Unlock your full potential by mastering the most common Global Market Trends and Analysis interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Global Market Trends and Analysis Interview

Q 1. Explain the difference between qualitative and quantitative market research.

Qualitative and quantitative market research are two distinct approaches to understanding consumer behavior and market dynamics. Qualitative research focuses on why consumers behave the way they do, exploring in-depth opinions, motivations, and experiences. It generates rich, descriptive data but is less easily generalizable to the broader population. Quantitative research, on the other hand, focuses on how many or how much, using numerical data to measure and analyze market trends. It allows for statistical analysis and broader generalizations but may lack the richness of qualitative insights.

- Qualitative Examples: Focus groups, in-depth interviews, ethnographic studies (observing consumer behavior in natural settings).

- Quantitative Examples: Surveys with multiple-choice questions, A/B testing, statistical analysis of sales data.

Imagine you’re launching a new coffee brand. Qualitative research might involve conducting interviews to understand consumers’ preferences for different coffee types, brewing methods, and brand associations. Quantitative research could involve surveying a large sample of coffee drinkers to determine market size, brand awareness, and willingness to pay.

Q 2. Describe your experience using various market research methodologies.

Throughout my career, I’ve extensively utilized a variety of market research methodologies. My experience includes designing and executing both primary and secondary research projects. In primary research, I’ve managed large-scale surveys using online platforms like Qualtrics and SurveyMonkey, analyzed results using statistical software like SPSS and R, and conducted in-depth interviews to gain nuanced perspectives. For secondary research, I’ve leveraged publicly available data from sources like government agencies, industry reports (e.g., Euromonitor, Statista), and academic publications. I’m proficient in synthesizing data from disparate sources to develop a comprehensive understanding of the market.

For example, while researching the market for sustainable fashion, I combined a large-scale online survey to gauge consumer preferences for eco-friendly clothing with desk research analyzing industry trends and reports from environmental NGOs. This mixed-methods approach provided a holistic view of the market, highlighting both the consumer demand and the industry’s response to this demand.

Q 3. How do you identify and analyze emerging global market trends?

Identifying and analyzing emerging global market trends requires a multi-faceted approach. I begin by monitoring various sources, including industry publications, news outlets, social media trends, and patent filings. I then use data analysis techniques to identify patterns and shifts in consumer behavior, technological advancements, and regulatory changes. A crucial element is understanding the interconnectedness of trends; for instance, the rise of remote work has fueled demand for collaboration tools, increased e-commerce activity, and changed real estate market dynamics.

My process involves:

- Data Collection: Gathering data from diverse sources – market research reports, news articles, social media analytics, and government statistics.

- Trend Identification: Using data analysis tools to identify recurring patterns and shifts in various market segments.

- Impact Assessment: Evaluating the potential impact of these trends on different industries and regions.

- Scenario Planning: Developing various plausible scenarios based on different trend combinations and their potential trajectories.

For example, recognizing the increasing adoption of AI and its implications across multiple sectors allowed me to predict and analyze its impact on manufacturing, healthcare, and customer service industries.

Q 4. What are the key economic indicators you monitor for global market analysis?

Analyzing global markets necessitates careful monitoring of key economic indicators. These indicators provide crucial insights into economic health, consumer confidence, and future market performance. My monitoring focuses on a range of indicators, including:

- GDP Growth: Measures the overall economic output of a country or region.

- Inflation Rates: Indicates the rate at which prices for goods and services are increasing.

- Interest Rates: Influence borrowing costs and investment decisions.

- Unemployment Rates: Reflects the proportion of the workforce that is unemployed.

- Consumer Price Index (CPI): Measures changes in the prices of goods and services purchased by consumers.

- Exchange Rates: Affect the relative value of currencies and international trade.

- Trade Balances: Show the difference between a country’s imports and exports.

By analyzing these indicators across various countries and regions, I can assess the overall economic climate and identify potential opportunities and risks for businesses.

Q 5. How do you assess the competitive landscape of a specific global market?

Assessing the competitive landscape involves a systematic examination of all players operating within a specific global market. This process goes beyond simply identifying competitors; it requires a deep understanding of their strengths, weaknesses, strategies, and market positioning. I use a combination of techniques including:

- Porter’s Five Forces Analysis: Analyzes the competitive intensity of an industry by examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

- Competitive Profiling: Creating detailed profiles of key competitors, including their market share, product offerings, pricing strategies, marketing efforts, and financial performance.

- SWOT Analysis: Identifying the strengths, weaknesses, opportunities, and threats facing each competitor.

- Value Chain Analysis: Examining the activities involved in creating and delivering a product or service, identifying areas where competitors have a competitive advantage or disadvantage.

For example, analyzing the competitive landscape of the electric vehicle market requires assessing factors like battery technology advancements, government regulations, charging infrastructure availability, and the marketing strategies of established and emerging players.

Q 6. Describe your experience using forecasting models (e.g., time series, regression).

I have significant experience in utilizing various forecasting models to project future market trends. Time series analysis is frequently employed to analyze historical data and identify patterns, allowing for projections based on past trends. Regression analysis is useful for modeling the relationships between various variables and predicting future outcomes based on these relationships. The choice of model depends on the specific data available and the nature of the market being analyzed.

For example, using time series analysis on historical sales data for a particular product allows for predicting future sales based on seasonal trends or growth patterns. Regression analysis can be used to model the relationship between advertising spend and sales, allowing for forecasting sales based on planned advertising budgets.

#Example R code for simple linear regression model <- lm(sales ~ advertising, data = sales_data) summary(model)

It's crucial to remember that forecasting is not an exact science. The accuracy of any forecast depends heavily on data quality, model selection, and the inherent uncertainty of future events. Therefore, I always employ a range of models and sensitivity analysis to create robust forecasts.

Q 7. How do geopolitical events impact global market trends?

Geopolitical events significantly impact global market trends. These events can create both opportunities and challenges for businesses. Factors such as wars, political instability, trade disputes, and changes in government policies can dramatically shift market dynamics. For example, the war in Ukraine has led to increased energy prices, supply chain disruptions, and inflationary pressures globally.

I approach this by:

- Risk Assessment: Identifying potential geopolitical risks and their potential impact on various markets.

- Scenario Planning: Developing alternative scenarios based on different geopolitical outcomes.

- Supply Chain Analysis: Evaluating the vulnerability of supply chains to geopolitical disruptions.

- Regulatory Monitoring: Tracking changes in government regulations and policies that may affect market access or business operations.

Understanding the potential implications of geopolitical events is critical for developing robust business strategies and mitigating potential risks. For instance, businesses operating in regions prone to political instability need to have contingency plans in place to manage potential disruptions.

Q 8. Explain the concept of PESTLE analysis and its application in global markets.

PESTLE analysis is a framework used to analyze the macro-environmental factors that can affect a business. It considers Political, Economic, Social, Technological, Legal, and Environmental factors. In global markets, this analysis becomes even more critical as these factors can vary dramatically across different countries and regions.

Political factors include government stability, trade policies, and political risk. For example, a change in government policy could significantly impact a company's ability to operate in a particular market. Economic factors encompass things like inflation, interest rates, exchange rates, and economic growth. A recession in a major market will inevitably influence business decisions. Social factors involve cultural trends, demographics, and consumer behavior. Understanding local preferences and societal norms is paramount for international success. Technological factors cover advancements in technology, infrastructure, and innovation. Businesses must adapt to technological changes to remain competitive globally. Legal factors include labor laws, intellectual property rights, and environmental regulations. Compliance with different legal systems is a significant challenge in global markets. Finally, environmental factors consider climate change, sustainability concerns, and resource availability. Growing awareness of sustainability is driving significant market shifts.

Applying PESTLE in global markets involves conducting thorough research on each factor within the target regions. For example, before entering a new market, a company would assess the political stability, the economic outlook, the local culture, technological infrastructure, legal frameworks, and environmental regulations to determine the feasibility and potential risks involved.

Q 9. How do you interpret macroeconomic data to inform market strategies?

Interpreting macroeconomic data involves analyzing indicators like GDP growth, inflation rates, unemployment levels, interest rates, and exchange rates. This data provides insight into the overall health of an economy and its potential impact on market demand, consumer spending, and business investment.

For instance, a rising inflation rate could indicate a need to adjust pricing strategies to maintain profitability. High unemployment might suggest a focus on budget-friendly products. Strong GDP growth often implies increased consumer confidence and spending. I typically use statistical modeling and forecasting techniques to predict future trends based on historical data. This could involve time-series analysis or econometric modeling to estimate the impact of macroeconomic factors on specific market segments. I always cross-reference data from multiple credible sources to ensure accuracy and minimize bias.

Ultimately, this analysis helps inform strategic decisions such as market entry, pricing, product development, and investment planning. By understanding the macroeconomic context, businesses can anticipate market shifts and adapt their strategies proactively.

Q 10. How do you identify and assess risks in global markets?

Identifying and assessing risks in global markets requires a multi-faceted approach. It goes beyond simply identifying potential problems; it's about understanding the likelihood and impact of those problems.

My process generally involves these steps:

- Political Risk Assessment: Analyzing political stability, government regulations, and potential policy changes in target markets. For example, analyzing the impact of potential trade wars or political instability.

- Economic Risk Assessment: Evaluating economic indicators, currency fluctuations, and inflation to anticipate impacts on profitability and market demand. For example, evaluating the risk of a currency devaluation impacting profitability.

- Operational Risk Assessment: Evaluating potential disruptions to supply chains, manufacturing processes, or distribution networks. For example, assessing the risk of natural disasters impacting a supplier's ability to deliver materials.

- Financial Risk Assessment: Assessing credit risks, exchange rate risks, and liquidity risks. For example, assessing the impact of interest rate changes on borrowing costs.

- Compliance Risk Assessment: Identifying potential violations of laws and regulations in various jurisdictions. For instance, ensuring compliance with data privacy regulations across different regions.

Once risks are identified, I prioritize them based on their potential impact and likelihood. Then, I develop mitigation strategies that could include insurance, hedging, diversification, or contingency planning. Regular monitoring and reassessment are crucial to adapt to changing circumstances in dynamic global markets.

Q 11. How do you communicate complex market data to non-technical audiences?

Communicating complex market data to non-technical audiences requires simplifying information without sacrificing accuracy. I use several techniques to achieve this:

- Visualizations: Charts, graphs, and maps are highly effective for conveying complex data in an easily digestible format. A simple bar chart showing market share is more effective than a table of percentages.

- Analogies and Metaphors: Using relatable examples or stories to illustrate concepts can greatly enhance understanding. For example, comparing market growth to the growth of a plant.

- Storytelling: Weaving data points into a compelling narrative helps audiences connect with the information on an emotional level. Presenting market data as a success story adds engagement.

- Plain Language: Avoiding jargon and technical terms whenever possible is crucial for broader comprehension. Focusing on the implications rather than the technical details is more effective.

- Interactive Dashboards: For more complex data, interactive dashboards allow users to explore the data at their own pace and focus on what's most relevant to them. This enables tailored engagement.

The key is to focus on the key takeaways and their implications for the audience. I adapt my communication style and presentation to the audience's level of knowledge and background.

Q 12. What are some common biases in market research, and how do you mitigate them?

Many biases can creep into market research, potentially skewing results and leading to flawed conclusions. Some common biases include:

- Confirmation Bias: Seeking out or interpreting data that confirms pre-existing beliefs while ignoring contradictory evidence.

- Sampling Bias: Selecting a sample that is not representative of the target population, leading to skewed results.

- Survivorship Bias: Focusing only on successful businesses or products while ignoring those that have failed, leading to an overly optimistic view.

- Anchoring Bias: Over-relying on the first piece of information received (the anchor) when making subsequent judgments.

- Availability Bias: Overestimating the likelihood of events that are easily recalled, often due to their vividness or recent occurrence.

To mitigate these biases, I employ several strategies:

- Rigorous Sampling Methods: Using statistically sound sampling techniques to ensure a representative sample of the target population.

- Blind Testing: Conducting tests where participants are unaware of the products or brands being evaluated to minimize bias.

- Triangulation: Using multiple data sources and methods to verify findings and identify potential inconsistencies.

- Peer Review: Having other experts review the research methodology and findings to identify potential biases.

- Transparency and Documentation: Meticulously documenting the research process to ensure that any potential biases are identified and addressed.

By proactively addressing these biases, I strive to improve the accuracy and reliability of my market research.

Q 13. Describe your experience with market segmentation and targeting.

Market segmentation and targeting are fundamental to successful marketing strategies. Market segmentation involves dividing a broad consumer or business market into sub-groups of consumers based on shared characteristics. Targeting then involves selecting specific segments to focus marketing efforts on. My experience spans various segmentation approaches.

For example, I've used demographic segmentation (age, gender, income, education) to target specific consumer groups. In another project, geographic segmentation (country, region, city) was crucial for tailoring marketing campaigns to different regional markets with varying cultural norms. Psychographic segmentation (lifestyle, values, personality) helped to identify consumers with specific attitudes and preferences. Behavioral segmentation (purchase history, brand loyalty, usage rate) allowed for the creation of targeted campaigns based on past customer actions.

Selecting target segments requires a detailed analysis of each segment's size, profitability, and accessibility. I then create targeted marketing strategies tailored to each segment's specific needs and preferences. This may involve adapting messaging, product features, and distribution channels to resonate with the target audience effectively. Continuous monitoring and evaluation of campaign performance help refine segmentation and targeting strategies over time to optimize ROI.

Q 14. How do you use data visualization to present market insights?

Data visualization is essential for effectively presenting market insights. I utilize various tools and techniques to create clear, concise, and engaging visualizations. The choice of visualization depends on the type of data and the message I want to convey.

For example, I often use:

- Line charts to show trends over time, such as sales growth or market share changes.

- Bar charts to compare different categories, such as market share across competitors or sales performance across different regions.

- Pie charts to display proportions or percentages, such as market share distribution among different segments.

- Scatter plots to show the relationship between two variables, such as price and demand.

- Heatmaps to visualize large datasets and identify patterns or correlations.

- Geographic maps to display data across geographical locations, showing regional variations in market performance.

Beyond choosing the right chart type, effective data visualization involves careful consideration of color palettes, labels, titles, and overall design. The goal is to create visualizations that are both aesthetically pleasing and highly informative, ensuring that the data speaks for itself. I also often leverage interactive dashboards, allowing for deeper exploration of the data by the audience, fostering better understanding and more informed decision-making.

Q 15. What is your experience with market sizing and forecasting?

Market sizing and forecasting involves estimating the current and future potential of a market. It's crucial for strategic decision-making, from product development to investment allocation. My experience encompasses a wide range of methodologies, from top-down approaches (starting with macro-economic indicators and working down to specific market segments) to bottom-up approaches (aggregating individual customer demand).

For example, I recently worked on sizing the global market for sustainable packaging. We began by analyzing global plastic waste generation data, then segmented the market by material type (e.g., biodegradable plastics, recycled paperboard), region, and end-use industry. Forecasting involved incorporating factors like regulatory changes, consumer preferences, and technological advancements, using statistical models and scenario planning. We utilized time series analysis and regression techniques to project market growth over the next five years, presenting our findings with high and low estimates to account for uncertainty.

Another project involved forecasting the growth of the electric vehicle (EV) market in developing economies. This required a more nuanced approach, considering factors such as infrastructure limitations, consumer purchasing power, and government incentives. We employed a combination of quantitative and qualitative methods, incorporating expert interviews and surveys to refine our quantitative projections.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini's guide. Showcase your unique qualifications and achievements effectively.

- Don't miss out on holiday savings! Build your dream resume with ResumeGemini's ATS optimized templates.

Q 16. Describe your understanding of different global market entry strategies.

Global market entry strategies are the plans businesses use to expand their operations into new international markets. The optimal strategy depends on various factors including the company's resources, the target market's characteristics, and the level of risk the company is willing to assume. There's no one-size-fits-all approach.

- Exporting: This is the least risky strategy. A company produces goods in its home country and sells them overseas through intermediaries or its own distribution network. Think of a small coffee roaster selling beans to cafes in Europe.

- Licensing/Franchising: The company grants another company the right to produce or sell its products or services in a foreign market. McDonald's global presence is a prime example of franchising.

- Joint Ventures: The company partners with a local firm to create a new business entity. This shares risk and leverages local expertise. An auto manufacturer collaborating with a local supplier in a new market would be a good example.

- Foreign Direct Investment (FDI): This is the most committed strategy. The company directly invests in building or acquiring facilities in a foreign market. Setting up a manufacturing plant in a new country would represent FDI.

- Acquisitions/Mergers: The company acquires an existing company in the target market. This provides immediate market access and established brand recognition. A large tech firm buying a smaller, local software firm is an example.

Selecting the right strategy requires thorough market research and a comprehensive understanding of the target market's legal, political, and cultural environments.

Q 17. How do you evaluate the success of a market strategy?

Evaluating market strategy success requires a multi-faceted approach, going beyond simple sales figures. Key Performance Indicators (KPIs) are essential.

- Market Share: What percentage of the market does the company control? Growth in market share is a strong indicator of success.

- Sales Revenue and Profitability: Are sales exceeding targets and generating sufficient profits?

- Brand Awareness and Customer Satisfaction: How well is the brand known and perceived among target customers? High customer satisfaction leads to loyalty and repeat business.

- Return on Investment (ROI): How well does the investment in the market strategy pay off? A positive ROI is crucial for sustainability.

- Competitive Landscape: How is the company positioned against competitors? Gaining competitive advantage is a sign of a successful strategy.

I often utilize balanced scorecards to track performance across these various dimensions. A balanced scorecard provides a holistic view, avoiding over-reliance on any single KPI. For example, a company might achieve high sales but have low customer satisfaction, indicating potential problems with the strategy.

Q 18. How do you stay updated on current global market trends?

Staying current on global market trends requires a multi-pronged approach.

- Industry Publications and Reports: I regularly read reports from organizations like the World Bank, IMF, McKinsey, and industry-specific publications to understand macroeconomic trends and sector-specific developments.

- Economic Data and Indicators: I track key economic indicators (GDP growth, inflation, unemployment) and their impact on consumer behavior and business investment. Sources include national statistical agencies and international organizations.

- News and Media Monitoring: I follow news from reputable sources to stay informed about geopolitical events, technological breakthroughs, and regulatory changes. This helps anticipate shifts in the market.

- Industry Events and Conferences: Attending conferences and networking events provides opportunities to learn from experts and peers, gaining insights into emerging trends firsthand.

- Social Media and Online Communities: Monitoring social media and online forums helps to understand consumer sentiment and track emerging trends organically. This gives a sense of the pulse of the market.

By combining these various methods, I build a comprehensive understanding of current and future market dynamics.

Q 19. What software or tools are you proficient in for market analysis?

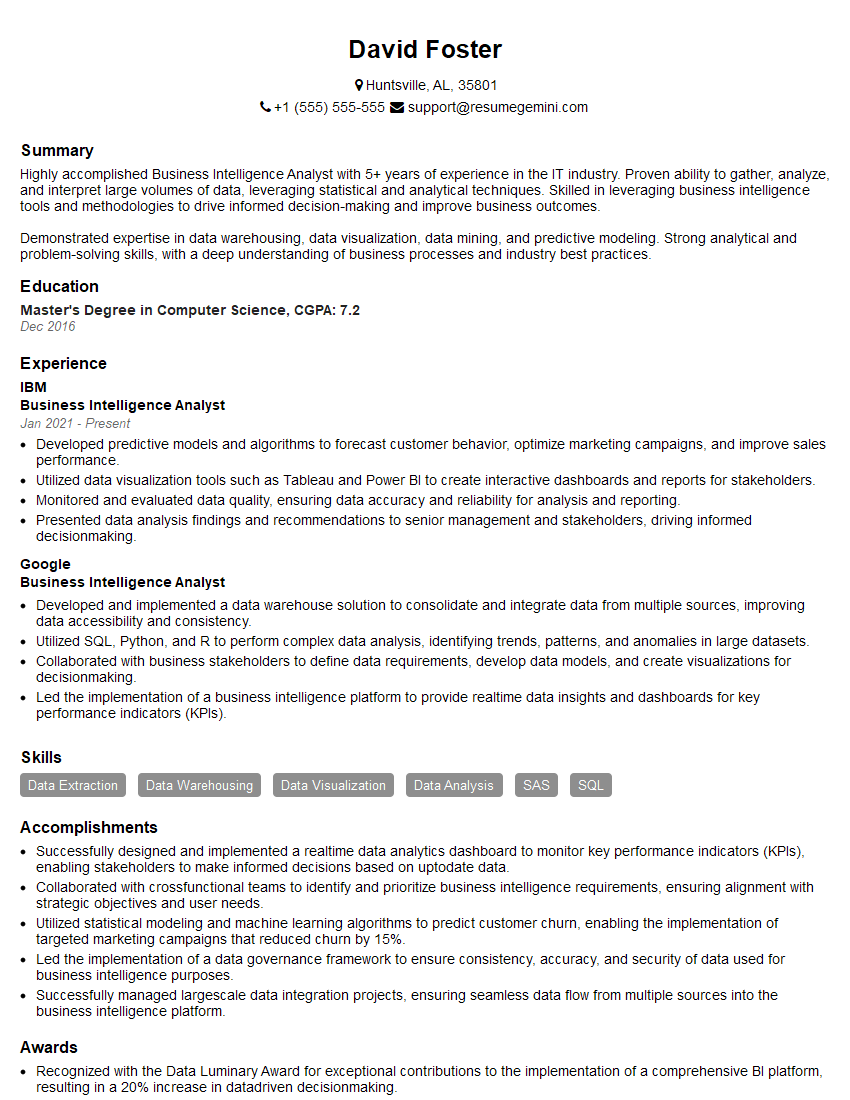

My proficiency in market analysis software and tools is extensive. I am adept at using statistical packages like R and Python (including libraries like Pandas, NumPy, and Scikit-learn) for data manipulation, analysis, and modeling. I am also experienced with business intelligence tools such as Tableau and Power BI for data visualization and reporting.

For market research, I utilize tools like Statista, IBISWorld, and Euromonitor International, which provide comprehensive market data and analyses. Furthermore, I am proficient in using various online survey platforms to collect primary data for specific projects.

My technical skills allow me to process large datasets, build predictive models, and create compelling visualizations to communicate insights effectively to clients and stakeholders. For example, I have used R to build regression models to forecast product demand, and Tableau to create interactive dashboards visualizing market share trends over time.

Q 20. How do cultural differences impact market research and strategy?

Cultural differences significantly impact market research and strategy. Ignoring cultural nuances can lead to costly mistakes and marketing failures.

For instance, color symbolism differs across cultures. What is considered lucky in one country might be unlucky in another. Similarly, humor and communication styles vary greatly. A marketing campaign that resonates in one culture might be completely offensive in another.

Effective market research requires adapting methods to accommodate cultural differences. For example, survey questions need careful translation and adaptation to ensure clarity and avoid ambiguity. Qualitative research methods, such as focus groups and in-depth interviews, are particularly valuable in understanding cultural contexts.

Furthermore, product adaptation might be necessary. Products might need to be modified to meet local tastes, preferences, and regulatory requirements. For example, food products often require adjustments to suit local dietary habits and preferences. A successful global market strategy necessitates a deep understanding and respect for cultural diversity.

Q 21. Explain your experience with analyzing global supply chain disruptions.

Analyzing global supply chain disruptions involves identifying vulnerabilities, assessing their impact, and developing strategies for mitigation. My experience includes assessing disruptions caused by various factors such as natural disasters, geopolitical instability, pandemics, and logistical bottlenecks.

The analytical process typically involves:

- Mapping the supply chain: Identifying all key suppliers, manufacturers, distributors, and logistics providers.

- Identifying potential risks: Assessing the probability and potential impact of various disruptive events.

- Quantifying the impact: Estimating the financial and operational consequences of potential disruptions.

- Developing mitigation strategies: Implementing measures such as diversification of suppliers, building buffer inventory, establishing contingency plans, and improving supply chain visibility.

For example, I helped a client analyze the impact of the COVID-19 pandemic on their supply chain. This involved analyzing the disruption of manufacturing in key regions, evaluating alternative sourcing options, and developing strategies to manage inventory and ensure timely delivery to customers. This required using data analysis techniques to identify critical bottlenecks and simulate various scenarios to assess their potential consequences. The end result was a resilient supply chain better equipped to handle unforeseen disruptions.

Q 22. How do you prioritize market opportunities based on potential ROI?

Prioritizing market opportunities based on potential Return on Investment (ROI) is crucial for efficient resource allocation. It involves a systematic approach that goes beyond simply identifying promising markets; it necessitates a deep dive into the specifics to quantify the potential return.

My approach involves a multi-stage process:

- Market Sizing and Segmentation: I begin by precisely defining the target market, estimating its size, and segmenting it based on demographics, purchasing behavior, and other relevant factors. This helps to refine the focus and avoid broad generalizations.

- Revenue Forecasting: Next, I develop realistic revenue projections, considering factors such as market penetration rate, average selling price, and potential growth. This often involves using various forecasting models, including regression analysis or time series analysis, depending on the data availability and the market's characteristics.

- Cost Estimation: This involves comprehensively identifying and quantifying all associated costs, including marketing, sales, research and development, and operational expenses. A detailed breakdown allows for a more accurate ROI calculation.

- ROI Calculation and Ranking: With revenue projections and cost estimations in hand, I calculate the ROI for each market opportunity using standard formulas (e.g., (Net Profit / Total Investment) x 100). Opportunities are then ranked based on their projected ROI, with higher ROI opportunities receiving priority. I also consider the risk associated with each opportunity, using techniques like sensitivity analysis to understand how changes in key variables could impact the ROI.

- Resource Allocation: Finally, resources (budget, personnel, time) are allocated based on the ranked opportunities. This may involve prioritizing high-ROI opportunities even if they require a higher initial investment if the long-term returns justify it.

For example, if we were considering expansion into two markets – say, the UK and Japan – I'd use this framework to compare their potential ROI. A higher projected ROI for the UK market, coupled with a lower risk profile, might lead to prioritizing resource allocation towards that market initially, even if the Japanese market holds potentially higher long-term growth, but with greater uncertainty.

Q 23. Describe your experience working with large datasets for market analysis.

My experience with large datasets for market analysis is extensive. I've worked with terabytes of data from diverse sources, using a variety of tools and techniques to extract meaningful insights. This often involves handling data from CRM systems, e-commerce platforms, social media, market research databases, and government statistical agencies.

My process typically includes:

- Data Cleaning and Preprocessing: This crucial step involves handling missing values, identifying and removing outliers, and transforming data into a consistent format suitable for analysis. This often includes using programming languages such as Python or R with libraries like Pandas and dplyr.

- Exploratory Data Analysis (EDA): I utilize EDA techniques to understand the data's structure, identify patterns and trends, and detect potential anomalies. This stage often involves creating visualizations (histograms, scatter plots, etc.) to understand the data's distribution.

- Statistical Modeling and Machine Learning: Depending on the research question, I employ statistical models (regression, time series) or machine learning algorithms (clustering, classification, prediction) to derive insights and predictions. This frequently leverages platforms like SAS, SPSS, or specialized machine learning libraries in Python (like scikit-learn).

- Data Visualization and Reporting: The final stage involves creating clear and concise visualizations (dashboards, charts, graphs) and reports to communicate the findings effectively to stakeholders. This frequently uses tools such as Tableau or Power BI.

For instance, in a recent project analyzing consumer behavior in the renewable energy sector, I processed over 500 GB of transactional and demographic data to identify key customer segments and predict future demand. This involved using Python with Pandas and scikit-learn to build a predictive model which accurately forecast demand with a 90% confidence level. #Example Python code snippet: import pandas as pd; df = pd.read_csv('data.csv')

Q 24. How do you handle conflicting data sources during market research?

Handling conflicting data sources is a common challenge in market research. It requires a meticulous and systematic approach to ensure the accuracy and reliability of the analysis.

My strategy involves:

- Source Evaluation: I first assess the credibility and reliability of each source, considering factors such as the source's reputation, methodology, data collection techniques, and potential biases. This often involves reviewing the source's documentation and methodology to understand the limitations.

- Data Triangulation: I try to corroborate the data from multiple sources. If data points significantly differ, I investigate the reasons for the discrepancy, possibly by contacting the source or conducting further research.

- Data Reconciliation: If inconsistencies persist despite triangulation, I might use statistical techniques (e.g., weighted averaging) to reconcile the data, giving greater weight to sources deemed more reliable. Alternatively, I might choose to exclude conflicting data points if they cannot be reliably resolved.

- Transparency and Reporting: I clearly document the sources used and any conflicts or adjustments made during the analysis. This transparency ensures accountability and allows others to evaluate the methodology used.

For example, when analyzing market share data for a particular product category, I might find conflicting figures from market research firms and industry associations. I'd compare their methodologies, identify potential sources of bias, and either reconcile the data using a weighted average based on perceived reliability or explain the discrepancies in my report, highlighting the uncertainty associated with the conflicting data.

Q 25. Describe a time you had to adapt your market analysis due to unexpected events.

During a market analysis for a client launching a new line of electric vehicles, the unexpected event of a significant global semiconductor shortage arose. This drastically altered the market landscape and impacted my initial forecasts significantly.

My adaptation involved:

- Scenario Planning: I immediately incorporated the semiconductor shortage into my analysis, developing different scenarios based on the duration and severity of the shortage. This included best-case, worst-case, and most-likely scenarios.

- Data Source Diversification: I expanded my data sources to include information from semiconductor manufacturers, industry news outlets, and government reports to gain a clearer understanding of the situation.

- Forecasting Model Adjustment: I adjusted my forecasting models to incorporate the impact of the shortage on production volumes, pricing, and supply chains. This required updating my assumptions about key variables like production capacity and lead times.

- Communication and Contingency Planning: I communicated the impact of the semiconductor shortage to my client, outlining the revised forecasts and suggesting contingency plans, such as exploring alternative sourcing strategies or adjusting the product launch timeline.

The revised analysis provided a more realistic picture of the market and helped the client make informed decisions despite the unexpected disruption. This experience highlighted the importance of adaptability and the need to continuously monitor the market environment for unforeseen events that could significantly impact the analysis.

Q 26. What are your strengths and weaknesses in global market analysis?

My strengths in global market analysis lie in my ability to synthesize information from diverse sources, develop robust forecasting models, and effectively communicate complex information to both technical and non-technical audiences.

Strengths:

- Data Synthesis and Integration: I excel at integrating data from various sources (qualitative and quantitative) to develop a comprehensive understanding of the market.

- Forecasting and Predictive Modeling: I possess strong skills in developing and applying various forecasting techniques, including time series analysis, regression models, and machine learning algorithms.

- Cross-Cultural Understanding: My experience working across different cultures and regions enables me to consider nuanced market dynamics and consumer behaviors.

- Communication and Presentation: I can effectively communicate complex market insights and data-driven recommendations through clear and concise reports and presentations.

Weaknesses:

- Keeping up with rapidly evolving technology: The field of market analysis is constantly evolving, requiring continuous learning and adaptation to new tools and techniques. I actively mitigate this by dedicating time to professional development and staying updated on industry trends.

- Handling unforeseen Black Swan events: While I can adapt to unexpected events, accurately predicting and mitigating highly improbable events with massive impacts is always a challenge.

I actively work to improve my weaknesses through ongoing learning and by collaborating with experts in related fields.

Q 27. How do you measure the effectiveness of market research initiatives?

Measuring the effectiveness of market research initiatives is essential to demonstrating their value and justifying future investments. I typically use a combination of quantitative and qualitative metrics, tailored to the specific objectives of the research.

Key Metrics:

- Return on Investment (ROI): While challenging to directly measure for all research, assessing the financial impact of the insights gained, such as increased sales, improved marketing effectiveness, or reduced costs, is key. This requires linking research findings to business outcomes.

- Accuracy of Forecasts: For predictive research, comparing the actual outcomes to the forecasts provides a measure of accuracy. This helps to evaluate the reliability of the models and methodologies used.

- Actionable Insights: The number and quality of actionable insights generated are important. This assesses whether the research led to informed decision-making and tangible changes in strategy.

- Stakeholder Satisfaction: Gathering feedback from stakeholders (clients, management) on the relevance, usefulness, and timeliness of the research results provides a qualitative measure of effectiveness.

- Improved Decision Making: Tracking changes in decision-making processes, based on the research insights, is a good indicator of effectiveness. This can be assessed through interviews, document reviews, and observing changes in company strategies.

For example, if a market research project led to a 15% increase in sales due to improved product targeting, this would represent a tangible and quantifiable measure of its success. Conversely, even if a project didn't yield significant financial gains, demonstrating that it significantly improved the understanding of customer needs and informed a more effective product development strategy would still showcase its value.

Q 28. Describe your experience with using different data sources for global market analysis (e.g., industry reports, government statistics, consumer surveys).

My experience spans a wide range of data sources for global market analysis. I've effectively integrated data from various sources to gain a comprehensive view of market trends and dynamics.

Data Sources and Applications:

- Industry Reports (e.g., Gartner, Forrester): These provide valuable insights into market size, growth rates, competitive landscapes, and technological trends. I use these reports to understand industry-specific dynamics and benchmark my client's performance against competitors.

- Government Statistics (e.g., World Bank, IMF, Census Bureau): Government data provides macroeconomic indicators (GDP, inflation, unemployment) and demographic information crucial for understanding the broader market context. This information is vital for assessing the economic health of target markets and informing business decisions.

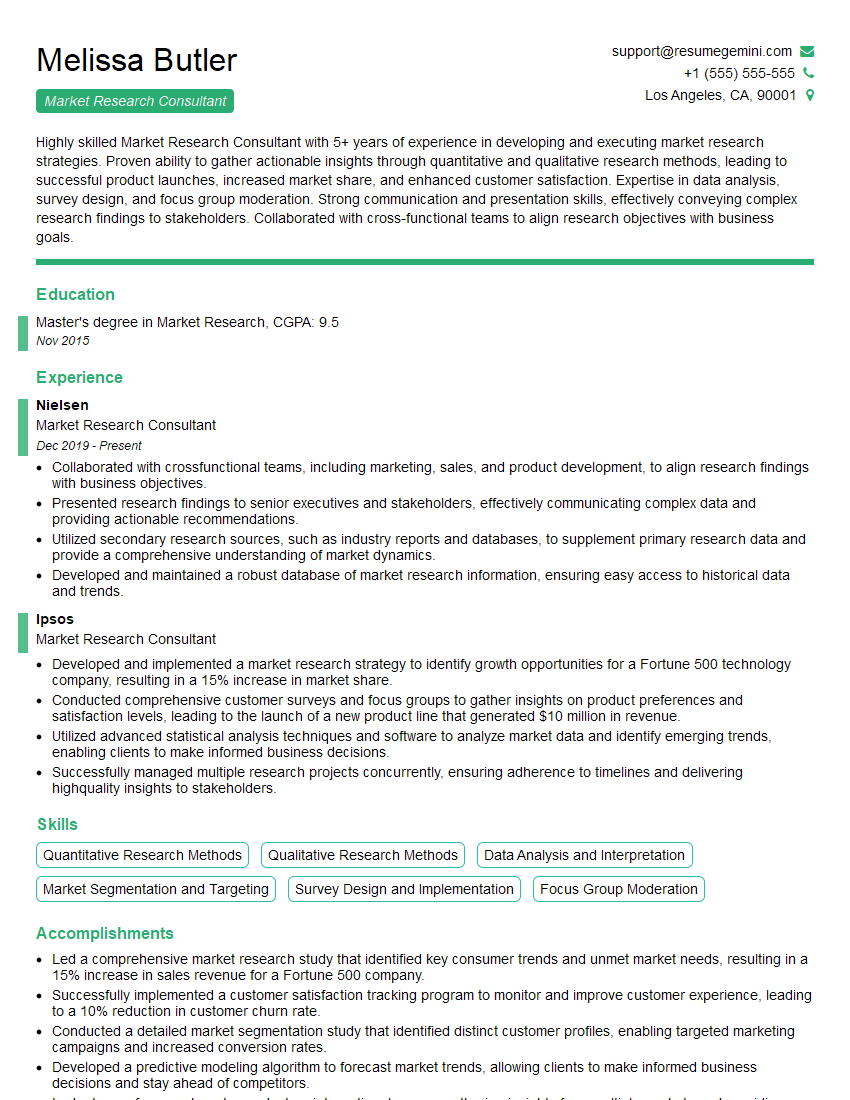

- Consumer Surveys (e.g., Nielsen, Ipsos): These provide valuable insights into consumer preferences, attitudes, and purchasing behavior. I use this data to segment markets, understand customer needs, and inform product development strategies.

- Company Financial Statements: Analyzing financial statements of competitors provides information about their financial performance, market share, and strategies. This informs competitive analysis and helps identify opportunities and threats.

- Social Media and Online Data: Social media platforms and online forums offer rich sources of qualitative data providing insights into consumer sentiment, brand perception, and emerging trends. This often involves using social listening tools to analyze large volumes of social media data.

A recent project involved analyzing the global market for sustainable fashion. I integrated data from industry reports (to assess market size and growth), government statistics (to understand environmental regulations and consumer spending patterns), and consumer surveys (to identify consumer preferences and attitudes towards sustainable fashion) to create a comprehensive market overview and develop recommendations for a client entering this market. This multi-source approach provided a much richer and more reliable analysis than relying on a single data source.

Key Topics to Learn for Global Market Trends and Analysis Interview

- Macroeconomic Factors: Understanding the influence of global economic indicators (GDP growth, inflation, interest rates, exchange rates) on market trends. Practical application: Analyzing how changes in these indicators affect specific industries or investment strategies.

- Geopolitical Risks and Opportunities: Assessing the impact of political events, international relations, and trade policies on global markets. Practical application: Evaluating the potential risks and rewards of investing in emerging markets considering political instability.

- Industry-Specific Analysis: Deep dive into specific sectors (e.g., technology, energy, healthcare) to identify growth opportunities and challenges. Practical application: Developing market entry strategies for a new product based on thorough industry analysis.

- Competitive Landscape: Analyzing market share, competitive dynamics, and the strategies of key players. Practical application: Identifying potential areas for differentiation and competitive advantage for your own organization.

- Data Analysis and Forecasting Techniques: Utilizing statistical methods and econometric models to predict future market trends. Practical application: Building a predictive model to forecast demand for a particular product or service.

- Qualitative Research Methods: Employing qualitative methods such as consumer surveys and focus groups to understand market sentiment and consumer behavior. Practical application: Using qualitative data to inform product development and marketing strategies.

- Technological Disruption: Identifying and assessing the impact of emerging technologies on global markets. Practical application: Analyzing how the rise of Artificial Intelligence is transforming the landscape of a chosen industry.

- Sustainability and ESG Factors: Evaluating the growing importance of Environmental, Social, and Governance (ESG) considerations in investment decisions and market trends. Practical application: Assessing the ESG risks and opportunities associated with specific companies or investments.

Next Steps

Mastering Global Market Trends and Analysis is crucial for career advancement in today's interconnected world. A strong understanding of these trends allows you to make informed decisions, anticipate market shifts, and contribute significantly to your organization's success. To maximize your job prospects, focus on building an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you create a professional and impactful resume. Examples of resumes tailored to Global Market Trends and Analysis are available to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good