Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Taste and Aroma Evaluation interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Taste and Aroma Evaluation Interview

Q 1. Explain the difference between orthonasal and retronasal olfaction.

Orthonasal olfaction refers to smelling something through your nostrils, like when you sniff a flower. Retronasal olfaction, on the other hand, is the perception of odorants during swallowing and exhalation. This is how we experience the aroma of food while we are eating it. The key difference lies in the pathway the odor molecules take to reach the olfactory receptors. In orthonasal olfaction, the air carrying volatile compounds travels directly through the nasal cavity, while in retronasal olfaction, the volatile compounds are carried through the retronasal pathway from the back of the mouth, passing through the nasopharynx to reach olfactory receptors. Think of it this way: orthonasal is smelling something in the air, while retronasal is smelling the food *in* your mouth.

For example, when you smell freshly baked bread, that’s orthonasal. But the rich, yeasty aroma you experience *while* eating the bread is retronasal. This is why the same food can have a completely different aromatic profile depending on whether you are just smelling it or tasting it.

Q 2. Describe the four basic tastes and their respective receptors.

The four basic tastes are sweetness, sourness, saltiness, and bitterness. Each is detected by specific taste receptor cells located on taste buds primarily on the tongue, but also the palate and epiglottis. These receptors are specialized proteins that bind to taste molecules, triggering a signal transduction cascade that ultimately leads to a nerve impulse to the brain.

- Sweetness: Detected by G protein-coupled receptors (GPCRs), primarily T1R2 and T1R3, which are activated by sugars, artificial sweeteners, and some amino acids. Think of the sweetness of sucrose in sugar cane.

- Sourness: Detected by proton channels (H+ channels) that respond to the hydrogen ion concentration of acidic substances. The more acidic (lower pH) the food, the sourer it tastes. Think of the sourness of lemon juice.

- Saltiness: Detected by sodium ion (Na+) channels that allow sodium ions to pass through the membrane of taste cells. The higher the concentration of sodium chloride, the saltier it tastes. Consider the saltiness of sea salt.

- Bitterness: Detected by a family of GPCRs called T2Rs, which can bind to a vast array of bitter compounds. Many bitter compounds act as a defense mechanism in plants, warning us of potential toxins. Think of the bitterness of coffee.

It’s important to note that taste perception is complex and influenced by other factors like temperature, texture, and aroma.

Q 3. What are the key principles of a well-designed sensory panel?

A well-designed sensory panel is crucial for obtaining reliable and objective data. Key principles include:

- Panel Selection and Training: Recruit panelists who are screened for their sensory acuity and ability to discriminate between samples. Provide comprehensive training on sensory vocabulary, evaluation methods, and hygiene protocols.

- Sample Preparation and Presentation: Maintain consistency in sample preparation and presentation to minimize bias. Use coded samples to prevent bias from prior knowledge.

- Environment Control: Conduct evaluations in a controlled environment free from distractions (noise, odors, visual cues). Use booths to isolate panelists and ensure uniform lighting.

- Statistical Design: Employ appropriate statistical methods to analyze the data and ensure the validity of the results. This could involve randomized designs and appropriate statistical tests to draw meaningful conclusions.

- Data Recording and Analysis: Use standardized forms for recording sensory data. This allows for clear, concise and comparable data. Employ suitable statistical techniques to analyze data.

For instance, a panel evaluating the bitterness of beers would need training on different levels of bitterness, using standardized descriptors. Maintaining consistent temperature and using coded samples would prevent panelists from being influenced by their expectations.

Q 4. How do you handle outliers in sensory data?

Outliers in sensory data can significantly skew results. Before removing them, it’s crucial to investigate the cause. They could be due to genuine differences in product, panellist error (a distracted panelist), or data entry error.

Handling outliers involves a combination of strategies:

- Data Inspection: Carefully examine individual panelists’ data for unusual patterns. Review the data for possible errors in recording or data entry.

- Statistical Analysis: Use statistical methods like the Grubbs’ test or other outlier detection tests to identify statistically significant outliers. These tests determine the probability of a data point arising by chance from the same population as the other data points.

- Investigate the Cause: Before removal, attempt to determine the reason for the outlier. Was the panelist adequately trained? Was there a problem with the sample?

- Removal (Cautious): Only remove outliers if a clear and justifiable reason exists, and document the removal process thoroughly. Extreme caution is required here; removing outliers without investigation can bias the data.

- Alternative Analyses: Consider using non-parametric tests which are less sensitive to outliers. This is particularly useful when the number of outliers is substantial.

For example, if one panelist consistently rates all samples extremely high, this warrants further investigation before deciding whether to remove their data.

Q 5. Explain the difference between affective and descriptive sensory testing.

Affective and descriptive sensory testing methods differ significantly in their objectives and methodologies.

- Affective testing focuses on measuring consumer preferences and overall liking. It gauges the emotional response to a product. Methods include hedonic scaling (rating liking on a scale) and preference tests (choosing between samples). This type of testing is useful in market research, helping companies understand consumer appeal.

- Descriptive testing aims to quantitatively characterize the sensory attributes of a product. Trained panelists describe the sensory properties using a standardized vocabulary. Methods include quantitative descriptive analysis (QDA) where panelists assign numerical scores to specific attributes. The goal is to create a comprehensive sensory profile of the product, assisting in product development and quality control.

For example, an affective test might ask consumers to rate the enjoyment of a new chocolate bar on a scale of 1 to 9. In contrast, a descriptive test would have trained panelists evaluate the chocolate’s attributes using terms such as ‘chocolatey notes’, ‘bitterness’, ‘creaminess’ and assign numerical scores to each.

Q 6. What are some common sensory evaluation methods?

Several common sensory evaluation methods exist, each suited to different objectives:

- Difference tests: Determine if there’s a perceptible difference between two or more samples (e.g., triangle test, paired comparison test).

- Hedonic scaling: Measures consumer liking or preference using scales (e.g., 9-point hedonic scale).

- Ranking tests: Panelists rank samples in order of preference or intensity of a specific attribute.

- Quantitative Descriptive Analysis (QDA): Trained panelists quantitatively describe product attributes.

- Preference mapping: Uses consumer preference data to create a visual representation of product positioning in the sensory space.

The choice of method depends on the research question and the type of information required. For example, a difference test would be appropriate for comparing two versions of a product, while QDA is best for detailed sensory characterization.

Q 7. How do you control for bias in sensory testing?

Controlling for bias is crucial for the validity of sensory testing. Strategies include:

- Blind testing: Samples are coded (e.g., with random three-digit numbers) to prevent panelists from knowing the identity of the samples.

- Balanced presentation: Samples are presented in a randomized order to avoid order effects or carryover effects from one sample to another.

- Mouth cleaning: Panelists use palate cleansers (water, crackers) between samples to remove lingering tastes or aromas.

- Panel training: Thorough training reduces individual bias and ensures consistent application of descriptors.

- Counterbalancing: Different orderings of stimuli are used with different subsets of participants.

- Use of appropriate statistical methods: Analysis of variance (ANOVA) or other suitable statistical methods allows for the detection of systematic errors.

Imagine a study comparing two brands of coffee. Blind testing prevents panelists from favoring one brand due to pre-existing brand loyalty. Random presentation order ensures that a strong-tasting sample doesn’t unduly influence the perception of subsequent samples.

Q 8. Describe the process of creating a sensory profile.

Creating a sensory profile involves systematically describing the sensory attributes of a product. Think of it like creating a detailed ‘sensory fingerprint’. It’s a structured process, usually involving a trained sensory panel. The process typically begins with selecting a panel, then defining the attributes to be evaluated (e.g., for a coffee, this could include aroma intensity, acidity, bitterness, body, etc.). Panelists then use standardized scales or descriptive language to rate the intensity or presence of each attribute. For example, they might score aroma intensity on a scale of 1 to 7, with 1 being ‘very weak’ and 7 being ‘very strong’. The data is then analyzed to create a comprehensive sensory profile that differentiates the product.

Steps involved:

- Panel Selection & Training: Choosing and training panelists to ensure consistency and reliability in their assessments.

- Attribute Definition: Clearly defining the sensory attributes to be evaluated using a vocabulary that everyone understands.

- Sample Preparation: Ensuring consistent sample presentation across the panel.

- Sensory Evaluation: Panellists assess the product based on the defined attributes.

- Data Analysis: Statistical methods are used to summarize and interpret the data collected.

- Profile Development: A comprehensive summary of sensory attributes is created.

For example, a sensory profile of a wine might highlight notes of blackcurrant, cedar, and vanilla in the aroma, a medium body, and high tannins.

Q 9. Explain the concept of sensory thresholds (detection, recognition, difference).

Sensory thresholds represent the minimum level of a stimulus that can be detected or perceived by a sensory panellist. There are three main types:

- Detection Threshold (Absolute Threshold): The lowest concentration of a stimulus that can be detected at least 50% of the time. For instance, the lowest concentration of sugar in water that a taster can detect as sweet.

- Recognition Threshold: The lowest concentration of a stimulus that can be correctly identified. For example, the lowest concentration of vanilla extract in a pudding that can be correctly identified as vanilla.

- Difference Threshold (Just Noticeable Difference or JND): The smallest detectable difference between two stimuli. This is the minimum change in concentration that a taster can reliably distinguish. For example, the smallest amount of salt that needs to be added to a soup for a taster to notice a difference in saltiness.

Understanding these thresholds is crucial for product development. For example, knowing the JND for sweetness helps determine the optimal level of sweetener to use without causing an overly sweet taste.

Q 10. How do you calibrate a sensory panel?

Calibrating a sensory panel is essential to ensure panelists are assessing samples consistently and accurately. It involves a series of exercises to check the panelists’ ability to perceive sensory attributes and to detect differences between samples. Think of it as tuning a musical instrument before a performance.

Calibration methods include:

- Threshold Tests: These assess panelists’ detection and recognition thresholds for relevant attributes (e.g., sweetness, bitterness). This helps to screen out individuals with less acute sensitivity.

- Discrimination Tests: Tests like triangle tests (identifying the odd sample out of three), duo-trio tests (identifying which sample matches a reference), or paired comparison tests (choosing the sample with more intense attribute), evaluate panelists’ ability to discern differences between samples.

- Ranking and Scaling Exercises: Panelists rank or rate samples based on intensity of a specific attribute, to ensure consistency in scoring. For instance, ranking several samples of jam according to their sweetness intensity.

- Descriptive Analysis Training: For trained panels, intensive sessions focus on developing a shared vocabulary and consistently applying descriptive terms to sensory characteristics.

Regular calibration throughout the evaluation period ensures the panel remains sensitive and objective, providing reliable results.

Q 11. What are some common challenges in sensory evaluation?

Sensory evaluation faces several challenges, including:

- Panellist Variability: Individual differences in sensitivity, perception, and biases can affect results. Careful selection and training are crucial to minimize this.

- Environmental Factors: Ambient temperature, lighting, and noise can influence the sensory experience. Controlled testing environments are vital.

- Sample Presentation: Inconsistencies in sample preparation (e.g., temperature, serving size) can lead to inaccurate results. Standardized procedures are essential.

- Order Effects: The order in which samples are presented can influence perception. Randomization of sample order is vital. For example, a highly intense sample presented early can affect the perception of subsequent, less intense samples.

- Cognitive Biases: Panelists may be influenced by their expectations or personal preferences. Blinding (masking the identity of samples) is crucial in mitigating this.

- Data Analysis Complexity: Statistical analysis of sensory data can be complex, requiring specialized expertise.

Overcoming these challenges requires meticulous planning, rigorous protocols, and careful data analysis. In my experience, a robust training programme and continuous panel monitoring are key.

Q 12. Describe your experience with statistical analysis in sensory data.

Statistical analysis is fundamental to sensory evaluation. It allows us to objectively interpret data, identify significant differences between products, and draw meaningful conclusions. My experience encompasses a wide range of techniques:

- Descriptive Statistics: Mean, standard deviation, and frequency distributions to summarize sensory data.

- Analysis of Variance (ANOVA): To compare the means of different samples across multiple attributes and identify statistically significant differences.

- Principal Component Analysis (PCA): To reduce the dimensionality of data and visualize the relationships between different samples based on their sensory profiles.

- Cluster Analysis: To group samples with similar sensory profiles together.

- Non-parametric tests: Such as Friedman’s test and the Wilcoxon signed-rank test, which are useful when data does not meet assumptions of normality.

For example, I’ve used ANOVA to determine if there were significant differences in perceived sweetness between three different formulations of a yogurt, and PCA to visualize the overall sensory differences between competing brands of chocolate. Software such as R and XLSTAT are crucial for these analyses.

Q 13. How do you interpret a triangle test result?

The triangle test is a discrimination test designed to determine if there is a detectable difference between two samples. Panelists are presented with three samples – two are identical, and one is different. They are asked to identify the odd one out.

Interpretation: The results are evaluated using statistical tables to determine if the number of correct identifications is significantly higher than what would be expected by chance (33%). If the result is statistically significant (e.g., p < 0.05), it suggests there is a detectable difference between the two samples. If not, the samples are considered sensory equivalent.

For instance, if 60% of panelists correctly identify the odd sample in a triangle test, and the statistical analysis shows this is significant (p<0.05), we conclude there's a discernible difference between the two samples. A low percentage of correct answers, not exceeding chance levels, suggests the samples are perceptually similar.

Q 14. What is the difference between a trained and untrained sensory panel?

The main difference lies in their level of training and expertise in sensory evaluation.

- Untrained Panels: Consist of individuals without prior sensory training. They are typically used for simple discrimination tests (e.g., triangle tests) to assess overall preference or detect significant differences between products. Their assessments are based on personal perception.

- Trained Panels: Undergo rigorous training to develop their ability to detect, identify, and describe sensory attributes with precision and consistency. They use standardized vocabulary and scales to rate various sensory characteristics. They are employed in more complex sensory evaluation methods such as quantitative descriptive analysis (QDA) where the aim is to generate detailed sensory profiles.

For example, an untrained panel might be used to compare the overall liking of two different types of bread, whereas a trained panel would be used to generate a detailed sensory profile of a complex food item, identifying specific aroma compounds, texture characteristics, and flavour notes.

Q 15. Explain the importance of proper sample preparation in sensory evaluation.

Proper sample preparation is paramount in sensory evaluation because it ensures that the sensory attributes being assessed are representative of the product itself, not artifacts of poor handling. Inconsistencies in temperature, presentation, or serving conditions can significantly skew results. Imagine trying to judge the flavor of a fine wine served lukewarm – the experience would be drastically different from a perfectly chilled glass.

- Temperature Control: Samples should be served at the ideal temperature for optimal aroma and taste release. For instance, coffee should be served hot, while ice cream needs to be at a consistent, cold temperature.

- Serving Vessels: The type of glassware or utensil used can influence sensory perception. Using clear, odorless glasses helps avoid masking the aroma of the product. For example, strong odors from plastic containers can taint the sample.

- Sample Presentation: Samples should be presented uniformly to minimize bias. Blind testing, where panelists don’t know the identity of the sample, is often employed to eliminate preconceived notions. Consistent portion sizes are essential for fair comparison.

- Sample Handling: Protecting samples from contamination and degradation is crucial. Proper storage conditions, avoiding exposure to light or air, and minimizing handling time can preserve the integrity of the sample.

In short, meticulous sample preparation minimizes variability, leading to more reliable and reproducible sensory data, essential for accurate product development and quality control.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you manage sensory fatigue during testing?

Sensory fatigue, the decline in sensitivity of the senses after prolonged exposure to stimuli, is a major challenge in sensory evaluation. Panelists can become desensitized to specific tastes or aromas, leading to inaccurate assessments. To manage this, several strategies are implemented:

- Rest Periods: Regular breaks are incorporated into testing sessions. For instance, after evaluating several samples with strong flavors, a palate cleanser like water or bread may be provided. The length and frequency of breaks depend on the intensity and duration of the testing.

- Sample Sequence: The order of sample presentation can influence perception. Randomizing the order helps avoid adaptation and ensures that panelists don’t develop biases toward specific samples. A balanced presentation, with similar samples interspersed, reduces the potential for sensory fatigue.

- Sample Size: Restricting the number of samples evaluated in a single session limits the onset of fatigue. Multiple sessions, spread out over time, can be more effective than a single, marathon tasting.

- Palate Cleansing: Using appropriate palate cleansers such as plain water, crackers, or neutral-flavored bread can help reset the sensory receptors between sample evaluations.

- Panelist Training: Proper training helps panelists recognize the signs of sensory fatigue and adopt effective coping strategies. This training could involve practice sessions with different sample types and intensities.

By carefully managing these factors, we can mitigate sensory fatigue and ensure the accuracy and reliability of the sensory evaluation data.

Q 17. What are some common flavor compounds and their sensory characteristics?

Many flavor compounds contribute to the overall sensory experience. The interaction of these compounds determines the complexity of a product’s flavor profile. Here are a few examples:

- Vanillin: This is the primary aroma compound in vanilla, providing a sweet, warm, and slightly spicy note.

- Citral: Found in citrus fruits, it contributes a fresh, lemony-citrusy aroma.

- Ethyl Acetate: Often described as having a sweet, fruity, and slightly solvent-like aroma, it’s found in many fruits and wines.

- Methyl Mercaptan: While present in very small amounts, this compound contributes to the characteristic aroma of coffee, imparting a sulfurous, roasted note.

- Linalool: Found in lavender and many other flowers, it contributes a floral, sweet aroma.

- Diacetyl: Contributes a buttery, creamy note, commonly found in butter and dairy products.

It’s important to remember that the perception of these compounds can be influenced by concentration, interaction with other compounds, and individual differences in sensory perception.

Q 18. Describe the influence of temperature on taste and aroma perception.

Temperature plays a significant role in both taste and aroma perception. Changes in temperature affect the volatility of aroma compounds and the activity of taste receptors. For instance, cold temperatures reduce the volatility of aromatic compounds, making aromas less intense. Conversely, warming a product often intensifies aroma.

- Aroma: Increased temperature generally increases the volatility of aroma compounds, leading to a more intense aroma experience. Think of the difference between a cold cup of coffee and a hot one – the aroma of the hot coffee is far more noticeable.

- Taste: Temperature affects the sensitivity of taste receptors. Some tastes are perceived more intensely at specific temperatures. For example, sweetness is often perceived more strongly at higher temperatures, while bitterness may be more pronounced at lower temperatures.

- Texture: Temperature also influences the perception of texture. Think of the difference in texture between a cold and warm chocolate bar.

Optimizing the serving temperature is crucial for achieving the desired sensory experience. Consider the example of ice cream: if it’s too cold, the taste can be muted and the texture too hard, but if it’s too warm, the texture can become overly soft and the flavors less distinct. Finding that ‘goldilocks’ temperature is crucial for providing the optimal sensory experience.

Q 19. How do you assess the interaction between taste and aroma?

Taste and aroma are intricately intertwined, and their interaction significantly impacts the overall flavor perception. This is often referred to as orthonasal (aroma perceived through the nose) and retronasal (aroma perceived through the back of the throat when chewing) olfaction.

Assessing the interaction involves employing techniques that isolate and evaluate each sensory modality separately and then together. This can include:

- Descriptive Analysis: Panelists describe the taste and aroma attributes individually, followed by an assessment of how the two combine to create the overall flavor impression. This involves careful consideration of how different aroma components enhance, modify, or even mask particular taste notes.

- Aroma Removal: Techniques like holding the nose while tasting can help isolate the pure taste experience. This allows panelists to evaluate the taste without the influence of aroma, providing a basis for comparison.

- Time Intensity Analysis: This method tracks changes in taste and aroma intensity over time, highlighting how the two sensory modalities evolve and interact during consumption.

- Check-all-that-apply (CATA) questionnaires: These offer a structured method for panelists to express both taste and aroma perceptions simultaneously, revealing connections and interdependencies.

Understanding this interaction is crucial for product development, as it allows for the fine-tuning of flavor profiles by manipulating the interaction between taste and aroma components. For example, enhancing the fruitiness of a yogurt might involve adjusting both the fruity taste compounds and the volatile aroma compounds that contribute to the perception of fruitiness.

Q 20. Explain the concept of aroma impact compounds.

Aroma impact compounds are the key volatile compounds that contribute most significantly to the overall aroma profile of a food or beverage. These compounds are often present in relatively low concentrations but exert a disproportionately large influence on how we perceive the aroma. They are the ‘stars’ of the aromatic show.

Identifying aroma impact compounds can be challenging and often involves techniques like gas chromatography-mass spectrometry (GC-MS) coupled with sensory analysis. Sensory techniques such as aroma extraction dilution analysis (AEDA) can help isolate and rank the relative importance of different odorants.

For example, in wine, certain esters can be aroma impact compounds, even if present at low concentrations, because they are highly potent and influence our perception of the fruitiness or floral notes. In coffee, specific sulfur-containing compounds can have a substantial impact on the perceived roasted notes, even at low levels. Identifying and manipulating these aroma impact compounds allows food scientists to develop products with specific aromatic profiles.

Q 21. What are some common aroma descriptors used in sensory evaluation?

Aroma descriptors used in sensory evaluation are carefully chosen words that help panelists accurately and consistently describe the aromas they perceive. These descriptors need to be specific and unambiguous, and are often categorized for improved clarity.

Examples of common aroma descriptors include:

- Fruity: Apple, banana, citrus, berry, pineapple

- Floral: Rose, lavender, jasmine, honeysuckle

- Spicy: Pepper, clove, cinnamon, ginger

- Herbal: Mint, basil, thyme, rosemary

- Sweet: Honey, caramel, vanilla, maple

- Woody: Cedar, oak, sandalwood

- Earthy: Mushroom, damp soil, moss

- Chemical: Solvent, plastic, rubber

- Burnt: Roasted, smoky, charred

The choice of descriptors depends on the product being evaluated. A well-trained panel utilizes a standardized lexicon to ensure consistency and minimize subjective bias. The selection and training of sensory panelists are critical for obtaining reliable and meaningful sensory data.

Q 22. How do you use sensory data to guide product development?

Sensory data is the cornerstone of successful product development. It allows us to objectively understand how consumers perceive a product’s attributes, particularly taste and aroma. We use this data to guide formulation, optimize existing products, and even develop entirely new ones. For example, if sensory testing reveals that a new yogurt’s tartness is too high, we can adjust the recipe by reducing the amount of acid or adding a sweetener to improve its acceptability.

- Descriptive Analysis: We use trained panels to precisely describe the sensory attributes (e.g., sweet, sour, fruity, floral) of a product. This provides detailed information about its sensory profile.

- Affective Testing: We assess consumer preferences using hedonic scales (discussed later) to understand overall liking. This guides decisions on which product formulations are most likely to be successful in the market.

- Consumer Acceptance Testing: This involves larger groups of consumers to evaluate overall acceptance and purchase intent. This helps to predict market success.

By combining these approaches, we can create a complete picture of consumer perceptions and use this to refine the product until it meets both sensory and market demands.

Q 23. Describe your experience with sensory software or analysis tools.

Throughout my career, I’ve extensively used various sensory software and analysis tools to enhance the efficiency and accuracy of our evaluations. I’m proficient in using software such as FIZZ, SensoryView, and Compusense. These platforms allow for streamlined data collection, statistical analysis, and report generation. For instance, SensoryView allows for the creation of digital questionnaires, real-time data capture during sensory sessions, and detailed statistical analysis including ANOVA and principal component analysis (PCA). These tools help us to identify significant differences between product formulations and pinpoint areas for improvement. Furthermore, I have experience working with specialized software for aroma analysis, such as those that interface with gas chromatography-mass spectrometry (GC-MS) data. This allows for a more complete picture of the volatile compounds contributing to a product’s aroma profile.

Q 24. Explain your understanding of hedonic scaling.

Hedonic scaling is a method used to measure the degree of liking or pleasure associated with a sensory experience. It’s a crucial component of affective testing. Participants rate their liking of a product using a structured scale, often a linear scale ranging from ‘dislike extremely’ to ‘like extremely’, sometimes with numerical anchors (e.g., 1-9). Sometimes we use faces to represent the different levels of liking; this is particularly useful for children or those with limited language skills. For example, a 9-point hedonic scale might be used to assess liking of a new chocolate bar. The data collected is then statistically analyzed to determine the overall level of liking and identify factors influencing consumer preferences. This helps in making informed decisions about product optimization or formulation changes.

Q 25. How do you ensure the accuracy and reliability of sensory data?

Ensuring the accuracy and reliability of sensory data is paramount. We achieve this through rigorous methodologies. This includes:

- Panelist Selection and Training: We carefully select panelists based on their sensory acuity, ability to follow instructions, and freedom from sensory biases. They undergo thorough training to ensure consistent evaluation protocols. Regular calibration sessions and performance monitoring are key.

- Controlled Testing Environment: Testing is conducted in a standardized environment that minimizes external distractions and ensures consistent sample presentation (e.g., temperature, lighting, ambiance). This includes using appropriate booths to isolate panelists.

- Balanced Designs: We utilize statistically sound experimental designs (e.g., balanced incomplete block designs) to minimize bias and ensure data robustness. This approach ensures that the order of presentation of samples doesn’t influence the results.

- Statistical Analysis: Appropriate statistical techniques (e.g., ANOVA, t-tests) are used to analyze the data, identify significant differences, and reduce the influence of random error.

Through these measures, we build confidence that our sensory data is a true reflection of consumer perceptions.

Q 26. What are some ethical considerations in sensory evaluation?

Ethical considerations are central to sensory evaluation. Our paramount responsibility is the well-being and fair treatment of our panelists. This includes:

- Informed Consent: Panelists must provide informed consent, fully understanding the purpose of the study and any potential risks or discomforts.

- Compensation and Recognition: Fair compensation for their time and effort is essential. This may include monetary payment, gift certificates, or even social recognition.

- Confidentiality: The identity and responses of the panelists must be kept confidential and protected.

- Minimizing Bias: We must be vigilant in minimizing potential biases in our testing protocols, such as sample presentation order or suggestive questioning.

- Avoiding Undue Influence: It’s unethical to influence panelists in their evaluations. The process must be objective and unbiased.

Adherence to these ethical guidelines ensures that our data is collected responsibly and reflects genuine consumer perceptions.

Q 27. How would you evaluate the aroma of a new wine?

Evaluating the aroma of a new wine requires a systematic approach. First, we’d use descriptive analysis. A trained sensory panel would smell the wine, identifying and quantifying various aroma attributes. We might use standardized aroma wheels as a framework to guide the description, identifying notes like fruity (e.g., red fruit, citrus), floral (e.g., rose, violet), spicy (e.g., pepper, clove), woody (e.g., oak, cedar), earthy (e.g., mushroom, wet soil), and herbaceous (e.g., green grass, mint). The intensity of each aroma would be rated on a scale. This creates a comprehensive aroma profile. We might then supplement this with instrumental analysis (GC-MS) to identify the specific volatile compounds responsible for these aromas. This combined approach offers a detailed and reliable description of the wine’s aroma, valuable for quality control, marketing, and comparisons with similar wines.

Q 28. How would you determine the optimal sweetness level for a new beverage?

Determining the optimal sweetness level for a new beverage involves a combination of sensory testing and market research. First, we’d create several formulations with varying levels of sweetness. Then, we’d use consumer acceptance testing with a large, representative panel. Hedonic scales (e.g., 9-point scale) would be used to assess liking of each formulation. We’d also collect data on purchase intent at each sweetness level. By analyzing the results, we can identify the sweetness level that receives the highest liking scores and demonstrates strong purchase intent. This optimal level would ideally balance consumer preference with the overall product profile and target market. This data-driven approach ensures that the chosen sweetness level reflects actual consumer preferences and ultimately maximizes market success.

Key Topics to Learn for Taste and Aroma Evaluation Interview

- Sensory Perception: Understanding the physiological mechanisms of taste and smell, including the role of receptors and neural pathways. Practical application: Describing how different factors (temperature, texture) influence sensory perception.

- Descriptive Sensory Analysis: Mastering standardized vocabulary and methodologies for accurately describing taste and aroma attributes. Practical application: Analyzing and comparing the sensory profiles of different food or beverage samples.

- Flavor Chemistry: Familiarity with key volatile compounds and their contribution to aroma profiles; understanding the relationship between chemical composition and sensory perception. Practical application: Explaining how specific compounds influence the overall flavor experience.

- Statistical Analysis in Sensory Evaluation: Understanding and applying basic statistical methods used to analyze sensory data, such as ANOVA and principal component analysis. Practical application: Interpreting statistical results to draw conclusions about sensory differences.

- Sensory Testing Methodologies: Knowledge of different sensory testing methods (e.g., triangle test, ranking test, hedonic scaling) and their appropriate applications. Practical application: Selecting the most suitable method for a specific research question or quality control task.

- Quality Control and Assurance: Applying sensory evaluation techniques to ensure product consistency and quality. Practical application: Developing sensory protocols for quality control in a food or beverage production setting.

- Consumer Sensory Research: Understanding how consumer preferences and perceptions influence product development and marketing. Practical application: Designing and conducting consumer sensory studies to gather valuable insights.

Next Steps

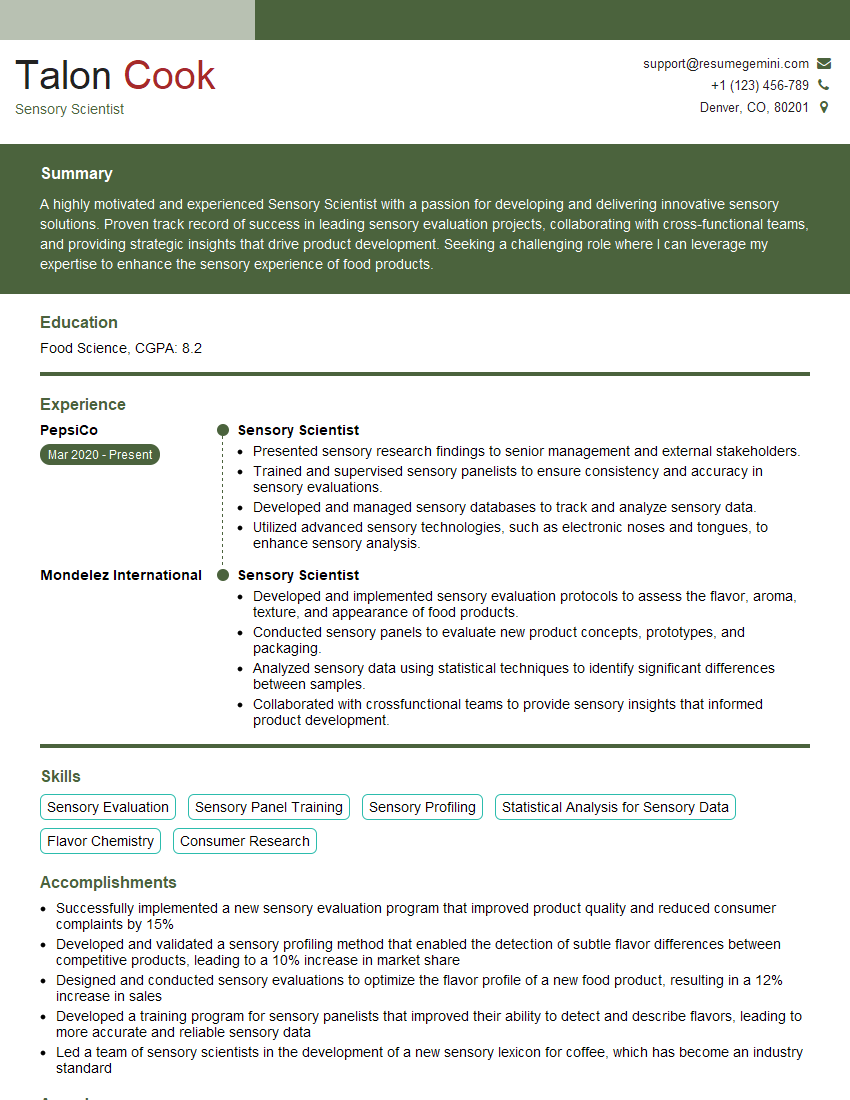

Mastering Taste and Aroma Evaluation opens doors to exciting career opportunities in the food and beverage industry, research, and quality control. A strong resume is crucial to showcasing your skills and experience. Creating an ATS-friendly resume is essential for maximizing your job prospects. We highly recommend using ResumeGemini to build a professional and impactful resume that effectively highlights your expertise in Taste and Aroma Evaluation. ResumeGemini provides examples of resumes tailored to this specific field, helping you present your qualifications in the most compelling way.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good