Cracking a skill-specific interview, like one for Auditing (Internal and External), requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Auditing (Internal and External) Interview

Q 1. Explain the difference between internal and external auditing.

Internal and external audits, while both aiming to assess the effectiveness of an organization’s processes and controls, differ significantly in their scope, objectives, and reporting lines.

- Internal Audit: An independent appraisal function within an organization. Internal auditors evaluate and improve the effectiveness of risk management, control, and governance processes. They report to the organization’s audit committee or board of directors, offering recommendations for improvement. Think of them as the organization’s internal ‘watchdogs’. For example, an internal audit might assess the efficiency of a company’s inventory management system or the effectiveness of its cybersecurity protocols.

- External Audit: Conducted by independent, external audit firms to provide an objective opinion on the fairness and accuracy of a company’s financial statements. They comply with Generally Accepted Auditing Standards (GAAS) and ensure the financial reports adhere to relevant accounting frameworks (like GAAP or IFRS). Their findings are primarily for external stakeholders like investors, creditors, and regulatory bodies. For instance, a big four accounting firm auditing a publicly traded company’s financial statements is an example of an external audit.

In essence, internal audit focuses on improving the organization from within, while external audit provides an independent assurance on financial information for external users.

Q 2. Describe the audit process from planning to reporting.

The audit process is a systematic approach involving several key phases:

- Planning: This crucial initial stage involves understanding the organization’s structure, operations, and risks. We define the audit’s scope, objectives, and the resources needed. This often includes risk assessments, developing an audit plan, and establishing timelines.

- Fieldwork: This phase involves collecting audit evidence. We perform procedures like testing internal controls, reviewing documents, conducting interviews, and observing processes. The goal is to gather sufficient and appropriate evidence to support our conclusions.

- Analysis and Evaluation: This stage involves analyzing the collected evidence to determine whether the organization’s processes and controls are operating effectively and whether its financial statements are fairly presented. We identify discrepancies, weaknesses, or areas of improvement.

- Reporting: The final phase involves documenting the audit findings and communicating them to the appropriate stakeholders. The report typically outlines the audit’s scope, methodology, findings, conclusions, and recommendations for improvement. This might involve formal audit reports for external audits and management letters for internal audits.

Throughout the process, maintaining professional skepticism and adhering to ethical standards is paramount.

Q 3. What are the key components of an effective internal control system?

An effective internal control system (ICS) comprises several interconnected components working together to mitigate risks and ensure organizational objectives are achieved. The key components are often described using frameworks like COSO:

- Control Environment: This sets the tone at the top. It encompasses the organization’s ethical values, commitment to competence, and the overall culture of control consciousness. A strong ethical tone at the top is crucial.

- Risk Assessment: Identifying and analyzing risks that could prevent the organization from achieving its objectives. This requires understanding the nature, likelihood, and potential impact of various risks.

- Control Activities: These are the actions established through policies and procedures to mitigate identified risks. They can be preventative (stopping errors before they occur) or detective (identifying errors after they occur). Examples include authorizations, reconciliations, and segregation of duties.

- Information and Communication: Effective systems for recording, processing, and communicating information are vital for monitoring and evaluating controls. Clear communication channels ensure all relevant personnel understand their roles and responsibilities.

- Monitoring Activities: Ongoing evaluations to ensure the ICS is functioning effectively. This includes regular reviews, audits, and performance monitoring.

Think of these components as a chain; the strength of the entire system depends on the strength of each individual link.

Q 4. How do you identify and assess audit risks?

Identifying and assessing audit risks is crucial for effective audit planning. We employ a risk-based approach:

- Understanding the Entity and its Environment: This involves gaining a thorough understanding of the organization’s industry, business operations, regulatory environment, and internal control structure. This provides the context for risk identification.

- Identifying Risks: We identify inherent risks (risks inherent to the organization’s activities) and control risks (risks that controls may not effectively mitigate inherent risks). Brainstorming sessions, reviewing prior audit reports, and using industry benchmarks are some techniques employed.

- Assessing Risks: We assess the likelihood and impact of identified risks. This often involves a qualitative assessment (high, medium, low) or a quantitative assessment (using probabilities and financial impact). Materiality is a key consideration here.

- Responding to Risks: Based on the risk assessment, we design audit procedures to address identified risks. Higher risks require more extensive testing. This might involve increasing sample sizes, using more sophisticated testing techniques, or adjusting the audit strategy.

For example, a company operating in a volatile market may face a higher inherent risk of financial statement misstatement, requiring more robust audit procedures.

Q 5. What are your experiences with different audit methodologies (e.g., risk-based auditing)?

My experience encompasses various audit methodologies, with a strong emphasis on risk-based auditing.

- Risk-Based Auditing: This is my preferred approach, focusing resources on areas with the highest risk of material misstatement. It’s more efficient and effective than traditional compliance-based auditing, which might spend time on low-risk areas.

- Compliance Auditing: I’ve also conducted compliance audits, ensuring adherence to regulations, laws, and internal policies. This is particularly relevant in regulated industries like finance or healthcare.

- Operational Auditing: I have experience in evaluating the efficiency and effectiveness of business processes. This often involves analyzing operational data and providing recommendations for improvement.

- IT Auditing: I’m familiar with auditing information systems and evaluating the security and controls related to data processing, storage, and access. This is crucial in today’s digital environment.

The choice of methodology depends on the audit’s objectives and the specific context. However, a risk-based approach forms the foundation of my work, ensuring efficiency and the allocation of resources to high-risk areas.

Q 6. Explain your understanding of Generally Accepted Auditing Standards (GAAS).

Generally Accepted Auditing Standards (GAAS) are a set of guidelines established by the Auditing Standards Board (ASB) of the AICPA (American Institute of Certified Public Accountants) that govern the conduct of audits of financial statements in the United States. They aim to ensure that audits are performed with professional competence and objectivity.

Key principles underpinning GAAS include:

- Independence: Auditors must maintain independence in fact and appearance to ensure objectivity.

- Due Professional Care: Auditors must exercise due professional care in the planning and performance of the audit.

- Professional Skepticism: Auditors should maintain a questioning mind and critically assess evidence.

- Planning and Supervision: Audits must be properly planned and supervised.

- Sufficient Appropriate Audit Evidence: Auditors must obtain sufficient and appropriate audit evidence to support their findings.

Adherence to GAAS ensures the reliability and credibility of audit reports, fostering trust in the financial markets.

Q 7. How do you handle disagreements with auditees?

Handling disagreements with auditees requires a professional and diplomatic approach. My strategy involves:

- Clearly Understanding the Disagreement: I begin by carefully listening to the auditee’s perspective, seeking to understand the root cause of the disagreement. Is it a misunderstanding of facts, a difference in interpretation, or a genuine conflict of opinion?

- Documenting Everything: All communications, evidence, and discussions related to the disagreement are meticulously documented. This creates a clear audit trail.

- Seeking Common Ground: I explore options for reaching a mutually agreeable solution. This often involves discussing alternative interpretations or presenting additional supporting evidence.

- Escalation if Necessary: If the disagreement cannot be resolved at the working level, I escalate it to the appropriate management level within the organization. This might involve discussions with the audit committee or senior management.

- Maintaining Professionalism: Throughout the process, I maintain a professional and respectful demeanor, focusing on the objective facts and avoiding personal attacks.

Ultimately, the goal is to resolve the disagreement constructively, ensuring the audit’s integrity and maintaining a positive working relationship with the auditee. Open communication and a collaborative approach are often key to success.

Q 8. Describe a situation where you had to deal with a significant audit finding.

During an internal audit of a manufacturing company, I discovered a significant discrepancy in inventory valuation. The company was using a FIFO (First-In, First-Out) method for costing, but our testing revealed that in several instances, the LIFO (Last-In, First-Out) method was being applied, leading to a material understatement of the cost of goods sold and an overstatement of net income. This was not intentional; rather, it stemmed from a lack of clear procedures and inadequate staff training on inventory management software.

To address this, I first documented my findings meticulously, including specific examples of the mismatched costing methods with supporting evidence from the inventory system. Then, I collaborated with the inventory management team to understand the root causes. We discovered a flaw in the software’s default settings, which inadvertently led to the incorrect costing application.

My recommendations involved implementing stricter internal controls, providing additional training to the inventory team on proper software usage and inventory accounting principles, and recommending a system-level fix to prevent the default setting issue from recurring. We also updated the company’s inventory policy to explicitly outline the acceptable costing methods and reinforce proper procedures. The issue was resolved successfully, improving the accuracy of financial reporting and strengthening internal controls.

Q 9. How do you ensure audit independence and objectivity?

Maintaining audit independence and objectivity is paramount. It’s about ensuring our judgment isn’t influenced by any biases or relationships that could compromise the integrity of our work. This is achieved through a multi-faceted approach.

- Organizational Structure: Auditing functions should be independent from the areas they are auditing. For instance, internal audit should report directly to the audit committee, not to the department being audited.

- Ethical Standards: Strict adherence to professional codes of conduct, such as those set by IIA (Institute of Internal Auditors) for internal audits and AICPA (American Institute of Certified Public Accountants) for external audits is crucial. This includes avoiding conflicts of interest and maintaining confidentiality.

- Documentation and Review: Thoroughly documented audit procedures and findings undergo rigorous review by senior team members to ensure objectivity and to identify potential biases or oversights. Peer reviews are vital in this process.

- Rotation of Auditors: Regularly rotating audit teams and assigning auditors to different areas helps prevent familiarity bias and ensures fresh perspectives.

- Continuing Professional Education (CPE): Staying up-to-date with the latest auditing standards, techniques, and regulations enhances professionalism and prevents outdated practices that could lead to biased assessments.

Imagine a doctor diagnosing a patient – their objectivity is essential for a proper diagnosis. Similarly, auditors must maintain an objective stance to provide credible and reliable audit opinions.

Q 10. What is your experience with audit software and tools?

My experience encompasses a wide range of audit software and tools, including ACL, IDEA, and TeamMate. I am proficient in using these tools for data extraction, analysis, testing, and reporting. For example, I’ve used ACL to perform data analytics on large datasets, identifying anomalies and exceptions that would be difficult to detect manually. This included identifying unusual transactions, potential fraud indicators, and inconsistencies in data.

I’m also familiar with specialized audit management software such as TeamMate, which assists in managing the entire audit lifecycle, from planning and fieldwork to reporting and follow-up. This involves creating audit programs, tracking audit progress, documenting findings, and generating reports. My ability to leverage these tools significantly improves audit efficiency and effectiveness, allowing for more comprehensive and insightful analysis.

Q 11. How do you prioritize audit tasks and manage your time effectively?

Prioritizing audit tasks and managing time effectively is critical for successful audit completion. I use a combination of techniques:

- Risk-Based Approach: I prioritize tasks based on the assessed risk. High-risk areas receive more attention and resources early in the audit process.

- Project Planning: Creating detailed audit plans with clearly defined tasks, timelines, and responsibilities. This plan involves breaking down complex tasks into smaller, manageable units.

- Time Budgeting: Allocating specific timeframes to each task, allowing for contingency planning and managing unexpected delays.

- Regular Monitoring and Progress Reporting: Tracking progress against the plan, identifying any potential bottlenecks early, and adjusting the schedule as needed. Regular communication with the audit team and management is crucial.

- Prioritization Matrices: Using tools like Eisenhower Matrix (Urgent/Important) or MoSCoW method (Must have, Should have, Could have, Won’t have) to effectively prioritize tasks based on their urgency and impact.

Think of it like building a house: You wouldn’t start painting before laying the foundation. Similarly, high-risk areas require attention first in an audit.

Q 12. Explain your understanding of COSO framework.

The COSO framework (Committee of Sponsoring Organizations of the Treadway Commission) is a widely accepted internal control framework that provides a comprehensive model for designing, implementing, and monitoring internal control systems. It focuses on five interconnected components:

- Control Environment: This sets the tone at the top, encompassing the organization’s ethics, values, and commitment to internal control.

- Risk Assessment: This involves identifying and analyzing potential risks that could impact the achievement of objectives.

- Control Activities: These are the actions established to mitigate risks and ensure objectives are achieved. Examples include authorizations, reconciliations, and segregation of duties.

- Information and Communication: This component addresses how information is captured, processed, and communicated within the organization to support internal control.

- Monitoring Activities: This involves regularly assessing the effectiveness of internal controls and making necessary adjustments. This includes ongoing monitoring and separate evaluations.

COSO provides a structured approach to evaluate and improve internal controls, enhancing the reliability of financial reporting, operational efficiency, and compliance.

Q 13. Describe your experience with data analytics in auditing.

Data analytics has revolutionized auditing. I’ve extensively used data analytics techniques to enhance audit efficiency and effectiveness. For example, I used predictive modeling to identify potential risks of fraud in a large financial institution. By analyzing transactional data, we could flag transactions that deviated from established patterns, which allowed us to focus our audit efforts on high-risk areas.

I’ve also used data visualization tools to present audit findings in a clear and concise manner to stakeholders, making complex data more easily understandable. Furthermore, data analytics has helped to automate some aspects of the audit process, freeing up time to focus on more complex issues and judgment-based assessments. Specific techniques include Benford’s Law analysis to detect potential fraud and regression analysis to identify correlations between different data points.

Q 14. How do you document your audit procedures and findings?

Documentation is the cornerstone of a successful audit. We meticulously document all aspects of the audit process, from planning and fieldwork to reporting and follow-up.

- Audit Programs: These outline the detailed procedures to be performed for each audit area, ensuring consistency and completeness.

- Working Papers: These are the detailed records of our audit procedures, findings, and conclusions. They provide an audit trail that allows others to understand and review our work.

- Audit Findings: These are formally documented, including descriptions of the issues identified, their impact, and our recommendations for remediation.

- Management Letters: These communicate our findings and recommendations to management. They typically include a summary of significant issues, potential risks, and suggested corrective actions.

- Audit Reports: These summarize our findings and conclusions, often including an opinion on the effectiveness of internal controls or the fairness of financial statements (depending on the type of audit).

Imagine a detective’s case file – it meticulously documents every piece of evidence and investigation step. Similarly, our audit documentation provides a complete record of our work, allowing for review, verification, and accountability.

Q 15. How do you communicate audit results effectively to management?

Communicating audit results effectively to management requires a clear, concise, and objective approach. It’s not just about presenting findings; it’s about facilitating understanding and action. I begin by tailoring my communication to the audience’s level of understanding, avoiding overly technical jargon. I use a combination of methods:

Executive Summary: A high-level overview highlighting key findings, risks, and recommendations. This ensures busy executives grasp the core issues quickly.

Detailed Report: A comprehensive document providing supporting evidence, methodologies used, and a deeper analysis of each finding. This allows for a thorough understanding of the audit process and its conclusions.

Visual Aids: Charts, graphs, and tables help illustrate complex data effectively and improve comprehension. A picture is often worth a thousand words, especially when dealing with financial data.

Presentation: A structured presentation allows for interactive discussion and clarification. I encourage questions and actively listen to management’s perspectives.

Follow-up: I ensure that management understands the next steps and that appropriate action plans are implemented. This might involve scheduling a follow-up meeting to review progress.

For example, in a recent audit of a client’s procurement process, I discovered weaknesses in their vendor selection process. Instead of simply stating the weaknesses, I presented a clear, visually appealing summary showing the increased risk of fraud and cost overruns. This enabled management to quickly understand the severity of the issue and prioritize implementing the recommended solutions.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are your experiences with Sarbanes-Oxley (SOX) compliance?

I have extensive experience with Sarbanes-Oxley (SOX) compliance, having led numerous audits under the framework. SOX is a critical legislation designed to protect investors by improving the accuracy and reliability of corporate disclosures. My experience encompasses:

Internal Control Assessments: Conducting detailed assessments of internal controls over financial reporting (ICFR) in accordance with the COSO framework, identifying control deficiencies and their impact.

Testing of Controls: Performing various tests of controls, including walkthroughs, inquiries, inspections, and re-performance, to validate the design and operating effectiveness of key controls.

Documentation: Creating and maintaining comprehensive documentation of the internal control environment, including process flowcharts, control matrices, and risk assessments. This is essential for demonstrating compliance.

Reporting: Preparing reports detailing audit findings, including material weaknesses, significant deficiencies, and control deficiencies, along with recommendations for remediation.

In a recent engagement, we identified a significant deficiency in the client’s revenue recognition process. Through detailed testing and analysis, we helped the client remediate the issue by implementing stronger controls and documentation procedures, ensuring compliance with SOX regulations and minimizing financial reporting risks.

Q 17. Explain your understanding of materiality in auditing.

Materiality in auditing refers to the significance of an error or omission in the financial statements. An item is considered material if its misstatement could reasonably influence the decisions of users of the financial statements. It’s a qualitative and quantitative judgment. The concept is crucial because auditors don’t need to examine every single transaction; instead, they focus on those items that could materially affect the financial statements.

Quantitative factors include the absolute size of the misstatement and its relationship to key financial statement figures (e.g., revenue, net income). Qualitative factors consider the nature of the misstatement (e.g., fraud is more material than an unintentional error), the potential impact on specific financial ratios, and whether the misstatement involves a violation of laws or regulations.

For example, a $10,000 misstatement might be immaterial for a large company with billions of dollars in revenue, but it could be highly material for a small company with only a few million in revenue. Similarly, a small misstatement related to a critical accounting policy could be more material than a large misstatement in a less significant area.

Determining materiality involves professional judgment based on the specific circumstances of each audit. Auditors use their professional experience, knowledge of the client’s business, and relevant industry standards to assess materiality.

Q 18. How do you assess the effectiveness of internal controls?

Assessing the effectiveness of internal controls involves a systematic approach. I typically use a risk-based approach, focusing on areas with higher inherent risk. My process generally involves the following steps:

Understanding the Internal Control Environment: This includes reviewing organizational charts, policies, procedures, and other relevant documentation to understand the client’s control structure.

Identifying Key Controls: Determining which controls are critical to mitigating key risks related to financial reporting.

Performing Tests of Controls: Using a variety of audit procedures such as observation, inquiry, inspection, and re-performance to evaluate the design and operating effectiveness of key controls.

Documenting Findings: Maintaining detailed documentation of the testing procedures and results.

Evaluating Control Deficiencies: Analyzing identified deficiencies to determine their severity (significant deficiencies or material weaknesses) based on their likelihood and potential impact.

Reporting Findings: Communicating findings to management and providing recommendations for improvement.

For instance, in a recent audit, we assessed the effectiveness of a client’s inventory management system. By performing tests of controls, such as observing the physical inventory count process and reviewing inventory records, we identified a weakness in the reconciliation process. This weakness posed a risk of material misstatement, which we reported to management along with recommendations for improvement.

Q 19. What are the ethical considerations in auditing?

Ethical considerations are paramount in auditing. Auditors have a responsibility to act with integrity, objectivity, and professional skepticism. Key ethical considerations include:

Independence: Maintaining independence from the client is crucial to avoid conflicts of interest. This involves avoiding any relationships that could impair objectivity.

Objectivity: Performing audits without bias and basing conclusions on evidence. Auditors must not allow personal feelings or relationships to influence their judgments.

Professional Skepticism: Approaching the audit with a questioning mind, critically evaluating evidence, and not accepting management’s assertions at face value.

Confidentiality: Protecting client information and not disclosing confidential data to unauthorized individuals.

Professional Competence: Maintaining the necessary skills and knowledge to perform audits effectively and adhering to professional standards.

For example, an auditor who has a close personal relationship with the client’s CEO may face challenges in maintaining independence. Similarly, an auditor who fails to question management’s explanations for unusual transactions may lack professional skepticism. Adherence to ethical standards is non-negotiable; violations can have serious consequences.

Q 20. Describe your experience with fraud detection and prevention.

My experience with fraud detection and prevention involves proactively identifying and mitigating risks of fraudulent activities. This includes:

Risk Assessment: Identifying factors that increase the risk of fraud, such as weak internal controls, a culture of non-compliance, or pressure to meet unrealistic targets.

Fraud Prevention Procedures: Recommending and assessing the effectiveness of preventative measures, such as segregation of duties, authorizations, and regular reconciliations.

Fraud Detection Techniques: Utilizing data analytics, anomaly detection techniques, and investigative procedures to identify potential indicators of fraud.

Investigative Procedures: Conducting thorough investigations when fraud is suspected, gathering evidence, and documenting findings.

In one instance, we used data analytics to identify unusual patterns in sales transactions that flagged a potential revenue recognition scheme. Our investigation uncovered evidence of fraudulent activity, leading to the recovery of significant funds and improved controls within the client’s revenue cycle.

Q 21. How do you stay up-to-date on auditing standards and best practices?

Staying up-to-date on auditing standards and best practices is crucial for maintaining professional competence. I utilize several methods:

Professional Development Courses: Participating in continuing professional education (CPE) courses and seminars offered by professional organizations such as the AICPA and IIA.

Industry Publications: Reading industry journals, magazines, and newsletters to stay abreast of current trends and emerging issues.

Networking: Attending industry conferences and networking with other auditors to share knowledge and best practices.

Professional Organizations: Actively participating in professional organizations to receive updates and guidance on auditing standards and regulatory changes.

For example, I recently completed a course on the latest updates to the AICPA’s auditing standards, ensuring that I am equipped to perform audits in accordance with the most current requirements. I am also a member of several professional organizations that regularly provide updates on changes to auditing standards and best practices.

Q 22. What is your experience with auditing IT systems and controls?

My experience with auditing IT systems and controls spans over eight years, encompassing both internal and external audits. I’ve worked extensively with various frameworks like COBIT, ISO 27001, and NIST Cybersecurity Framework. My expertise includes assessing the effectiveness of IT general controls (ITGCs) such as access controls, change management, and data security policies. I also have significant experience in evaluating application controls, focusing on the accuracy, completeness, and security of data processing within specific applications. For example, in a recent audit of a financial institution, I reviewed their access control procedures, ensuring segregation of duties and compliance with regulatory requirements like SOX. This involved analyzing user access rights, reviewing audit logs, and interviewing key personnel. I identified a critical vulnerability where a single administrator had excessive privileges, a finding that led to immediate remediation and improved system security.

Beyond the technical aspects, I understand the importance of integrating IT audits into the overall organizational risk assessment. I’m proficient in using data analytics tools to identify trends and anomalies that might indicate potential control weaknesses, allowing for more targeted and efficient audits.

Q 23. Explain your understanding of sampling techniques in auditing.

Sampling techniques are crucial in auditing because it’s often impractical to examine every single transaction or piece of data. The goal is to select a representative sample that allows us to draw reasonable conclusions about the entire population. Several techniques exist, each with its strengths and weaknesses:

- Random Sampling: Every item has an equal chance of being selected. This ensures unbiasedness but might not be efficient if the population isn’t homogenous.

- Stratified Sampling: The population is divided into subgroups (strata), and a sample is drawn from each stratum. This is useful when there’s significant variation within the population, ensuring representation from each segment.

- Systematic Sampling: Every nth item is selected. This is easy to implement but can be problematic if there’s a pattern in the data that aligns with the sampling interval.

- Monetary Unit Sampling (MUS): Each monetary unit has an equal chance of selection. This is particularly useful for auditing financial statements, as it focuses on items with higher monetary value.

The choice of sampling technique depends heavily on the audit objective, the characteristics of the population, and the acceptable level of risk. Regardless of the technique used, it’s critical to carefully document the sampling methodology and justify the sample size to ensure the audit’s validity and reliability.

Q 24. How do you handle audit exceptions and discrepancies?

Handling audit exceptions and discrepancies requires a systematic and thorough approach. My process typically involves these steps:

- Identification and Documentation: Clearly identify and document each exception or discrepancy, including details such as the nature of the issue, its location within the system or process, and the potential impact.

- Verification and Confirmation: Independently verify the exception or discrepancy through additional testing or inquiry. This might involve reviewing supporting documentation, interviewing personnel, or performing additional procedures.

- Root Cause Analysis: Determine the underlying cause of the exception or discrepancy. This step is crucial for recommending effective corrective actions.

- Communication and Reporting: Communicate findings clearly and concisely to the auditee and senior management, outlining the significance of the issue and potential risks.

- Follow-up and Remediation: Monitor the auditee’s remediation efforts, ensuring corrective actions are implemented and effective. Follow-up testing may be necessary to validate the effectiveness of the remediation.

For instance, if I discover a material misstatement in the financial records, I’d investigate to understand if it’s due to a control weakness, human error, or intentional fraud. My report would detail the issue, its impact, the root cause, and recommendations for preventing recurrence. It’s vital to maintain objectivity and professionalism throughout the process.

Q 25. Describe your experience with regulatory compliance audits.

I possess extensive experience in regulatory compliance audits, primarily focusing on SOX (Sarbanes-Oxley Act), HIPAA (Health Insurance Portability and Accountability Act), and GDPR (General Data Protection Regulation). My experience includes designing audit programs tailored to specific regulatory requirements, performing risk assessments to identify areas of potential non-compliance, testing controls relevant to each regulation, and documenting findings in accordance with professional standards. For example, in a HIPAA compliance audit, I’d evaluate controls related to the protection of Protected Health Information (PHI), including access controls, encryption, and employee training programs. My reports would highlight any gaps in compliance and provide recommendations for improvement.

I understand the evolving nature of regulatory landscapes and the importance of staying updated on changes and amendments to ensure the audits remain relevant and effective. I believe in a proactive approach to compliance, working collaboratively with the auditee to identify and mitigate risks before they become significant issues.

Q 26. How do you manage conflicting priorities in an audit engagement?

Managing conflicting priorities in an audit engagement requires careful planning, effective communication, and prioritization skills. I use a risk-based approach, prioritizing audit areas with the highest potential impact on the organization. This involves clearly understanding the scope of the audit and the objectives of each stakeholder. I employ project management techniques, such as creating detailed audit plans with realistic timelines and milestones. Open and frequent communication with the auditee and senior management is critical to ensure everyone is aware of the progress, challenges, and potential changes in priorities. If necessary, I will work to adjust the scope of the audit or renegotiate deadlines to ensure the most critical areas are adequately addressed while maintaining the overall integrity of the engagement. Flexibility and adaptability are key to successfully navigating conflicting priorities.

Q 27. What is your experience with auditing in a specific industry (e.g., healthcare, finance)?

My most extensive experience is within the financial services industry, specifically in auditing investment banks and hedge funds. This experience encompasses financial statement audits, internal control audits, and compliance audits related to SEC regulations. I am familiar with the unique risks and challenges within this sector, such as the complexities of derivative instruments, valuation methodologies, and regulatory reporting requirements. I’ve worked extensively with financial data analysis techniques to identify anomalies and potential areas of misstatement. For example, I was involved in an audit that uncovered a material misstatement in the valuation of a complex derivative, leading to the correction of the financial statements and enhanced oversight of the valuation process. This experience has honed my analytical skills and my understanding of the intricate regulatory environment within the financial services sector.

Q 28. Describe a time you had to adapt your audit approach due to unforeseen circumstances.

During a recent internal audit of a client’s procurement process, we encountered an unforeseen circumstance: the unexpected resignation of the key personnel responsible for the procurement system. This individual possessed critical knowledge of the system’s intricacies and controls. To adapt, we immediately adjusted our initial audit plan. We prioritized interviews with other personnel familiar with the system, supplementing this with a thorough review of system documentation and audit trails. We also employed data analytics techniques to identify potential anomalies and control weaknesses that might otherwise have been missed. We increased the scope of our testing to account for the lack of direct access to the key individual. While this deviation from the initial plan required additional resources and time, it allowed us to complete the audit to a satisfactory level, and our findings still allowed us to identify a crucial oversight in the approval process that was addressed by the client’s team.

This experience highlighted the importance of flexibility and adaptability in auditing. We successfully navigated the unexpected event by being resourceful and leveraging alternative audit procedures to achieve our audit objectives.

Key Topics to Learn for Auditing (Internal and External) Interview

- Financial Statement Auditing: Understanding the audit process, audit opinions, and generally accepted auditing standards (GAAS) or International Standards on Auditing (ISA).

- Internal Controls: Evaluating the effectiveness of internal controls over financial reporting (ICFR), including COSO framework, and designing appropriate testing procedures.

- Risk Assessment: Identifying and assessing inherent and control risks, developing audit strategies to mitigate those risks, and documenting the risk assessment process.

- Audit Sampling and Evidence: Selecting appropriate audit samples, gathering sufficient and appropriate audit evidence, and documenting the audit procedures performed.

- Analytical Procedures: Performing analytical procedures to identify potential misstatements and assess the reasonableness of financial statement balances.

- Fraud Auditing: Understanding the elements of fraud, recognizing red flags, and applying fraud detection techniques.

- Data Analytics in Auditing: Applying data analytics techniques to improve audit efficiency and effectiveness, including data extraction, cleaning, and analysis.

- Regulatory Compliance: Understanding relevant accounting standards (e.g., GAAP, IFRS) and regulations impacting the audited entity.

- Communication and Reporting: Effectively communicating audit findings to management and the audit committee, preparing clear and concise audit reports.

- Professional Ethics and Standards: Understanding the importance of professional skepticism, independence, and adherence to professional ethics.

- Practical Application: Consider how these concepts apply in real-world scenarios. For example, how would you design tests of controls for a specific area of a company’s operations? How would you respond to a potential fraud risk?

- Problem-Solving: Practice applying your knowledge to solve hypothetical audit challenges. Consider different approaches and justify your choices.

Next Steps

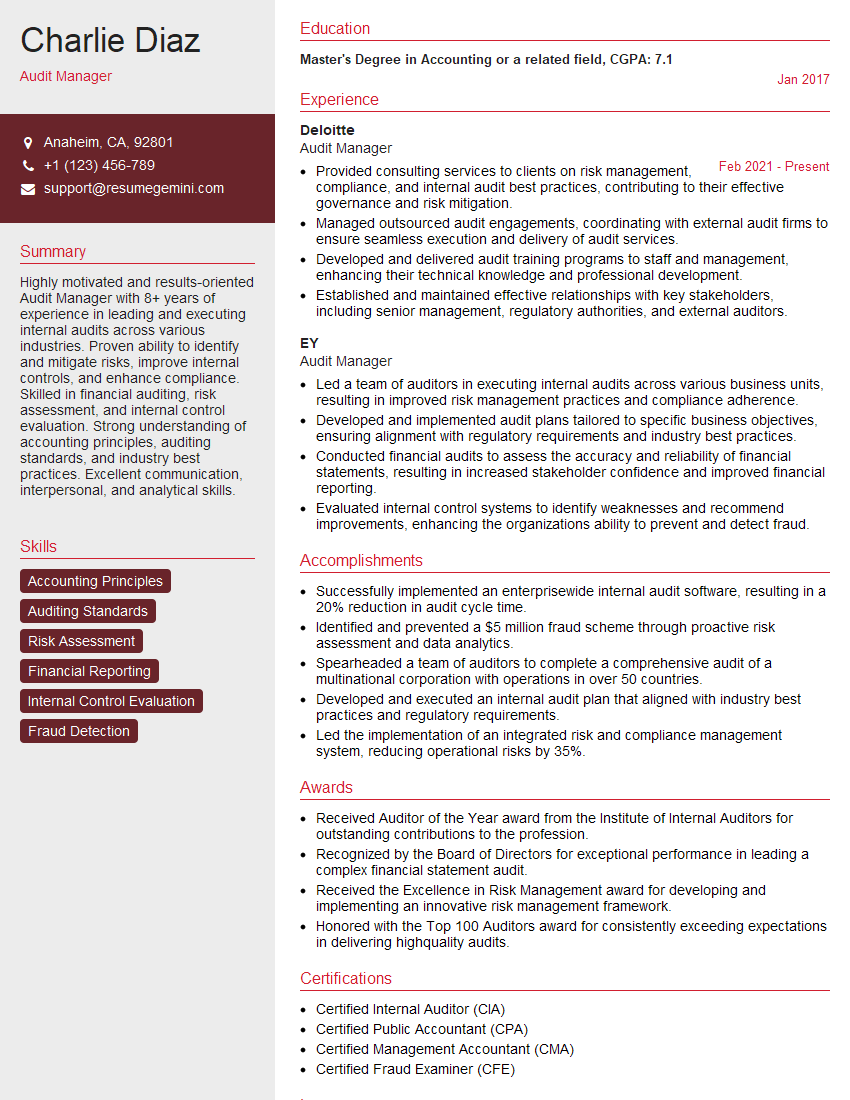

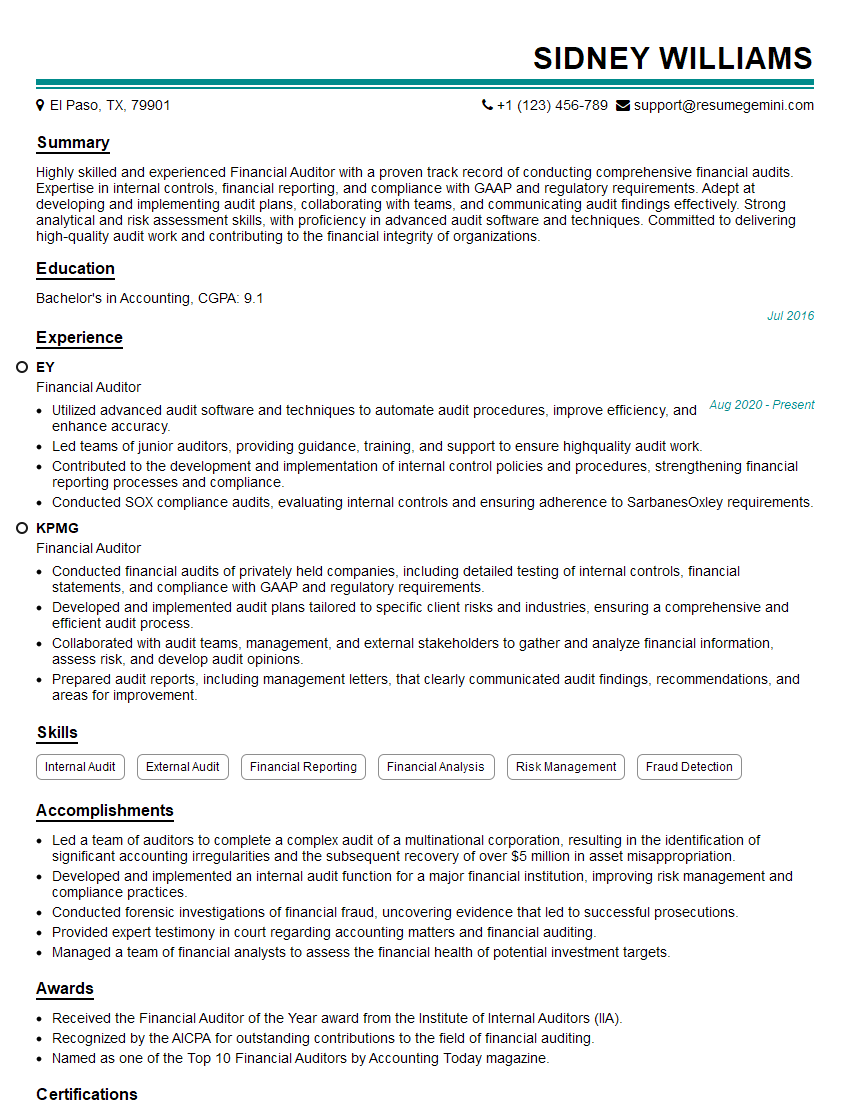

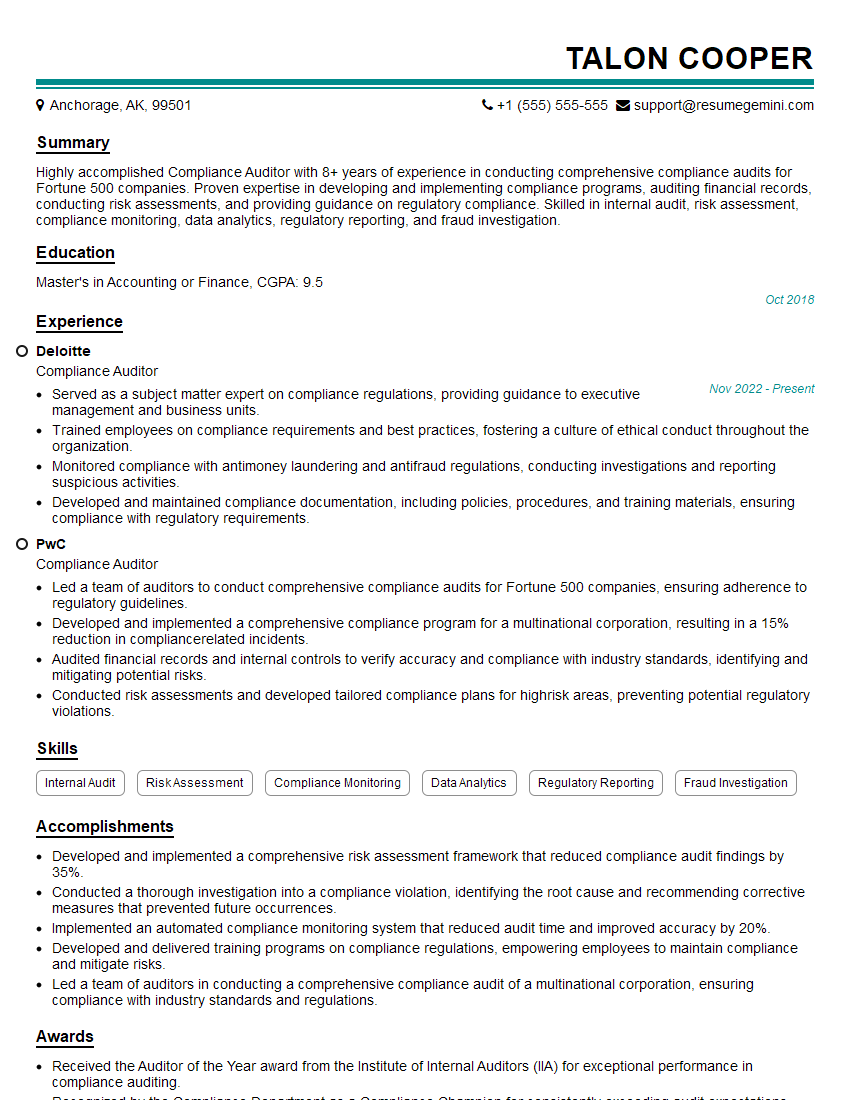

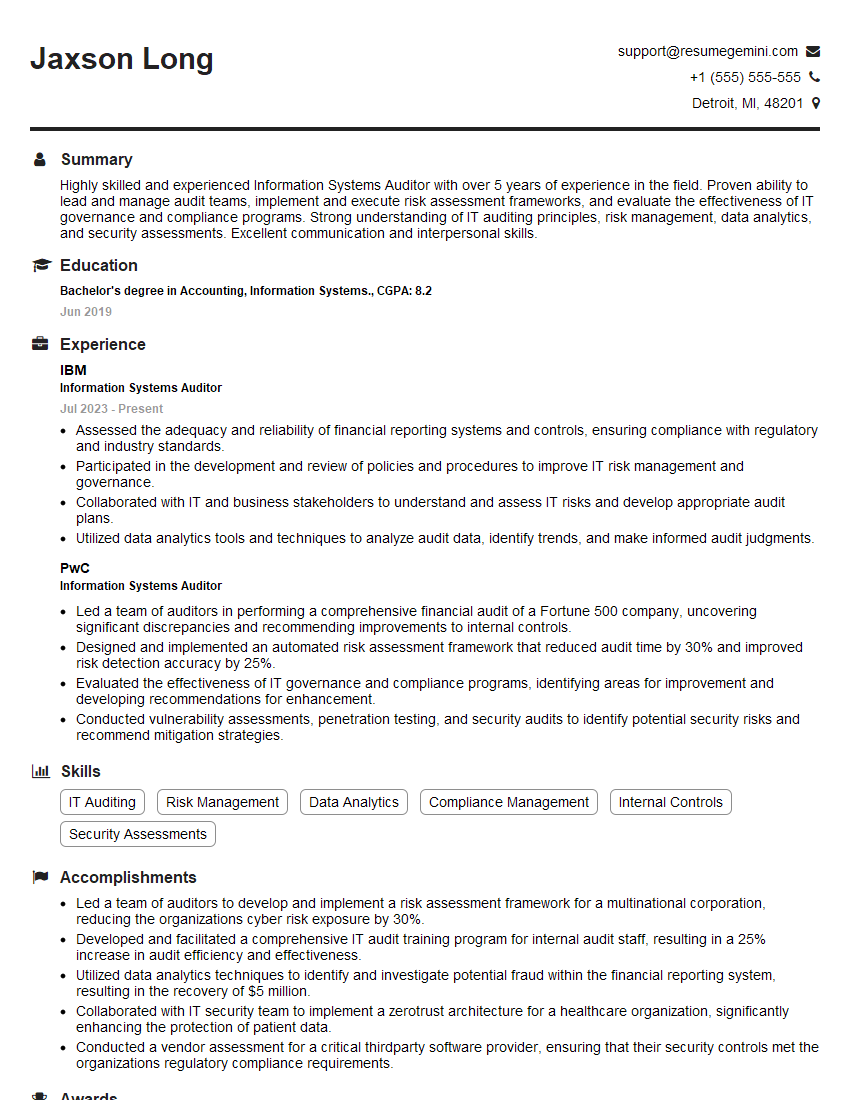

Mastering Auditing (Internal and External) principles opens doors to exciting career opportunities with significant growth potential, offering diverse roles and high earning prospects. A strong resume is crucial for showcasing your expertise and securing interviews. Building an ATS-friendly resume increases your chances of getting noticed by recruiters. ResumeGemini is a trusted resource to help you create a professional, impactful resume that highlights your unique skills and experience in Auditing. Examples of resumes tailored specifically to Auditing (Internal and External) roles are available to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hello,

we currently offer a complimentary backlink and URL indexing test for search engine optimization professionals.

You can get complimentary indexing credits to test how link discovery works in practice.

No credit card is required and there is no recurring fee.

You can find details here:

https://wikipedia-backlinks.com/indexing/

Regards

NICE RESPONSE TO Q & A

hi

The aim of this message is regarding an unclaimed deposit of a deceased nationale that bears the same name as you. You are not relate to him as there are millions of people answering the names across around the world. But i will use my position to influence the release of the deposit to you for our mutual benefit.

Respond for full details and how to claim the deposit. This is 100% risk free. Send hello to my email id: [email protected]

Luka Chachibaialuka

Hey interviewgemini.com, just wanted to follow up on my last email.

We just launched Call the Monster, an parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

We’re also running a giveaway for everyone who downloads the app. Since it’s brand new, there aren’t many users yet, which means you’ve got a much better chance of winning some great prizes.

You can check it out here: https://bit.ly/callamonsterapp

Or follow us on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call the Monster App

Hey interviewgemini.com, I saw your website and love your approach.

I just want this to look like spam email, but want to share something important to you. We just launched Call the Monster, a parenting app that lets you summon friendly ‘monsters’ kids actually listen to.

Parents are loving it for calming chaos before bedtime. Thought you might want to try it: https://bit.ly/callamonsterapp or just follow our fun monster lore on Instagram: https://www.instagram.com/callamonsterapp

Thanks,

Ryan

CEO – Call A Monster APP

To the interviewgemini.com Owner.

Dear interviewgemini.com Webmaster!

Hi interviewgemini.com Webmaster!

Dear interviewgemini.com Webmaster!

excellent

Hello,

We found issues with your domain’s email setup that may be sending your messages to spam or blocking them completely. InboxShield Mini shows you how to fix it in minutes — no tech skills required.

Scan your domain now for details: https://inboxshield-mini.com/

— Adam @ InboxShield Mini

Reply STOP to unsubscribe

Hi, are you owner of interviewgemini.com? What if I told you I could help you find extra time in your schedule, reconnect with leads you didn’t even realize you missed, and bring in more “I want to work with you” conversations, without increasing your ad spend or hiring a full-time employee?

All with a flexible, budget-friendly service that could easily pay for itself. Sounds good?

Would it be nice to jump on a quick 10-minute call so I can show you exactly how we make this work?

Best,

Hapei

Marketing Director

Hey, I know you’re the owner of interviewgemini.com. I’ll be quick.

Fundraising for your business is tough and time-consuming. We make it easier by guaranteeing two private investor meetings each month, for six months. No demos, no pitch events – just direct introductions to active investors matched to your startup.

If youR17;re raising, this could help you build real momentum. Want me to send more info?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?

good