The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Material Sourcing and Evaluation interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Material Sourcing and Evaluation Interview

Q 1. Explain your experience with different sourcing strategies (e.g., competitive bidding, negotiation, long-term contracts).

Sourcing strategies are crucial for securing the right materials at the best possible price. My experience encompasses a range of approaches, each tailored to the specific situation.

- Competitive Bidding: This involves soliciting bids from multiple suppliers for the same materials. It’s effective for standardized items with readily available alternatives. For example, when sourcing basic packaging materials, I’ve used this method successfully, receiving quotes from at least three vendors to ensure competitive pricing and identify the most cost-effective option. I typically use a standardized request for quotation (RFQ) template to ensure consistent comparison.

- Negotiation: For specialized or complex materials where standardization is limited, direct negotiation with a chosen supplier is often necessary. This allows for a more nuanced understanding of their capabilities, potential challenges, and pricing considerations. A recent example involved negotiating a long-term contract for a newly developed composite material. We focused not only on price but also on guaranteed delivery times, quality assurance procedures, and volume discounts.

- Long-Term Contracts: These offer stability and predictability by establishing ongoing relationships with select suppliers. They’re particularly useful for critical materials to ensure consistent supply and potentially secure favorable pricing. I’ve successfully implemented long-term contracts for key components, which allowed for optimized inventory management and strengthened our relationships with key suppliers, leading to proactive problem solving and early identification of potential disruptions.

The choice of strategy depends on factors such as the material’s uniqueness, market volatility, supply risk, and the desired level of supplier engagement.

Q 2. Describe your process for evaluating potential suppliers.

Evaluating potential suppliers is a multi-stage process that goes beyond just price. My approach emphasizes a comprehensive assessment across several key areas:

- Financial Stability: I review the supplier’s financial statements to gauge their creditworthiness and ability to meet their obligations. This helps mitigate the risk of late deliveries or bankruptcy.

- Technical Capabilities: Thorough assessment of their manufacturing processes, quality control measures, and technological advancements is vital. This often includes site visits and detailed discussions with their engineering and production teams. For example, a potential supplier of precision-machined parts was assessed based on their ISO certification, equipment capabilities, and demonstrated track record of quality.

- Quality Management Systems: Verifying their adherence to standards like ISO 9001 ensures a commitment to quality. I also review their defect rates and customer satisfaction data to evaluate their past performance.

- Capacity and Delivery: Understanding their current capacity, lead times, and ability to scale production to meet our projected demand is essential. This often involves detailed discussions and potential trial runs to verify their capabilities.

- Compliance and Ethics: Ensuring adherence to environmental regulations, labor laws, and ethical sourcing practices is vital. This includes reviewing their sustainability policies and conducting audits when appropriate.

This holistic approach ensures that we select suppliers not just on price but on their overall reliability, capability, and alignment with our values.

Q 3. How do you identify and mitigate risks in the supply chain?

Supply chain risk is an ever-present concern. My approach involves proactive identification and mitigation strategies:

- Risk Assessment: I regularly conduct risk assessments to identify potential disruptions, such as natural disasters, political instability, supplier financial difficulties, or geopolitical events. This involves using various techniques, including SWOT analysis and Failure Mode and Effects Analysis (FMEA).

- Supplier Diversification: Relying on a single source for critical materials is risky. I prioritize diversifying our supplier base to reduce our dependence on any one vendor. This minimizes the impact of disruptions from one supplier impacting the entire supply chain.

- Inventory Management: Strategic inventory management helps buffer against potential delays or shortages. This involves balancing the cost of holding inventory with the risk of stockouts.

- Contingency Planning: We develop contingency plans to address potential disruptions. This might involve identifying backup suppliers, securing alternative transportation routes, or adjusting production schedules.

- Monitoring and Communication: Continuous monitoring of supplier performance and maintaining clear communication channels are crucial for early detection and swift response to emerging issues.

By implementing a robust risk management framework, we aim to proactively mitigate potential disruptions and ensure the continuity of our supply chain.

Q 4. What are your preferred methods for negotiating prices with suppliers?

Price negotiation requires a strategic approach that goes beyond simply haggling. My preferred methods include:

- Data-Driven Approach: I leverage market data, competitor pricing, and historical cost trends to establish a fair and competitive baseline price. This provides a solid foundation for negotiations.

- Value-Based Negotiation: I highlight the value we bring to the supplier, such as long-term contracts, guaranteed volumes, and opportunities for collaborative innovation. This demonstrates our commitment to a mutually beneficial relationship.

- Strategic Partnerships: Building strong, collaborative relationships with suppliers allows for more open and productive negotiations. Transparency and mutual understanding create a foundation for finding mutually acceptable solutions.

- Total Cost of Ownership (TCO): I don’t solely focus on the unit price. I consider the total cost of ownership, including factors such as transportation, quality control, and potential warranty costs. This helps us make informed decisions that consider the entire cost landscape.

- Leveraging Competition: Having alternative suppliers helps strengthen our negotiating position. However, it’s essential to maintain positive relationships with all potential partners.

Negotiation is a collaborative process aiming for a win-win scenario, ensuring both parties are satisfied with the outcome.

Q 5. How do you manage supplier relationships?

Managing supplier relationships is crucial for a smooth and efficient supply chain. I focus on building long-term, collaborative partnerships based on trust and mutual benefit:

- Regular Communication: Open and frequent communication is vital. This includes regular meetings, performance reviews, and proactive information sharing.

- Performance Monitoring: I closely monitor supplier performance against agreed-upon metrics, such as delivery times, quality levels, and responsiveness. This allows for early identification and resolution of any potential problems.

- Collaboration and Innovation: I actively seek opportunities for collaboration and innovation with our suppliers. This can involve joint problem-solving, process improvements, and the development of new materials or technologies.

- Feedback Mechanisms: I establish clear feedback mechanisms to ensure that both parties can openly communicate concerns and suggestions for improvement. This fosters a culture of continuous improvement.

- Fair and Ethical Practices: Maintaining fair and ethical practices is essential. This includes respecting intellectual property, paying promptly, and treating suppliers with respect and dignity.

Building strong, collaborative relationships translates to enhanced supply chain resilience and improved value for both parties.

Q 6. Describe a time you had to resolve a supplier performance issue.

In one instance, a key supplier of specialized fasteners experienced significant production delays due to an unforeseen equipment malfunction. This threatened our production schedule for a critical new product launch.

To resolve this, I immediately initiated a multi-pronged approach:

- Direct Communication: I contacted the supplier’s management team to understand the root cause of the delay and their proposed solution.

- Alternative Sourcing: While working with the primary supplier to expedite repairs, I explored alternative sourcing options to mitigate further delays. This involved contacting secondary suppliers and evaluating their capabilities and lead times.

- Negotiation: I negotiated a revised delivery schedule with the primary supplier, incorporating incentives for expedited production and compensation for the incurred delays.

- Production Adjustments: We slightly adjusted our production schedule to accommodate the delayed components while minimizing the impact on the launch date.

Through proactive communication, swift action, and a collaborative approach, we successfully mitigated the impact of the supplier’s performance issue and ensured the timely launch of our new product. The experience underscored the importance of proactive contingency planning and maintaining strong, open relationships with our suppliers.

Q 7. How do you ensure the quality of materials received?

Ensuring material quality is paramount. My approach combines proactive measures and rigorous quality control:

- Supplier Audits: Regular audits of our suppliers’ facilities and quality management systems help verify their compliance with our standards and industry best practices.

- Incoming Inspection: We implement rigorous incoming inspection procedures for all materials received. This includes visual inspection, dimensional checks, and material testing, using methods such as tensile strength testing or chemical analysis as needed.

- Sampling and Testing: We employ statistical sampling methods to efficiently evaluate the quality of incoming materials, focusing on key characteristics and ensuring they meet specifications. Failure to meet specifications results in immediate actions, including contacting the supplier and potentially rejecting the batch.

- Quality Control Documentation: Comprehensive documentation of all quality control procedures and results is maintained. This creates an auditable trail and provides valuable data for continuous improvement.

- Traceability: Maintaining full traceability of materials throughout the supply chain allows us to quickly pinpoint the source of any quality issues.

This multi-faceted approach helps us to ensure that the materials we receive consistently meet our quality standards and the specifications required for our products.

Q 8. What are your experiences with different types of contracts (e.g., fixed-price, cost-plus)?

Different contract types offer varying levels of risk and reward for both buyer and supplier. I have extensive experience negotiating and managing fixed-price, cost-plus, and time and materials contracts.

- Fixed-Price Contracts: These define a specific price for a defined scope of work. The supplier bears the risk of cost overruns, while the buyer has price certainty. An example is a contract for the supply of 1000 widgets at $10 each. The total price is fixed, regardless of the supplier’s actual costs.

- Cost-Plus Contracts: These reimburse the supplier for their actual costs plus a pre-agreed markup or fee. The buyer bears the risk of cost overruns, but has more flexibility in scope changes. Imagine a contract for custom tooling where the exact costs are difficult to predict upfront. A cost-plus contract would be suitable.

- Time and Materials Contracts: These are based on the supplier’s time spent and materials used. It’s often used for projects with undefined scope or requiring iterative development. This type is often used in engineering or consulting projects where the final requirements may evolve during execution.

My experience includes successfully negotiating favorable terms within each contract type, focusing on clear deliverables, change management processes, and robust payment schedules to mitigate potential disputes.

Q 9. Explain your understanding of Total Cost of Ownership (TCO).

Total Cost of Ownership (TCO) is a crucial concept in material sourcing. It goes beyond the initial purchase price to encompass all costs associated with an item throughout its entire lifecycle. This holistic view ensures informed decision-making, optimizing long-term value, rather than just focusing on immediate savings.

Consider the example of purchasing two different types of bearings for a machine. One might have a lower upfront cost, but requires more frequent replacements due to lower quality. The TCO calculation would include the initial purchase price, transportation costs, installation, maintenance, potential downtime due to failures, and eventual disposal costs. The seemingly cheaper bearing might actually have a significantly higher TCO due to its shorter lifespan and higher maintenance.

In my experience, implementing TCO analysis helps identify cost-saving opportunities across the entire supply chain. It allows for more strategic sourcing decisions by considering factors like durability, reliability, maintainability, and environmental impact.

Q 10. How familiar are you with various material certifications (e.g., ISO, RoHS)?

Material certifications are paramount for ensuring quality, safety, and compliance. I’m very familiar with a wide range of certifications, including:

- ISO 9001: Relates to Quality Management Systems, demonstrating a supplier’s commitment to consistently meeting customer requirements.

- ISO 14001: Focuses on Environmental Management Systems, highlighting a commitment to minimizing environmental impact.

- RoHS (Restriction of Hazardous Substances): Mandates the restriction of certain hazardous materials in electrical and electronic equipment.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Regulates the manufacturing and import of chemicals within the European Union.

- UL (Underwriters Laboratories): Provides safety certifications for various products, demonstrating compliance with safety standards.

My work involves verifying supplier certifications, auditing their processes to ensure ongoing compliance, and ensuring that all incoming materials meet the necessary standards. Failure to adhere to these certifications can lead to significant legal and reputational risks.

Q 11. Describe your experience with Supplier Relationship Management (SRM) software.

I have extensive experience utilizing Supplier Relationship Management (SRM) software. These systems are essential for streamlining communication, collaboration, and performance tracking with suppliers. I’ve worked with systems like [mention specific software examples if comfortable, e.g., Coupa, SAP Ariba].

Key functionalities I’ve leveraged include:

- Supplier onboarding and qualification: Efficiently managing the process of vetting and registering new suppliers.

- Contract management: Centralized storage and management of contracts, ensuring easy access and version control.

- Performance monitoring: Tracking key performance indicators (KPIs) and identifying areas for improvement in supplier performance.

- Communication and collaboration: Facilitating seamless communication and collaboration with suppliers through the platform.

- Risk management: Identifying and mitigating potential risks associated with suppliers.

The use of SRM software significantly improves efficiency, transparency, and collaboration throughout the sourcing process.

Q 12. How do you track key performance indicators (KPIs) related to material sourcing?

Tracking key performance indicators (KPIs) is crucial for monitoring the effectiveness of material sourcing strategies. I typically track:

- On-time delivery rate: Percentage of orders delivered on or before the scheduled date.

- Quality defects rate: Percentage of defective materials received.

- Lead time: Time taken from order placement to receipt of materials.

- Supplier compliance rate: Adherence to contractual obligations and quality standards.

- Cost per unit: Tracking fluctuations in material costs.

- Inventory turnover rate: Efficiency of inventory management.

Data is gathered through various sources, including supplier portals, ERP systems, and quality control reports. Regular analysis of these KPIs allows for proactive identification of trends, potential problems, and areas for improvement in supplier performance and sourcing strategies.

Q 13. How do you handle unexpected material shortages?

Unexpected material shortages require a swift and decisive response. My approach involves a structured process:

- Immediate Assessment: Determine the severity and impact of the shortage on production or projects.

- Communication: Immediately notify relevant stakeholders (production, project management, etc.) to coordinate mitigation efforts.

- Supplier Collaboration: Contact the supplier to understand the root cause of the shortage and explore potential solutions, including expedited shipments or alternative sourcing options.

- Inventory Review: Check existing inventory for potential substitutes or alternatives.

- Alternative Sourcing: Identify and qualify alternative suppliers if necessary, weighing cost, quality, and lead time considerations.

- Production Adjustments: If necessary, adjust production schedules or project timelines to minimize the impact of the shortage.

- Root Cause Analysis: Once the shortage is resolved, conduct a root cause analysis to identify vulnerabilities in the supply chain and implement preventative measures.

In a recent scenario, a critical component shortage threatened a major project. By quickly engaging with the supplier, identifying an alternative source, and temporarily adjusting our production schedule, we mitigated the impact and avoided significant delays or cost overruns.

Q 14. Explain your understanding of different sourcing models (e.g., global, regional, local).

Different sourcing models each have advantages and disadvantages depending on various factors, including cost, risk, quality, and logistics.

- Global Sourcing: Procuring materials from suppliers worldwide. This offers access to a wider range of suppliers, potentially leading to lower costs, but also increases complexity and risks related to logistics, quality control, and geopolitical factors. This approach can be beneficial for high-volume, standardized components.

- Regional Sourcing: Focusing on suppliers within a specific geographic region. This reduces transportation costs and lead times compared to global sourcing, improving responsiveness and potentially enhancing quality control. It is a suitable strategy for items with complex supply chains or stringent local regulatory requirements.

- Local Sourcing: Procuring materials from suppliers within a close proximity to the manufacturing facility. This minimizes lead times, transportation costs, and environmental impact. However, it may limit the choice of suppliers and increase potential price sensitivity.

The optimal sourcing model depends on a thorough assessment of the specific needs of each product or component. My approach involves evaluating all three models, considering their implications on cost, risk, and quality, to select the most appropriate strategy for each situation.

Q 15. How do you balance cost, quality, and delivery time in your sourcing decisions?

Balancing cost, quality, and delivery time in material sourcing is a crucial aspect of effective procurement. It’s often referred to as the ‘iron triangle’ because optimizing one aspect often requires compromises on the others. My approach involves a multi-step process:

- Prioritization: First, I clearly define the project’s priorities. Is this a high-volume, cost-sensitive project where slight quality variations are acceptable? Or is it a critical component requiring top-tier quality, even at a premium cost? This dictates the weighting of each factor.

- Supplier Analysis: I meticulously evaluate potential suppliers, considering not just their price but also their quality certifications (ISO 9001, etc.), production capabilities, delivery track record, and their overall reputation. I’ll often conduct site visits to witness their operations firsthand.

- Negotiation and Trade-offs: Once I’ve shortlisted suppliers, I use a strategic negotiation process. For instance, if a supplier offers excellent quality and timely delivery but is slightly more expensive, I might explore options like longer-term contracts to secure price reductions or collaborating on reducing lead times through process improvements.

- Data-Driven Decisions: I rely heavily on data analysis, tracking key performance indicators (KPIs) like on-time delivery, defect rates, and total cost of ownership (TCO) to monitor supplier performance and inform future sourcing decisions. This data allows me to justify the trade-offs I’ve made.

For example, in a previous project involving sourcing electronic components, we prioritized quality and delivery time due to tight project deadlines. This resulted in a slightly higher cost, but the avoidance of potential delays and defects significantly outweighed the added expense in the long run. We found a supplier with a strong track record of on-time delivery and robust quality control processes, even if they weren’t the absolute cheapest option.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with RFIs, RFPs, and RFQs.

RFIs (Requests for Information), RFPs (Requests for Proposal), and RFQs (Requests for Quotation) are essential tools in the material sourcing process. They help gather information, compare offers, and select the best suppliers.

- RFIs: These are used to gather preliminary information from potential suppliers about their capabilities, resources, and experience. They’re often used to screen suppliers before proceeding with more formal requests.

- RFPs: These are more detailed documents that outline the project requirements and request proposals from suppliers on how they would meet those requirements. RFPs require suppliers to present a comprehensive solution, often including technical specifications, pricing, and project timelines.

- RFQs: These are used to obtain price quotes from pre-qualified suppliers for specific goods or services. After assessing proposals in an RFP, RFQs are used to receive concrete pricing information for chosen options.

My experience involves developing and managing these documents, evaluating responses, and effectively communicating with suppliers throughout the process. I’ve used project management software to streamline the process, track responses, and ensure transparency and consistency. In one instance, we used an RFP to source a complex manufacturing process for a new product. The detailed specifications in the RFP helped us select a supplier with the necessary expertise and capacity. We followed this with an RFQ to obtain precise pricing based on the proposals received.

Q 17. How do you assess the financial stability of potential suppliers?

Assessing a supplier’s financial stability is crucial to mitigate risk. My approach is multi-faceted:

- Financial Statements Review: I carefully examine the supplier’s financial statements, including balance sheets, income statements, and cash flow statements. I look for indicators like consistent profitability, healthy cash reserves, and a low debt-to-equity ratio.

- Credit Reports: Using credit reporting agencies like Dun & Bradstreet or Experian, I obtain a credit report to assess their creditworthiness and payment history. This highlights any potential red flags.

- Industry Benchmarks: I compare the supplier’s financial performance to industry benchmarks to understand how they stand against their competitors. This provides valuable context for the financial data.

- Due Diligence: This might include contacting the supplier’s bank for references, checking for any liens or judgments against the company, and even verifying their insurance coverage.

For example, during a recent sourcing project, we identified a supplier with attractive pricing. However, their financial statements revealed consistently declining profits and a high debt load, indicating potential instability. This prompted us to select a more financially sound supplier, albeit at a slightly higher cost, to mitigate the risk of potential supply disruptions or contract defaults. Choosing financial stability over a small initial cost saving proved to be a wise decision.

Q 18. How do you ensure ethical and sustainable sourcing practices?

Ethical and sustainable sourcing practices are paramount. My approach focuses on several key areas:

- Supplier Code of Conduct: I ensure that all our suppliers adhere to a strict code of conduct that covers areas like labor standards, environmental protection, and fair business practices. This code is enforced through regular audits and performance evaluations.

- Environmental Impact Assessment: I evaluate the environmental footprint of the materials and the supplier’s manufacturing processes. We prioritize suppliers committed to reducing their carbon emissions, waste generation, and water consumption.

- Social Responsibility: We assess suppliers’ commitment to fair labor practices, including safe working conditions, fair wages, and no child labor. This includes conducting social audits and verifying compliance with international labor standards.

- Transparency and Traceability: We promote transparency throughout our supply chain, ensuring traceability of materials from their origin to our final products. This helps us identify and address potential ethical or environmental issues.

For instance, we recently transitioned to a supplier of recycled aluminum for a product, reducing our environmental impact and supporting a circular economy. We regularly audit our suppliers to ensure compliance with our code of conduct and conduct environmental impact assessments to ensure sustainability.

Q 19. Describe your experience with different material selection criteria.

Material selection criteria vary significantly depending on the application. However, common criteria I consider include:

- Mechanical Properties: Strength, hardness, elasticity, fatigue resistance, and ductility are essential considerations, especially for structural applications.

- Physical Properties: Density, melting point, thermal conductivity, electrical conductivity, and magnetic properties are crucial for diverse applications.

- Chemical Properties: Corrosion resistance, reactivity, and toxicity are important considerations, especially in harsh environments or applications involving food or medical devices.

- Cost: The price of the material, including processing and manufacturing costs, is always a critical factor.

- Availability: Ensuring a reliable supply of the material is vital for continuous production.

- Sustainability: Environmental impact, recyclability, and the use of sustainable materials are increasingly important factors.

- Processability: The ease of manufacturing with the material, including machinability, weldability, and formability, is another key criterion.

In a previous project, we were selecting a material for a high-temperature application. We considered materials like nickel alloys and ceramics, evaluating their thermal properties, strength at high temperatures, and corrosion resistance. Ultimately, we selected a nickel-based superalloy that offered the best balance of properties despite being more costly than other options because its superior performance justified the price differential.

Q 20. How do you utilize data analytics in material sourcing and evaluation?

Data analytics plays a vital role in optimizing material sourcing and evaluation. I leverage data analytics in several ways:

- Supplier Performance Monitoring: I track KPIs such as on-time delivery, quality defects, lead times, and costs. This data helps identify top-performing suppliers and areas for improvement with underperforming ones.

- Demand Forecasting: Analyzing historical demand patterns helps predict future material needs, enabling proactive sourcing and inventory management, reducing waste and storage costs.

- Market Trend Analysis: Analyzing market data on material prices, availability, and supply chain disruptions helps anticipate potential risks and opportunities.

- Spend Analysis: Analyzing historical spending patterns helps identify areas where cost savings can be achieved through better negotiation, supplier consolidation, or material substitution.

- Predictive Modeling: I use advanced analytics techniques to build predictive models that forecast material costs, identify potential supply chain risks, and optimize inventory levels.

For example, by analyzing historical data on lead times and defect rates from various suppliers, I built a predictive model that helped us anticipate potential delays and proactively adjust our procurement strategy to minimize the impact. Using statistical analysis and data visualization, we were able to identify trends, outliers, and areas for significant cost savings.

Q 21. What is your experience with lean manufacturing principles and their impact on material sourcing?

Lean manufacturing principles significantly impact material sourcing by emphasizing waste reduction and efficiency improvements throughout the supply chain. My experience shows that integrating lean principles results in:

- Just-in-Time (JIT) Inventory: Lean sourcing focuses on minimizing inventory holding costs by receiving materials only when needed. This reduces storage space requirements and minimizes the risk of obsolescence.

- Supplier Collaboration: Building strong relationships with suppliers is crucial. Collaborative partnerships focus on continuous improvement, sharing information, and optimizing processes to achieve mutual benefits.

- Value Stream Mapping: Analyzing the entire material flow from supplier to production helps identify bottlenecks, waste, and areas for improvement in the process.

- Reduced Lead Times: Lean principles promote streamlined processes, reducing lead times for material procurement and delivery.

- Improved Quality: By working closely with suppliers to establish robust quality control systems, defects are minimized, leading to reduced waste and improved efficiency.

In one project, we implemented JIT inventory with a key supplier. This resulted in significant reductions in warehousing costs and minimized the risk of obsolete inventory. We collaborated closely with the supplier to optimize delivery schedules and improve communication, leading to a more efficient and responsive supply chain. The overall improvement in efficiency and reduction in waste directly benefited both the supplier and our organization.

Q 22. How do you manage inventory levels to optimize costs?

Optimizing inventory costs involves a delicate balance between ensuring sufficient stock to meet demand and avoiding excessive holding costs. This requires a sophisticated approach leveraging various inventory management techniques.

I utilize a combination of methods, including:

- Demand Forecasting: Accurate prediction of future demand is paramount. I employ statistical forecasting models, incorporating historical data, seasonality, and market trends to anticipate fluctuations. For example, I might use an ARIMA model for stable demand and exponential smoothing for products with trending demand.

- Economic Order Quantity (EOQ): This classic model helps determine the optimal order quantity to minimize the total cost of inventory, including ordering costs and holding costs. The EOQ formula takes into account factors like demand rate, ordering cost, and holding cost. In practice, I often use software to calculate the EOQ and adjust based on real-world factors.

- Just-in-Time (JIT) Inventory: For certain materials with stable supply chains and predictable demand, JIT minimizes inventory holding costs by receiving materials only when needed for production. This requires strong collaboration with suppliers and precise scheduling.

- Safety Stock: To account for unexpected demand fluctuations or supply chain disruptions, I strategically maintain a safety stock. The level of safety stock depends on the criticality of the material, lead times, and demand variability. I regularly review safety stock levels to ensure they remain optimized.

- Inventory Turnover Rate Monitoring: I consistently monitor the inventory turnover rate (the number of times inventory is sold or used in a period) to identify slow-moving items or potential obsolescence risks. This helps in making informed decisions about inventory adjustments.

By combining these techniques and adapting them to the specific characteristics of each material, I ensure that inventory levels are optimized for cost-effectiveness without compromising production or customer service.

Q 23. Describe your experience working with cross-functional teams in a sourcing project.

Cross-functional collaboration is essential in sourcing. In a recent project sourcing sustainable packaging materials, I worked closely with teams from engineering, marketing, and procurement.

My role involved:

- Requirements Gathering: Collaborating with engineering to define the technical specifications for the new packaging, considering factors like material strength, recyclability, and compatibility with existing production processes.

- Supplier Identification and Evaluation: Working with the procurement team to identify and evaluate potential suppliers based on factors like price, capacity, sustainability certifications, and lead times. We used a weighted scoring system to rank the suppliers.

- Negotiation: Participating in negotiations with shortlisted suppliers, leveraging my understanding of market dynamics and industry benchmarks to secure favorable terms and conditions. This included negotiating price, payment terms, and quality control procedures.

- Communication and Reporting: Keeping all stakeholders informed of progress, challenges, and decisions throughout the sourcing process. Regular updates and transparent communication were key to maintaining alignment.

This collaborative approach ensured that the selected packaging met all technical requirements, aligned with marketing objectives, and offered the best value for the company. Successful cross-functional collaboration requires excellent communication, active listening, and a willingness to compromise and find mutually beneficial solutions.

Q 24. How do you stay updated on industry trends and best practices in material sourcing?

Staying abreast of industry trends and best practices in material sourcing is crucial for remaining competitive. I employ several strategies to ensure my knowledge remains current:

- Industry Publications and Journals: I regularly read publications such as the Journal of Purchasing and Supply Management and industry-specific newsletters to stay informed about new technologies, regulations, and market developments.

- Conferences and Workshops: Attending industry conferences and workshops provides opportunities to network with peers, learn from experts, and discover the latest innovations. This hands-on experience is invaluable.

- Online Resources and Databases: I utilize online databases like those provided by industry associations to access market research, supplier information, and best-practice guidelines.

- Professional Networks: Participating in professional organizations like ISM (Institute for Supply Management) allows me to connect with other professionals in the field, share knowledge, and learn from their experiences. I also leverage LinkedIn for professional networking.

- Supplier Relationships: Maintaining strong relationships with key suppliers provides insights into emerging trends and technologies, directly from the source. They often share valuable market intelligence.

By actively pursuing these avenues, I ensure that my knowledge and skills remain relevant and that I can leverage the latest advancements in material sourcing to benefit my organization.

Q 25. Explain your understanding of different procurement processes.

Procurement processes encompass a series of steps involved in acquiring goods and services. Several different processes exist, each suited to various contexts and organizational structures.

- Spend Analysis: This initial step involves analyzing historical purchasing data to identify opportunities for cost savings and efficiency improvements. This might involve categorizing spend by supplier, material, and department.

- Request for Information (RFI): An RFI is used to gather information from potential suppliers to determine their capabilities and suitability for a particular requirement. It’s often a preliminary step before issuing an RFP.

- Request for Proposal (RFP): An RFP is a formal document that solicits proposals from qualified suppliers for a specific product or service. Suppliers submit detailed proposals outlining their solutions and pricing.

- Request for Quotation (RFQ): Similar to an RFP, but typically used for simpler procurements where detailed proposals aren’t necessary. Suppliers provide quotes based on a specific set of requirements.

- Negotiation: This crucial step involves negotiating terms and conditions with selected suppliers to ensure the best possible value for money. This might involve negotiating price, payment terms, and delivery schedules.

- Supplier Selection: Based on the evaluation of proposals and negotiations, the most suitable supplier is selected. Factors like price, quality, reliability, and sustainability are considered.

- Contract Management: This involves managing the contract with the selected supplier, monitoring performance, and ensuring compliance with agreed-upon terms.

- Supplier Performance Management: Continuously monitoring supplier performance against key metrics such as on-time delivery, quality, and cost. This helps to identify areas for improvement and maintain high standards.

The specific procurement process used depends on factors such as the complexity of the procurement, the value of the goods or services, and the organization’s internal policies and procedures.

Q 26. How do you measure the success of your sourcing initiatives?

Measuring the success of sourcing initiatives requires a multifaceted approach that goes beyond simply achieving cost reductions. I use a combination of quantitative and qualitative metrics to assess success.

- Cost Savings: This is a key metric, comparing the cost of materials before and after the sourcing initiative. It’s important to consider the total cost of ownership, including factors like transportation, quality control, and potential risks.

- Supplier Performance: Metrics such as on-time delivery rate, quality defects, and lead time reductions help assess the performance of selected suppliers. This ensures continuous improvement in the supply chain.

- Inventory Turnover: Improved inventory turnover indicates better inventory management and reduced holding costs. A higher turnover rate generally suggests efficiency gains.

- Risk Mitigation: Assessing the reduction in supply chain risks, such as disruptions or supplier defaults, demonstrates the effectiveness of diversification strategies and risk management plans.

- Sustainability Metrics: If sustainability was a key objective, measuring the reduction in carbon footprint, improved waste management, or increased use of recycled materials demonstrates the positive impact of the initiative.

- Stakeholder Satisfaction: Gathering feedback from internal stakeholders (engineering, production, procurement) on the quality of materials, supplier responsiveness, and overall satisfaction is crucial. This ensures alignment and continuous improvement.

By using a balanced scorecard of these metrics, I can gain a comprehensive understanding of the success and overall impact of sourcing initiatives.

Q 27. Describe a challenging sourcing project and how you overcame the obstacles.

One challenging project involved sourcing a specialized component for a new product launch. The component required unique technical specifications and had a very tight deadline. Initial supplier quotes were significantly higher than our budget, and several potential suppliers lacked the capacity to meet the required volume.

To overcome these obstacles, I implemented the following strategies:

- Value Engineering: I worked with the engineering team to explore alternative designs or specifications that could achieve the same functionality at a lower cost without compromising performance. This involved identifying areas where specifications could be relaxed.

- Global Sourcing: I expanded the search beyond our traditional supplier base to explore opportunities in other regions. This broadened the pool of potential suppliers and helped to identify a supplier with both the capacity and competitive pricing.

- Strategic Partnerships: I forged a strong partnership with the selected supplier, ensuring clear communication and collaboration throughout the manufacturing process. This included joint quality control processes and early warning systems to mitigate any potential issues.

- Negotiation and Contractual Agreements: I conducted rigorous negotiations with the selected supplier, focusing on securing favorable payment terms, quality guarantees, and penalties for non-compliance. A comprehensive contract was put in place to protect our interests.

By combining these strategies, we successfully sourced the component within the budget and timeline, ensuring the timely launch of the new product. This project highlighted the importance of flexibility, creativity, and strong collaboration to navigate complex sourcing challenges.

Q 28. How do you handle conflicting priorities in material sourcing?

Conflicting priorities in material sourcing are common. For example, a project might require a balance between cost, quality, and delivery time. I address these conflicts using a prioritization framework that considers the overall impact of each factor.

My approach includes:

- Prioritization Matrix: I utilize a prioritization matrix to weigh the importance of different criteria based on the project’s objectives. This could be a simple weighted scoring system or a more sophisticated multi-criteria decision analysis (MCDA) approach.

- Trade-off Analysis: I explicitly analyze the trade-offs between different criteria. For example, choosing a higher-quality material might increase the cost but reduce the risk of defects and rework. I clearly articulate these trade-offs to stakeholders.

- Stakeholder Alignment: I ensure that all key stakeholders are involved in the prioritization process and that their perspectives are considered. This helps to build consensus and manage expectations.

- Negotiation and Compromise: Negotiation is crucial in resolving conflicting priorities. I work with suppliers and internal stakeholders to find mutually acceptable solutions that balance competing demands. This might involve compromising on certain criteria to achieve greater success in others.

- Contingency Planning: I develop contingency plans to address potential risks associated with prioritizing certain criteria over others. This might involve having backup suppliers or alternative materials on hand.

This structured approach ensures that decisions are made in a transparent and informed manner, balancing conflicting priorities to achieve the best overall outcome for the project.

Key Topics to Learn for Material Sourcing and Evaluation Interview

- Supplier Selection & Management: Understanding criteria for selecting reliable suppliers, negotiating contracts, and managing supplier relationships. Practical application: Analyzing supplier performance data to identify areas for improvement and cost reduction.

- Material Cost Analysis: Developing methods for accurate cost estimation, identifying cost drivers, and exploring cost-saving opportunities. Practical application: Performing a Total Cost of Ownership (TCO) analysis for different material options.

- Material Quality Control & Assurance: Implementing and monitoring quality control procedures throughout the sourcing process, ensuring materials meet specifications and industry standards. Practical application: Developing and implementing inspection protocols and addressing non-conformance issues.

- Sustainability & Ethical Sourcing: Understanding and applying principles of sustainable and ethical sourcing, including environmental impact assessment and social responsibility. Practical application: Evaluating suppliers based on their environmental and social performance.

- Material Specifications & Standards: Interpreting and applying material specifications, industry standards (e.g., ISO), and regulatory compliance requirements. Practical application: Creating and revising material specifications to meet evolving project needs.

- Risk Management in Sourcing: Identifying and mitigating potential risks associated with material sourcing, such as supply chain disruptions and quality issues. Practical application: Developing contingency plans to address potential supply chain disruptions.

- Technology & Data Analysis in Sourcing: Utilizing software and data analytics tools to improve efficiency and decision-making in material sourcing and evaluation. Practical application: Using data analysis to optimize inventory levels and reduce waste.

Next Steps

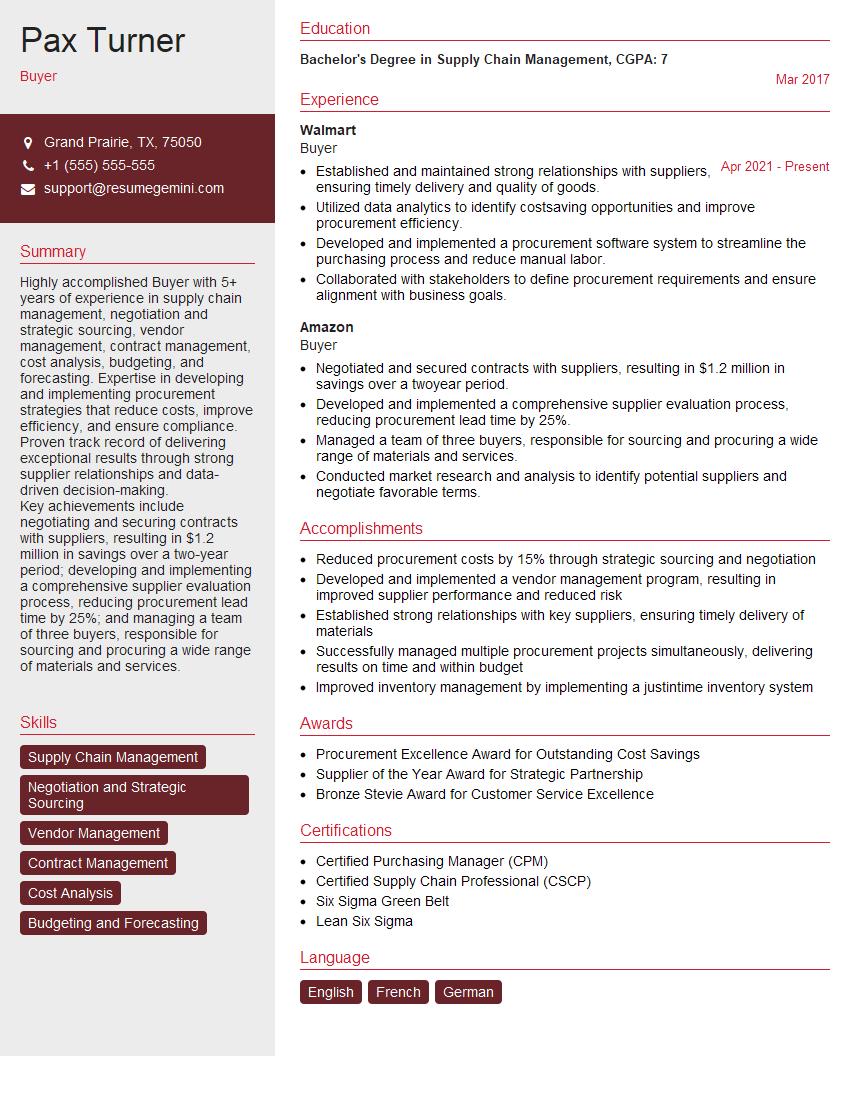

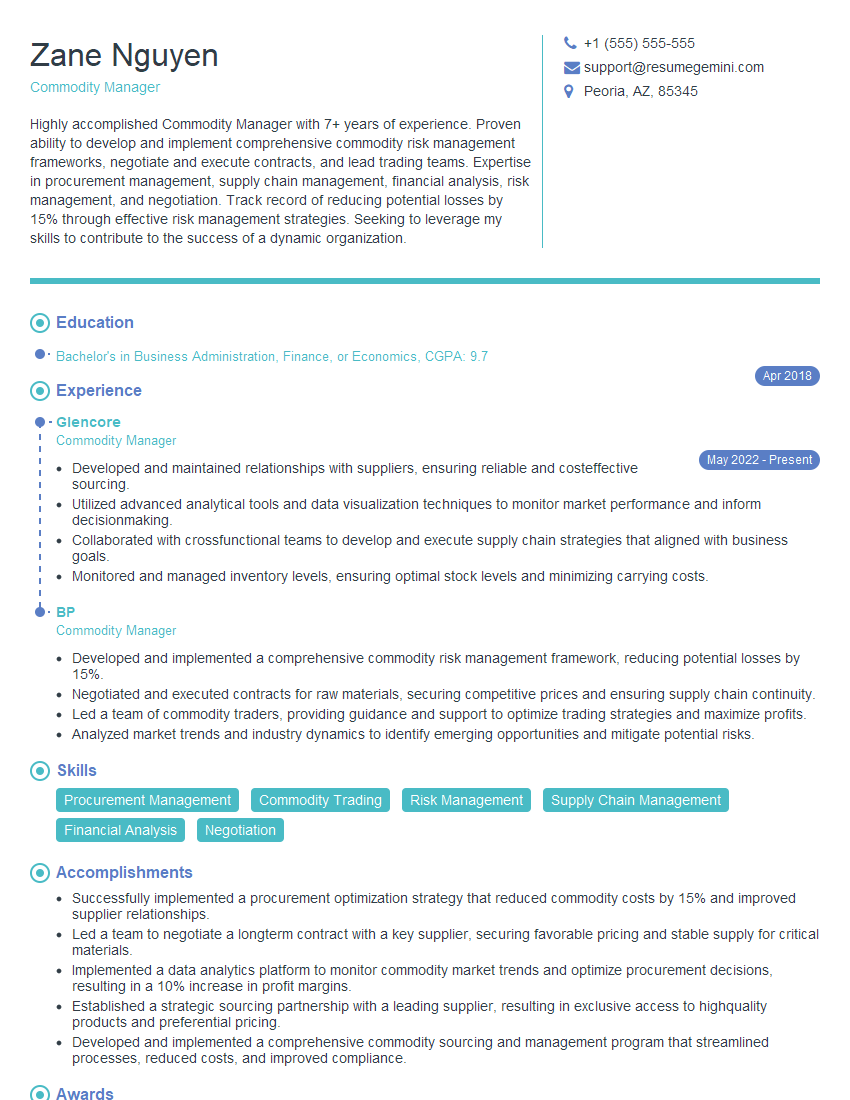

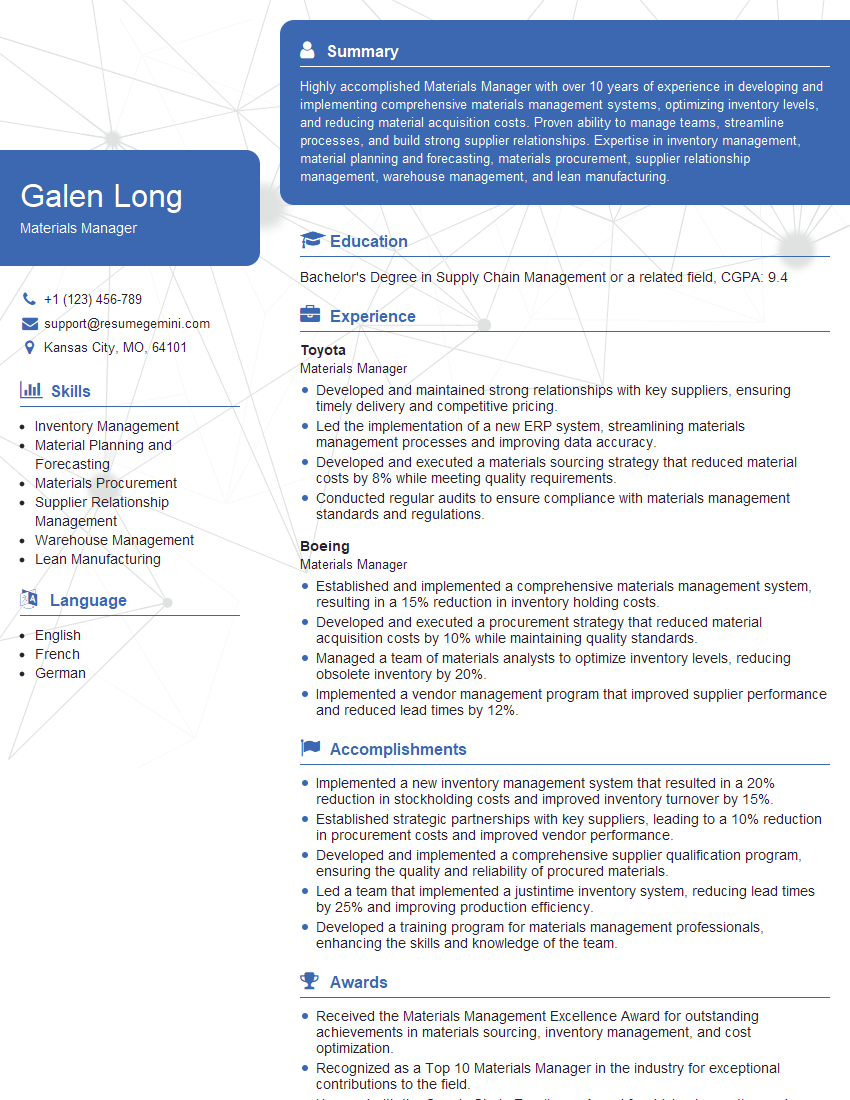

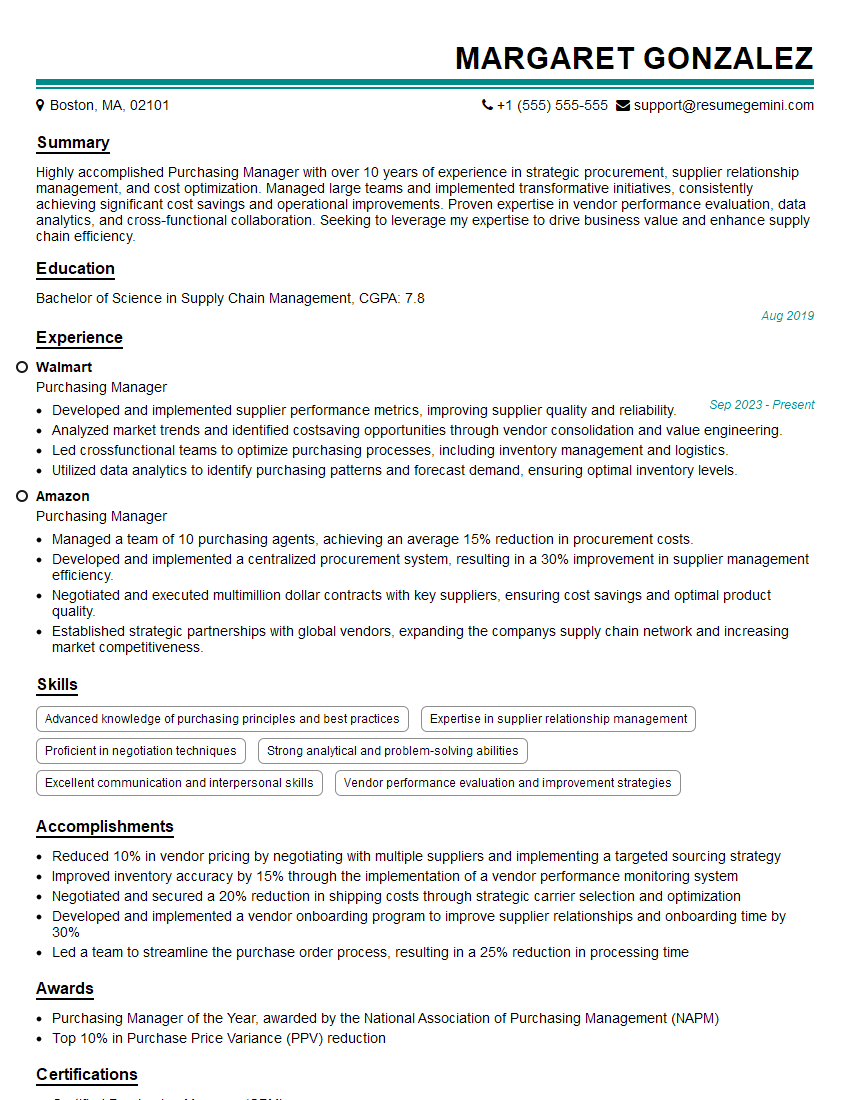

Mastering Material Sourcing and Evaluation is crucial for career advancement in procurement, supply chain management, and related fields. A strong understanding of these concepts demonstrates valuable skills highly sought after by employers. To significantly improve your job prospects, focus on creating an ATS-friendly resume that effectively highlights your expertise. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to the specific requirements of Material Sourcing and Evaluation roles. Examples of resumes tailored to this field are available within ResumeGemini to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good