Preparation is the key to success in any interview. In this post, we’ll explore crucial Knowledge of industryspecific regulations interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Knowledge of industryspecific regulations Interview

Q 1. Explain your understanding of [Specific Industry Regulation, e.g., HIPAA, GDPR].

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a US federal law designed to protect sensitive patient health information. It establishes national standards for the electronic exchange, physical protection, and privacy of Protected Health Information (PHI). Think of PHI as any individually identifiable health information, from medical records to billing details. HIPAA isn’t just about protecting data; it’s about fostering trust in the healthcare system by ensuring patient privacy and security.

HIPAA’s main components include the Privacy Rule, the Security Rule, and the Breach Notification Rule. The Privacy Rule dictates how PHI can be used and disclosed. The Security Rule sets standards for safeguarding electronic PHI. Finally, the Breach Notification Rule mandates reporting of any data breaches involving PHI. These rules impact everyone in the healthcare industry, from doctors and hospitals to insurance companies and technology vendors. Non-compliance can result in hefty fines and legal repercussions.

For example, a doctor’s office must obtain a patient’s authorization before disclosing PHI to an insurance company, except under certain specific circumstances permitted by the Privacy Rule. Similarly, a hospital must implement appropriate administrative, physical, and technical safeguards to protect electronic PHI, as mandated by the Security Rule. This could include measures like access controls, encryption, and regular security audits.

Q 2. Describe a situation where you had to interpret and apply a complex regulation.

During my time at [Previous Company Name], we faced a challenge interpreting the GDPR’s definition of ‘consent’ in the context of personalized advertising. The GDPR requires explicit consent for processing personal data for marketing purposes. However, the legislation is fairly nuanced regarding what constitutes ‘explicit consent’. Simply having a pre-checked box wasn’t sufficient; users had to actively opt-in, making the process more transparent and user-friendly.

We had previously relied on a system where consent was implied through continued website usage. This approach was deemed insufficient under the stricter interpretation of GDPR’s consent requirement. To rectify this, we had to re-design our consent mechanism to ensure it met the standards of explicit consent. This involved revising our user interface and modifying our backend systems to accurately record and manage user consent preferences, implementing a granular consent management system that allowed users to control exactly which data points they shared and for what purpose.

The process required a cross-functional effort involving legal, marketing, and IT teams. We needed to collaborate closely to ensure that the revised system not only complied with the regulation but also maintained a positive user experience. The result was a more compliant and user-friendly consent process which in turn increased our users trust and engagement.

Q 3. How do you stay updated on changes in industry-specific regulations?

Staying updated on regulatory changes is crucial. I utilize a multi-pronged approach:

- Subscription to industry newsletters and journals: This provides me with regular updates on regulatory changes and relevant case law.

- Membership in professional organizations: Organizations like [Mention relevant organizations, e.g., IAPP for GDPR, AHIMA for HIPAA] offer valuable resources, webinars, and networking opportunities to stay informed.

- Monitoring government websites and regulatory agencies: I actively monitor websites of regulatory bodies such as the Office for Civil Rights (OCR) for HIPAA or the Information Commissioner’s Office (ICO) for GDPR for official announcements and updates.

- Attending industry conferences and workshops: These events provide opportunities to learn from experts and network with peers.

- Utilizing legal databases and online resources: Services providing up-to-date legal information are essential to tracking modifications in the regulations.

This holistic approach allows for a comprehensive understanding of the latest developments, ensuring I’m always aware of emerging compliance challenges.

Q 4. What is your approach to identifying potential compliance risks?

My approach to identifying potential compliance risks is proactive and systematic. I use a risk assessment framework that considers:

- Data mapping: Identifying all personal data processed, its location, and how it’s used.

- Gap analysis: Comparing current practices against regulatory requirements to identify potential weaknesses.

- Vulnerability assessments: Regularly testing systems and processes for vulnerabilities that could expose data.

- Third-party risk assessment: Evaluating the compliance posture of vendors and partners who process data on our behalf.

- Employee training and awareness: Ensuring that employees understand their responsibilities in maintaining compliance.

This framework allows me to pinpoint areas of risk, prioritize remediation efforts, and implement preventative measures to mitigate potential breaches. For example, a gap analysis might reveal a lack of strong password policies, highlighting a potential security risk that needs immediate attention.

Q 5. How would you handle a situation where a regulation is ambiguous or unclear?

When faced with ambiguous regulations, I employ a structured approach:

- Thorough review of the legislation: I carefully examine the relevant sections of the regulation, paying close attention to the context and legislative history.

- Consultation with legal counsel: Seeking expert legal advice is crucial for interpreting complex or unclear aspects of the regulation.

- Review of guidance documents and case law: Regulatory bodies often issue guidance documents or interpretative statements that clarify ambiguities. Reviewing relevant case law can also provide valuable insights into how courts have interpreted the regulation.

- Industry best practices: Reviewing the practices of industry leaders and peers can provide further guidance on interpreting unclear regulations.

- Documenting interpretations: Once an interpretation is reached, it’s critically important to document the rationale and decision-making process.

This approach ensures that decisions are well-founded, legally sound, and consistent with best practices.

Q 6. Describe your experience with conducting compliance audits.

I have extensive experience conducting compliance audits. My approach involves a structured methodology encompassing:

- Planning and scoping: Defining the scope of the audit, including the specific regulations being assessed, the timeframe, and the resources required.

- Data collection: Gathering evidence through interviews, document reviews, and system assessments. This could involve reviewing policies, procedures, training materials, and system configurations.

- Risk assessment: Identifying and assessing potential compliance risks, prioritizing high-risk areas for further investigation.

- Testing and verification: Performing tests to verify compliance with relevant regulations, often using checklists and standardized procedures.

- Reporting and remediation: Documenting findings in a comprehensive report, including recommendations for remediation of identified deficiencies.

I use a combination of automated tools and manual processes to conduct efficient and thorough audits. The ultimate goal is to identify vulnerabilities and strengthen the organization’s compliance posture.

Q 7. How do you ensure compliance across different departments or locations?

Ensuring compliance across different departments and locations requires a multifaceted approach:

- Centralized compliance program: Establishing a centralized compliance program with clear policies, procedures, and training materials applicable to all departments and locations.

- Consistent implementation: Ensuring that policies and procedures are consistently implemented across all departments and locations through regular monitoring and audits.

- Regular communication and training: Providing regular communication and training to employees on compliance requirements, emphasizing the importance of data protection and privacy.

- Use of technology: Leveraging technology solutions such as centralized data management systems, access control mechanisms, and automated reporting tools to enhance compliance efforts.

- Regular reporting and monitoring: Establishing a mechanism for regular reporting and monitoring of compliance activities across all departments and locations.

This ensures a consistent approach to compliance regardless of geographical location or department, promoting a company-wide culture of compliance.

Q 8. What are the key penalties for non-compliance in [Specific Industry]?

Penalties for non-compliance in the pharmaceutical industry, for example, can be severe and far-reaching. They depend on the nature and severity of the violation, as well as the regulatory body involved (e.g., FDA in the US, EMA in Europe). Key penalties can include:

- Financial Penalties: This could range from substantial fines to complete forfeiture of profits. The amount depends on the infraction; a minor labeling error might result in a smaller fine compared to a case of falsified data resulting in serious patient harm.

- Product Recalls: Mandatory recalls of defective or contaminated products lead to significant financial losses and reputational damage. The cost of recalling and destroying a batch of medication is considerable, not to mention the loss of market share.

- Criminal Charges: In cases of egregious violations, such as deliberate falsification of data or manufacturing of counterfeit drugs, criminal charges can be brought against individuals and companies, leading to imprisonment and hefty fines.

- Import/Export Bans: Non-compliance can result in the inability to import or export products to certain markets, disrupting global supply chains and significantly impacting revenue.

- License Revocation or Suspension: This is possibly the most severe penalty, effectively shutting down operations and causing irreparable damage to the company’s reputation and future prospects. A revoked license would mean a complete cessation of pharmaceutical activities.

- Injunctions: Courts may issue injunctions prohibiting certain activities or requiring specific corrective actions, disrupting ongoing operations and demanding considerable resources to comply.

For instance, a company failing to adhere to Good Manufacturing Practices (GMP) could face all of the above penalties, depending on the extent of the non-compliance and its consequences.

Q 9. Explain your understanding of risk assessment related to industry regulations.

Risk assessment in relation to industry regulations is a systematic process to identify, analyze, and evaluate potential hazards and their associated risks that could lead to regulatory non-compliance. It’s about proactively identifying vulnerabilities and implementing controls before they become problems. Think of it like a preemptive strike against potential regulatory headaches.

This involves:

- Identifying potential hazards: This could include anything from outdated equipment, inadequate training, to insufficient data security or failure to implement proper record-keeping procedures.

- Analyzing the likelihood and severity of each hazard: How probable is it that this hazard will manifest? What are the potential consequences if it does? This often involves scoring each risk on a scale (e.g., low, medium, high).

- Evaluating the overall risk level: Combining likelihood and severity gives a holistic picture of the risk. Higher risk areas need more attention and robust mitigation strategies.

- Developing and implementing mitigation strategies: This could include things like process improvements, updated training materials, investing in new technologies or improved internal controls.

- Monitoring and reviewing the effectiveness of the mitigation strategies: It’s a continuous cycle, regularly reviewing the effectiveness of controls to ensure they’re still adequate and adjust them as needed.

For example, a pharmaceutical company might assess the risk of data breaches by reviewing their cybersecurity protocols. If the risk is high, they might invest in stronger firewalls and employee training to reduce the likelihood of a breach and the severity of its impact.

Q 10. How do you prioritize compliance efforts when resources are limited?

Prioritizing compliance efforts with limited resources requires a strategic approach. It’s not about doing everything, it’s about doing the most important things first.

A useful framework is to prioritize based on:

- Risk: Focus first on areas with the highest risk of non-compliance and the most severe potential consequences. Use the risk assessment as the roadmap here. A high-risk area with a low probability is still high risk overall and should be addressed.

- Regulatory Focus: Pay close attention to areas that are currently under increased scrutiny from regulators. Keep abreast of regulatory changes and announcements.

- Impact: Address areas that could have the most significant impact on the business if they go wrong. This might be areas impacting patient safety or leading to significant financial repercussions.

- Feasibility: Prioritize initiatives that are realistically achievable within existing resource constraints. Start with quick wins to demonstrate progress and build momentum.

For example, if a medical device company has limited resources, they might prioritize compliance training for employees handling sterilization processes (high risk, high impact) before focusing on updating less critical documentation procedures.

Q 11. Describe your experience with developing and implementing compliance training programs.

Developing and implementing compliance training programs is a crucial aspect of ensuring a culture of compliance. My experience includes designing and delivering tailored training programs that address specific regulatory requirements and company-specific needs. This is not a one-size-fits-all approach.

The process typically involves:

- Needs assessment: Identify training gaps through employee surveys, audits, and regulatory updates.

- Curriculum development: Create engaging and informative training materials – these shouldn’t be tedious compliance lectures, but active learning experiences tailored to diverse learning styles. Consider videos, interactive modules, and case studies.

- Delivery: Choose the optimal delivery method (online modules, in-person workshops, blended learning). Ensure accessibility and accommodate different learning styles.

- Evaluation: Assess the effectiveness of the training through pre- and post-training assessments, knowledge checks, and follow-up quizzes. Tracking is key to identifying areas that need improvement.

- Documentation: Maintain comprehensive records of all training activities, including attendance records and assessment results to demonstrate compliance to regulatory bodies.

In a previous role, I developed a training program for a manufacturing company on the updated ISO 9001 standards. This involved creating interactive modules, incorporating real-world examples, and providing regular quizzes to assess understanding. We also conducted regular refresher courses to reinforce key learnings.

Q 12. How would you respond to a regulatory audit?

Responding to a regulatory audit requires meticulous preparation and a collaborative approach. The goal is to demonstrate a commitment to compliance and transparency.

My approach includes:

- Pre-audit preparation: Review all relevant documentation, ensure policies and procedures are up-to-date, and identify any potential areas of concern. Internal audits can prepare you for the real thing.

- Designated Point of Contact: Establish a clear point of contact for the auditors and ensure they have access to necessary information and personnel.

- Open Communication: Maintain open and honest communication with the auditors, addressing their questions and concerns thoroughly and promptly.

- Documentation Readiness: Ensure all required documentation is readily available and organized, allowing auditors to easily access the information they need. This is a critical step.

- Corrective Action Plan: If any deficiencies are identified, develop a detailed and timely corrective action plan to address them. Auditors appreciate proactive remediation.

- Post-Audit Follow-up: After the audit, follow up on any outstanding issues and implement the corrective actions. Keep records and demonstrate the effectiveness of the changes.

In one instance, we successfully navigated a regulatory audit by having a robust document management system, a clear chain of command for addressing auditor inquiries, and a well-defined corrective action plan which led to a positive audit outcome.

Q 13. How do you document compliance activities?

Documenting compliance activities is crucial for demonstrating adherence to regulations and for internal process improvement. It provides an audit trail and facilitates continuous improvement.

Effective documentation should be:

- Comprehensive: Capture all relevant information related to compliance activities.

- Accurate: Ensure information is correct and up-to-date.

- Organized: Use a consistent filing system that allows for easy retrieval of documents.

- Accessible: Make documents easily accessible to authorized personnel.

- Secure: Protect documents from unauthorized access or modification.

- Version Controlled: Maintain version history of documents to track changes.

We often use a combination of electronic and physical record-keeping systems. For example, electronic systems provide better search functionality and version control, while physical files may be used for critical documents needing extra security. A combination approach is best for many companies.

Q 14. How do you effectively communicate compliance requirements to non-compliance personnel?

Communicating compliance requirements to non-compliance personnel requires a multifaceted approach that combines clear communication, training, and ongoing support. It’s about fostering a culture where compliance is not just a rule, but a shared responsibility.

Effective communication strategies include:

- Clear and Concise Language: Avoid jargon and use simple, straightforward language that everyone can understand.

- Multiple Communication Channels: Use a variety of methods, such as training sessions, email updates, posters, and one-on-one conversations, to reach a diverse audience.

- Interactive Training: Engage employees through interactive training programs and sessions that incorporate practical exercises and scenarios.

- Regular Communication: Provide regular updates on regulatory changes and compliance requirements to keep everyone informed.

- Feedback Mechanisms: Establish mechanisms for feedback and questions, such as suggestion boxes or regular Q&A sessions.

- Leadership Buy-in: Ensure that leadership visibly supports and champions compliance initiatives. This is perhaps the most important element.

In a previous role, we effectively communicated updated safety protocols by holding interactive workshops, distributing clear and concise guidelines, and using regular email reminders to reinforce key messages and provide a forum for questions and feedback.

Q 15. Explain your understanding of whistleblower protection laws and how they relate to compliance.

Whistleblower protection laws are designed to safeguard individuals who report illegal or unethical activities within their organizations. These laws are crucial for compliance because they incentivize the reporting of violations, which is vital for maintaining ethical business practices and preventing further harm. Without such protection, employees might hesitate to report wrongdoing, fearing retaliation. The laws typically prohibit employers from retaliating against whistleblowers, such as by firing, demoting, or harassing them. Specific protections vary by jurisdiction and often depend on the type of violation reported (e.g., securities fraud, environmental violations, healthcare fraud). For example, the Sarbanes-Oxley Act in the US offers significant protection to whistleblowers in publicly traded companies. These laws create a system of accountability, encouraging a culture of compliance within organizations.

The relationship to compliance is direct: robust whistleblower protection enhances compliance efforts. When employees feel safe reporting potential violations, organizations can identify and address issues quickly, preventing them from escalating into larger problems with potentially severe consequences, including hefty fines, reputational damage, and legal action.

Career Expert Tips:

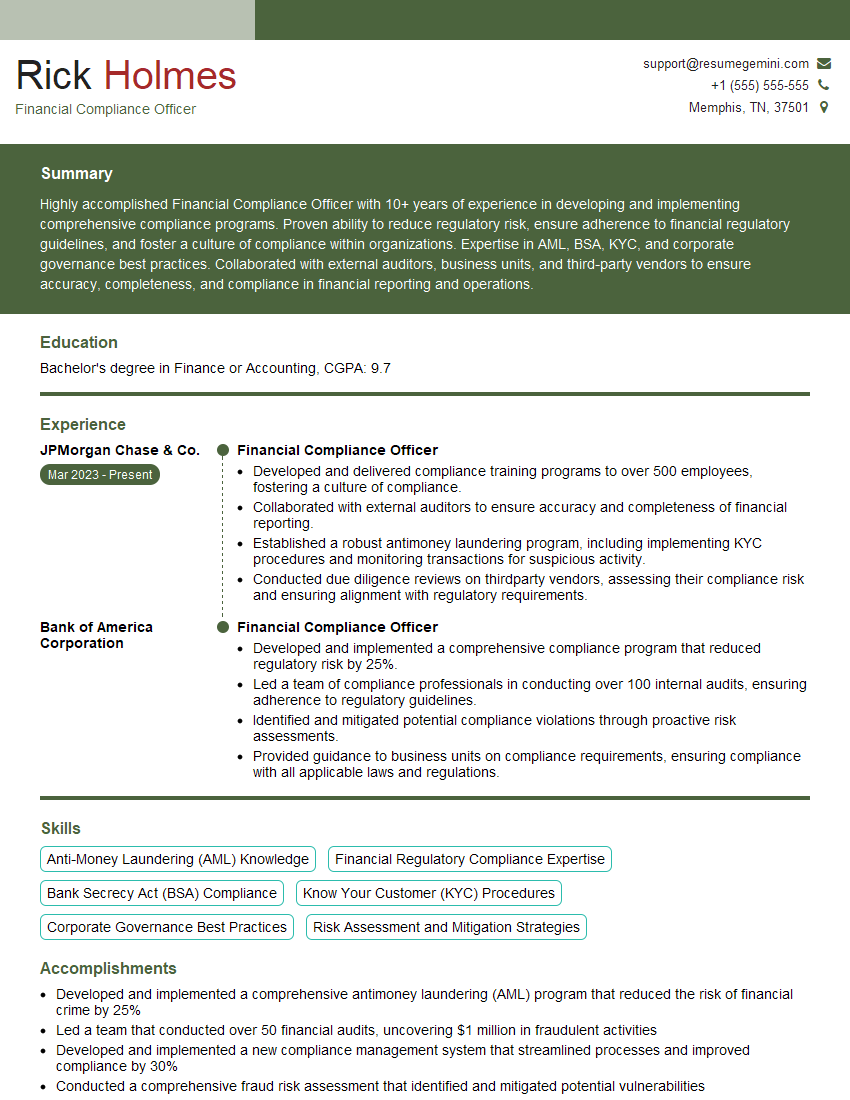

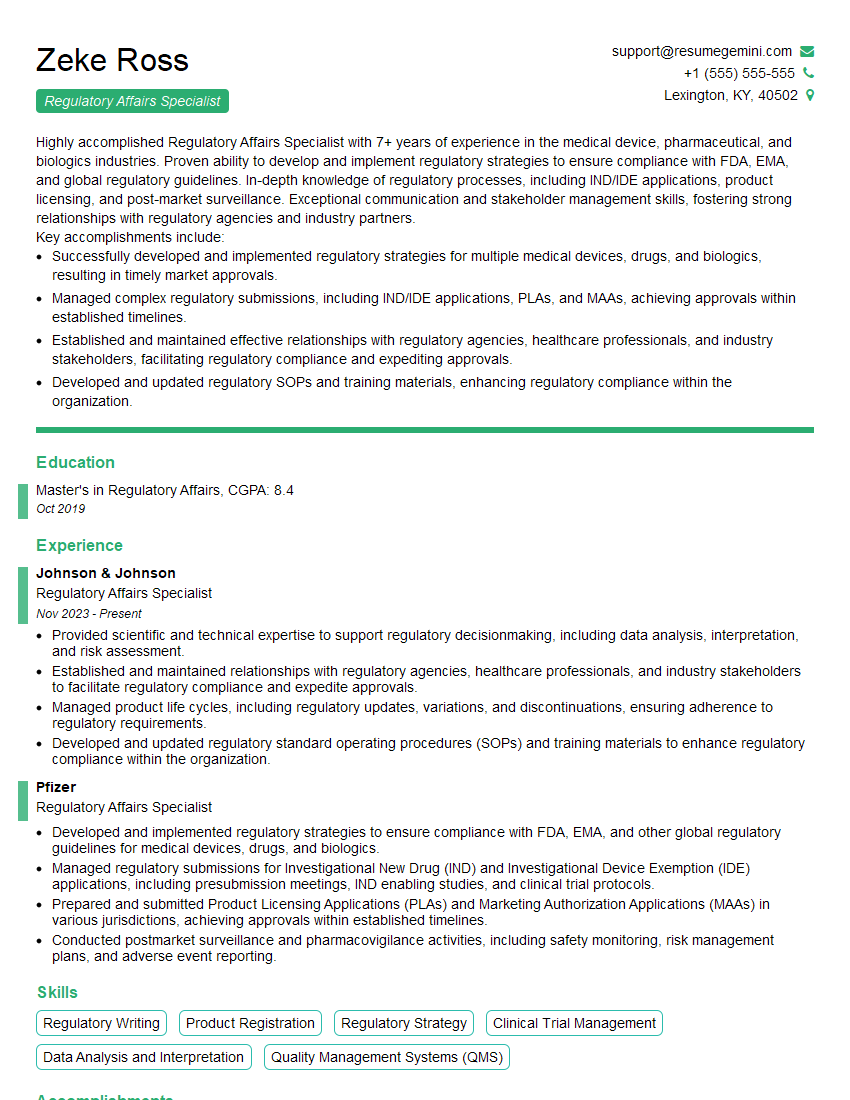

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience in working with regulatory bodies.

Throughout my career, I’ve had extensive interactions with various regulatory bodies, including the Environmental Protection Agency (EPA), the Securities and Exchange Commission (SEC), and the Occupational Safety and Health Administration (OSHA). My experience spans several projects, encompassing both proactive engagement and responding to inquiries or investigations. For example, while working at [Previous Company Name], I led the effort to obtain and maintain our ISO 14001 certification, working closely with external auditors to ensure compliance with environmental regulations. This included regular reporting and detailed documentation of our environmental performance. In another instance, I collaborated with the SEC during an internal investigation into potential accounting irregularities, ensuring transparency and providing all necessary information to their investigators.

These experiences have instilled in me a deep understanding of the regulatory landscape, the importance of meticulous record-keeping, and the need for proactive communication with regulatory bodies. I understand the nuances of regulatory expectations and am adept at navigating complex procedures.

Q 17. How familiar are you with industry best practices regarding compliance?

My familiarity with industry best practices regarding compliance is extensive. I stay abreast of the latest developments through professional organizations, industry publications, and continuous learning. Best practices encompass a wide range of elements, including:

- Risk assessment and management: Proactively identifying potential compliance risks and implementing mitigation strategies.

- Code of conduct and ethics training: Providing regular training to employees on ethical conduct and compliance regulations.

- Internal controls and audit functions: Establishing robust internal controls to prevent and detect violations, and conducting regular audits to ensure effectiveness.

- Third-party risk management: Assessing and managing the compliance risks associated with third-party vendors and suppliers.

- Documentation and record-keeping: Maintaining comprehensive and accurate records to demonstrate compliance.

- Incident response and remediation: Establishing clear procedures for responding to and remediating compliance violations.

I have applied these best practices in numerous settings and am confident in my ability to implement and maintain a strong compliance program.

Q 18. Have you ever had to report a compliance issue? Describe your process.

Yes, I have. In a previous role, I discovered a potential violation of data privacy regulations involving the improper handling of customer data. My process followed these steps:

- Documentation: I meticulously documented the nature of the violation, including dates, individuals involved, and supporting evidence.

- Internal Reporting: I reported the issue through the company’s established internal reporting channels, adhering to their whistleblower protection policy.

- Investigation: I cooperated fully with the internal investigation team, providing all necessary information and assisting in identifying corrective actions.

- Remediation: I participated in the development and implementation of corrective actions to prevent future occurrences.

- Follow-up: I followed up to ensure the corrective actions were effective and that the issue had been fully resolved.

Throughout the process, I prioritized maintaining objectivity, transparency, and adherence to the company’s internal policies and procedures. The experience reinforced the importance of a well-defined reporting structure and a proactive approach to compliance.

Q 19. How do you maintain confidentiality when dealing with sensitive compliance matters?

Maintaining confidentiality when dealing with sensitive compliance matters is paramount. My approach involves:

- Need-to-know basis: Limiting access to sensitive information to only those individuals who require it to perform their duties.

- Secure data storage: Utilizing secure data storage systems and encryption to protect sensitive data from unauthorized access.

- Confidentiality agreements: Utilizing confidentiality agreements with individuals involved in handling sensitive information.

- Data anonymization: Anonymizing data whenever possible to protect the privacy of individuals.

- Adherence to regulations: Strictly adhering to all applicable data privacy regulations, such as HIPAA, GDPR, or CCPA.

I understand that breaches of confidentiality can have serious consequences, both legally and ethically, and I am committed to upholding the highest standards of confidentiality in my work.

Q 20. What is your approach to proactively preventing compliance violations?

My approach to proactively preventing compliance violations is multifaceted and relies on a combination of strategies:

- Risk Assessment: Regularly conducting comprehensive risk assessments to identify potential compliance vulnerabilities.

- Policy Development and Implementation: Developing and implementing clear, concise, and easily accessible compliance policies and procedures.

- Training and Education: Providing ongoing training and education to employees on compliance requirements and best practices.

- Monitoring and Auditing: Implementing a robust monitoring and auditing program to identify and address potential violations early.

- Communication and Reporting: Establishing effective communication channels for reporting potential compliance issues and ensuring timely investigation and resolution.

- Continuous Improvement: Continuously reviewing and improving compliance processes to adapt to evolving regulations and industry best practices.

This proactive approach minimizes the risk of violations, protects the organization from potential penalties, and fosters a culture of ethical conduct.

Q 21. How do you use data analytics to monitor compliance?

Data analytics plays a crucial role in monitoring compliance. By analyzing large datasets, we can identify patterns and anomalies that might indicate potential compliance violations. For example, analyzing sales data can reveal potential violations of anti-bribery laws, while analyzing employee timekeeping data can uncover potential violations of labor laws. Specific applications include:

- Automated anomaly detection: Using algorithms to identify unusual patterns or outliers in data that might suggest a compliance issue.

- Trend analysis: Tracking key compliance metrics over time to identify emerging trends or risks.

- Predictive modeling: Developing predictive models to anticipate potential compliance violations based on historical data and external factors.

- Real-time monitoring: Using real-time data analysis to detect compliance violations as they occur.

The insights gained through data analytics enhance the effectiveness of compliance programs by allowing for more proactive and targeted interventions. It moves us beyond simply reacting to violations and allows for a more preventative approach.

Q 22. Describe a time you identified a potential compliance gap. What was your solution?

During a recent project involving the development of a new medical device, I noticed a potential compliance gap concerning the FDA’s Quality System Regulation (QSR). Our documentation process for design changes lacked the necessary rigor and traceability required by 21 CFR Part 820. Specifically, we weren’t consistently capturing all design changes and their justifications in a way that would withstand a regulatory audit. This gap could lead to non-compliance, potentially impacting product safety and our ability to market the device.

My solution involved a three-pronged approach. First, I collaborated with the engineering and quality assurance teams to develop a revised design change control procedure. This included clear templates for documenting changes, assigning responsibilities, and implementing robust review and approval processes. Second, I implemented a training program to educate all relevant personnel on the new procedure and the importance of adhering to the QSR. Finally, I created a system for regularly auditing our design change documentation to ensure compliance, identifying and addressing any recurring issues proactively. This multi-faceted approach ensured a robust and auditable system, effectively closing the compliance gap.

Q 23. How would you create a compliance program for a new product or service?

Creating a compliance program for a new product or service requires a systematic and proactive approach. Think of it like building a house – you wouldn’t start without a blueprint. The first step involves a thorough risk assessment, identifying all relevant regulations and standards that apply to the product or service. This will vary depending on the industry; for example, a financial product will have different regulatory requirements than a food product.

- Identify Applicable Regulations: This involves researching and understanding all relevant laws, regulations, and industry standards (e.g., GDPR, HIPAA, CCPA, ISO standards).

- Develop Policies and Procedures: Based on the identified regulations, create detailed policies and procedures that outline how the company will comply. This includes data security protocols, record-keeping procedures, and employee training programs.

- Implement Training Programs: Effective training ensures all employees understand their compliance responsibilities. This should be tailored to different roles and responsibilities and regularly updated.

- Establish Monitoring and Auditing Mechanisms: Regular monitoring and internal audits are crucial to identify potential compliance gaps and ensure effectiveness. These should be documented and reviewed regularly.

- Establish a Reporting and Remediation System: A clear process for reporting compliance issues and for correcting identified weaknesses is critical. This fosters a culture of transparency and accountability.

Finally, it’s essential to regularly review and update the compliance program to reflect changes in regulations and the evolving needs of the business. This is an ongoing process, not a one-time event.

Q 24. What are the key elements of an effective compliance culture?

A strong compliance culture is the cornerstone of any successful compliance program. It’s more than just following rules; it’s about embedding ethical behavior and responsibility into the fabric of the organization. Key elements include:

- Leadership Commitment: Top management must visibly support and champion the compliance program. This sets the tone from the top down.

- Clear Communication: Compliance expectations must be clearly communicated to all employees through various channels. This includes training, newsletters, and regular updates.

- Accountability: Employees at all levels must be held accountable for their compliance responsibilities. This includes establishing clear consequences for non-compliance.

- Open Communication Channels: Employees should feel comfortable reporting compliance concerns without fear of reprisal. A confidential reporting mechanism is crucial.

- Continuous Improvement: The compliance program should be regularly evaluated and improved based on lessons learned, audits, and changing regulations.

- Ethical Decision-Making Framework: A clear ethical framework guiding decision-making helps employees navigate complex situations and make choices aligned with the company’s values.

Imagine a sports team: a strong compliance culture is like having a well-defined playbook and a coach who consistently reinforces the rules and values of the game. It ensures everyone is on the same page and working toward the same goal, ethically and legally.

Q 25. Describe your experience with implementing a compliance management system.

In my previous role, I was instrumental in implementing a comprehensive compliance management system (CMS) using a SaaS platform. This involved several key stages:

- Selection of CMS Software: We carefully evaluated different platforms based on functionality, scalability, and integration with our existing systems.

- System Configuration and Customization: We customized the CMS to reflect our specific needs and regulatory requirements, mapping policies and procedures into the system.

- Data Migration: We migrated relevant data from existing systems into the CMS, ensuring data integrity and accuracy.

- User Training and Adoption: We conducted thorough training for all employees on how to effectively use the new CMS. This included interactive sessions and ongoing support.

- Process Integration: We integrated the CMS with other business systems, such as HR and IT, to streamline workflows and improve efficiency.

- Ongoing Monitoring and Maintenance: Regular monitoring and updates of the CMS were crucial to its ongoing effectiveness.

The result was a more efficient and effective compliance program, with improved tracking of compliance activities, enhanced risk management, and better overall visibility into our compliance posture. The CMS acted as a central repository for all compliance-related documents and information, making it easier to access and manage.

Q 26. How do you measure the effectiveness of your compliance program?

Measuring the effectiveness of a compliance program is crucial to demonstrate its value and identify areas for improvement. This can be done through a variety of methods:

- Key Performance Indicators (KPIs): Establish KPIs that reflect the program’s goals, such as the number of compliance training courses completed, the number of reported compliance issues, and the time taken to resolve these issues.

- Internal Audits: Regularly conduct internal audits to assess the effectiveness of the compliance controls and identify potential weaknesses.

- External Audits: Undergo periodic external audits by regulatory bodies or independent third parties to ensure compliance with all relevant regulations.

- Employee Surveys: Conduct anonymous surveys to gather employee feedback on the effectiveness of the compliance program and identify any areas for improvement.

- Incident Reporting and Analysis: Analyze incident reports to identify patterns and trends, and to understand the root causes of compliance failures.

- Benchmarking: Compare the organization’s compliance performance against industry benchmarks to identify areas of strength and weakness.

By tracking these metrics and analyzing the data, it’s possible to identify areas of success and areas needing improvement, continually refining the program to enhance its effectiveness.

Q 27. Explain your understanding of the relationship between ethics and compliance.

Ethics and compliance are intrinsically linked; compliance is the legal and regulatory framework, while ethics provides the moral compass. Compliance ensures adherence to the letter of the law, whereas ethics focuses on doing what is right and just, even if not explicitly required by law. A strong ethical foundation informs and strengthens the compliance program.

Think of it as two sides of the same coin: Compliance is the minimum standard, while ethics represents a higher aspiration. While compliance focuses on avoiding penalties, ethics aims at fostering a culture of integrity and trust. A company that operates ethically is more likely to have a robust and effective compliance program, because its employees are intrinsically motivated to do the right thing.

Q 28. How do you balance compliance with business objectives?

Balancing compliance with business objectives is a constant challenge, but it’s not an either/or proposition. It requires a strategic approach where compliance is viewed not as an obstacle, but as a crucial enabler of sustainable business growth.

This involves proactive risk assessment and planning. Understanding the potential compliance risks associated with business decisions is crucial. This involves proactively identifying and mitigating risks associated with new products, services, or business strategies. Solutions should be cost-effective and practical; overly burdensome compliance can hinder business objectives. Finally, it requires effective communication and collaboration between compliance and business teams to find solutions that achieve both objectives simultaneously. A well-designed compliance program ensures the business can operate efficiently while minimizing legal and reputational risks, creating a sustainable and responsible business model.

Key Topics to Learn for Knowledge of Industry-Specific Regulations Interview

- Regulatory Landscape Overview: Understanding the fundamental frameworks and agencies governing your industry. This includes knowing the key legislation and its purpose.

- Compliance Procedures: Practical application of regulations in daily operations. This involves outlining specific steps taken to ensure adherence, including record-keeping and reporting methods.

- Risk Assessment and Mitigation: Identifying potential regulatory violations and developing strategies to minimize risks. This includes understanding potential penalties and consequences for non-compliance.

- Data Privacy and Security: Understanding and applying relevant data protection regulations (e.g., GDPR, CCPA). This includes knowing how to handle sensitive information and maintain data security.

- Ethical Considerations: Applying ethical principles within the regulatory framework. This includes understanding potential conflicts of interest and maintaining professional integrity.

- Recent Regulatory Changes: Staying current with the latest updates and amendments to relevant regulations. Demonstrating awareness of evolving legal landscapes is crucial.

- Problem-Solving Scenarios: Analyzing hypothetical scenarios involving regulatory breaches and proposing effective solutions. This requires strong critical thinking and problem-solving skills.

Next Steps

Mastering industry-specific regulations is paramount for career advancement. A strong understanding demonstrates your commitment to ethical practices and professionalism, making you a highly desirable candidate. To maximize your job prospects, create an ATS-friendly resume that highlights your knowledge and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We offer examples of resumes tailored to showcasing expertise in Knowledge of Industry-Specific Regulations, providing you with a template for success. Take the next step towards your dream job today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good