The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Art Valuation interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Art Valuation Interview

Q 1. Explain the different approaches to art valuation (e.g., market, replacement cost, income approach).

Art valuation isn’t an exact science; it’s more of a careful assessment using various approaches. Three primary methods are employed: the market approach, the replacement cost approach, and the income approach.

- Market Approach: This is the most common method, focusing on comparable sales of similar artworks. We look at recent auction results, gallery sales, and private transactions of pieces with similar characteristics – artist, style, size, condition, and subject matter. Think of it like comparing house prices in a neighborhood; similar houses sell for similar prices, adjusting for differences in features. For example, if a comparable painting by the same artist sold for $100,000 recently, and the artwork being valued has similar attributes and condition, its value would likely fall within a similar range.

- Replacement Cost Approach: This method determines the cost of recreating the artwork. It’s most relevant for unique, custom-made pieces or for insurance purposes. This involves factoring in the cost of materials, artist’s labor, and any other associated expenses. Imagine a bespoke sculpture; its replacement cost would include the cost of the materials, the sculptor’s time and expertise, and perhaps even studio rental.

- Income Approach: Less frequently used in fine art valuation, this approach is applicable when the artwork generates income, such as through licensing or royalties. We would project future income streams and discount them back to present value to arrive at an estimated worth. This method is more common with works that are commercially exploited, like highly successful illustrations used for numerous products.

In practice, appraisers often use a combination of these approaches, weighting them according to the specific artwork and available data. The goal is to arrive at a reasoned and well-supported estimate of value.

Q 2. Describe the factors influencing the value of a piece of art.

Many factors intertwine to determine an artwork’s value. It’s a complex interplay of artistic merit and market forces. Key influences include:

- Artist’s Reputation and Significance: The artist’s renown, historical importance, and position within the art historical canon significantly impact value. A well-established, historically important artist will command higher prices than a lesser-known artist, even if the works are stylistically similar.

- Rarity and Uniqueness: Limited editions, unique works, and pieces with unusual characteristics often fetch higher prices due to their scarcity. A one-of-a-kind sculpture will naturally have more value than a print of the same subject.

- Condition: The physical condition of the artwork significantly affects its value. Damage, restoration, and overall preservation impact its desirability and market appeal. A painting with significant craquelure (cracking) will be less valuable than an identical piece in pristine condition.

- Provenance: A clear and well-documented history of ownership adds value, particularly for significant artworks. A documented chain of ownership from the artist to the current owner enhances authenticity and desirability.

- Market Demand and Trends: Current market trends, collector interest, and public perception influence prices. A surge in popularity for a particular artistic style or artist can drastically increase demand and value.

- Size and Medium: Larger works or those executed in rare or prestigious media often command higher prices. A large-scale oil painting will typically be more valuable than a smaller watercolor painting of comparable quality.

- Subject Matter: While less impactful than other factors, the subject matter can influence value, depending on current trends and collector preferences.

Q 3. How do you determine the authenticity of an artwork?

Authenticity verification is crucial and often involves a multi-pronged approach. It’s not just about looking at the painting; it’s about detective work.

- Visual Examination: A trained eye examines the artwork for stylistic consistency, brushstrokes, and material characteristics consistent with the artist’s known works and techniques. This is often the first step and might involve comparing the suspected work to known authenticated pieces by the artist.

- Scientific Analysis: Techniques like pigment analysis, X-ray, infrared reflectography, and other scientific methods can reveal underlying layers of paint, canvas structure, and other physical characteristics that might indicate forgery or alteration. These methods can reveal if the materials are consistent with the artist’s known techniques and the historical period.

- Archival Research: Examination of the artist’s biography, letters, studio records, exhibition history, and sales records helps establish the artwork’s context and authenticity. This research might involve digging through archives, auction records, or contacting experts familiar with the artist’s oeuvre.

- Provenance Documentation: A well-documented provenance, showing a chain of ownership from the artist onward, adds weight to the authenticity claim. This involves tracing the artwork’s ownership history through sales records, exhibition catalogs, and other documentary evidence.

- Expert Consultation: Seeking opinions from recognized experts in the field, especially those specializing in the artist or artistic style, is essential. These experts can offer invaluable insights based on their extensive knowledge and experience.

The process is often iterative, with several tests and analyses performed to build a strong case for or against authenticity.

Q 4. What are the key elements of a professional art appraisal report?

A professional art appraisal report is a formal document providing a reasoned estimate of an artwork’s value. It should be clear, comprehensive, and legally sound. Key elements include:

- Identification of the Artwork: Detailed description of the artwork, including artist, title, date, dimensions, medium, and any identifying marks or signatures.

- Appraiser’s Qualifications: Statement of the appraiser’s credentials, experience, and any relevant affiliations. This establishes the appraiser’s expertise and credibility.

- Purpose of the Appraisal: Clearly stating the reason for the appraisal (e.g., insurance, donation, estate planning) as this influences the approach taken.

- Valuation Methodology: A detailed explanation of the methods used to determine the value, referencing specific comparable sales, market data, and any other relevant information.

- Value Estimate: The appraiser’s final estimate of value, often presented as a range, reflecting the inherent uncertainties in the art market.

- Supporting Documentation: Inclusion of supporting evidence, such as photographs of the artwork, copies of comparable sales records, and relevant research materials. This offers transparency and allows for scrutiny of the valuation process.

- Statement of Limitations: Acknowledgement of any limitations or uncertainties in the valuation, reflecting the inherent complexities and risks involved in appraising art.

- Date and Signature of the Appraiser: The report should be dated and signed by the appraiser, signifying its legitimacy and accountability.

A well-structured report provides not only a value estimate but also the rationale behind it, making it a robust and credible document for its intended use.

Q 5. Explain the concept of provenance and its importance in art valuation.

Provenance refers to the documented history of ownership of an artwork, tracing its journey from the artist to the present owner. It’s essentially the artwork’s pedigree.

Provenance is immensely important because it establishes authenticity and enhances value. A strong provenance provides irrefutable evidence that the artwork is genuine and has passed through legitimate channels. A documented chain of ownership adds a layer of trust and transparency, reducing the risk of fraud or questionable acquisition. For example, a painting with a provenance showing its acquisition directly from the artist’s estate or a prominent gallery will usually command a higher price than an identical painting with unclear ownership history. A missing piece of the provenance or an unclear link can raise suspicions and significantly decrease an artwork’s value. It essentially acts as a guarantee of authenticity and legitimacy, adding significantly to its market value.

Q 6. How do you handle conflicting valuation opinions?

Conflicting valuation opinions are not uncommon in the art world, given the subjective nature of valuation. Handling these requires a careful and methodical approach:

- Review the Appraisals: Thoroughly examine each appraisal report, comparing methodologies, data sources, and assumptions. Identify the points of divergence and potential reasons for the differences.

- Assess Appraiser Qualifications: Evaluate the credentials and experience of each appraiser, looking for any biases or potential conflicts of interest.

- Verify Data and Methodology: Cross-reference data sources, ensuring accuracy and relevance. Verify if the chosen methodologies are appropriate for the artwork in question.

- Seek Additional Expert Opinions: If the discrepancy remains significant, consider seeking a third, independent appraisal from a highly respected expert in the field. This can provide a more objective and well-supported estimate.

- Consider Market Context: Evaluate the appraisals within the context of recent market trends and comparable sales. Fluctuations in market demand can lead to temporary variations in value estimates.

- Documentation: Maintain detailed records of all appraisals, correspondence, and analysis undertaken to ensure transparency and accountability.

Ultimately, the goal is to arrive at a reasoned and informed decision, weighing the evidence carefully and acknowledging the inherent uncertainties in art valuation.

Q 7. How do you research the market value of a particular artwork?

Researching market value requires a systematic and thorough approach. It’s not just a simple Google search.

- Auction Records: Consult major auction houses’ online databases (like Sotheby’s and Christie’s) to identify comparable sales of similar artworks. These databases usually provide detailed information on past sales, including prices realized, buyer/seller details, and images.

- Gallery Records: Research the sales records of galleries specializing in the artist or style of the artwork. Many galleries maintain online inventories or databases of their past sales, offering insights into market pricing.

- Private Sales Databases: Some specialized databases track private transactions, providing access to a broader range of sales data beyond public auctions and gallery sales.

- Art Market Publications and Indices: Stay informed about current market trends and prices through art market publications and indices, such as Artnet Price Database and the Mei Moses Art Index. These resources offer valuable market overviews and analyses.

- Expert Networks: Consult with art specialists, appraisers, and dealers specializing in the relevant artistic period and style. Their expertise can provide valuable insights and context for interpretation of market data.

- Comparable Sales Analysis: After gathering data, meticulously analyze comparable sales, accounting for factors like condition, size, provenance, and date of sale, to arrive at an informed estimate of market value.

The key is to be thorough, methodical, and to consult a variety of sources to obtain a holistic and well-informed understanding of market value.

Q 8. What are the ethical considerations involved in art valuation?

Ethical considerations in art valuation are paramount, ensuring fairness, transparency, and the avoidance of conflicts of interest. It’s crucial to maintain objectivity, avoiding bias based on personal preferences or relationships with the artwork’s owner or potential buyers. Full disclosure of any potential conflicts is essential. For instance, if I’ve previously worked with the seller, I must declare that relationship upfront. Further, accurate representation of the artwork’s condition, provenance, and any relevant historical data is paramount. Inflating values to benefit a client or undervaluing to avoid tax implications is a serious ethical breach. Confidentiality of client information is also crucial. Think of it like doctor-patient confidentiality, only applied to the world of art. The valuation report itself must be unbiased, supported by credible research, and must reflect the current market conditions honestly. Failure to uphold these ethical standards can lead to legal ramifications and damage professional reputation.

Q 9. What are some common pitfalls to avoid in art valuation?

Common pitfalls in art valuation stem from a lack of thorough research and a failure to account for all relevant factors. One major mistake is relying solely on comparable sales without considering the unique qualities of the artwork in question. For example, a seemingly identical painting might be worth significantly less if its provenance is unclear or if it exhibits signs of restoration. Another pitfall is neglecting to account for current market trends; a painting might have been worth X a few years ago, but current market conditions could substantially affect its value today. Overlooking condition issues, such as damage, repairs, and age-related deterioration, significantly impacts value. Ignoring authentication issues is equally problematic. A painting might be attributed to a famous artist, but if proper authentication can’t be established, its value plummets. Finally, failure to consult with specialists in relevant areas, such as conservation or provenance research, can lead to inaccurate valuations. It’s a multi-faceted process that demands expertise and thoroughness.

Q 10. Discuss the role of technology in modern art valuation.

Technology is revolutionizing art valuation. Online databases provide access to a wealth of auction records, allowing for more comprehensive market analysis. Advanced imaging techniques like X-ray fluorescence (XRF) and infrared reflectography (IRR) provide detailed insights into an artwork’s composition and underlying layers, helping determine authenticity and condition. AI and machine learning algorithms can analyze vast datasets to predict future market trends and identify patterns in pricing, leading to more sophisticated valuation models. Furthermore, blockchain technology is emerging as a tool for tracking provenance, establishing authenticity, and enhancing transparency in the art market. This increased transparency and data accessibility contributes to more robust and defensible valuations. Imagine a world where the history of an artwork, from creation to ownership, is securely recorded and readily available, improving accuracy and trust in the art world.

Q 11. How do you value art damaged or restored?

Valuing damaged or restored art requires a nuanced approach. The value is generally lower than an undamaged, unrestored piece. The extent of the damage and the quality of any restoration are critical factors. For instance, minor scratches might have little impact, but significant canvas tears or repainting will substantially lower the value. Expert conservation reports are essential in documenting the damage and the restoration process. These reports detail the techniques used, the materials employed, and their impact on the artwork’s integrity. The valuation process needs to consider the cost of restoration, as well as any reduction in value due to the irreversible alteration of the artwork. In some cases, the cost of restoration might even exceed the value of the piece, rendering it uneconomical to restore. Essentially, the value is determined through a careful evaluation of the artwork’s condition before and after restoration, along with expert opinions.

Q 12. Explain the difference between fair market value and insurance value.

Fair market value (FMV) and insurance value differ significantly. FMV represents the price a willing buyer would pay a willing seller in a typical market transaction. It’s the price you’d expect to receive if you were to sell the artwork in the open market. Insurance value, on the other hand, is the cost to replace or repair the artwork in case of loss or damage. It’s typically higher than FMV because it reflects the full replacement cost, including potential appreciation and any expenses related to restoration. Consider a painting worth $10,000 in the open market (FMV). The insurance value might be $12,000 or even higher, taking into account the cost to replace it with a similar piece, or potentially to recreate it if no equivalent can be found. So, while FMV focuses on the current market price, insurance value emphasizes the cost of replacement or repair.

Q 13. How do you deal with a situation where there’s limited market data for a specific artwork?

Limited market data presents a challenge, demanding a more comprehensive and creative approach. First, thorough research is crucial to uncover any available sales records, even if they are limited or indirect. Consult auction records, private sales databases, and art market specialists. Expert opinions from recognized authorities on the artist or style are indispensable. Furthermore, comparative analysis of similar artworks by the same or similar artists can provide insights. Even seemingly disparate pieces can offer valuable reference points, allowing for adjustments based on differences in size, condition, and provenance. In addition to these traditional methods, analyzing the artist’s career trajectory, critical reception of their work, and their current market standing can aid in forming a justifiable valuation. Remember, a thorough explanation and justification are essential for any valuation, especially when data is scarce.

Q 14. What are the different types of art appraisal qualifications and certifications?

Several organizations offer appraisal qualifications and certifications. The most widely recognized in the United States is the American Society of Appraisers (ASA). ASA offers designations such as Accredited Senior Appraiser (ASA) in various specialties, including fine arts. Other reputable organizations include the Appraisers Association of America (AAA) and the International Society of Appraisers (ISA). These organizations have rigorous requirements for education, experience, and adherence to professional ethics. The specific designations and certifications vary, but they all indicate a high level of expertise and adherence to professional standards. When selecting an appraiser, look for individuals holding these certifications, ensuring that the appraiser has the appropriate experience and specialized knowledge relevant to the artwork being valued. It’s analogous to choosing a specialist physician rather than a general practitioner; you wouldn’t trust a general practitioner to perform open heart surgery, and similarly you shouldn’t trust a general appraiser to value a rare Ming dynasty vase.

Q 15. Describe your experience with different art mediums (painting, sculpture, etc.).

My experience spans a wide range of art mediums, encompassing painting, sculpture, printmaking, photography, and even digital art. Understanding the nuances of each medium is crucial for accurate valuation. For instance, the condition of a painting – considering factors like canvas deterioration, cracking paint (craquelure), and the presence of any restoration – significantly impacts its worth. Similarly, the material and technique used in a sculpture (bronze casting, marble carving, welded steel) directly influence its value and the potential for damage. With photography, the print’s edition number, the printing technique (e.g., gelatin silver print, pigment print), and the photographer’s signature are all key elements influencing value. My appraisal experience includes working with both original artworks and limited-edition prints, requiring a deep understanding of the artistic process and its effect on the final piece.

I’ve handled works ranging from delicate watercolors to large-scale bronze sculptures, each requiring a specialized approach to examination and assessment. This multifaceted experience provides me with a holistic perspective when evaluating art, allowing me to identify intrinsic value regardless of the medium employed.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you value contemporary art compared to established masters?

Valuing contemporary art differs significantly from valuing established masters. Contemporary art, by its nature, lacks the established historical context and market track record of works by recognized masters. Valuation relies heavily on the artist’s current market standing, their gallery representation, critical reception (reviews, museum acquisitions), and participation in significant exhibitions. Factors like the artist’s trajectory, influence, and innovation within their field become paramount. We often look at comparable sales, though this can be challenging due to the inherent volatility of the contemporary market.

In contrast, established masters benefit from a robust historical record, readily available comparable sales data, and a well-defined collector base. Their works are generally more predictable in terms of value appreciation, though exceptions exist. The process involves meticulous research into provenance (the history of ownership), condition, authenticity, and market trends for the specific artist and period. While rarity and condition remain significant factors, the historical significance and cultural impact of the artwork also strongly influence its value.

Think of it like comparing a new, promising tech startup to a well-established Fortune 500 company. The startup has potential but carries higher risk, while the established company has a more predictable, albeit potentially slower, growth trajectory.

Q 17. Explain your experience with handling high-value artworks.

My experience with high-value artworks involves a rigorous and meticulous approach, prioritizing security and careful handling throughout the entire appraisal process. This includes understanding and adhering to best practices for transporting, storing, and examining artwork. I’ve worked with pieces insured for millions of dollars, requiring a deep understanding of insurance protocols and documentation. For example, I’ve overseen the careful packing and shipping of fragile sculptures requiring custom crates and climate-controlled transport. Moreover, I’ve collaborated with conservators to assess the condition of valuable paintings and recommend appropriate restoration procedures, always documenting every step of the process.

Beyond the physical handling, the legal and ethical considerations involved in valuing and managing high-value artworks are paramount. This includes understanding the implications of authenticity and provenance verification, potential legal challenges related to ownership and import/export regulations, and maintaining confidentiality throughout the appraisal process. I always prioritize transparency and clear communication with clients throughout these intricate procedures.

Q 18. Describe your knowledge of art market trends and cycles.

The art market, much like other financial markets, experiences cyclical trends. We’ve seen periods of significant growth followed by corrections, influenced by factors such as global economic conditions, geopolitical events, and shifts in collector preferences. Currently, there’s a strong interest in art from emerging markets and diverse artistic voices. Specific mediums, styles, and even individual artists experience periods of heightened demand, driving up prices. For instance, the market for Impressionist and Post-Impressionist paintings has historically seen strong growth, but other sectors, like contemporary photography or digital art, have shown rapid growth in recent years.

Understanding these cycles is essential for accurate valuation. My knowledge is based on extensive research, analysis of auction results and sales data, and close observation of market trends reported in specialist publications and online resources. I also track the performance of different art indices to understand broader trends. This allows me to provide clients with informed projections and perspectives.

Q 19. How do you stay up-to-date on the latest developments in art valuation?

Staying current in the dynamic field of art valuation requires a multi-pronged approach. I subscribe to leading art market publications and online databases providing up-to-date market reports and sales data. I regularly attend art fairs, auctions, and gallery exhibitions to observe current trends firsthand. Participation in professional development activities, such as conferences and workshops organized by appraisal organizations, ensures I remain familiar with the latest methodologies and best practices in the field. Networking within the art community also offers valuable insights and perspectives on emerging trends.

Furthermore, I actively engage with academic research on art market dynamics and valuation methodologies. This ensures that my understanding extends beyond current market conditions to the underlying economic forces driving valuation trends.

Q 20. What software or databases do you use for research and valuation?

My research and valuation processes rely on a combination of specialized software and databases. I utilize art market databases such as Artnet, Artprice, and Invaluable, which provide comprehensive sales data and artist biographies. These platforms offer invaluable insights into comparable sales, auction results, and market trends. In addition, I utilize specialized software for image analysis and condition reporting, enabling me to systematically document the condition of artworks and identify any areas requiring attention. This documentation is essential for accurate valuation and insurance purposes.

Beyond these digital resources, I maintain a comprehensive library of art historical literature and auction catalogs, providing a deeper understanding of the context surrounding the artworks I appraise. My approach combines technological tools with traditional research methodologies, ensuring a thorough and accurate valuation.

Q 21. How do you handle clients with differing expectations regarding valuation?

Handling clients with differing expectations regarding valuation requires clear communication, transparency, and a robust methodology. I begin by establishing realistic expectations, clearly explaining the valuation process and the factors influencing the final appraisal. This includes discussing the limitations of valuation, acknowledging uncertainties inherent in the art market, and clarifying the difference between market value, insurance value, and fair market value. I always provide a detailed report supporting my valuation, which includes documentation of the research, methodology, and any relevant comparable sales. This ensures transparency and allows clients to understand the rationale behind my assessment.

If discrepancies remain, I am prepared to explain my conclusions thoroughly, providing clear evidence and addressing client concerns patiently. In some cases, a second opinion from another qualified appraiser might be suggested to foster consensus and provide further reassurance. Ultimately, the goal is to reach a shared understanding and a valuation that fairly reflects the artwork’s characteristics and market context, even if it doesn’t perfectly align with initial client expectations.

Q 22. Describe a challenging art valuation project you’ve worked on and how you overcame the challenges.

One of the most challenging valuations I undertook involved a collection of early 20th-century avant-garde sculptures. The challenge stemmed from the lack of readily available comparable sales data. These were works by relatively lesser-known artists, even within the avant-garde movement, and their styles blended several influences, making direct comparisons difficult. The sculptures also exhibited some minor damage requiring expert conservation assessments to factor into the valuation.

To overcome these hurdles, I employed a multi-pronged approach. First, I conducted extensive archival research, examining artist biographies, exhibition records, and critical reviews to establish provenance and contextualize the artistic merit. Second, I consulted with leading conservators to obtain detailed reports on the condition of each sculpture and the costs associated with restoration. Third, I expanded my comparable sales research beyond direct market equivalents, considering sales of works by artists sharing similar stylistic elements and historical contexts. Finally, I built a valuation model incorporating factors such as artist reputation, rarity, condition, provenance, and market trends, weighting each based on its relative significance for this specific case. The resulting valuation report was meticulously detailed and justified each element of the assessment, ultimately satisfying the client’s need for a thorough and defensible valuation.

Q 23. How do you present your valuation findings to clients?

Presenting valuation findings requires clarity, transparency, and sensitivity to the client’s needs. My approach always begins with a comprehensive verbal summary of the key findings, presented in plain language, avoiding overly technical jargon. I then provide a detailed written report, incorporating high-quality images of the artwork and meticulously documenting the methodology, rationale, and all supporting data. This report clearly states the valuation range, the assumptions underpinning the valuation, and any limitations or uncertainties. I often include a glossary of terms to ensure complete understanding. For high-value pieces, I’m prepared to present the findings in person, allowing for a more interactive dialogue to answer any questions and clarify any uncertainties.

Ultimately, my goal is not just to deliver a number but to provide the client with a clear understanding of the process and the factors influencing the value of their artwork. This builds trust and ensures that the valuation is both useful and actionable.

Q 24. How do you manage your workload effectively, especially during peak seasons?

Effective workload management is crucial in this field. During peak seasons, I employ several strategies. First, I prioritize projects based on urgency and client needs, using a project management system to track deadlines and progress. Second, I delegate tasks whenever possible, utilizing administrative support for data entry and research tasks. Third, I establish realistic timelines with clients from the outset, setting clear expectations about turnaround times. Fourth, I proactively communicate with clients throughout the process, keeping them updated on progress and addressing any concerns promptly. Finally, I maintain a healthy work-life balance to avoid burnout, ensuring that I can maintain my focus and accuracy throughout busy periods. Regular breaks and efficient time management techniques are essential components of my approach.

Q 25. How familiar are you with international art market regulations?

I am very familiar with international art market regulations, including those related to import/export controls, customs duties, taxation, and sanctions. My knowledge encompasses regulations in major art markets like the US, UK, EU, and China. I understand the nuances of CITES regulations (Convention on International Trade in Endangered Species) as they pertain to art containing animal products, and I’m aware of the complexities of provenance research and documentation required to navigate international art transactions legally and ethically. Staying abreast of these evolving regulations is a crucial aspect of my practice. I subscribe to legal updates and attend relevant professional development conferences to keep my knowledge current.

Q 26. What are the legal implications of misrepresenting the value of an artwork?

Misrepresenting the value of an artwork has significant legal implications, potentially leading to civil and even criminal charges. In civil cases, clients who suffer financial losses due to inaccurate valuations may sue for damages. Such lawsuits could involve claims for breach of contract, negligence, or fraud. Criminal charges, particularly for fraud, are more likely when the misrepresentation is intentional and involves a significant financial gain. This could result in substantial fines and imprisonment. Therefore, maintaining the highest standards of accuracy and transparency in all valuations is not just a professional imperative but a legal necessity.

Q 27. Describe your experience working with insurance companies on art valuations.

I have extensive experience collaborating with insurance companies on art valuations for insurance purposes. These valuations typically focus on establishing the insurable value of an artwork, which often differs from market value due to considerations of replacement cost and potential depreciation. My work involves understanding the specific needs of insurers, including their requirements for documentation, methodology, and reporting. I provide detailed reports that adhere to industry best practices and clearly outline any assumptions made in determining the insurable value. I am familiar with different valuation methodologies employed by various insurers and can adapt my approach to meet their specific requirements. Building strong working relationships with insurance companies involves open communication, clear reporting, and a commitment to providing accurate and reliable valuations that help them manage their risk effectively.

Q 28. Explain your understanding of the impact of art authentication on its value.

Art authentication profoundly impacts an artwork’s value. A certificate of authenticity from a reputable expert can significantly increase an artwork’s market value, providing buyers with confidence in its legitimacy and provenance. Conversely, doubts about authenticity can dramatically reduce or even eliminate an artwork’s value. A work deemed a forgery, even a convincing one, holds little to no monetary value. The authentication process involves thorough examination of the artwork’s physical characteristics, stylistic elements, provenance, and historical context. Often, scientific analysis, such as pigment testing or stylistic comparisons, is employed. The reputation and expertise of the authenticator are crucial; a certificate from a highly regarded specialist holds significantly more weight than one from an unknown individual. This is why a well-documented provenance and authentication history are vital components of a piece’s valuation.

Key Topics to Learn for Art Valuation Interview

- Market Research & Analysis: Understanding auction records, price databases, and market trends to inform valuation decisions. Practical application: Analyzing comparable sales to determine a fair market value for a specific artwork.

- Attribution & Authenticity: Identifying the artist, period, and provenance of a work to verify its authenticity and impact on value. Practical application: Evaluating stylistic characteristics and provenance documentation to assess the likelihood of an artwork being genuine.

- Condition Assessment: Determining the physical condition of an artwork and its impact on its value. Practical application: Identifying and documenting restoration, damage, or wear and tear and assessing their impact on market value.

- Artistic Merit & Significance: Assessing the historical, cultural, and artistic importance of a work and its influence on value. Practical application: Researching the artist’s career, critical reception, and market standing to determine the artwork’s significance.

- Valuation Methods: Understanding and applying different valuation approaches (e.g., comparable sales, income approach, cost approach). Practical application: Selecting the most appropriate valuation method based on the type of artwork and available data.

- Legal & Ethical Considerations: Understanding legal and ethical issues related to art valuation, including disclosure requirements and conflicts of interest. Practical application: Ensuring transparency and objectivity in valuation reports and adhering to professional standards.

- Financial Modeling & Reporting: Creating professional valuation reports and communicating findings effectively. Practical application: Presenting clear and concise valuation justifications supported by robust data analysis.

Next Steps

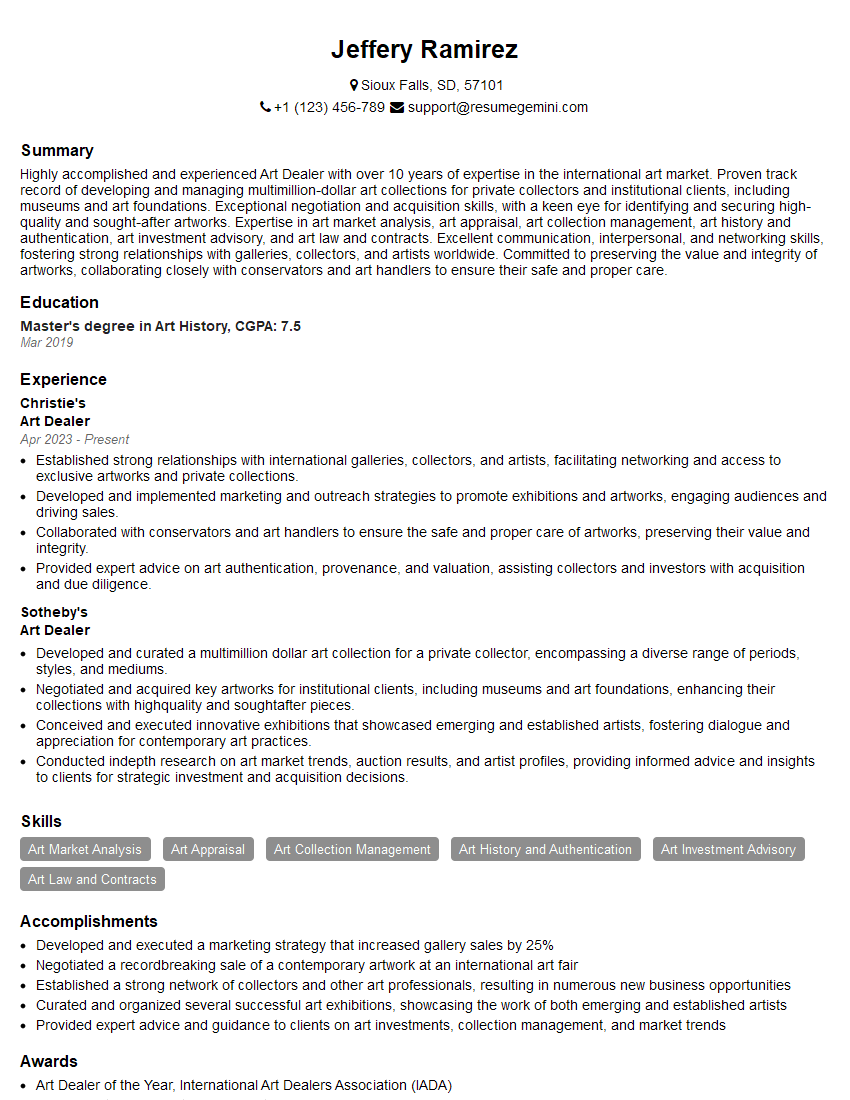

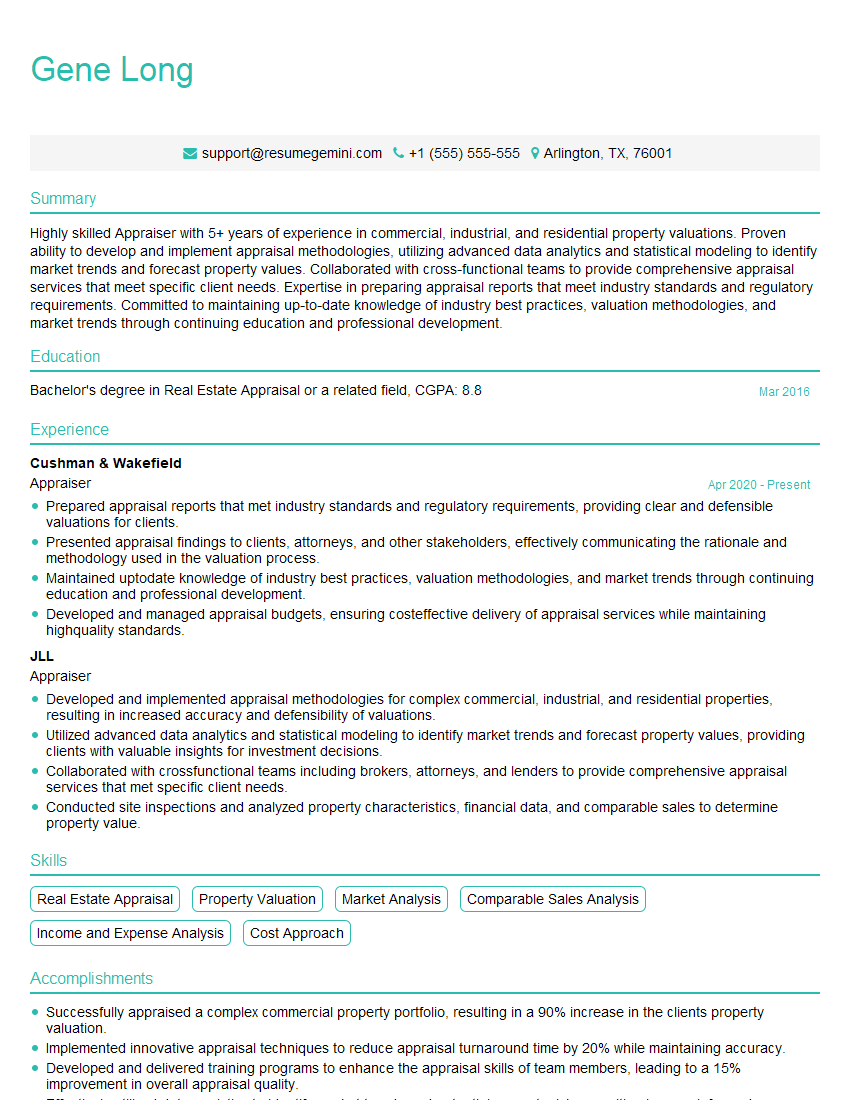

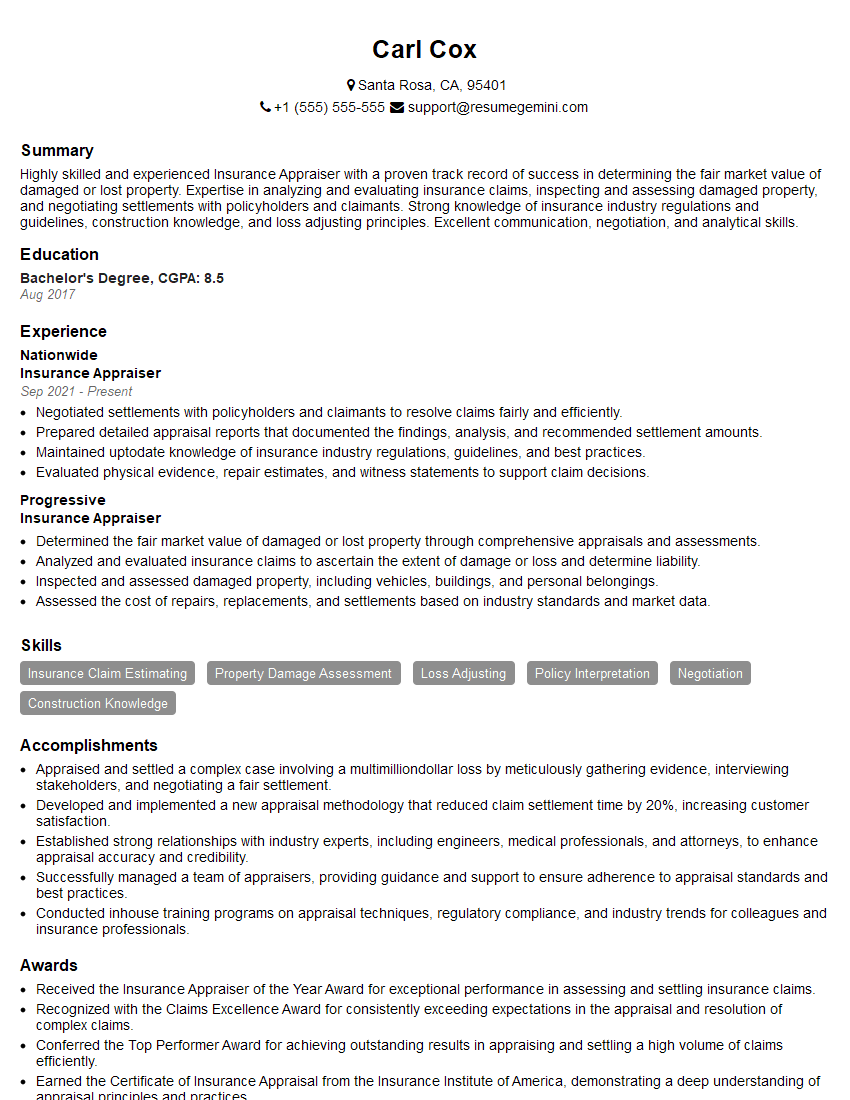

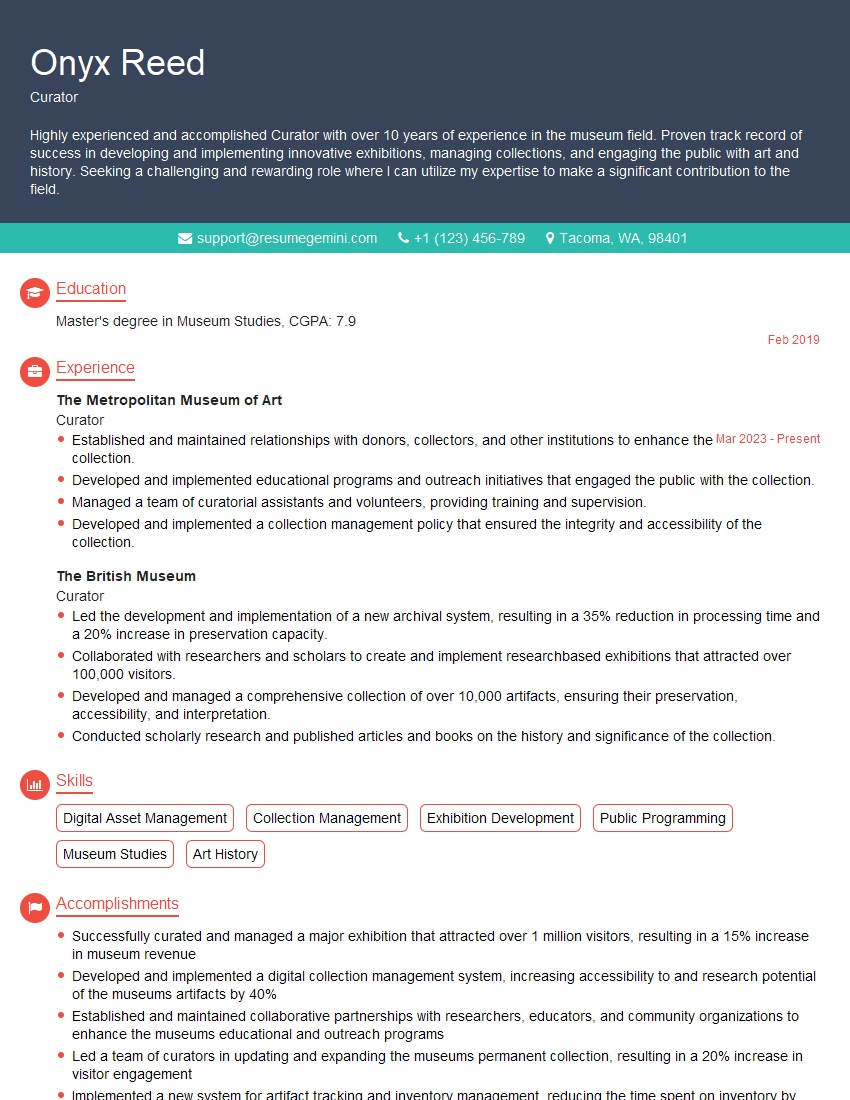

Mastering art valuation opens doors to exciting career opportunities in the art world, offering rewarding challenges and substantial growth potential. A strong resume is crucial for landing your dream role. Creating an ATS-friendly resume significantly increases your chances of getting noticed by recruiters. We strongly encourage you to leverage ResumeGemini, a trusted resource for building professional and impactful resumes. ResumeGemini provides examples of resumes tailored specifically to the Art Valuation field, giving you a head start in crafting a compelling application that showcases your skills and experience.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

we currently offer a complimentary backlink and URL indexing test for search engine optimization professionals.

You can get complimentary indexing credits to test how link discovery works in practice.

No credit card is required and there is no recurring fee.

You can find details here:

https://wikipedia-backlinks.com/indexing/

Regards

NICE RESPONSE TO Q & A

hi

The aim of this message is regarding an unclaimed deposit of a deceased nationale that bears the same name as you. You are not relate to him as there are millions of people answering the names across around the world. But i will use my position to influence the release of the deposit to you for our mutual benefit.

Respond for full details and how to claim the deposit. This is 100% risk free. Send hello to my email id: [email protected]

Luka Chachibaialuka

Hey interviewgemini.com, just wanted to follow up on my last email.

We just launched Call the Monster, an parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

We’re also running a giveaway for everyone who downloads the app. Since it’s brand new, there aren’t many users yet, which means you’ve got a much better chance of winning some great prizes.

You can check it out here: https://bit.ly/callamonsterapp

Or follow us on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call the Monster App

Hey interviewgemini.com, I saw your website and love your approach.

I just want this to look like spam email, but want to share something important to you. We just launched Call the Monster, a parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

Parents are loving it for calming chaos before bedtime. Thought you might want to try it: https://bit.ly/callamonsterapp or just follow our fun monster lore on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call A Monster APP

To the interviewgemini.com Owner.

Dear interviewgemini.com Webmaster!

Hi interviewgemini.com Webmaster!

Dear interviewgemini.com Webmaster!

excellent

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good