Are you ready to stand out in your next interview? Understanding and preparing for Understanding of Cotton Market Dynamics interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Understanding of Cotton Market Dynamics Interview

Q 1. Explain the factors influencing global cotton prices.

Global cotton prices are a fascinating dance of supply and demand, influenced by a complex interplay of factors. Think of it like a delicate ecosystem where a change in one area can ripple through the entire system.

Supply: This is the most fundamental driver. World cotton production, influenced by weather, pest infestations, and technological advancements in farming practices, directly impacts supply. A poor harvest in a major producing region can drastically reduce supply and drive prices up. Conversely, bumper crops can lead to lower prices.

Demand: Global textile manufacturing, a major consumer of cotton, is another key influencer. Booming economies often mean increased demand for clothing and textiles, pushing cotton prices upward. Conversely, economic downturns can lead to decreased demand and lower prices.

Government Policies: Subsidies, trade tariffs, and quotas implemented by various governments can significantly alter the global cotton market. For instance, government support for cotton farmers in a specific country can increase production and potentially affect global prices.

Speculation in Futures Markets: The cotton futures market is a powerful mechanism for price discovery and hedging. However, speculation by traders can create price volatility, sometimes irrespective of underlying supply and demand dynamics. A wave of bullish speculation can inflate prices, even in the absence of significant changes in production or consumption.

Currency Exchange Rates: The relative strength of currencies influences the international trade of cotton. A stronger U.S. dollar (the currency in which cotton is often traded) can make U.S. cotton more expensive for importers, affecting demand.

Substitute Fibers: The availability and price of alternative fibers like polyester and synthetic blends directly compete with cotton. If synthetic fiber prices fall, cotton demand might decrease, pushing cotton prices down.

Q 2. Describe the different cotton grades and their respective applications.

Cotton grades are categorized based on several characteristics, primarily fiber length, strength, uniformity, and color. Think of it like grading wine – different grades suit different purposes.

Extra-long Staple (ELS): This is the highest grade, featuring fibers longer than 1 3/8 inches. Its superior length, strength, and softness make it ideal for high-end products like luxury apparel, bedding, and medical applications.

Long Staple: Fibers range from 1 1/8 to 1 3/8 inches. These grades offer a good balance of quality and price, finding use in various textile applications.

Medium Staple: Fiber lengths are typically between 1 and 1 1/8 inches. This is the most common grade, suitable for a wide range of textiles, including apparel, home furnishings, and industrial fabrics.

Short Staple: Fibers are less than 1 inch long. Often used for lower-cost applications like towels, blends, and industrial textiles.

The grade significantly impacts the final product’s quality and price. For example, ELS cotton is used in premium shirts due to its luxurious feel and durability, while shorter staple cotton may be better suited for workwear.

Q 3. What are the key characteristics of the cotton futures market?

The cotton futures market, primarily traded on exchanges like ICE Futures US, is a standardized marketplace where buyers and sellers agree to transact cotton at a future date and price. Imagine it as a giant, organized betting pool on future cotton prices.

Standardized Contracts: Contracts define specific quantities, quality, and delivery terms, ensuring transparency and ease of trading.

Price Discovery: Trading activity helps determine the market price for cotton, providing a benchmark for physical transactions.

Hedging: Farmers, textile mills, and traders utilize futures contracts to manage risk associated with price fluctuations. Farmers can “lock in” a price for their future crop, while mills can secure cotton supplies at a known cost.

Speculation: Investors participate to profit from price movements, adding liquidity to the market, but also contributing to price volatility.

Understanding futures contracts is crucial for anyone involved in the cotton industry, enabling them to mitigate risk and make informed decisions.

Q 4. How do weather patterns impact cotton production and pricing?

Weather is arguably the most significant uncontrollable factor impacting cotton production and pricing. Think of it as nature’s wild card.

Rainfall: Adequate rainfall is crucial during the growing season. Too little leads to drought stress, reducing yields and quality, driving prices upward. Excessive rainfall, however, can cause flooding and fungal diseases, damaging crops and impacting supply.

Temperature: Extreme heat or cold can negatively affect cotton development and boll (cotton seed pod) formation, leading to reduced yields and potentially higher prices.

Pests and Diseases: Favorable weather conditions can promote the spread of pests and diseases, leading to crop losses and increased prices. For instance, boll weevils thrive in warm, humid conditions, devastating cotton crops if not managed effectively.

Weather forecasts and climate models are crucial tools for both farmers and traders in anticipating potential yield impacts and adjusting their strategies accordingly.

Q 5. Explain the role of the USDA in the cotton market.

The United States Department of Agriculture (USDA) plays a vital role in the cotton market, acting as a key source of information and market regulation.

Data Collection and Reporting: The USDA collects and publishes extensive data on cotton production, consumption, and stocks, providing valuable insights into market trends and influencing pricing decisions. Their monthly reports are closely followed by traders and stakeholders worldwide.

Market Support Programs: Historically, the USDA has implemented various market support programs, such as price supports and loan programs, to help stabilize cotton prices and support farmers. These programs can influence supply and demand dynamics.

Research and Development: The USDA invests in research to improve cotton production technologies, pest control, and fiber quality, ultimately aiming to enhance efficiency and productivity.

The USDA’s actions significantly impact the cotton market’s stability and competitiveness, both domestically and internationally.

Q 6. Discuss the impact of international trade policies on cotton prices.

International trade policies profoundly impact cotton prices. Think of them as the international rules of engagement for cotton.

Tariffs and Quotas: Import tariffs and quotas imposed by countries can restrict cotton imports, reducing supply and potentially increasing domestic prices. Conversely, the removal of trade barriers can increase global competition, putting downward pressure on prices.

Trade Agreements: Multilateral and bilateral trade agreements significantly affect cotton trade flows. Agreements that reduce or eliminate tariffs can stimulate trade and lead to price adjustments.

Regional Trade Blocks: Regional trade agreements, like the EU or NAFTA (now USMCA), can create preferential trade arrangements for cotton within the bloc, affecting prices globally.

Sanctions and Embargoes: Political sanctions and embargos can severely disrupt cotton trade, impacting prices significantly. A ban on cotton imports from a major producing country, for example, can create shortages and price spikes in the global market.

Staying informed about international trade policies is crucial for understanding price volatility and adapting strategies accordingly.

Q 7. What are the major cotton-producing countries and their market share?

The global cotton market is dominated by a few key players, each with its own influence on prices. Think of it as a few major players controlling a significant portion of the game board.

India: A leading producer and consumer of cotton, its production levels and policies significantly affect global supply and demand.

United States: A major exporter of high-quality cotton, its production and export policies have a significant impact on international prices.

China: A large producer and consumer, China’s domestic policies and import/export decisions heavily influence global cotton markets.

Brazil: A significant producer, particularly of longer staple varieties, impacting the premium segment of the cotton market.

Pakistan: A substantial producer, often influencing the global supply, especially in certain seasons.

Australia: Contributes substantially to the high-quality cotton segments, impacting pricing for premium varieties.

The market share of each country fluctuates yearly due to weather patterns, government policies, and global economic conditions.

Q 8. Explain the concept of cotton hedging and its importance for businesses.

Cotton hedging is a risk management strategy used by businesses involved in the cotton industry to protect themselves against price fluctuations. Imagine you’re a textile manufacturer; you need a certain amount of cotton in six months to fulfill orders. However, cotton prices are volatile. Hedging allows you to lock in a price today for future delivery, eliminating the risk of prices rising and impacting your profitability. This is typically done through the purchase or sale of cotton futures contracts on an exchange.

How it works: Let’s say you need 10,000 bales of cotton in six months. You could buy 10,000 futures contracts (each representing a specific amount of cotton) at the current price. If the price rises by the delivery date, you still get your cotton at the locked-in price, making a profit on the futures contracts. If the price drops, you’ll lose money on the futures contracts, but this loss offsets the gain you’d make from buying cotton at a lower price. Essentially, you trade price risk for a certain, albeit possibly less profitable, outcome.

Importance for Businesses: Hedging provides price certainty, improving budgeting and financial planning. It allows businesses to focus on other aspects of their operations, such as production and sales, without the constant worry of price swings wiping out profits. It is crucial for maintaining competitiveness and stability in a volatile market.

Q 9. How do you analyze cotton supply and demand dynamics?

Analyzing cotton supply and demand dynamics involves considering several key factors. Think of it like a balancing act – the scale needs to be even.

- Supply-Side Factors: This includes global cotton production (influenced by weather patterns, pest infestations, technological advancements in farming, and government policies), harvested area, and existing stock levels. We look at reports from major producing countries like India, the US, Brazil, and China to understand crop size and quality.

- Demand-Side Factors: This involves global textile consumption (driven by fashion trends, economic growth, and consumer spending), demand from various textile industries (such as apparel, home furnishings, and industrial uses), and changes in the use of synthetic alternatives.

- Other Factors: We also consider the impact of government subsidies and trade policies, speculative trading activity (which can lead to bubbles and crashes), and currency exchange rates (affecting import/export prices).

Analytical Tools: I use a combination of quantitative and qualitative methods, including statistical models, market intelligence reports, and even on-the-ground assessments of crop conditions. This allows for a thorough understanding of the current market and future projections.

Q 10. What are the current trends and future outlook for the cotton market?

The cotton market is currently experiencing a dynamic period, shaped by several intertwining factors. The pandemic’s impact on supply chains is still being felt, alongside shifts in consumer demand and increasing sustainability concerns.

- Current Trends: We’re seeing increased demand for sustainable cotton, leading to a focus on organic and responsibly sourced materials. Prices have fluctuated significantly based on global weather patterns and geopolitical events. There’s growing competition from synthetic fibers which are cheaper and often perceived as more durable.

- Future Outlook: The future is likely to involve increased volatility. The demand for sustainable cotton is a key driver, but the challenges lie in scaling sustainable practices to meet the growing demand while also dealing with price volatility and competition from synthetic fibers. Technological advancements in both cotton production and textile manufacturing will play a significant role in shaping the market’s future.

It’s a complex landscape, requiring constant monitoring and adaptation. The successful players will be those who understand and respond to these trends effectively.

Q 11. Describe the different types of cotton contracts.

Cotton contracts come in various forms, each serving a different purpose. The most common include:

- Futures Contracts: These are standardized contracts traded on exchanges, specifying the quantity, quality, and delivery date of cotton. They are used for hedging and speculation.

- Options Contracts: These give the buyer the right, but not the obligation, to buy or sell cotton at a specific price on or before a certain date. They allow for more flexibility than futures contracts.

- Forward Contracts: These are customized contracts negotiated directly between buyers and sellers, specifying the terms of the transaction. They are commonly used for large volumes of cotton.

- Spot Contracts: These contracts involve immediate delivery of cotton at the current market price.

Understanding the nuances of each contract type is essential for effective cotton trading. The choice depends on the specific needs and risk tolerance of the buyer and seller.

Q 12. Explain the role of cotton exchanges in price discovery.

Cotton exchanges play a vital role in price discovery by providing a centralized marketplace where buyers and sellers can interact. The process is driven by supply and demand, with prices fluctuating based on the forces of trading.

Mechanism: The constant interaction of buyers and sellers, with their individual perceptions of supply, demand, and risk, determines the equilibrium price – the price at which the quantity demanded equals the quantity supplied. This interaction is transparent and visible to all participants through real-time price quotes.

Importance: Cotton exchanges provide transparency, liquidity, and price discovery. They create a fair and efficient marketplace, making it easier for businesses to buy and sell cotton at competitive prices. This enhances market efficiency and helps reduce price manipulation.

Q 13. How do you assess the creditworthiness of cotton buyers and sellers?

Assessing the creditworthiness of cotton buyers and sellers is paramount to mitigating risk in the industry. It’s like checking a person’s credit score before lending them money.

Methods: I use a multi-faceted approach, including:

- Financial Statements Analysis: Reviewing balance sheets, income statements, and cash flow statements to understand the financial health and stability of the company.

- Credit Reports: Obtaining credit reports from reputable agencies that provide information on payment history and potential risks.

- Industry Reputation: Checking the company’s track record and reputation within the cotton industry, gathering information through industry networks and references.

- Due Diligence: Conducting thorough due diligence, including site visits and interviews, to verify the information and assess the overall operational efficiency.

This comprehensive process helps in identifying potential risks and making informed decisions, protecting against potential losses from non-payment or bankruptcy.

Q 14. What are the key risks associated with cotton trading?

Cotton trading involves several significant risks. It’s crucial to understand these risks before entering any transaction.

- Price Risk: The most significant risk is the volatility of cotton prices. Unexpected changes in supply and demand can lead to substantial gains or losses.

- Credit Risk: The risk of non-payment from buyers or sellers, particularly in transactions involving large volumes or extended payment terms. This is mitigated through credit checks and robust contracts.

- Quality Risk: The risk of receiving cotton that does not meet the specified quality standards. Clear contracts with detailed quality specifications are critical to minimize this risk.

- Operational Risk: Risks associated with logistics, storage, and handling of cotton. This involves issues like delays, damage, and theft.

- Political and Regulatory Risk: Changes in government policies, trade regulations, or geopolitical events can significantly impact cotton prices and trading activities.

Effective risk management strategies, including hedging, diversification, and thorough due diligence, are essential for navigating these risks successfully.

Q 15. Explain the process of cotton quality control and assurance.

Cotton quality control and assurance is a crucial process that ensures the fiber meets specific standards for length, strength, fineness, uniformity, color, and cleanliness. This impacts the final product’s quality and value. It begins in the field with practices like proper planting, irrigation, and pest management. Then, during harvesting and ginning, careful handling minimizes damage to the fibers. Subsequently, laboratories use sophisticated instruments to assess various quality parameters. For instance, High Volume Instrument (HVI) testing provides a detailed profile of fiber properties. Finally, classification systems, such as those used by the USDA, categorize cotton based on these tests, providing a standardized grading system that facilitates trade and pricing.

Imagine you’re buying fabric for a high-end shirt. You wouldn’t want low-quality cotton with short, weak fibers that make the shirt flimsy and prone to tearing. Quality control ensures that the cotton used meets the necessary standards for strength, drape, and overall feel, leading to a superior product. Without stringent quality control, inconsistencies in the final product could arise, harming the reputation of brands and leading to customer dissatisfaction.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe the various methods for storing and handling cotton.

Storing and handling cotton requires careful consideration to prevent deterioration and maintain quality. Methods vary based on scale and location. For large-scale storage, warehouses with controlled environments are preferred. These warehouses maintain optimal temperature and humidity to prevent pest infestation and fiber degradation. Cotton is often stored in bales, which are tightly compressed units. Proper stacking and ventilation within the warehouse are critical. Smaller-scale storage might involve using covered sheds or containers to protect the cotton from the elements. Regardless of the method, keeping the cotton clean and dry is paramount. Handling involves using appropriate equipment – from forklifts to specialized machinery – to move bales carefully and avoid damage. Regular inspections for pest infestation and moisture buildup are essential for long-term storage.

Think of it like storing fine wine. You wouldn’t leave it exposed to sunlight and fluctuating temperatures. Similarly, proper storage conditions for cotton preserve its quality and value, preventing damage and reducing losses.

Q 17. How do you manage price risk in cotton trading?

Managing price risk in cotton trading is crucial due to its volatility. Several strategies are employed, including hedging using futures contracts on exchanges like the Intercontinental Exchange (ICE). This involves taking an offsetting position in the futures market to mitigate potential losses from price fluctuations in the spot market. Another technique is price risk insurance or options trading, which allows traders to buy or sell options contracts, providing the right, but not the obligation, to buy or sell cotton at a specific price. Diversification, spreading investments across various cotton grades and origins, also minimizes risk. Careful market analysis, understanding supply and demand dynamics, weather patterns, and global economic factors are vital in making informed trading decisions. Furthermore, having strong relationships with reliable suppliers and buyers provides some level of predictability and reduces uncertainty.

Imagine a textile company that needs to purchase cotton for production six months in advance. Hedging with futures contracts protects them from a price surge, securing their input costs and enabling them to plan their budgets effectively. Without effective risk management, price fluctuations could severely impact profitability.

Q 18. What is the impact of technological advancements on cotton production?

Technological advancements have revolutionized cotton production, improving efficiency, yield, and sustainability. Precision agriculture techniques, using GPS, sensors, and data analytics, optimize irrigation, fertilizer application, and pest control, minimizing resource waste and maximizing yields. Genetically modified (GM) cotton varieties offer increased pest resistance and herbicide tolerance, reducing the need for chemical inputs. Mechanization in harvesting and ginning has significantly increased productivity, reducing labor costs and processing time. Remote sensing technologies monitor crop health and identify stress factors early on, enabling timely intervention and improving overall crop management. These technologies contribute to higher quality yields and enhanced sustainability in cotton production.

Think of it as the evolution from manual farming to using advanced tractors and drones. Technology not only increases output but also optimizes resource utilization, making cotton production more efficient and environmentally friendly.

Q 19. Explain the role of sustainability in the cotton industry.

Sustainability is increasingly important in the cotton industry, driven by consumer demand and environmental concerns. Sustainable cotton production focuses on minimizing the environmental impact throughout the supply chain, from seed to finished product. This involves reducing water consumption through efficient irrigation techniques, minimizing pesticide use through integrated pest management, and promoting biodiversity. Organic cotton farming avoids synthetic pesticides and fertilizers. Traceability systems ensure that cotton originates from sustainable sources, providing transparency and accountability. Recycling and upcycling cotton waste reduce landfill burden. The industry is also working towards more sustainable fiber processing and manufacturing practices, making the entire process more environmentally friendly.

Consumers are increasingly aware of the environmental footprint of their clothing. Demand for sustainable cotton is rising, driving the industry to adopt more eco-conscious practices.

Q 20. Discuss the challenges of cotton farming in developing countries.

Cotton farming in developing countries faces numerous challenges, including limited access to resources like improved seeds, fertilizers, and irrigation systems. Climate change impacts, such as droughts and floods, severely affect yields. Poor infrastructure, inadequate storage facilities, and limited market access hinder farmers’ ability to sell their produce at fair prices. Pest and disease infestations can devastate crops, leading to significant economic losses. Lack of access to credit and insurance further complicates their situation. Many smallholder farmers lack the knowledge and resources to adopt sustainable farming practices. These challenges contribute to low productivity and perpetuate a cycle of poverty for many cotton farmers.

Imagine a small farmer in a drought-prone region with limited resources and access to markets. The challenges they face are significant, highlighting the need for targeted support and investments in agricultural development.

Q 21. How do you use market data and analytics to inform trading decisions?

Market data and analytics are essential for informed trading decisions in the cotton market. I utilize various sources such as ICE Futures US cotton price data, USDA reports on supply and demand, weather forecasts, and global economic indicators. I use statistical models and forecasting techniques to analyze historical price trends, identify patterns, and predict future price movements. This involves studying factors like production levels, consumption patterns, inventory levels, and geopolitical events that impact cotton prices. Data visualization tools help identify key trends and insights. Risk management models are used to assess the potential impact of various scenarios on trading positions. Furthermore, I utilize news and industry reports to stay updated on market sentiment and any significant developments affecting the cotton industry.

For example, an analysis might show a correlation between a specific weather event in a major cotton-producing region and a subsequent price increase. This information is valuable for making strategic trading decisions, either taking advantage of the price increase or hedging against potential losses.

Q 22. Describe your experience with different cotton trading platforms.

My experience spans various cotton trading platforms, both physical and electronic. I’ve worked extensively with platforms like the ICE Futures US (Intercontinental Exchange), where I’ve executed numerous futures and options contracts on cotton. This platform provides real-time price data, order execution capabilities, and risk management tools crucial for effective trading. I’m also familiar with electronic trading platforms used by larger cotton merchants, offering functionalities such as automated order routing, and sophisticated analytical tools. These platforms are essential for efficient inventory management, hedging strategies, and facilitating transactions across international markets. Beyond these electronic platforms, I have experience in the physical trading aspect, understanding the logistics and negotiations involved in direct purchases and sales of cotton bales, dealing with various grading systems and documentation. This combination of experience in electronic and physical trading allows for a comprehensive understanding of the market from both perspectives.

Q 23. Explain your understanding of cotton fiber properties.

Understanding cotton fiber properties is paramount in determining its quality and suitability for various applications. Key properties include fiber length, strength, fineness, maturity, and color. Fiber length, measured in inches or millimeters, significantly impacts yarn strength and spinning performance. Longer fibers generally produce stronger, finer yarns. Fiber strength, measured in grams per tex, relates to the yarn’s tensile strength and durability. Fineness, expressed in micrometers, impacts yarn softness and overall fabric hand feel. Higher maturity indicates a more complete fiber development, leading to better strength and processing characteristics. Finally, color, typically assessed using a colorimeter, influences the acceptability of the fiber for specific textile applications; whiter cotton is generally more desirable. These properties interact to determine the overall quality and value of the cotton.

Q 24. How do you evaluate the quality of cotton samples?

Evaluating cotton quality involves a multi-step process combining visual inspection and laboratory testing. I begin with a visual assessment, checking for cleanliness (foreign matter), color uniformity, and the presence of any damage. This is followed by laboratory testing using standardized methods. Fiber length is determined using instruments like the AFIS (Advanced Fiber Information System), providing a detailed length distribution. Strength is measured using a high-volume instrument (HVI) that also assesses other properties like micronaire (fiber fineness) and maturity. Color is precisely measured with a colorimeter. By combining these visual and instrumental evaluations, I can generate a comprehensive quality profile that aligns with international standards like the US Cotton Standards or the International Cotton Standards. For example, a higher micronaire reading might indicate a softer, but potentially weaker fiber, requiring a trade-off consideration in price and application. Such detailed analysis is crucial for fair pricing and quality control throughout the supply chain.

Q 25. What are the ethical considerations in cotton sourcing?

Ethical considerations in cotton sourcing are increasingly important to consumers and brands. Key aspects include ensuring fair labor practices, preventing child labor, promoting safe working conditions, and protecting the environment. This requires sourcing cotton from farms and ginners committed to sustainable agricultural practices, such as reducing water consumption, minimizing pesticide use, and protecting biodiversity. Several certifications, like Better Cotton Initiative (BCI) and organic cotton standards, help verify these ethical and environmental practices. Traceability systems are crucial to ensure transparency and accountability throughout the supply chain. For example, using blockchain technology can allow for tracking cotton from the farm to the finished product, enhancing consumer confidence and supporting ethical sourcing decisions. Ignoring these ethical aspects can lead to reputational damage and loss of market share.

Q 26. Discuss the impact of geopolitical events on cotton prices.

Geopolitical events significantly impact cotton prices due to their influence on supply, demand, and trade policies. For example, political instability in major cotton-producing regions can disrupt harvests and limit exports, leading to price increases. Trade wars and sanctions can restrict access to international markets, affecting supply and demand dynamics. Changes in government policies regarding subsidies or export quotas can also influence prices. For instance, a drought in a key growing area would cause a supply shortage, driving prices upward, whereas a major shift in global trade agreements could lead to price volatility as markets readjust. Therefore, monitoring geopolitical events, through reliable news sources and political risk analysis, is vital for forecasting cotton price trends and managing risk effectively in trading and investment decisions.

Q 27. Explain your understanding of cotton price forecasting models.

Cotton price forecasting models employ various statistical and econometric techniques to predict future prices. These models often incorporate factors like past price data, production estimates, consumption forecasts, and macroeconomic indicators. Simple models might use moving averages or exponential smoothing to identify trends. More sophisticated models incorporate econometric techniques, like regression analysis, to account for the relationship between cotton prices and influencing variables. For example, a model might predict prices based on factors like previous year’s yield, global demand, and exchange rate fluctuations. These models, however, are not perfect and their accuracy depends on the quality of data and the underlying assumptions. Combining multiple models and incorporating expert judgment can improve forecasting accuracy. It is critical to understand the limitations of each model and to avoid over-reliance on any single prediction.

Q 28. How do you stay updated on the latest developments in the cotton market?

Staying updated on cotton market developments requires a multi-faceted approach. I regularly monitor industry publications such as Cotton International, various agricultural news sources, and market reports from organizations like the USDA (United States Department of Agriculture). I attend industry conferences and workshops to network with other professionals and learn about the latest trends. I also utilize specialized market data providers for real-time price information, production forecasts, and global trade data. Furthermore, I actively engage in discussions with industry contacts, including farmers, traders, and textile manufacturers, to gather firsthand insights and perspectives. This combination of formal and informal information gathering ensures I maintain a comprehensive understanding of the dynamic cotton market.

Key Topics to Learn for Understanding of Cotton Market Dynamics Interview

- Global Supply and Demand: Analyze factors influencing global cotton production (weather patterns, acreage planted, technological advancements) and consumption (textile industry trends, competing fibers).

- Price Determination and Forecasting: Understand the interplay of supply, demand, and speculation in shaping cotton prices. Explore various forecasting methods and their limitations.

- Trading and Hedging Strategies: Learn about different trading mechanisms (futures, options, spot markets) and risk management techniques employed by cotton producers, traders, and consumers.

- Market Regulations and Policies: Familiarize yourself with government policies (subsidies, trade agreements) impacting the cotton market and their influence on price and trade flows.

- Quality and Standards: Understand cotton grading systems, quality parameters, and their impact on pricing and market access. Explore the role of certifications and standards.

- Risk Management and Analysis: Develop your skills in identifying and assessing risks associated with cotton market volatility. Practice applying quantitative and qualitative analysis techniques.

- Technological Advancements: Stay updated on the latest technologies impacting cotton production, processing, and trading, and their potential market implications.

- Sustainability and Ethical Sourcing: Understand the growing importance of sustainable cotton production practices and their influence on market dynamics and consumer preferences.

Next Steps

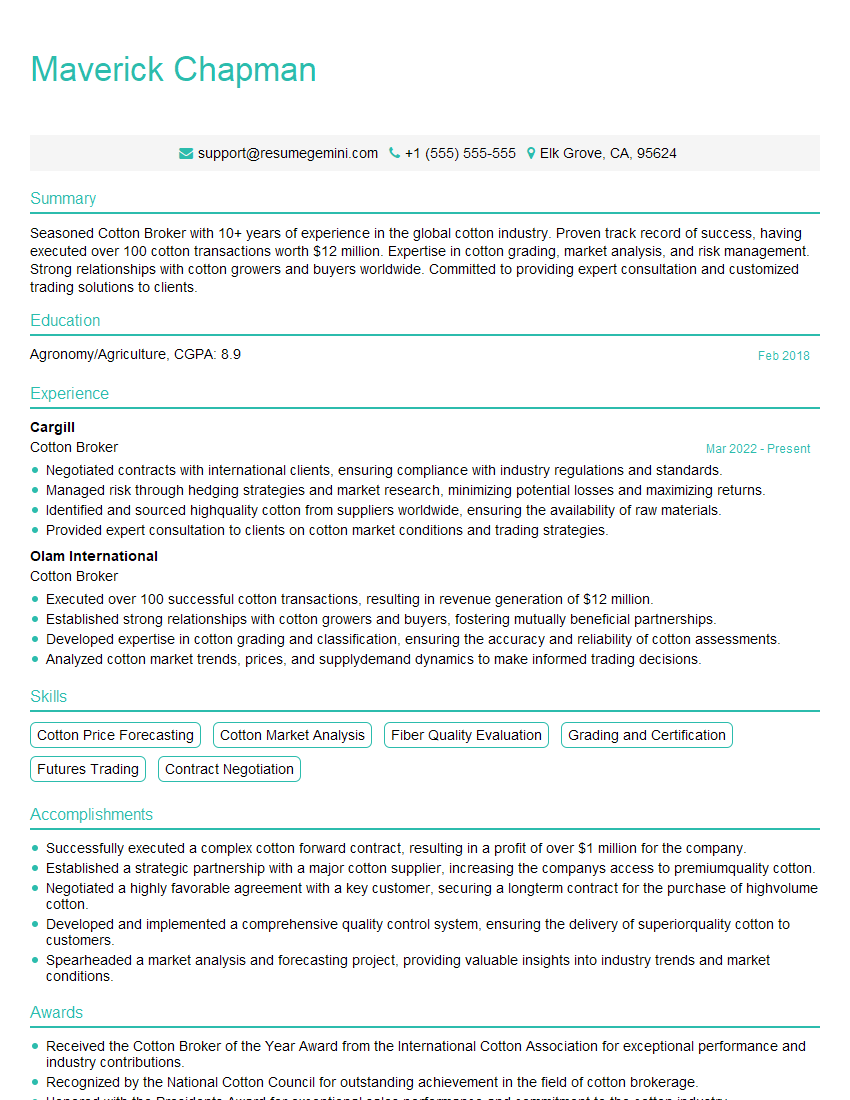

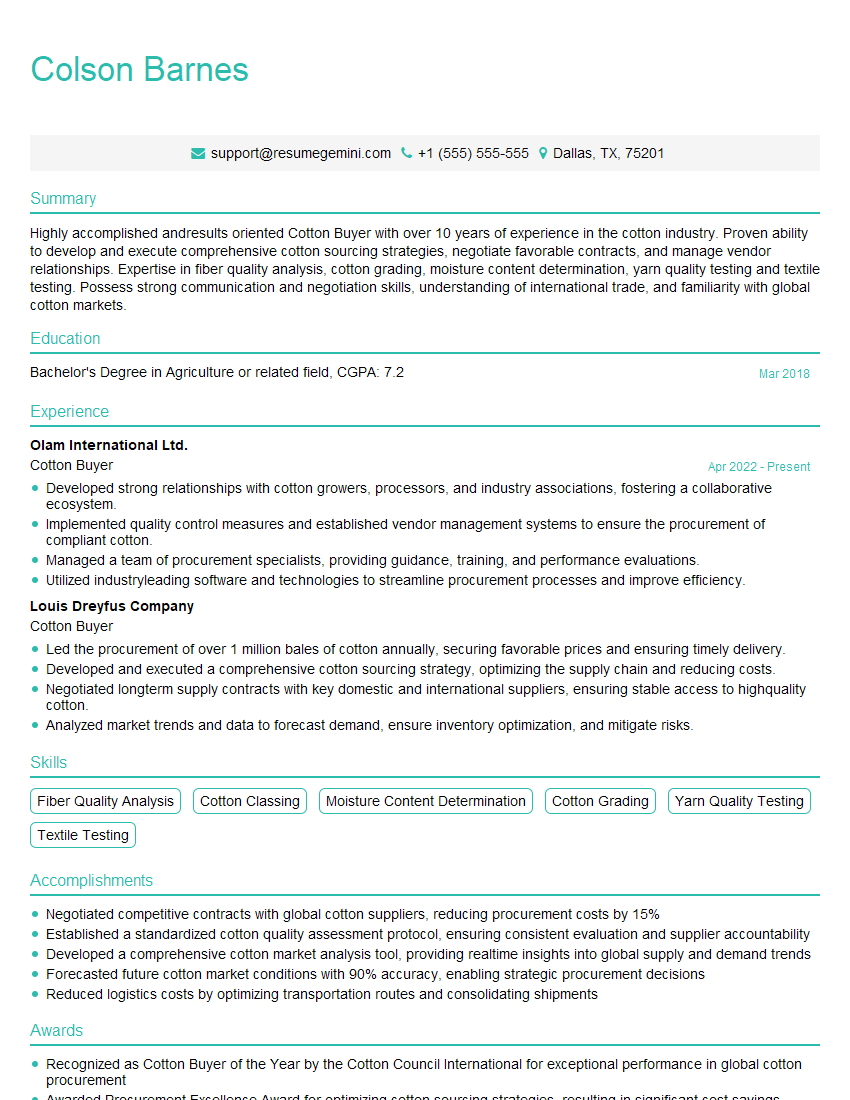

Mastering the intricacies of cotton market dynamics is crucial for career advancement in the agricultural, textile, and finance sectors. A strong understanding of these concepts demonstrates valuable analytical and problem-solving skills highly sought after by employers. To significantly boost your job prospects, invest time in crafting an ATS-friendly resume that effectively highlights your expertise. ResumeGemini is a trusted resource that can help you build a professional and impactful resume, showcasing your skills and experience in the best possible light. Examples of resumes tailored specifically to roles requiring an Understanding of Cotton Market Dynamics are available through ResumeGemini, providing valuable templates and guidance for your application process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good