Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Scouting Opponents interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Scouting Opponents Interview

Q 1. Describe your experience gathering and analyzing competitive intelligence.

Gathering and analyzing competitive intelligence is like being a detective for your business. It involves systematically collecting information about your competitors to understand their strategies, strengths, weaknesses, and potential threats. My experience spans over ten years, working across various industries, from tech startups to established Fortune 500 companies. I’ve honed my skills in identifying relevant data sources, performing in-depth analysis, and translating complex information into actionable insights that inform strategic decision-making. For instance, in a recent project for a SaaS company, I uncovered a competitor’s upcoming product launch through analyzing their social media activity and patent filings, allowing my client to proactively adjust their marketing strategy and product roadmap.

- Data Collection: Gathering data from various sources like market research reports, competitor websites, press releases, social media, and industry events.

- Data Analysis: Identifying trends, patterns, and insights from the collected data. This often involves SWOT analysis, competitive profiling, and market share analysis.

- Insight Generation: Translating raw data into actionable recommendations for the business, such as pricing strategies, product development, or marketing campaigns.

Q 2. Explain your process for identifying key competitors.

Identifying key competitors requires a multi-faceted approach. It’s not just about the biggest players in the market; it’s about identifying those who directly impact your business goals. My process starts with defining the market scope and target customer segment. Then, I use a combination of methods:

- Market Research: Reviewing industry reports and databases to identify companies operating in the same market space.

- Customer Feedback: Understanding who our customers mention as alternatives or competitors.

- Website and Social Media Analysis: Examining competitor websites, social media presence, and online reviews to understand their offerings and target audience.

- Sales Data: Analyzing sales data to identify companies that frequently appear in lost deals.

For example, while analyzing a new entrant into the sustainable clothing market, we identified not only the established giants but also several niche players targeting the same sustainable and ethical consumer base, who represented a significant threat despite their smaller size.

Q 3. How do you assess the strengths and weaknesses of competitors?

Assessing competitor strengths and weaknesses involves a structured approach. I typically use a SWOT analysis framework (Strengths, Weaknesses, Opportunities, Threats) tailored to the specific context. This goes beyond a simple list; I delve into the ‘why’ behind each factor, exploring the underlying reasons for their success or failure.

- Strengths: What are their competitive advantages? Do they have superior technology, a strong brand reputation, a wider distribution network, or a more efficient operational model?

- Weaknesses: Where are their vulnerabilities? Do they have a high customer churn rate, a weak marketing presence, or a limited product portfolio?

- Opportunities: What market opportunities can they capitalize on? Are there untapped market segments or emerging technologies they could leverage?

- Threats: What external factors might negatively impact their business? Are there regulatory changes, economic downturns, or disruptive innovations that could threaten their market position?

To illustrate, I helped a client understand why a seemingly stronger competitor was losing market share by identifying weaknesses in their customer service and supply chain processes. This allowed my client to focus on these aspects and gain a competitive advantage.

Q 4. What methods do you use to collect competitive intelligence?

My competitive intelligence collection methods are diverse and ethically sound. I prioritize open-source intelligence, but also utilize other techniques when necessary. This includes:

- Open-Source Intelligence (OSINT): This is the foundation. I regularly scan competitor websites, press releases, social media, industry publications, and news articles. I use tools like Google Alerts to monitor mentions of competitors.

- Market Research Reports: Subscription to industry databases and reports from reputable firms provides valuable insights into market trends and competitor activities.

- Reverse Engineering: Analyzing competitor products or services to understand their features and functionalities. (Always done ethically and legally).

- Competitive Benchmarking: Comparing our performance to competitors across key metrics such as customer satisfaction, pricing, and market share.

- Networking and Industry Events: Attending conferences and engaging with industry professionals to gather insights and network.

I always ensure that all data collection activities comply with relevant laws and regulations and maintain ethical standards.

Q 5. How do you prioritize competitive intelligence based on business impact?

Prioritizing competitive intelligence is crucial for maximizing its business impact. I use a framework that considers both the urgency and importance of the information:

- Urgency: How quickly do we need this information to make critical decisions?

- Impact: How significantly will this information influence our strategic plans and business outcomes?

This creates a matrix. High urgency, high impact information (e.g., a competitor’s major product launch) is prioritized immediately. Lower urgency, lower impact information (e.g., a minor change in competitor’s marketing campaign) might be addressed later. This ensures that our efforts are focused on the most critical areas and yield the highest return on investment.

Q 6. How do you validate the accuracy of your competitive intelligence?

Validating the accuracy of competitive intelligence is paramount. A single piece of misinformation can lead to flawed decisions. My validation process involves:

- Triangulation: Cross-referencing information from multiple independent sources to verify its accuracy. If three different sources report the same fact, confidence increases.

- Source Credibility Assessment: Evaluating the reliability and trustworthiness of each source based on reputation, expertise, and potential biases.

- Fact-Checking: Verifying specific claims and data points through additional research and independent verification. This might involve contacting industry analysts or conducting primary research.

- Internal Consistency Checks: Ensuring that different pieces of intelligence fit together logically and do not contradict each other.

Imagine receiving information about a competitor’s new product launch. I would verify the information by checking multiple news sources, analyzing their website, and possibly even contacting industry experts. Multiple confirmations drastically increase the validity.

Q 7. How do you present your competitive intelligence findings to stakeholders?

Presenting competitive intelligence findings effectively is crucial for influencing strategic decisions. My presentations are tailored to the audience and always prioritize clarity and actionability. I typically use a combination of techniques:

- Executive Summaries: Concise summaries highlighting key findings and actionable insights for busy executives.

- Visualizations: Graphs, charts, and other visuals to communicate complex data effectively. A simple bar chart comparing market share can be much more impactful than a lengthy table of numbers.

- Storytelling: Framing the findings within a narrative to make them more engaging and memorable.

- Interactive Dashboards: For ongoing monitoring, I develop interactive dashboards to allow stakeholders to track key metrics and identify emerging trends.

Ultimately, my goal is not just to present information, but to empower stakeholders to make informed decisions that enhance the company’s competitive advantage.

Q 8. Explain how you’ve used competitive intelligence to inform strategic decisions.

Competitive intelligence is the systematic collection and analysis of information about competitors to inform strategic decision-making. I’ve used it extensively to identify market opportunities, anticipate competitor moves, and optimize our strategies. For example, in a previous role, we were launching a new product. By analyzing our competitor’s product launch cycles, marketing strategies, and pricing models – gleaned from press releases, financial reports, and market research – we were able to identify a gap in the market, allowing us to position our product uniquely and achieve significant market share.

Another instance involved a competitor aggressively expanding into a new geographic region. Through competitive intelligence, we discovered their initial marketing campaign was weak. This allowed us to preemptively target that region with a more effective campaign, securing a significant head start. This proactive approach, based on sound competitive intelligence, significantly reduced our market entry costs and risks.

Q 9. Describe a time you had to adapt your competitive intelligence strategy.

My competitive intelligence strategy had to adapt significantly when a major competitor unexpectedly acquired a smaller firm specializing in a complementary technology. This acquisition completely changed the competitive landscape, rendering our previous assumptions about their capabilities and future plans obsolete. We immediately adjusted our strategy by:

- Expanding our data sources to include the acquired company’s information, such as their patents, publications, and customer base.

- Conducting rapid market research to understand the implications of the merger on the overall market dynamics.

- Re-evaluating our competitive advantages and adjusting our product roadmap accordingly.

This experience highlighted the importance of flexibility and adaptability in competitive intelligence. We moved from a primarily proactive strategy to a more reactive, but agile approach, successfully navigating this unexpected disruption.

Q 10. What are some common pitfalls to avoid when scouting opponents?

Several pitfalls can hinder effective opponent scouting. One common mistake is relying solely on publicly available information, ignoring valuable insights from less obvious sources like industry events, customer feedback, and employee networks. This can lead to an incomplete or biased picture of the competitor.

- Confirmation Bias: Interpreting information to confirm pre-existing beliefs, rather than objectively assessing data.

- Ignoring Indirect Competitors: Focusing only on direct competitors and neglecting indirect players that might impact market share or influence customer decisions.

- Insufficient Data Analysis: Collecting data without proper analysis, failing to identify trends and significant patterns.

- Neglecting Ethical Considerations: Employing unethical or illegal methods to obtain competitive information.

To avoid these, one should use diverse data sources, implement rigorous data analysis techniques, and strictly adhere to ethical practices while always remaining aware of potential biases.

Q 11. How do you handle incomplete or conflicting information?

Handling incomplete or conflicting information requires a structured approach. I typically employ triangulation, cross-referencing information from multiple reliable sources to validate findings and identify inconsistencies.

If information conflicts, I analyze the credibility and potential biases of each source. For example, a competitor’s press release might be promotional, while an independent analyst report could offer a more neutral perspective. Weighting information based on source reliability allows for a more accurate assessment.

For incomplete data, I use inferential analysis, drawing logical conclusions based on available information and making educated guesses while acknowledging the limitations of the incomplete dataset. This could involve using statistical models to estimate missing values or using qualitative information to fill in gaps in quantitative data.

Q 12. How familiar are you with different competitive intelligence tools?

I’m proficient in using a variety of competitive intelligence tools. This includes market research databases like IBISWorld and Mintel, providing insights into market size, trends, and competitor profiles. I also utilize social listening tools to monitor competitor activity on social media platforms. Web scraping tools help gather data from company websites, and specialized software allows for the analysis of patent filings and news articles to identify technological advancements and strategic directions.

Furthermore, I am experienced in using Business Intelligence (BI) platforms to consolidate data from various sources and visualize trends, providing a comprehensive overview of the competitive landscape. My experience spans various tools, and I readily adapt to new technologies to enhance the effectiveness of my competitive intelligence efforts.

Q 13. Describe your experience using SWOT analysis in a competitive context.

SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a crucial framework for understanding our competitive position. I’ve used it repeatedly to identify opportunities and address threats. For example, in a recent project, we used SWOT to assess our position relative to a new market entrant.

Our analysis revealed that while the competitor had strong brand recognition (Strength), their product lacked certain features our product offered (Weakness). We leveraged this insight to position ourselves as offering superior functionality. Moreover, we identified an untapped market segment as an opportunity, and developed a focused marketing campaign to capitalize on it. Meanwhile, potential government regulations posed a significant threat (Threat), and we developed contingency plans to mitigate this risk. The SWOT analysis helped us to strategically leverage our strengths, mitigate our weaknesses, capitalize on opportunities, and address threats, leading to successful market penetration.

Q 14. How do you track competitor activity and market trends?

Tracking competitor activity and market trends involves a multi-faceted approach. I regularly monitor news sources, industry publications, and social media for competitor announcements, product launches, marketing campaigns, and executive changes. This provides timely information about their strategic moves. I also use web scraping tools to automatically collect data from competitor websites, such as product specifications, pricing information, and customer testimonials. Finally, I leverage market research reports, analyst briefings, and industry events to gather broader perspectives on market trends and identify emerging opportunities and threats.

This combination of proactive monitoring and data-driven analysis enables me to develop a comprehensive understanding of the competitive landscape and anticipate future market developments effectively.

Q 15. How do you measure the effectiveness of your competitive intelligence efforts?

Measuring the effectiveness of competitive intelligence (CI) hinges on tying it directly to business outcomes. We can’t just collect data; we need to show its impact. I use a multi-faceted approach. First, I establish Key Performance Indicators (KPIs) before launching any CI initiative. These KPIs might include market share growth, improved product development speed, or successful counter-strategies against competitor actions. Then, I meticulously track these KPIs both before and after implementing the insights derived from our CI efforts.

For example, if we identified a competitor’s weakness in their supply chain through CI, and subsequently launched a targeted marketing campaign highlighting our own robust supply chain, we would track the resulting increase in market share. This quantifiable improvement directly demonstrates the value of the CI. We also conduct regular post-project reviews, analyzing what worked, what didn’t, and how we can refine our methods for future projects. This includes feedback from stakeholders who utilize the CI data in their daily work.

- Qualitative Feedback:Gathering feedback from sales, product development, and marketing teams on how CI insights influenced their decision-making is crucial.

- Return on Investment (ROI): Calculating the ROI of CI activities by comparing the cost of intelligence gathering to the financial gains achieved through its application.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you prioritize which competitors to focus on?

Prioritizing competitors is crucial for efficient CI. I use a framework combining market share, strategic overlap, and potential threat. Competitors are categorized into three tiers:

- Tier 1: Direct Competitors – These are companies offering nearly identical products or services, targeting the same customer segments. They require the most intense scrutiny.

- Tier 2: Indirect Competitors – These companies operate in related markets or offer substitute products. Monitoring their activities provides valuable insights into emerging trends and potential threats.

- Tier 3: Emerging Competitors – These are new entrants or companies with disruptive technologies. While potentially less immediate, their monitoring is crucial for identifying future threats and opportunities.

To illustrate, imagine a coffee shop. Tier 1 might be other nearby coffee shops with similar menus and pricing. Tier 2 could include tea houses or bakeries offering similar morning-time experiences. Tier 3 might be innovative companies entering the market with entirely new coffee brewing methods. The prioritization process uses a weighted scoring system, factoring in each competitor’s market share, innovative activity, and potential to impact our market position.

Q 17. Explain your experience with PESTLE analysis and its application in competitive intelligence.

PESTLE analysis is a crucial tool in CI. It helps identify macro-environmental factors that impact the competitive landscape. PESTLE stands for Political, Economic, Social, Technological, Legal, and Environmental factors. I use it to gain a holistic understanding of the external environment and its influence on competitor strategies and our own.

For instance, a political change like a new trade agreement could significantly impact a competitor’s sourcing strategy, making it more or less cost-competitive. An economic downturn may force competitors to cut R&D, offering an opportunity for us to gain an advantage. Social trends such as increasing health consciousness might impact demand for certain products, forcing competitors to adapt their offerings. Technological advancements can disrupt entire industries, making it vital to track emerging technologies and their potential impact.

In practice, I start with brainstorming sessions involving cross-functional teams to identify key PESTLE factors relevant to our industry. We then gather data from reputable sources like government reports, industry publications, and news articles. Finally, we analyze this data to identify potential threats and opportunities and integrate these insights into our competitive strategies.

Q 18. What are some ethical considerations when gathering competitive intelligence?

Ethical considerations are paramount in CI. Gathering intelligence illegally or unethically can have severe consequences, including legal repercussions and reputational damage. Our CI activities must always adhere to the highest ethical standards and legal regulations.

- Respect for Privacy: We avoid activities that violate an individual’s or company’s privacy. This includes refraining from accessing confidential information without authorization.

- Transparency and Honesty: We are transparent about our CI activities with our own company and do not engage in deceptive practices.

- Respect for Intellectual Property: We never copy or misappropriate a competitor’s intellectual property.

- Data Security: We implement robust security measures to protect the collected data and prevent unauthorized access.

For example, while publicly available information can be freely used, we would never attempt to gain access to a competitor’s internal documents through illegal means such as hacking. We maintain a strict code of conduct and conduct regular training for our CI team on ethical guidelines and legal compliance.

Q 19. How do you identify emerging threats and opportunities in the competitive landscape?

Identifying emerging threats and opportunities requires a proactive and forward-looking approach. I use several methods:

- Trend Analysis: Analyzing long-term trends in the market, consumer behavior, and technology to anticipate future shifts.

- Scenario Planning: Developing various future scenarios to assess potential impacts on the competitive landscape and prepare contingency plans.

- Social Media Monitoring: Tracking online conversations, news, and social media buzz to identify emerging issues and customer concerns.

- Patent Analysis: Monitoring competitor patent filings to detect emerging technologies and innovations.

- Start-up Monitoring: Observing innovative start-ups that could potentially disrupt the market.

For example, observing a surge in interest in sustainable packaging on social media could signal an emerging opportunity for our company to develop environmentally friendly products, while noticing a competitor filing patents in a disruptive technology would indicate a potential threat requiring an immediate strategic response. This combination of reactive and proactive methods offers a comprehensive approach to identifying shifts in the competitive landscape.

Q 20. Describe your experience with different data sources for competitive intelligence (e.g., public records, industry reports, social media).

My experience spans a variety of data sources. It’s not about using one source, but rather creating a comprehensive picture by combining many. The data needs to be both relevant and reliable:

- Public Records: Company filings, government reports, and news articles provide valuable background information and financial data. For example, reviewing SEC filings gives crucial insights into a competitor’s financial health.

- Industry Reports: Market research reports, industry analyses, and competitor profiles from firms like Gartner or Forrester offer structured overviews of the market landscape.

- Social Media: Platforms like Twitter, LinkedIn, and Facebook can provide valuable insights into customer perception, brand reputation, and competitor marketing campaigns.

- Competitor Websites: Analyzing a competitor’s website, including their products, services, pricing, and marketing messages, is a direct source of information about their current strategy.

- News and Media: Press releases, news articles, and industry publications provide insights into recent events and company announcements.

I always prioritize credible and verified sources and cross-reference information from multiple sources to ensure accuracy and reliability. This multi-faceted approach ensures a well-rounded view of the competitive landscape.

Q 21. How do you translate competitive intelligence into actionable recommendations?

Translating CI into actionable recommendations requires careful analysis and clear communication. I typically follow these steps:

- Synthesize Findings: Organize and synthesize the gathered intelligence into a concise and easily understandable format.

- Identify Key Insights: Extract the most important findings and insights from the data analysis.

- Develop Strategic Recommendations: Translate insights into specific, measurable, achievable, relevant, and time-bound (SMART) recommendations.

- Communicate Effectively: Clearly communicate the findings and recommendations to relevant stakeholders, using visuals and presentations when appropriate.

- Monitor and Evaluate: Track the implementation of recommendations and evaluate their effectiveness using established KPIs.

For instance, if CI reveals a competitor is experiencing supply chain challenges, a recommended action might be to proactively strengthen our own supply chain and communicate the reliability of our supply chain to customers through targeted marketing. The entire process emphasizes clear, concise communication, ensuring the actionable insights contribute directly to strategic decision-making.

Q 22. Explain your experience using scenario planning in a competitive intelligence setting.

Scenario planning in competitive intelligence is about proactively anticipating various future scenarios and their potential impact on our business and our competitors. Instead of relying solely on forecasting a single, most likely outcome, we develop multiple plausible scenarios, each with different assumptions about market trends, competitor actions, and external factors like economic conditions or regulatory changes.

In my previous role at Acme Corp, we used scenario planning to assess the potential impact of a new disruptive technology. We developed three scenarios: a ‘Fast Adoption’ scenario where the technology rapidly gained market share, a ‘Slow Adoption’ scenario with gradual market penetration, and a ‘Failure to Launch’ scenario. For each scenario, we developed a detailed competitive landscape, outlining potential competitor responses and our best strategic options. This allowed us to develop contingency plans and remain flexible, regardless of the eventual market outcome.

- Scenario 1 (Fast Adoption): Aggressive competitor response requiring rapid innovation and marketing.

- Scenario 2 (Slow Adoption): More measured response, focusing on organic growth and market education.

- Scenario 3 (Failure to Launch): Opportunity to consolidate market share and focus on existing products.

This approach helped us allocate resources more effectively and prepared us for a wider range of possibilities, significantly reducing uncertainty and risk.

Q 23. How do you forecast future competitor actions based on current intelligence?

Forecasting future competitor actions requires a multi-faceted approach combining current intelligence with an understanding of the competitor’s past behavior, strategic goals, and the overall industry dynamics. We analyze their financial performance, recent product launches, marketing campaigns, and any public statements to identify patterns and trends.

For instance, if a competitor is consistently investing heavily in R&D, focusing on a specific niche, and making aggressive pricing moves, it’s reasonable to forecast future product innovation, market consolidation within that niche, and a potential price war. We also leverage publicly available information such as patents, regulatory filings, and news articles to further inform our forecasts.

Think of it like studying a chess game: you analyze your opponent’s past moves, their preferred strategies, and the current state of the board to predict their next move. The same logic applies to forecasting competitor actions. We use qualitative insights gleaned from industry experts and qualitative data like news articles to supplement quantitative financial and market data.

Q 24. Describe a time you had to defend your competitive intelligence analysis.

During a product launch strategy meeting, my analysis indicated that a competitor’s new product launch would significantly impact our market share. My recommendation was to preemptively launch a counter-campaign to mitigate the potential loss. However, some colleagues challenged my assessment, arguing that our current marketing strategy was sufficient.

To defend my analysis, I presented a detailed breakdown of the competitor’s product, including its features, pricing, target market, and potential marketing reach. I presented data showing the competitor’s previous successful launches and their consistent market penetration in similar products. I further presented a comprehensive model showing the projected impact of the competitor’s launch on our market share under different scenarios, clearly illustrating the need for a more aggressive response. This model factored in various assumptions, enabling an objective discussion based on data.

Ultimately, my analysis prevailed. We implemented a revised marketing strategy that effectively countered the competitor’s product launch, minimizing market share loss and exceeding projected sales targets. This situation underscored the importance of well-supported, data-driven competitive intelligence analysis.

Q 25. How do you stay up-to-date on industry trends and competitor activities?

Staying up-to-date requires a multi-pronged approach. I regularly monitor industry news sources, trade publications, and specialized websites. This gives me a broad overview of market trends and competitor activities.

I also actively engage in industry events, conferences, and webinars. Networking with industry professionals provides valuable insights and allows me to uncover information not readily available through traditional channels. I use social media (LinkedIn, Twitter, etc.) to track competitor announcements and industry discussions. Finally, I use specialized competitive intelligence databases and tools that provide access to company profiles, financial statements, and news articles to get deeper, more data-rich analysis of our competitors.

It’s a continuous process; staying informed requires constant vigilance and a proactive approach to information gathering.

Q 26. How familiar are you with Porter’s Five Forces framework and its application in competitive analysis?

Porter’s Five Forces is a fundamental framework for analyzing the competitive intensity and attractiveness of an industry. It helps to understand the overall profitability potential and the forces that shape competition. The five forces are:

- Threat of New Entrants: How easy is it for new competitors to enter the market?

- Bargaining Power of Suppliers: How much power do suppliers have to raise prices?

- Bargaining Power of Buyers: How much power do customers have to negotiate lower prices?

- Threat of Substitute Products or Services: Are there readily available alternatives to the products or services offered in the industry?

- Rivalry Among Existing Competitors: How intense is the competition among established players?

In competitive analysis, we use Porter’s Five Forces to identify opportunities and threats. For example, a high threat of new entrants might signal the need for proactive strategies to defend our market share. A strong bargaining power of buyers may necessitate strategies to differentiate our products or enhance customer value. It provides a holistic view of the competitive landscape, helping to inform strategic decision-making.

Q 27. Describe your experience with competitor profiling and creating competitor maps.

Competitor profiling involves creating detailed profiles of key competitors, including their strengths, weaknesses, opportunities, and threats (SWOT analysis). This often incorporates aspects from Porter’s Five Forces as well. This includes their market share, financial performance, product offerings, marketing strategies, and target markets.

Competitor maps visually represent the competitive landscape, showing the relative positions of different competitors based on key characteristics such as price, product features, and target market. They’re crucial tools for understanding market segmentation and identifying strategic gaps. I have extensive experience in creating these maps using various software tools and visualization techniques.

For example, in a previous project for a software company, I created competitor profiles covering over 10 key competitors. These profiles included details on their product features, pricing strategies, market share, customer base, and marketing approach. I then created a competitor map that plotted each competitor based on its product functionality and pricing, making it easy to spot gaps in the market and identify opportunities for differentiation.

Q 28. How do you handle sensitive or confidential competitive intelligence information?

Handling sensitive competitive intelligence information requires strict adherence to ethical guidelines and legal regulations. This starts with securing the information itself, with secure storage systems, access control measures, and encryption wherever necessary. Only authorized personnel with a legitimate need to know should have access to this information.

Furthermore, we must always be mindful of the sources of information and the terms and conditions related to their usage. Respecting confidentiality agreements is crucial, and any information obtained illegally or unethically is strictly avoided. Our processes also include regular audits to ensure compliance and to prevent any misuse or leakage of sensitive data.

Data is often anonymized or aggregated where possible to protect sensitive details while maintaining the analytical value of the information. This ensures that the process is compliant and reduces the risk of sensitive information being compromised.

Key Topics to Learn for Scouting Opponents Interview

- Competitive Intelligence Gathering: Understanding the methods and ethics of collecting information on competitors. This includes identifying key players, their strategies, and market position.

- Strategic Analysis: Applying analytical frameworks to interpret gathered intelligence and identify opportunities and threats. This includes SWOT analysis and competitive benchmarking.

- Risk Assessment & Mitigation: Evaluating potential risks associated with competitor actions and developing strategies to mitigate negative impacts.

- Scenario Planning: Developing proactive strategies by considering various potential scenarios based on competitor actions and market dynamics.

- Data Visualization & Presentation: Effectively communicating competitive intelligence findings through clear and concise presentations using data visualization techniques.

- Legal & Ethical Considerations: Understanding the boundaries of acceptable intelligence gathering practices and adhering to ethical guidelines.

- Technological Tools & Resources: Familiarity with software and databases used for competitive intelligence gathering and analysis.

Next Steps

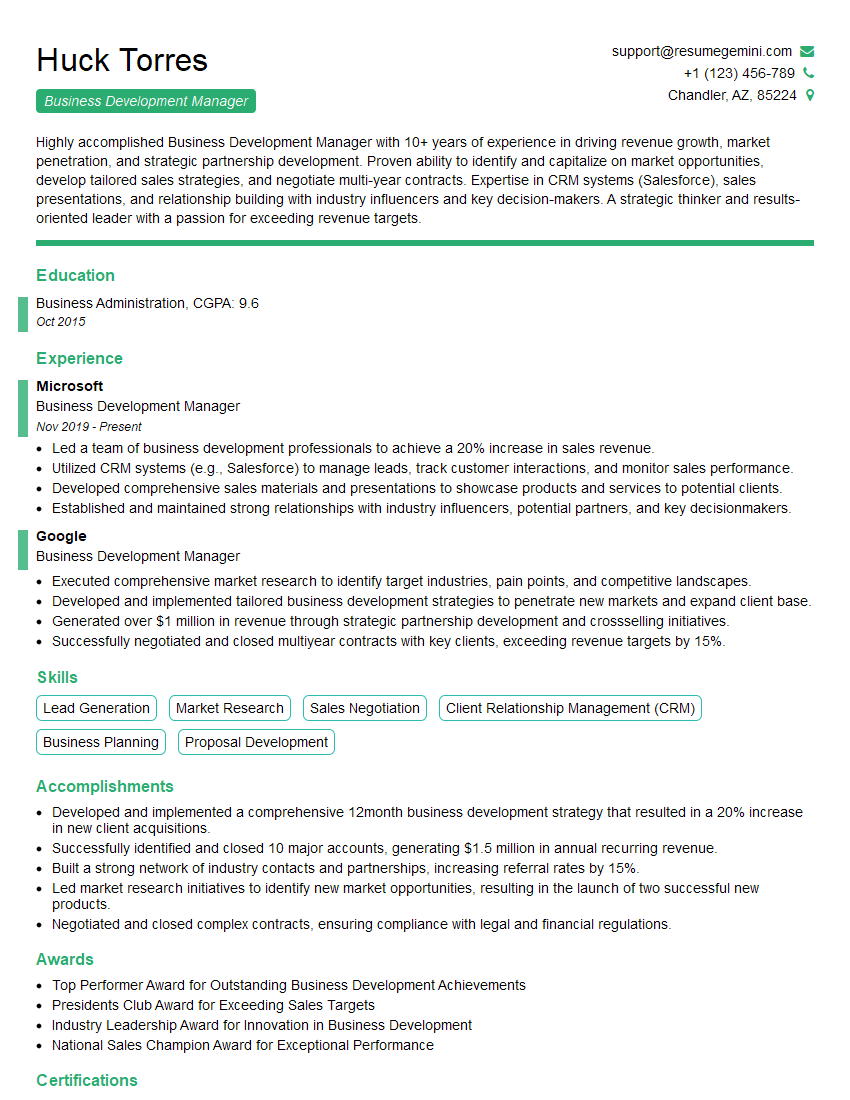

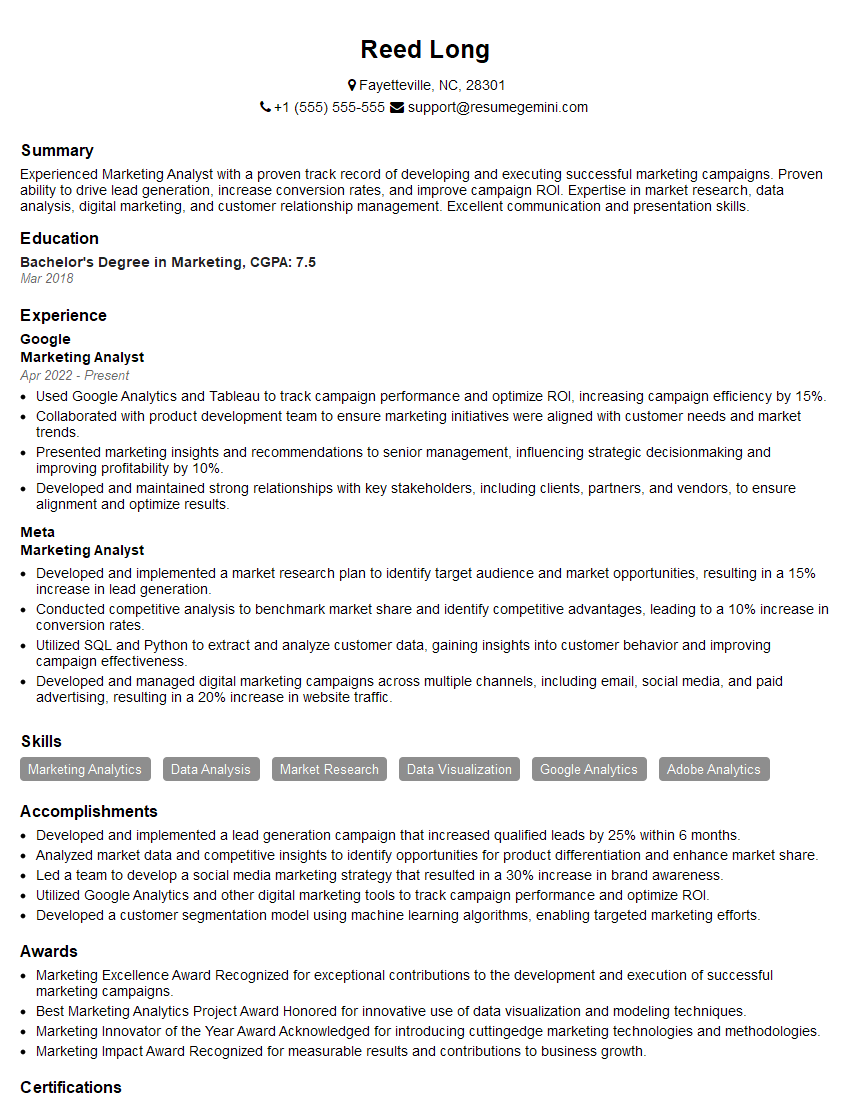

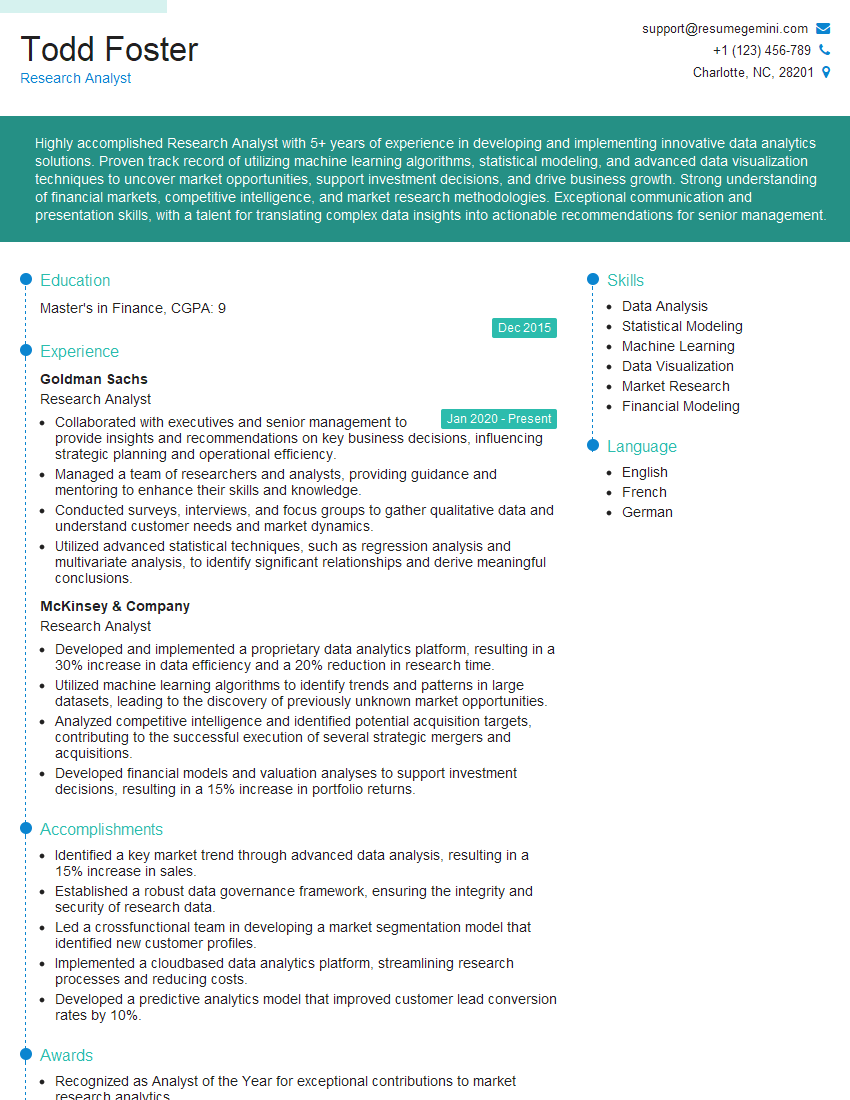

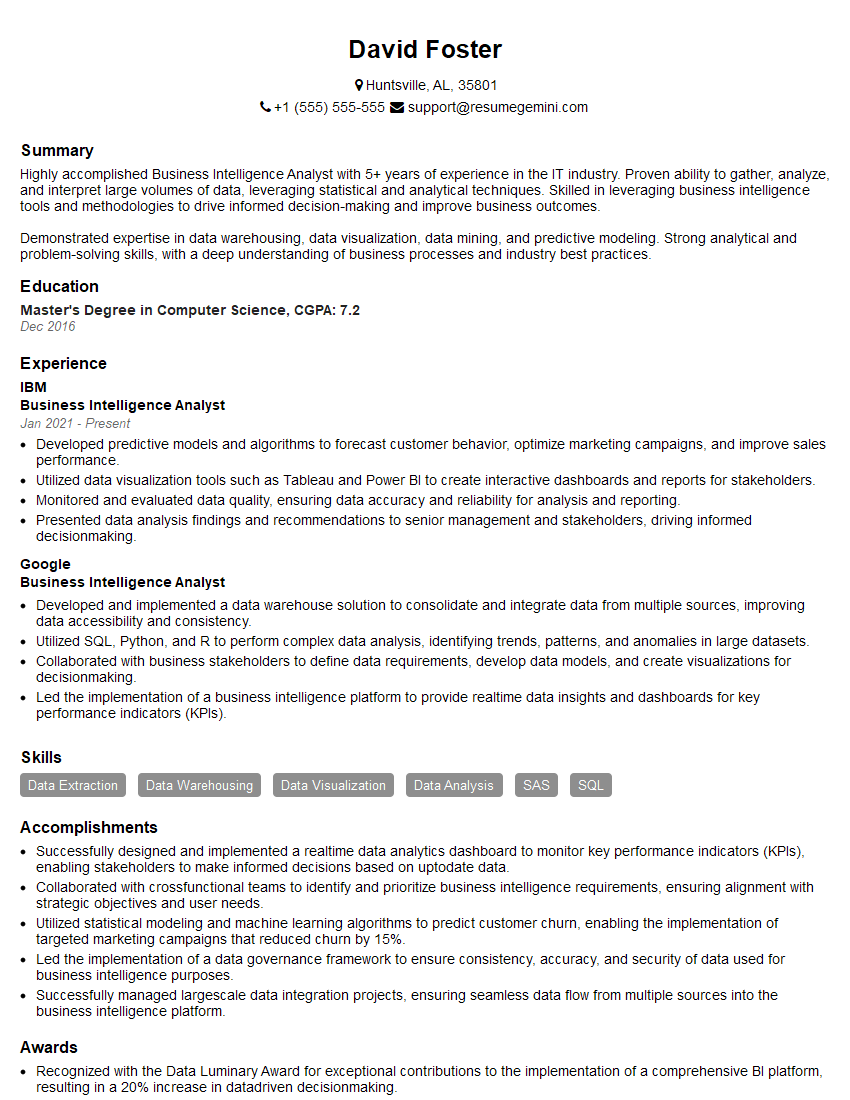

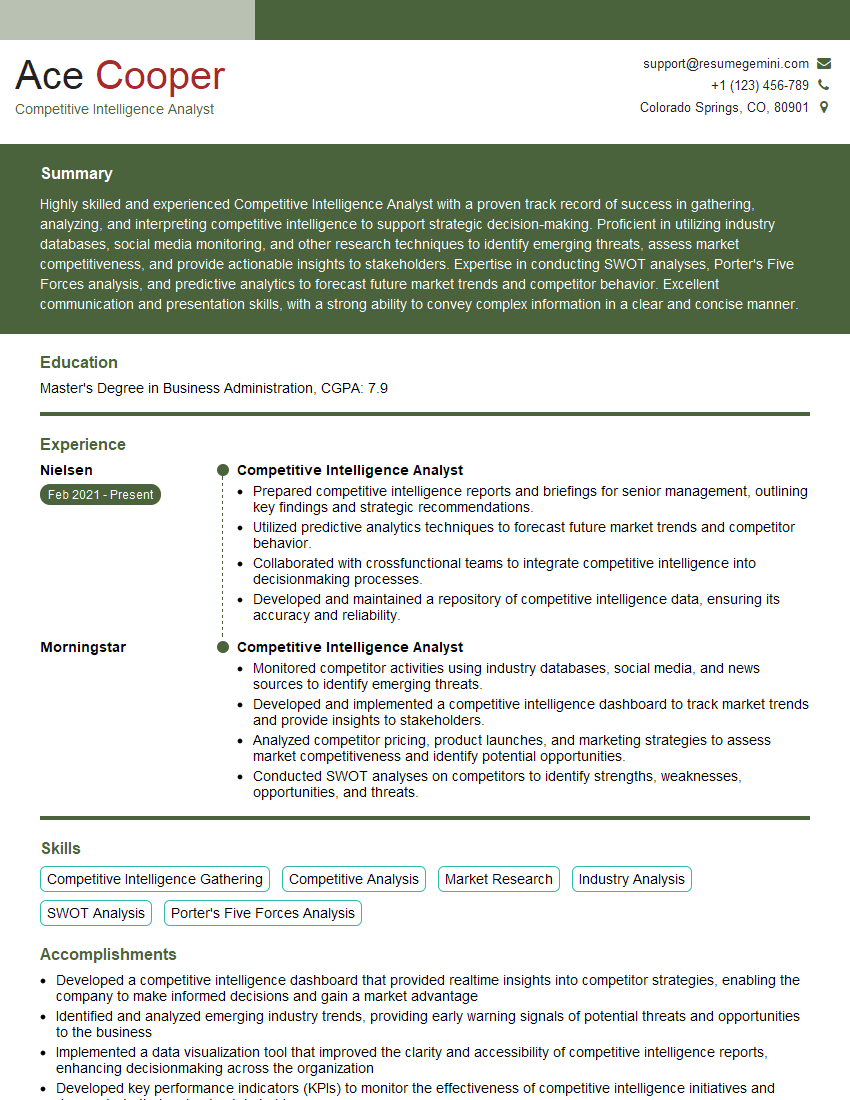

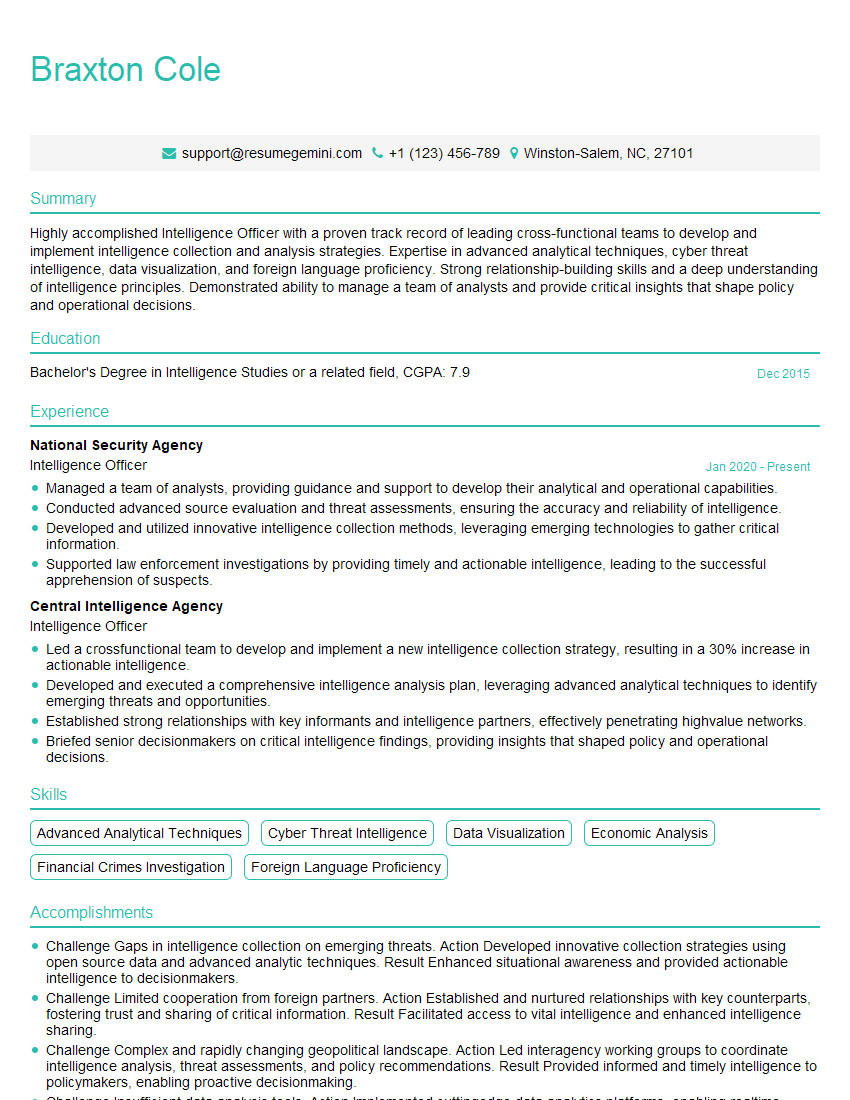

Mastering the art of Scouting Opponents is crucial for career advancement in today’s competitive landscape. It demonstrates strategic thinking, analytical skills, and a proactive approach to problem-solving – highly valued attributes in many industries. To significantly boost your job prospects, create an ATS-friendly resume that highlights these skills. ResumeGemini is a trusted resource that can help you craft a compelling and effective resume. We provide examples of resumes tailored to Scouting Opponents roles to help guide you. Take the next step towards your dream job – build a resume that showcases your expertise in Scouting Opponents today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good