Cracking a skill-specific interview, like one for Marine Insurance and Claims Management, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Marine Insurance and Claims Management Interview

Q 1. Explain the different types of marine insurance policies.

Marine insurance policies are broadly categorized into Hull & Machinery, Cargo, and Protection & Indemnity (P&I). Let’s break them down:

- Hull & Machinery Insurance: This covers the vessel itself, including its machinery and equipment, against various perils like collision, grounding, fire, and even the cost of salvage operations. Think of it as car insurance for a ship. For instance, if a ship collides with another vessel, causing damage to its hull and engine, the Hull & Machinery policy would cover the repair costs.

- Cargo Insurance: This protects goods being transported by sea against loss or damage during transit. It covers a wide range of risks, from fire and sinking to theft and pilferage. Imagine exporting a container of electronics: Cargo insurance would safeguard those goods against any mishap at sea.

- Protection & Indemnity (P&I) Insurance: This type of insurance covers the shipowner’s liability to third parties, such as for collisions, pollution, and personal injury. It acts as a safety net for potential legal claims. For example, if a ship negligently damages another vessel or pollutes the environment, the P&I club would cover the resulting liabilities.

Beyond these core types, various specialized policies exist, tailored to specific needs, such as freight insurance, container insurance, or even policies specific to certain types of cargo (e.g., perishable goods).

Q 2. Describe the process of handling a marine cargo claim.

Handling a marine cargo claim is a multi-step process, involving meticulous documentation and investigation. The steps usually include:

- Notification: The insured party must promptly notify the insurer of the loss or damage, usually within a stipulated timeframe.

- Documentation: This is crucial. Gathering evidence such as the bill of lading, commercial invoice, packing list, survey reports, and photographs of the damaged goods is essential.

- Investigation: The insurer may conduct their own investigation, potentially involving a surveyor to assess the extent of the damage and the cause of loss. This helps determine liability.

- Valuation: The value of the damaged or lost goods needs to be determined. This may involve reference to market prices, invoices, and other relevant documentation.

- Negotiation and Settlement: Once the investigation is complete, and the cause of loss and value are determined, the insurer and the insured negotiate a settlement. This might involve full or partial reimbursement of the losses.

- Payment: Following agreement on the settlement amount, the insurer releases payment to the insured.

For example, if a shipment of furniture is damaged due to seawater ingress during a storm, the insured would provide the necessary documentation to their insurer, who would then investigate and assess the claim based on the policy terms and conditions.

Q 3. What are the key elements of a marine insurance contract?

A marine insurance contract, like any insurance contract, requires key elements to be legally binding. These include:

- Offer and Acceptance: A clear offer by the insured to purchase insurance and acceptance of that offer by the insurer.

- Consideration: The payment of the premium by the insured in exchange for the insurer’s promise to indemnify against specified losses.

- Insurable Interest: The insured must have a financial interest in the subject matter of the insurance (e.g., the cargo owner must have a financial stake in the goods being shipped).

- Subject Matter of Insurance: Clearly defined what is being insured (e.g., specific cargo, vessel, etc.).

- Perils Insured Against: The specific risks covered by the policy. This is usually specified in detail, often using established clauses like the Institute Cargo Clauses.

- Policy Period: The duration of the insurance cover.

- Valuation: Determining the value of the insured goods or vessel, important for claim assessment.

Absence of any of these elements could render the contract invalid or unenforceable.

Q 4. How do you determine the cause of loss in a marine claim?

Determining the cause of loss in a marine claim requires a thorough investigation. This often involves:

- Review of Documentation: Examining the bill of lading, cargo manifest, and other shipping documents for anomalies or discrepancies.

- Physical Inspection: Surveying the damaged goods or vessel to assess the extent and nature of the damage.

- Witness Statements: Gathering statements from crew members, port authorities, or other parties involved in the shipment.

- Expert Opinions: Consulting with experts, such as marine surveyors or cargo loss adjusters, to determine the cause of the loss.

- Analysis of Weather Data: Reviewing meteorological reports to determine if adverse weather conditions contributed to the loss.

For instance, if cargo arrives waterlogged, the investigation might include determining if this was due to a leak in the ship’s hull, improper packing, or rough seas. The investigation helps establish liability and determine if the loss is covered under the policy.

Q 5. Explain the concept of ‘general average’ in marine insurance.

General average is a principle of maritime law where all parties involved in a sea voyage contribute proportionally to a loss incurred to save the entire venture. Imagine a ship encounters a storm, and the captain orders the jettisoning of cargo to prevent the ship from sinking. This sacrifice benefits everyone; thus, all parties – shipowner, cargo owners, and even insurers – share the loss proportionately.

Let’s illustrate. If the jettisoned cargo was worth $100,000, and the total value of the saved cargo and vessel was $1,000,000, then each party would contribute 10% ($10,000) towards the loss. This ensures fairness and prevents a single party from bearing the entire burden of a sacrifice made for the common good.

Q 6. What are the common exclusions in marine cargo insurance policies?

Marine cargo insurance policies typically exclude certain risks. These exclusions are often designed to mitigate potentially high-risk situations or to prevent fraudulent claims. Common exclusions include:

- Inherent Vice: Damage caused by the nature of the goods themselves (e.g., perishable goods spoiling due to heat). This means the goods were destined for damage regardless of transit.

- Delay: Losses resulting solely from delays, unless they are caused by a covered peril.

- Strikes and Lockouts: Losses due to labor unrest at ports or other shipping facilities.

- War and Terrorism: Losses due to acts of war, piracy, or terrorism.

- Unseaworthiness: Damage arising from defects in the vessel itself (although this is sometimes covered by additional clauses).

- Willful misconduct: Damage intentionally caused by the insured party.

It’s vital to carefully review the policy wording to understand the specific exclusions as they vary between policies and insurers. A well-defined exclusion clause is important to manage risk effectively.

Q 7. How do you assess the value of damaged goods in a marine claim?

Assessing the value of damaged goods in a marine claim requires a careful and objective approach. The goal is to determine the financial loss incurred by the insured. Methods include:

- Market Value: The value of similar goods at the time and place of loss. This is often used for readily available, standard goods.

- Invoice Value: The cost of the goods as recorded on the commercial invoice. However, this might not reflect the current market value.

- Repair Costs: The expense of repairing the damaged goods to their pre-loss condition. This is particularly relevant if the damage is repairable.

- Replacement Costs: The cost of replacing the damaged goods with new ones of similar quality. This is used if repair isn’t feasible.

- Salvage Value: The amount the damaged goods could be sold for in their damaged state.

The chosen method depends on the type of goods, the extent of damage, and the policy terms. Often, a combination of methods is used to arrive at a fair and accurate assessment. Expert valuation from independent surveyors is often crucial to avoid disputes.

Q 8. Describe the role of a marine surveyor in a claims process.

A marine surveyor plays a crucial role in the marine claims process, acting as an independent expert to assess the damage and determine the cause of loss. They are essentially the investigators of the maritime world. Their expertise helps ensure fair and accurate claim settlements.

Their duties include:

- On-site inspection: Conducting thorough inspections of damaged vessels, cargo, or equipment to document the extent of the damage using photographs, sketches, and detailed reports.

- Cause of loss determination: Investigating the circumstances surrounding the loss, identifying the root cause (e.g., collision, fire, storm damage), and whether the cause is covered under the insurance policy.

- Damage assessment: Quantifying the financial losses incurred, including repair costs, replacement values, salvage costs, and any consequential losses.

- Preparing a detailed report: Compiling a comprehensive report that presents their findings, supported by evidence and professional opinions. This report becomes a vital document used by both the insurer and the insured in the claims process.

For example, if a cargo ship encounters a storm and suffers damage, a marine surveyor will assess the extent of damage to the hull and cargo, determine the cause (the storm), and estimate the cost of repairs or replacements. Their report will be crucial in determining the insurance payout.

Q 9. What are the key challenges in managing marine claims?

Managing marine claims presents unique challenges due to the complex nature of maritime operations and the often remote locations of incidents. Here are some key challenges:

- Establishing causality: Determining the exact cause of loss can be difficult, especially in incidents involving multiple contributing factors. Was it solely due to a storm, or was there negligence involved?

- Assessing damage in remote locations: Accurately assessing damage to vessels or cargo at sea or in remote ports can be logistically challenging and expensive. Expert surveyors might need to travel to remote locations, adding costs and complexity.

- Investigating fraud: Marine insurance is susceptible to fraudulent claims, requiring thorough investigation and expert detection strategies. False claims can cause major financial losses for insurance companies.

- Jurisdictional issues: Marine incidents can occur in international waters, leading to complex jurisdictional issues and disputes regarding applicable laws and regulations.

- Delay and documentation: Delays in reporting incidents, coupled with inadequate documentation, can significantly hinder the claims process and lead to disputes over the extent of coverage.

- Consequential losses: Calculating and proving consequential losses such as loss of market, demurrage, and loss of profit can be particularly difficult, requiring detailed financial records and expert analysis.

Q 10. Explain the difference between Institute Cargo Clauses (A, B, C).

Institute Cargo Clauses (ICC) A, B, and C are standardized clauses used in marine cargo insurance policies to define the extent of coverage offered. They represent different levels of coverage, with ‘A’ offering the broadest protection and ‘C’ the most limited.

- ICC A: This clause provides the widest coverage, insuring against almost all risks of loss or damage to the cargo during transit, except for those specifically excluded (like inherent vice – damage due to the nature of the goods themselves). Think of it as all-risk coverage.

- ICC B: This clause offers a more limited coverage than A. It covers losses caused by specific named perils such as fire, collision, stranding, and other risks stated in the policy. It excludes risks not explicitly listed. It’s like a named-peril car insurance.

- ICC C: This provides the narrowest coverage, only insuring against major perils like fire, stranding, and sinking of the vessel. It excludes most other types of loss or damage.

Think of it like this: ICC A is like a comprehensive health insurance plan, ICC B is like a standard health insurance plan, and ICC C is like a very basic plan with limited coverage.

Q 11. How do you handle a claim involving a dispute between the insured and the insurer?

Disputes between insured and insurer are unfortunately common in marine claims. Handling them requires a structured approach that prioritizes fairness and efficiency.

The process typically involves:

- Mediation: A neutral third party attempts to facilitate a mutually agreeable settlement. This is often the preferred method to avoid costly and time-consuming litigation.

- Arbitration: If mediation fails, a binding arbitration process can be used, where a neutral arbitrator hears evidence and makes a final decision. This avoids court procedures and is quicker and more cost effective.

- Litigation: As a last resort, the matter can be brought before a court of law. This is usually a more expensive and protracted process.

Throughout the dispute, clear communication, transparency, and a focus on the factual evidence are crucial. A detailed claims file, including the surveyor’s report, supporting documents, and correspondence, serves as the cornerstone of the dispute resolution process.

In practice, many disputes are resolved through negotiation and agreement, even when initially seemingly intractable. Fair assessment of liability and transparent communication of the reasons for claims decisions are key in maintaining client relations and avoiding litigation.

Q 12. What is the importance of proper documentation in marine claims?

Proper documentation is the backbone of successful marine claims management. It forms the basis for assessing liability, determining the extent of damage, and supporting the claim. The absence of proper documentation can lead to disputes, delays, and claim denials.

Crucial documentation includes:

- Bill of Lading: A crucial document acknowledging receipt of goods and outlining the terms of carriage.

- Cargo Manifest: A detailed list of the cargo carried onboard.

- Insurance Policy: The policy document containing the terms and conditions of the insurance coverage.

- Surveyor’s Report: A detailed report from a marine surveyor assessing the damage and determining the cause of loss.

- Photographs and Videos: Visual evidence of the damage to the vessel, cargo, or equipment.

- Witness Statements: Statements from individuals who witnessed the incident or have relevant information.

- Repair Invoices and Estimates: Documentation of repair costs incurred.

Imagine trying to claim for damage to cargo without a bill of lading – it would be incredibly difficult to prove what was lost or damaged and the value of the loss. Proper documentation provides undeniable evidence and facilitates a fair and efficient claims process.

Q 13. Explain the concept of subrogation in marine insurance.

Subrogation in marine insurance is the right of an insurer, after settling a claim with its insured, to recover the amount paid from a third party who may be legally responsible for the loss. It’s like the insurer stepping into the shoes of the insured to pursue recovery.

For example, if a collision damages a vessel insured by Company X, Company X will pay the claim to their insured. However, if the collision was caused by the negligence of another vessel, Company X can pursue subrogation against the owner or insurer of the negligent vessel to recover the funds they paid out.

This principle is crucial in ensuring fairness and reducing the overall cost of insurance. It prevents those at fault from escaping responsibility for their actions, while also helping insurance companies recover their losses and keep premiums affordable. The success of subrogation relies heavily on strong evidence gathered during the initial claim investigation.

Q 14. How do you investigate fraudulent marine claims?

Investigating fraudulent marine claims requires a highly analytical and meticulous approach. It typically involves:

- Reviewing all documentation: A thorough review of all documents submitted with the claim, looking for inconsistencies, inaccuracies, or missing information.

- Analyzing loss patterns: Looking for patterns of similar claims from the same insured or related parties, which could suggest organized fraud.

- On-site inspections: Conducting independent on-site inspections to verify the reported damage and circumstances of the loss. Often discrepancies are found between what was reported and actual damage.

- Conducting interviews: Interviewing the insured, witnesses, and other relevant parties to gather information and assess their credibility.

- Employing specialized investigators: Engaging fraud investigators with expertise in maritime operations and insurance claims to conduct detailed inquiries.

- Data analysis: Utilizing data analytics to identify suspicious trends and patterns in claims data. This may include analyzing claim frequencies, claim amounts, and other relevant metrics.

Fraudulent claims can significantly impact insurers’ financial stability and ultimately drive up premiums for all policyholders. A robust fraud detection program is essential to protect the integrity of the marine insurance industry.

Q 15. Describe your experience with different types of marine losses (e.g., fire, theft, collision).

My experience encompasses a wide range of marine losses, from the most common to the highly specialized. I’ve handled numerous claims involving fire damage, where the investigation often focuses on the origin and extent of the fire, requiring detailed analysis of damage reports and expert testimony. Theft claims present a unique challenge, requiring meticulous tracing of the stolen goods and potentially working with international law enforcement agencies. I’ve also extensively dealt with collision cases, where liability determination becomes crucial. This involves examining nautical charts, vessel logs, and witness statements to establish fault and apportion responsibility. Furthermore, I’ve worked on cases involving stranding, sinking, and even general average, where shared losses need to be fairly distributed among all parties involved in the voyage. Each type of loss demands a unique approach, combining investigative skills with a strong understanding of marine insurance policies and international maritime law.

For instance, in one case involving a fire on a container ship, we had to assess the damage to the cargo, the ship itself, and any consequential losses incurred by delays. This involved coordinating with surveyors, salvage companies, and various stakeholders to ascertain the cause of the fire and determine the extent of the insured’s liability. Another case involved a collision between two tankers, necessitating a thorough analysis of navigational data to determine fault and subsequently handle the complex claim involving multiple parties and insurers.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the key factors influencing the premium of a marine insurance policy?

Several key factors determine the premium of a marine insurance policy. The most significant is the nature of the cargo being shipped. High-value goods, fragile items, or hazardous materials naturally command higher premiums due to the increased risk of loss or damage. The type of vessel also plays a role; older vessels or those with a poor safety record will attract higher premiums than newer, well-maintained ships. The voyage itself is a major factor; longer voyages or those through hazardous waters increase the risk and, consequently, the premium. The insured’s history is another critical element. A company with a history of claims will typically face higher premiums compared to a company with a strong safety record. Finally, market conditions, including global events and economic fluctuations, affect the overall cost of marine insurance. The insurer also considers various clauses and coverage options selected by the insured, which directly impact the premium calculation.

Think of it like car insurance: a sports car will be more expensive to insure than a family sedan. Similarly, transporting valuable electronics across a war zone will be significantly more expensive than transporting grain across calm waters.

Q 17. Explain the role of the International Maritime Organization (IMO) in marine insurance.

The International Maritime Organization (IMO) plays a vital, albeit indirect, role in marine insurance. While not directly involved in setting insurance premiums or handling claims, the IMO’s work significantly impacts the risk profile of maritime operations, which underpins the insurance industry. The IMO develops and enforces international standards for ship safety, security, and pollution prevention. Compliance with IMO regulations and conventions reduces the risk of accidents, and this translates into lower insurance premiums for compliant vessels and operators. Furthermore, IMO conventions provide a framework for liability and compensation in case of accidents, which simplifies the claims process. Failure to comply with IMO standards can lead to increased premiums or even difficulty in obtaining insurance coverage altogether. Therefore, IMO standards impact the marine insurance landscape significantly by setting a baseline for safety and responsibility.

Q 18. What is your understanding of the York-Antwerp Rules?

The York-Antwerp Rules are a set of internationally recognized guidelines for adjusting general average losses in marine insurance. General average occurs when a deliberate sacrifice (e.g., jettisoning cargo) or extraordinary expense (e.g., salvage operations) is incurred to save the entire venture (ship and cargo) from a common peril. The rules provide a standardized framework for determining the contribution that each party involved in the voyage must make to compensate for the loss. They cover aspects such as the calculation of losses, the allocation of expenses, and the process of settling claims. They are regularly updated to reflect evolving maritime practices and legal interpretations, ensuring their continued relevance in the global shipping industry.

Essentially, the York-Antwerp Rules act as a universally understood rulebook for fairly distributing losses in extraordinary circumstances, ensuring a fair and transparent settlement process amongst all interested parties.

Q 19. How do you handle claims involving multiple parties?

Claims involving multiple parties require a methodical and organized approach. The first step is to clearly identify all parties involved, including the insured, the insurer, any third parties (e.g., other vessels, cargo owners, port authorities), and any subrogated parties. Once identified, I would collect all relevant documentation from each party, including contracts, bills of lading, survey reports, and any other evidence pertaining to the loss. A comprehensive investigation is then carried out to establish the facts surrounding the incident, determine liability, and assess the extent of damages. I then use this information to negotiate a settlement that is fair and equitable to all involved parties, keeping in mind the principles of contractual obligations and potential legal ramifications. If negotiation fails, I may recommend arbitration or litigation to resolve the dispute.

For example, in a collision case, we might have the owner of one vessel, the owner of the other vessel, their respective insurers, and potentially cargo owners as parties. Each party would have their own perspective on liability and damages, requiring meticulous investigation and negotiation to reach a fair settlement.

Q 20. Explain the process of negotiating settlements in marine claims.

Negotiating settlements in marine claims involves a delicate balance of legal expertise, insurance principles, and effective communication. The process begins with a thorough review of the claim documentation and the investigation findings. A fair valuation of the damages is crucial, often requiring input from independent surveyors and experts. The next step involves engaging in direct communication with all relevant parties, explaining our position clearly and supporting our arguments with concrete evidence. We are prepared to present counter-arguments while always striving for mutual understanding. Throughout the negotiation, the goal is to find a solution that is acceptable to all parties involved, while considering the potential costs and risks of litigation. This requires flexibility and a willingness to compromise, yet maintaining the integrity of the claims process and our client’s interests. Successful negotiation usually results in a mutually agreeable settlement that avoids protracted legal battles.

For example, we might start by offering a settlement based on our initial assessment of the damages, then adjust the offer based on the responses received from the other parties. It might require multiple rounds of discussion and counter-offers before reaching a final agreement.

Q 21. What are your skills in using marine insurance software?

I possess extensive experience with various marine insurance software applications, including claims management systems, policy administration platforms, and risk assessment tools. I’m proficient in using these systems to track claims, manage documentation, generate reports, and analyze risk profiles. My skills encompass data entry, report generation, claims processing and workflow management. I am also adept at using software to model various scenarios and assess the financial implications of potential claims. I am confident in utilizing technology to streamline the claims process, improve efficiency, and maintain accurate records, contributing to faster and more effective claim resolutions. Specific software packages I’ve worked with include [mention specific software names if comfortable, otherwise remove this sentence]. My proficiency extends to data analysis using these tools to identify trends and potential risk areas in the portfolio of insured vessels and cargo.

Q 22. How do you stay updated on changes in marine insurance regulations?

Staying current with marine insurance regulations is crucial for accurate claims handling and compliance. I employ a multi-pronged approach:

- Subscription to specialized publications and online resources: I regularly review publications like the Journal of Marine Insurance and online resources from organizations such as the International Union of Marine Insurance (IUMI) and national maritime authorities. This ensures I’m aware of legislative changes, case law updates, and emerging risks.

- Participation in industry conferences and webinars: Attending industry events provides valuable insights into current trends and challenges directly from experts and regulators. Networking with other professionals allows for the exchange of best practices and knowledge of recent regulatory shifts.

- Monitoring regulatory bodies’ websites: I actively monitor the websites of relevant international and national regulatory bodies. This includes checking for updates on circulars, guidelines, and amendments to existing regulations. For instance, I regularly check the website of the IMO (International Maritime Organisation) for updates on the SOLAS convention or the relevant national maritime authority for updates on local regulations.

- Professional Development Courses: I actively participate in continuing professional development courses focused on marine insurance regulations to maintain my expertise and keep abreast of the latest changes.

This combination of methods helps me ensure that my knowledge base remains robust and up-to-date, leading to more efficient and compliant claims handling.

Q 23. Describe your experience with marine insurance claims adjusting software.

My experience with marine insurance claims adjusting software is extensive. I’m proficient in several leading industry software packages, including [mention specific software names, e.g., ‘ClaimsManager Pro’ and ‘MarineClaimsSuite’]. These systems streamline various aspects of the claims process, from initial data entry and documentation management to loss assessment and reserve setting.

For example, using ‘ClaimsManager Pro’, I can efficiently track all stages of a claim, generate reports detailing the claim’s progress, and maintain a centralized database of all relevant documents. This software’s capabilities in calculating Average Particular Average (APA) and General Average (GA) are especially valuable in complex claims. The software also helps in automating certain tasks, like generating correspondence and reports, significantly improving efficiency and accuracy. Furthermore, these systems often integrate with other business tools, improving workflow and collaboration with stakeholders.

Q 24. How do you prioritize claims based on urgency and complexity?

Prioritizing claims involves a multifaceted approach combining urgency and complexity. I use a system that considers several key factors:

- Immediacy of Risk: Claims involving potential loss of life, significant environmental damage, or immediate financial jeopardy receive top priority. For instance, a vessel in distress requires immediate attention compared to a delayed cargo delivery.

- Complexity of the Claim: Claims involving multiple parties, extensive damage, or intricate legal considerations are assessed for their complexity. A claim involving a collision with several vessels and multiple jurisdictions will naturally require more resources and time.

- Policy Coverage: Understanding the scope of coverage under the insurance policy is crucial. Claims with clear policy provisions are prioritized higher than those requiring extensive investigation into policy interpretation.

- Financial Exposure: Claims with higher potential financial liabilities get priority consideration due to their significant impact on the insurer’s reserves.

I often employ a matrix-based system, weighing these factors to assign a priority score to each claim. This allows for a systematic and objective approach to resource allocation. The system is regularly reviewed and refined to adapt to changing circumstances and emerging challenges.

Q 25. What is your understanding of salvage operations in marine insurance?

Salvage operations in marine insurance are actions taken to minimize further loss or damage to insured property after a marine casualty. The goal is to preserve the remaining value of the vessel or cargo and prevent further deterioration. These operations are often complex and require specialized expertise.

The insurer has a vested interest in successful salvage as it can significantly reduce the overall claim payout. For example, after a grounding incident, salvage efforts might involve refloating a damaged vessel, securing cargo to prevent further loss, or carrying out emergency repairs. The costs associated with salvage are usually recoverable under the insurance policy, subject to the policy’s terms and conditions. The insurer appoints a salvage team, often working closely with marine surveyors, to manage the operation and oversee cost control. Successful salvage can significantly reduce the insured’s loss, making it a critical aspect of marine insurance claims management.

A key consideration is the concept of ‘General Average’ where the expenses of a salvage operation are shared proportionally by all parties whose cargo or vessel benefitted from it.

Q 26. Explain the difference between hull and cargo insurance.

Hull and Cargo insurance are two distinct types of marine insurance, covering different aspects of a maritime voyage:

- Hull Insurance: This covers the vessel itself – its structure, machinery, and equipment – against risks such as collision, grounding, fire, and other perils at sea. It protects the owner’s investment in the ship. The policy typically covers repair costs, replacement costs, and potential liabilities arising from damage to the vessel.

- Cargo Insurance: This covers the goods being transported by sea – the merchandise, raw materials, or manufactured products. It protects the cargo owner against loss or damage during transit. The policy covers various perils, including fire, theft, water damage, and even risks associated with delays or spoilage of goods.

While both are crucial for protecting maritime interests, they have separate policy terms, coverage limits, and insured parties. A shipowner might purchase hull insurance, while the cargo owner or shipper typically purchases cargo insurance.

Q 27. How do you calculate total loss in a marine insurance claim?

Calculating a total loss in a marine insurance claim depends on the nature of the loss – whether it’s a constructive total loss (CTL) or an actual total loss (ATL).

- Actual Total Loss (ATL): This occurs when the insured property is completely destroyed or irretrievably lost. The calculation is straightforward; it’s the insured value of the property at the time of the loss, less any salvage value that can be recovered.

- Constructive Total Loss (CTL): This is more complex. It occurs when the cost of repairing the damage exceeds the value of the property after repair, plus the cost of salvage. The calculation involves determining the cost of repairs, adding the cost of salvage, and comparing it to the property’s value post-repair. If the repair costs plus salvage exceed the post-repair value, it’s considered a CTL.

For example, a vessel sustaining significant damage in a collision: if the repair costs plus salvage exceed the market value of the vessel post-repair, even if it’s technically repairable, it’s a CTL and the insurer will usually pay the insured value, less any salvage.

In both cases, the calculation involves considering the insured value, salvage value, and any applicable policy deductibles or clauses.

Q 28. Describe your experience working with international clients and insurers.

I have extensive experience collaborating with international clients and insurers across diverse geographical locations and jurisdictions. This includes working with clients in [mention specific regions/countries, e.g., ‘Europe, Asia, and North America’], handling claims involving different legal frameworks and insurance policies.

My approach to working with international clients emphasizes clear communication, cultural sensitivity, and a deep understanding of the relevant legal and regulatory environments. I am fluent in [mention languages], which aids in effective communication and negotiation. This cross-cultural experience has provided me with the skills to navigate complex situations involving different languages, legal systems, and business practices. For instance, I’ve successfully managed claims involving different valuation methods, liability regulations, and insurance policy interpretations across various international markets, ensuring timely and fair settlements for all parties involved. The use of technology, including video conferencing and secure document sharing platforms, plays a pivotal role in overcoming geographical barriers and enhancing collaboration.

Key Topics to Learn for Marine Insurance and Claims Management Interview

- Marine Insurance Fundamentals: Understanding different types of marine insurance policies (Hull & Machinery, Cargo, P&I, Freight), their coverage, and limitations.

- Claims Handling Process: From initial notification to final settlement, including investigation, assessment, negotiation, and documentation.

- Risk Assessment and Mitigation in Marine Insurance: Identifying and evaluating potential risks associated with marine transportation and developing strategies for risk reduction.

- Marine Cargo Claims: Specific challenges in cargo claims, including determining liability, assessing damage, and handling documentation like Bills of Lading and Certificates of Insurance.

- Hull & Machinery Claims: Understanding the complexities of insuring vessels and handling claims related to repairs, salvage, and total loss scenarios.

- Legal and Regulatory Frameworks: Familiarity with relevant international conventions (e.g., York-Antwerp Rules, Hague-Visby Rules) and national regulations.

- Loss Prevention and Risk Management Techniques: Understanding practical strategies employed to minimize losses and improve safety in marine operations.

- Claims Investigation Techniques: Developing skills in evidence gathering, interviewing witnesses, and analyzing data to determine the cause of loss.

- Negotiation and Settlement Strategies: Effective negotiation techniques and strategies for reaching mutually acceptable settlements in claims.

- Insurance Policy Interpretation and Application: Ability to accurately interpret policy wording and apply it to specific claim scenarios.

Next Steps

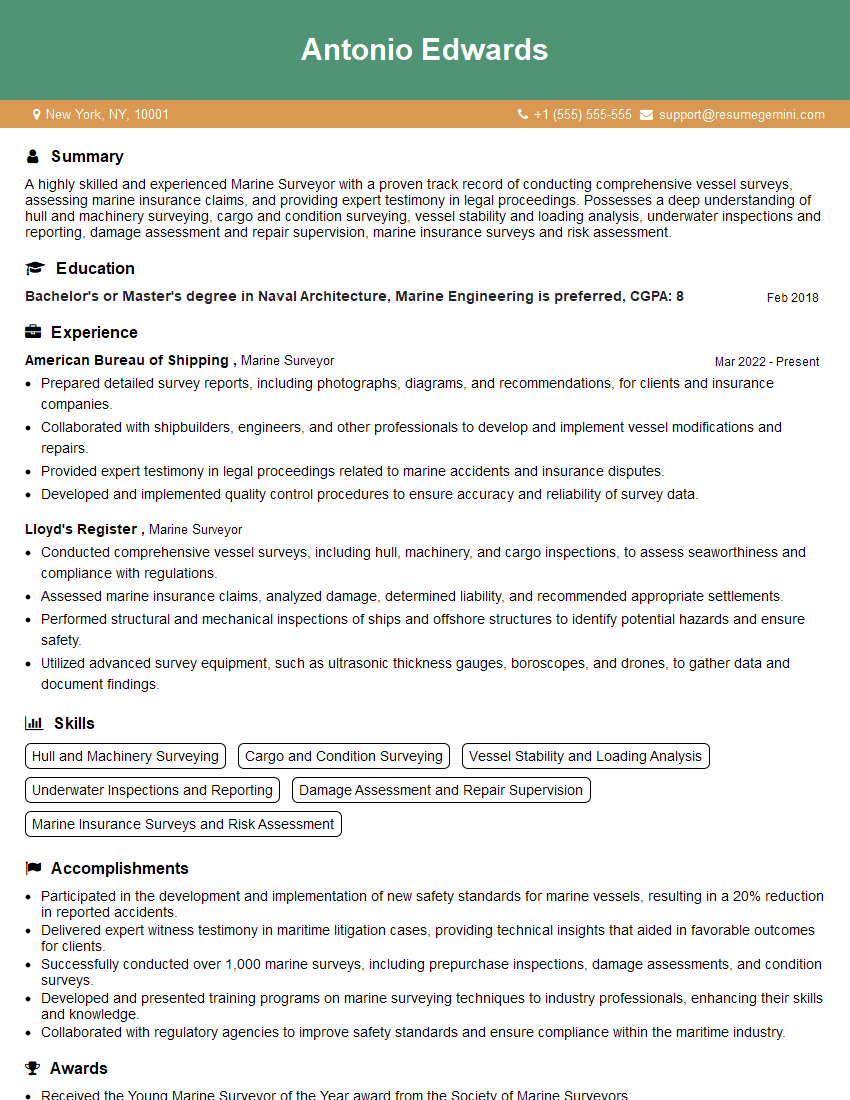

Mastering Marine Insurance and Claims Management opens doors to a rewarding career with excellent growth potential. A strong understanding of these areas positions you as a valuable asset to any organization. To maximize your job prospects, it’s crucial to create a compelling and ATS-friendly resume that effectively showcases your skills and experience. ResumeGemini is a trusted resource to help you build a professional resume that stands out. We provide examples of resumes tailored to Marine Insurance and Claims Management to guide you through the process. Invest time in crafting a strong resume – it’s your first impression with potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good