Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Knowledge of Insurance Requirements interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Knowledge of Insurance Requirements Interview

Q 1. Explain the key differences between commercial and personal lines insurance.

The primary difference between commercial and personal lines insurance lies in the nature of the insured risk. Personal lines insurance covers individuals and their families, protecting their personal assets and liabilities. Commercial lines insurance, on the other hand, protects businesses and organizations, covering their operations, property, and potential liabilities arising from their business activities.

- Personal Lines: This includes homeowners insurance (protecting your house and belongings), auto insurance (covering accidents and damage), renters insurance (protecting your personal property in a rental), and umbrella insurance (providing additional liability coverage).

- Commercial Lines: This encompasses a much broader range, including general liability insurance (protecting against lawsuits), commercial property insurance (covering business buildings and contents), workers’ compensation insurance (covering employee injuries), commercial auto insurance (covering business vehicles), professional liability insurance (protecting professionals from malpractice claims), and many more specialized coverages.

For example, a homeowner’s insurance policy would cover damage to a residential property from a fire, while a commercial property policy would cover damage to a business building from the same event. The policy terms, coverage limits, and the types of risks covered are distinctly different.

Q 2. Describe your understanding of the Insurance Regulatory and Information System (IRIS) reporting.

The Insurance Regulatory and Information System (IRIS) reporting is a crucial component of insurance regulatory oversight. It’s a system where insurance companies submit financial and operational data to state insurance regulators. This data allows regulators to monitor the financial health and solvency of insurers, identify potential risks, and ensure compliance with regulations. IRIS uses a sophisticated system of ratios and analyses to flag companies that may be experiencing financial difficulties or engaging in risky practices.

Essentially, it’s a early warning system. By analyzing key metrics like loss ratios, expense ratios, and reserve adequacy, regulators can proactively identify potential problems and take steps to protect policyholders. Think of it as a comprehensive financial health check-up for insurance companies.

Imagine a doctor using various tests to monitor a patient’s health. IRIS is similar in that it provides a quantitative and qualitative assessment of an insurance company’s financial stability, helping to prevent significant issues down the line.

Q 3. What are the main components of an insurance policy?

An insurance policy is a legally binding contract between an insurance company (the insurer) and a policyholder (the insured). It outlines the terms and conditions under which the insurer agrees to indemnify the insured against specified losses or liabilities. The main components are:

- Declarations Page: This page summarizes key information about the policy, including the insured’s name and address, policy number, coverage limits, and effective dates.

- Insuring Agreements: This section details the specific risks covered by the policy and the insurer’s obligations to the insured in the event of a covered loss.

- Exclusions: This section lists events or circumstances that are not covered by the policy. For example, many homeowners’ policies exclude damage caused by floods or earthquakes.

- Conditions: These are the rules and requirements the insured must meet to maintain coverage. This might include things like paying premiums on time, reporting claims promptly, and cooperating with investigations.

- Definitions: This section clarifies the meaning of key terms used throughout the policy.

Think of it as a detailed agreement, similar to a rental agreement or a service contract. Understanding all its components is crucial for both the insurer and the insured.

Q 4. How do you handle a situation where an insured fails to meet policy requirements?

When an insured fails to meet policy requirements, the process depends on the specific requirement and the severity of the breach. For example, failure to pay premiums may result in policy cancellation, while failure to provide prompt notice of a claim might affect the claim settlement process.

My approach involves a multi-step process:

- Investigation: I would thoroughly investigate the situation to understand the reasons behind the non-compliance.

- Communication: I would communicate clearly with the insured, explaining the consequences of their actions and the available options.

- Documentation: All communication and actions would be meticulously documented.

- Negotiation/Resolution: Depending on the circumstances, I might negotiate a payment plan for outstanding premiums or work with the insured to rectify other issues. In some cases, it might involve partial or total denial of the claim.

- Application of Policy Terms: The ultimate decision will be based on the specific terms and conditions outlined in the insurance policy.

The goal is always to find a fair and equitable solution while adhering to the legal and contractual obligations of the policy.

Q 5. What is your experience with different types of insurance claims (e.g., property, liability, health)?

My experience encompasses a wide range of insurance claims, including property, liability, and health. I’ve handled:

- Property Claims: These include claims for damage to residential or commercial property due to fire, wind, water, theft, or vandalism. I’ve assessed damages, negotiated settlements, and managed the repair or replacement process. For example, I handled a claim where a homeowner’s house was damaged by a hail storm. This involved assessing the damage, arranging for repairs, and determining the appropriate payout based on the policy coverage.

- Liability Claims: These involve claims for bodily injury or property damage caused by the insured’s negligence. I’ve investigated accidents, reviewed medical reports, and negotiated settlements with injured parties or their legal representatives. I have worked on cases involving slip and falls in a business, resolving liability and payout amounts.

- Health Claims: My experience includes processing and adjudicating health insurance claims, verifying medical necessity, and ensuring compliance with regulatory requirements. I’ve reviewed various medical bills, ensured proper billing codes, and checked for consistency with the patient’s health plan.

This diverse experience provides me with a comprehensive understanding of the different claim processes and the complexities involved in each.

Q 6. Explain the concept of risk assessment in insurance.

Risk assessment in insurance is the systematic process of identifying, analyzing, and evaluating potential risks associated with an insured individual or entity. The goal is to determine the likelihood and potential severity of various risks, enabling insurers to price policies appropriately and manage their overall exposure.

This involves several key steps:

- Identifying Potential Risks: This could involve reviewing applications, conducting inspections, and analyzing historical data.

- Analyzing the Likelihood and Severity of Each Risk: This often involves statistical modeling and actuarial analysis.

- Determining the Appropriate Premium: The premium is calculated based on the assessed level of risk. Higher-risk individuals or entities will typically pay higher premiums.

- Implementing Risk Mitigation Strategies: Insurers may implement measures to reduce the likelihood or severity of risks, such as safety inspections or recommending preventative measures.

For example, an insurer assessing risk for auto insurance might consider factors like the driver’s age, driving history, and the type of vehicle. A young driver with a poor driving record driving a high-performance car will be considered a higher risk and charged a higher premium than an older driver with a clean record driving a smaller car.

Q 7. What are some common insurance regulations and compliance requirements you’re familiar with?

I’m familiar with a variety of insurance regulations and compliance requirements, including:

- State Insurance Regulations: Each state has its own set of insurance regulations governing licensing, solvency, rates, and claim handling. These vary widely, requiring insurers to comply with specific state laws and regulations.

- Federal Regulations: Federal regulations such as the Gramm-Leach-Bliley Act (GLBA) concerning consumer privacy, and the Affordable Care Act (ACA) impacting health insurance, are crucial considerations.

- Data Privacy and Security Regulations: Regulations like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) dictate how insurers must handle sensitive customer data.

- Anti-Money Laundering (AML) Regulations: Insurers are required to comply with AML regulations to prevent the use of insurance products for illegal activities.

- Fair Credit Reporting Act (FCRA): This act dictates how insurers can obtain and use consumer credit information.

Staying current with these ever-evolving regulations is crucial for ensuring compliance and maintaining the integrity of the insurance industry. Non-compliance can lead to significant penalties and legal repercussions.

Q 8. Describe your experience with insurance audits.

Insurance audits are crucial for ensuring the financial health and regulatory compliance of an insurance company. My experience encompasses both internal and external audits, focusing on areas like reserving adequacy, loss ratio analysis, and compliance with accounting standards like US GAAP or IFRS. I’ve been involved in audits across various lines of business, including property & casualty, health, and life insurance.

For instance, during a recent internal audit of a P&C insurer, I identified a potential shortfall in the reserves for catastrophic events. By analyzing historical claims data and employing statistical modeling, I was able to quantify the potential shortfall and recommend adjustments to the reserving methodology to ensure the company’s solvency. This involved not just identifying the issue, but collaborating with the actuarial team to develop and implement a revised approach.

In external audits, my role has been to provide assurance to stakeholders that the insurer’s financial reporting is accurate and reliable. This involved reviewing documentation, testing internal controls, and ensuring compliance with regulatory requirements. A notable example was verifying the accuracy of the insurer’s loss development triangles to assess the adequacy of their incurred but not reported (IBNR) reserves.

Q 9. How do you ensure compliance with data privacy regulations in the insurance industry (e.g., GDPR, CCPA)?

Data privacy is paramount in the insurance industry. Ensuring compliance with regulations like GDPR and CCPA requires a multi-faceted approach. It starts with a thorough understanding of the regulations themselves, which includes identifying the types of personal data we collect, how it’s used, and who has access to it.

We implement robust data governance policies and procedures, including data minimization (only collecting necessary data), purpose limitation (using data only for specified purposes), and data security measures (encryption, access controls, etc.). We also establish clear procedures for handling data subject requests (access, rectification, erasure) and data breach notification. Training programs for all employees on data privacy best practices are essential. Regular audits and risk assessments help identify and address potential vulnerabilities.

For example, we utilize data masking techniques to protect sensitive personal information during analysis and reporting. Our data security protocols are regularly updated to adapt to evolving threats. We document all data processing activities in a way that’s easily auditable. Finally, working with a dedicated data privacy officer ensures consistent compliance.

Q 10. Explain the concept of reinsurance and its role in risk management.

Reinsurance is essentially insurance for insurance companies. It’s a risk management tool where an insurer (the ceding company) transfers some or all of its risk to another insurer (the reinsurer). This allows the ceding company to reduce its potential losses and maintain financial stability, especially when faced with large or catastrophic events.

Imagine a homeowner’s insurer facing the risk of a major hurricane hitting a coastal area. The potential payouts could be enormous. By using reinsurance, the insurer can transfer a portion of this risk to a reinsurer, who specializes in handling such high-risk events. This reduces the insurer’s exposure and protects its capital. There are various types of reinsurance, such as proportional (where risk is shared proportionally) and non-proportional (where risk is shared based on the severity of losses).

The role of reinsurance in risk management is crucial. It enhances the insurer’s solvency, allows them to underwrite more business, and offers a crucial safety net against unforeseen events, enabling them to continue offering insurance services without significant financial disruption.

Q 11. How do you interpret and apply insurance policy language?

Interpreting insurance policy language requires careful attention to detail and a thorough understanding of legal and insurance terminology. I approach this by systematically reviewing each clause and definition within the policy. I pay particular attention to exclusions, limitations, and conditions that may impact coverage. Understanding the context and the insured’s situation is critical to proper interpretation.

For example, a policy might exclude coverage for “intentional acts.” Determining whether an incident was intentional requires a careful analysis of facts and circumstances. Ambiguous language is often clarified through case law or industry best practices. When uncertainty exists, I always err on the side of providing a clear and conservative interpretation to protect the insurer’s interests.

I use various resources like policy manuals, legal precedents, and industry guides to support my interpretations. My approach ensures that claims are handled fairly and consistently with the terms of the policy.

Q 12. Describe your experience with insurance rate making and pricing strategies.

Insurance rate making involves determining the appropriate premiums to charge for insurance coverage. This is a complex process that considers various factors such as loss experience, expenses, desired profit margins, and regulatory requirements. My experience encompasses the use of actuarial models to analyze historical claims data, project future losses, and develop appropriate rate changes.

I’ve worked with various pricing strategies, including experience rating (based on the insured’s past loss experience), territory rating (based on geographic location), and class rating (based on shared characteristics within a group of insureds). The choice of strategy depends on the specific line of business and the available data. I also have experience with competitive analysis to understand market pricing and adjust our strategies accordingly.

A recent project involved developing a new rating model for a commercial auto insurance portfolio. This involved analyzing historical claims data, identifying key risk factors, developing a statistical model, and obtaining regulatory approval for the new rates. The result was a more accurate and equitable pricing structure that reflected the risk profile of each insured.

Q 13. What is your understanding of different types of insurance reserves?

Insurance reserves are crucial for ensuring an insurer’s financial stability. They represent an estimate of the amount of money needed to pay future claims. Different types of reserves cater to specific needs:

- Case reserves: Estimates for individual claims that have already occurred.

- IBNR (Incurred But Not Reported) reserves: Estimates for claims that have occurred but haven’t yet been reported to the insurer.

- Bulk reserves: Estimates for groups of claims with similar characteristics.

- Unearned premium reserves: Represent the portion of premiums collected that cover future periods of coverage.

Understanding the nuances of each reserve type is critical for accurate financial reporting and solvency assessment. The methodologies used to calculate these reserves vary depending on the type of insurance and data availability, often involving statistical modeling and actuarial judgment. Accurate reserving is crucial for a healthy insurance company; underestimation can lead to insolvency, and overestimation can hamper profitability.

Q 14. How do you identify and mitigate potential risks in an insurance portfolio?

Identifying and mitigating risks in an insurance portfolio is a continuous process. This involves regularly reviewing the portfolio’s composition, analyzing historical data, and considering emerging trends and potential catastrophes. A robust risk management framework is essential.

My approach involves several key steps:

- Risk identification: This involves identifying potential sources of loss, including natural disasters, fraud, changes in regulations, and market fluctuations.

- Risk assessment: Analyzing the likelihood and potential impact of each identified risk.

- Risk mitigation: Developing and implementing strategies to reduce or transfer the identified risks. This may include diversification, reinsurance, risk transfer, or improved underwriting practices.

- Monitoring and reporting: Regularly monitoring the effectiveness of mitigation strategies and reporting on the overall risk profile of the portfolio.

For example, in a portfolio heavily exposed to earthquake risk, we might implement reinsurance to transfer a portion of that risk. We might also improve underwriting practices by implementing stricter building codes for new policies or conducting more thorough inspections. Consistent monitoring and adjustments to the portfolio are key to minimizing its overall risk profile.

Q 15. Describe your experience using insurance software and systems.

Throughout my career, I’ve extensively utilized various insurance software and systems, ranging from policy administration systems (PAS) to claims management systems (CMS) and actuarial modeling platforms. My experience encompasses both large-scale enterprise systems and smaller, niche solutions. For example, I’ve worked with Guidewire ClaimCenter for claims processing, which allowed me to streamline workflows and improve efficiency in handling claims from initiation to settlement. I’m also proficient in using actuarial software like SAS and R for data analysis and predictive modeling. My expertise extends to understanding the intricacies of data integration between different systems, ensuring seamless data flow and accurate reporting. I’m comfortable with both using pre-built functionalities within these systems and customizing them to meet specific business needs, as demonstrated by my work in creating custom reports to track key performance indicators (KPIs) in a previous role.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How familiar are you with insurance industry best practices?

I am intimately familiar with insurance industry best practices, encompassing all aspects from underwriting and risk management to claims handling and regulatory compliance. My understanding is grounded in years of hands-on experience and continuous professional development. Key areas of expertise include adhering to the principles of actuarial soundness, implementing robust risk assessment frameworks, and maintaining the highest standards of customer service. I understand the importance of utilizing data-driven decision-making, implementing effective internal controls, and proactively addressing emerging risks. For instance, I’ve helped organizations successfully navigate the challenges of implementing new regulations like GDPR, ensuring complete data privacy and security. Understanding and implementing these best practices are crucial for minimizing losses, maintaining a strong reputation, and driving profitability.

Q 17. Explain the concept of underwriting and the role of an underwriter.

Underwriting is the process of assessing and classifying risks associated with potential insurance policyholders. An underwriter evaluates applications, determines eligibility, and sets premiums based on the assessed risk. Think of it as a careful evaluation of how likely someone is to file a claim. The underwriter’s role is crucial; they are the gatekeepers, deciding which risks are acceptable for the insurance company to take on. They use various data points like age, health history (in health insurance), driving record (in auto insurance), property location (in homeowners insurance), and credit history to determine the risk profile of an applicant. Based on this assessment, they decide whether to offer coverage, and if so, at what premium. Poor underwriting practices can lead to significant financial losses for the insurance company, while overly stringent underwriting can lead to losing potential customers. A skilled underwriter balances these factors to maintain a profitable and sustainable portfolio.

Q 18. How do you stay updated on changes in insurance regulations and laws?

Staying current on insurance regulations and laws is paramount in this dynamic environment. I actively utilize several methods to achieve this. I regularly monitor regulatory agency websites (e.g., the NAIC in the US), subscribe to industry publications and newsletters (like Insurance Journal or Best’s Review), and attend industry conferences and webinars. Further, I leverage professional networks and engage in discussions with colleagues and peers to share insights and knowledge regarding recent regulatory changes. I also use advanced search tools to track legislative developments and interpret complex legal changes to ensure our operations consistently comply with the latest legal standards.

Q 19. What is your experience with insurance claims investigation and settlement?

My experience in claims investigation and settlement involves a thorough understanding of policy language, investigative techniques, and negotiation strategies. I’ve been involved in all stages of the claims process, from initial reporting to final settlement. This includes verifying the validity of claims, investigating the circumstances surrounding incidents, gathering evidence, and negotiating fair and equitable settlements. For example, in one case I successfully reduced a potential payout by 30% by thoroughly investigating the claim and uncovering inconsistencies in the claimant’s statements. My expertise also involves working with external investigators, legal counsel, and medical professionals when necessary to ensure claims are handled effectively and within regulatory compliance. Fair and efficient claims handling is crucial for maintaining customer satisfaction and the reputation of the insurance company.

Q 20. Describe your experience with actuarial modeling or analysis.

I possess extensive experience in actuarial modeling and analysis. My skills encompass building predictive models to forecast future claims costs, analyzing historical data to identify trends and patterns, and conducting financial modeling to evaluate the impact of various pricing strategies. I’m proficient in using statistical software such as SAS and R to perform complex analyses and develop sophisticated actuarial models. For instance, I’ve developed models to assess the impact of demographic changes on future healthcare costs, which were instrumental in guiding the company’s strategic decision-making regarding product pricing and reserve adequacy. These models enable companies to make sound financial decisions, ensuring long-term profitability and solvency. My understanding of various statistical techniques and modeling approaches is a critical asset in this role.

Q 21. What is your experience working with insurance brokers or agents?

I’ve worked closely with insurance brokers and agents throughout my career, fostering strong relationships built on trust and mutual respect. My experience includes collaborating on client acquisition strategies, providing technical support and product knowledge, and coordinating the seamless flow of information between the insurer and the intermediaries. Effective communication is vital here, as clear and concise explanations of policy details and coverage options are essential for successful collaboration. Strong relationships with brokers and agents are crucial, as they are often the first point of contact for potential clients, influencing their decisions and representing the company’s image. I understand the importance of providing them with the tools and resources they need to succeed, ultimately benefitting the insurer.

Q 22. Explain the difference between indemnity and liability insurance.

Indemnity and liability insurance, while both types of insurance, protect against very different types of losses. Indemnity insurance aims to restore the insured to their pre-loss financial position. It compensates for actual losses suffered. Think of it like making you ‘whole’ again after an incident. For example, if your house burns down and you have homeowner’s insurance (an indemnity policy), the insurer will pay for the cost of rebuilding your house up to the insured value, minus your deductible. They won’t make you richer than you were before the fire; they just replace what you lost.

Liability insurance, on the other hand, protects you from financial loss arising from your legal responsibility for causing harm or damage to someone else. It covers your liability to third parties. Consider a car accident where you’re at fault. Your liability insurance would cover the medical bills and property damage of the other party involved. You’re not being compensated for your own losses; you’re paying for the damage you caused to someone else.

The key difference lies in who is being compensated: indemnity covers your own losses, while liability covers the losses of others due to your actions.

Q 23. How familiar are you with different types of insurance contracts (e.g., adhesion, aleatory)?

I’m very familiar with various types of insurance contracts. Understanding the nuances of these contracts is crucial for accurate risk assessment and effective claims handling. Let’s explore two key contract types:

- Contract of Adhesion: Insurance contracts are primarily contracts of adhesion. This means one party (the insurer) drafts the contract terms, and the other party (the insured) essentially ‘adheres’ to them with little or no negotiation. Courts typically interpret ambiguities in these contracts in favor of the insured, recognizing the power imbalance inherent in the relationship.

- Aleatory Contract: Insurance contracts are also aleatory. This means the performance of the contract depends on an uncertain future event. The insurer’s obligation to pay (the benefit) only arises if a covered event occurs. The premium paid by the insured may be significantly less than the potential payout, reflecting the uncertain nature of the risk.

Other relevant contract types, though perhaps less central to the core definition of insurance, include Unilateral (one-sided promise from the insurer), and Conditional (the insurer’s duty to perform is conditional upon the insured fulfilling certain requirements).

Q 24. How do you handle disputes between insureds and insurers?

Handling disputes between insureds and insurers requires a fair, impartial, and efficient approach. My process typically involves:

- Thorough Review of the Policy and Supporting Documentation: Carefully examining the policy wording, the claim documentation, and any relevant evidence to understand the context of the dispute.

- Communication and Negotiation: Open communication with both the insured and the insurer to understand their perspectives and identify areas of potential compromise. This often involves explaining policy terms clearly and patiently.

- Mediation or Arbitration (if necessary): If negotiation fails, I facilitate or utilize mediation or arbitration as a neutral third-party process to reach a resolution. This is often a faster and less expensive alternative to litigation.

- Documentation: Maintaining detailed records of all communications, negotiations, and decisions made throughout the dispute resolution process.

The goal is always to find a fair and equitable solution that aligns with the policy terms and applicable laws.

Q 25. Describe your experience with the claims process from initial report to settlement.

My experience encompasses the entire claims process, from initial report to final settlement. I’ve handled numerous claims across various lines of insurance, including:

- Initial Report: Receiving the initial claim notification, gathering preliminary information, and assigning a claim adjuster if needed.

- Investigation: Thorough investigation, which includes reviewing documentation, interviewing witnesses, and potentially visiting the site of the incident.

- Evaluation: Assessing the claim’s validity, coverage, and the extent of the insured’s losses.

- Negotiation and Settlement: Negotiating with the insured and other parties involved to reach a fair settlement, considering policy limits and applicable law.

- Documentation and Payment: Preparing thorough documentation for the claim file and ensuring timely payment of the settlement to the insured.

I am proficient in using various claims management software and have experience with both simple and complex claims, often involving multiple parties and significant financial implications.

Q 26. What are your strengths and weaknesses in relation to insurance requirements?

My strengths lie in my analytical abilities, attention to detail, and strong communication skills. I can quickly grasp complex insurance policies and regulations, analyze claim information effectively, and clearly explain complex issues to both insured and insurers. I also have a proven track record of successfully navigating challenging claims and resolving disputes amicably. I consistently strive to stay up-to-date on industry best practices and changes in legislation.

My weakness, if I had to identify one, would be my perfectionist tendencies. While this ensures accuracy and thoroughness, it can sometimes lead to spending extra time on tasks. However, I am actively working on improving my time management skills to better balance thoroughness with efficiency.

Q 27. How do you prioritize competing demands in a fast-paced insurance environment?

Prioritizing competing demands in a fast-paced insurance environment requires a structured approach. I utilize a system combining urgency and importance:

- Urgent and Important: These tasks, such as handling a critical claim nearing its deadline or addressing a regulatory issue, receive immediate attention.

- Important but Not Urgent: These tasks, like reviewing policy updates or preparing for an upcoming audit, are scheduled into the calendar to ensure they don’t get overlooked.

- Urgent but Not Important: These tasks are often delegated or handled efficiently, prioritizing the larger, more important tasks.

- Neither Urgent Nor Important: These tasks are either postponed or delegated.

This approach ensures that time is allocated effectively and prevents urgent issues from overshadowing important, long-term goals.

Q 28. Describe a time you had to make a difficult decision related to insurance requirements.

I once had to make a difficult decision regarding a homeowner’s claim involving a significant water damage incident. The insured claimed the damage was due to a sudden and accidental pipe burst, a covered event. However, a thorough investigation revealed evidence suggesting the damage resulted from prolonged neglect and lack of maintenance, which wasn’t covered under the policy. This put me in a challenging position. I had to balance the need to be fair and compassionate to the insured with adhering strictly to the policy terms.

After carefully reviewing all available evidence and consulting with senior management, I determined that the claim should be partially covered for the portion directly attributable to the sudden pipe burst, but not for the extensive damage resulting from the pre-existing neglect. This decision wasn’t easy, but it was fair and consistent with the policy’s wording and industry standards. It highlighted the importance of thorough investigation and adherence to policy terms, even when faced with difficult circumstances.

Key Topics to Learn for Knowledge of Insurance Requirements Interview

- Types of Insurance: Understanding the differences between life, health, property, casualty, and liability insurance, including key features and coverage variations.

- Insurance Regulations and Compliance: Familiarize yourself with relevant state and federal regulations, including reporting requirements and ethical considerations within the insurance industry.

- Risk Assessment and Management: Learn how to identify, assess, and mitigate risks associated with different insurance products and policies. Understand the principles of underwriting and risk selection.

- Policy Interpretation and Application: Practice interpreting insurance policy language, including clauses, exclusions, and definitions. Be prepared to explain policy terms and conditions clearly and concisely.

- Claims Handling and Processing: Understand the claims process, from initial reporting to investigation, assessment, and settlement. Familiarize yourself with different claim types and dispute resolution methods.

- Insurance Technology and Data Analytics: Explore the role of technology in insurance, including data analytics for risk modeling, fraud detection, and customer relationship management.

- Insurance Contracts and Legal Aspects: Grasp the legal principles underpinning insurance contracts, including contract formation, interpretation, and enforceability.

- Financial Aspects of Insurance: Understand key financial concepts such as premiums, reserves, loss ratios, and profitability in the insurance context.

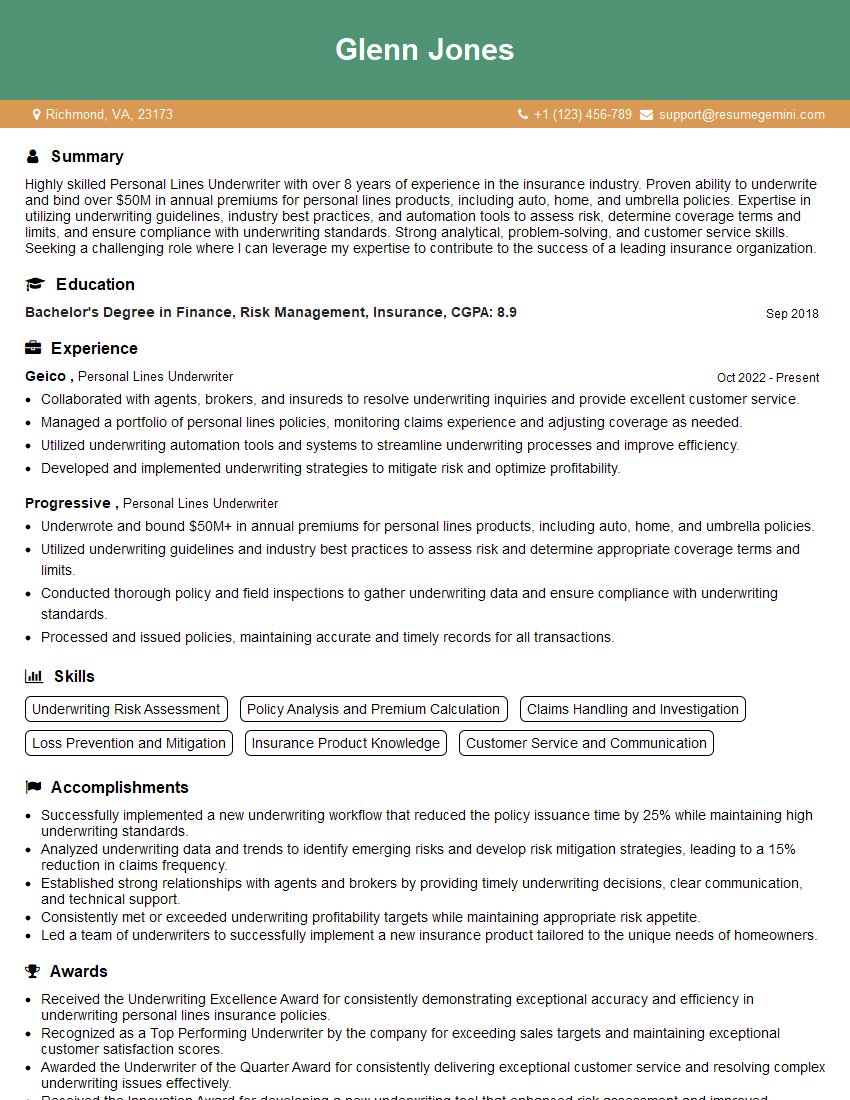

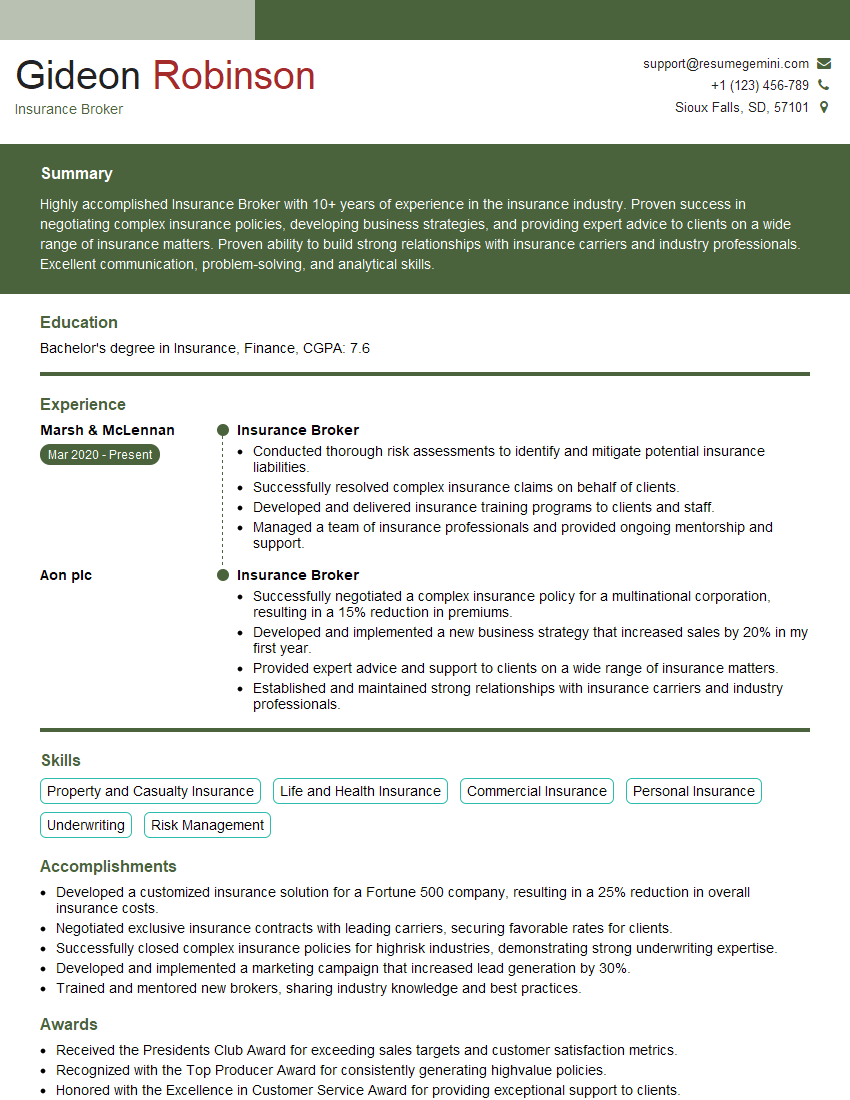

Next Steps

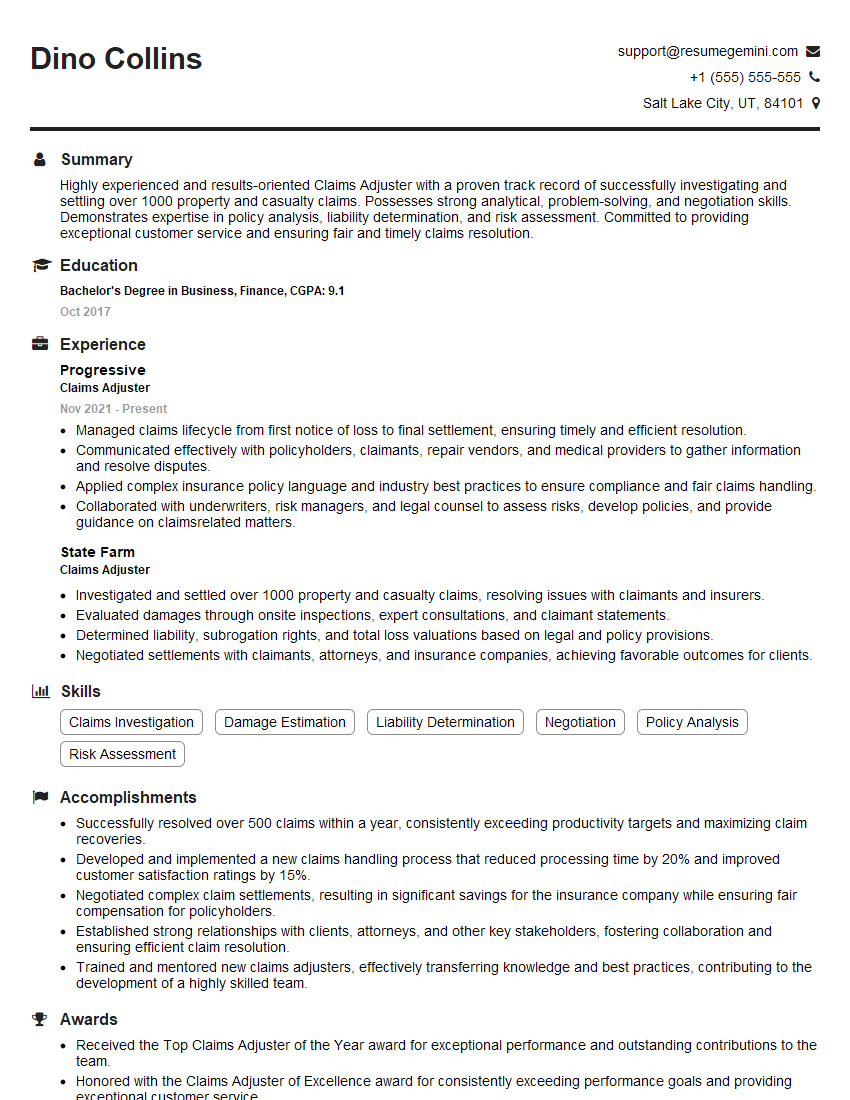

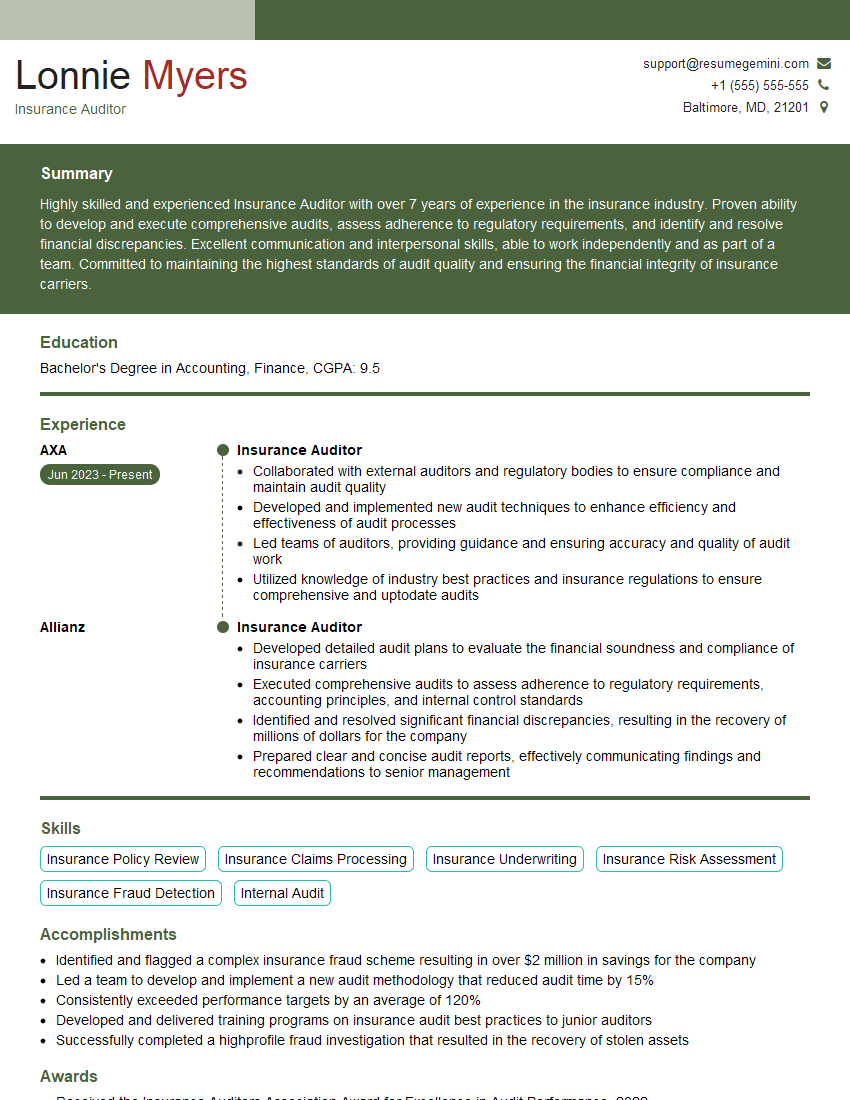

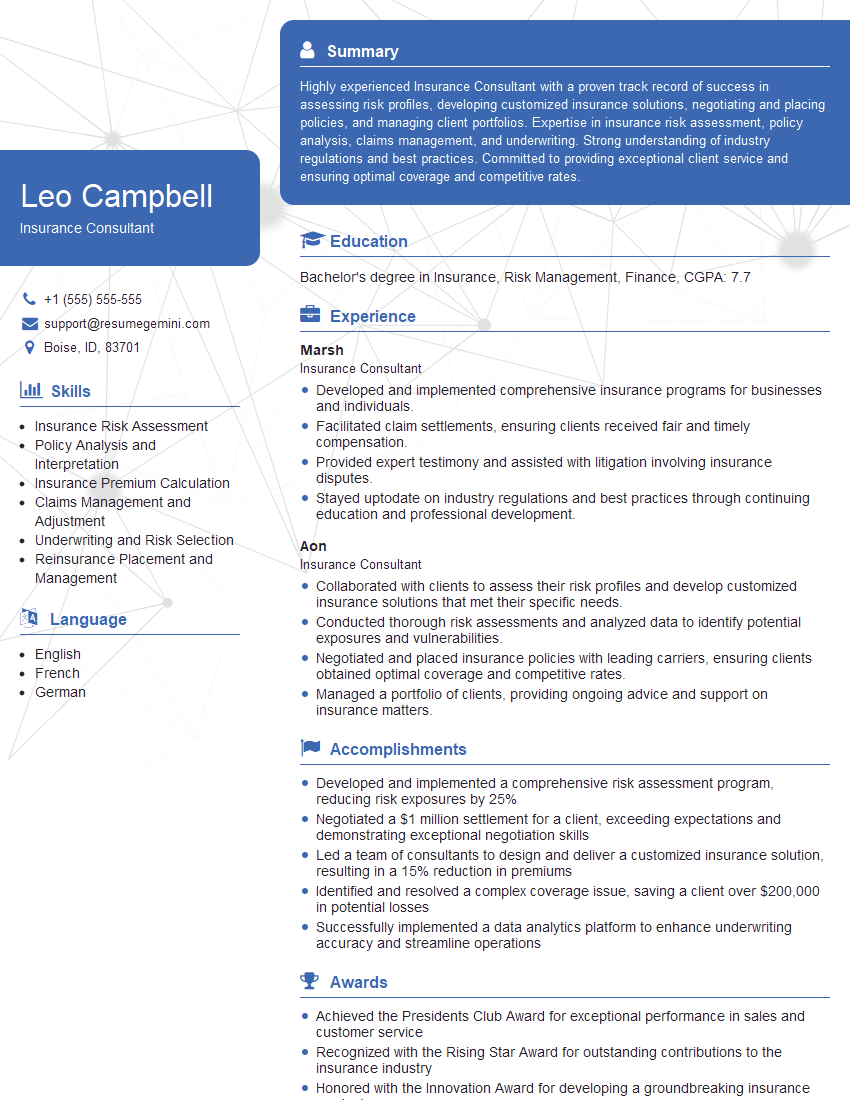

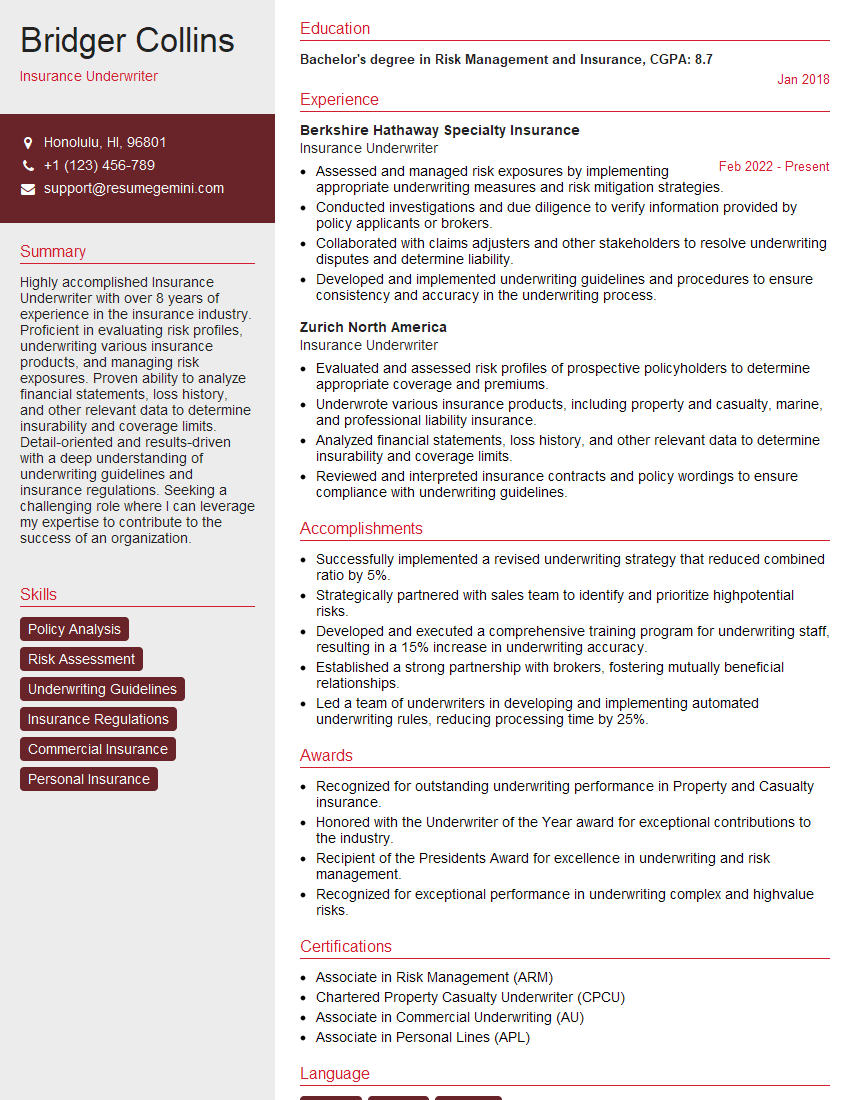

Mastering Knowledge of Insurance Requirements is crucial for advancing your career in this dynamic and growing field. A strong understanding of these concepts will significantly enhance your interview performance and open doors to exciting opportunities. To maximize your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini can help you create a compelling and effective resume that highlights your skills and experience. We provide examples of resumes tailored to Knowledge of Insurance Requirements to help you build a standout application. Take the next step towards your dream career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good