Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Business and Market Analysis interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Business and Market Analysis Interview

Q 1. Explain your understanding of market segmentation.

Market segmentation is the process of dividing a broad consumer or business market, normally consisting of existing and potential customers, into sub-groups of consumers based on some type of shared characteristics. This allows businesses to target their marketing efforts more effectively, tailoring their products, services, and messaging to resonate with specific customer segments.

For example, instead of trying to sell running shoes to everyone, a company might segment the market by age (youth, adult, senior), activity level (beginner, intermediate, advanced), or even preferred running surface (road, trail). This allows them to create shoes with features and marketing campaigns that appeal directly to each segment, improving sales and brand loyalty.

Common segmentation bases include:

- Demographic: Age, gender, income, education, occupation, family size, etc.

- Geographic: Location, climate, population density, etc.

- Psychographic: Lifestyle, values, attitudes, interests, personality, etc.

- Behavioral: Purchase history, brand loyalty, usage rate, benefits sought, etc.

Effective segmentation leads to more focused marketing strategies and ultimately higher return on investment.

Q 2. Describe a time you identified a market opportunity.

During my time at [Previous Company Name], we noticed a growing trend of consumers seeking healthier, convenient meal options. While many companies were focusing on pre-packaged frozen meals, we identified a gap in the market for fresh, ready-to-eat meal kits targeting busy professionals. Our research indicated a strong demand for high-quality ingredients, portion control, and minimal cooking time. This wasn’t simply about convenience; it was about a desire for healthier eating without sacrificing time or taste.

We validated this opportunity through surveys, focus groups, and competitive analysis. We found that while existing meal delivery services existed, none were effectively addressing the specific needs of this busy professional demographic with the focus on both freshness and health. This insight allowed us to develop a successful product line that quickly gained market traction and significantly increased revenue for the company.

Q 3. How would you analyze the competitive landscape of a new product?

Analyzing a new product’s competitive landscape requires a systematic approach. I would use a framework that combines several key steps:

- Identify Key Competitors: This includes direct competitors offering similar products, indirect competitors offering substitutes, and potential future entrants.

- Competitive Profiling: Create profiles for each competitor, detailing their strengths, weaknesses, market share, target audience, pricing strategy, marketing efforts, and overall competitive advantage.

- Market Share Analysis: Determine the market share of each competitor to understand the competitive dynamics and identify any dominant players.

- Competitive Advantage Assessment: Evaluate your own product’s competitive advantages compared to those of your competitors. What makes your product unique and desirable?

- SWOT Analysis (Competitor Perspective): Conduct a SWOT analysis for each key competitor to understand their internal and external factors influencing their success and vulnerability.

- Competitive Matrix: Use a matrix (e.g., Porter’s Five Forces) to analyze the overall attractiveness of the market and identify opportunities and threats.

Ultimately, the goal is to identify market gaps, opportunities for differentiation, and potential competitive threats to inform product development, marketing strategy, and pricing decisions.

Q 4. What are the key metrics you would track to measure market success?

The key metrics for measuring market success depend on the specific goals and context, but generally include:

- Market Share: The percentage of the total market that your product controls.

- Revenue Growth: The rate at which your revenue is increasing over time.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Lifetime Value (CLTV): The total revenue generated by a customer over their relationship with the company.

- Customer Churn Rate: The percentage of customers who stop using your product or service.

- Brand Awareness: The level of familiarity and recognition of your brand among the target market.

- Customer Satisfaction (CSAT): Measured through surveys and feedback, reflecting how happy customers are with your product/service.

- Net Promoter Score (NPS): A metric that gauges customer loyalty and willingness to recommend your product/service.

By tracking these metrics, we can gain a holistic view of market performance and make data-driven decisions to optimize strategies.

Q 5. Explain your experience with SWOT analysis.

SWOT analysis is a fundamental strategic planning tool that assesses the internal Strengths and Weaknesses of an organization and the external Opportunities and Threats it faces. I’ve used it extensively throughout my career for various business decisions, from launching new products to entering new markets.

For example, when considering launching a new product, I would conduct a SWOT analysis, considering:

- Strengths: Internal positive attributes, such as strong brand reputation, innovative technology, efficient operations.

- Weaknesses: Internal limitations, such as limited resources, lack of expertise in a specific area, outdated technology.

- Opportunities: External factors that could benefit the organization, such as emerging market trends, unmet customer needs, government regulations.

- Threats: External factors that could harm the organization, such as intense competition, economic downturns, changing consumer preferences.

The SWOT analysis helps prioritize actions, mitigate risks, and capitalize on opportunities. It’s a crucial tool for making informed decisions and developing effective strategies.

Q 6. How would you interpret a regression analysis report?

Interpreting a regression analysis report involves understanding the statistical significance of the coefficients, the overall fit of the model, and the potential limitations.

A typical report shows:

- Coefficients: These indicate the relationship between each independent variable and the dependent variable. A positive coefficient means a positive relationship, while a negative coefficient indicates a negative relationship. The magnitude of the coefficient represents the strength of the relationship.

- P-values: These indicate the statistical significance of each coefficient. A p-value less than a predetermined significance level (e.g., 0.05) suggests that the relationship between the independent and dependent variable is statistically significant, and not due to random chance.

- R-squared: This value represents the proportion of variance in the dependent variable that is explained by the independent variables. A higher R-squared indicates a better fit of the model.

- Adjusted R-squared: A modified version of R-squared that adjusts for the number of independent variables in the model, preventing overfitting.

- Standard error: A measure of the variability of the model’s predictions.

Example: If a regression analysis shows a positive and statistically significant coefficient for advertising spending and sales, it suggests that increasing advertising spending is likely to lead to an increase in sales.

It is crucial to consider potential limitations such as multicollinearity (high correlation between independent variables), outliers, and the assumptions of the regression model (linearity, independence of errors, etc.) before drawing definitive conclusions.

Q 7. Describe your experience with data visualization tools.

I have extensive experience with various data visualization tools, including Tableau, Power BI, and Python libraries such as Matplotlib and Seaborn. I leverage these tools to create insightful and compelling visualizations for different audiences, from executive summaries to detailed technical reports.

For instance, I used Tableau to create interactive dashboards showing key market trends, customer segmentation analysis, and sales performance. The dashboards allowed stakeholders to easily explore the data, identify patterns, and make informed decisions. In other projects, I utilized Python libraries to create customized visualizations tailored to specific analytical needs, allowing for flexibility and precision not always found in off-the-shelf tools.

My experience includes creating:

- Line charts: To visualize trends over time.

- Bar charts: To compare different categories.

- Scatter plots: To explore relationships between two variables.

- Maps: To visualize geographic data.

- Interactive dashboards: To allow users to explore data dynamically.

Data visualization is not just about creating pretty pictures; it’s about effectively communicating insights and fostering data-driven decision-making. I strive to create clear, concise, and impactful visualizations that tell a compelling story with the data.

Q 8. Explain the difference between qualitative and quantitative market research.

Qualitative and quantitative market research are two distinct approaches to understanding consumer behavior and market dynamics. They differ fundamentally in their data collection methods and the type of insights they provide.

Qualitative research focuses on exploring in-depth understanding of underlying opinions, reasons, assumptions, and motivations. It uses methods like focus groups, in-depth interviews, and ethnographic studies to gather rich, descriptive data. Think of it as getting the ‘why’ behind consumer actions. For example, a qualitative study might explore the emotional connection consumers feel towards a particular brand through open-ended interviews.

Quantitative research, conversely, emphasizes numerical data and statistical analysis to quantify market characteristics and establish relationships between variables. Surveys, experiments, and observational studies using structured questionnaires or instruments are common quantitative methods. The focus is on ‘how many’ or ‘how much’. For instance, a quantitative study might measure the market share of a product through a large-scale survey with multiple-choice questions.

In essence, qualitative research provides deep understanding while quantitative research provides broad overview. Often, they are complementary, with qualitative research used to inform hypotheses that are later tested quantitatively.

Q 9. How do you handle conflicting data from different sources?

Conflicting data from various sources is a common challenge in market analysis. Addressing this requires a systematic approach:

- Source Evaluation: First, I assess the credibility and reliability of each source. This involves considering the source’s reputation, methodology, potential biases, and sample size. A government report, for example, generally holds more weight than an anonymous online forum.

- Data Triangulation: If possible, I look for converging evidence from multiple reliable sources. If several credible sources point towards the same conclusion, it strengthens the validity of the findings. Discrepancies, however, need further investigation.

- Data Reconciliation: I attempt to identify the root cause of the conflict. This might involve examining differences in data collection methods, timeframes, or target populations. For instance, conflicting sales figures could stem from differences in accounting practices across different regions.

- Sensitivity Analysis: I may incorporate the conflicting data into a model and perform a sensitivity analysis to understand how much each data point influences the final results. This helps determine the impact of the discrepancy on the overall conclusion.

- Qualitative Insights: In some cases, qualitative research can help resolve conflicting quantitative data. For example, if sales figures are lower than expected, focus groups might reveal that consumers are having difficulty using the product, explaining the discrepancy.

Ultimately, the goal is to arrive at the most accurate and nuanced understanding of the market, acknowledging the limitations and uncertainties inherent in any data.

Q 10. Describe a time you had to make a data-driven decision.

During a product launch strategy for a new mobile app, we had conflicting data regarding target audience preferences. Initial quantitative survey data suggested a strong preference for a feature-rich, complex app. However, qualitative feedback from user interviews revealed that simplicity and ease of use were prioritized. This conflict could have led to a costly mistake.

To resolve this, I employed a multi-step approach. First, I segmented the survey respondents based on various demographic and psychographic factors, uncovering that the preference for complexity was mainly driven by a specific segment, primarily tech-savvy users. Second, I weighted the qualitative data based on the relative size and importance of each user segment. This led to a data-driven decision to develop a simplified core version of the app with options to add more features for advanced users through in-app purchases. This strategy proved successful, balancing the needs of all target segments and resulted in higher adoption rates.

Q 11. How familiar are you with different forecasting methods?

I’m proficient in a range of forecasting methods, selecting the most appropriate technique based on the context and data availability. Some commonly used methods include:

- Time Series Analysis: Methods such as ARIMA, exponential smoothing, and moving averages are useful for forecasting future values based on historical data. This is particularly relevant for predicting sales trends or customer churn.

- Regression Analysis: This involves identifying relationships between a dependent variable (e.g., sales) and independent variables (e.g., price, advertising spend). Linear regression, multiple regression, and logistic regression are frequently applied.

- Causal Forecasting: Methods such as econometric modeling explore the causal relationships between variables to predict future outcomes. This requires strong theoretical understanding of the underlying economic or market forces.

- Qualitative Forecasting: Techniques such as Delphi method and market research surveys are invaluable when historical data is scarce or unreliable, relying instead on expert judgment and market insights.

My experience also encompasses understanding forecast accuracy and limitations, particularly the importance of considering potential error margins and regularly updating forecasts as new data becomes available.

Q 12. Explain your experience with statistical software (e.g., SPSS, R, Python).

I have extensive experience using statistical software packages such as SPSS, R, and Python. My skills include data cleaning, transformation, and exploratory data analysis (EDA) using these tools. I’m comfortable performing various statistical tests such as t-tests, ANOVA, regression analysis, and hypothesis testing. In Python, I utilize libraries like pandas for data manipulation, scikit-learn for machine learning, and matplotlib and seaborn for data visualization. In R, I’m skilled with packages like dplyr, ggplot2, and various statistical modeling packages. In SPSS, I’m proficient in running advanced statistical procedures and creating insightful reports.

Furthermore, I understand the importance of data visualization in communicating complex findings effectively, producing charts and graphs that simplify insights for stakeholders with varying levels of analytical skills.

Q 13. How would you define market size and potential?

Market size refers to the overall revenue or units sold within a specific market during a particular period. It represents the current scale of the market. For example, the market size of the global smartphone market in 2023 could be measured in terms of total revenue generated from smartphone sales.

Market potential, on the other hand, represents the total potential revenue or units that could be sold within a market under ideal conditions. This is an estimation of the maximum possible market size, considering factors like future growth and unmet demand. For example, the market potential for electric vehicles could be significantly larger than the current market size, considering factors such as technological advancements and government incentives. Estimating market potential involves considerable forecasting and assumptions.

Q 14. How do you approach analyzing customer behavior?

Analyzing customer behavior is a crucial aspect of market analysis. My approach involves a multi-faceted strategy:

- Data Collection: I leverage multiple data sources including transactional data, website analytics, social media monitoring, customer surveys, and CRM data. Each source provides unique insights into different aspects of customer behavior.

- Segmentation: I segment customers based on demographics, psychographics, purchase history, and other relevant attributes to identify distinct groups with shared characteristics. This allows for targeted marketing and product development strategies.

- Customer Journey Mapping: I create customer journey maps to visualize the customer’s experience with a product or service, identifying pain points and areas for improvement. This aids in understanding the customer experience from initial awareness to post-purchase interactions.

- Statistical Analysis: I employ statistical methods like regression analysis, clustering, and association rule mining to uncover relationships between customer attributes and behaviors. This might reveal patterns in purchasing behavior or predict future actions.

- Qualitative Insights: I supplement quantitative data with qualitative insights from focus groups, interviews, and social media listening to gain a deeper understanding of the motivations and underlying reasons behind customer behavior.

The ultimate goal is to build a comprehensive understanding of customer behavior to inform strategic decisions regarding product development, marketing, and customer service.

Q 15. What is your experience with A/B testing?

A/B testing, also known as split testing, is a randomized experiment where two or more versions of a webpage, email, or other marketing asset are shown to different groups of users to determine which version performs better. It’s a cornerstone of data-driven decision-making. In my experience, I’ve used A/B testing extensively to optimize various aspects of online businesses, from landing page conversion rates to email open and click-through rates.

For example, in a recent project for an e-commerce client, we A/B tested two different versions of their product page: one with a prominent call-to-action button and another with a more subtle approach. The version with the prominent button resulted in a 15% increase in conversions, demonstrating the value of data-driven optimization. The process typically involves defining a clear hypothesis, selecting metrics to track (e.g., click-through rate, conversion rate), segmenting the audience, running the test for a statistically significant duration, and finally, analyzing the results to determine a winning variant. I am proficient in using tools like Google Optimize and Optimizely to facilitate this process.

Beyond simple button changes, A/B testing has been instrumental in refining copy, images, and even the overall layout of websites to improve user experience and ultimately, business outcomes. It’s a continuous process of improvement based on hard data, not guesswork.

Career Expert Tips:

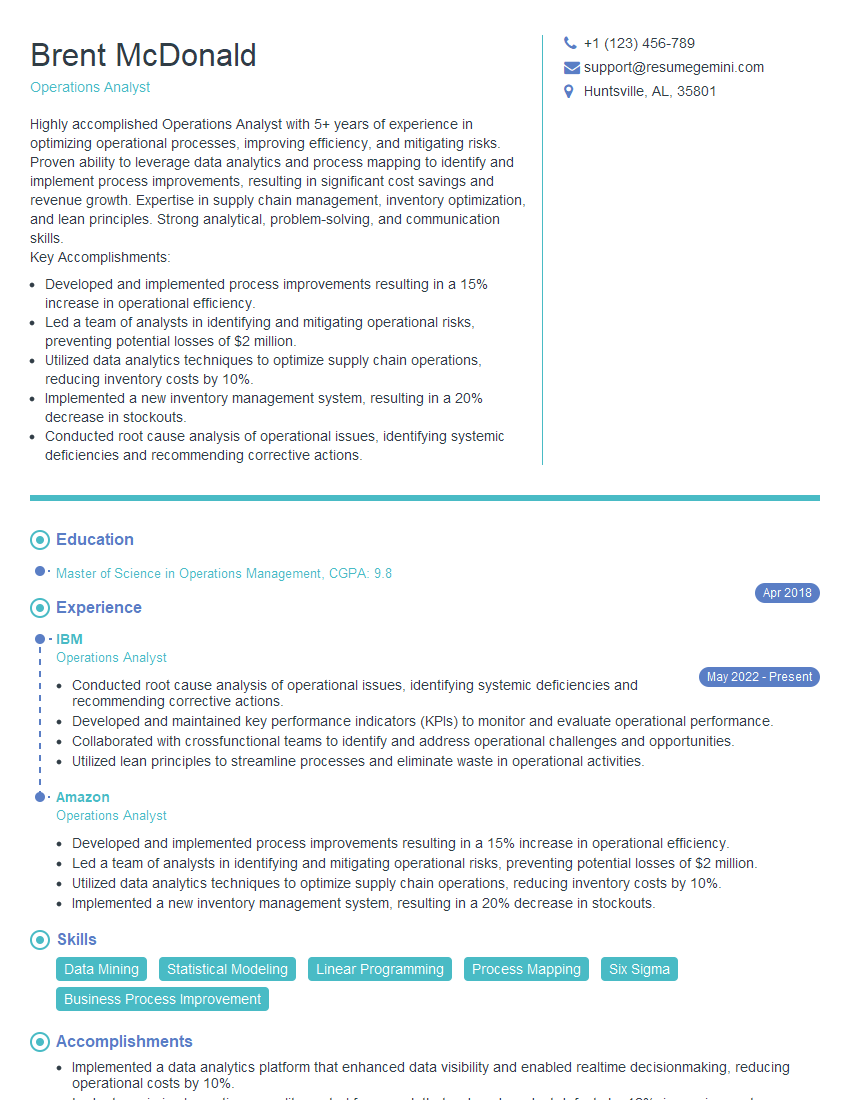

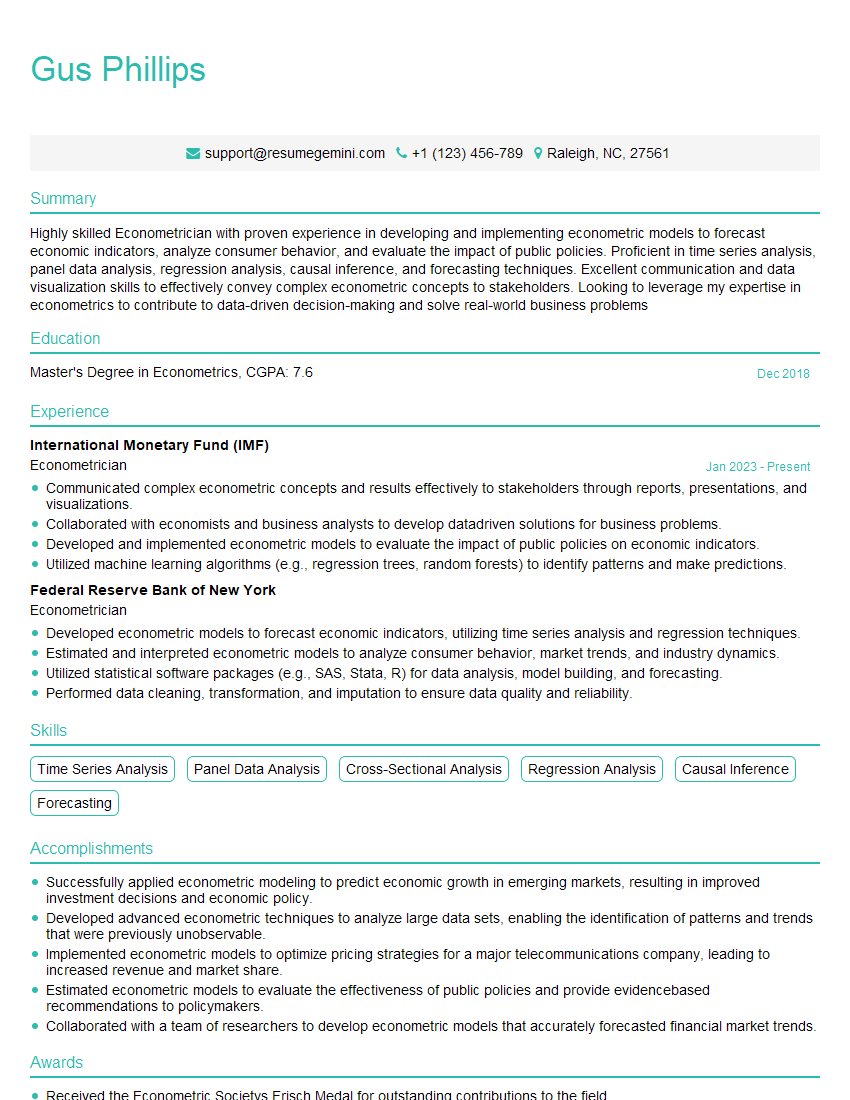

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with market trend analysis.

Market trend analysis involves identifying patterns and shifts in consumer behavior, competition, and technological advancements. My experience includes utilizing both qualitative and quantitative methods to understand these trends. I regularly track industry publications, news articles, and social media conversations to identify emerging trends. I also leverage market research reports, economic indicators, and data analytics tools to quantitatively assess market trends.

For instance, while working on a market entry strategy for a sustainable food company, I analyzed trends related to consumer preferences for organic products, plant-based diets, and ethical sourcing. This involved analyzing sales data from competing brands, consumer surveys, and social media sentiment analysis to gain a holistic view of the market. This allowed us to accurately position the product and anticipate potential market shifts.

The key to effective market trend analysis is to combine various data sources, ensuring a balanced view and avoiding reliance on any single source. It’s about connecting the dots to paint a comprehensive picture of the future market landscape, helping businesses proactively adapt and capitalize on new opportunities.

Q 17. How would you identify key performance indicators (KPIs) for a new business?

Identifying KPIs for a new business is crucial for tracking progress and making data-driven decisions. The specific KPIs will depend on the business model and stage of development. However, some universal KPIs include revenue, customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate.

For example, a new SaaS (Software as a Service) company might focus on monthly recurring revenue (MRR) as a primary KPI, complemented by customer churn rate to monitor customer retention. A new e-commerce business might focus on conversion rates, average order value (AOV), and website traffic. It’s important to select KPIs that are relevant, measurable, achievable, relevant, and time-bound (SMART).

Furthermore, for a new business, it’s essential to track early-stage metrics that signal future success. For example, early engagement metrics like app downloads or website signups, and feedback metrics like customer satisfaction scores can help predict long-term growth. Regularly reviewing and adjusting the KPI dashboard is essential to ensure you’re measuring the right things at the right time as the business evolves.

Q 18. Explain your understanding of Porter’s Five Forces.

Porter’s Five Forces is a framework for analyzing the competitive intensity and attractiveness of an industry. It helps businesses understand the forces that shape profitability and inform strategic decisions. The five forces are:

- Threat of New Entrants: How easy is it for new competitors to enter the market?

- Bargaining Power of Suppliers: How much power do suppliers have to raise prices or reduce quality?

- Bargaining Power of Buyers: How much power do customers have to negotiate lower prices or demand higher quality?

- Threat of Substitute Products or Services: Are there alternative products or services that customers can switch to?

- Rivalry Among Existing Competitors: How intense is the competition among existing players in the market?

By analyzing each force, a business can understand its competitive position and identify opportunities and threats. For example, a high threat of new entrants might signal the need for a strong brand and economies of scale. High buyer power might necessitate differentiating products or offering exceptional customer service. Understanding these forces guides strategic choices regarding pricing, product development, and market positioning.

Q 19. How would you assess the financial viability of a new market entry?

Assessing the financial viability of a new market entry requires a thorough analysis of potential revenues, costs, and risks. This typically involves creating a detailed financial model that projects key financial metrics over a specific time horizon (e.g., 3-5 years).

The model should incorporate factors such as initial investment costs (e.g., marketing, R&D, infrastructure), operating costs (e.g., salaries, rent, marketing expenses), revenue projections (based on market size, pricing strategy, and sales forecasts), and potential risks (e.g., economic downturns, competitive pressures, regulatory changes). Key metrics to analyze include net present value (NPV), internal rate of return (IRR), and payback period. A positive NPV and an IRR above the cost of capital indicate financial viability.

Sensitivity analysis is also critical. This involves adjusting key assumptions (e.g., sales volume, pricing) to see how changes affect the financial projections. This helps identify the most critical uncertainties and potential risks to the project. A robust financial model, combined with a realistic assessment of market risks and opportunities, is vital for making informed decisions about market entry.

Q 20. Describe your experience with pricing strategies.

Pricing strategies are crucial for profitability and market positioning. My experience encompasses various strategies, each with its own strengths and weaknesses. These include:

- Cost-plus pricing: Adding a markup to the cost of goods sold.

- Value-based pricing: Setting prices based on the perceived value to the customer.

- Competitive pricing: Pricing products in relation to competitors’ prices.

- Premium pricing: Charging a higher price to signal superior quality or exclusivity.

- Penetration pricing: Setting a low price to gain market share quickly.

- Price skimming: Setting a high price initially, then gradually lowering it over time.

The choice of strategy depends on factors such as the product’s uniqueness, the competitive landscape, customer price sensitivity, and the overall business goals. For example, a new innovative product might warrant price skimming to maximize profit from early adopters, while a product in a highly competitive market might require penetration pricing to establish market share.

Dynamic pricing, where prices are adjusted in real-time based on demand, supply, and competitor actions, is also increasingly common, particularly in the online marketplace. Choosing the right pricing strategy requires careful analysis of market dynamics and a deep understanding of customer behavior.

Q 21. How do you identify and mitigate market risks?

Identifying and mitigating market risks is a continuous process that requires a proactive approach. This begins with a thorough market analysis to understand potential threats. Common market risks include:

- Economic downturns: Reduced consumer spending and decreased demand.

- Competitive pressures: New entrants, price wars, and increased product substitution.

- Regulatory changes: New laws and regulations that impact business operations.

- Technological disruptions: New technologies that render existing products or services obsolete.

- Geopolitical events: Political instability or international conflicts that affect market conditions.

Mitigating these risks often involves developing contingency plans, diversification strategies, and robust risk management processes. For example, a business facing the risk of economic downturn might diversify its product portfolio or build up a cash reserve. A company vulnerable to competitive pressure might focus on innovation, brand building, or customer loyalty programs. Regular monitoring of market conditions and early identification of emerging risks are critical to proactive risk mitigation. Building resilience and adaptability into the business model are essential for navigating unforeseen challenges.

Q 22. How would you present complex data to a non-technical audience?

Presenting complex data to a non-technical audience requires translating technical jargon into plain language and using visuals to tell a compelling story. I begin by identifying the key takeaways – the one or two most important points I want the audience to remember. Then, I choose the right visual aids. For example, instead of a detailed spreadsheet, I might use a bar chart to show trends or a pie chart to illustrate proportions. Think of it like baking a cake: the data is the raw ingredients, but the presentation is the icing and decoration that makes it appealing and understandable.

For instance, if I’m presenting market share data, I wouldn’t overwhelm the audience with precise percentages. Instead, I’d use a simple bar chart comparing the market share of the top three competitors, highlighting the growth or decline of each. I would then use clear, concise language to explain the implications of this data, such as ‘Company X has increased its market share by 15%, indicating a successful new product launch.’

Finally, I always leave time for questions and make sure to answer them in a way that’s easy to understand, avoiding technical terms whenever possible. The goal is not just to present information but to foster understanding and encourage engagement.

Q 23. Explain your experience with market research methodologies.

My experience with market research methodologies is extensive, encompassing both quantitative and qualitative approaches. Quantitative research involves using numerical data to draw conclusions, often through surveys, experiments, and data analysis. Qualitative research, on the other hand, explores underlying reasons, opinions, and motivations, often through interviews, focus groups, and observational studies. I’ve utilized both methods extensively throughout my career.

For example, in a recent project for a new coffee brand, we conducted a large-scale survey to determine consumer preferences for different coffee types and brewing methods (quantitative). This was complemented by focus groups to understand the emotional connection consumers have with coffee and their routines (qualitative). The combined data provided a complete picture of the market, allowing us to identify target audiences and position the brand effectively.

I’m proficient in various data analysis techniques, including statistical modeling and regression analysis, allowing me to extract meaningful insights from large datasets. My experience also includes designing research questionnaires, conducting fieldwork, and interpreting findings to generate actionable recommendations for business strategies.

Q 24. Describe your understanding of the product life cycle.

The product life cycle describes the stages a product goes through from its introduction to the market until its eventual decline. These stages typically include: introduction, growth, maturity, and decline. Understanding this cycle is crucial for making informed business decisions regarding pricing, marketing, and product development.

- Introduction: The product is launched, sales are slow, and marketing focuses on creating awareness.

- Growth: Sales accelerate rapidly as the product gains popularity. Competition may begin to emerge.

- Maturity: Sales growth slows or plateaus as the market becomes saturated. Competition is intense, and companies focus on maintaining market share.

- Decline: Sales begin to decline, often due to technological advancements, changing consumer preferences, or increased competition. Companies may decide to discontinue the product or reposition it to extend its life.

For example, consider the evolution of personal computers. The initial introduction stage saw high prices and limited functionality. The growth stage saw explosive growth in sales as technology advanced and prices decreased. Today, the market is mature, with intense competition and focus on innovation in areas like design and software integration. Some segments, like desktop PCs, may be entering decline.

Q 25. How do you prioritize tasks in a fast-paced environment?

In fast-paced environments, effective task prioritization is essential. I use a combination of methods, including the Eisenhower Matrix (urgent/important), to categorize tasks and allocate my time accordingly. This helps me focus on high-impact activities first.

The Eisenhower Matrix helps visualize tasks. Urgent and important tasks are addressed immediately. Important but not urgent tasks are scheduled for later. Urgent but not important tasks are delegated if possible, or quickly handled. Tasks that are neither urgent nor important are eliminated.

Beyond the matrix, I utilize project management software to track deadlines, collaborate with team members, and maintain transparency. Regularly reviewing my to-do list and adjusting priorities as needed keeps me adaptable to changing circumstances. Proactive communication with stakeholders ensures everyone is aligned on priorities and potential roadblocks are addressed promptly.

Q 26. Describe your experience working with large datasets.

I have significant experience working with large datasets using various tools and techniques. My expertise includes data cleaning, transformation, and analysis using SQL, Python (with libraries like Pandas and NumPy), and statistical software such as R. I’m comfortable working with databases like SQL Server and PostgreSQL.

For example, in a previous role, I analyzed a dataset containing millions of customer transactions to identify patterns in purchasing behavior. This involved cleaning the data to handle missing values and inconsistencies, then using SQL queries to extract relevant information. Python was employed to perform further analysis and build predictive models that helped the company personalize marketing campaigns and improve customer retention.

My approach involves breaking down large datasets into manageable chunks, employing efficient data processing techniques, and leveraging visualization tools like Tableau or Power BI to communicate findings effectively. I always prioritize data integrity and ensure the accuracy of my analyses.

Q 27. How familiar are you with different business modeling frameworks?

I’m familiar with a variety of business modeling frameworks, each offering a unique perspective on a business’s operations and strategy. Some of the most useful frameworks I regularly employ include:

- SWOT Analysis: Identifies internal Strengths and Weaknesses, and external Opportunities and Threats, providing a comprehensive overview of the competitive landscape.

- Porter’s Five Forces: Analyzes the competitive intensity of an industry by examining the threat of new entrants, bargaining power of suppliers and buyers, threat of substitutes, and rivalry among existing competitors.

- Value Chain Analysis: Examines all activities involved in creating and delivering a product or service, highlighting areas for cost reduction or value enhancement.

- Business Model Canvas: Provides a visual representation of a business’s key components, including customer segments, value propositions, revenue streams, and key activities.

The choice of framework depends on the specific business problem being addressed. For instance, a SWOT analysis is helpful for strategic planning, while Porter’s Five Forces is valuable for assessing industry attractiveness. I often use a combination of frameworks to get a holistic understanding of a business situation.

Q 28. Explain your experience with market share analysis.

Market share analysis is a crucial aspect of competitive analysis. It involves measuring a company’s sales relative to its competitors, revealing its position within the market. This analysis provides valuable insights into market dynamics, competitive threats, and opportunities for growth.

I use various methods for market share analysis, including analyzing sales data from industry reports, company financial statements, and market research firms. I also employ statistical techniques to forecast future market share based on historical trends and projected growth rates. Data visualization is critical for communicating insights effectively, often using charts and graphs to illustrate trends and comparisons.

For example, in a recent analysis for a technology company, I used publicly available data to track the market share of competing software platforms. This helped us identify emerging competitors and develop strategies to maintain our market leadership. The analysis highlighted the need to focus on innovation and customer experience to counter growing competition and retain customers.

Key Topics to Learn for Business and Market Analysis Interview

- Market Research & Sizing: Understanding methodologies like top-down and bottom-up analysis, defining target markets, and estimating market potential. Practical application: Developing a market entry strategy for a new product.

- Competitive Analysis: Identifying key competitors, analyzing their strengths and weaknesses, and understanding competitive landscapes. Practical application: Creating a competitive matrix to inform strategic decision-making.

- Financial Modeling & Forecasting: Building financial models to project revenue, expenses, and profitability. Practical application: Developing a pro forma income statement to assess the financial viability of a new business venture.

- Data Analysis & Interpretation: Utilizing statistical methods and data visualization techniques to extract insights from market data. Practical application: Analyzing sales trends to identify growth opportunities or areas needing improvement.

- SWOT Analysis & Strategic Planning: Conducting SWOT analyses to identify opportunities and threats, and developing strategic plans to achieve business objectives. Practical application: Developing a marketing strategy based on SWOT analysis findings.

- Industry Trends & Analysis: Staying abreast of current industry trends and their impact on business performance. Practical application: Identifying emerging technologies and their potential disruption to existing markets.

- Presentation & Communication Skills: Effectively communicating complex data and analysis to diverse audiences. Practical application: Presenting market research findings to senior management.

Next Steps

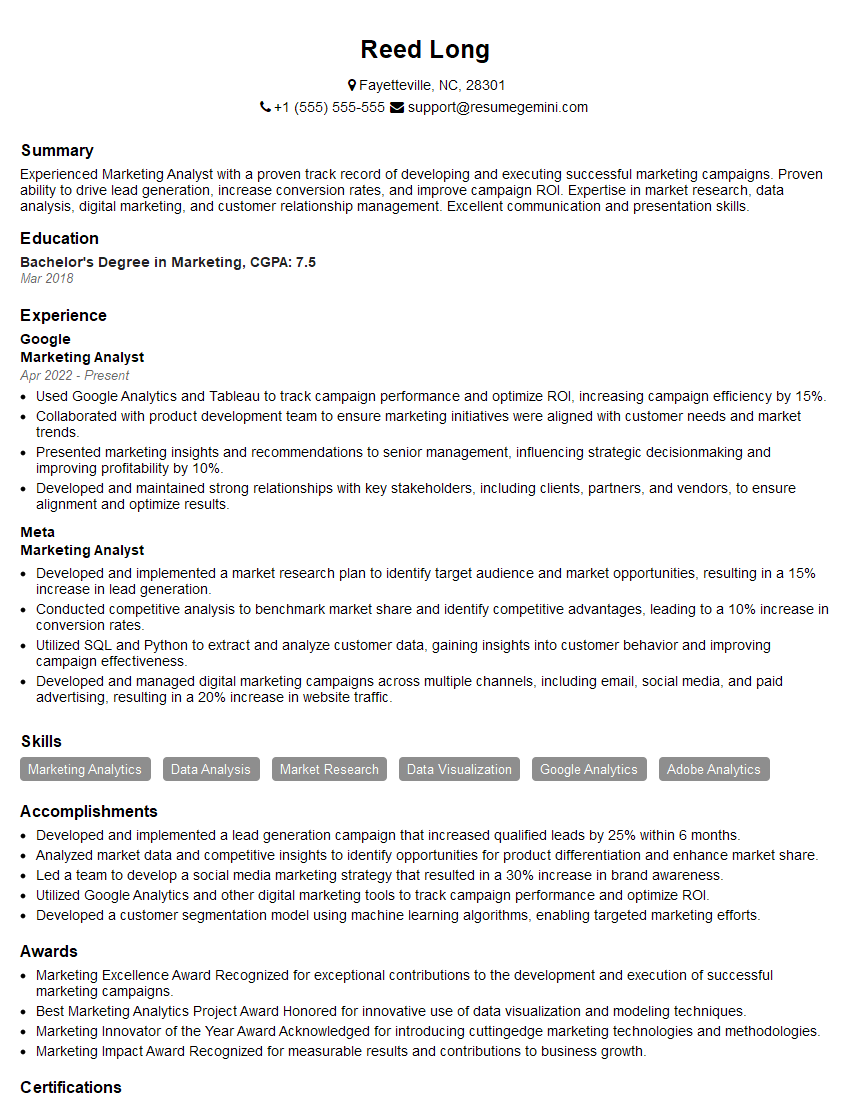

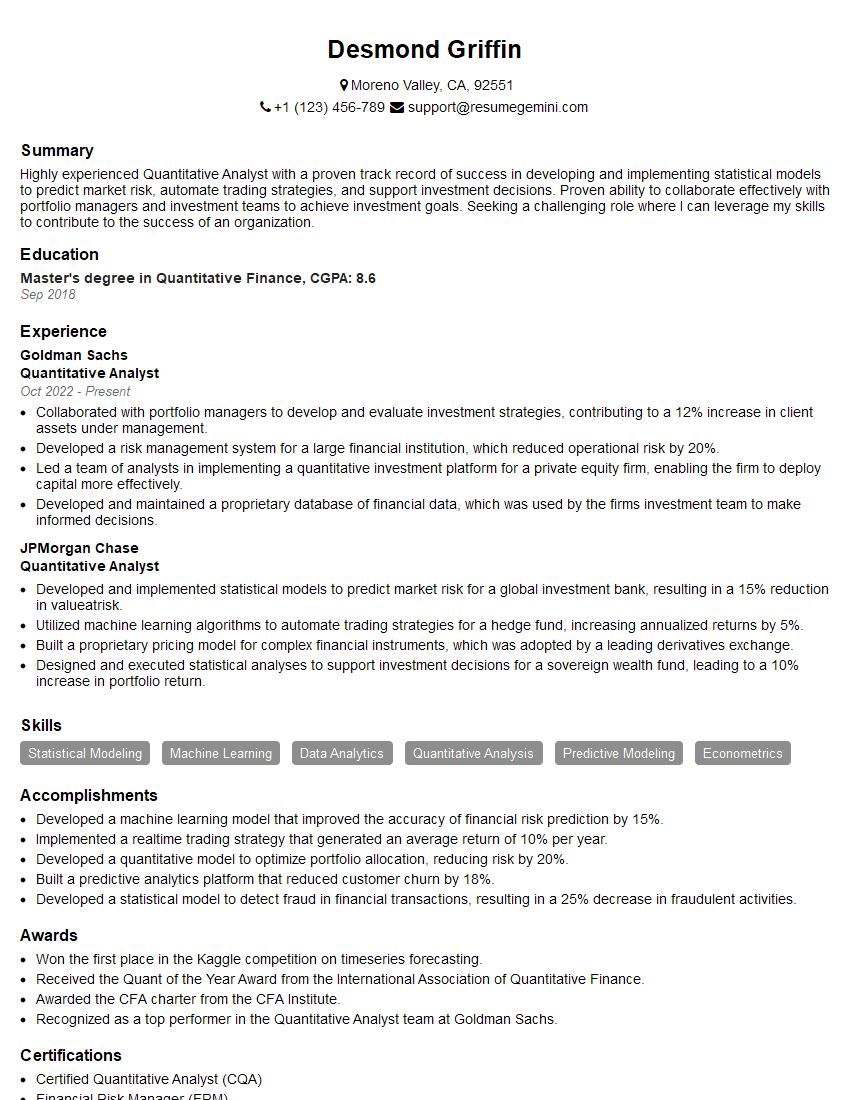

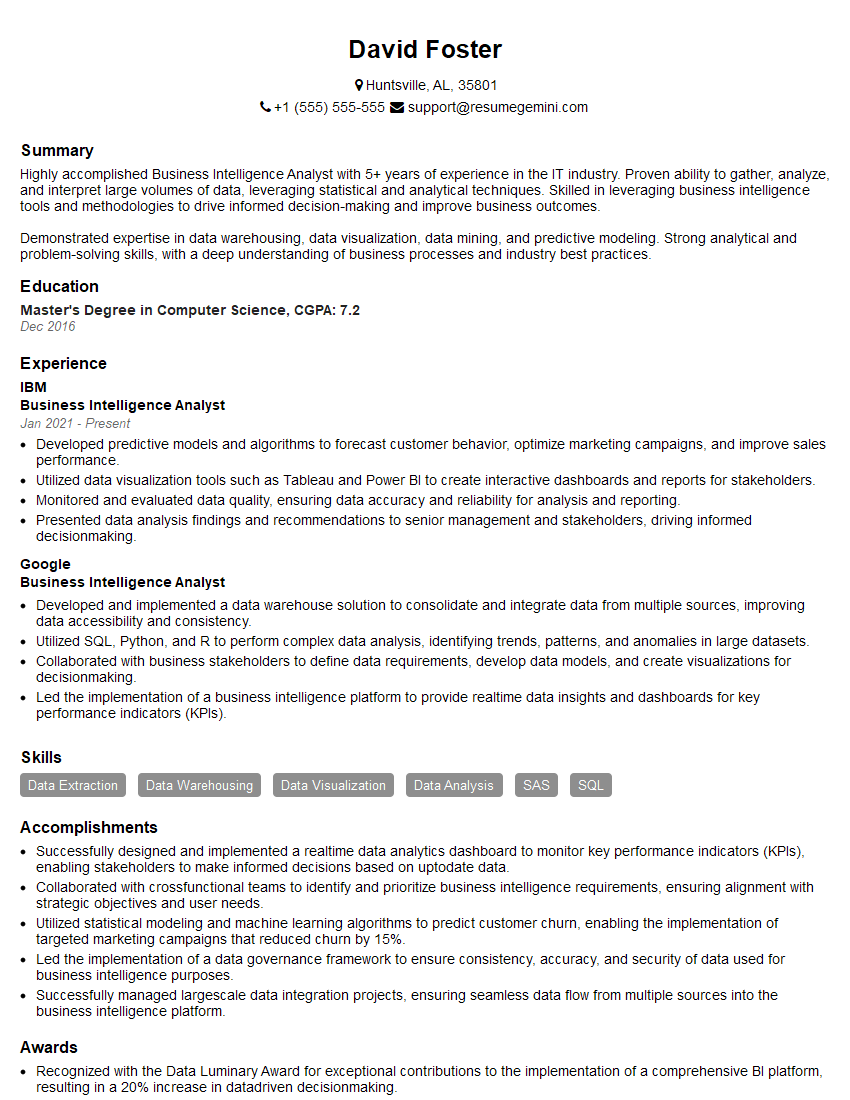

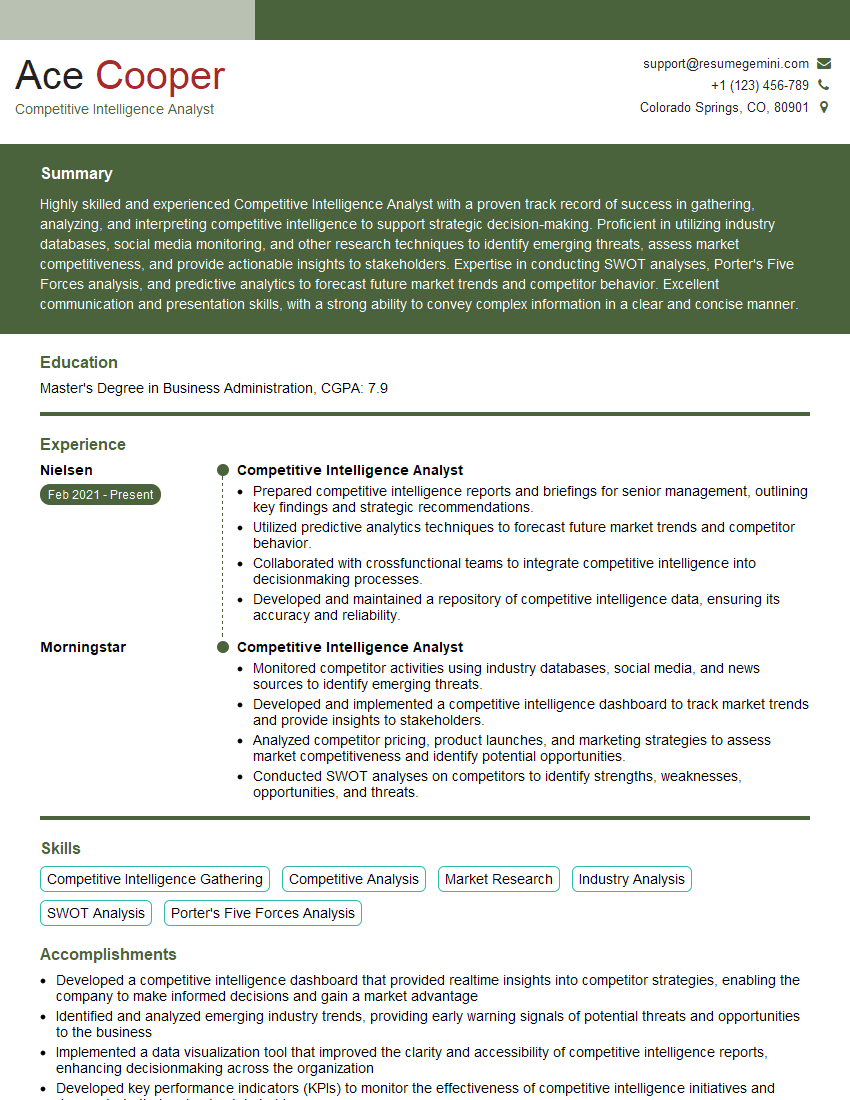

Mastering Business and Market Analysis is crucial for career advancement, opening doors to high-impact roles with significant responsibility and earning potential. A strong, ATS-friendly resume is your first step to showcasing your skills and experience. To make your resume stand out and increase your chances of landing your dream job, consider using ResumeGemini – a trusted resource designed to help you create a compelling and effective resume. ResumeGemini provides examples of resumes tailored specifically to Business and Market Analysis roles, helping you create a document that truly reflects your capabilities. Invest in your future; invest in a professional resume.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good