Cracking a skill-specific interview, like one for Forecasting Models, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Forecasting Models Interview

Q 1. Explain the difference between univariate and multivariate forecasting models.

The core difference between univariate and multivariate forecasting models lies in the number of variables they consider. Univariate models predict a single variable’s future values based solely on its past data. Think of it like predicting tomorrow’s temperature based only on today’s and yesterday’s temperatures. Multivariate models, on the other hand, incorporate multiple variables to improve prediction accuracy. Predicting tomorrow’s temperature might now also involve factors like humidity, wind speed, and perhaps even the sun’s radiation. This allows for a more comprehensive and potentially more accurate forecast.

Example: Predicting sales of a product. A univariate model would only use past sales data. A multivariate model might also consider advertising spend, competitor actions, economic indicators (like GDP growth), and seasonal trends.

- Univariate: Simpler, easier to implement, requires less data.

- Multivariate: More complex, potentially more accurate, requires more data and careful consideration of variable relationships.

Q 2. What are the assumptions of linear regression in forecasting?

Linear regression, while a powerful tool, relies on several key assumptions for reliable forecasting. Violating these assumptions can lead to inaccurate or misleading results.

- Linearity: The relationship between the dependent variable (what you’re forecasting) and independent variables (predictors) is linear. This means a straight line can reasonably approximate the relationship.

- Independence of Errors: The errors (residuals – the differences between actual and predicted values) are independent of each other. This means the error in one prediction doesn’t influence the error in another.

- Homoscedasticity: The variance of the errors is constant across all levels of the independent variables. The spread of the data points around the regression line should be roughly uniform.

- Normality of Errors: The errors are normally distributed. This ensures that statistical tests based on the normal distribution are valid.

- No Multicollinearity: Independent variables are not highly correlated with each other. High multicollinearity can make it difficult to isolate the individual effects of each predictor.

- No Autocorrelation: Errors are not correlated over time (relevant primarily in time series data).

Example: If you’re forecasting product sales using advertising spend as a predictor, and the relationship isn’t truly linear (e.g., increased advertising yields diminishing returns), linear regression will likely provide a poor forecast.

Q 3. Describe the limitations of using moving averages for forecasting.

Moving averages, while simple and intuitive, have limitations that can affect their forecasting accuracy.

- Lagging effect: Moving averages are inherently lagging indicators. They smooth out short-term fluctuations, which can be useful, but this also means they react slowly to changes in the underlying trend. This lag can be significant, particularly for short-period moving averages.

- Loss of data points at the beginning and end: Calculating a moving average requires a specific number of past data points. This results in a loss of data at the beginning and end of the time series, reducing the effective length of your data.

- Inability to handle seasonality or trends effectively: Simple moving averages don’t inherently account for seasonal patterns or trends in the data. To address this, you would need more sophisticated techniques like seasonal moving averages, but these increase complexity.

- Sensitivity to outliers: Outliers (extreme values) can significantly influence the moving average, leading to inaccurate forecasts, especially if your moving average has a short period.

Example: Forecasting stock prices with a simple moving average will often lag behind actual price movements, potentially leading to missed opportunities or late reactions to market shifts.

Q 4. How do you handle seasonality in time series data?

Seasonality refers to recurring patterns in time series data that occur at fixed intervals, such as daily, weekly, monthly, or yearly. Handling seasonality is crucial for accurate forecasting.

- Seasonal Decomposition: This method separates the time series into its constituent components: trend, seasonality, and residuals (irregular fluctuations). Once decomposed, the seasonal component can be used to adjust the forecast. This can be additive or multiplicative depending on the relationship between seasonality and trend.

- Dummy Variables in Regression: Include binary variables (0 or 1) in your regression model to represent each season. This allows the model to capture the seasonal effects explicitly.

- Seasonal ARIMA models (SARIMA): These models explicitly incorporate seasonal components into the ARIMA framework, providing a more comprehensive and sophisticated approach to modeling seasonality.

- Exponential Smoothing Methods (e.g., Holt-Winters): These methods handle seasonality by tracking both the level and seasonal components of the time series. Different versions can manage additive or multiplicative seasonality.

Example: Predicting ice cream sales would require accounting for higher sales during summer months and lower sales during winter.

Q 5. Explain the concept of autocorrelation in time series analysis.

Autocorrelation describes the correlation between a time series and a lagged version of itself. In simpler terms, it measures how much a data point at one time point is related to data points at previous time points. High autocorrelation indicates that past values significantly influence current values. This is a key characteristic of many time series.

Example: Consider daily stock prices. There’s often significant autocorrelation; today’s price is usually somewhat correlated with yesterday’s price, the day before that, and so on. This means you can’t treat each day’s price as independent observations.

Understanding autocorrelation is critical because ignoring it when building a model can lead to biased and inefficient forecasts. Many time series models, like ARIMA, explicitly account for autocorrelation.

Q 6. What is ARIMA modeling and when is it appropriate to use it?

ARIMA stands for AutoRegressive Integrated Moving Average. It’s a powerful class of models for forecasting time series data that exhibits autocorrelation and potentially trends.

ARIMA models are defined by three parameters (p, d, q):

- p (Autoregressive order): The number of lagged observations included in the model.

- d (Differencing order): The number of times the time series needs to be differenced to make it stationary (remove trends).

- q (Moving average order): The number of lagged forecast errors included in the model.

When is ARIMA appropriate? ARIMA is suitable when your time series data shows:

- Autocorrelation

- Stationarity (or can be made stationary through differencing)

- No significant seasonality (for non-seasonal ARIMA; SARIMA handles seasonality)

Example: Forecasting monthly electricity consumption might be well-suited for an ARIMA model, given the tendency for past consumption patterns to influence current consumption and the potential presence of trends.

Determining the optimal (p, d, q) values often involves iterative model fitting and evaluation using methods like AIC (Akaike Information Criterion) or BIC (Bayesian Information Criterion).

Q 7. How do you evaluate the accuracy of a forecasting model?

Evaluating the accuracy of a forecasting model is crucial. Several metrics are commonly used, each offering a different perspective on forecast performance.

- Mean Absolute Error (MAE): The average absolute difference between actual and predicted values. Easy to interpret, but doesn’t penalize large errors disproportionately.

- Mean Squared Error (MSE): The average of the squared differences between actual and predicted values. Penalizes larger errors more heavily than MAE.

- Root Mean Squared Error (RMSE): The square root of MSE. Has the same units as the original data, making it easier to interpret than MSE.

- Mean Absolute Percentage Error (MAPE): The average absolute percentage difference between actual and predicted values. Useful for comparing forecasts across different scales.

- Symmetric Mean Absolute Percentage Error (sMAPE): An improvement over MAPE as it handles cases where actual values are near zero, which can cause infinite MAPE values.

In addition to these metrics, visual inspection of the forecasts compared to the actual data (e.g., plotting residuals) is essential to identify any systematic biases or patterns in the errors. You might use techniques like residual plots and autocorrelation tests to check for model inadequacies.

Example: When forecasting sales, a low RMSE indicates that the model’s predictions are generally close to the actual sales figures. A high MAPE might suggest that the model struggles to capture large changes in sales.

The choice of evaluation metric depends on the specific context and priorities. For example, in a situation where large forecast errors are highly costly, RMSE is preferred to MAE.

Q 8. What are some common forecasting error metrics?

Forecasting error metrics quantify the difference between actual and predicted values, helping us assess model performance. Common metrics include:

- Mean Absolute Error (MAE): The average absolute difference between predicted and actual values. It’s easy to understand and interpret but doesn’t penalize large errors disproportionately.

MAE = (1/n) * Σ|Actuali - Predictedi| - Mean Squared Error (MSE): The average of the squared differences between predicted and actual values. It penalizes larger errors more heavily than MAE, making it sensitive to outliers.

MSE = (1/n) * Σ(Actuali - Predictedi)2 - Root Mean Squared Error (RMSE): The square root of the MSE. It’s often preferred over MSE because it’s in the same units as the original data, making it easier to interpret.

RMSE = √MSE - Mean Absolute Percentage Error (MAPE): The average absolute percentage difference between predicted and actual values. It expresses error as a percentage, useful for comparing models across different scales.

MAPE = (1/n) * Σ(|Actuali - Predictedi|/Actuali) * 100(Note: MAPE can be undefined if Actuali is zero.) - Symmetric Mean Absolute Percentage Error (sMAPE): A variation of MAPE that addresses the issue of undefined values when Actuali is zero. It averages the percentage errors in both directions.

sMAPE = (1/n) * Σ(2 * |Actuali - Predictedi| / (|Actuali| + |Predictedi|) * 100

Choosing the right metric depends on the specific context and the priorities of the forecasting task. For example, in a financial forecasting context where large errors are highly undesirable, RMSE might be preferred over MAE.

Q 9. Explain the difference between accuracy and precision in forecasting.

Accuracy and precision are crucial aspects of forecasting model evaluation, but they represent different characteristics of the model’s performance:

- Accuracy refers to how close the forecast is to the actual value. A highly accurate model produces predictions that are consistently close to the true values. Think of it as the overall closeness to the bullseye in a dart game.

- Precision refers to how consistent the forecasts are. A precise model generates predictions that cluster closely together, even if they’re not necessarily very close to the actual value. It’s like consistently hitting the same spot on the dartboard, even if that spot isn’t the bullseye.

Ideally, a good forecasting model should be both accurate and precise. A model can be accurate but not precise (e.g., consistently overestimating by a small amount), or precise but not accurate (e.g., consistently missing the target by a large margin). The choice between prioritizing accuracy or precision depends on the specific application. For example, in inventory management, consistent overestimation (high precision but low accuracy) might be preferable to large fluctuations in prediction (low precision).

Q 10. How do you deal with outliers in forecasting data?

Outliers in forecasting data can significantly skew model results and lead to inaccurate predictions. Several strategies can be used to handle them:

- Identification: First, we must identify outliers using methods like box plots, scatter plots, or statistical tests (e.g., z-scores). Visual inspection can be very helpful here.

- Removal: For certain types of outliers (e.g., data entry errors), simply removing them might be appropriate, especially if they are few in number and clearly erroneous. However, this should be done cautiously, and ideally after careful investigation to understand the cause of the outlier.

- Transformation: Applying a data transformation (e.g., logarithmic transformation) can sometimes reduce the influence of outliers by compressing the range of values.

- Winsorizing or Trimming: Winsorizing replaces extreme values with less extreme values (e.g., the 95th percentile value), while trimming removes a certain percentage of the highest and lowest values.

- Robust Models: Employing robust forecasting methods, such as those based on quantiles or median instead of mean, are less sensitive to outliers. Robust methods are particularly valuable when you suspect the presence of many outliers or are dealing with datasets whose distribution is unknown.

The best approach depends on the nature of the outliers and the size of the dataset. It’s crucial to document the chosen method and its rationale.

Q 11. What are the advantages and disadvantages of using exponential smoothing?

Exponential smoothing is a popular forecasting method that assigns exponentially decreasing weights to older observations. This means recent data points have a greater influence on the forecast than older ones.

- Advantages:

- Simplicity: It’s easy to understand and implement.

- Computational Efficiency: It’s computationally inexpensive, making it suitable for large datasets.

- Adaptability: It can adapt to changes in the data over time by adjusting the smoothing parameter (alpha).

- Disadvantages:

- Limited Flexibility: It’s less flexible than other methods (e.g., ARIMA) and may not capture complex patterns.

- Parameter Selection: Choosing the appropriate smoothing parameter (alpha) is crucial and can be challenging. Improper parameter selection will reduce accuracy.

- Lagging Behavior: Because it gives greater weight to recent data, it can lag behind sudden changes in the data.

Despite its limitations, exponential smoothing remains a widely used method due to its simplicity and effectiveness, particularly for short-term forecasting with relatively stable data.

Q 12. Describe your experience with different forecasting software or tools.

Throughout my career, I’ve worked extensively with various forecasting software and tools, including:

- R: Using packages like

forecast,tseries, andprophetfor time series analysis and forecasting, including ARIMA, exponential smoothing, and more advanced techniques. - Python: Utilizing libraries like

statsmodels,pmdarima, andfbprophetfor similar tasks as in R, alongside machine learning libraries likescikit-learnfor regression-based approaches. - SAS: Employing SAS/ETS for advanced time series analysis, including sophisticated modeling techniques and forecasting capabilities.

- Specialized Forecasting Platforms: I also have experience with commercially available forecasting platforms which offer user-friendly interfaces and automated model selection features. These are often preferred for business users with less technical expertise.

My experience extends beyond simply using these tools; I understand the underlying statistical principles and can effectively choose and implement the most appropriate method for the problem at hand.

Q 13. Explain the concept of model selection in forecasting.

Model selection in forecasting is the process of choosing the best forecasting model from a range of candidate models. This involves a systematic comparison of different models’ performance based on various criteria.

The process typically includes:

- Defining the Objective: Clearly specifying the goals of the forecasting exercise (e.g., minimizing error, capturing trends, generating probabilistic forecasts).

- Data Preparation: Cleaning, transforming, and splitting the data into training and validation sets.

- Model Specification: Selecting potential candidate models based on the nature of the data and the forecasting objective (e.g., simple moving average, exponential smoothing, ARIMA, machine learning models).

- Model Estimation: Fitting each model to the training data and obtaining parameter estimates.

- Model Evaluation: Evaluating the performance of each model on the validation set using appropriate error metrics (e.g., MAE, RMSE, MAPE). This might involve techniques like cross-validation.

- Model Selection: Choosing the model that performs best based on the evaluation criteria and considering factors such as model complexity and interpretability.

It’s crucial to use a rigorous approach to model selection, avoiding overfitting and ensuring the chosen model generalizes well to new data. This often involves a balance between model complexity (the ability to capture nuances) and simplicity (ease of interpretation and reduced risk of overfitting).

Q 14. How do you handle missing data in a forecasting dataset?

Handling missing data in forecasting datasets is crucial for accurate predictions. The approach depends on the nature and extent of the missing data:

- Identify the Pattern: First, determine if the missing data is Missing Completely at Random (MCAR), Missing at Random (MAR), or Missing Not at Random (MNAR). This impacts the choice of imputation method.

- Imputation Methods:

- Simple Imputation: Replace missing values with a simple statistic like the mean, median, or last observed value. This is easy to implement but can introduce bias, especially if missing data is not MCAR.

- Advanced Imputation: More sophisticated methods include k-nearest neighbors (k-NN), multiple imputation (using chained equations), or model-based imputation (e.g., predicting missing values based on other variables using a regression model).

- Model Selection: Some models are more robust to missing data than others. For instance, machine learning models like random forests and gradient boosting machines can often handle missing values directly without imputation.

- Data Deletion: In cases with minimal missing data that is clearly not informative, removing the rows or columns containing the missing values may be acceptable. However, this should be done cautiously, as deleting significant data may harm the accuracy of the forecasts.

The choice of method depends on the context and the characteristics of the data. Always consider the potential bias introduced by imputation and document the chosen methodology.

Q 15. What are some common challenges in forecasting?

Forecasting, while powerful, is inherently challenging. Uncertainty is the biggest hurdle. We can’t predict the future with absolute certainty; unexpected events always have the potential to throw off even the most sophisticated model.

- Data limitations: Insufficient data, noisy data, or data that’s not representative of the future can significantly impact accuracy. Imagine trying to forecast ice cream sales based on data only from winter months – the results would be wildly inaccurate.

- Model limitations: No single model is perfect for every situation. Choosing the wrong model or mis-specifying a model can lead to poor forecasts. It’s like trying to fit a square peg into a round hole.

- External factors: Unforeseen events like economic downturns, natural disasters, or sudden changes in consumer behavior can dramatically impact forecasts. The COVID-19 pandemic, for instance, completely disrupted many established forecasting models.

- Dynamic systems: Many systems we try to forecast are dynamic; their underlying behavior changes over time. A model that worked well last year might be completely useless this year because of shifts in market trends or technological advancements.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you incorporate external factors into your forecasting models?

Incorporating external factors is crucial for building robust forecasting models. We achieve this through several techniques:

- Regression models: These models directly incorporate external factors as independent variables. For example, when forecasting sales, we might include factors like advertising spend, competitor pricing, and economic indicators as predictor variables in a multiple linear regression model.

y = β0 + β1*x1 + β2*x2 + ... + ε, where ‘y’ is the dependent variable (sales), ‘x1’, ‘x2’ are independent variables (advertising spend, competitor pricing), and ‘ε’ is the error term. - Qualitative adjustments: Expert judgment can be incorporated to adjust model outputs based on qualitative information like upcoming marketing campaigns or planned product launches. This adds a layer of human expertise that compensates for limitations in quantitative data.

- Scenario planning: Instead of relying on a single forecast, we can generate forecasts under different scenarios (e.g., optimistic, pessimistic, most likely). This provides a range of possible outcomes and helps stakeholders understand the uncertainty involved.

- Time-varying parameters: For dynamic systems, we can use models with parameters that change over time to reflect shifts in underlying relationships. This allows the model to adapt to changes in external conditions more effectively.

Q 17. Explain the concept of forecasting bias and how to mitigate it.

Forecasting bias refers to systematic errors in forecasts that consistently overestimate or underestimate the true value. This can stem from various sources such as flawed data, model misspecification, or cognitive biases of the forecaster.

To mitigate forecasting bias:

- Data validation and cleaning: Thoroughly examining the data for errors, outliers, and inconsistencies is paramount. Cleaning the data is as critical as choosing the right model.

- Model diagnostics: After model building, we carefully assess the model’s residuals (the difference between actual and predicted values) for patterns. If there are systematic patterns, it indicates bias and suggests the need for model refinement.

- Cross-validation: Dividing the data into training and testing sets allows us to assess the model’s performance on unseen data, providing a more realistic picture of its accuracy and helping uncover biases that might not appear in the training set.

- Regular model updates: Forecasting models should not be static; they need to be regularly reassessed and updated with new data to account for evolving patterns and reduce the accumulation of bias over time.

- Ensemble methods: Combining forecasts from multiple models can help reduce the impact of bias in individual models. It’s a powerful way to leverage the strengths of various approaches while mitigating the risks associated with single model predictions.

Q 18. What is the difference between causal and time series forecasting?

Causal and time series forecasting differ fundamentally in their approach to prediction:

- Time series forecasting focuses solely on the historical pattern of the variable being forecast. It assumes that past trends and seasonality will continue into the future. Think of it as looking backward to predict forward. Methods like ARIMA and exponential smoothing fall under this category.

- Causal forecasting goes beyond historical patterns and identifies the underlying factors (or causal variables) that drive the variable being forecast. It assumes that understanding the relationships between these variables will lead to more accurate predictions. Regression models are a prime example, where sales might be predicted based on advertising spending, seasonality and price.

Example: Predicting ice cream sales. A time series model might only look at past ice cream sales to predict future sales. A causal model, however, might additionally consider factors like temperature, price, and marketing campaigns to make the prediction.

Q 19. Describe your experience with different types of forecasting models (e.g., ARIMA, exponential smoothing, regression).

I have extensive experience with various forecasting models, including:

- ARIMA (Autoregressive Integrated Moving Average): I’ve used ARIMA models for forecasting time series data with trends and seasonality, particularly in applications involving economic data and stock prices. Determining the optimal (p,d,q) parameters is critical for accurate predictions.

- Exponential Smoothing: This family of models (Simple, Double, Triple Exponential Smoothing) is well-suited for short-term forecasting, especially when dealing with data exhibiting trends or seasonality. It’s computationally efficient and easy to interpret.

- Regression models (Linear, Multiple Linear, Polynomial): I’ve used regression to model the relationships between a dependent variable and one or more independent variables. This is especially useful when external factors significantly influence the variable being forecast, for instance, predicting crop yields based on rainfall, fertilizer usage, and temperature.

- Prophet (developed by Facebook): This model is particularly effective for forecasting time series data with strong seasonality and trend, handling outliers gracefully. It’s suitable for business applications where strong seasonality patterns are expected (e.g., retail sales).

My experience involves selecting the appropriate model based on data characteristics, evaluating model performance through various metrics (e.g., RMSE, MAE), and regularly updating models to reflect changing conditions.

Q 20. How do you communicate forecasting results to non-technical stakeholders?

Communicating forecasts effectively to non-technical stakeholders requires a clear, concise, and visually appealing approach:

- Focus on the key message: Avoid overwhelming them with technical details. Highlight the main forecast, its uncertainty, and its implications for decision-making.

- Visualizations: Graphs and charts are much more effective than tables of numbers. Use clear and intuitive visuals that illustrate the forecast and its uncertainty.

- Plain language: Avoid technical jargon. Explain concepts in simple terms and use analogies to make complex ideas easier to understand.

- Scenario planning: Presenting a range of possible outcomes (best-case, worst-case, most likely) is more informative than a single point forecast, conveying the inherent uncertainty involved.

- Focus on implications and actions: Explain what the forecast means for the organization and what actions should be taken based on the predictions.

For example, instead of saying “the ARIMA model predicts a 10% increase in sales with a 95% confidence interval of 8% to 12%,” I would say “We expect sales to grow by about 10%, but this could be anywhere between 8% and 12%. This suggests we should… (recommended action based on the forecast).”

Q 21. How do you validate your forecasting model?

Validating a forecasting model is crucial to ensuring its reliability. I employ several techniques:

- Backtesting: Applying the model to historical data and comparing its predictions to actual values. This helps assess its accuracy and identify potential biases. A good backtest should cover a reasonable portion of historical data.

- Cross-validation: Dividing the data into training and testing sets allows for unbiased evaluation. The model is trained on the training set and then tested on the unseen testing set, providing a more realistic measure of its future performance.

- Residual analysis: Examining the residuals (differences between actual and predicted values) for patterns or autocorrelation. Systematic patterns suggest model misspecification or bias. Ideally, residuals should be randomly distributed.

- Forecast accuracy metrics: Using appropriate metrics like Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), Mean Absolute Percentage Error (MAPE), and R-squared to quantify the model’s performance. The choice of metric depends on the specific application and business objectives.

- Out-of-sample forecasting: Generating forecasts for a period of time not used in model training and comparing to actual results when they become available. This provides a true test of the model’s predictive power on new, unseen data.

The goal is to ensure that the chosen model not only fits the historical data well but also generalizes to future data, producing accurate and reliable forecasts.

Q 22. What is your experience with forecasting accuracy improvement techniques?

Improving forecasting accuracy is a continuous process. My experience encompasses a range of techniques, broadly categorized into model selection, feature engineering, and model refinement. Model selection involves choosing the appropriate forecasting method – ARIMA for time series with trends and seasonality, Exponential Smoothing for simpler series, or machine learning models like Random Forests or Gradient Boosting for complex patterns with numerous predictors. Feature engineering focuses on crafting relevant input variables. This might include transforming existing variables (e.g., logarithmic transformations to handle skewed data), creating lagged variables (incorporating past values), or adding external regressors (economic indicators, weather data). Model refinement involves techniques like hyperparameter tuning (optimizing model settings), cross-validation (assessing model generalization), and ensemble methods (combining multiple models for improved robustness).

For example, in predicting sales for a retail chain, I might initially use ARIMA. If the accuracy is unsatisfactory, I’d explore adding external regressors like promotional spending and competitor activity. Further improvement might involve using Gradient Boosting, tuning its hyperparameters via grid search, and employing cross-validation to prevent overfitting. Finally, averaging the predictions from ARIMA and Gradient Boosting could create a more robust ensemble forecast.

Q 23. Explain the concept of overfitting in forecasting models.

Overfitting occurs when a forecasting model learns the training data too well, including its noise and random fluctuations. This leads to excellent performance on the training data but poor performance on unseen data – the model essentially ‘memorizes’ the training set instead of learning underlying patterns. Imagine trying to fit a complex curve through a scatter plot of points; a highly flexible curve will perfectly fit all points, but will wildly oscillate between them, failing to generalize to new data points. In forecasting, an overfit model will produce highly accurate predictions for the past data but inaccurate predictions for future data.

Techniques to mitigate overfitting include:

- Using simpler models: A less complex model is less prone to overfitting.

- Regularization: Adding penalty terms to the model’s complexity.

- Cross-validation: Evaluating the model’s performance on multiple subsets of the data.

- Feature selection: Choosing the most relevant predictors.

- Pruning (for decision trees): Removing less important branches to simplify the model.

Q 24. How do you choose the appropriate forecasting horizon?

The forecasting horizon is the length of time into the future that the forecast covers. Choosing the appropriate horizon depends on the specific application and data characteristics. A shorter horizon (e.g., next week’s sales) is usually more accurate because there’s less uncertainty. Longer horizons (e.g., next year’s sales) are less accurate due to the increased influence of unforeseen events. Consider these factors:

- Data availability and quality: The further into the future, the less reliable the data may be.

- Forecast accuracy requirements: The required precision will influence the chosen horizon.

- Planning horizon: The time frame for decision-making, like inventory management or strategic planning.

- Data patterns: The presence of strong seasonal patterns might justify longer horizons if the pattern is reliable.

For instance, a daily demand forecast for a fast-moving consumer good might only cover a week ahead, while a long-term infrastructure project might require a 10-year forecast, even with lower accuracy.

Q 25. Explain the importance of data quality in forecasting.

Data quality is paramount in forecasting. Garbage in, garbage out – inaccurate, incomplete, or inconsistent data will lead to unreliable forecasts. Issues like missing values, outliers, and incorrect data types can significantly affect model performance.

Ensuring data quality involves:

- Data cleaning: Handling missing values (imputation or removal), identifying and addressing outliers.

- Data validation: Verifying data accuracy and consistency.

- Data transformation: Converting data into a suitable format for the chosen model (e.g., scaling, normalization).

- Data preprocessing: Feature engineering to improve model inputs.

A simple example: If sales data contains errors (e.g., incorrect entry of sales figures), the forecast will be skewed, leading to poor decisions on inventory levels or staffing.

Q 26. What are some ethical considerations in forecasting?

Ethical considerations in forecasting are crucial. Forecasts should be presented transparently, highlighting their limitations and uncertainties. Avoid overselling the precision of a forecast or using it to manipulate stakeholders. Important ethical considerations include:

- Transparency: Clearly communicate the methods used, assumptions made, and limitations of the forecast.

- Objectivity: Avoid bias in data selection, model development, and interpretation.

- Accuracy: Strive for the most accurate forecast possible, acknowledging inherent uncertainties.

- Responsible use: Avoid using forecasts to justify unethical actions or make misleading claims.

- Data privacy: Protecting sensitive information used in the forecasting process.

For example, a forecast predicting a significant economic downturn should be presented with caveats about its uncertainty and potential impact on various stakeholders, avoiding panic-inducing sensationalism.

Q 27. Describe a situation where your forecasting model failed and what you learned from it.

In a project forecasting energy consumption for a smart grid, our initial model, a simple linear regression, failed to capture the impact of unexpected weather events (extreme heatwaves). This led to significant discrepancies between predicted and actual energy usage. The lesson learned was the importance of incorporating external factors and employing more robust models capable of handling non-linear relationships and outliers. We revised the model by including weather data (temperature, humidity) as predictors and switched to a Gradient Boosting model, which demonstrated superior accuracy and resilience to unexpected events. The new model showed a much improved forecast by accounting for the significant variance caused by these weather related events.

Q 28. How do you stay up-to-date with the latest advancements in forecasting techniques?

Staying current in forecasting requires continuous learning. I regularly engage in several strategies:

- Academic journals: I follow publications like the Journal of Forecasting and the International Journal of Forecasting.

- Conferences and workshops: Attending industry conferences and workshops keeps me abreast of the latest advancements.

- Online courses and webinars: Platforms like Coursera and edX offer valuable resources on forecasting techniques.

- Professional organizations: Membership in professional organizations provides access to publications and networking opportunities.

- Industry blogs and newsletters: Staying updated through specialized publications on data science and forecasting.

- Open-source projects and code repositories: Exploring and learning from open-source forecasting tools and libraries on platforms like GitHub.

By combining these resources, I ensure that my knowledge remains current and relevant, allowing me to effectively leverage new tools and techniques in my work.

Key Topics to Learn for Forecasting Models Interview

- Time Series Analysis: Understanding different time series components (trend, seasonality, cyclical, irregular), and methods for decomposition and forecasting (e.g., moving averages, exponential smoothing).

- ARIMA Models: Learn the principles of Autoregressive Integrated Moving Average models, including model identification, parameter estimation, and diagnostic checking. Practical application: forecasting sales figures based on historical data.

- Regression Models for Forecasting: Explore various regression techniques (linear, multiple, polynomial) and their application in forecasting. Consider the importance of feature engineering and model selection.

- Prophet (Facebook’s Forecasting Model): Understand the strengths and limitations of this popular model, particularly for business applications with seasonality and trend changes. Practical application: demand forecasting for an e-commerce platform.

- Model Evaluation Metrics: Master the use of key metrics like RMSE, MAE, MAPE to assess forecast accuracy and compare different models. Understand their implications and limitations.

- Forecasting Error Analysis: Learn how to identify and interpret forecasting errors, understand bias vs. variance trade-off, and improve model accuracy through error analysis.

- Qualitative Forecasting Methods: Become familiar with qualitative methods like Delphi method, expert opinions, and market research, and understand when to use them in conjunction with quantitative techniques.

- Data Preprocessing and Feature Engineering: Understand the crucial role of data cleaning, transformation, and feature engineering in improving forecasting model accuracy. This includes handling missing values, outliers, and seasonality.

Next Steps

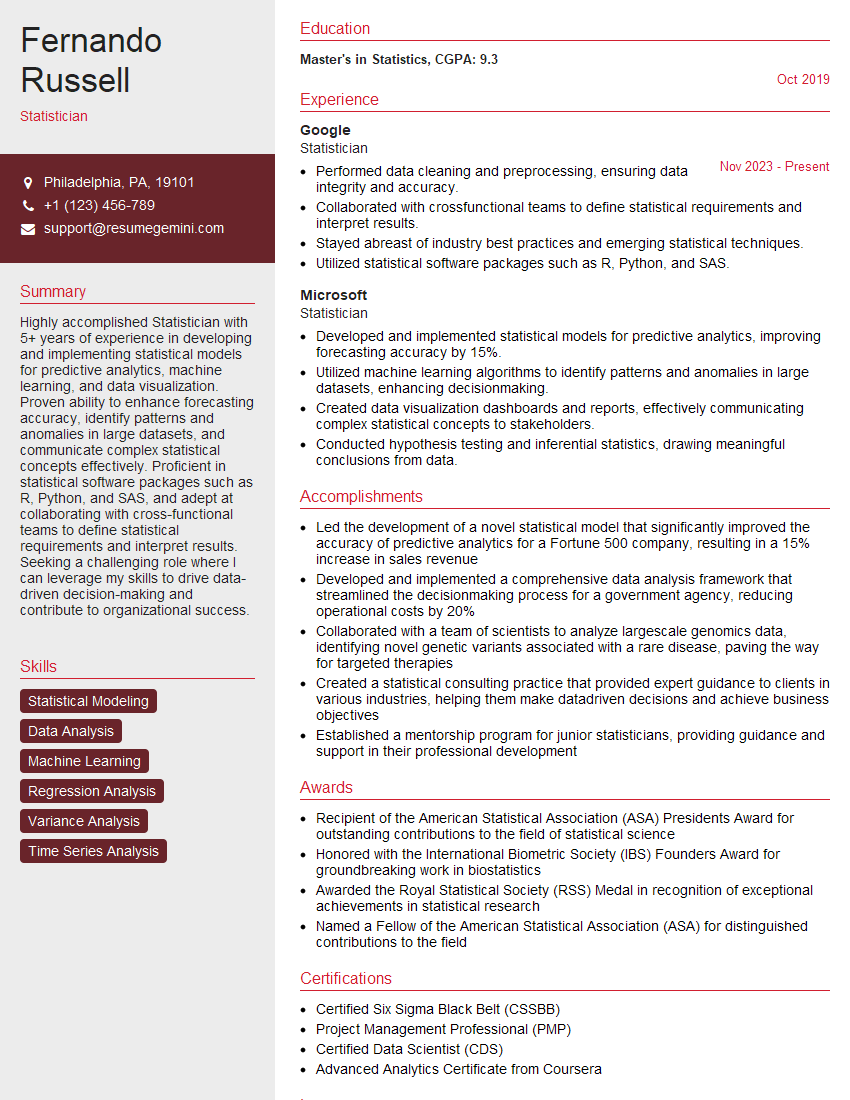

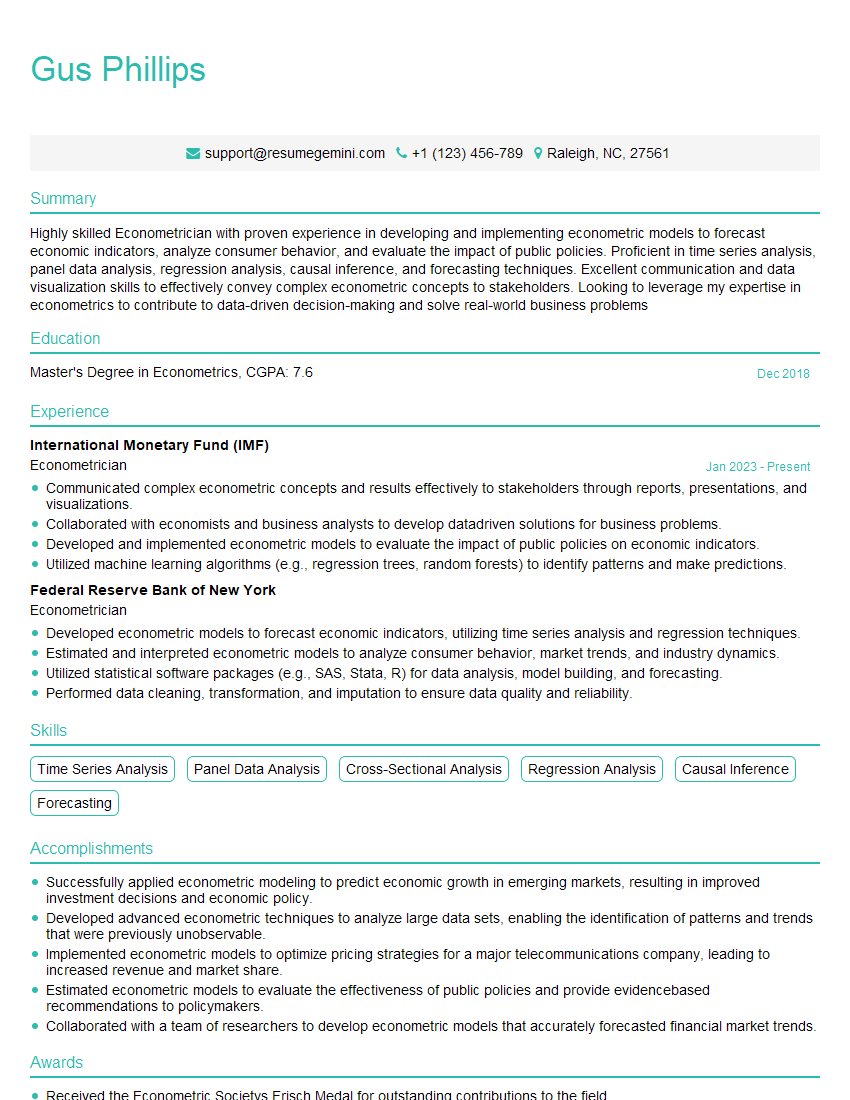

Mastering forecasting models is crucial for a successful career in data science, business analytics, and finance, opening doors to exciting roles with high growth potential. A strong resume is your key to unlocking these opportunities. Creating an ATS-friendly resume significantly increases your chances of getting noticed by recruiters. To help you build a compelling and effective resume, we recommend using ResumeGemini. ResumeGemini provides a user-friendly platform and offers examples of resumes tailored specifically for candidates with expertise in Forecasting Models, giving you a head start in your job search.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

we currently offer a complimentary backlink and URL indexing test for search engine optimization professionals.

You can get complimentary indexing credits to test how link discovery works in practice.

No credit card is required and there is no recurring fee.

You can find details here:

https://wikipedia-backlinks.com/indexing/

Regards

NICE RESPONSE TO Q & A

hi

The aim of this message is regarding an unclaimed deposit of a deceased nationale that bears the same name as you. You are not relate to him as there are millions of people answering the names across around the world. But i will use my position to influence the release of the deposit to you for our mutual benefit.

Respond for full details and how to claim the deposit. This is 100% risk free. Send hello to my email id: [email protected]

Luka Chachibaialuka

Hey interviewgemini.com, just wanted to follow up on my last email.

We just launched Call the Monster, an parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

We’re also running a giveaway for everyone who downloads the app. Since it’s brand new, there aren’t many users yet, which means you’ve got a much better chance of winning some great prizes.

You can check it out here: https://bit.ly/callamonsterapp

Or follow us on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call the Monster App

Hey interviewgemini.com, I saw your website and love your approach.

I just want this to look like spam email, but want to share something important to you. We just launched Call the Monster, a parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

Parents are loving it for calming chaos before bedtime. Thought you might want to try it: https://bit.ly/callamonsterapp or just follow our fun monster lore on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call A Monster APP

To the interviewgemini.com Owner.

Dear interviewgemini.com Webmaster!

Hi interviewgemini.com Webmaster!

Dear interviewgemini.com Webmaster!

excellent

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good