Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Consumer Insight interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Consumer Insight Interview

Q 1. Explain the difference between qualitative and quantitative consumer insights research.

Qualitative and quantitative consumer insights research are two distinct approaches that provide complementary perspectives on consumer behavior. Qualitative research focuses on understanding the why behind consumer actions, delving into motivations, attitudes, and beliefs. It employs methods like focus groups, in-depth interviews, and ethnographic studies to gather rich, descriptive data. Quantitative research, on the other hand, focuses on the what – measuring and quantifying consumer behavior through surveys, experiments, and data analysis. It provides numerical data that can be statistically analyzed to identify trends and patterns.

Example: Imagine you’re launching a new coffee blend. Qualitative research might involve conducting focus groups to understand consumers’ preferences for coffee flavor profiles, brewing methods, and overall coffee drinking experience. Quantitative research could involve a large-scale survey to determine the market size for this specific coffee blend and how many consumers would be willing to purchase it at various price points.

Q 2. Describe your experience with various research methodologies (e.g., surveys, focus groups, ethnography).

Throughout my career, I’ve extensively used various research methodologies. Surveys are invaluable for collecting large-scale data on consumer demographics, attitudes, and behaviors. I’ve designed and implemented both online and offline surveys, using tools like Qualtrics and SurveyMonkey, ensuring the questions are clear, concise, and unbiased. Focus groups offer a deeper understanding of consumer perspectives through guided discussions, allowing for rich insights into group dynamics and shared beliefs. Ethnographic research, which involves observing consumers in their natural environment, has been particularly illuminating in understanding the context of their choices. For example, I once conducted ethnographic research to understand how consumers interact with a new mobile app, observing their behavior in their homes and workplaces.

Beyond these, I’m proficient in A/B testing to compare different marketing strategies, conjoint analysis to understand consumer preferences for product features, and sentiment analysis to gauge public opinion from online reviews and social media.

Q 3. How do you identify and prioritize key consumer insights from large datasets?

Analyzing large datasets requires a structured approach. I begin by defining clear research objectives and identifying the key variables relevant to those objectives. Then, I employ data mining and statistical techniques to uncover patterns and correlations. For example, I might use cluster analysis to segment consumers based on their purchasing behaviors or regression analysis to understand the impact of specific factors on consumer satisfaction. It’s crucial to visualize the data using charts and graphs to identify significant trends. Finally, I prioritize insights based on their strategic importance to the business and their potential impact on marketing decisions. Insights are ranked considering their novelty, reliability, and actionability.

Example: Suppose we have data on website traffic, purchase history, and customer service interactions. By combining these data sources, we could identify specific customer segments who are highly engaged but have low conversion rates. This insight would be prioritized as it suggests an area for immediate marketing intervention, potentially through personalized messaging or improved website design.

Q 4. Explain your process for developing a consumer insights research plan.

Developing a consumer insights research plan is a systematic process. It begins with clearly defining the business objectives and translating them into specific research questions. Next, I identify the target audience and choose appropriate research methodologies based on the research questions and available resources. A detailed timeline is crucial, outlining key milestones and deliverables. This includes outlining the data collection methods (surveys, interviews, etc.), the sample size, and the data analysis plan. Finally, the budget is determined, considering all costs associated with the research project. This plan serves as a roadmap for the project and keeps it on track.

Example: If the business objective is to increase sales of a new product, the research plan might involve surveys to assess consumer awareness and interest, focus groups to explore consumer perceptions and needs, and A/B testing to evaluate different marketing messages.

Q 5. How do you ensure the validity and reliability of your consumer insights research?

Ensuring validity and reliability is paramount. Validity refers to the accuracy of the research findings – do they truly measure what they intend to measure? Reliability refers to the consistency of the findings – would the same results be obtained if the research were repeated? To ensure validity, I use well-established research methodologies and carefully design instruments (e.g., questionnaires) to minimize bias. To ensure reliability, I employ rigorous data collection and analysis procedures, including appropriate sampling techniques and statistical tests. Triangulation, using multiple data sources and methods, further enhances both validity and reliability, allowing for a more comprehensive understanding.

Example: In a survey, using a representative sample of the target population, pretesting the questionnaire to identify and correct ambiguities, and utilizing appropriate statistical techniques for data analysis will all enhance the validity and reliability.

Q 6. How do you translate consumer insights into actionable marketing strategies?

Translating consumer insights into actionable marketing strategies requires a clear understanding of both the insights and the business context. I begin by identifying key themes and patterns emerging from the research data. Then, I link these findings to specific marketing objectives, such as increasing brand awareness, improving customer loyalty, or driving sales. This may involve identifying a specific target audience segment for a tailored marketing campaign, refining the product or service based on consumer feedback, or adjusting the pricing strategy based on price sensitivity analysis. The insights are then used to develop targeted marketing messages, choose the most effective marketing channels, and to track the performance of marketing campaigns.

Example: If consumer research reveals a strong preference for eco-friendly products, this insight could inform the development of a sustainable packaging strategy or a marketing campaign highlighting the environmental benefits of the product.

Q 7. Describe a time you had to overcome a challenge in a consumer insights project.

In one project, we faced a challenge with low response rates to our online survey. The initial survey was long and complex, leading to respondent fatigue. To overcome this, we redesigned the survey, shortening it considerably and simplifying the questions. We also incorporated gamification elements, such as progress bars and interactive questions, to maintain respondent engagement. We also segmented our audience to send more targeted invitations, resulting in a significant increase in response rates and a more accurate representation of the target audience. Learning to adapt and troubleshoot during a project is crucial for generating high-quality, useful insights.

Q 8. How do you present consumer insights to stakeholders at different levels?

Presenting consumer insights effectively depends heavily on tailoring the message to the audience’s needs and understanding. For executive stakeholders, I focus on the high-level strategic implications, using concise summaries, compelling visuals (charts showing key trends, market share changes), and a clear statement of the recommended actions. For example, if we found a significant untapped market segment, I’d present a concise executive summary highlighting the size and potential profitability of that segment and then suggest a focused marketing strategy. Mid-level managers require more detail – a deeper dive into the data and methodology. I’d include specific data points, segment breakdowns, and the rationale behind my conclusions. Finally, for team members involved in the execution, I provide very detailed information, including the raw data, analysis, and specific tasks assigned based on the findings. This layered approach ensures everyone receives the information relevant to their roles and responsibilities, maximizing impact and engagement.

Q 9. How familiar are you with statistical analysis and data visualization techniques?

I’m highly proficient in statistical analysis and data visualization. My expertise encompasses various techniques, including regression analysis (linear, logistic), cluster analysis, factor analysis, and conjoint analysis. I’m adept at using these methods to uncover hidden patterns, segment audiences, and predict consumer behavior. Regarding data visualization, I prioritize clarity and impact. I use tools like Tableau and Power BI to create compelling dashboards and presentations that effectively communicate complex information. For instance, to illustrate the relationship between age and product preference, I’d utilize a bar chart or a scatter plot depending on the specific needs. Example: A scatter plot can show the correlation between age and spending on a particular product category. I always ensure the chosen visualization accurately reflects the data and is easily understood by the intended audience, even those without a strong statistical background.

Q 10. What experience do you have using specific market research software (e.g., SPSS, Qualtrics)?

I have extensive experience with SPSS and Qualtrics. In my previous role, I used SPSS for advanced statistical modeling, particularly for analyzing large datasets from surveys and experiments. For example, I used SPSS to perform regression analysis to understand the factors driving customer satisfaction. I used Qualtrics to design, deploy, and analyze online surveys, A/B testing experiments, and other forms of quantitative and qualitative research. I’m comfortable with creating complex survey logic, branching questions, and data cleaning within the Qualtrics platform. My proficiency in both tools allows me to conduct comprehensive research projects, from design to analysis and reporting.

Q 11. How do you stay current with trends and best practices in consumer insights?

Staying current in the dynamic field of consumer insights requires a multi-pronged approach. I regularly attend industry conferences (e.g., ESOMAR, IIeX) and webinars, read industry publications (e.g., Marketing Science Institute reports, Journal of Marketing Research), and follow thought leaders on social media and professional networking sites like LinkedIn. I also actively participate in online communities and forums to learn from peers and engage in discussions about new methodologies and trends. Further, I actively seek out and review case studies of successful consumer insights initiatives to learn from best practices and adapt them to my own work.

Q 12. Describe your experience working with diverse consumer segments.

I have a proven track record of working with diverse consumer segments, including generational cohorts (Millennials, Gen Z, Baby Boomers), socioeconomic groups, and cultural backgrounds. For instance, in a recent project for a food company, I segmented the market based on dietary preferences (vegan, vegetarian, omnivore) and cultural backgrounds, enabling the development of targeted marketing campaigns that resonated with each specific group. Understanding nuances and avoiding generalizations is crucial when working with diverse segments; this requires using culturally sensitive research methods, employing diverse research teams and ensuring representation in the sampling process. Employing empathy and a deep understanding of cultural contexts allows me to develop effective and impactful insights.

Q 13. How do you handle conflicting consumer insights from different research methods?

Conflicting insights from different research methods are common and require careful consideration. My approach is systematic: First, I scrutinize the methodology of each study, looking for potential biases or limitations. Second, I examine the sample characteristics to ensure they are comparable. Third, I look for patterns or underlying themes that can reconcile seemingly disparate findings. Often, the conflict points to a deeper understanding. For example, qualitative data (e.g., focus groups) might reveal unmet needs that quantitative data (e.g., surveys) doesn’t capture. In such instances, I synthesize the information, giving weight to the reliability and validity of each method. If the conflict remains irresolvable, I might recommend further research to clarify the discrepancy, potentially using a triangulation approach combining quantitative and qualitative methods.

Q 14. How do you measure the success of a consumer insights project?

Measuring the success of a consumer insights project depends on clearly defined objectives at the outset. Key performance indicators (KPIs) must be established upfront. These might include improvements in marketing campaign effectiveness (e.g., higher conversion rates, increased brand awareness), product innovation leading to improved sales figures, or a significant increase in customer satisfaction scores. After the project is completed, I analyze the data to determine whether the project met its predetermined KPIs. For example, if the objective was to identify unmet consumer needs for a product redesign, success would be measured by the increased sales and customer satisfaction associated with the redesigned product. If the KPIs weren’t met, a post-project analysis is undertaken to understand why, informing future projects and improving the overall research process.

Q 15. Explain your experience with developing consumer personas.

Developing consumer personas involves creating detailed representations of your ideal customers. It’s not just about demographics; it’s about understanding their motivations, frustrations, goals, and behaviors. I approach this by combining quantitative data (e.g., market research reports, website analytics) with qualitative data (e.g., interviews, focus groups, surveys). For example, in a project for a sustainable clothing brand, I conducted in-depth interviews with potential customers to uncover their values and purchasing habits, leading to the creation of three distinct personas: the ‘Eco-Conscious Minimalist,’ the ‘Ethical Fashionista,’ and the ‘Practical Environmentalist.’ Each persona had a name, a backstory, a visual representation, and detailed information about their needs and preferences, guiding the brand’s marketing and product development efforts. This systematic approach ensures that personas are more than just stereotypes; they are actionable representations of real consumers.

- Data Collection: Using diverse methods like surveys, interviews, and observational research.

- Synthesis and Analysis: Identifying patterns and commonalities across the data collected.

- Persona Development: Creating detailed profiles including demographics, psychographics, behavioral patterns, and motivations.

- Validation: Testing the accuracy and relevance of personas with stakeholders and potential customers.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you balance the need for speed and accuracy in consumer insights research?

Balancing speed and accuracy in consumer insights research is a constant challenge. It’s about finding the right methodology for the specific business problem and timeframe. A fast approach might involve utilizing readily available secondary data and conducting short surveys, prioritizing speed over depth. However, for critical decisions, a more thorough and potentially longer process with in-depth interviews and observational studies might be necessary. Think of it like choosing between a quick snapshot versus a detailed portrait – both serve a purpose. I use agile methodologies to adapt quickly to changing priorities while ensuring data quality. For example, I might start with quick surveys to identify key trends, then follow up with more in-depth interviews to validate those findings. Prioritization is key, focusing on the most critical questions to answer within the given time constraints.

I also ensure that all research protocols are well-defined from the outset, minimizing the need for extensive revisions and delays. Regular check-ins with stakeholders keep the research aligned with the overall goals and allows for course correction if needed.

Q 17. How do you identify and address potential biases in consumer insights research?

Addressing bias is crucial. I employ several strategies. Firstly, I ensure diverse research samples, representing a wide range of demographics and backgrounds. Secondly, I carefully consider the wording of survey questions and interview prompts to avoid leading questions or loaded language. For example, instead of asking ‘Do you agree that our product is superior?’, I might ask ‘What are your thoughts on our product compared to our competitors?’ Thirdly, I use triangulation – employing multiple research methods (e.g., surveys, interviews, observational studies) to cross-validate findings and identify potential inconsistencies. Finally, I am transparent about potential limitations of the research, acknowledging any potential biases that may be present in the data.

Regularly reviewing and reflecting on my own biases is equally important. This self-awareness helps in designing research that is more objective and less prone to subjective interpretations.

Q 18. Describe your experience working with cross-functional teams.

Cross-functional collaboration is essential for successful consumer insights. I have extensive experience working with marketing, product development, engineering, and sales teams. My approach is built on clear communication, active listening, and a shared understanding of project goals. I believe in translating complex research findings into easily digestible formats for non-researchers. For instance, during a recent product launch, I worked with the marketing team to develop campaign messaging based on consumer feedback gathered from focus groups. I also collaborated with the product team to ensure that design decisions were aligned with user needs and preferences. I often use visual aids like dashboards and presentations to effectively communicate insights and facilitate discussion amongst diverse teams.

Q 19. How do you use consumer insights to inform product development decisions?

Consumer insights are the bedrock of effective product development. They provide the evidence base for crucial decisions, from initial concept design to final product launch. I utilize consumer insights to define target audiences, identify unmet needs, refine product features, and evaluate market viability. For example, in a project involving a new mobile app, we used user testing to uncover usability issues and pain points. This feedback directly informed design changes, improving the user experience and ultimately increasing user adoption. Furthermore, consumer insights helped prioritize features based on user preferences and market demands.

Q 20. How do you incorporate consumer feedback into the product lifecycle?

Consumer feedback is incorporated throughout the product lifecycle – from concept ideation through to post-launch evaluation. Early-stage feedback, gathered through surveys and focus groups, shapes the initial product design. Beta testing and user feedback during the development phase allows for iterative improvements before a final launch. Post-launch, I use monitoring tools (e.g., app store reviews, social media sentiment) and conduct customer satisfaction surveys to understand ongoing customer needs and address any issues. This continuous feedback loop is critical for product success and ensuring customer loyalty.

Q 21. Explain your understanding of different consumer segmentation techniques.

Consumer segmentation is the process of dividing a broad consumer market into sub-groups based on shared characteristics. Several techniques exist, including:

- Demographic Segmentation: Grouping consumers based on age, gender, income, education, etc. For example, targeting young adults with budget-friendly products.

- Psychographic Segmentation: Dividing consumers based on their lifestyles, values, attitudes, and interests. For instance, targeting environmentally conscious consumers with eco-friendly products.

- Geographic Segmentation: Grouping consumers based on their location (country, region, city). Adapting marketing strategies to regional preferences.

- Behavioral Segmentation: Grouping consumers based on their purchasing habits, brand loyalty, and usage patterns. This might involve identifying high-value customers for loyalty programs.

- Value-Based Segmentation: Dividing consumers according to what they are seeking from a product or service (e.g. value, quality, convenience).

The choice of segmentation technique depends on the research objectives and the nature of the product or service. Often, a combination of techniques is used to create a more nuanced understanding of the target market.

Q 22. How do you handle sensitive or confidential consumer data?

Handling sensitive consumer data is paramount. It’s not just about compliance; it’s about building trust. My approach is multi-faceted and begins with adhering strictly to all relevant data privacy regulations like GDPR, CCPA, etc. This involves implementing robust security measures, such as data encryption both in transit and at rest, access control restrictions based on the principle of least privilege, and regular security audits.

Beyond compliance, we anonymize and pseudonymize data whenever possible, minimizing the risk of identifying individuals. We use techniques like hashing and data masking to protect sensitive attributes. For example, instead of storing a customer’s full name, we might only use a unique identifier. We also obtain explicit consent before collecting and processing any personal data, clearly explaining how the data will be used and for what purpose. Finally, we have clear data retention policies, deleting data once its purpose is fulfilled.

Imagine a survey about sensitive health information. We’d never store names alongside responses; instead, we’d use unique IDs linking answers to demographic data, stripped of identifying details. This ensures research insights while safeguarding individual privacy.

Q 23. Describe your experience in competitive analysis using consumer insights.

Competitive analysis fueled by consumer insights is crucial for strategic advantage. I’ve led numerous projects where we analyzed competitor offerings, messaging, and customer reviews to understand their strengths and weaknesses relative to our client’s. For example, we conducted a comprehensive analysis of a beverage company’s competitors. We used social media listening, online surveys, and focus groups to gain a granular understanding of customer perceptions of each brand. We also analyzed sales data and market share to identify key trends. This allowed us to pinpoint unmet needs, explore potential opportunities for differentiation, and refine our clients’ marketing strategies to gain a competitive edge.

This involved not just identifying what competitors were *doing*, but also understanding *why* it was resonating (or not) with consumers. We used sentiment analysis tools to gauge consumer feelings towards various brands, which revealed hidden opportunities and vulnerabilities in the market. For instance, one competitor might have superior product quality, but poor customer service, providing us with actionable insights for our client to focus on service excellence.

Q 24. How do you communicate complex consumer insights to non-research audiences?

Communicating complex consumer insights to non-research audiences requires simplifying the data and focusing on actionable takeaways. I avoid jargon and technical terms whenever possible, using clear and concise language. I use storytelling techniques, transforming raw data into compelling narratives that resonate with the audience. Visualizations such as charts, graphs, and infographics are incredibly effective for illustrating key findings. For example, instead of presenting a complex statistical model, I might show a simple bar graph demonstrating the preference for a particular product feature.

Consider a presentation to the marketing team on customer feedback regarding a new product. Instead of showing reams of qualitative data, I’d focus on 3-5 key themes, backed by supporting visuals—for example, a pie chart showing the proportion of customers who found the product easy vs difficult to use, or a word cloud illustrating frequently mentioned features.

I always tailor my communication to the specific audience, their background, and their needs. Finally, I ensure that my presentation always includes clear, actionable recommendations that the audience can directly implement.

Q 25. How do you prioritize competing demands for consumer insights resources?

Prioritizing competing demands for consumer insights resources requires a strategic approach. I typically use a framework that considers the following factors: business urgency, potential impact, resource availability, and alignment with overall business objectives. I start by clearly defining the goals of each project and then assess the potential return on investment (ROI) for each. A project with high urgency and potential impact will likely take precedence over one with low urgency and minimal impact, even if the latter is interesting.

Imagine a situation where we need to understand customer feedback on a product launch, and simultaneously explore long-term market trends. I’d prioritize the immediate need for the product launch feedback, as this is time-sensitive and directly impacts sales. Longer-term research would be scheduled accordingly, and might involve resource allocation across different teams or phasing the project.

Regularly reviewing priorities and adapting based on changing business needs is also crucial. A flexible and data-driven approach ensures that resources are allocated efficiently and effectively.

Q 26. How do you utilize consumer insights to inform pricing strategies?

Consumer insights are invaluable for developing effective pricing strategies. By understanding consumer perceptions of value, price sensitivity, and willingness to pay, we can optimize prices to maximize revenue and profitability. For example, understanding a consumer segment’s perceived value of a feature might allow us to justify a premium price. Conversely, price sensitivity analysis can highlight segments receptive to discounts or promotions. We often use conjoint analysis, a sophisticated statistical technique, to determine the relative importance of different product attributes in influencing customer purchasing decisions.

Let’s say we’re launching a new software. We’d use consumer research to understand how much customers are willing to pay for various feature sets (e.g., basic vs. premium). This information would be used to set optimal pricing tiers that maximize profitability while remaining competitive and attractive to different customer segments.

This includes not only what consumers are willing to pay but also their perception of fair pricing. A price deemed too high, regardless of perceived value, could lead to lost sales. This nuanced understanding is vital for building a sustainable business model.

Q 27. What are some of the ethical considerations in consumer insights research?

Ethical considerations in consumer insights research are paramount. Transparency and informed consent are fundamental. Participants must be fully aware of the purpose of the research, how their data will be used, and their rights to withdraw at any time. It’s crucial to avoid any practices that could mislead, deceive, or exploit participants. Data privacy and confidentiality must be strictly protected, adhering to all relevant regulations. Furthermore, it’s important to ensure that research does not reinforce existing biases or stereotypes, and to be mindful of potential cultural sensitivities.

For instance, a study involving vulnerable populations would require special ethical considerations. We must ensure that researchers are adequately trained to handle sensitive information and to obtain informed consent from participants. We’d work closely with an ethics review board to ensure that our research is conducted responsibly and ethically.

Maintaining objectivity and avoiding manipulation is key to ensure the integrity of the research and to protect the trust of participants. Responsible data handling and analysis are also vital aspects of ethical research.

Q 28. Describe your experience with using social media listening for consumer insights.

Social media listening is a powerful tool for gathering consumer insights. It offers real-time feedback, allowing us to monitor brand mentions, analyze sentiment, and track trending topics. I have extensive experience using social listening tools to understand customer perceptions of our clients’ brands, products, and services. This involves monitoring various platforms—Twitter, Facebook, Instagram, etc.—to identify key themes, concerns, and opportunities. Tools like Brandwatch or Sprout Social allow us to perform sentiment analysis, to track the emotional tone of conversations around our clients’ brands, allowing for immediate responses to negative feedback or capitalizing on positive buzz.

For example, during a product launch, we might use social media listening to identify any initial issues or bugs being reported by users. This enables immediate corrective action, minimizing potential damage to the brand’s reputation. We can also use this data to inform future product development, ensuring we address customer needs and preferences.

It’s crucial, however, to remember that social media data is often unstructured and requires careful analysis and interpretation. Combining social listening with other qualitative and quantitative data sources provides a more holistic and robust understanding of consumer behavior.

Key Topics to Learn for Consumer Insight Interview

- Understanding Consumer Behavior: Explore models like Maslow’s Hierarchy of Needs and the Consumer Decision-Making Process. Consider how cultural influences, demographics, and psychographics shape purchasing decisions.

- Market Research Methodologies: Gain proficiency in qualitative methods (focus groups, interviews, ethnography) and quantitative methods (surveys, data analysis). Understand the strengths and weaknesses of each approach and when to apply them.

- Data Analysis and Interpretation: Develop skills in interpreting market research data, identifying key trends and insights, and communicating findings effectively through compelling visualizations and presentations.

- Competitive Analysis: Learn how to analyze competitors’ strategies, understand their target audiences, and identify opportunities for differentiation and market penetration. This includes understanding market share, brand positioning, and competitive advantages.

- Segmentation and Targeting: Master the art of segmenting markets into distinct groups based on shared characteristics and tailoring marketing strategies to specific target segments. Understand the value proposition for each segment.

- Developing Consumer Personas: Practice creating detailed and insightful consumer profiles that represent key customer segments. Use these personas to inform product development, marketing campaigns, and overall business strategy.

- Problem-Solving and Strategic Thinking: Develop your ability to identify business challenges, translate consumer insights into actionable recommendations, and present your findings with confidence and clarity.

Next Steps

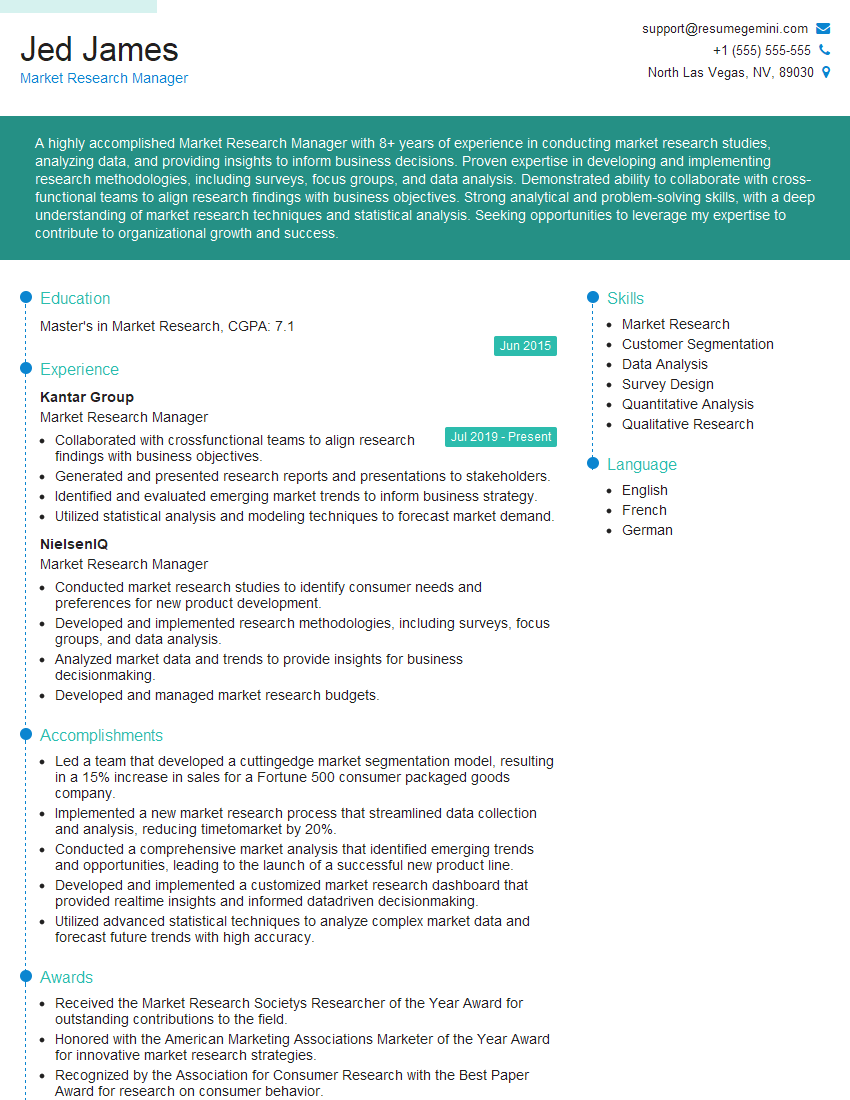

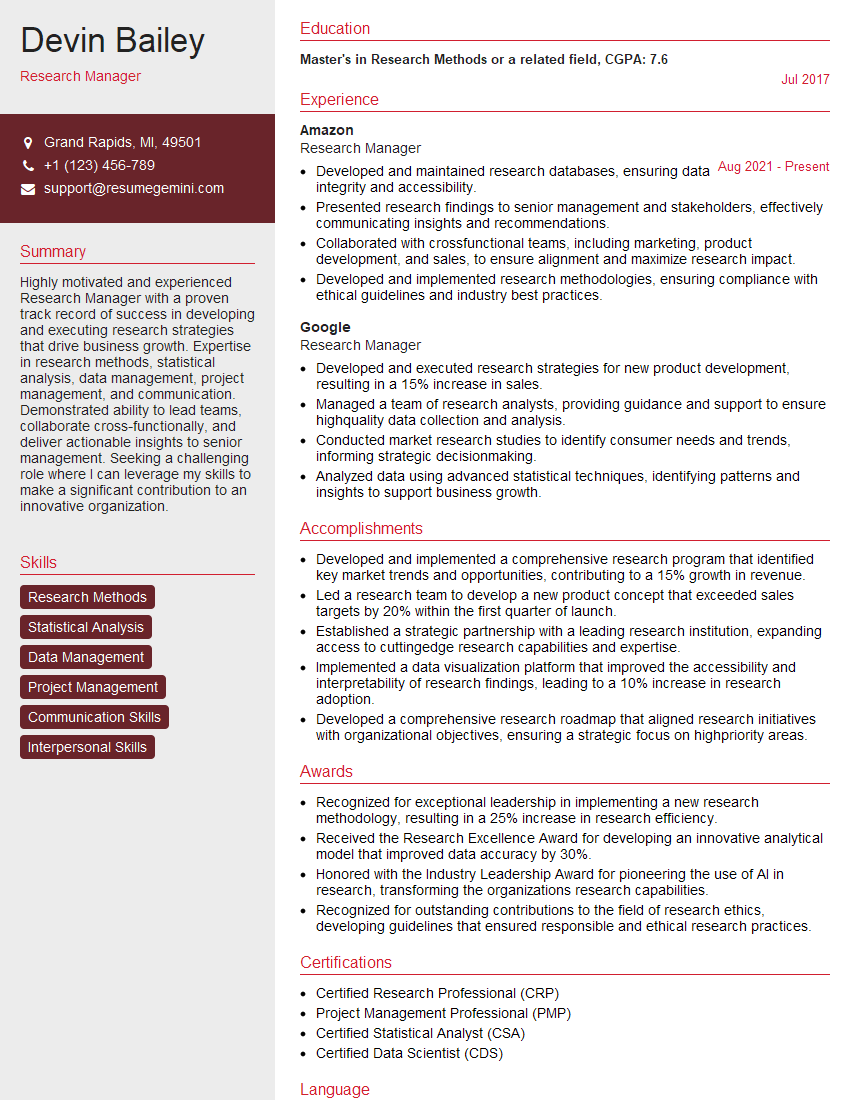

Mastering Consumer Insight is crucial for a successful and rewarding career. A strong understanding of consumer behavior and market trends positions you for leadership roles and impactful contributions to any organization. To significantly boost your job prospects, creating an ATS-friendly resume is essential. ResumeGemini can help you build a compelling and effective resume that highlights your skills and experience in Consumer Insight. Examples of resumes tailored to Consumer Insight roles are available to help guide your resume creation. Invest the time to craft a strong resume; it’s your first impression with potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good