Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Real Estate Knowledge interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Real Estate Knowledge Interview

Q 1. Explain the difference between a fee simple and a life estate.

The core difference between a fee simple and a life estate lies in the duration of ownership. A fee simple represents the most complete form of ownership. It grants the owner full rights to the property, including the right to possess, use, enjoy, and dispose of it (sell, lease, or will it) indefinitely. It’s essentially outright ownership, passing down to heirs upon the owner’s death.

In contrast, a life estate grants ownership only for the duration of a specific person’s life – the ‘life tenant’. Once that person dies, ownership reverts to the original grantor (the person who created the life estate) or a designated remainderman. The life tenant has the right to use and enjoy the property but cannot sell it or leave it in their will. Think of it as a temporary ownership.

Example: Imagine Grandma gifting her house to her daughter with a life estate. The daughter can live in the house and receive its benefits for her lifetime. However, she cannot sell it. Upon the daughter’s death, the property reverts to Grandma’s estate or a designated heir (remainderman).

Q 2. Describe the process of a real estate closing.

A real estate closing is the final stage of a real estate transaction where all parties complete their obligations and transfer ownership of the property. It’s a complex process involving numerous steps and documents. Here’s a breakdown:

- Pre-Closing Activities: This includes securing financing (mortgage), conducting a final walk-through inspection, reviewing and signing all necessary documents (loan documents, deed, closing disclosure, etc.).

- The Closing Meeting: All parties involved (buyer, seller, real estate agents, lender, title company representative) meet to finalize the transaction. Documents are signed, funds are exchanged (buyer pays seller), and the title is transferred.

- Title Transfer: The title company ensures clear ownership of the property. This involves searching the public records to verify no encumbrances (liens, easements). A deed is prepared and recorded with the relevant authorities, officially transferring ownership.

- Funds Disbursement: The buyer’s funds (down payment, loan proceeds) are disbursed to the seller, after deductions for closing costs, taxes, and mortgage payments. The seller pays off any existing mortgages or liens on the property.

- Post-Closing Activities: This involves recording the deed and other relevant documents, paying property taxes, and notifying relevant parties of the transaction’s completion.

The entire process requires meticulous attention to detail, and working with experienced real estate professionals ensures a smooth transaction.

Q 3. What are the key factors influencing property values?

Property values are influenced by a complex interplay of factors that can be broadly categorized as:

- Location: This is arguably the most significant factor. Proximity to amenities (schools, parks, shopping centers), transportation, employment opportunities, and overall neighborhood desirability heavily impact value. A prime location commands higher prices.

- Property Features: Size, layout, number of bedrooms and bathrooms, condition, architectural style, and included amenities (pool, garage) all influence value. Well-maintained properties with desirable features fetch higher prices.

- Market Conditions: Overall supply and demand in the market play a crucial role. A seller’s market (high demand, low supply) increases prices, while a buyer’s market (low demand, high supply) depresses prices.

- Economic Conditions: Interest rates, inflation, economic growth, and unemployment rates directly affect buyer purchasing power and lender lending practices, impacting property values.

- External Factors: These include local government regulations, zoning laws, the quality of local infrastructure, and even recent events like natural disasters, which can all influence property values positively or negatively.

A professional appraisal considers all these factors to provide an objective assessment of a property’s market value.

Q 4. How do you analyze a property’s financial viability?

Analyzing a property’s financial viability involves a thorough assessment of its potential profitability. This often entails these steps:

- Estimate potential rental income: Research comparable rental properties in the area to determine a realistic rental rate.

- Calculate operating expenses: This includes property taxes, insurance, maintenance, utilities (if applicable), and property management fees.

- Determine net operating income (NOI): Subtract operating expenses from rental income. This gives you the property’s profit before debt service.

- Assess financing costs: Calculate the monthly mortgage payments (principal and interest), as well as any associated loan fees.

- Calculate cash flow: Subtract total debt service from NOI. Positive cash flow indicates the property is generating profit.

- Analyze capitalization rate (Cap Rate): This metric helps evaluate the return on investment (ROI). It’s calculated by dividing NOI by the property’s purchase price. A higher Cap Rate generally indicates a better investment.

- Consider appreciation potential: Estimate the potential increase in property value over time. This adds to the long-term ROI.

By carefully considering these factors, investors can make informed decisions about a property’s financial viability.

Q 5. What are the different types of mortgages available?

Several mortgage types cater to different borrower needs and circumstances:

- Conventional Mortgages: These are not insured or guaranteed by the government and typically require a larger down payment (often 20%) and a higher credit score.

- FHA Loans: Insured by the Federal Housing Administration, these loans allow for lower down payments and more lenient credit requirements, making homeownership more accessible.

- VA Loans: Backed by the Department of Veterans Affairs, these loans offer favorable terms to eligible veterans and military personnel, often with no down payment required.

- USDA Loans: Guaranteed by the U.S. Department of Agriculture, these loans are designed for rural homebuyers and often feature low down payments and interest rates.

- Adjustable-Rate Mortgages (ARMs): These mortgages have interest rates that adjust periodically based on market conditions. They can offer lower initial rates but carry greater risk due to potential rate increases.

- Fixed-Rate Mortgages: These mortgages have a fixed interest rate for the entire loan term, providing stability and predictability.

The best mortgage type depends on the individual borrower’s financial situation, credit history, and risk tolerance.

Q 6. Explain the concept of leverage in real estate investing.

Leverage in real estate investing refers to using borrowed funds (debt) to magnify returns. By using a mortgage or other forms of financing, investors can acquire larger or more expensive properties than they could afford with cash alone. This amplifies both potential profits and potential losses.

Example: Imagine you have $100,000 and want to buy a $500,000 property. Using leverage (a mortgage), you can borrow $400,000. If the property appreciates by 10%, that’s a $50,000 increase. On your $100,000 investment, that’s a 50% return. Without leverage, the return would have been much lower.

However, leverage also increases risk. If property values decline, losses are magnified proportionally.

Q 7. How do you identify and mitigate risks in real estate transactions?

Identifying and mitigating risks in real estate transactions requires a proactive and thorough approach:

- Due Diligence: Conduct comprehensive research on the property, including title searches, property inspections, environmental assessments, and neighborhood analysis. This helps uncover potential problems early on.

- Negotiation: Carefully negotiate the purchase contract, including contingencies (financing, inspection, appraisal) to protect your interests.

- Risk Assessment: Evaluate potential risks (market fluctuations, legal issues, environmental hazards, etc.) and develop strategies to mitigate them.

- Legal Counsel: Consult with experienced real estate attorneys to ensure all legal aspects of the transaction are handled correctly.

- Insurance: Obtain adequate insurance coverage (title insurance, property insurance) to protect against unforeseen events.

- Professional Expertise: Work with experienced real estate professionals (agents, inspectors, appraisers) who can provide valuable insights and guidance.

- Diversification: Avoid putting all your eggs in one basket. Diversify your real estate investments across different properties and locations to reduce risk.

By employing these strategies, you can significantly reduce the likelihood of encountering significant problems in real estate transactions.

Q 8. What are the common legal issues encountered in real estate?

Common legal issues in real estate are multifaceted and can significantly impact transactions. They often revolve around contract law, property rights, and regulatory compliance.

- Contract Disputes: Breaches of purchase agreements, disputes over contingencies (financing, inspections), and disagreements on closing costs are frequent. For example, a buyer might back out after the inspection reveals unforeseen problems, leading to a legal battle over deposit forfeiture.

- Title Issues: Problems with ownership, liens (unpaid debts attached to the property), easements (rights of way granted to others), and encroachments (structures extending onto neighboring land) can delay or derail closings. Imagine discovering an unrecorded easement during the title search, potentially affecting the property’s usability.

- Zoning and Building Code Violations: Properties that don’t comply with local regulations can face legal challenges. This could involve issues with permitted use, setbacks (minimum distances from property lines), or building safety standards. A homeowner might be forced to make costly renovations to bring their property into compliance.

- Real Estate Agent Disputes: Conflicts can arise between buyers, sellers, and real estate agents regarding commission, disclosure of material facts, or agency representation. A misunderstanding about dual agency (representing both buyer and seller) can create serious ethical and legal ramifications.

- Property Tax Assessments: Disputes over the valuation of a property for tax purposes are common. Property owners can challenge assessments they believe are too high.

Understanding these potential issues requires a thorough review of all relevant documents and, often, the assistance of legal counsel.

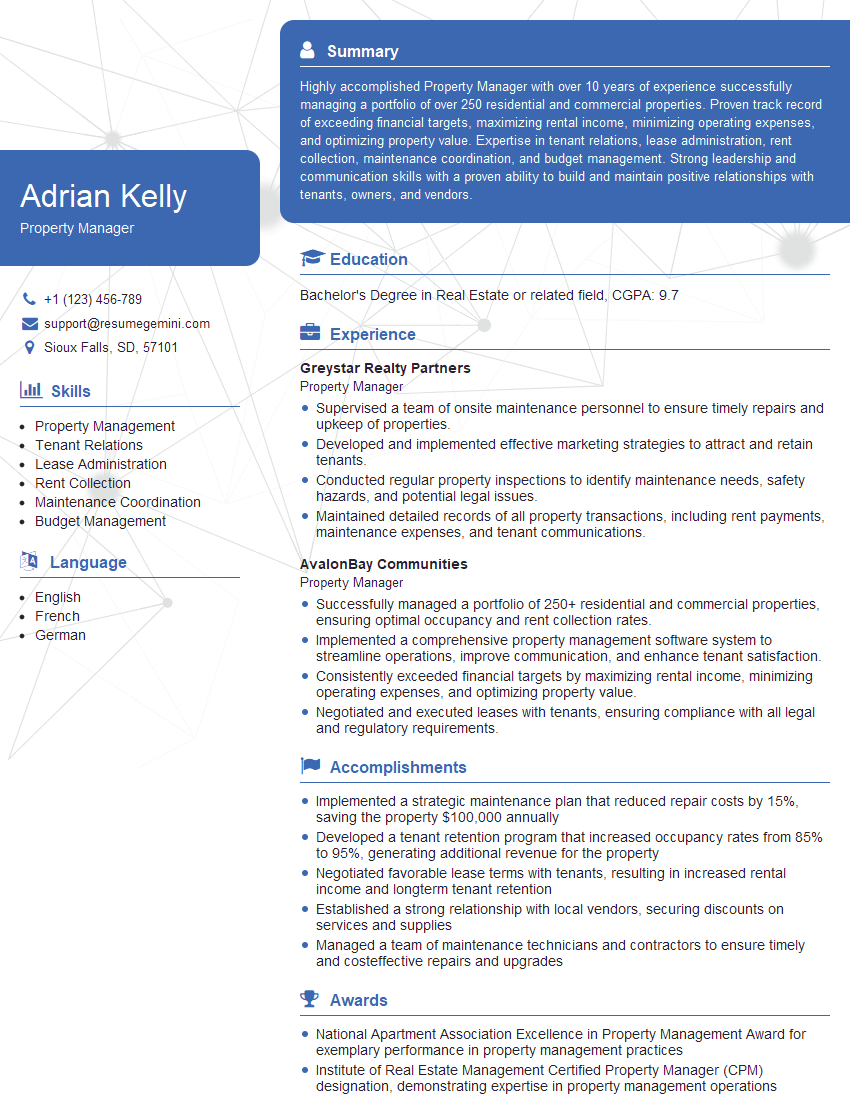

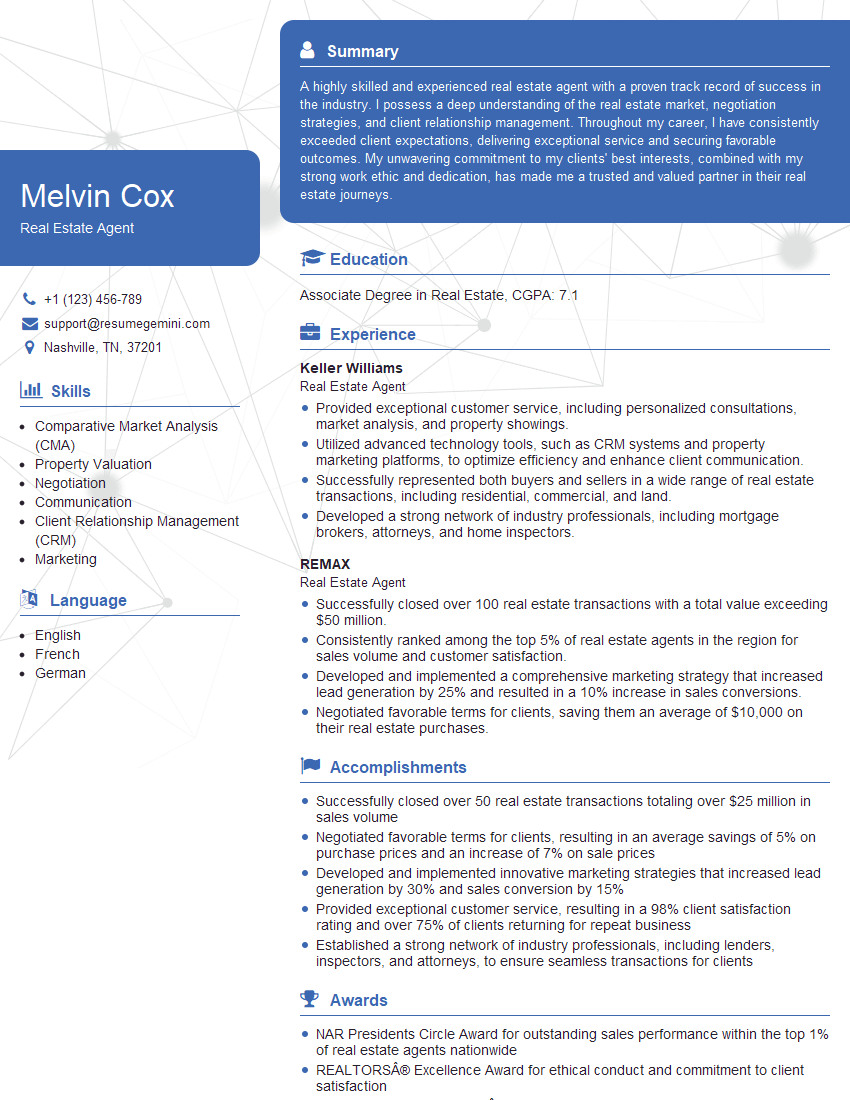

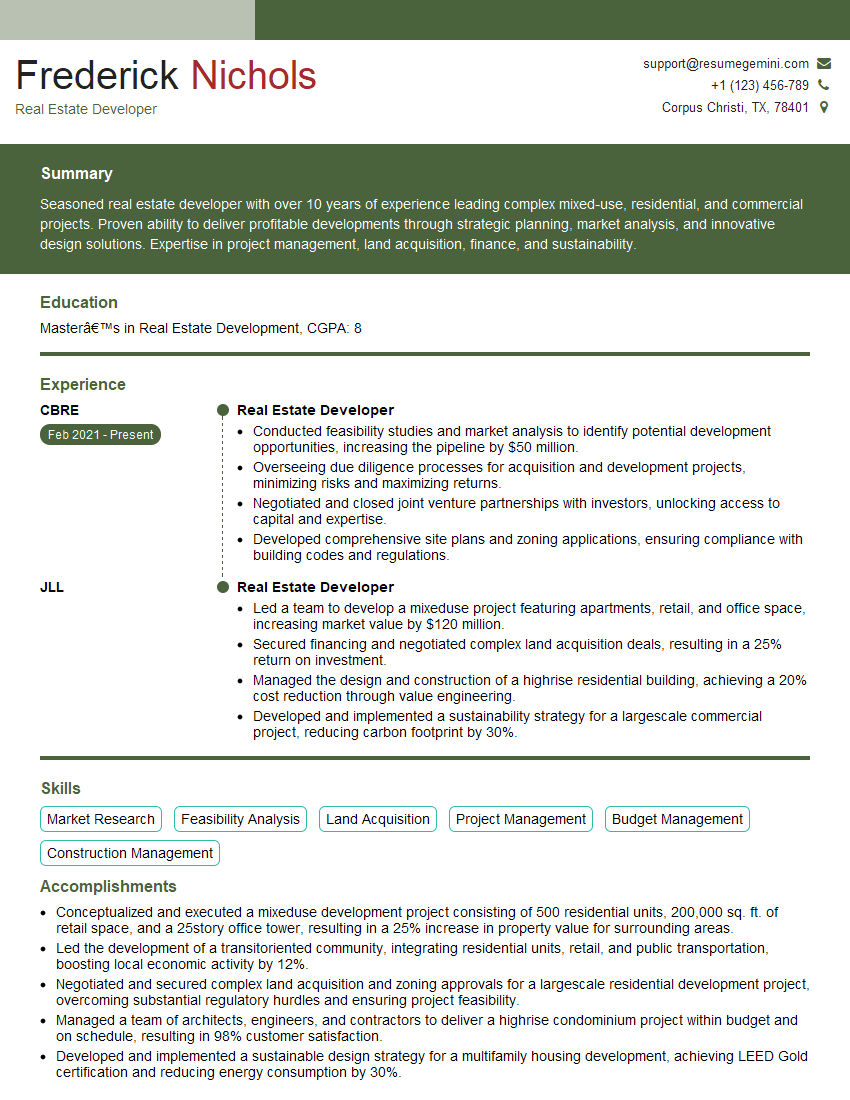

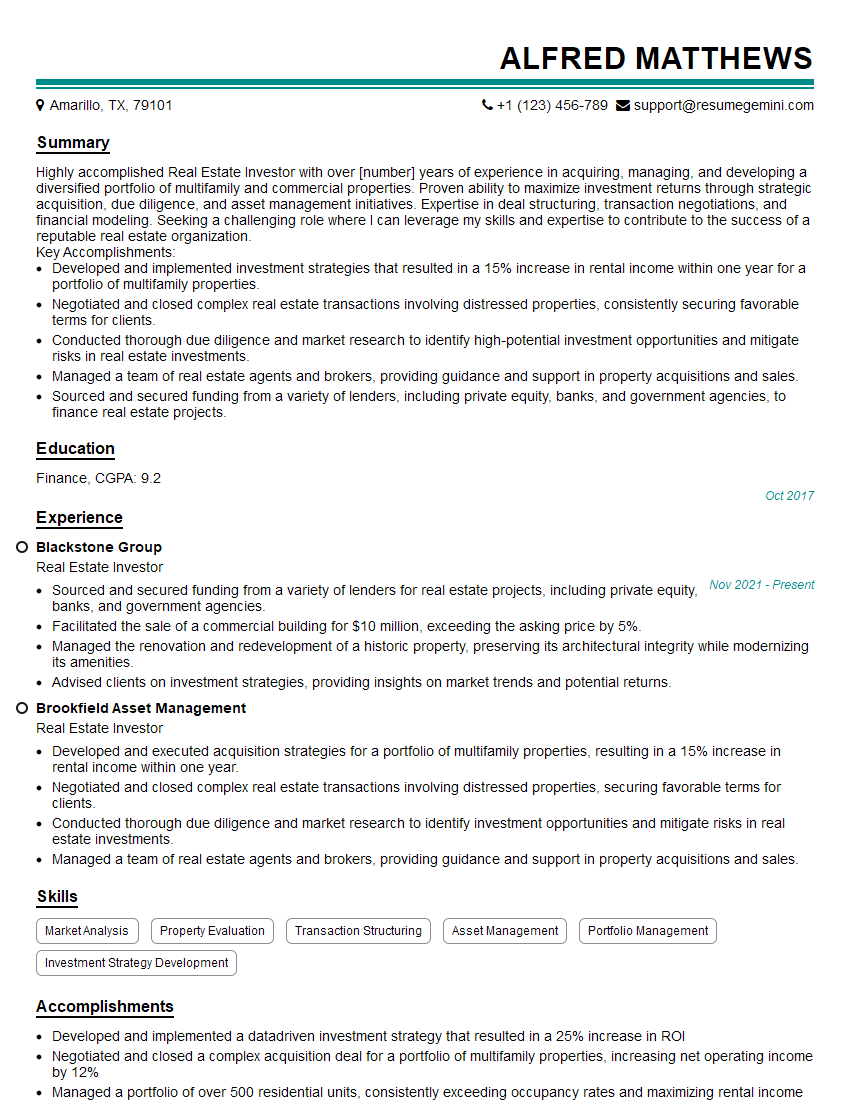

Q 9. Describe your experience with property management.

My experience in property management spans over eight years, encompassing a diverse portfolio of residential and commercial properties. I’ve overseen all aspects, from tenant acquisition and lease administration to maintenance, repairs, and rent collection.

In my previous role at Acme Property Management, I managed a portfolio of 150 units. My responsibilities included developing and implementing effective marketing strategies to attract high-quality tenants, conducting thorough tenant screenings to mitigate risk, and consistently maintaining occupancy rates above 95%. I’ve successfully navigated challenging situations such as tenant disputes, emergency repairs, and rent collection difficulties, always prioritizing effective communication and problem-solving.

I’m proficient in utilizing property management software to streamline operations, track expenses, and generate financial reports. I’m also adept at creating and enforcing lease agreements that protect both the landlord and the tenant’s interests. My experience ensures the smooth and efficient operation of properties, maximizing return on investment for owners while providing a positive experience for tenants.

Q 10. How do you handle difficult clients or situations?

Handling difficult clients or situations requires patience, empathy, and a structured approach. My strategy centers around active listening, clear communication, and finding mutually agreeable solutions.

- Active Listening: I make a conscious effort to understand the client’s perspective, even if I disagree with their approach. This often involves asking clarifying questions and summarizing their concerns to ensure I fully grasp the situation.

- Clear Communication: I use clear, concise language to explain processes, policies, and potential solutions. I avoid jargon and ensure the client understands the implications of their choices.

- Problem-Solving: I collaborate with the client to brainstorm solutions, exploring various options and considering their constraints. Sometimes, compromise is necessary to reach a mutually acceptable outcome.

- Documentation: Thorough documentation of all interactions, agreements, and decisions is critical. This protects both the client and myself from future misunderstandings.

- Escalation Protocol: In cases where I cannot resolve the issue, I have a clear escalation protocol in place to involve senior management or legal counsel, as necessary.

For instance, I once had a tenant who consistently delayed rent payments. Instead of immediately resorting to eviction, I actively communicated with the tenant, understood their financial challenges, and collaboratively worked out a payment plan. This prevented a costly legal battle and maintained a positive tenant-landlord relationship.

Q 11. What are your negotiation skills and how have you used them in real estate?

Negotiation is a cornerstone of successful real estate transactions. My negotiation style is collaborative and results-oriented, focusing on finding win-win solutions for all parties involved.

I’ve successfully negotiated numerous deals, ranging from residential sales to commercial leases. One notable example involved a property with multiple competing offers. By carefully analyzing each offer’s strengths and weaknesses, understanding the buyers’ motivations, and strategically presenting counter-offers, I secured the best possible terms for my client, exceeding their initial expectations. This involved not just focusing on price but also addressing contingencies, closing timelines, and other crucial aspects.

My skills encompass active listening, strategic planning, understanding market dynamics, and effectively managing expectations. I’m adept at identifying the other party’s needs and leveraging that understanding to achieve favorable outcomes. I believe that a successful negotiation is not just about winning, but about building trust and establishing long-term relationships.

Q 12. How familiar are you with local zoning regulations and building codes?

I’m very familiar with local zoning regulations and building codes, having worked extensively within [Mention City/County]. My understanding encompasses permitted land uses (residential, commercial, industrial), setbacks, height restrictions, parking requirements, and environmental considerations.

I regularly consult these codes and regulations to advise clients on feasibility, compliance, and potential development opportunities. For instance, I recently helped a client determine the optimal use for their property by carefully reviewing zoning regulations and identifying allowable building heights and densities. This ensured they maximized the potential return on their investment while remaining compliant with all local ordinances. I stay updated on any changes or amendments to these regulations through regular review of official government publications and professional development courses.

Q 13. Explain your understanding of environmental concerns related to real estate.

Environmental concerns are increasingly important in real estate. My understanding encompasses several key areas:

- Environmental Site Assessments (ESAs): These assessments identify potential environmental hazards such as contamination from previous industrial activities or underground storage tanks. ESAs are crucial for due diligence in property transactions, especially for older properties.

- Brownfields Redevelopment: I’m familiar with programs and initiatives that encourage the redevelopment of contaminated sites, transforming them into productive assets while mitigating environmental risks.

- Environmental Regulations: I’m aware of federal, state, and local environmental regulations that affect real estate development and transactions, including those related to wetlands protection, endangered species, and hazardous waste disposal.

- Energy Efficiency: The growing emphasis on sustainable buildings and energy efficiency plays a significant role in property value and marketability. I’m knowledgeable about energy-efficient design and construction practices and their impact on property assessments.

- Lead-Based Paint and Asbestos: I understand the requirements for disclosure and remediation related to lead-based paint in older homes and asbestos in various building materials.

Ignoring environmental concerns can lead to significant legal and financial liabilities. A thorough understanding of these issues is essential for responsible real estate practice.

Q 14. What are your strategies for marketing real estate properties?

My marketing strategies for real estate properties are multifaceted and tailored to each property’s unique characteristics and target market. I utilize a blend of traditional and digital approaches to maximize exposure and attract potential buyers or tenants.

- Professional Photography and Videography: High-quality visuals are critical for showcasing properties online. I invest in professional photography and videography that highlights the property’s best features.

- Multiple Listing Service (MLS) Listings: I ensure comprehensive and accurate listings on the MLS, providing detailed descriptions, high-resolution images, and virtual tours.

- Online Portals: I leverage popular real estate websites such as Zillow, Realtor.com, and Trulia to reach a wider audience.

- Social Media Marketing: I utilize platforms like Facebook, Instagram, and potentially others, to reach target demographics through visually appealing posts and targeted advertising campaigns.

- Email Marketing: I maintain a database of prospective buyers or tenants to distribute targeted emails announcing new listings or property updates.

- Open Houses and Brokerage Events: I organize open houses and participate in brokerage events to provide in-person opportunities to showcase properties and interact with potential buyers.

- Targeted Advertising: I use targeted advertising to reach specific demographics based on their interests, location, and online behavior.

The effectiveness of each marketing strategy is continually monitored and adjusted based on analytics and market feedback. This data-driven approach ensures optimization and maximizes the return on investment.

Q 15. How do you stay updated on current market trends and legislation?

Staying abreast of real estate market trends and legislation requires a multi-pronged approach. I utilize a combination of resources to ensure I’m always informed. This includes regularly reading industry publications like the Wall Street Journal, The Real Estate Investor, and local market newsletters. I also actively participate in professional organizations such as the National Association of Realtors (NAR) and attend continuing education courses and conferences that cover the latest legal updates and market shifts. Finally, I maintain close relationships with other professionals in the field – lawyers, appraisers, and fellow realtors – to gain valuable insights and perspectives on emerging trends.

For legislation, I subscribe to legal updates and utilize online resources from government agencies to monitor changes in zoning laws, tax regulations, and other relevant legislation impacting the real estate sector. This proactive approach ensures I can provide my clients with informed advice and navigate legal complexities effectively.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your approach to conducting market research?

My approach to market research is rigorous and data-driven. It begins with defining the scope – which specific area, property type, and investment goals am I analyzing? Once that’s clear, I gather data from multiple sources. This includes analyzing comparable properties (comps) recently sold in the target area, studying local economic indicators such as population growth, employment rates, and new construction projects. I also consult public records for property tax assessments, foreclosure rates, and demographic data. Finally, I leverage advanced analytical tools and software to model potential rental income, expenses, and capitalization rates (Cap Rates), providing a comprehensive understanding of the market dynamics.

For instance, if evaluating a multifamily property, I wouldn’t simply look at the sales price of similar buildings; I’d also delve into their occupancy rates, rental income, operating expenses, and potential for rent increases to develop a truly robust market analysis. This provides a detailed and comprehensive understanding, avoiding costly mistakes based on incomplete data.

Q 17. Explain the difference between a 1031 exchange and a regular sale.

A 1031 exchange, formally known as a like-kind exchange under Section 1031 of the Internal Revenue Code, allows investors to defer capital gains taxes when selling an investment property and reinvesting the proceeds into a similar property. This is in stark contrast to a regular sale, where capital gains taxes are due immediately upon the sale of the property. The key difference lies in the tax implications.

In a 1031 exchange, the investor must adhere to strict IRS rules and deadlines. They must identify potential replacement properties within 45 days of selling the original property and complete the purchase within 180 days. The replacement property must be of like-kind, meaning it serves a similar purpose as the original investment property (e.g., exchanging an apartment building for another apartment building). A regular sale, on the other hand, involves a straightforward sale where the seller receives the proceeds and pays capital gains taxes. Choosing between a 1031 exchange and a regular sale depends on the investor’s tax situation and investment strategy.

Q 18. How do you calculate net operating income (NOI)?

Net Operating Income (NOI) is a key metric in real estate investment analysis, representing the profitability of a property before accounting for debt service (mortgage payments) and income taxes. It’s calculated by subtracting all operating expenses from the property’s annual revenue.

The formula is:

NOI = Annual Revenue - Annual Operating Expenses

Annual Revenue includes all rental income, parking fees, laundry income, etc. Annual Operating Expenses include property taxes, insurance, maintenance, utilities, management fees, and other expenses directly related to the property’s operation. It’s crucial to use only operating expenses and not include capital expenditures (like roof replacement) in this calculation.

For example, if a property generates $100,000 in annual rental income and has operating expenses of $30,000, the NOI would be $70,000. NOI is a critical factor in determining a property’s value and its potential return on investment.

Q 19. What are the different types of real estate investment trusts (REITs)?

Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate across a range of property sectors. They are categorized into several types:

- Equity REITs: These REITs own and operate income-producing real estate, such as apartment buildings, office spaces, shopping centers, or hotels. They generate income from rent and property appreciation.

- Mortgage REITs (mREITs): These REITs invest in mortgage-backed securities and other mortgage loans instead of directly owning properties. They profit from interest income and capital gains.

- Hybrid REITs: These REITs combine characteristics of both equity and mortgage REITs, owning properties and investing in mortgages simultaneously.

Furthermore, REITs can be further categorized by the type of properties they invest in (e.g., residential, commercial, healthcare, industrial).

Q 20. How do you evaluate the financial health of a real estate investment?

Evaluating the financial health of a real estate investment requires a thorough analysis encompassing several key metrics and factors. I use a combination of quantitative and qualitative methods to assess risk and potential return.

Quantitative analysis involves scrutinizing financial statements, including income statements, balance sheets, and cash flow statements. Key metrics like NOI, capitalization rate (Cap Rate), debt-to-equity ratio, and debt service coverage ratio (DSCR) are crucial indicators of financial health. A low DSCR, for example, suggests that the property might struggle to meet its debt obligations. A high cap rate generally indicates a potentially higher return but can also signal increased risk.

Qualitative analysis focuses on aspects like the property’s location, condition, management quality, and market demand. Site visits are essential to assess the physical condition and identify potential maintenance needs. Analyzing the surrounding market’s strength and future growth potential is equally important.

By combining these quantitative and qualitative assessments, I develop a comprehensive understanding of the investment’s financial strength, risks, and potential for future returns.

Q 21. What is your experience with preparing and analyzing financial statements for properties?

I have extensive experience in preparing and analyzing financial statements for properties. This includes:

- Preparing income statements: Accurately reflecting rental income, operating expenses, and resulting NOI.

- Developing balance sheets: Showing assets, liabilities, and equity of the property.

- Creating cash flow statements: Illustrating the inflows and outflows of cash related to the property.

- Analyzing key financial ratios: such as occupancy rates, vacancy rates, and debt service coverage ratio to assess the property’s profitability and financial stability.

- Pro-forma modeling: Projecting future financial performance based on market analysis and assumptions.

This experience allows me to make informed investment decisions, assess the risk profile of properties, and provide clients with comprehensive financial reports that clearly communicate the financial implications of various scenarios.

For example, in preparing a pro-forma for a multi-family property, I would project potential rental income based on market rents and occupancy rates, factoring in potential rent increases over time. This, coupled with carefully estimated operating expenses, would allow me to provide a clear picture of the future NOI and potential return on investment.

Q 22. Explain your understanding of due diligence in real estate.

Due diligence in real estate is the investigative process buyers and lenders undertake to verify all aspects of a property before closing a transaction. Think of it as a thorough background check for a house. It’s crucial to mitigate risks and ensure the property aligns with expectations and legal requirements.

- Property Inspection: A professional inspector assesses the physical condition of the property, identifying any structural, mechanical, or other issues. This could reveal hidden problems like foundation cracks or faulty plumbing.

- Title Search and Insurance: This verifies ownership and identifies any liens, easements, or encumbrances on the title. Title insurance protects the buyer and lender from potential title defects.

- Environmental Assessment: This check investigates the presence of environmental hazards like asbestos, lead paint, or radon gas, especially important in older properties.

- Zoning and Compliance: Verification of compliance with local zoning regulations and building codes. This ensures the property’s intended use is permissible.

- Review of Disclosures: Careful review of all seller disclosures to understand any known defects or issues with the property. This might include things like previous water damage or pest infestations.

For example, during a recent transaction, due diligence revealed a significant crack in the foundation, leading to a renegotiation of the purchase price or even withdrawal from the deal. This saved my client from a potentially costly repair down the line.

Q 23. How do you handle title issues or discrepancies?

Title issues and discrepancies can range from minor clerical errors to significant ownership disputes. My approach is systematic and involves:

- Identifying the Issue: Carefully examine the title report to pinpoint the exact nature of the discrepancy, whether it’s a missing document, conflicting claims, or a lien.

- Investigating the Root Cause: Research the history of the property to understand the origin of the issue. This often involves contacting relevant parties, such as previous owners or lien holders.

- Developing a Resolution Strategy: The solution depends on the nature of the problem. This could include obtaining a quitclaim deed to resolve a minor ownership error, negotiating with lien holders to settle outstanding debts, or engaging in a quiet title action to resolve a legal dispute.

- Negotiating with Parties Involved: Effective communication and negotiation skills are crucial in resolving title issues. I aim to find a mutually acceptable solution for all parties.

- Escrow Management: Ensure proper escrow management of funds to protect all parties during the resolution process.

For instance, I recently handled a case involving a clouded title due to an unresolved mortgage from a previous owner. Through thorough research and negotiation, I successfully cleared the title and facilitated a smooth closing for my clients.

Q 24. What is your experience with different types of property insurance?

My experience encompasses various types of property insurance, crucial for protecting both buyers and sellers. These include:

- Homeowners Insurance: This covers damage to the property itself, such as from fire, wind, or theft, as well as liability protection for injuries occurring on the property.

- Condo Insurance: Similar to homeowners, but with a focus on the interior of the condo unit and personal belongings. The condo association typically covers the building’s exterior.

- Flood Insurance: This is separate from homeowners insurance and protects against damage caused by flooding, a critical aspect in areas prone to such events.

- Earthquake Insurance: Earthquake coverage is often not included in standard homeowners insurance policies and is a necessity in high-risk zones.

- Commercial Property Insurance: This protects commercial properties and businesses from various risks, encompassing building damage, liability, and business interruption.

I advise my clients on the appropriate coverage based on factors like location, property type, and their individual risk tolerance. Proper insurance is an indispensable part of securing a real estate investment.

Q 25. What are your strengths and weaknesses as a real estate professional?

My strengths lie in my strong negotiation skills, attention to detail, and commitment to providing exceptional client service. I thrive in high-pressure situations and consistently deliver positive outcomes for my clients. My in-depth market knowledge enables me to effectively advise clients on pricing strategies and market trends.

A weakness I’m actively working on is delegation. As a detail-oriented person, I sometimes find it challenging to delegate tasks. However, I am progressively learning to trust my team and better allocate responsibilities for increased efficiency.

Q 26. Describe your experience with real estate technology and software.

I am proficient in using several real estate technologies and software, including:

- CRM (Customer Relationship Management) software: For managing client interactions, tracking leads, and organizing communication.

- Multiple Listing Service (MLS) systems: To access property listings, update information, and manage transactions efficiently.

- Virtual Tour and Presentation Software: For showcasing properties effectively to potential buyers, even remotely.

- Document Management Systems: For secure storage and access to vital transactional documents.

- Market Analysis Tools: For performing comparative market analyses and understanding current market trends.

These tools enhance my productivity and communication, ultimately benefiting my clients with faster and more informed services.

Q 27. How do you prioritize tasks and manage your time effectively?

Effective time management is essential in this dynamic industry. My approach involves:

- Prioritization: I use a combination of task management systems and prioritization matrices (like Eisenhower Matrix) to identify and tackle the most important tasks first.

- Time Blocking: I allocate specific time slots for various activities to ensure focus and avoid distractions. This helps me dedicate uninterrupted time for client meetings, research, and administrative tasks.

- Delegation: As mentioned earlier, I am improving my delegation skills to free up my time for higher-priority activities.

- Regular Review and Adjustment: I regularly review my schedule and adjust it based on changing priorities and unexpected events. Flexibility is crucial.

Analogy: I treat my time like a valuable asset that needs careful investment. Just as a prudent investor diversifies their portfolio, I diversify my time across essential tasks to maximize productivity and client satisfaction.

Q 28. Describe your understanding of fair housing laws.

Fair Housing Laws are crucial for ensuring equal housing opportunities for all individuals, regardless of race, color, national origin, religion, sex, familial status, or disability. Understanding these laws is paramount for ethical and legal real estate practice.

- Prohibition of Discrimination: These laws prohibit discriminatory practices in all aspects of real estate transactions, including advertising, lending, and property management.

- Reasonable Accommodations: Landlords and sellers must make reasonable accommodations for people with disabilities unless it causes undue financial or administrative burdens.

- Accessibility Requirements: New construction and modifications to existing properties must comply with accessibility standards for people with disabilities.

- Enforcement and Penalties: Violations of Fair Housing Laws can result in significant legal penalties, including fines and court orders.

I stay informed about the latest updates and interpretations of Fair Housing Laws through professional development and adherence to industry best practices. Ensuring fair and equitable housing opportunities is not just a legal obligation, but a moral imperative.

Key Topics to Learn for Your Real Estate Knowledge Interview

- Market Analysis: Understanding market trends, supply and demand, and conducting comparative market analyses (CMAs). Practical application: Accurately pricing properties and advising clients on market conditions.

- Property Valuation: Mastering different appraisal methods and understanding factors influencing property value. Practical application: Justifying listing prices, negotiating offers, and identifying undervalued properties.

- Real Estate Law & Regulations: Familiarity with relevant legislation, contracts, and agency relationships. Practical application: Ensuring legal compliance in all transactions and protecting clients’ interests.

- Financing & Mortgages: Understanding mortgage types, loan qualification processes, and closing procedures. Practical application: Advising clients on financing options and navigating the complexities of mortgage approvals.

- Property Management: Knowledge of tenant selection, lease agreements, property maintenance, and rent collection. Practical application: Managing properties effectively and minimizing risk for owners.

- Investment Strategies: Understanding different real estate investment approaches (e.g., flipping, wholesaling, buy-and-hold). Practical application: Advising clients on investment opportunities and risk mitigation strategies.

- Contract Negotiation & Closing Procedures: Skill in negotiating contracts, understanding closing costs, and ensuring a smooth transaction. Practical application: Successfully navigating negotiations and achieving optimal outcomes for clients.

- Client Communication & Relationship Building: Effective communication and rapport-building skills essential for building trust and securing clients. Practical application: Managing client expectations, resolving conflicts, and providing excellent customer service.

Next Steps

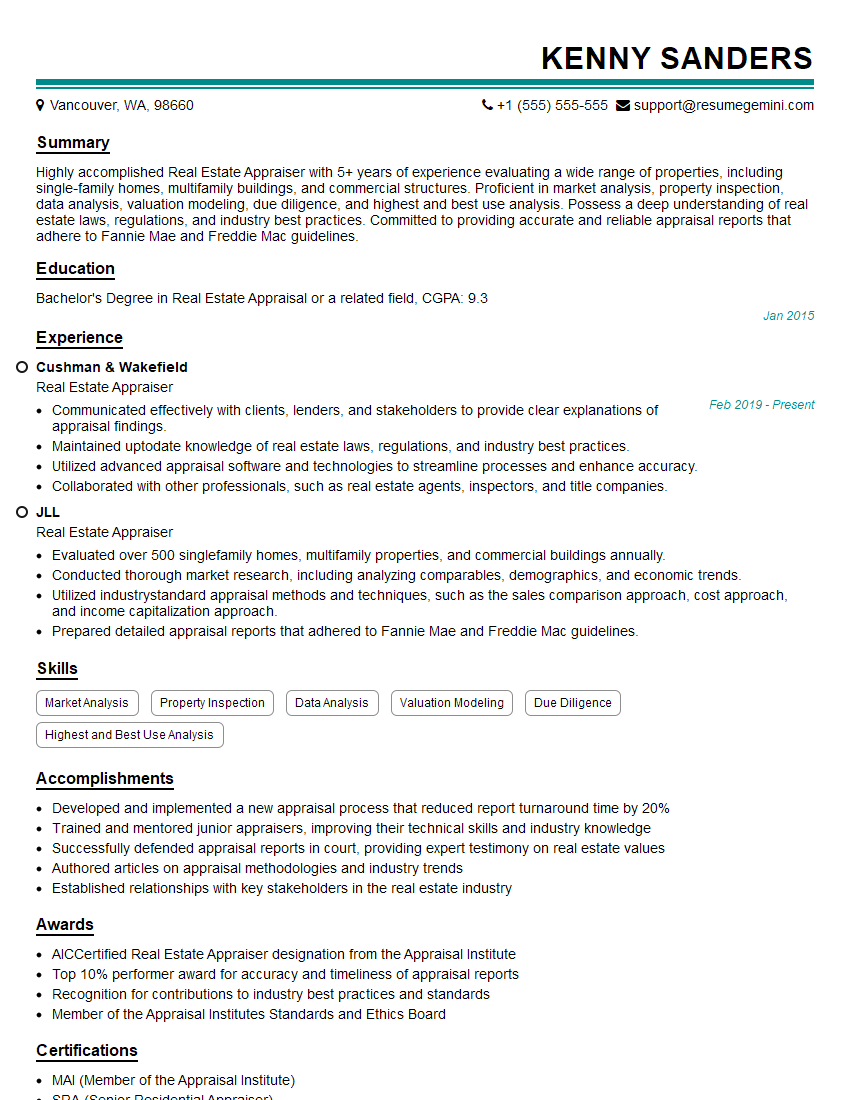

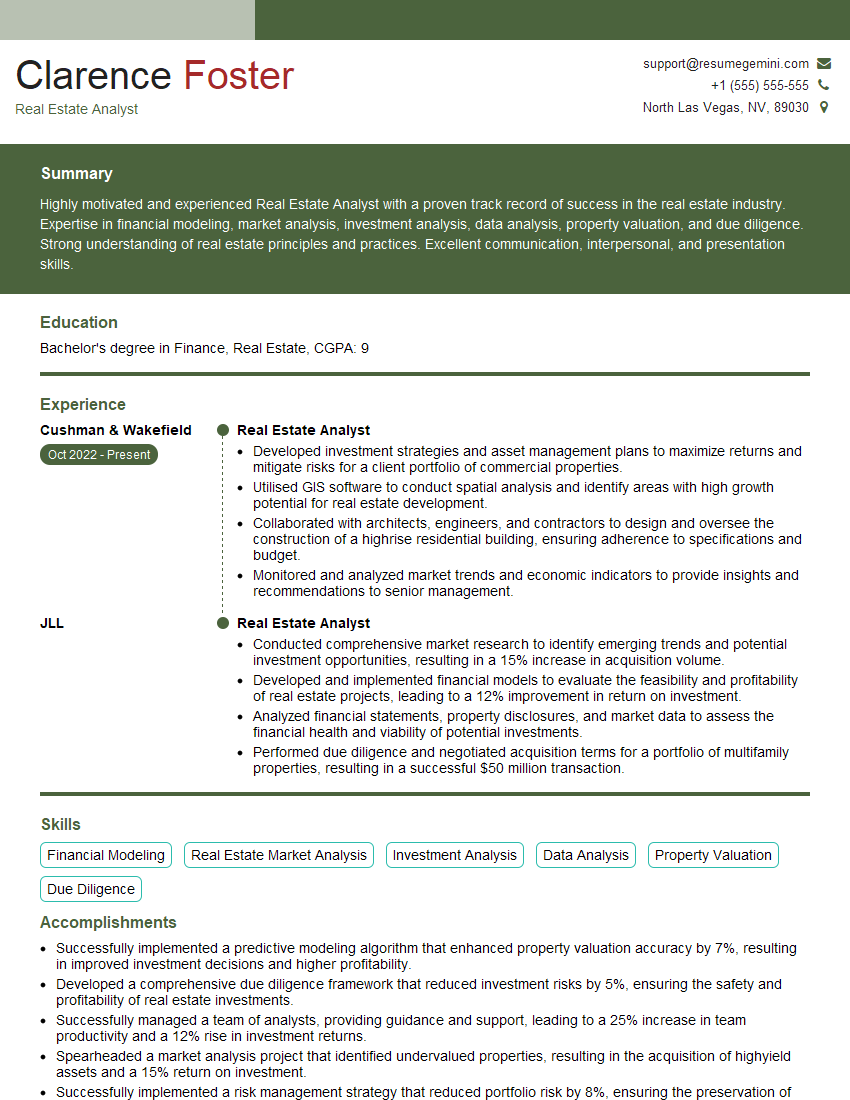

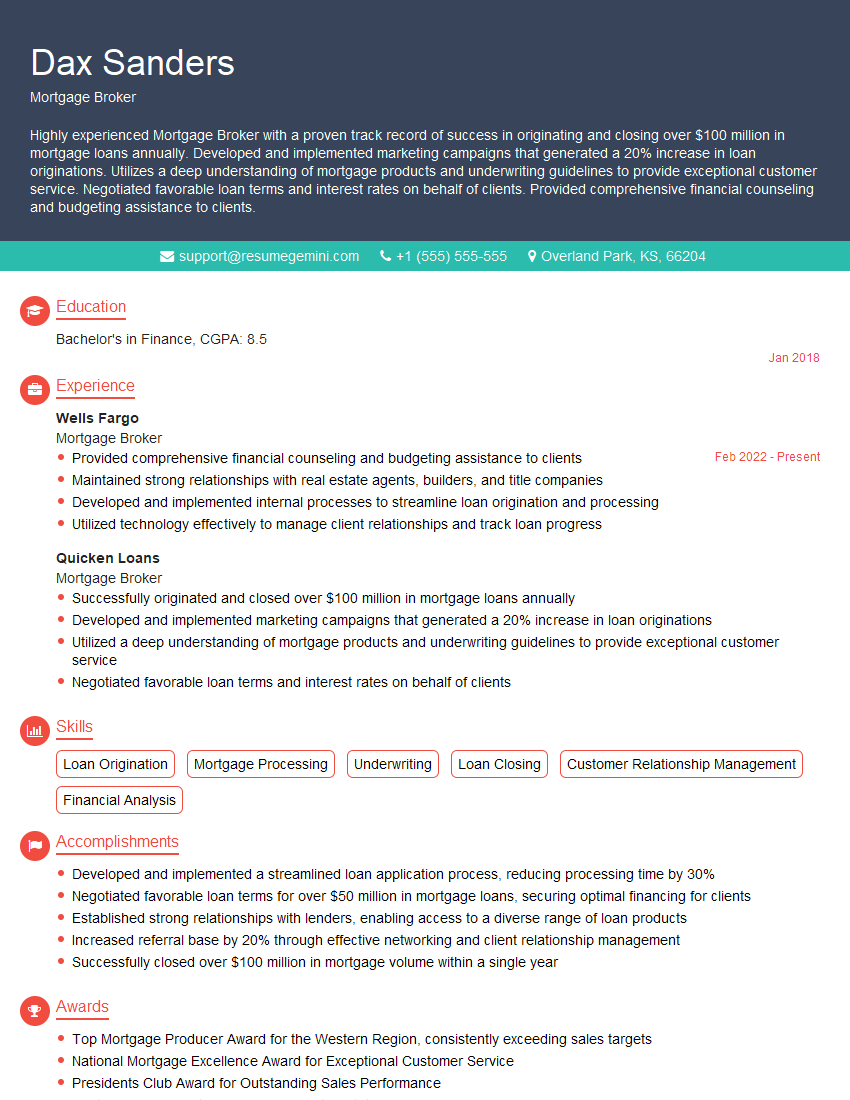

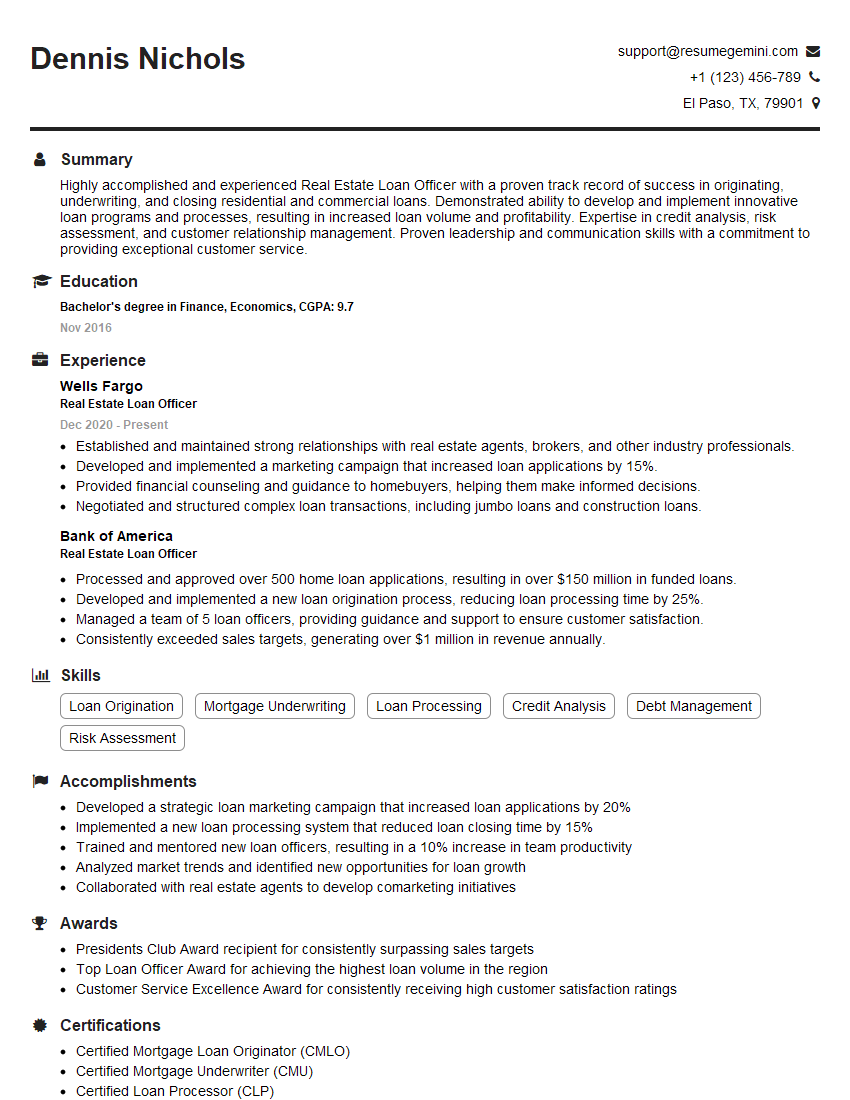

Mastering these key areas of Real Estate Knowledge is crucial for career advancement and securing your dream role. A strong understanding of these concepts will significantly improve your interview performance and demonstrate your readiness to contribute meaningfully to a real estate firm. To enhance your job prospects, focus on building an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you craft a compelling resume that showcases your expertise. They provide examples of resumes tailored to Real Estate Knowledge professionals, helping you present yourself in the best possible light. Take the next step towards your successful real estate career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good