Cracking a skill-specific interview, like one for Product Knowledge and Placement, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Product Knowledge and Placement Interview

Q 1. Explain your understanding of product lifecycle management.

Product Lifecycle Management (PLM) is a strategic approach to managing the entire lifecycle of a product, from its initial concept and design to its eventual discontinuation. It’s about optimizing the processes involved in bringing a product to market and ensuring its success throughout its lifespan. Think of it as a roadmap for a product’s journey.

The key stages typically include:

- Idea Generation and Concept Development: Identifying market needs and developing initial product ideas.

- Design and Development: Creating detailed designs, prototypes, and specifications.

- Manufacturing and Production: Setting up production processes and managing the manufacturing of the product.

- Marketing and Sales: Launching the product and driving sales.

- Distribution and Support: Getting the product to customers and providing after-sales service.

- End-of-Life Management: Planning for the product’s eventual retirement, including recycling or disposal.

Effective PLM involves utilizing software and collaborative tools to manage data, track progress, and ensure efficient communication across different teams and stakeholders. For instance, a company developing a new smartphone would use PLM to manage design changes, track component sourcing, schedule production, and monitor customer feedback, all in one integrated system.

Q 2. Describe a time you successfully positioned a product for a specific market segment.

I once worked on launching a premium line of organic dog food. The initial market research indicated a niche market of affluent pet owners who prioritized high-quality, natural ingredients. To position the product effectively, we focused on several key strategies:

- Premium Packaging and Branding: We used sophisticated packaging design and a brand name that conveyed luxury and natural ingredients.

- Targeted Marketing Channels: We focused on high-end pet stores and online retailers frequented by our target demographic. We also utilized social media marketing campaigns featuring influencer endorsements.

- Highlighting Unique Selling Propositions (USPs): We emphasized the use of ethically sourced, organic ingredients, along with independent lab testing results that validated the quality.

- Price Point Strategy: We positioned the product at a premium price point to reflect its superior quality and ingredients.

This targeted approach resulted in a successful product launch, exceeding initial sales projections and establishing a strong brand presence within the specific market segment. We tracked success through sales data, customer feedback, and social media engagement.

Q 3. How do you identify key features that differentiate a product from its competitors?

Identifying key differentiating features requires a thorough competitive analysis. This involves understanding the competitive landscape, analyzing competitor products, and pinpointing areas where your product excels or offers a unique value proposition. Here’s my approach:

- Competitive Benchmarking: Create a matrix comparing your product to its main competitors across various features and attributes. This could be a simple spreadsheet or a more sophisticated competitive analysis tool.

- Feature Prioritization: Focus on features that are most important to your target customer segment and provide a significant advantage over the competition. Consider factors like price, performance, usability, and design.

- Value Proposition Definition: Clearly articulate the unique value your product offers to customers. What problem does it solve better than the alternatives? What makes it stand out?

- Customer Feedback: Gather customer feedback through surveys, focus groups, or reviews to understand what features are most valued and where improvements can be made.

For example, if I’m comparing two CRM systems, I wouldn’t just look at features, but analyze their ease of use, integration with other software, and the level of customer support offered. The key differentiator could be a superior user interface or powerful automation features.

Q 4. What metrics do you use to measure product success?

Measuring product success is crucial and requires a holistic approach, going beyond simple sales figures. Here are some key metrics I use:

- Sales Revenue and Growth: This is a fundamental indicator of market acceptance.

- Customer Acquisition Cost (CAC): How much does it cost to acquire a new customer?

- Customer Lifetime Value (CLTV): The predicted revenue a single customer will generate over their relationship with the company.

- Customer Churn Rate: The percentage of customers who stop using the product.

- Customer Satisfaction (CSAT): Measured through surveys, reviews, and feedback.

- Net Promoter Score (NPS): A measure of customer loyalty and willingness to recommend the product.

- Website Traffic and Engagement: For digitally distributed products, website analytics provide insights into user behavior.

- App Downloads and Usage: For apps, key metrics include download numbers, daily/monthly active users, and feature usage.

The specific metrics will vary depending on the product and business goals. However, a balanced approach incorporating both quantitative (sales, costs) and qualitative (customer feedback) data provides a comprehensive view of product performance.

Q 5. Explain your approach to analyzing market trends and identifying new product opportunities.

Analyzing market trends and identifying new product opportunities involves a systematic approach combining research, data analysis, and creative thinking. My approach typically follows these steps:

- Market Research: I start with thorough market research to understand current trends, customer needs, and competitor activities. This includes analyzing market reports, industry publications, and competitor websites.

- Trend Analysis: I identify emerging trends by analyzing data from various sources, including social media, online forums, and news articles. Tools like Google Trends can be invaluable.

- Customer Needs Assessment: I conduct customer surveys, interviews, and focus groups to understand unmet needs and pain points. This helps identify opportunities for new products or improved features.

- Competitive Analysis: I analyze the competitive landscape to identify gaps and underserved niches. Are there any unmet needs that existing products aren’t addressing?

- Idea Generation and Validation: I brainstorm potential product ideas based on my research and validate them through market testing and feasibility studies.

For instance, the rise of remote work led to an increased demand for collaboration tools, presenting a significant opportunity for new product development in that sector. Recognizing such trends early and understanding the associated customer needs is key to developing successful products.

Q 6. How do you prioritize features in product development?

Prioritizing features in product development is crucial for efficient resource allocation and timely product delivery. I use a prioritization framework that considers various factors:

- Value to the Customer: Features that deliver the most value to the target customer should be prioritized. This involves assessing the impact of each feature on user satisfaction and business goals.

- Development Cost and Effort: Some features might be high-value but require significant development resources. A cost-benefit analysis helps balance value with feasibility.

- Business Impact: Features directly contributing to key business objectives (e.g., increasing sales, improving customer retention) receive higher priority.

- Technical Feasibility: Consider the technical feasibility and integration with existing systems. Some features may require significant technical investment or pose integration challenges.

- Risk Assessment: Evaluate potential risks associated with each feature. Are there potential technical issues, market risks, or compliance concerns?

- Prioritization Frameworks: Tools like MoSCoW (Must have, Should have, Could have, Won’t have) or RICE scoring (Reach, Impact, Confidence, Effort) can help structure this process.

By systematically evaluating these factors, I can create a prioritized feature backlog that guides the development process effectively.

Q 7. Describe your experience with A/B testing and its role in product placement.

A/B testing is a powerful method for improving product placement and user experience. It involves creating two versions of a product element (e.g., website layout, button color, product description) and presenting them to different user groups. By analyzing the results, we can determine which version performs better.

In the context of product placement, A/B testing can be used to optimize:

- Website Layout: Test different page layouts to see which one leads to higher conversion rates.

- Product Descriptions: Compare different product descriptions to identify which one resonates most with customers.

- Call-to-Action Buttons: Experiment with different button colors, text, and placement to maximize click-through rates.

- Product Placement on a Website: Determine the optimal location for product placement on a webpage to improve visibility and sales.

- Promotional Offers and Pricing: Test different pricing strategies or promotional offers to determine what drives the most sales.

Example: Let’s say we’re testing two different product descriptions for a new coffee machine. Version A emphasizes the machine’s ease of use, while Version B focuses on its advanced features. By tracking the conversion rates (purchases) for each version, we can determine which description is more effective and adjust our marketing materials accordingly.

A/B testing provides data-driven insights to improve product placement and maximize user engagement, ultimately leading to better conversion rates and increased sales.

Q 8. How do you handle negative customer feedback related to product placement?

Negative customer feedback regarding product placement is invaluable. It’s not just a complaint; it’s a diagnostic tool revealing weaknesses in our strategy. My approach involves a multi-step process:

- Acknowledgement and Empathy: I begin by acknowledging the customer’s frustration and expressing empathy. A simple, ‘I understand your disappointment,’ goes a long way.

- Understanding the Issue: I carefully analyze the feedback, looking for patterns. Is the complaint about the product itself, its placement (too prominent, too hidden, inappropriate location), or the overall shopping experience?

- Data Analysis: I delve into sales data and website analytics around that specific placement to see if the feedback aligns with broader trends. Is there a drop in sales or engagement in that area?

- Solution Implementation: Based on the analysis, I propose solutions. This could involve repositioning the product, adjusting the marketing messaging, refining the product display, or even addressing the underlying product issue.

- Follow-up and Monitoring: I monitor the impact of implemented changes, tracking sales, customer feedback, and website analytics to assess the effectiveness of the solution. This iterative process ensures continuous improvement.

For example, if customers consistently complain about a specific product being hidden on a website, I might suggest A/B testing different placement options to see which one maximizes visibility and click-through rates.

Q 9. How do you stay up-to-date with industry trends and competitor activities?

Staying ahead in the dynamic world of product placement requires a proactive approach. I leverage multiple avenues to stay informed:

- Industry Publications and Trade Shows: I regularly read relevant industry magazines and journals and attend trade shows to stay abreast of emerging trends and innovations. This offers a chance to network and learn from industry leaders.

- Competitor Analysis: I meticulously track competitor activities, studying their product placement strategies across various channels (online, retail stores, etc.). This involves analyzing their website designs, marketing campaigns, and in-store displays.

- Market Research Reports: I utilize market research reports and data analytics tools to understand consumer behavior, market trends, and the effectiveness of different placement strategies. This provides valuable data-driven insights.

- Networking: I actively engage in networking with colleagues, industry experts, and potential clients. Conversations and collaborations often unearth valuable insights and innovative ideas.

- Online Tools and Databases: I use various online tools and databases to track social media mentions, customer reviews, and competitor activities. This provides real-time insights into consumer sentiment and market dynamics.

Think of it like a detective gathering evidence. Each piece of information contributes to a comprehensive understanding of the landscape.

Q 10. Describe your experience with pricing strategies for different product placements.

Pricing strategies for product placement are heavily dependent on the context. The value of a placement is determined by factors like reach, audience engagement, and brand synergy. Here are some examples:

- Cost-Plus Pricing: This is a simple method where the cost of the placement is calculated, and a markup is added. This is suitable for standard placements with predictable costs.

- Value-Based Pricing: This approach focuses on the perceived value of the placement to the advertiser. The price is determined by the anticipated impact on sales, brand awareness, and engagement.

- Competitive Pricing: This involves analyzing competitor pricing for similar placements and adjusting the price accordingly. This is suitable when many comparable options exist.

- Negotiated Pricing: This strategy is often employed for high-value placements. Prices are negotiated directly with the placement provider based on various factors, including exclusivity, promotional activities, and contract length.

For instance, a premium placement in a high-traffic area of a popular website might command a higher price using value-based pricing compared to a less prominent placement using cost-plus pricing.

Q 11. How do you define target audiences for different product placements?

Defining target audiences is crucial for effective product placement. It’s about identifying the ideal consumer segment most likely to engage with the product and the placement channel. My approach involves:

- Market Research: Analyzing demographic data, psychographic profiles (lifestyle, values, interests), and purchase history to understand consumer segments.

- Channel Analysis: Identifying the characteristics of the audience reached by each placement channel (e.g., magazine readership, website visitors, TV show viewers).

- Product Attributes: Understanding the unique selling points of the product and identifying the consumer groups most likely to value these features.

- Competitive Analysis: Analyzing the target audience of competitors to identify opportunities for differentiation and unique positioning.

For example, placing a high-end luxury watch in a fashion magazine targeted at affluent professionals would be a better fit than placing it in a skateboarding magazine. The target audience needs to align with the product’s value proposition and the channel’s reach.

Q 12. Explain your understanding of channel strategy for product distribution.

Channel strategy for product distribution is critical. It’s about choosing the optimal routes to reach the target consumers. A robust channel strategy considers various factors:

- Direct Channels: These involve selling directly to customers through owned channels like an e-commerce website or company-owned stores. This offers more control but requires significant investment.

- Indirect Channels: These involve using intermediaries like retailers, wholesalers, distributors, or online marketplaces. This expands reach but reduces control over pricing and marketing.

- Multi-channel Strategy: A hybrid approach combining direct and indirect channels. This leverages the strengths of both approaches for maximum reach and flexibility.

- Omnichannel Strategy: An advanced approach that seamlessly integrates all channels to create a unified customer experience. This requires significant coordination and technological integration.

Choosing the right channel(s) depends on the product, target audience, and business goals. For example, a high-end luxury car might utilize a direct sales model with exclusive showrooms, whereas a mass-market consumer product might rely heavily on retail partnerships and online marketplaces.

Q 13. Describe a time you had to make a difficult decision regarding product placement.

I once had to decide whether to proceed with a significant product placement opportunity in a popular TV show despite concerns about potential negative brand association. The show’s plotline involved a controversial character using the product. This presented a classic risk-reward dilemma:

The Challenge: The placement offered enormous potential reach but carried the risk of negative brand perception if viewers linked the product with the character’s actions.

My Decision-Making Process: I thoroughly analyzed the show’s demographics, the character’s storyline arc, and the potential impact on our brand image. I consulted with the marketing team and senior management, presenting a detailed risk assessment.

The Outcome: We ultimately decided to proceed with the placement but implemented mitigating strategies. We focused on positive product features in other aspects of the marketing campaign, and we carefully monitored social media sentiment to quickly address any negative reactions. While there were some negative comments, the overall positive impact from the large audience exposure outweighed the risks.

This experience highlighted the importance of careful risk assessment, data-driven decision making, and proactive crisis communication in managing challenging product placement scenarios.

Q 14. How do you measure the ROI of different product placement strategies?

Measuring the ROI of product placement strategies requires a multifaceted approach that goes beyond simply looking at sales. Here’s how I approach it:

- Sales Lift: Tracking the increase in sales directly attributable to the product placement. This requires isolating the impact of the placement from other marketing activities.

- Brand Awareness: Measuring changes in brand awareness using metrics like website traffic, social media engagement, and surveys. This assesses the impact on brand visibility and recall.

- Lead Generation: Tracking the number of leads generated as a result of the placement. This is especially relevant for B2B or high-value products.

- Website Traffic and Engagement: Monitoring website traffic and engagement metrics from specific links or campaigns associated with the placement. This gives insights into consumer interest and engagement.

- Social Media Sentiment: Analyzing social media mentions and conversations about the product to assess public perception and sentiment.

I usually combine quantitative data (sales figures, website analytics) with qualitative data (customer surveys, social media sentiment) to create a holistic view of the ROI. It’s often an iterative process, refining measurement techniques based on the data gathered. For example, using unique discount codes tied to specific placements allows us to directly track sales resulting from that particular placement.

Q 15. Explain your experience with sales forecasting and its role in product placement.

Sales forecasting is crucial for effective product placement. It involves predicting future sales based on historical data, market trends, and promotional plans. Accurate forecasting allows businesses to optimize inventory levels, allocate resources effectively, and ensure products are available where and when customers need them. In my experience, I’ve used a variety of forecasting methods, including time series analysis, regression models, and qualitative techniques like expert opinions. For example, when launching a new line of organic skincare products, I used a combination of historical sales data from similar products and market research to project initial demand. This forecast informed our initial inventory levels and placement strategy, allowing us to avoid stockouts and minimize waste. This also helped us secure prime shelf space in key retail locations.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with managing product inventory levels.

Managing product inventory levels is a balancing act between meeting customer demand and minimizing storage costs and waste. My approach involves using inventory management systems (IMS) to track stock levels in real-time, setting reorder points based on sales forecasts and lead times, and analyzing inventory turnover rates to identify slow-moving or obsolete products. For instance, I worked with a company that struggled with overstocking seasonal items. By implementing a more sophisticated forecasting model and using data analytics to monitor sales trends, we were able to reduce excess inventory by 20%, freeing up storage space and reducing costs. We also implemented a system for analyzing customer purchase patterns to better predict seasonal fluctuations.

Q 17. How do you handle supply chain challenges related to product placement?

Supply chain challenges are inevitable. My strategy for handling them involves proactive risk management, building strong relationships with suppliers, and having contingency plans in place. This includes diversifying sourcing, exploring alternative transportation routes, and maintaining safety stock for critical products. For example, during a period of global shipping disruptions, I worked to secure alternative suppliers for a key component of our product. This involved thorough due diligence and negotiating favorable terms to ensure a smooth product supply. We also implemented a system to monitor potential disruptions in real-time and have pre-emptive measures in place so that minimal product disruption happens.

Q 18. What strategies do you use to improve product discoverability?

Improving product discoverability requires a multi-faceted approach. This includes optimizing product listings for search engines (SEO), using compelling product descriptions and imagery, leveraging social media marketing, and strategically placing products within retail environments. For example, I helped a client improve online product discoverability by optimizing their product titles, descriptions, and tags with relevant keywords. We also implemented a targeted social media campaign to reach their ideal customer base. In physical stores, we focused on endcap placement and eye-level displays to maximize visibility. This holistic approach resulted in a significant increase in sales.

Q 19. Explain your experience with different distribution channels (online vs. offline).

My experience spans both online and offline distribution channels. Online channels, such as e-commerce platforms and company websites, offer wide reach and detailed analytics. Offline channels, such as brick-and-mortar stores and wholesale partnerships, provide opportunities for direct customer engagement and brand building. A successful strategy often incorporates both. For example, I worked with a brand that primarily sold online but wanted to expand to physical retail. We carefully selected retail partners whose customer base aligned with the brand’s target market and negotiated optimal placement within their stores. We also created an omnichannel strategy that integrated online and offline experiences to create a seamless customer journey.

Q 20. How do you evaluate the effectiveness of different promotional strategies for product placement?

Evaluating the effectiveness of promotional strategies involves tracking key metrics such as sales lift, website traffic, brand awareness, and customer engagement. I use A/B testing to compare different promotional approaches, and I analyze sales data to measure return on investment (ROI). For example, when evaluating a recent in-store promotion, I tracked sales during the promotional period and compared them to sales in a similar period before the promotion. I also analyzed customer feedback and website traffic data to assess the overall effectiveness. Based on this analysis, we refined our future promotional campaigns to better reach customers and create more impactful results.

Q 21. Describe your experience with using data analytics to improve product placement.

Data analytics plays a critical role in optimizing product placement. I utilize data from various sources, including sales data, customer purchase history, website analytics, and market research, to identify trends, predict demand, and personalize product recommendations. Tools like Google Analytics, and various CRM softwares provide valuable insights that we can use to make data-driven decisions. For example, using customer purchase history, we identified cross-selling opportunities and strategically placed complementary products together, leading to a significant increase in average order value. Through such data driven decisions we improved product placement across our various channels.

Q 22. Explain your understanding of different customer segmentation techniques.

Customer segmentation is the practice of dividing a broad consumer or business market into sub-groups of consumers based on some type of shared characteristics. This allows businesses to tailor their marketing efforts and product placement strategies for maximum impact. Effective segmentation helps maximize ROI by focusing resources on the most promising customer groups.

- Demographic Segmentation: This classic approach uses easily measurable characteristics like age, gender, income, education, family size, occupation, and ethnicity. For example, a high-end jewelry brand might target affluent, older demographics.

- Geographic Segmentation: This focuses on location—country, region, city, climate, etc. A ski resort would naturally target geographic areas with high snowfall and winter tourism.

- Psychographic Segmentation: This dives deeper into customers’ lifestyles, values, interests, attitudes, and personalities. A company selling eco-friendly products would target consumers with strong environmental values.

- Behavioral Segmentation: This looks at customer actions, such as purchase history, brand loyalty, usage rate, and response to marketing campaigns. A coffee shop might offer loyalty programs to reward frequent customers.

- Needs-Based Segmentation: This focuses on the specific needs and problems a product solves for different customer groups. A software company might segment based on whether customers need project management, collaboration, or communication tools.

Combining multiple segmentation methods (e.g., demographic and behavioral) often yields the most accurate and insightful customer profiles, leading to highly targeted product placement and marketing.

Q 23. How do you adapt your product knowledge and placement strategy to different cultural contexts?

Adapting product knowledge and placement to different cultural contexts is crucial for successful global marketing. Ignoring cultural nuances can lead to misinterpretations and even offense, resulting in failed product launches. Consider these factors:

- Language: Translations must be accurate and culturally appropriate. Direct translations might not capture the intended meaning or tone.

- Symbols and Colors: Certain colors or symbols can have different meanings in different cultures. What’s auspicious in one culture might be unlucky in another.

- Values and Beliefs: Product messaging should resonate with the target culture’s values and avoid clashing with religious or social norms.

- Customs and Traditions: Consider how product placement aligns with local customs and traditions regarding gift-giving, social events, or family structures.

- Consumer Behavior: Research how people in the target culture shop, make purchase decisions, and use similar products.

For example, a product launch in a collectivist culture (like Japan) might emphasize community and social harmony in its messaging, while a launch in an individualistic culture (like the US) could highlight personal benefits and self-expression. Thorough market research and cultural sensitivity are essential for successful global product placement.

Q 24. Describe your experience working with cross-functional teams on product placement projects.

My experience working with cross-functional teams on product placement projects has been extensive. Successful product placement requires collaboration across various departments, including marketing, sales, product development, and even legal and operations. I excel at fostering open communication, facilitating collaborative brainstorming sessions, and ensuring all stakeholders have a clear understanding of project goals and timelines.

In a recent project, we placed a new line of sustainable home goods in a major retailer. This involved working with the marketing team to develop compelling in-store displays, collaborating with sales to negotiate placement and shelf space, and coordinating with operations to ensure timely delivery and inventory management. Regular meetings, shared project documentation, and a clear communication plan were key to success. We achieved excellent placement and exceeded sales targets.

Q 25. How do you handle conflicts between different stakeholders regarding product placement?

Conflicts between stakeholders are inevitable in product placement projects. I approach these conflicts by:

- Active Listening: Understanding each stakeholder’s perspective and concerns is paramount.

- Data-Driven Decision Making: Using market research, sales data, and competitor analysis to support decisions.

- Facilitation and Mediation: Creating a safe space for open dialogue and helping stakeholders find common ground.

- Compromise and Negotiation: Finding solutions that satisfy the majority of stakeholders’ needs while minimizing negative impacts.

- Escalation Protocol: Knowing when to escalate unresolved issues to senior management for resolution.

For example, a disagreement between the marketing team (favoring high-visibility endcaps) and the sales team (preferring optimal shelf space for maximum sales) was resolved by conducting A/B testing to determine which placement strategy yielded better results. This data-driven approach provided evidence to support a decision and minimized conflict.

Q 26. Explain your understanding of the competitive landscape and its impact on product placement.

The competitive landscape significantly impacts product placement strategy. A thorough understanding of competitors’ products, pricing, placement strategies, and marketing campaigns is critical. This involves:

- Competitive Analysis: Identifying key competitors, analyzing their strengths and weaknesses, and understanding their target markets.

- Market Share Assessment: Determining the market share of each competitor and identifying opportunities for growth.

- Pricing Strategies: Analyzing competitors’ pricing models and determining the optimal price point for the product.

- Placement Analysis: Studying competitors’ product placement in retail stores and online channels.

- Differentiation: Identifying what makes the product unique and superior to competitors’ offerings.

For instance, if a competitor dominates shelf space in a particular retail location, our strategy might involve focusing on alternative distribution channels or creating a more compelling in-store display to attract attention.

Q 27. How do you communicate product information effectively to different audiences?

Effective communication of product information requires tailoring the message to the specific audience. This involves:

- Understanding the Audience: Identifying the needs, interests, and knowledge level of the target audience.

- Choosing the Right Channels: Selecting appropriate communication channels (e.g., social media, websites, in-store displays, print advertising) based on audience preferences.

- Clear and Concise Messaging: Using simple language, avoiding jargon, and highlighting key benefits.

- Visual Aids: Using images, videos, and infographics to enhance communication.

- Storytelling: Creating engaging narratives that connect with the audience on an emotional level.

For example, when communicating with technical experts, we’d use detailed specifications and technical jargon. However, when communicating with the general public, we’d focus on the benefits and ease of use of the product.

Q 28. How do you ensure product quality and consistency across different distribution channels?

Maintaining product quality and consistency across different distribution channels requires careful planning and execution. This involves:

- Quality Control Measures: Implementing rigorous quality control procedures at each stage of the production and distribution process.

- Supplier Management: Selecting reliable suppliers who meet quality standards.

- Inventory Management: Using efficient inventory management systems to track product movement and prevent spoilage or damage.

- Packaging and Handling: Using appropriate packaging and handling procedures to protect products during shipping and storage.

- Regular Audits: Conducting regular audits of distribution channels to ensure compliance with quality standards.

We might use barcode scanning and RFID tracking to monitor product movement across the supply chain, ensuring traceability and allowing for prompt identification and resolution of any quality issues.

Key Topics to Learn for Product Knowledge and Placement Interview

Mastering these areas will significantly boost your interview confidence and showcase your expertise.

- Understanding Product Lifecycle: From ideation to market launch and beyond. Consider the various stages and your role within each.

- Market Analysis & Competitive Landscape: Analyze market trends, identify key competitors, and understand your product’s unique selling proposition (USP).

- Product Positioning & Messaging: Define your target audience and craft compelling messaging that resonates with their needs and desires.

- Sales & Distribution Strategies: Explore different sales channels, distribution models, and their impact on product success.

- Pricing Strategies & Revenue Models: Understand various pricing models and how they contribute to profitability. Consider cost analysis and pricing optimization.

- Data Analysis & Performance Measurement: Learn to interpret key performance indicators (KPIs) to assess product performance and identify areas for improvement. Think about using data to drive decision-making.

- Problem-Solving & Case Studies: Practice applying your product knowledge to solve hypothetical challenges and analyze real-world case studies. Focus on structured problem-solving methodologies.

- Placement Strategies & Go-to-Market Planning: Develop a deep understanding of how products are strategically launched and positioned in the market.

Next Steps

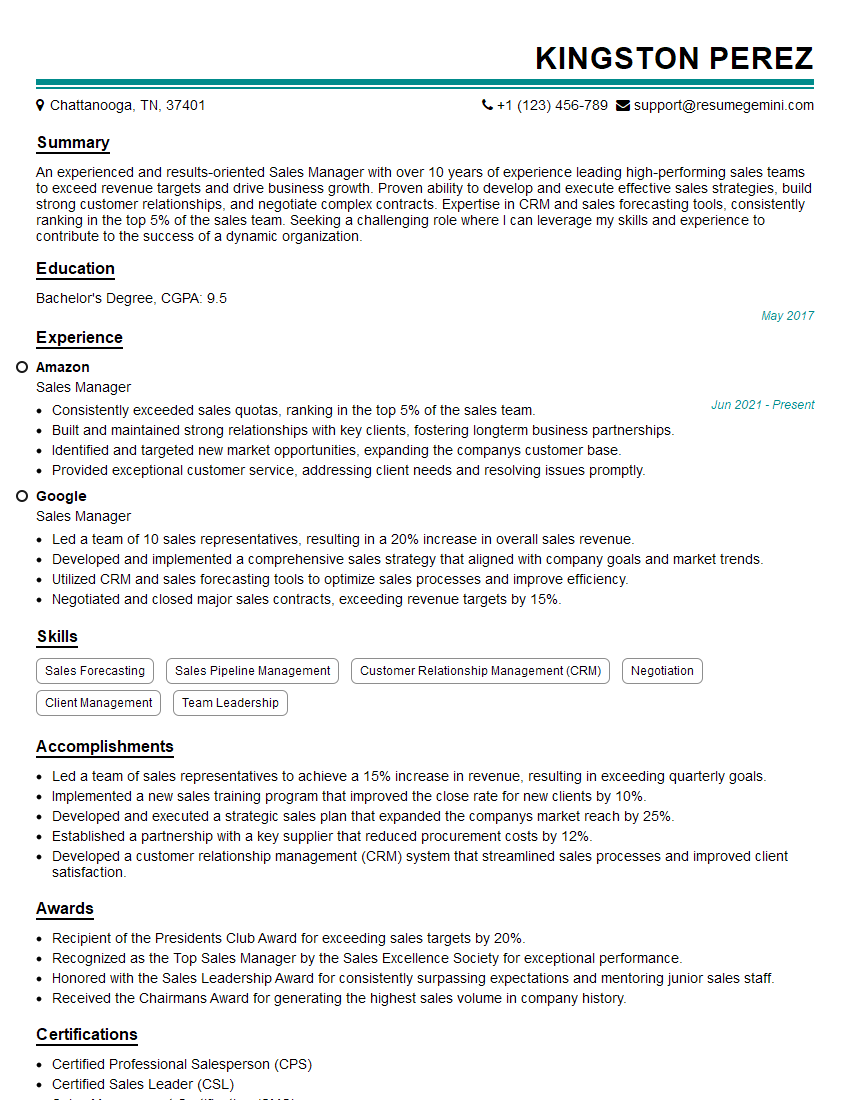

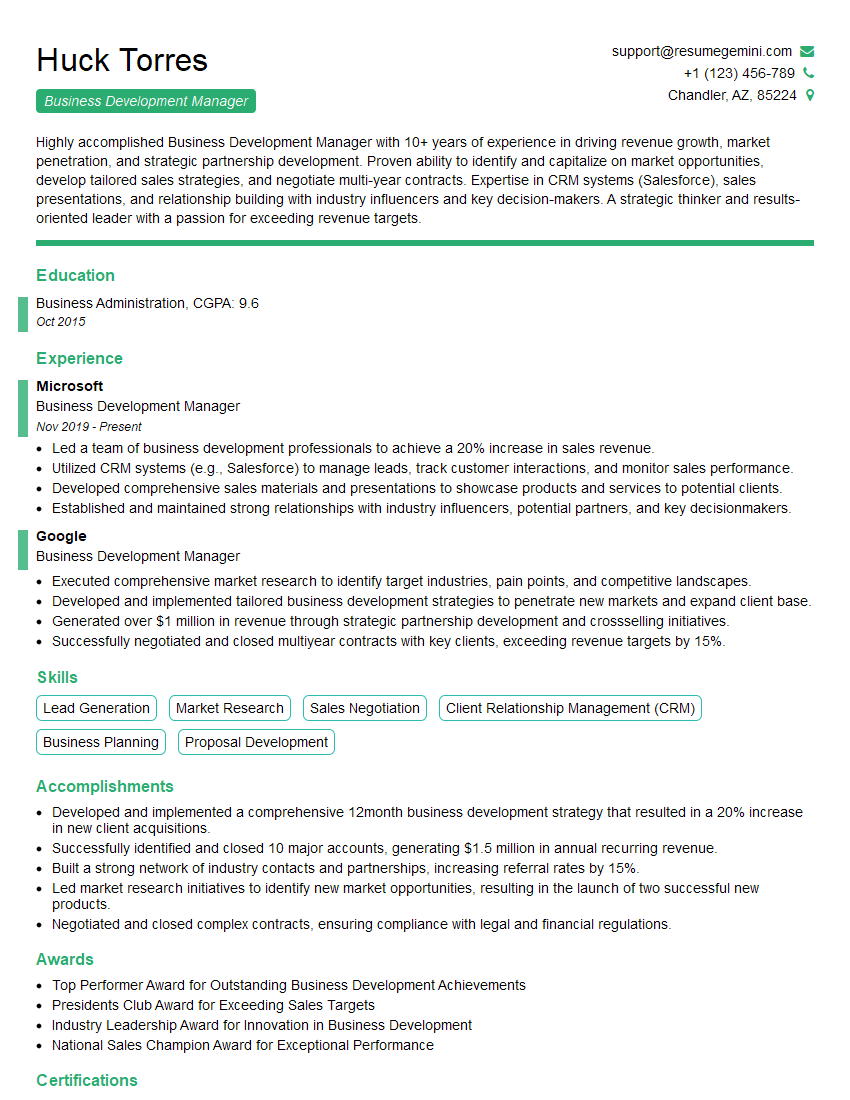

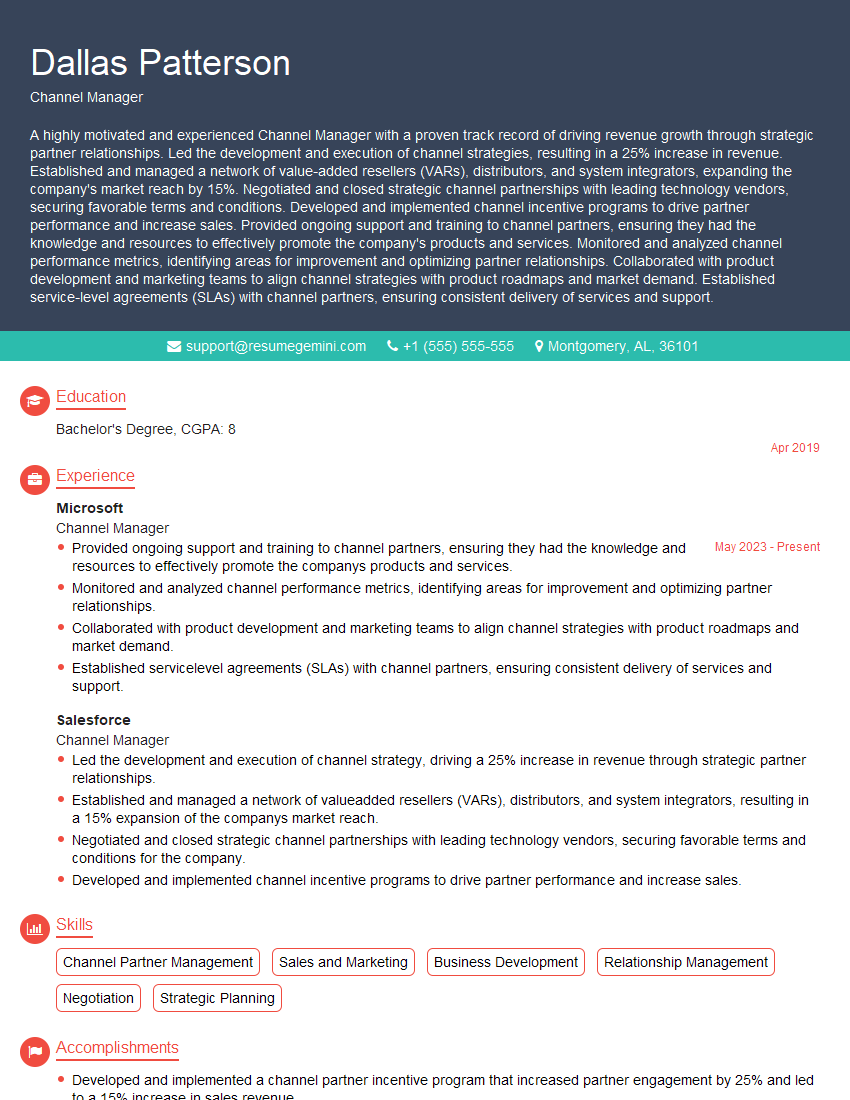

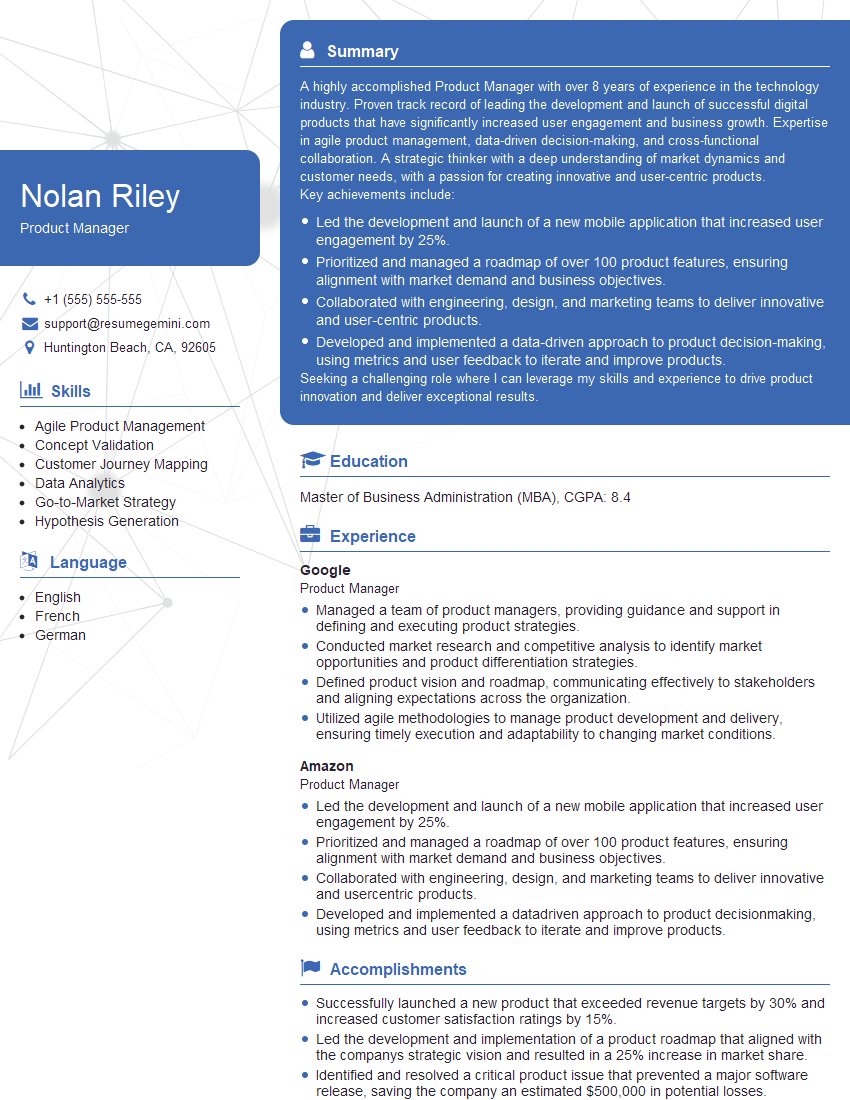

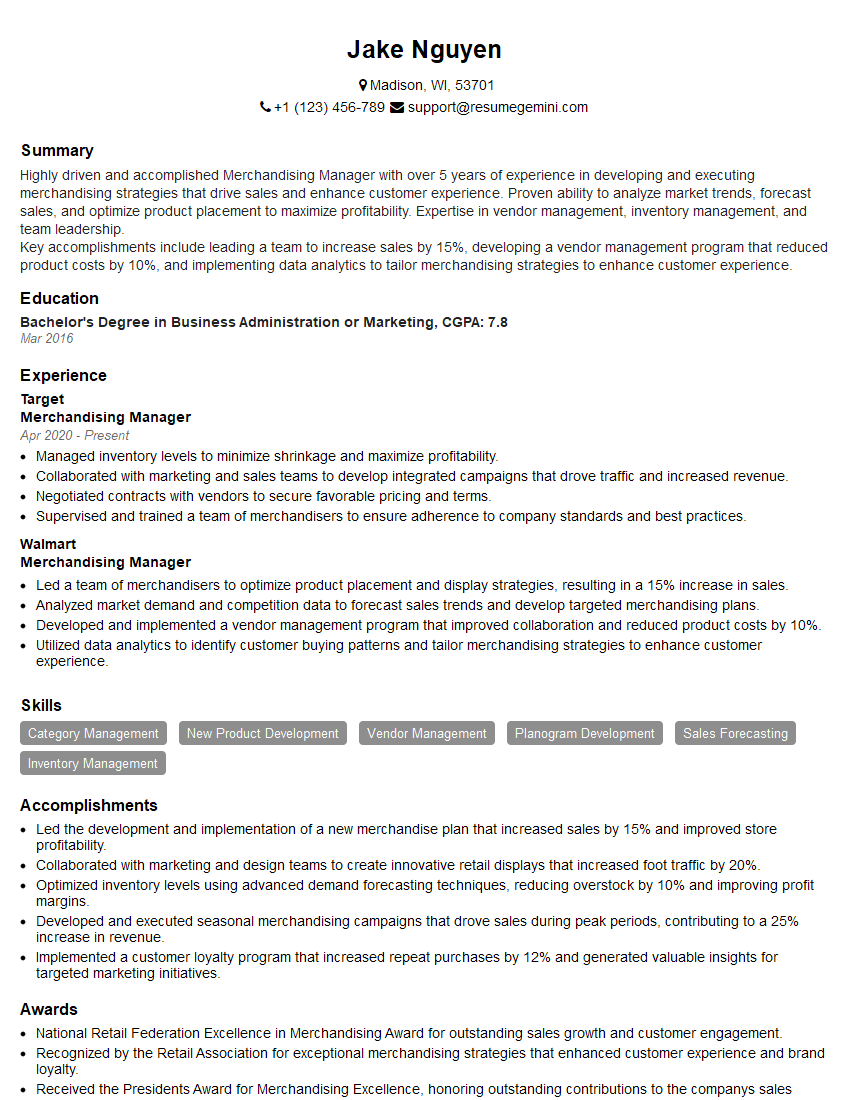

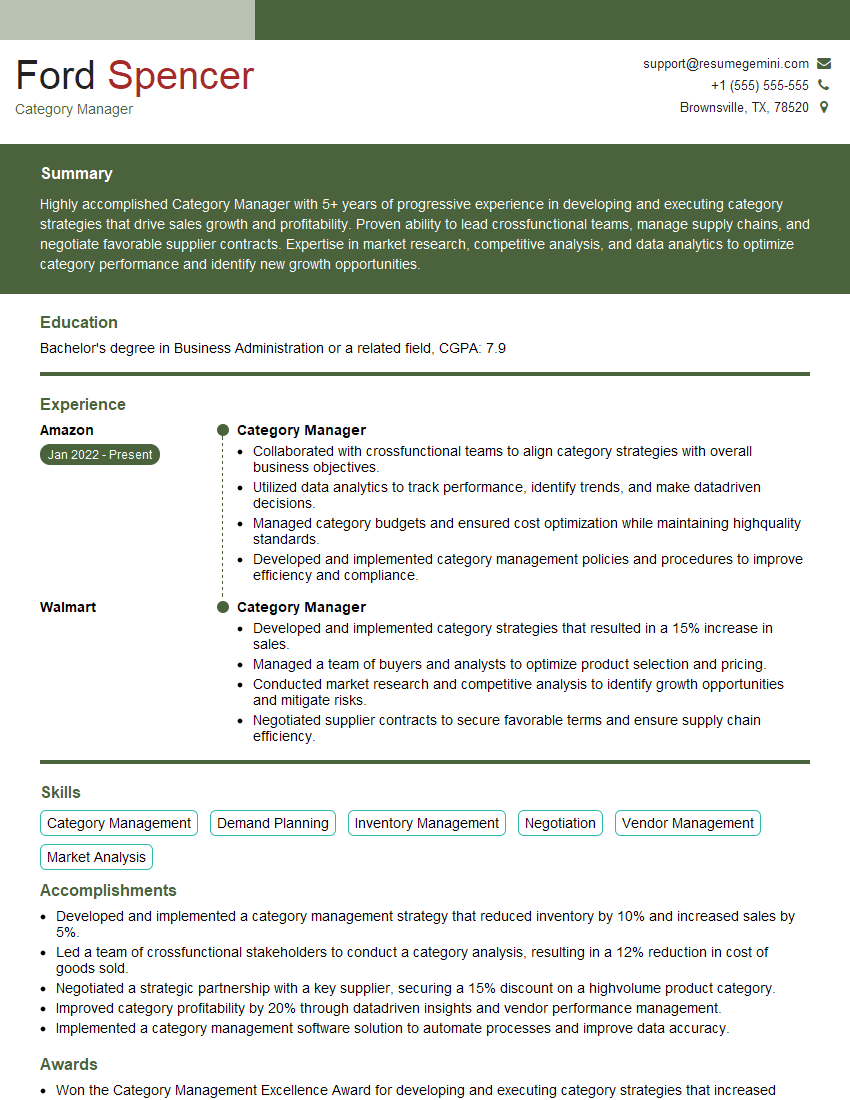

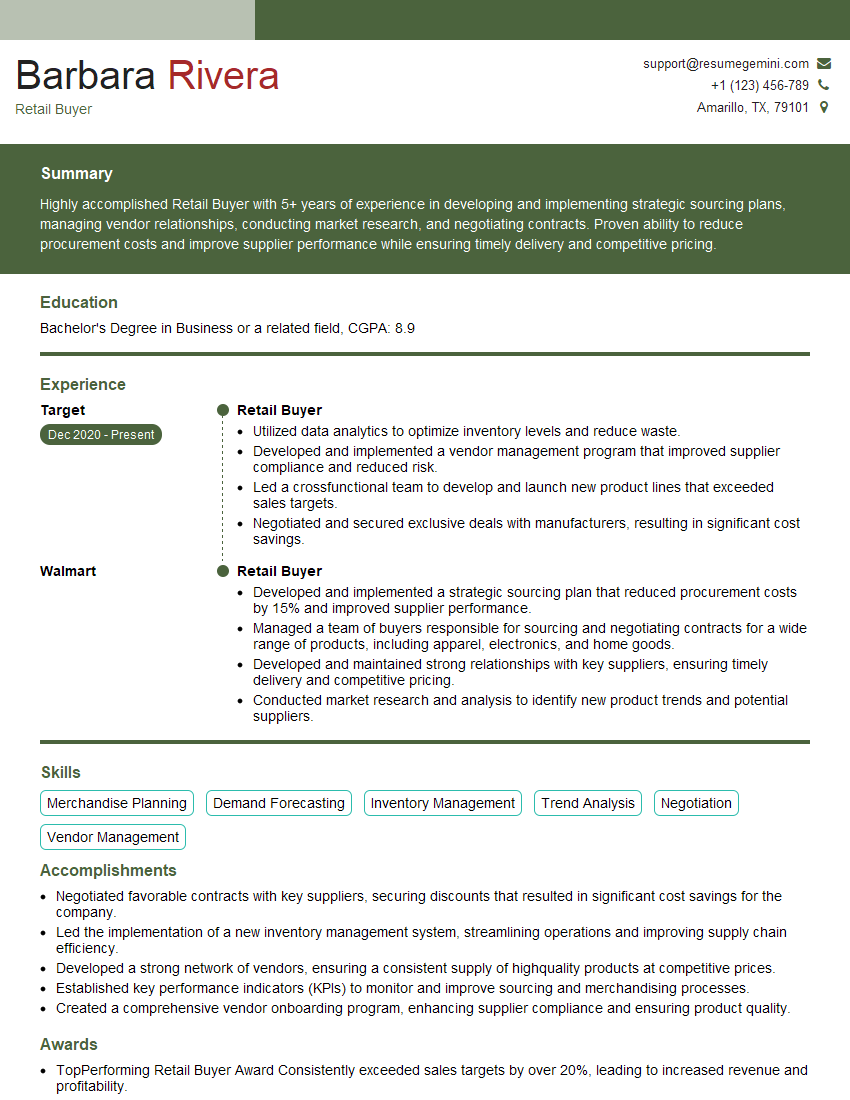

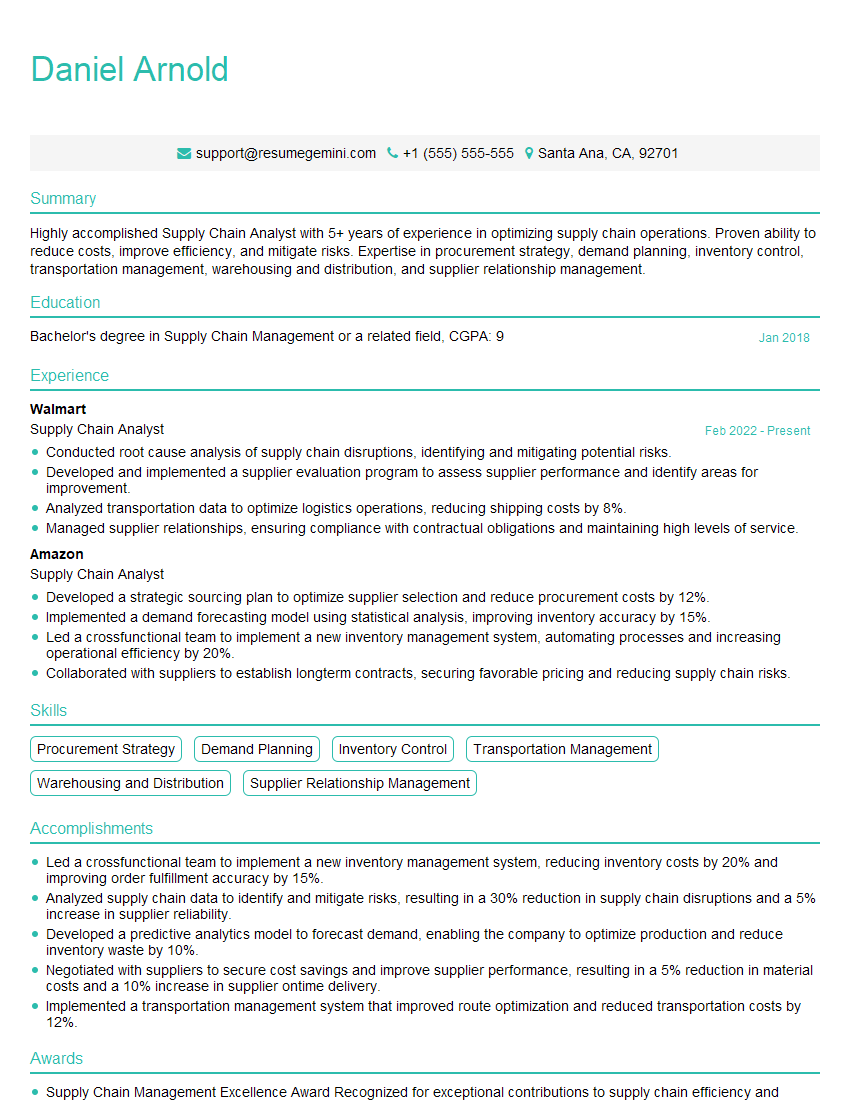

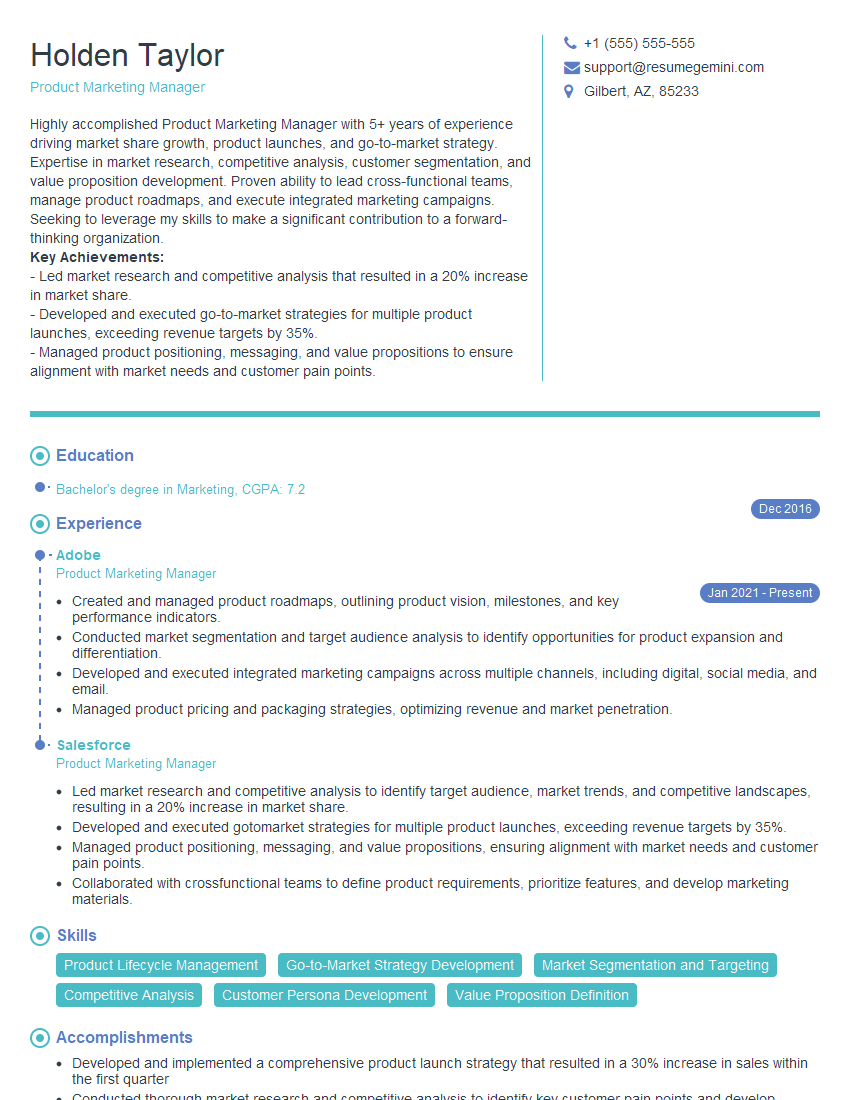

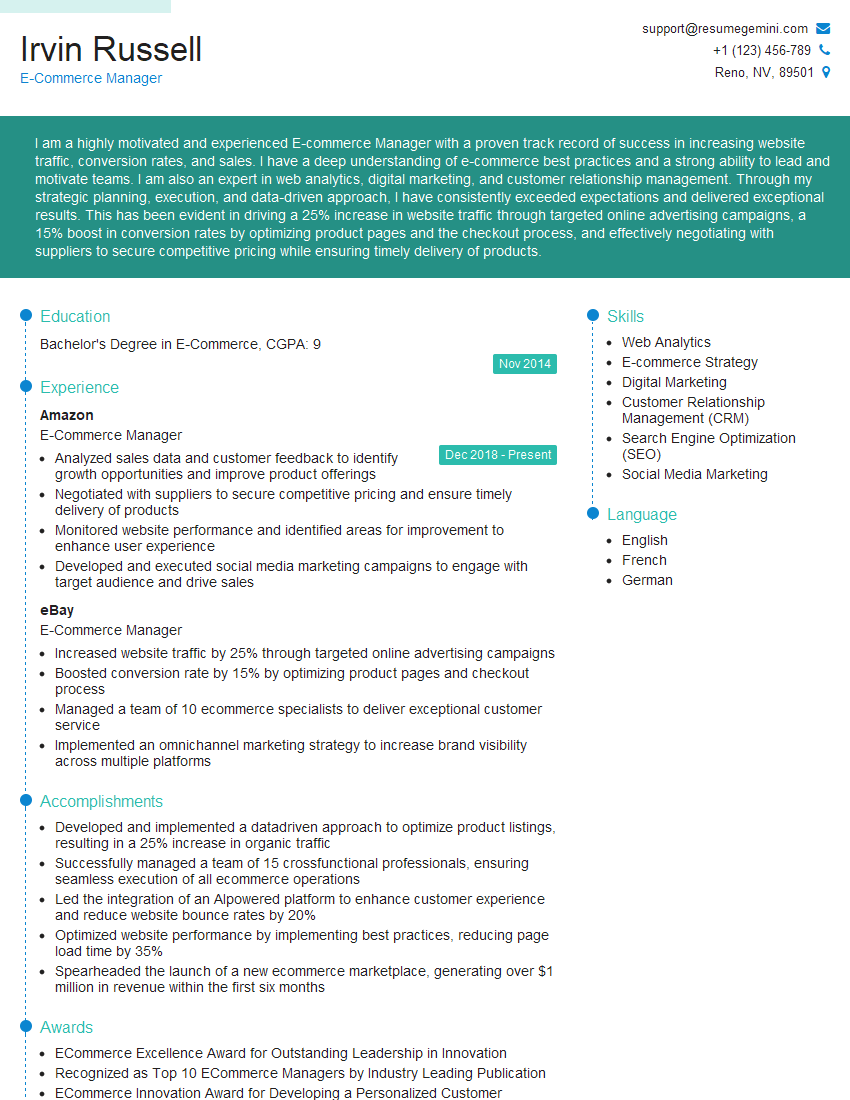

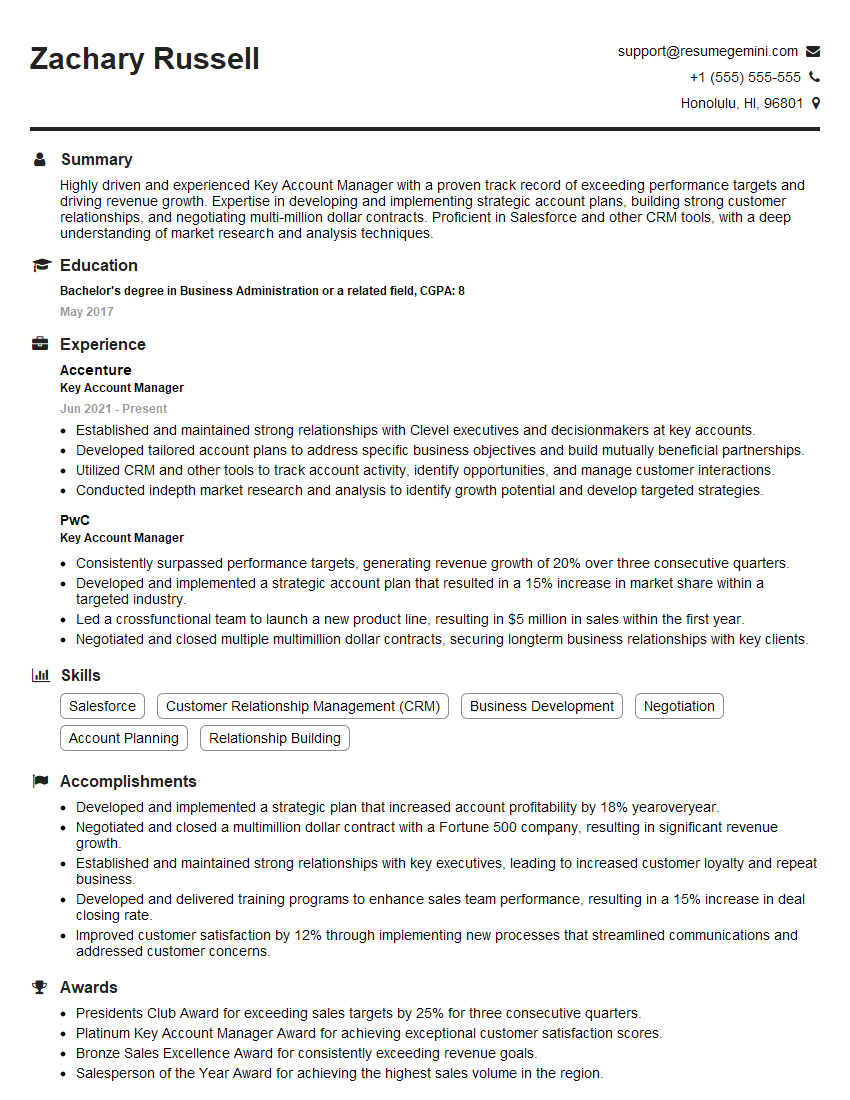

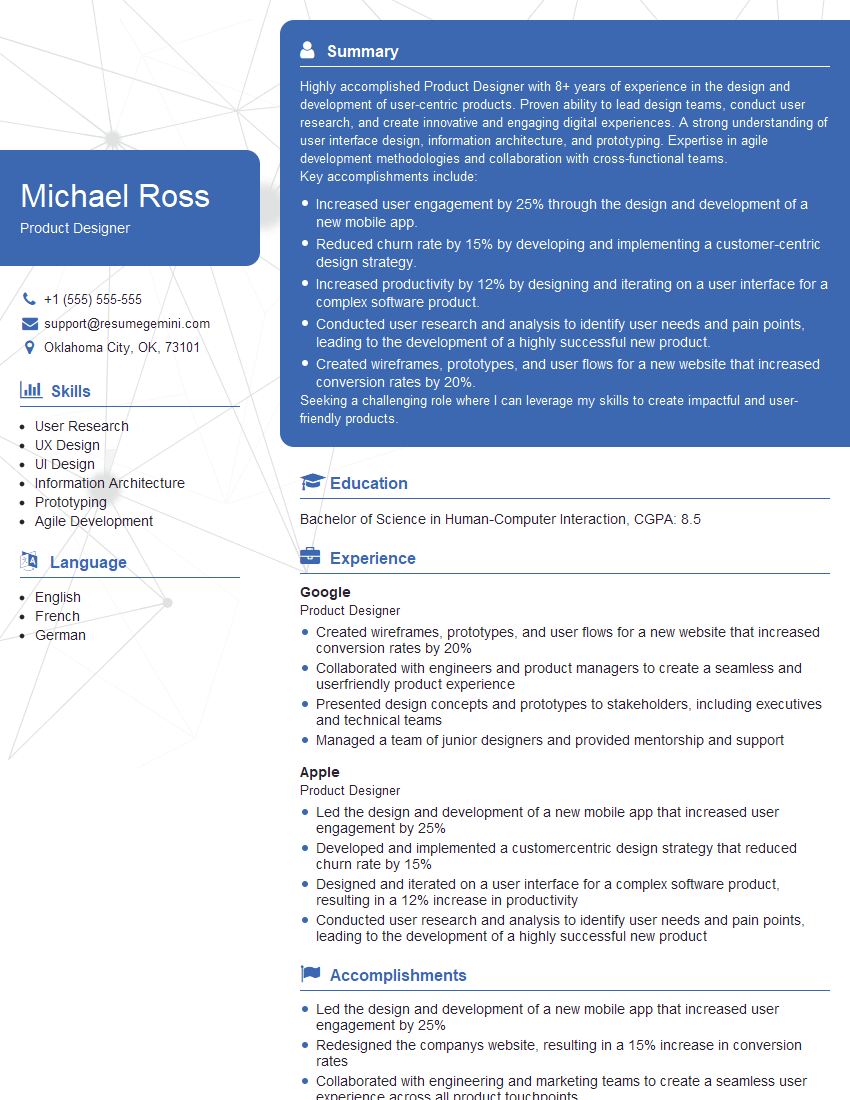

Proficiency in Product Knowledge and Placement is crucial for career advancement, opening doors to exciting opportunities and higher earning potential. A strong resume is your first impression – make it count! Crafting an ATS-friendly resume significantly increases your chances of landing an interview. ResumeGemini is a trusted resource to help you build a professional and effective resume tailored to your skills and experience.

We provide examples of resumes specifically designed for Product Knowledge and Placement roles to guide you. Use these examples as inspiration and tailor them to your unique accomplishments and career goals. Invest the time to build a compelling resume – it’s an investment in your future.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

we currently offer a complimentary backlink and URL indexing test for search engine optimization professionals.

You can get complimentary indexing credits to test how link discovery works in practice.

No credit card is required and there is no recurring fee.

You can find details here:

https://wikipedia-backlinks.com/indexing/

Regards

NICE RESPONSE TO Q & A

hi

The aim of this message is regarding an unclaimed deposit of a deceased nationale that bears the same name as you. You are not relate to him as there are millions of people answering the names across around the world. But i will use my position to influence the release of the deposit to you for our mutual benefit.

Respond for full details and how to claim the deposit. This is 100% risk free. Send hello to my email id: [email protected]

Luka Chachibaialuka

Hey interviewgemini.com, just wanted to follow up on my last email.

We just launched Call the Monster, an parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

We’re also running a giveaway for everyone who downloads the app. Since it’s brand new, there aren’t many users yet, which means you’ve got a much better chance of winning some great prizes.

You can check it out here: https://bit.ly/callamonsterapp

Or follow us on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call the Monster App

Hey interviewgemini.com, I saw your website and love your approach.

I just want this to look like spam email, but want to share something important to you. We just launched Call the Monster, a parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

Parents are loving it for calming chaos before bedtime. Thought you might want to try it: https://bit.ly/callamonsterapp or just follow our fun monster lore on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call A Monster APP

To the interviewgemini.com Owner.

Dear interviewgemini.com Webmaster!

Hi interviewgemini.com Webmaster!

Dear interviewgemini.com Webmaster!

excellent

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good