensures every dollar spent contributes to a strategic aim. Next, I meticulously identify all anticipated revenue streams. This might involve reviewing sales forecasts, analyzing market trends, and considering potential new revenue opportunities. Simultaneously, I categorize all expected expenses, from salaries and rent to marketing and materials. It’s crucial to be comprehensive here. Then, I allocate resources to each expense category, prioritizing those aligning with the organization’s strategic goals. This is where understanding the organization’s priorities is critical – often involving trade-offs and difficult decisions. Throughout this process, I conduct thorough research, utilizing market data, competitor analysis, and internal performance indicators. Finally, I create a detailed budget document, outlining all revenue streams, expenses, and the anticipated profit or loss. Regular review and adjustments are vital, making it a dynamic, rather than static, document.

Q 3. Explain your process for monitoring and controlling budget variances.

Monitoring and controlling budget variances involves a proactive, multi-step approach. Firstly, I establish clear benchmarks and regularly track actual spending against the budgeted amounts. I use dashboards and reporting tools to visualize performance and promptly identify any significant deviations. Secondly, for every variance that exceeds a predefined threshold (e.g., 5%), I conduct a root cause analysis. This may involve reviewing invoices, project timelines, and speaking with team members to understand the reasons behind the discrepancy. For example, if marketing spend is over budget, we would analyze campaign performance, assess the effectiveness of advertising channels, and examine any unforeseen costs. Thirdly, I develop corrective actions based on the root cause analysis. These actions could range from adjusting spending patterns to renegotiating contracts or improving operational efficiencies. Lastly, I document all variances, corrective actions, and their impact. This builds a valuable historical record to inform future budget planning and improve forecasting accuracy. It’s a continuous cycle of monitoring, analysis, correction, and learning.

Q 4. How do you identify and address potential budget overruns?

Identifying and addressing potential budget overruns requires vigilance and proactive measures. Firstly, I use forecasting techniques and scenario planning to anticipate potential risks and challenges. This might involve creating ‘what-if’ scenarios to assess the impact of various factors, such as changes in market demand or unforeseen supply chain disruptions. Secondly, I implement robust project management practices, including regular progress reporting, monitoring key performance indicators (KPIs), and establishing clear accountability for budget adherence. If I notice a potential overrun, I immediately investigate the cause, using data-driven analysis to identify the root problem. This may involve reviewing time sheets, material usage, or subcontractor invoices. Based on my findings, I implement corrective measures, which may include renegotiating contracts, adjusting project scope, or reallocating resources from lower-priority activities. Finally, I implement stronger controls to prevent similar overruns in the future. This could involve improved project planning, stricter expense approval processes, and enhanced communication among team members.

Q 5. What software or tools do you use for budget management?

My experience encompasses a range of budget management software and tools. I’m proficient in using enterprise resource planning (ERP) systems such as SAP and Oracle, which provide comprehensive financial management capabilities, including budgeting, forecasting, and reporting. I also have experience with specialized budget management software like Adaptive Insights and Vena, which offer more streamlined and user-friendly interfaces for building and managing budgets. Furthermore, I am comfortable using spreadsheet software like Microsoft Excel and Google Sheets for smaller-scale budgeting and financial modeling, leveraging their capabilities for data analysis and visualization. The choice of tool depends on the organization’s size, complexity, and specific needs. For example, a small business might find spreadsheet software sufficient, while a large corporation would benefit from a robust ERP system.

Q 6. Describe your experience with forecasting and financial modeling.

Forecasting and financial modeling are integral parts of my budget management process. I use various forecasting techniques, including time series analysis, regression analysis, and scenario planning, to predict future revenue and expenses. For instance, time series analysis helps identify trends and seasonality in sales data, enabling more accurate revenue projections. Regression analysis can help model the relationship between different variables, such as marketing spend and sales, to understand their impact on revenue. Scenario planning involves creating different possible future outcomes based on varying assumptions, helping assess the organization’s resilience to various economic and market conditions. I build financial models using spreadsheet software or dedicated financial modeling tools, incorporating assumptions about revenue, expenses, and capital investments. These models simulate the organization’s financial performance under various scenarios, providing insights into potential risks and opportunities. This allows for informed decision-making and proactive adjustment of the budget to achieve the organization’s financial objectives.

Q 7. How do you prioritize resource allocation in a constrained budget environment?

Prioritizing resource allocation in a constrained budget environment requires a strategic and data-driven approach. First, I align resource allocation with the organization’s strategic goals and priorities. This ensures that resources are directed towards activities that deliver the greatest impact on achieving key objectives. I use a variety of prioritization techniques, such as the Eisenhower Matrix (urgent/important), cost-benefit analysis, and return on investment (ROI) calculations. For example, a cost-benefit analysis would compare the costs and benefits of different projects or initiatives, allowing for informed decisions on where to allocate resources. Secondly, I involve key stakeholders in the resource allocation process. This ensures that decisions are transparent and reflect the needs of different departments or teams. Finally, I regularly monitor and review resource allocation decisions, making adjustments as needed. This ensures that resources are used efficiently and effectively, maximizing their impact on the organization’s performance. In essence, it’s about making tough choices, focusing on the highest-impact initiatives, and consistently tracking the results to ensure optimal resource utilization.

Q 8. How do you handle unexpected expenses or changes in project scope?

Handling unexpected expenses or scope changes requires a proactive and structured approach. The first step is to immediately assess the impact. This involves quantifying the cost of the unexpected expense or the additional work required by the scope change. Then, I analyze the project budget to identify areas where savings might be possible or where less critical tasks can be deferred or eliminated. We then engage in a collaborative discussion with stakeholders to determine the best course of action. This often involves prioritizing tasks based on their importance and impact, negotiating with vendors for better pricing or exploring alternative solutions. Finally, we revise the budget accordingly, documenting all changes, and ensuring transparency with all parties involved.

For example, imagine a construction project where unexpected soil conditions are encountered. Instead of panicking, we’d carefully evaluate the extra costs associated with addressing these issues. We might explore different solutions – perhaps a modified design to mitigate the problem – and then present various options to the stakeholders with their associated cost implications and timeline adjustments. The chosen solution would be documented, budget amended, and communicated to all concerned parties.

Q 9. Explain your understanding of Return on Investment (ROI) and its role in budget decisions.

Return on Investment (ROI) is a crucial metric for evaluating the profitability of a project or investment. It measures the efficiency of an investment by calculating the ratio of net profit to the cost of the investment. A high ROI indicates that the investment is generating a significant return relative to its cost, making it a worthwhile endeavor. In budget decisions, ROI helps prioritize projects with higher potential returns, optimizing resource allocation and ensuring that funds are invested strategically. We use ROI analysis to compare different projects or investment options, enabling us to make data-driven decisions and avoid allocating resources to projects with low potential returns.

For instance, let’s say we’re considering two marketing campaigns. Campaign A costs $10,000 and is projected to generate $25,000 in revenue, yielding a 150% ROI. Campaign B costs $5,000 and is projected to generate $10,000 in revenue, resulting in a 100% ROI. Although both campaigns have positive ROIs, Campaign A is more efficient, making it the preferable choice based on the ROI analysis.

Q 10. How do you communicate budget information to stakeholders?

Effective communication of budget information is crucial for keeping stakeholders informed and engaged. I tailor my communication style and the type of information shared based on the stakeholder’s role and information needs. I use a combination of methods including regular budget reports, presentations, and one-on-one meetings. Reports provide a summary of performance, while presentations offer a more in-depth analysis and discussion. One-on-one meetings help address individual concerns and provide clarification. I ensure that all communication is clear, concise, and easy to understand, avoiding technical jargon whenever possible. Visual aids like charts and graphs are used to make data more accessible.

For example, a high-level summary report for senior management might focus on key performance indicators and overall budget performance. On the other hand, a more detailed report for project managers would include specific line-item expenditures, variances, and forecasts. Regular communication keeps everyone updated and prevents misunderstandings.

Q 11. What are some key performance indicators (KPIs) you use to track budget performance?

Several Key Performance Indicators (KPIs) help track budget performance. These can include:

- Budget Variance: The difference between the planned budget and the actual expenditure. A positive variance indicates underspending, while a negative variance shows overspending.

- Cost Overrun Rate: The percentage by which actual costs exceed the planned budget.

- Return on Investment (ROI): As explained previously, a crucial metric for evaluating project profitability.

- Cost Per Unit: Useful for tracking the efficiency of production or service delivery.

- Purchase Order Completion Rate: Measures the efficiency of procurement processes.

These KPIs, combined with regular monitoring, provide a holistic view of budget performance, enabling timely corrective actions when needed.

Q 12. Describe your experience with variance analysis and reporting.

Variance analysis involves comparing planned and actual budget figures to identify and explain discrepancies. This is a crucial process for identifying areas of overspending or underspending. My approach includes thoroughly investigating the causes of variances. For instance, a significant negative variance in a specific cost category might be due to unforeseen circumstances (e.g., supply chain disruptions) or inefficiencies in project management. The analysis results are then documented in reports that are communicated to relevant stakeholders. These reports typically include graphs and charts that visually represent the variances, along with detailed explanations of their causes and potential corrective actions.

For example, if a project consistently shows a negative variance in labor costs, we’d examine time sheets, analyze employee productivity, and explore whether there were unexpected delays or unforeseen complexities that increased labor hours.

Q 13. How do you ensure budget accuracy and compliance?

Ensuring budget accuracy and compliance requires a multi-faceted approach. Firstly, a robust budgeting process is crucial, with clear guidelines and approval procedures. This includes accurate forecasting, detailed budgeting, and regular monitoring. Secondly, strong internal controls are implemented to prevent unauthorized expenditures. This can involve segregation of duties, regular audits, and use of budget management software. Thirdly, all transactions should be properly documented and reconciled regularly. Finally, compliance with relevant regulations and policies is essential. Regular training for staff on budget procedures and compliance guidelines is also vital.

For example, a system of purchase order approvals ensures that all expenses are authorized and documented before being incurred, minimizing the risk of unauthorized spending. Regular reconciliation of accounts ensures that all recorded expenses are accurate and aligned with actual transactions.

Q 14. How do you work with different departments to manage budgets effectively?

Effective budget management across different departments requires strong collaboration and communication. I facilitate this through regular meetings, shared budget templates, and clear communication channels. We establish a common understanding of budget goals and priorities. Each department is involved in the budgeting process, providing input on their anticipated expenditures and resource needs. Regular progress reports and discussions ensure transparency and alignment. Conflict resolution mechanisms are also in place to manage disagreements effectively. Moreover, I promote a culture of shared responsibility for budget management, fostering cooperation and accountability across departments.

For instance, when working with the marketing and sales departments on a joint promotion, we’d collaboratively develop a budget, outlining each department’s contribution and outlining clear KPIs to measure success and demonstrate ROI.

Q 15. What is your approach to conflict resolution regarding budget allocations?

My approach to conflict resolution regarding budget allocations centers around open communication, collaborative problem-solving, and a focus on achieving the overall organizational goals. I believe in fostering a transparent environment where all stakeholders feel comfortable expressing their needs and concerns.

My process typically involves:

- Understanding the root cause of the conflict: This involves actively listening to each party involved to identify their priorities and concerns related to the budget allocation.

- Identifying shared goals: Even with differing opinions, there are usually overarching organizational objectives that everyone agrees on. Highlighting these shared goals can help find common ground.

- Exploring creative solutions: Instead of a zero-sum game, I encourage brainstorming sessions to find mutually beneficial solutions. This might involve re-prioritizing projects, seeking additional funding, or reallocating resources within existing budgets.

- Documenting agreements: Once a solution is reached, I ensure it’s clearly documented and communicated to all stakeholders. This minimizes misunderstandings and ensures accountability.

- Monitoring and evaluation: After implementing the solution, I regularly monitor its effectiveness and make adjustments as needed. This demonstrates ongoing commitment and helps build trust.

For example, in a previous role, two departments were vying for the same limited funds for new equipment. By facilitating a discussion, we discovered both departments needed improved efficiency, not necessarily the same type of equipment. We found a solution that allowed us to invest in software that improved the workflow for both departments, ultimately saving more money than the initial equipment requests.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain your understanding of cost-benefit analysis.

Cost-benefit analysis (CBA) is a systematic approach to evaluating the relative merits of different courses of action by comparing the total expected costs to the total expected benefits. It’s a crucial tool for making informed decisions about resource allocation. A strong CBA considers both qualitative and quantitative factors.

The process generally includes:

- Identifying all costs: This includes direct costs (materials, labor), indirect costs (overhead, administration), and opportunity costs (the value of forgone alternatives).

- Quantifying benefits: Benefits can be monetary (increased revenue, cost savings) or non-monetary (improved safety, enhanced reputation). Where possible, these should be expressed in monetary terms.

- Estimating the time horizon: The analysis needs to consider the timeframe over which costs and benefits will be incurred. A longer time horizon requires more robust forecasting.

- Discounting future cash flows: Because money received in the future is worth less than money received today (due to inflation and the time value of money), future cash flows need to be discounted back to their present value.

- Comparing net present value (NPV): The final step involves calculating the net present value of the project – the difference between the present value of benefits and the present value of costs. A positive NPV suggests the project is worthwhile.

For instance, deciding whether to invest in new software involves calculating the cost of the software, implementation, training, and ongoing maintenance against the potential benefits, such as increased productivity, reduced errors, and improved customer satisfaction (which can be quantified in terms of increased revenue or cost savings).

Q 17. How do you track and manage project costs throughout the project lifecycle?

Tracking and managing project costs throughout the project lifecycle requires a proactive and systematic approach. This typically involves a combination of tools and techniques.

My approach includes:

- Developing a detailed budget at the outset: This includes breaking down the project into smaller, manageable tasks and assigning costs to each. The budget should be reviewed and approved by relevant stakeholders.

- Regular cost monitoring and reporting: I use project management software and spreadsheets to track actual costs against the budget. Regular reports highlight variances and potential issues.

- Earned Value Management (EVM): This technique combines scope, schedule, and cost data to assess project performance and predict future costs. It provides early warnings of potential cost overruns.

- Change management procedures: Any changes to the project scope or requirements are documented and their impact on the budget is assessed before approval. This prevents uncontrolled cost increases.

- Regular meetings and communication: I hold regular meetings with the project team to review progress, identify potential cost issues, and brainstorm solutions. Open communication is essential.

For example, using a project management software like Asana or Jira, we can assign costs to tasks, track time spent, and generate reports that automatically compare actual costs to the planned budget. This allows for early detection and mitigation of cost overruns.

Q 18. How do you ensure the efficient use of resources?

Ensuring the efficient use of resources requires a multi-faceted approach that combines strategic planning, process optimization, and effective resource allocation.

My strategies include:

- Resource optimization techniques: This includes identifying underutilized resources, streamlining workflows, and eliminating redundancies. Lean methodologies and Six Sigma principles are helpful here.

- Capacity planning: This involves accurately forecasting resource needs based on project requirements and historical data. This prevents bottlenecks and ensures sufficient resources are available when needed.

- Skill and competency matching: Assigning tasks to individuals with the right skills and experience maximizes productivity and minimizes errors. This also allows for talent development within the team.

- Technology utilization: Investing in appropriate technology, such as automation tools and project management software, can significantly enhance resource efficiency and reduce manual effort.

- Regular review and improvement: Continuously evaluating resource utilization and identifying areas for improvement is vital. This involves regular analysis of project performance data and seeking feedback from the team.

For example, by analyzing project data, we might discover that certain tasks are consistently taking longer than anticipated. This might indicate a need for additional training, improved tools, or a revised workflow to improve efficiency.

Q 19. Describe a time you had to make tough decisions regarding resource allocation.

In a previous project, we faced a significant budget shortfall mid-way through the project lifecycle. We had underestimated the complexity of certain tasks, leading to cost overruns. We had three options: 1) Reduce the project scope significantly, 2) Seek additional funding (which was unlikely), or 3) Re-allocate resources from other less critical projects.

The decision was difficult as reducing the scope would impact the project’s overall objectives, and seeking additional funding was highly improbable given the current budget constraints. Therefore, I led a meeting with all project stakeholders to explain the situation clearly and transparently. We jointly evaluated the relative importance of all ongoing projects and prioritized those with the highest strategic value to the organization. We decided to temporarily reduce the scope of two lower-priority projects and re-allocate their resources to the critical project.

While this decision involved temporarily delaying some less crucial initiatives, it ensured we completed the most vital project successfully, minimizing the overall negative impact on the organization.

Q 20. What strategies do you use to improve budget efficiency?

Improving budget efficiency requires a holistic approach focusing on both cost reduction and revenue enhancement. My strategies include:

- Negotiating better deals with suppliers: This involves exploring alternative suppliers, leveraging volume discounts, and negotiating favorable payment terms.

- Improving procurement processes: Streamlining the procurement process can reduce administrative overhead and lead times.

- Implementing cost-saving measures: This could involve reducing energy consumption, optimizing travel expenses, and consolidating IT infrastructure.

- Adopting value engineering techniques: Value engineering involves examining every aspect of a project to identify ways to reduce costs without compromising quality or functionality.

- Investing in technology: Automation tools and software can significantly reduce labor costs and increase productivity.

- Improving operational efficiency: Streamlining workflows, improving communication, and eliminating redundancies can lead to substantial cost savings.

For example, by negotiating better contracts with suppliers, we were able to reduce material costs by 15%, which significantly improved our overall budget efficiency.

Q 21. How do you incorporate risk management into your budget planning?

Incorporating risk management into budget planning is crucial for ensuring the project stays on track and within budget. It’s not about avoiding risks entirely but about identifying, assessing, and mitigating potential threats to the budget.

My approach involves:

- Identifying potential risks: This involves brainstorming sessions with the project team and stakeholders to identify potential risks that could impact the budget. These could be related to changes in market conditions, technology failures, or unforeseen delays.

- Assessing the likelihood and impact of each risk: Each risk is evaluated based on its likelihood of occurring and its potential impact on the budget. This helps prioritize mitigation efforts.

- Developing contingency plans: For high-impact risks, contingency plans are developed to outline actions to be taken if the risk occurs. This might include allocating a reserve fund to cover potential cost overruns.

- Monitoring and reviewing risks: Risks are monitored throughout the project lifecycle and contingency plans are updated as needed. Regular reviews ensure that risks are addressed proactively.

- Using sensitivity analysis: This technique helps understand how changes in key variables (e.g., material costs, labor rates) will affect the budget. It highlights areas where the budget is most vulnerable.

For instance, if there’s a risk of a supplier delay, a contingency plan might involve sourcing materials from a second supplier or allocating additional time in the project schedule to account for potential delays. This proactive approach helps prevent significant budget overruns.

Q 22. Describe your experience with budgeting in different economic climates.

My experience with budgeting spans various economic climates, from periods of robust growth to times of recession and uncertainty. In booming economies, the focus often shifts to strategic investments and expansion, requiring detailed forecasting and meticulous allocation of resources to capitalize on opportunities. This involves robust scenario planning to account for potential market fluctuations and ensuring sufficient contingency funds are available. For instance, during a period of strong economic growth in the tech sector, I was responsible for managing a budget that allocated significant resources towards R&D and aggressive marketing campaigns. Conversely, during economic downturns, the emphasis changes to cost optimization and efficiency. This necessitates rigorous scrutiny of expenditures, identifying areas for reduction without compromising operational effectiveness. A key strategy during a recessionary period was to implement a zero-based budgeting approach, where every expense was justified from the ground up, leading to significant cost savings without impacting core business functions. In both scenarios, strong communication and collaboration across departments are crucial for aligning expectations and ensuring everyone understands the financial constraints and goals.

Q 23. What are some common challenges in budget control and how do you overcome them?

Common challenges in budget control include inaccurate forecasting, unexpected expenses, lack of communication, and inadequate monitoring. Inaccurate forecasting stems from using unreliable data or failing to consider external factors. To overcome this, I rely on data-driven forecasting techniques, incorporating historical data, market analysis, and expert insights to create more realistic projections. Unexpected expenses, like equipment malfunctions or regulatory changes, can derail a budget. Building contingency funds and implementing robust risk management processes are crucial to mitigate these issues. A proactive approach to identifying potential risks and developing mitigation strategies is key. Poor communication between departments can lead to budget overruns. Regular budget reviews, transparent reporting, and clear communication channels are essential for alignment and accountability. Finally, inadequate monitoring can hinder early detection of problems. Utilizing real-time dashboards and automated reporting systems allows for proactive identification and resolution of issues. Think of it like managing a household budget – you need a plan, regular check-ups, and a safety net for unexpected expenses.

Q 24. How do you stay up-to-date with changes in budgeting and financial regulations?

Staying current with budgeting and financial regulations requires a multifaceted approach. I regularly subscribe to and read industry publications like the Journal of Finance and Harvard Business Review to stay abreast of best practices and emerging trends. I actively participate in professional development workshops and conferences organized by organizations like the Association for Financial Professionals (AFP). These events provide valuable insights into the latest regulatory changes and technological advancements in the field. Furthermore, I maintain a network of contacts within the financial community through professional associations and online forums. This network serves as a valuable resource for discussing challenges and sharing best practices. Finally, I leverage online resources and government websites to access updated regulatory information and compliance guidelines. Staying informed is an ongoing process; it’s not a one-time task but rather a continuous effort.

Q 25. What are your strengths and weaknesses in budget control and resource management?

My strengths lie in my analytical skills, proactive approach to problem-solving, and ability to build consensus among stakeholders. I’m adept at analyzing complex financial data to identify trends and develop effective budget strategies. My proactive nature allows me to anticipate potential challenges and take preventative measures. And I excel at building strong relationships and fostering collaboration, enabling effective communication and budget alignment across teams. My weakness, if I had to identify one, is my occasional tendency to take on too much responsibility, potentially sacrificing attention to detail in some areas. To mitigate this, I’m actively working on improving my delegation skills and time management techniques, prioritizing tasks effectively and assigning responsibilities where appropriate.

Q 26. How do you measure the success of your budget management strategies?

Measuring the success of budget management strategies involves a multi-pronged approach. Firstly, variance analysis is crucial – comparing actual spending against the budgeted amounts to identify areas of overspending or underspending. This helps pinpoint areas needing attention. Secondly, key performance indicators (KPIs) tailored to specific business objectives are vital. These might include return on investment (ROI) for projects, cost per unit produced, or customer acquisition cost. Meeting or exceeding these KPIs signifies successful budget management. Thirdly, conducting post-implementation reviews allows for valuable lessons to be learned for future budgeting cycles. These reviews analyze both successes and failures, providing insights for continuous improvement. Finally, regular reporting and dashboards provide real-time visibility into budget performance and facilitate timely corrective actions. Success isn’t just about staying within budget, but also about achieving organizational goals within the allocated resources.

Q 27. Describe a time you had to revise a budget due to unforeseen circumstances.

In a previous role, we faced an unexpected surge in raw material costs due to a natural disaster impacting a key supplier. This significantly threatened our project budget, as material costs represented a substantial portion of our overall expenses. To address this, we immediately initiated a comprehensive budget revision process. We first conducted a thorough assessment of the impact of the price increase on the project timeline and deliverables. Then, we explored several options, including renegotiating contracts with suppliers, seeking alternative materials, and streamlining processes to minimize material usage. We also explored securing additional funding through internal reallocation or external financing. Ultimately, we opted for a combination of strategies, renegotiating contracts for better pricing and implementing process improvements to reduce material wastage. This required extensive communication and collaboration with the procurement, production, and finance teams. The revised budget, while reflecting the increased material costs, minimized their impact by strategically optimizing resources and operations. The successful adaptation demonstrated our ability to swiftly respond to unforeseen circumstances and maintain project viability.

Key Topics to Learn for Budget Control and Resource Management Interview

- Budgeting Fundamentals: Understanding budgeting principles, different budgeting methods (e.g., zero-based budgeting, incremental budgeting), and the budget cycle.

- Financial Forecasting and Analysis: Developing accurate financial forecasts, analyzing variances between planned and actual results, and identifying trends.

- Resource Allocation: Strategic allocation of resources (human, financial, material) based on organizational priorities and project needs. This includes understanding cost-benefit analysis and return on investment (ROI).

- Performance Measurement and Reporting: Developing key performance indicators (KPIs) to track budget performance, preparing regular budget reports, and communicating findings effectively to stakeholders.

- Cost Control and Variance Analysis: Identifying and analyzing cost variances, implementing corrective actions to stay within budget, and understanding cost drivers.

- Risk Management in Budgeting: Identifying and mitigating potential risks that could impact budget performance, including contingency planning.

- Software and Tools: Familiarity with budgeting and financial planning software (mention general categories, not specific software names to remain generic).

- Ethical Considerations: Understanding ethical implications related to budget management and resource allocation.

- Problem-Solving and Decision-Making: Demonstrating the ability to analyze complex financial data, identify problems, and develop effective solutions within budgetary constraints.

Next Steps

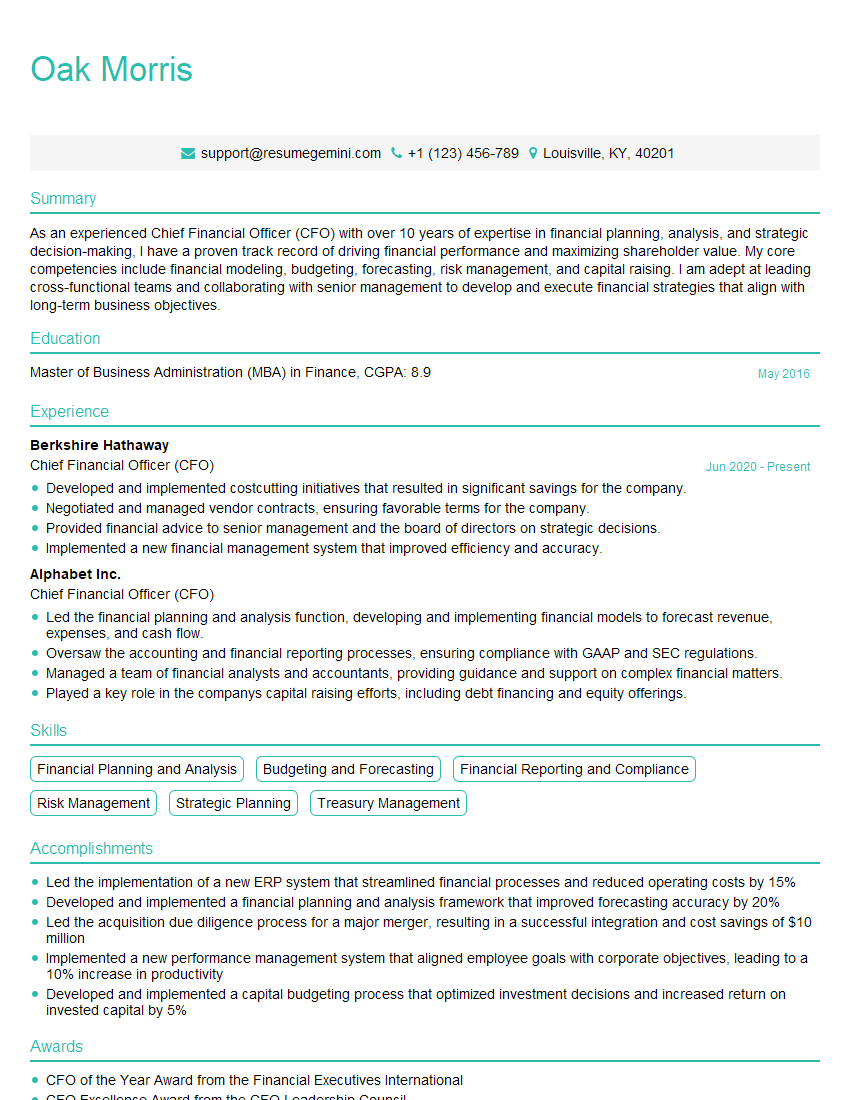

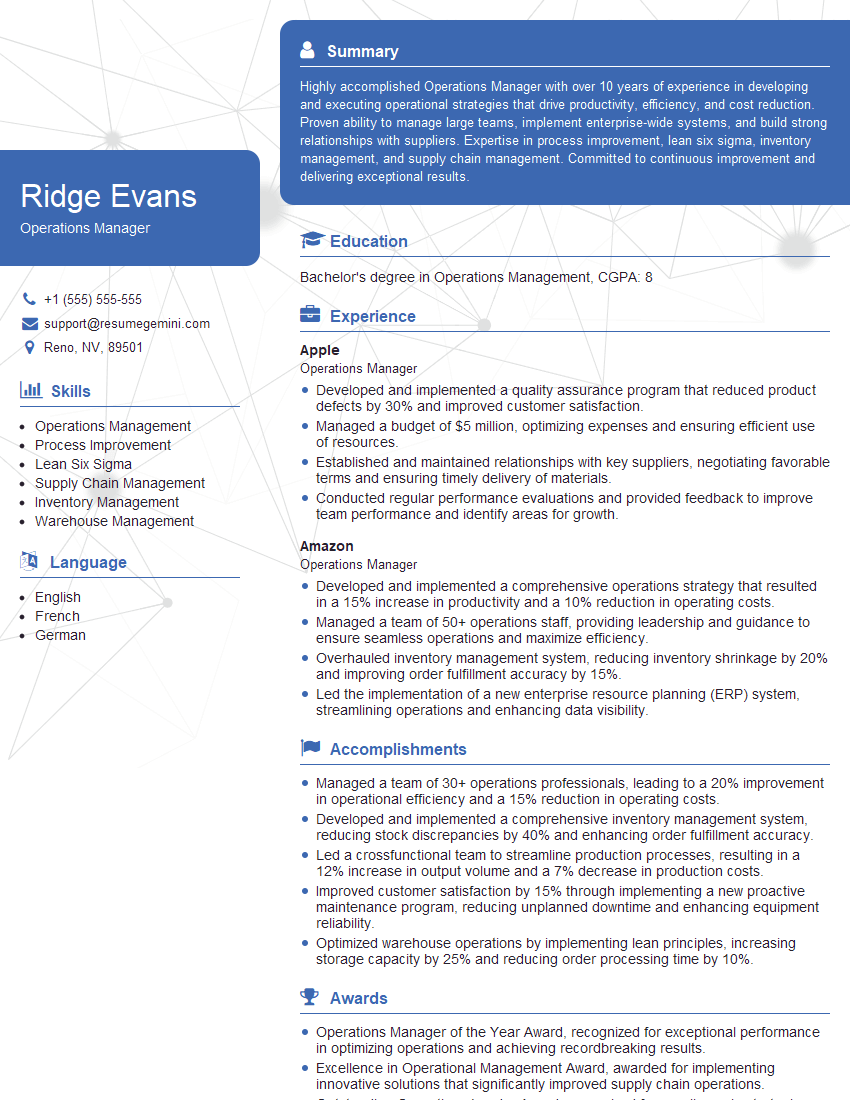

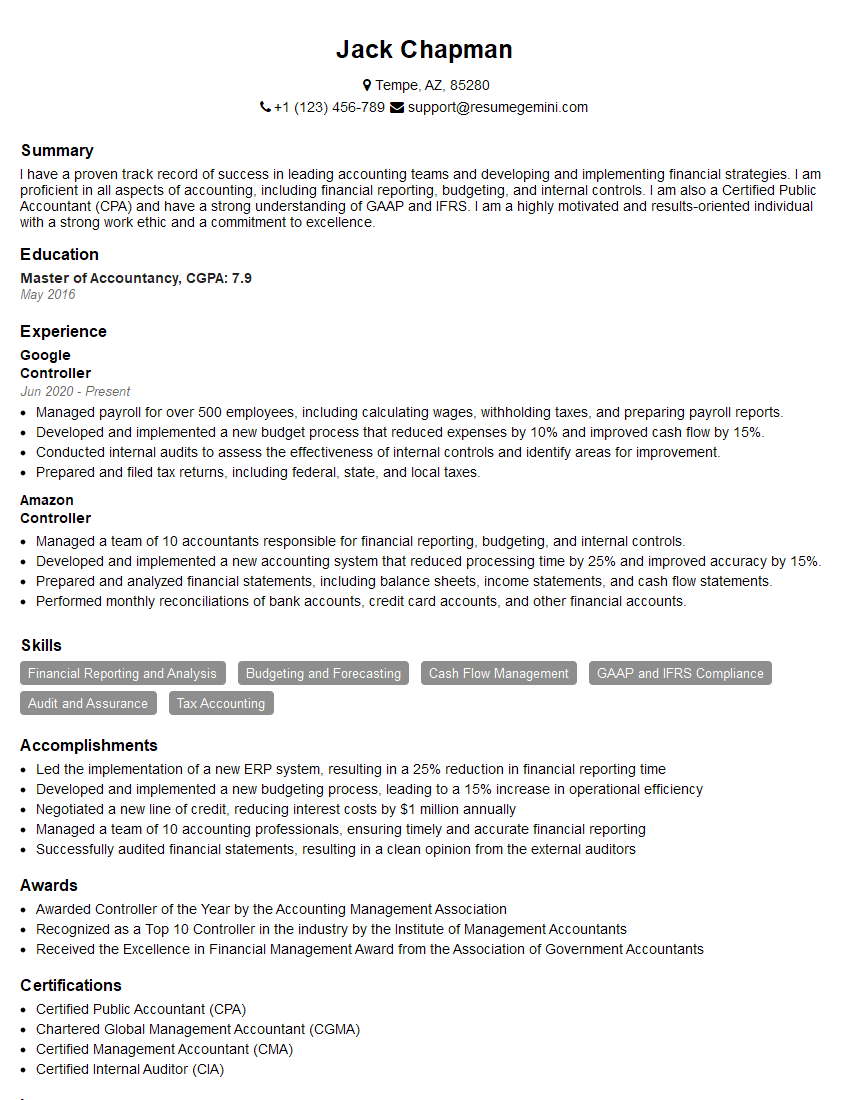

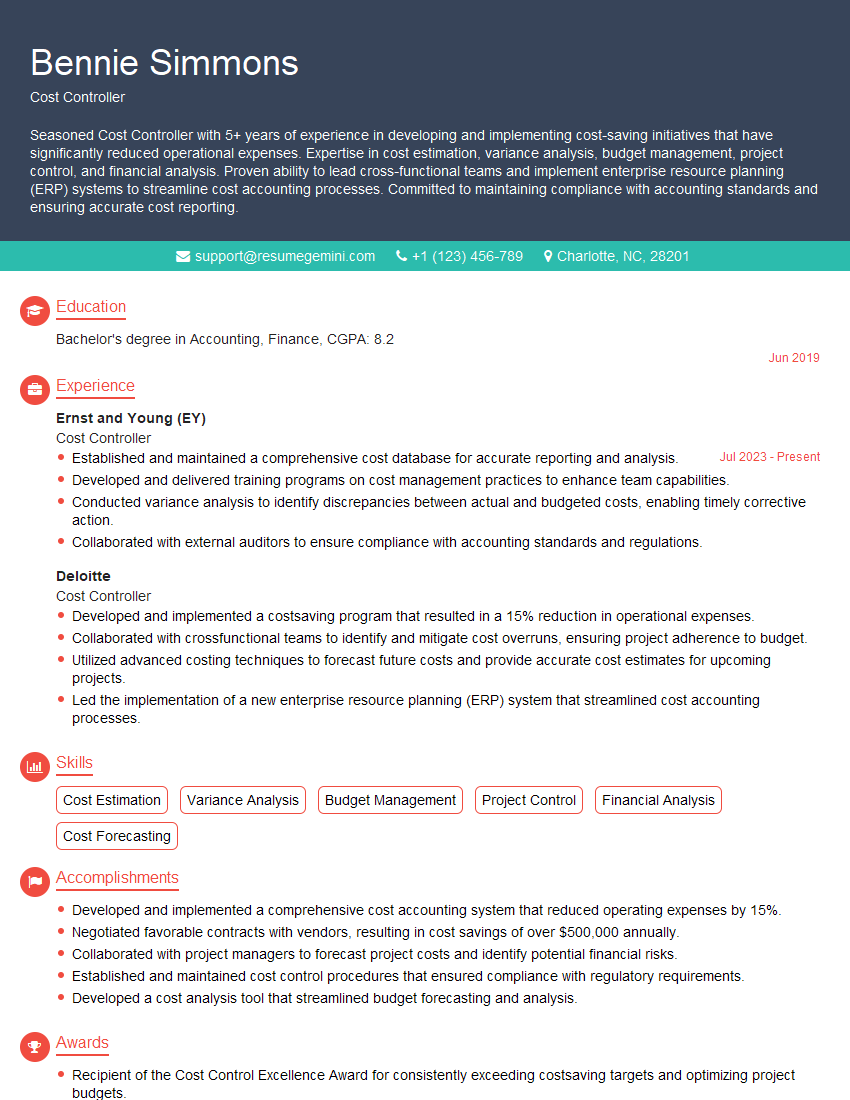

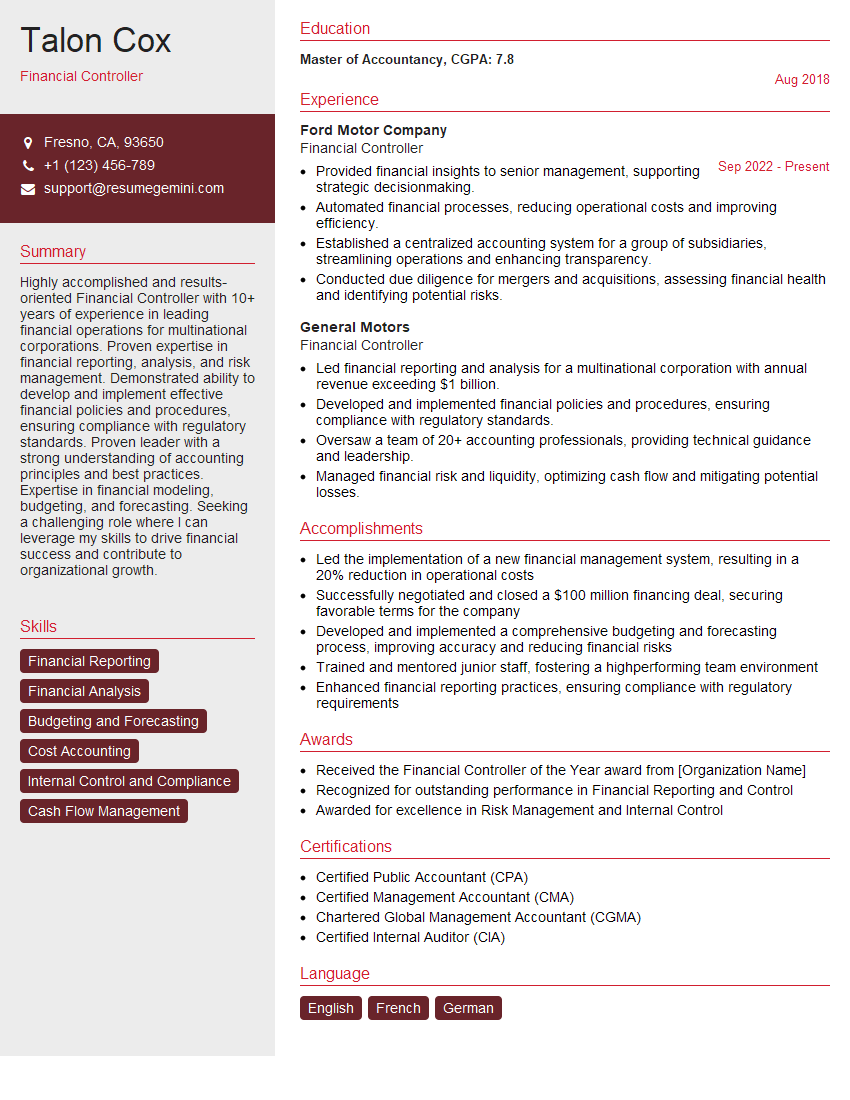

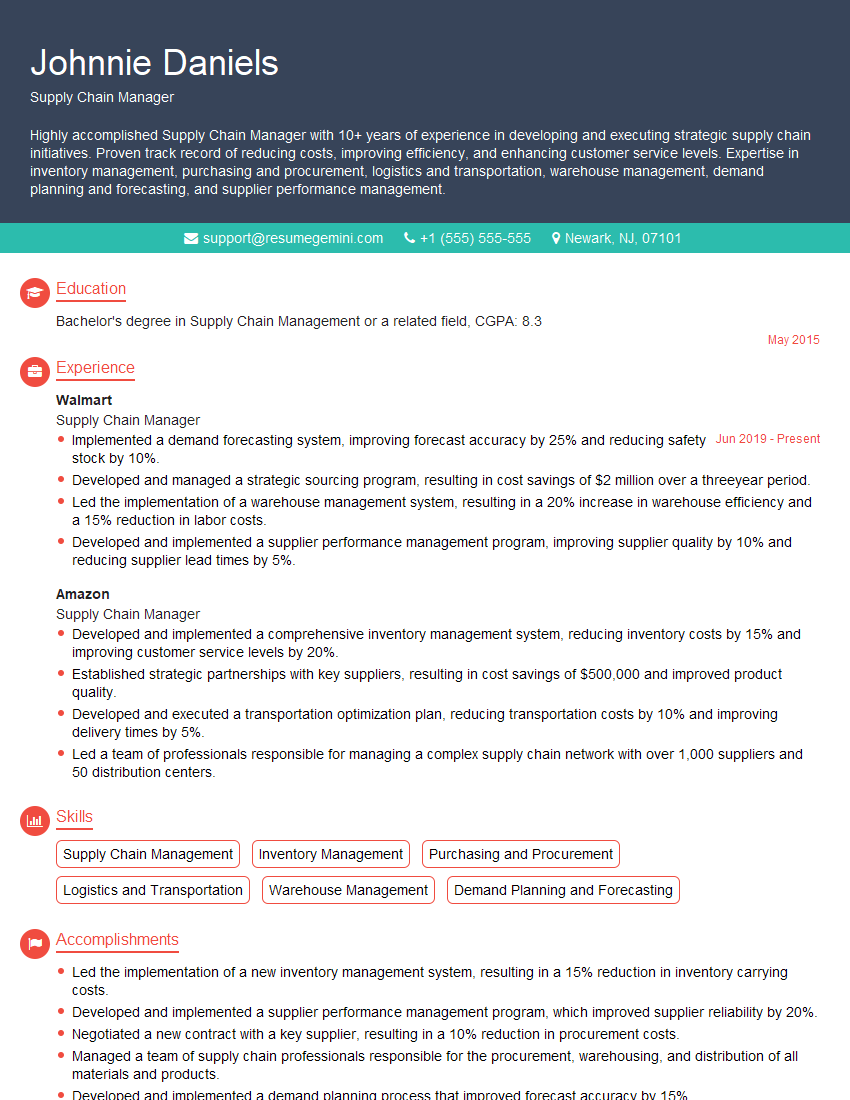

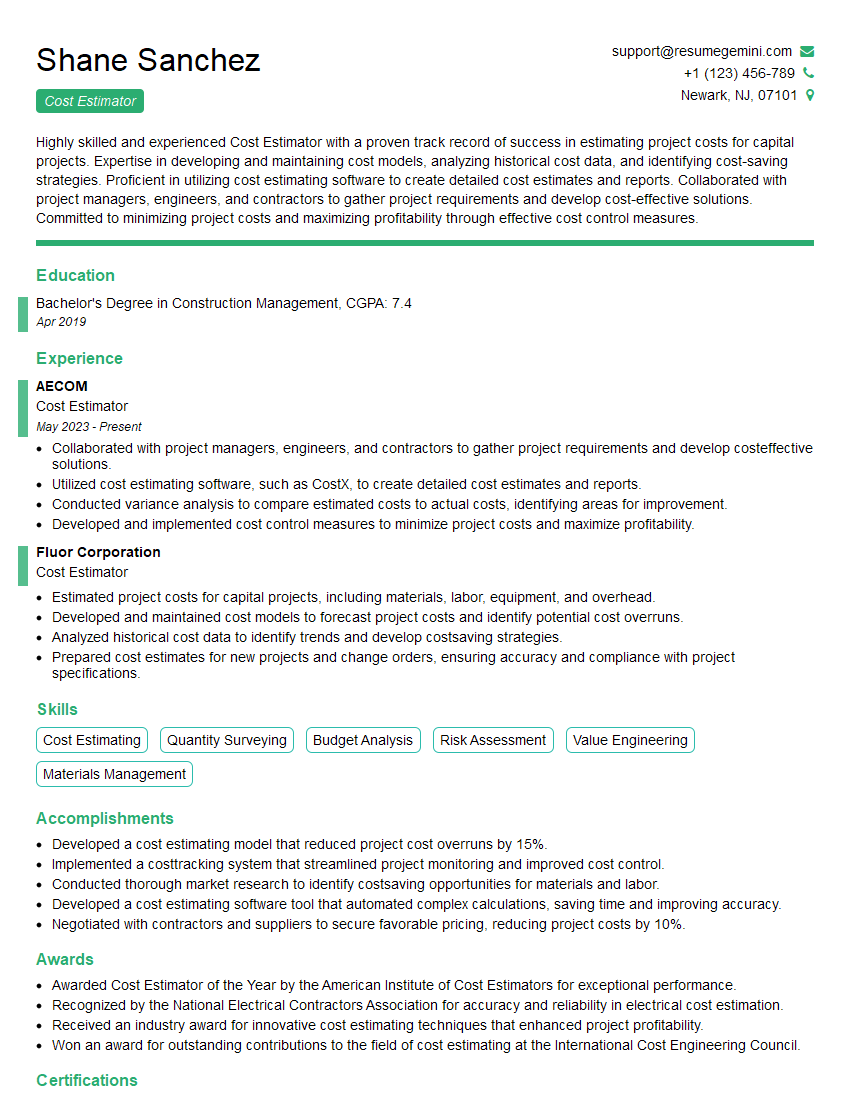

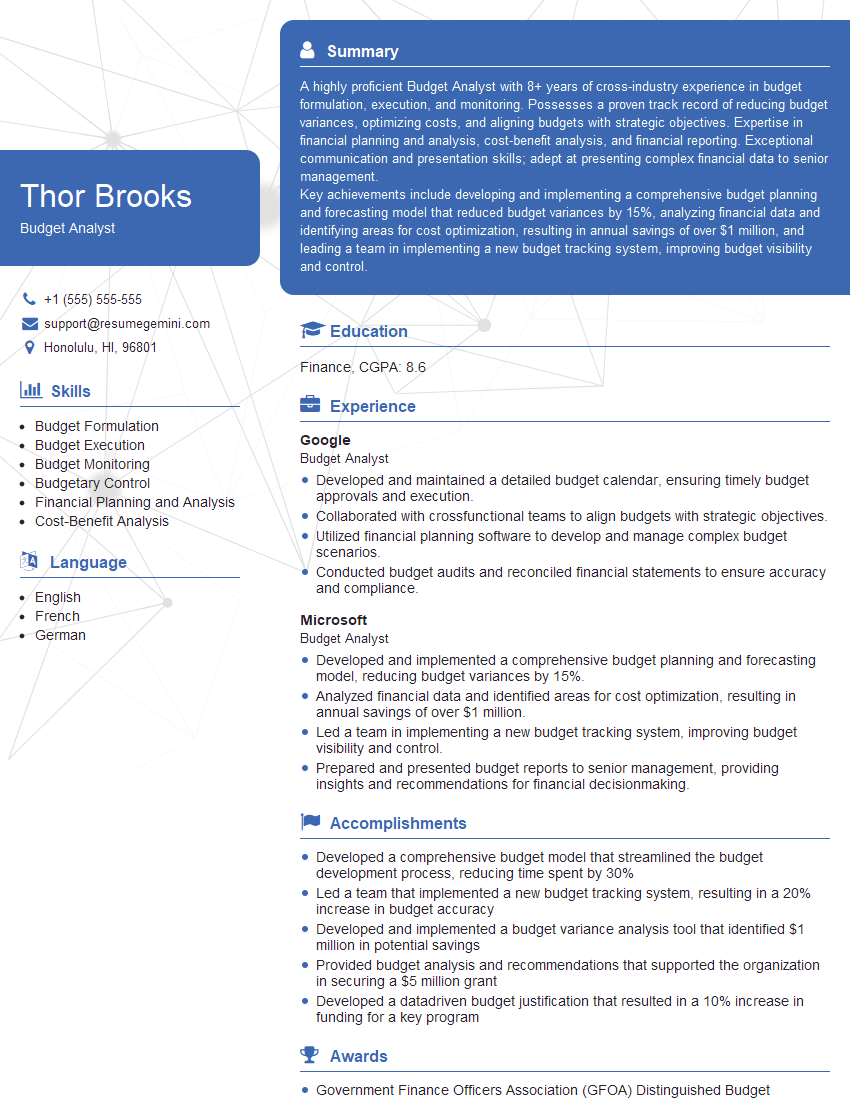

Mastering Budget Control and Resource Management is crucial for career advancement in finance and related fields. It demonstrates a strong understanding of financial planning, analytical skills, and strategic thinking – highly sought-after qualities in today’s competitive job market. To increase your chances of landing your dream role, crafting a compelling and ATS-friendly resume is essential. ResumeGemini can be a valuable tool to help you build a professional and impactful resume that highlights your skills and experience in Budget Control and Resource Management. ResumeGemini provides examples of resumes tailored to this specific field, making the process easier and more effective. Invest time in creating a strong resume – it’s your first impression with potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good