Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Strong Understanding of Accounting Principles interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Strong Understanding of Accounting Principles Interview

Q 1. Explain the difference between accrual and cash accounting.

The core difference between accrual and cash accounting lies in when revenue and expenses are recognized. Cash accounting records transactions only when cash changes hands – when money is received (revenue) or paid out (expenses). Think of it like tracking your personal checking account: you only see income when it’s deposited and expenses when they leave your account. Accrual accounting, on the other hand, recognizes revenue when it’s earned and expenses when they’re incurred, regardless of when cash actually flows. This means that revenue is recorded when a service is provided or goods are delivered, even if payment isn’t received immediately, and expenses are recorded when they are used, even if they haven’t been paid yet.

Example: Imagine a small bakery. Under cash accounting, they’d only record the sale of a cake when the customer pays. If the customer buys a cake on credit, the sale wouldn’t be recorded until the payment is received. Under accrual accounting, the sale would be recorded when the cake is delivered to the customer, regardless of when they pay.

Accrual accounting provides a more accurate picture of a company’s financial performance over time because it matches revenues and expenses more closely to when they actually occur. It’s the method required by Generally Accepted Accounting Principles (GAAP) for most businesses.

Q 2. What are the generally accepted accounting principles (GAAP)?

Generally Accepted Accounting Principles (GAAP) are a common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB). They’re designed to ensure that financial statements are consistently prepared, reliable, and comparable across different companies. Think of GAAP as a common language for financial reporting. Without them, comparing financial statements from different companies would be like comparing apples and oranges.

Key principles within GAAP include:

- Relevance: Financial information should be useful for decision-making.

- Reliability: Information should be verifiable and free from bias.

- Comparability: Statements should be comparable across time and between different companies.

- Consistency: A company should use the same accounting methods from period to period.

- Materiality: Only significant information needs to be disclosed.

- Conservatism: In situations of uncertainty, expenses and liabilities should be recognized more readily than revenues and assets.

Compliance with GAAP is crucial for public companies as it enhances transparency and investor confidence.

Q 3. Describe the accounting equation (Assets = Liabilities + Equity).

The accounting equation, Assets = Liabilities + Equity, is the foundation of double-entry bookkeeping. It highlights the fundamental relationship between a company’s resources (assets), its obligations (liabilities), and the owners’ stake (equity).

Assets are what a company owns – things like cash, accounts receivable (money owed to the company), inventory, equipment, and buildings. Liabilities represent what a company owes to others – things like accounts payable (money owed to suppliers), loans, and salaries payable. Equity is the residual interest in the assets of an entity after deducting its liabilities – essentially, the owners’ investment in the company plus retained earnings (profits accumulated over time).

Example: If a company has $100,000 in assets and $40,000 in liabilities, its equity is $60,000 ($100,000 = $40,000 + $60,000). This equation must always balance; every transaction affects at least two accounts to maintain this equality.

Q 4. How do you handle adjusting entries?

Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recognized in the correct period and that the financial statements accurately reflect the company’s financial position. They’re necessary because some transactions don’t have an immediate impact on the cash account.

Types of Adjusting Entries:

- Accruals: Recording revenue earned but not yet received (accrued revenue) or expenses incurred but not yet paid (accrued expenses). Example: Recording accrued salaries at the end of the month.

- Deferrals: Adjusting prepaid expenses (expenses paid in advance) or unearned revenue (revenue received in advance). Example: Adjusting prepaid insurance to reflect the portion used during the period.

- Depreciation: Allocating the cost of a long-term asset over its useful life. Example: Recording depreciation expense for equipment.

Process: Adjusting entries involve debiting one account and crediting another to maintain the accounting equation’s balance. They are made before preparing the financial statements.

Q 5. Explain the process of closing the books at the end of an accounting period.

Closing the books is the process of transferring the balances of temporary accounts (revenue, expense, and dividends) to the retained earnings account at the end of an accounting period. This prepares the accounts for the next period’s transactions, ensuring a clean slate. Think of it like resetting a game after a round.

Steps:

- Close revenue accounts: Debit each revenue account and credit retained earnings for the total revenue.

- Close expense accounts: Credit each expense account and debit retained earnings for the total expenses.

- Close dividends account: Debit retained earnings and credit the dividends account for the total dividends paid.

- Prepare a post-closing trial balance: Verify that the debit and credit balances are equal in permanent accounts (assets, liabilities, and equity).

After closing the books, only the permanent accounts retain their balances, ready for the next accounting cycle. This ensures that financial statements accurately reflect the company’s financial performance and position at the end of the period.

Q 6. What are the different types of financial statements?

Several key financial statements provide different perspectives on a company’s financial health. They’re often prepared at the end of each accounting period and are crucial for internal management and external stakeholders.

- Income Statement: Shows a company’s revenues, expenses, and resulting net income or net loss over a specific period.

- Balance Sheet: Presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows the accounting equation in action.

- Statement of Cash Flows: Tracks the movement of cash into and out of a company over a specific period, categorized into operating, investing, and financing activities.

- Statement of Changes in Equity: Details the changes in a company’s equity over a specific period, including contributions from owners, retained earnings, and dividends.

These statements, when considered together, offer a comprehensive understanding of a company’s financial performance and position.

Q 7. How is depreciation calculated, and what are the different methods?

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It reflects the decrease in an asset’s value due to wear and tear, obsolescence, or other factors. It’s not about determining the asset’s market value, but rather allocating its cost over the period it benefits the business.

Methods of Depreciation: Several methods exist, each with its own formula and assumptions:

- Straight-Line Depreciation: This is the simplest method, allocating an equal amount of depreciation expense each year.

Annual Depreciation = (Asset Cost - Salvage Value) / Useful Life - Declining Balance Depreciation: This method accelerates depreciation, resulting in higher expense in the early years and lower expense in later years. A fixed rate is applied to the asset’s book value each year.

- Units of Production Depreciation: This method bases depreciation on the asset’s actual usage. Depreciation expense is higher in years of greater usage.

Depreciation per Unit = (Asset Cost - Salvage Value) / Total Units Expected to be Produced

The choice of method depends on factors like the asset’s nature, its expected usage pattern, and company policy. It’s important to maintain consistency in the method used for a particular asset over its useful life.

Q 8. What is the difference between a debit and a credit?

Debits and credits are the foundation of double-entry bookkeeping. Think of them as two sides of the same coin, always balancing each other. A debit increases the balance of asset, expense, and dividend accounts, while it decreases the balance of liability, equity, and revenue accounts. Conversely, a credit increases the balance of liability, equity, and revenue accounts, while it decreases the balance of asset, expense, and dividend accounts.

A simple analogy: Imagine a seesaw. Debits are on one side, and credits are on the other. For the seesaw (your accounting equation) to remain balanced (Assets = Liabilities + Equity), every debit must have a corresponding credit, and vice-versa. This ensures the fundamental accounting equation always holds true.

- Example: If a company buys equipment for $10,000 cash, it debits the Equipment account (increasing its asset) and credits the Cash account (decreasing its asset). Both sides are impacted equally, maintaining balance.

Q 9. Explain the concept of working capital.

Working capital is a measure of a company’s short-term liquidity, representing its ability to meet its immediate obligations. It’s calculated as the difference between current assets (assets expected to be converted into cash within a year) and current liabilities (obligations due within a year).

Working Capital = Current Assets - Current Liabilities

A positive working capital indicates the company has enough readily available assets to cover its short-term debts. A negative working capital suggests potential liquidity issues. For example, a company with $50,000 in current assets and $30,000 in current liabilities has a working capital of $20,000, demonstrating a healthy financial position in the short term. Businesses regularly monitor working capital to ensure efficient operations and avoid financial distress.

Q 10. How do you reconcile bank statements?

Bank statement reconciliation is the process of comparing your company’s cash records (typically your checkbook or accounting software) to the bank’s statement to identify any discrepancies. This is a crucial internal control to prevent fraud and ensure the accuracy of your financial records.

The process typically involves these steps:

- Compare transactions: Match each transaction on your records with the bank statement.

- Identify outstanding checks: These are checks you’ve written but haven’t yet cleared the bank.

- Identify deposits in transit: These are deposits made by your company but not yet recorded by the bank.

- Account for bank charges and errors: Identify and account for bank fees, interest earned, or any errors made by the bank.

- Adjust for errors in your records: Correct any errors in your company’s cash records.

- Prepare a reconciliation statement: Summarize all adjustments to arrive at a balanced figure.

Regular bank reconciliations help catch errors early, identify potential fraud, and maintain accurate financial records, providing a clear picture of your company’s cash position.

Q 11. What is the importance of internal controls?

Internal controls are processes and procedures implemented within an organization to safeguard assets, ensure the accuracy and reliability of financial information, promote operational efficiency, and encourage adherence to company policies. They are essential for maintaining the integrity of the financial reporting process and reducing the risk of errors, fraud, and mismanagement.

Examples of internal controls include:

- Segregation of duties: Different individuals handle authorization, recording, and custody of assets.

- Physical controls: Safeguarding assets through locks, security systems, and restricted access.

- Reconciliations: Regularly comparing internal records to external sources (e.g., bank reconciliations).

- Authorizations and approvals: Establishing clear procedures for authorizing transactions.

- Regular audits: Independent reviews of financial records and processes.

Strong internal controls instill confidence in the reliability of financial statements, protect the company from losses, and improve overall operational efficiency.

Q 12. How do you handle accounts receivable and accounts payable?

Accounts receivable represent money owed to a company by its customers for goods or services sold on credit. Accounts payable represent money a company owes to its suppliers or vendors for goods or services received on credit.

Managing accounts receivable involves:

- Invoicing: Accurately and promptly preparing invoices.

- Credit checks: Assessing the creditworthiness of customers before extending credit.

- Following up on overdue payments: Taking appropriate action to collect outstanding amounts.

- Aging analysis: Tracking the age of outstanding receivables to identify potential bad debts.

Managing accounts payable involves:

- Processing invoices: Verifying the accuracy and legitimacy of supplier invoices.

- Matching invoices with purchase orders and receiving reports: Ensuring that goods or services were received as ordered.

- Approving payments: Authorizing payment of invoices according to established procedures.

- Making timely payments: Maintaining good relationships with suppliers and avoiding late payment penalties.

Effective management of both accounts receivable and payable is crucial for maintaining healthy cash flow and strong business relationships.

Q 13. Explain the concept of revenue recognition.

Revenue recognition is an accounting principle that dictates when revenue should be recorded in a company’s financial statements. The core principle is that revenue should be recognized when it is earned, not necessarily when cash is received. The generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) provide specific criteria for determining when revenue is earned.

Key aspects of revenue recognition include:

- Performance obligation: Identifying the specific goods or services the company is obligated to provide to the customer.

- Transaction price: Determining the amount of revenue the company will receive.

- Transfer of control: Recognizing revenue when the company transfers control of the goods or services to the customer.

For example, if a company sells a product to a customer on credit, revenue should be recognized at the time of sale (transfer of control), even though payment might be received later. Proper revenue recognition is critical for presenting a fair and accurate picture of a company’s financial performance.

Q 14. What is inventory valuation, and how is it calculated?

Inventory valuation is the process of assigning a monetary value to a company’s inventory. The valuation method chosen significantly impacts the cost of goods sold (COGS) and the value of inventory reported on the balance sheet. Several methods exist, including:

- First-In, First-Out (FIFO): Assumes that the oldest inventory items are sold first.

- Last-In, First-Out (LIFO): Assumes that the newest inventory items are sold first (Note: LIFO is not permitted under IFRS).

- Weighted-Average Cost: Calculates a weighted average cost for all inventory items.

The choice of method affects reported profits and taxes. FIFO generally results in higher net income during periods of inflation, while LIFO results in lower net income. The weighted-average cost method provides a more stable valuation. The selection should be consistent over time to ensure comparability.

For example, let’s say a company buys 10 units at $10 and 10 units at $12. Under FIFO, if they sell 10 units, COGS is $100; under LIFO, COGS is $120. Accurate inventory valuation is crucial for accurate financial reporting and effective inventory management.

Q 15. What are some common accounting errors?

Common accounting errors stem from human fallibility and can range from simple mistakes to more serious misstatements. Some frequent errors include:

- Incorrect journal entries: These can be due to wrong accounts used, incorrect amounts, or missing entries altogether. For example, recording a purchase of office supplies as an expense instead of an asset (supplies).

- Errors in posting: This happens when transactions are correctly journalized but incorrectly transferred to the general ledger. Imagine a $1000 payment being mistakenly posted as $100.

- Transposition errors: This is where digits are mistakenly swapped. For example, recording $2,400 as $2,040.

- Mathematical errors: Simple addition, subtraction, multiplication, and division errors in calculations. These can propagate throughout the financial statements.

- Failure to record transactions: Completely omitting transactions from the accounting records, potentially leading to understatement or overstatement of various financial statement items. For example, forgetting to record a sale.

- Misclassifications: Improper categorization of assets, liabilities, revenues, or expenses. This is a very common error.

- Inventory errors: Incorrect counting, valuation, or recording of inventory leading to inaccurate cost of goods sold and ending inventory.

Proper training, double-checking of work, and utilizing accounting software with error-checking mechanisms are essential to minimize these errors.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the concept of materiality.

Materiality refers to the significance of an accounting error or omission in influencing the decisions of financial statement users. Essentially, it’s about whether an error is big enough to matter. A misstatement is material if it could reasonably be expected to influence the decisions of users of the financial statements.

There’s no single quantitative threshold for materiality; instead, it’s a professional judgment based on the specific circumstances. Factors considered include the absolute size of the error, the relative size of the error compared to other financial statement items (e.g., net income, total assets), and the nature of the error (e.g., fraud versus an honest mistake).

Example: A $100 error in a company with $10 million in revenue is likely immaterial. However, a $100,000 error in the same company could be very material, potentially impacting key financial ratios and investor decisions. The context is crucial!

Q 17. How do you prepare a trial balance?

A trial balance is a summary of all general ledger accounts and their balances at a specific point in time. It’s used to verify that the debits and credits are equal. If they aren’t, it indicates an error somewhere in the accounting process. Preparation involves these steps:

- Gather account balances: Extract the ending balance for each account in the general ledger. Ensure accuracy.

- Prepare a worksheet: Create a worksheet with columns for account names, debit balances, and credit balances.

- Enter account balances: List each account in the worksheet and enter its debit or credit balance in the appropriate column.

- Calculate totals: Sum up the debit and credit columns separately.

- Verify equality: If the total debits equal the total credits, the trial balance is balanced, indicating that the double-entry accounting system is working correctly. If not, investigate and rectify the discrepancies.

Think of it as a crucial checkpoint before preparing financial statements. It doesn’t guarantee the accuracy of the financial statements (material errors can still exist), but it significantly improves the likelihood of accurate data.

Q 18. What are the key differences between IFRS and GAAP?

Both IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) are sets of accounting rules aimed at ensuring financial reporting transparency and comparability. However, significant differences exist:

- Principles-based vs. Rules-based: IFRS is considered more principles-based, offering broader guidelines and allowing for more professional judgment. GAAP is generally considered more rules-based, providing more specific guidance and leaving less room for interpretation.

- Inventory Valuation: IFRS allows for a wider range of inventory valuation methods (e.g., LIFO is not permitted under IFRS), while GAAP permits LIFO (Last-In, First-Out).

- Revenue Recognition: Both have converged toward similar revenue recognition principles under IFRS 15 and ASC 606, though implementation details might still differ.

- Lease Accounting: Both IFRS 16 and ASC 842 converged to a similar standard for accounting for leases, introducing significant changes.

- Intangible Assets: IFRS and GAAP have differing rules on accounting for development costs of intangible assets (e.g., software).

The choice between IFRS and GAAP depends on the jurisdiction in which the company operates and its listing requirements. Understanding these key differences is crucial for comparing the financial statements of companies using different sets of accounting standards.

Q 19. Explain the concept of deferred revenue.

Deferred revenue, also known as unearned revenue, represents cash received for goods or services that haven’t yet been delivered or performed. It’s a liability because the company owes its customers the performance of the goods or services promised. It’s a crucial concept for businesses that receive advance payments.

Example: A software company sells a subscription for $1200 for a year of service. If they receive the full $1200 upfront, they initially record it as deferred revenue (a liability). As they provide service each month, a portion of the deferred revenue is recognized as revenue (typically $100 per month).

Deferred revenue is initially recorded as a liability on the balance sheet and is recognized as revenue over time when the goods or services are provided. This aligns with the accrual accounting principle of matching revenues to the periods in which they are earned.

Q 20. How do you handle bad debt expense?

Bad debt expense refers to the losses a company incurs due to outstanding and uncollectible accounts receivable. It reflects the reality that some customers won’t pay their bills. There are two main methods to account for bad debt:

- Direct Write-off Method: This method records bad debt expense only when an account is deemed truly uncollectible. It’s simple but doesn’t match expenses with revenues very well. It’s generally not allowed under GAAP or IFRS for most businesses.

- Allowance Method: This method estimates the amount of uncollectible accounts at the end of each accounting period and creates an allowance for doubtful accounts (a contra-asset account that reduces the accounts receivable balance). This is the preferred method under GAAP and IFRS as it reflects the likely outcome more accurately.

Example (Allowance Method): A company estimates that 5% of its $100,000 in accounts receivable will be uncollectible. It would record a bad debt expense of $5,000 ($100,000 * 0.05) and increase the allowance for doubtful accounts by $5,000.

The allowance method provides a better matching of expenses and revenues and gives a more realistic picture of the company’s financial position.

Q 21. What is the difference between a balance sheet, income statement, and cash flow statement?

These three core financial statements provide a comprehensive picture of a company’s financial health:

- Balance Sheet: This statement provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It’s based on the accounting equation: Assets = Liabilities + Equity. It shows what a company owns (assets), what it owes (liabilities), and the owners’ stake (equity).

- Income Statement: This statement shows a company’s revenues and expenses over a period of time (e.g., a year or a quarter). The difference between revenues and expenses is the net income or net loss. It essentially answers the question: ‘How profitable was the company during this period?’

- Statement of Cash Flows: This statement shows the movement of cash in and out of a company during a period. It’s categorized into operating activities (day-to-day business), investing activities (long-term investments), and financing activities (funding sources). It answers: ‘Where did the cash come from and where did it go?’

These statements are interconnected. The net income from the income statement flows into the retained earnings section of the balance sheet. The cash flow statement shows the impact of operating, investing, and financing activities on the cash balance shown in the balance sheet.

Q 22. Describe the process of auditing financial statements.

Auditing financial statements is a systematic and independent examination of an organization’s financial records to ensure they accurately reflect the company’s financial position, performance, and cash flows. Think of it as a thorough health check for a company’s finances. It involves a detailed review of accounting records, internal controls, and financial transactions to assess the reliability and fairness of the presented information.

- Planning: The auditor first understands the client’s business, identifies risks, and develops an audit plan outlining the procedures to be performed.

- Risk Assessment: Auditors assess the risk of material misstatement in the financial statements. This includes evaluating internal controls and identifying areas requiring more intense scrutiny.

- Testing Internal Controls: Auditors test the effectiveness of internal controls designed to prevent or detect errors and fraud. This might involve observing procedures, reviewing documentation, and performing inquiries.

- Substantive Procedures: These procedures directly test the amounts and disclosures in the financial statements. This includes examining supporting documentation for transactions, performing analytical procedures (comparing financial data to expectations), and confirming balances with external parties.

- Reporting: The auditor issues an audit report expressing an opinion on the fairness of the financial statements. The opinion can be unqualified (clean), qualified (with some exceptions), adverse (statements are materially misstated), or disclaimer of opinion (insufficient evidence to form an opinion).

For example, imagine auditing a small retail business. We would examine sales records, inventory counts, bank statements, and accounts payable to verify the accuracy of reported revenues, costs, and profits. We’d also review internal controls, such as segregation of duties, to ensure that the company is minimizing the risk of fraud.

Q 23. Explain the concept of cost accounting.

Cost accounting is a specialized branch of accounting that focuses on the planning, recording, analyzing, and controlling of costs incurred in a business. It’s all about understanding where your money is going and how to manage it effectively. Instead of just focusing on overall financial performance, cost accounting dives deep into the individual costs of producing goods or services.

Its main goal is to help businesses make better decisions by providing detailed cost information. This information is used for pricing decisions, managing inventory, improving efficiency, and evaluating the profitability of different products or services. For example, a manufacturing company might use cost accounting to determine the cost of producing a single unit of its product, including direct materials, direct labor, and manufacturing overhead.

Key concepts in cost accounting include:

- Direct Costs: Directly traceable to a specific product or service (e.g., raw materials, direct labor).

- Indirect Costs: Not easily traceable to a specific product or service (e.g., factory rent, utilities).

- Cost Allocation: Assigning indirect costs to products or services based on a predetermined allocation method (e.g., machine hours, labor hours).

- Cost Behavior: How costs change in response to changes in activity levels (e.g., fixed costs, variable costs).

Q 24. How do you calculate cost of goods sold (COGS)?

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company. It’s a crucial figure for determining a company’s profitability. Calculating COGS involves summing up all the costs directly related to creating the products that were sold during a specific period.

The basic formula is:

Beginning Inventory + Purchases - Ending Inventory = Cost of Goods SoldLet’s break it down:

- Beginning Inventory: The value of inventory at the start of the accounting period.

- Purchases: The cost of all goods purchased during the accounting period.

- Ending Inventory: The value of inventory remaining at the end of the accounting period.

Example:

A bakery starts the month with $500 worth of ingredients (Beginning Inventory). They purchase an additional $1000 worth of ingredients (Purchases) during the month. At the end of the month, they have $300 worth of ingredients left (Ending Inventory). Therefore, their COGS is: $500 + $1000 – $300 = $1200

The method used to value inventory (FIFO, LIFO, weighted average) will impact the precise COGS figure.

Q 25. What is a variance analysis?

Variance analysis is a crucial technique used to compare planned or budgeted results with actual results. It helps businesses understand why things didn’t go as expected, pinpoint problem areas, and take corrective actions. The difference between the planned and actual figures is known as a variance. A favorable variance implies the actual performance is better than planned, while an unfavorable variance suggests otherwise.

Variance analysis is used across different areas, including sales, production, and costs. For example, a sales variance might compare actual sales revenue to the budgeted sales revenue. Similarly, a cost variance could compare actual production costs to the budgeted production costs. By analyzing variances, businesses can identify areas needing improvement, such as inefficiencies in production or underperformance in sales.

Example: A company budgets to produce 1000 units at a cost of $10 per unit ($10,000 total). They actually produce 950 units at a cost of $11 per unit ($10,450 total). The production cost variance is $10,450 – $10,000 = $450 unfavorable. This suggests a need for investigation into why the cost per unit is higher than planned.

Q 26. Explain the concept of break-even analysis.

Break-even analysis is a crucial financial tool that helps businesses determine the point at which their total revenue equals their total costs. In simpler terms, it’s the point where you’re neither making a profit nor incurring a loss. It’s a fundamental concept for understanding profitability and making strategic decisions.

The break-even point can be expressed in terms of units sold or revenue generated. The calculation typically involves identifying fixed costs (costs that remain constant regardless of production volume, such as rent) and variable costs (costs that change with production volume, such as raw materials).

Formula (units): Break-even point (units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Formula (sales revenue): Break-even point (sales revenue) = Fixed Costs / ((Sales Revenue – Variable Costs) / Sales Revenue)

Example: A company has fixed costs of $10,000, a selling price per unit of $20, and variable costs per unit of $10. Their break-even point in units is: $10,000 / ($20 – $10) = 1000 units. This means they need to sell 1000 units to cover all their costs.

Understanding the break-even point is essential for pricing strategies, sales targets, and investment decisions. It allows businesses to assess the viability of new products or services and make informed choices about resource allocation.

Q 27. What are some common accounting software programs?

The accounting software market offers a wide array of options catering to various business sizes and needs. Some popular choices include:

- QuickBooks: A widely used software for small and medium-sized businesses, offering various plans with different features, from simple bookkeeping to inventory management.

- Xero: A cloud-based accounting software gaining popularity for its ease of use and integration with other business tools. It’s particularly suitable for businesses requiring strong collaboration features.

- Sage: A comprehensive suite of accounting software solutions catering to businesses of all sizes, ranging from basic accounting tasks to enterprise resource planning (ERP) systems.

- SAP: A leading provider of enterprise resource planning (ERP) software, often used by large multinational corporations to manage complex accounting and financial processes.

- Oracle NetSuite: Another robust ERP solution, especially suitable for businesses seeking complete integration across various departments and functionalities.

The choice of software depends heavily on factors like business size, complexity of accounting needs, budget constraints, and desired level of integration with other systems.

Q 28. Describe your experience with financial modeling.

My experience with financial modeling spans several years, encompassing various industries and project types. I’ve built models for forecasting revenue, projecting cash flow, valuing businesses, and conducting sensitivity analysis. My expertise includes using spreadsheet software like Excel and specialized financial modeling software.

In a recent project, I developed a detailed three-statement financial model for a startup tech company seeking venture capital funding. This involved forecasting revenues based on market growth assumptions, estimating costs of goods sold and operating expenses, and projecting the company’s balance sheet and cash flow for the next five years. I incorporated key performance indicators (KPIs) to track the company’s progress against its targets and conducted sensitivity analysis to evaluate the impact of different variables on its financial performance. The model proved crucial in securing funding for the company. I also have experience with discounted cash flow (DCF) analysis and leveraged buyout (LBO) models, enabling me to comprehensively assess the financial implications of various business decisions.

My approach to financial modeling emphasizes clarity, transparency, and accuracy. I ensure that the models are well-documented, easy to understand, and robust enough to withstand scrutiny. I regularly test and validate the models to ensure the results are reliable and meaningful.

Key Topics to Learn for a Strong Understanding of Accounting Principles Interview

- Fundamental Accounting Equation: Understanding the relationship between assets, liabilities, and equity is the bedrock of accounting. Be prepared to discuss its application in various scenarios.

- Generally Accepted Accounting Principles (GAAP): Familiarize yourself with the core principles guiding financial reporting. Practice applying these principles to real-world financial transactions.

- Financial Statements: Master the preparation and analysis of balance sheets, income statements, and cash flow statements. Understand how these statements interrelate and provide insights into a company’s financial health.

- Revenue Recognition: Grasp the principles behind recognizing revenue in accordance with GAAP. Be ready to discuss different revenue recognition methods and their implications.

- Cost Accounting: Understand concepts like direct and indirect costs, fixed and variable costs, and how these are used in cost analysis and pricing decisions. Be prepared to discuss cost allocation methods.

- Inventory Management: Explore different inventory costing methods (FIFO, LIFO, weighted-average) and their impact on financial statements. Understand the implications of inventory obsolescence and write-downs.

- Depreciation and Amortization: Master the various methods used to depreciate assets and amortize intangible assets. Be able to explain the impact on financial statements and tax implications.

- Account Reconciliation: Understand the importance of accurate record-keeping and the process of reconciling accounts to ensure financial accuracy. Be prepared to discuss common reconciliation challenges and solutions.

- Ratio Analysis: Learn how to calculate and interpret key financial ratios to assess a company’s profitability, liquidity, and solvency. Be prepared to discuss the significance of different ratios and their limitations.

- Ethics in Accounting: Understand the ethical considerations and professional responsibilities of accountants. Be prepared to discuss situations involving ethical dilemmas and conflicts of interest.

Next Steps

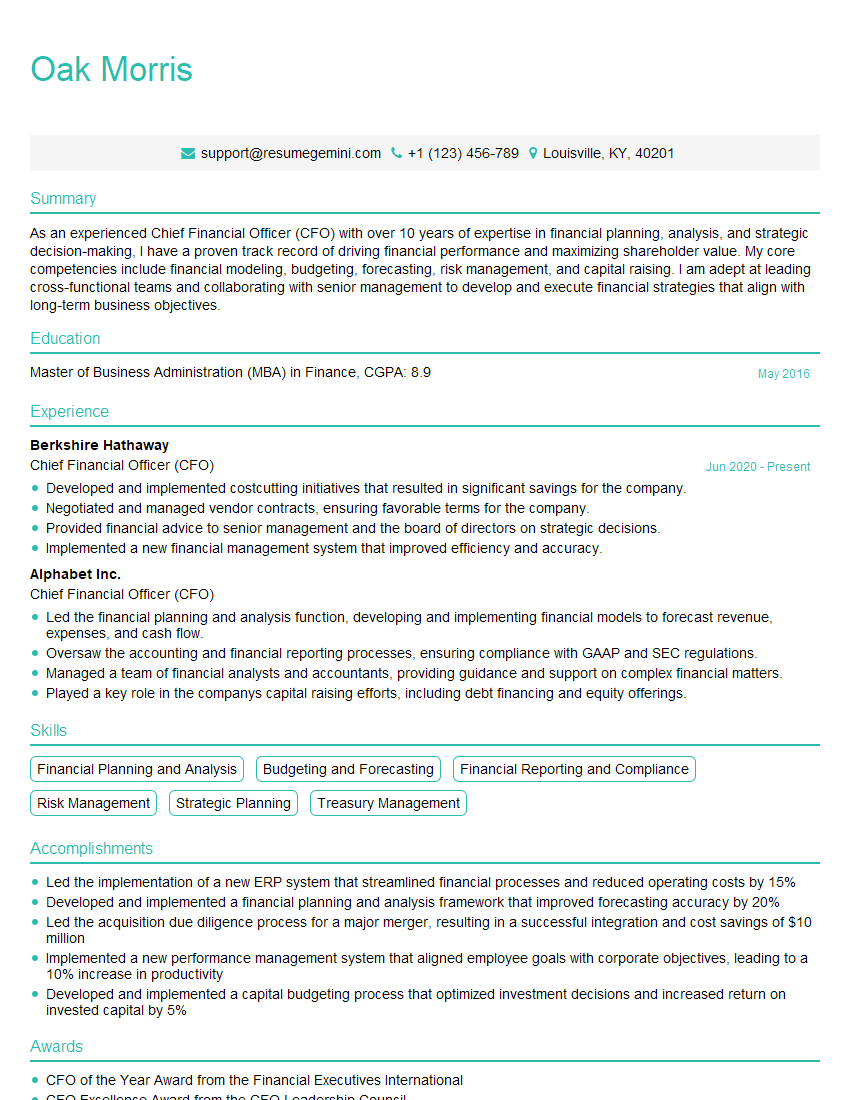

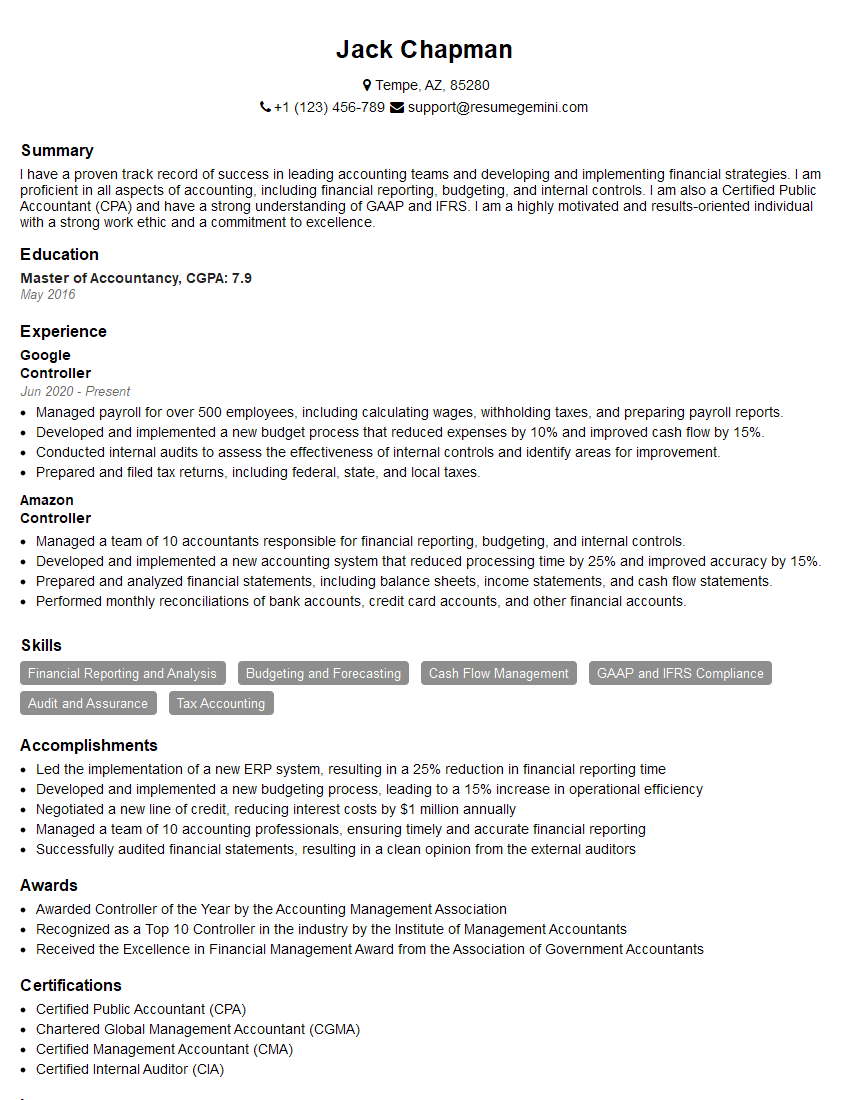

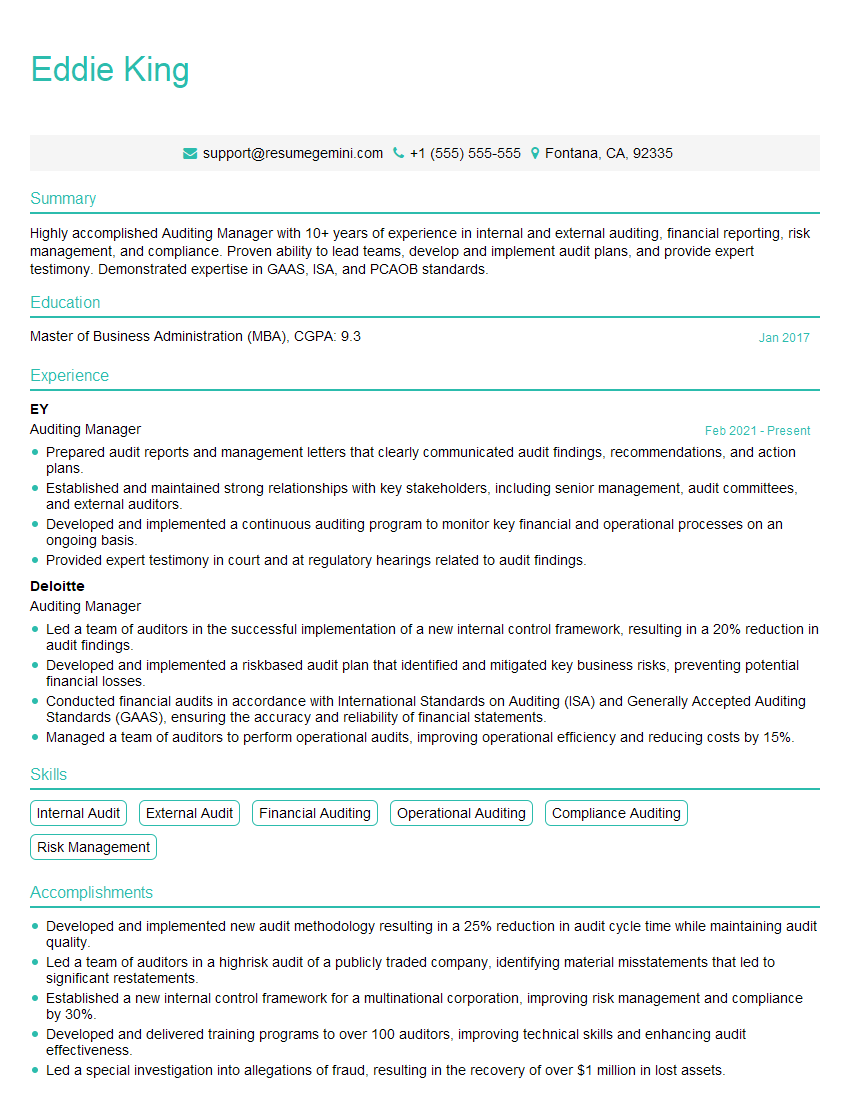

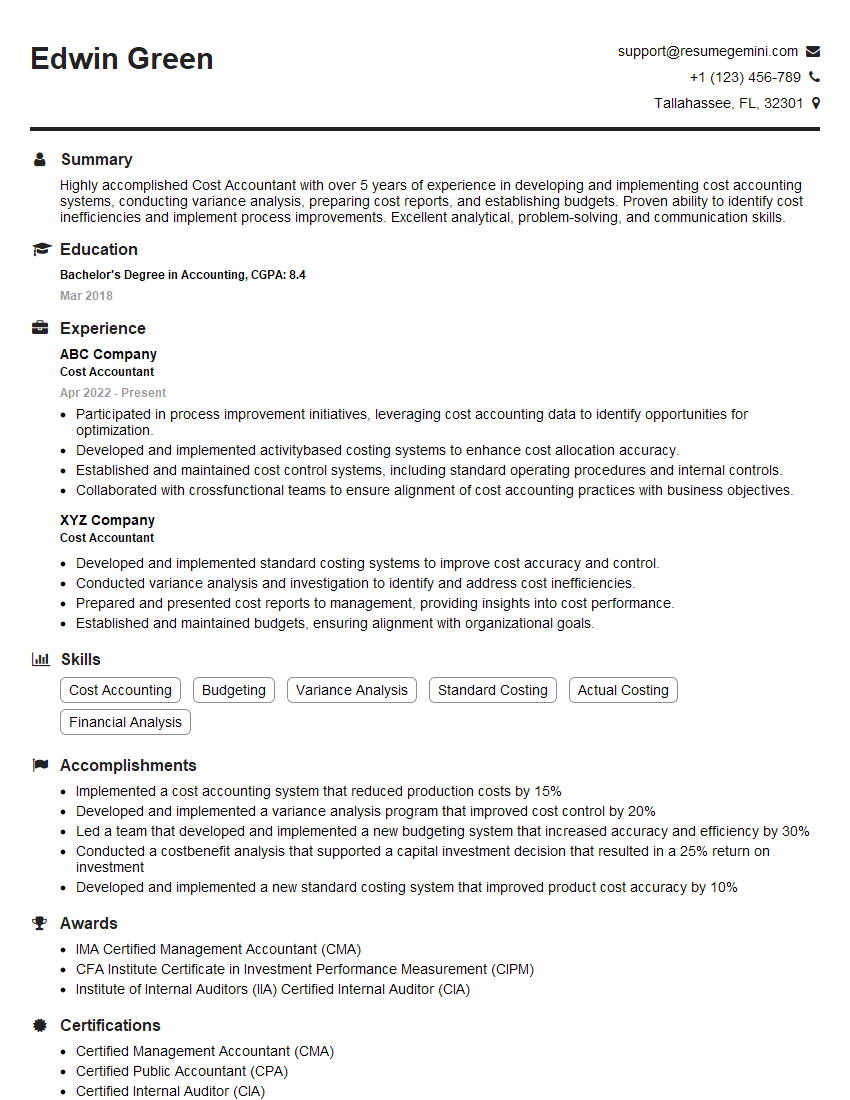

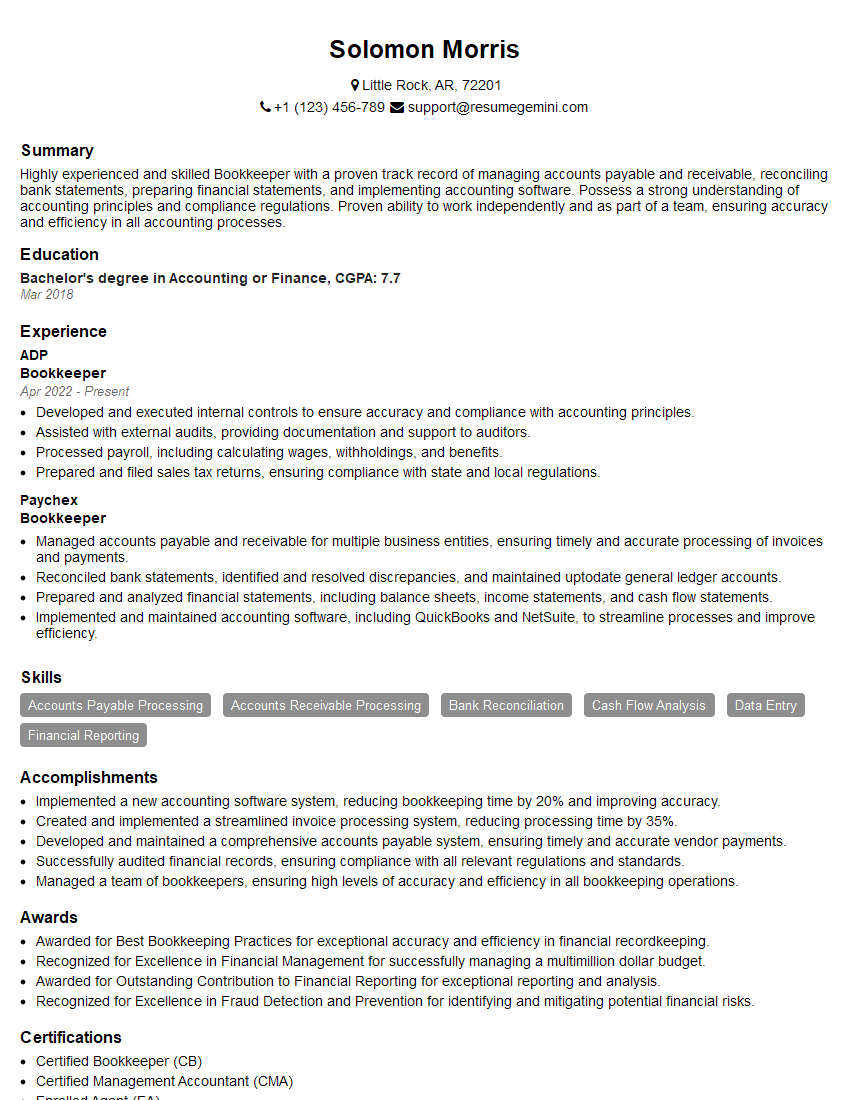

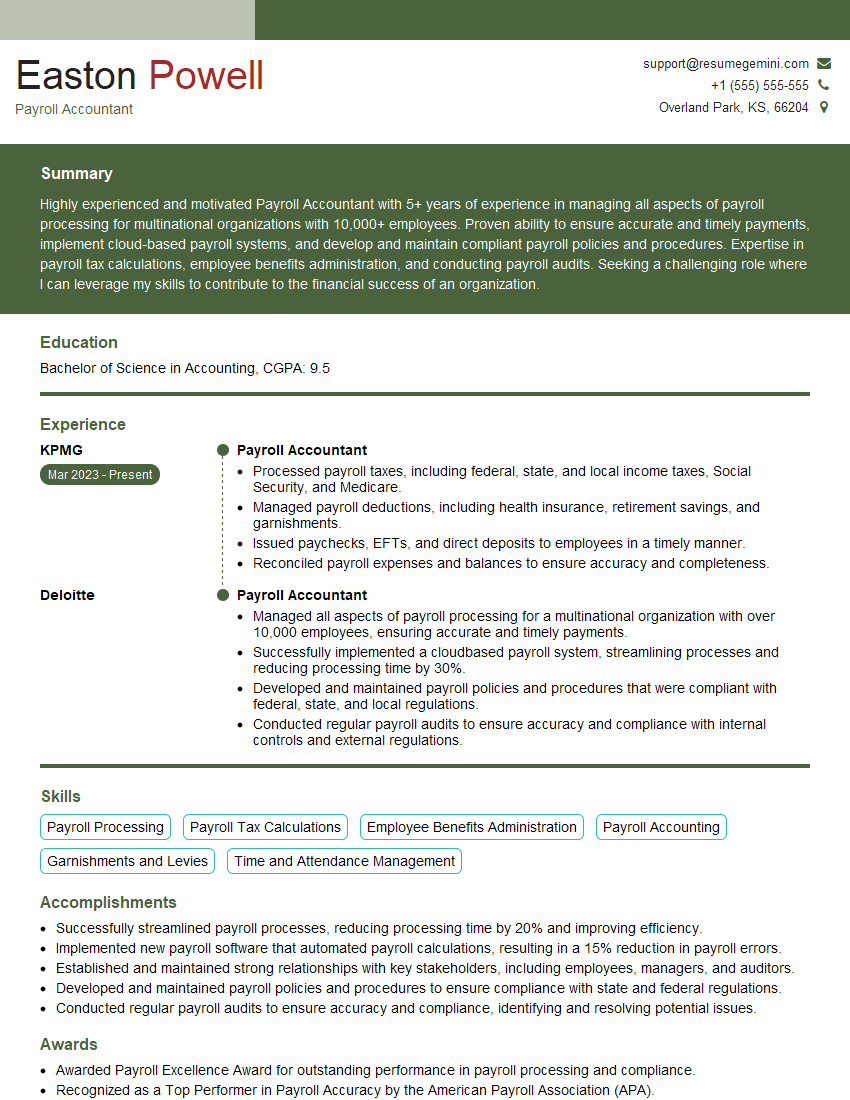

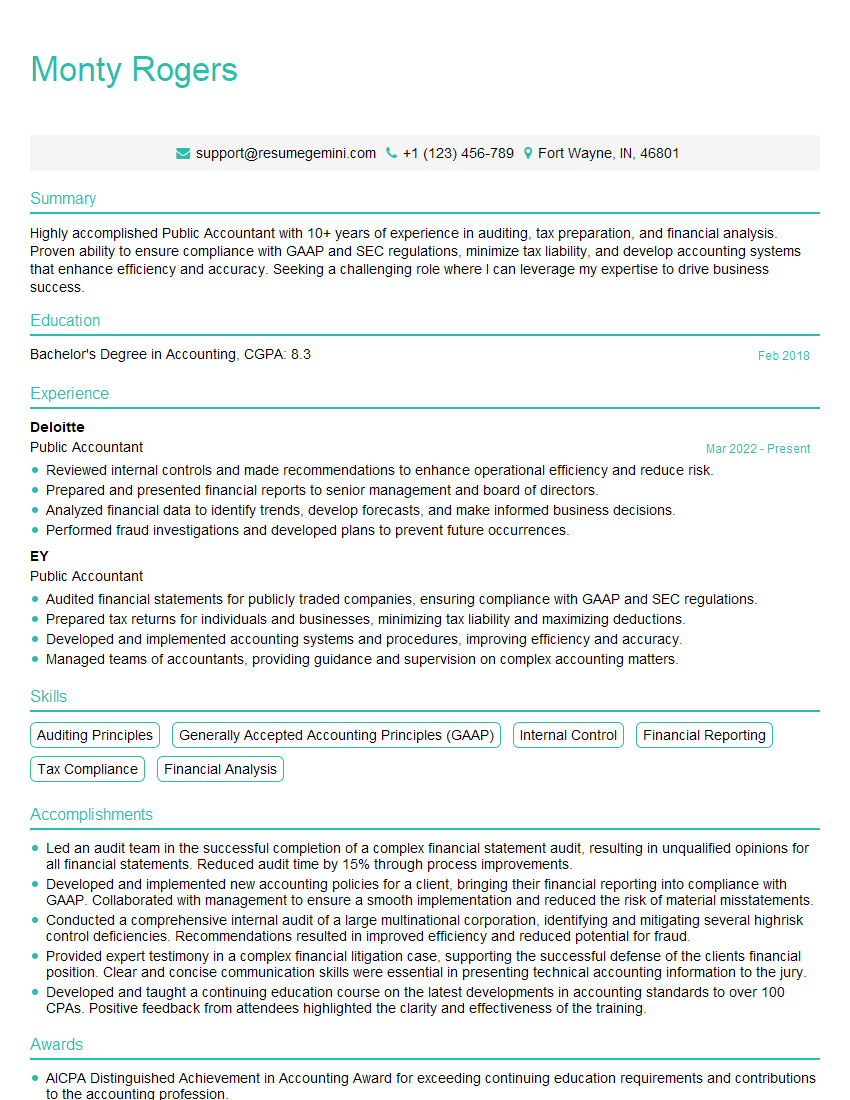

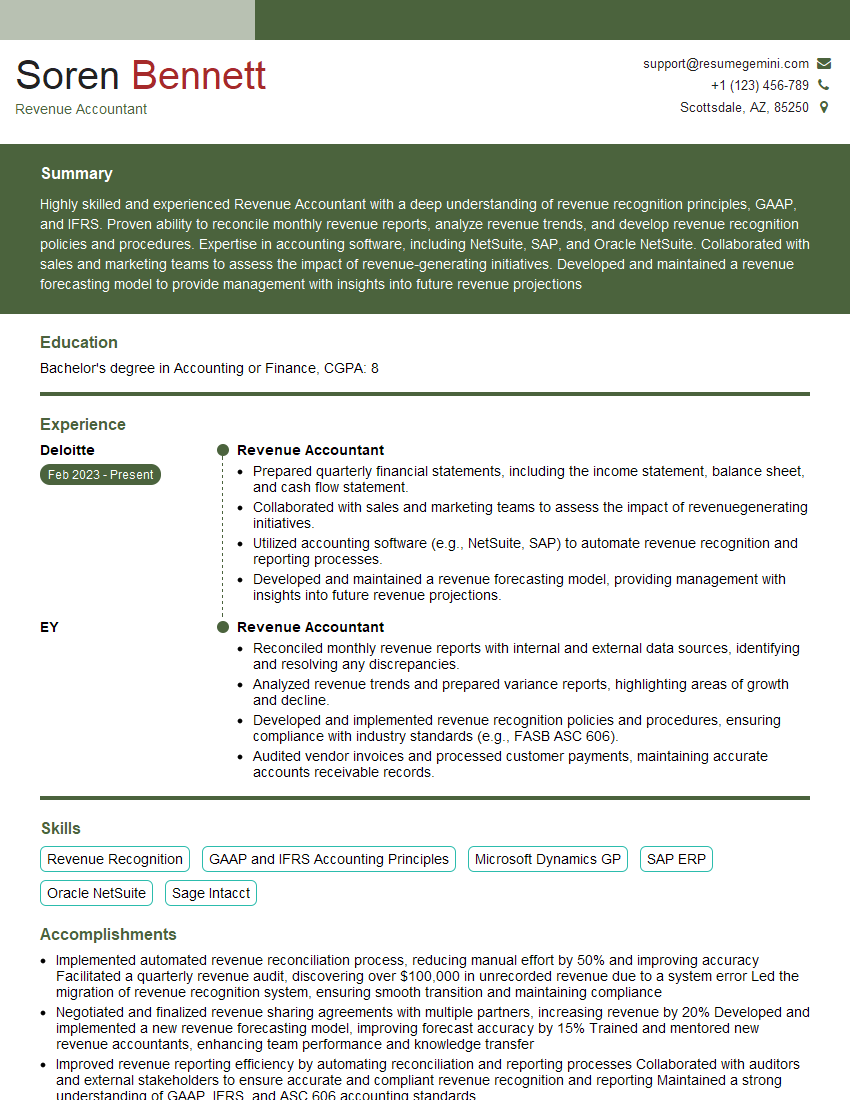

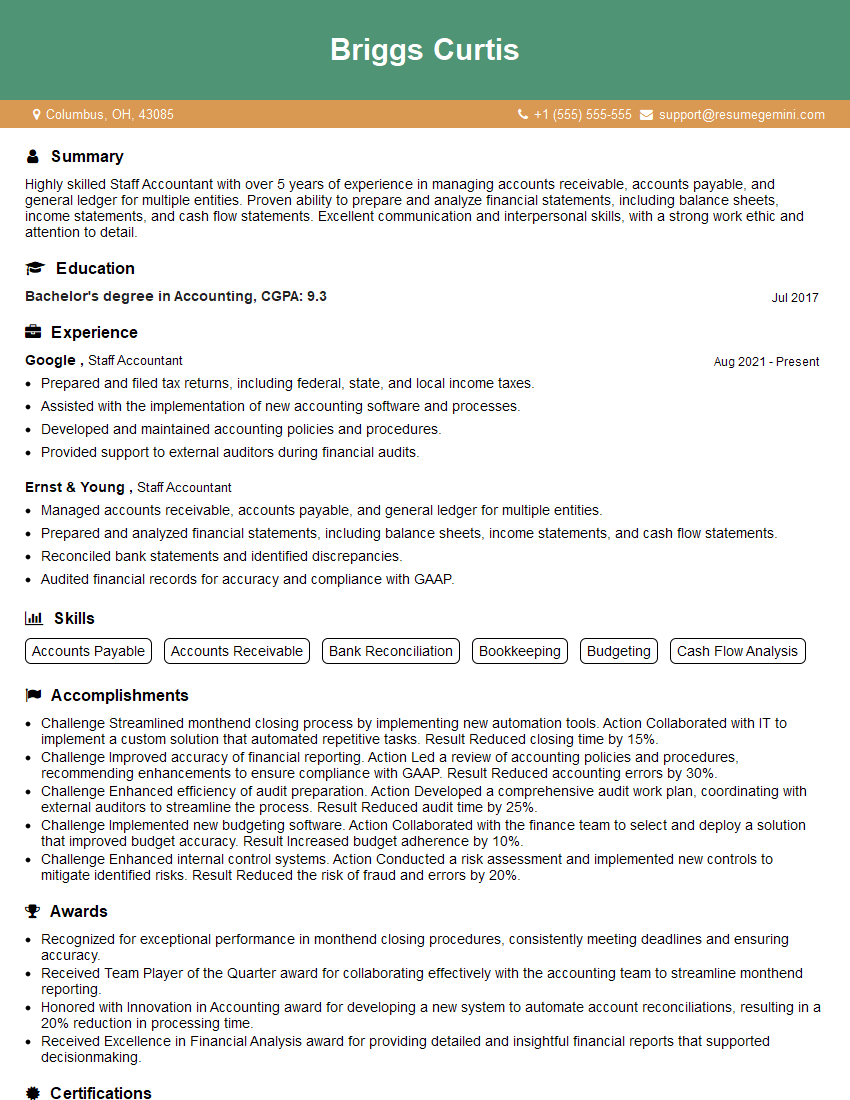

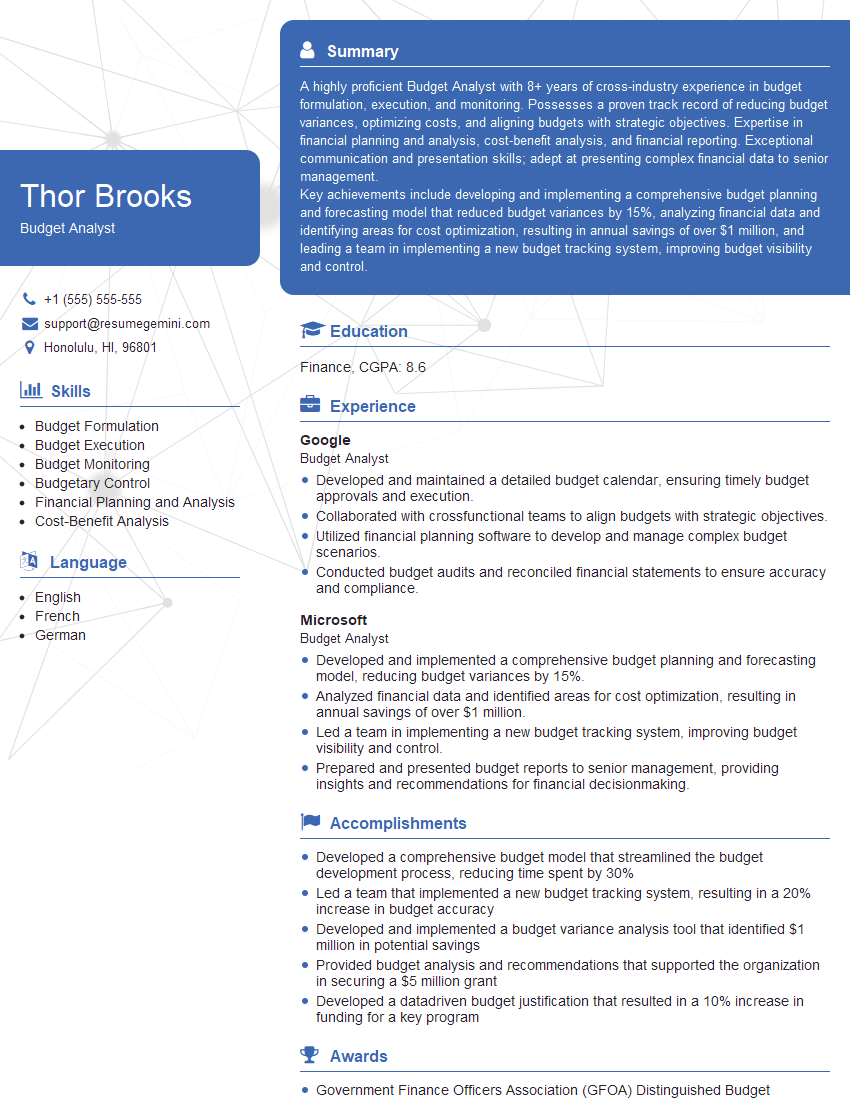

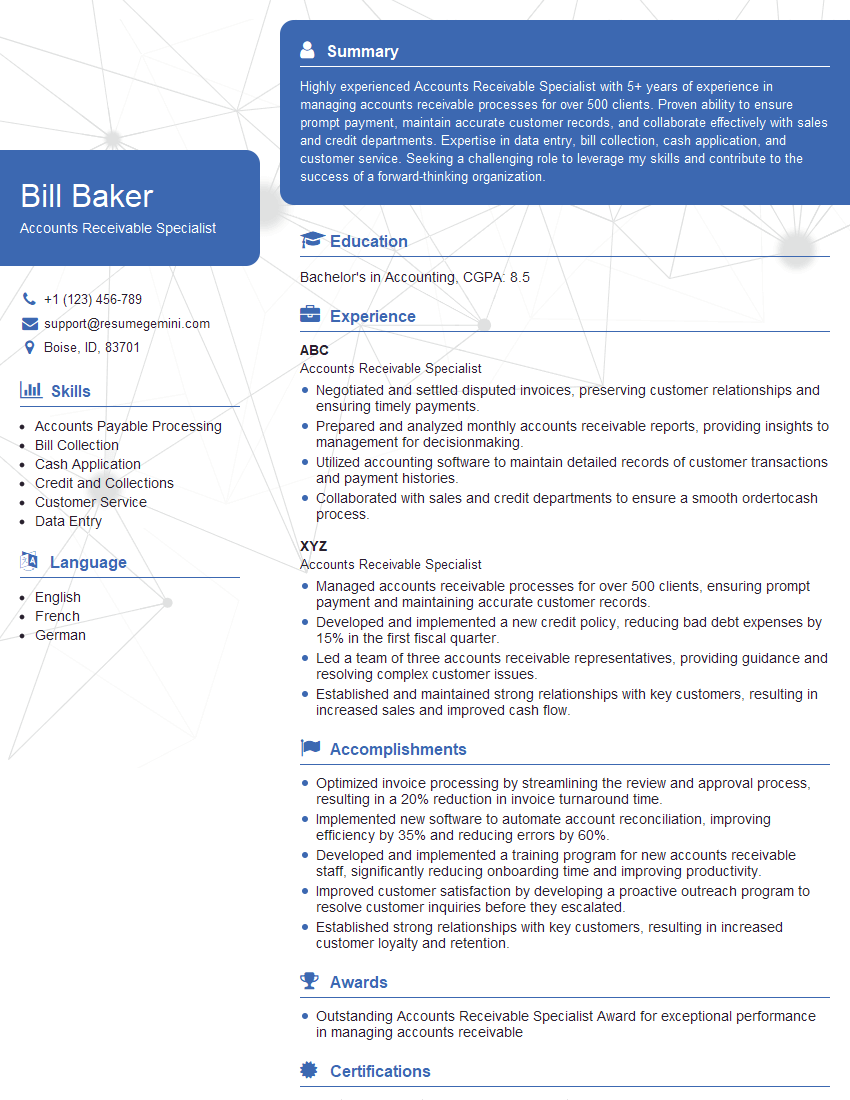

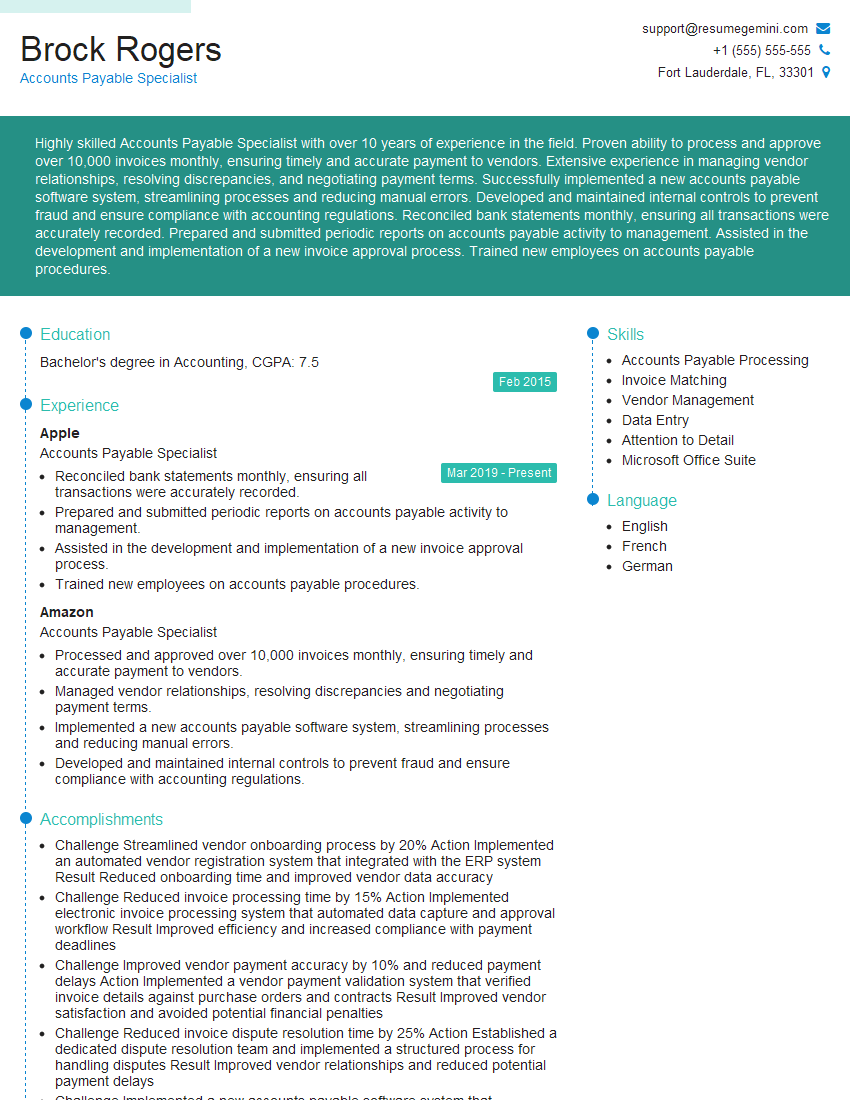

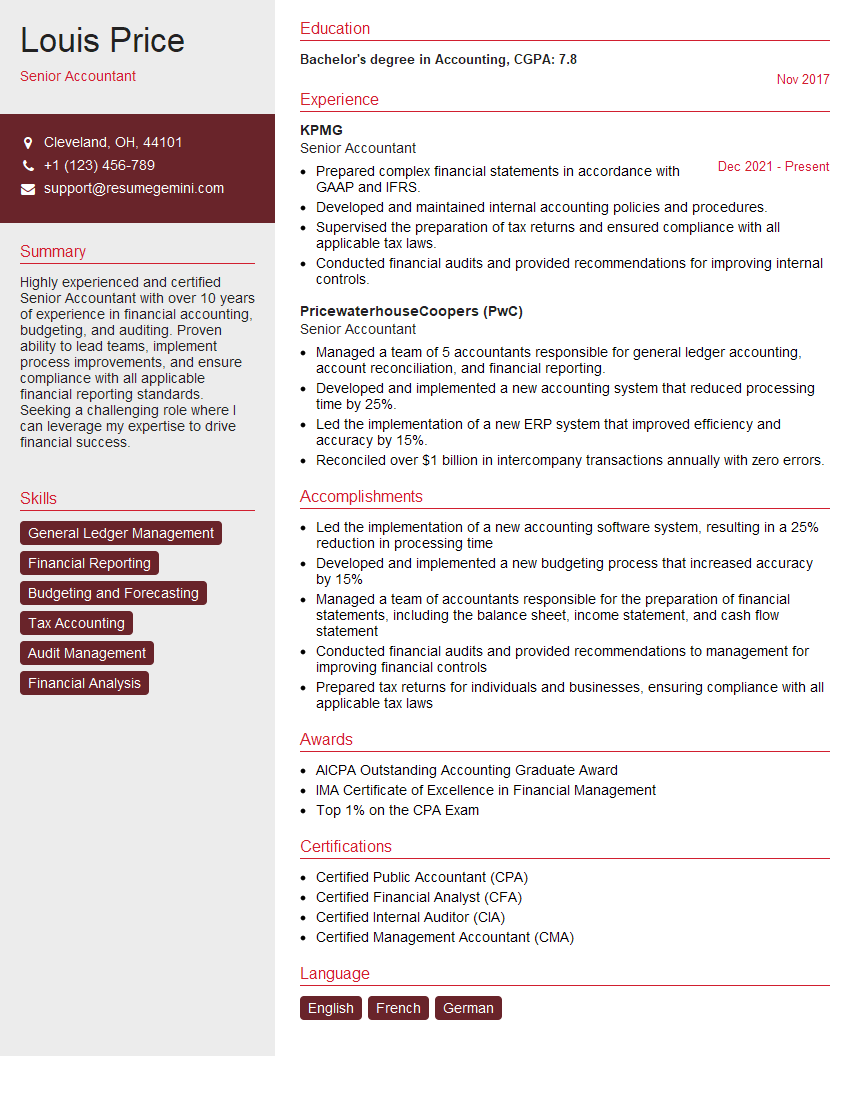

A strong understanding of accounting principles is crucial for career advancement in finance and accounting. It opens doors to higher-level roles and increased earning potential. To maximize your job prospects, crafting a compelling and ATS-friendly resume is essential. ResumeGemini can help you build a professional resume that highlights your skills and experience effectively. They provide examples of resumes tailored to showcase a strong understanding of accounting principles, giving you a head start in your job search.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good